- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Can Do to Prepare for a Stock Collapse

Image Source: pexels

You might worry about a stock collapse coming, but you can take control. Stock market crashes happen more often than many realize. Since 1946, there have been 34 big drops in U.S. stocks. When you prepare for a stock market crash, you give your investments a better chance to recover. Building a plan and sticking to it makes a real difference. History shows that having a smart plan during a stock market crash lowers your risk and helps protect your portfolio. Don’t let news of a stock market correction shake your confidence. Stay focused, and keep your plan clear during any market crash.

Key Takeaways

- Review your portfolio regularly to ensure your investments match your goals and risk level. A balanced mix of stocks, bonds, gold, and cash helps protect you during market drops.

- Diversify your investments across different assets and sectors to reduce risk. This strategy lowers the chance that one bad event will hurt your entire portfolio.

- Keep some cash available for emergencies and to buy investments when prices fall. Too much cash can slow growth, so balance it wisely.

- Avoid panic selling during a market crash. Staying calm and sticking to your plan helps you avoid losses and benefit from market recoveries.

- Use strategies like rebalancing, defensive assets, and dollar-cost averaging to manage risk and keep your investments on track for long-term success.

Prepare Your Portfolio for a Stock Collapse

Image Source: pexels

Getting ready for a stock market crash starts with understanding what you own and how much risk you face. You want to prepare your portfolio so it can handle tough times. Let’s break down the steps you can take to protect your investments and keep your investment portfolio strong.

Review Asset Allocation

Take a close look at your current portfolio. Ask yourself: Do you have too much money in one type of investment? Are you taking on more risk than you realize? Reviewing your asset allocation helps you spot problems before a market crash hits.

Empirical research from past crises, like the dot-com bubble and the COVID-19 crash, shows that reviewing and adjusting your portfolio before trouble starts can make a big difference. Portfolios that include a mix of stocks, bonds, gold, and even oil tend to do better when markets fall. If you only own stocks, you might lose more than you expect. But if you spread your money across different types of investments, you can lower your risk and improve your chances of bouncing back.

Tip: Check your portfolio at least once a year. Make sure your investments still match your goals and risk tolerance. If you feel unsure, a financial advisor can help you make smart adjustments.

Research also suggests that you should not chase short-term trends. Instead, focus on building a portfolio with a mix of assets that can weather different market conditions. During downturns, investors who stick with quality companies and keep a long-term view usually come out ahead.

Diversify Investments

Diversification is one of the best strategies to protect your investments from a stock market crash. When you diversify, you spread your money across different assets, sectors, and even countries. This way, if one part of the market falls, your whole portfolio does not drop as much.

Statistical studies show that adding assets with low or negative correlation to your portfolio reduces risk and smooths out returns. For example, if you own about 20 to 30 different stocks, you can cut your risk by more than half compared to owning just one stock. But diversification is not just about stocks. You should also include bonds, cash, and even precious metals like gold.

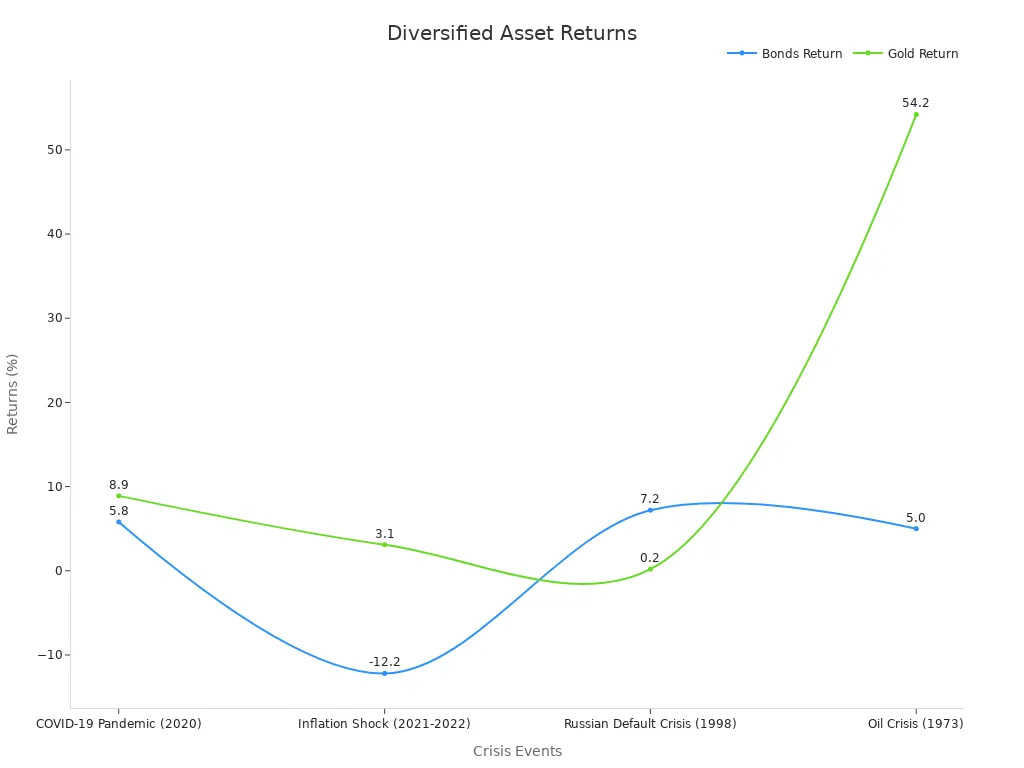

Here’s a table showing how different assets performed during major crises:

| Crisis/Event | Stocks Return | Commodities Return | Bonds Return | Gold Return |

|---|---|---|---|---|

| COVID-19 Pandemic (2020) | -14.9% | -16.8% | +5.8% | +8.9% |

| Inflation Shock (2021-2022) | -15.9% | +21.8% | -12.2% | +3.1% |

| Russian Default Crisis (1998) | -21.1% | -2.7% | +7.2% | +0.2% |

| Oil Crisis (1973) | -31.8% | -67.0% | +5.0% | +54.2% |

As you can see, bonds and gold often go up or hold steady when stocks fall. This is why a diversified portfolio can help you hedge against a market crash. By diversifying your investments, you reduce the chance that one bad event will wipe out your savings.

Note: Diversification does not remove all risk, but it does help you manage it. Make sure you include a mix of stocks, bonds, cash, and other assets in your investment portfolio.

Increase Cash Reserves

Cash is your safety net during a stock market crash. It gives you the flexibility to cover emergencies or take advantage of new opportunities when prices drop. But holding too much cash can hurt your returns over time, especially since cash barely keeps up with inflation.

- Cash provides quick access to funds for emergencies or to buy investments at lower prices during a downturn.

- A balanced portfolio with cash, bonds, stocks, and alternatives can help you stay steady when markets get rough.

- Too much cash can mean you miss out on gains from stocks and bonds, which usually grow faster than inflation.

- Cash is best used for short-term needs or as a buffer, not as a long-term investment.

- During the 2008-2009 crisis, some investors held too much cash and missed the recovery, slowing their progress toward their goals.

Liquidity matters, especially when markets get shaky. After the financial crisis, experts noticed that markets with more cash on hand handled shocks better. When you prepare for a stock market crash, keeping some cash in your portfolio helps you avoid selling investments at a loss and gives you peace of mind.

Tip: Use a goals-based approach. Keep enough cash for emergencies and near-term needs, but invest the rest in a mix of assets to grow your wealth.

If you feel unsure about how much cash to hold or how to balance your investments, talking to a financial advisor can help. They can guide you on the right mix for your situation and help you make adjustments as your needs change.

By taking these steps—reviewing your asset allocation, diversifying your investments, and increasing your cash reserves—you can prepare your portfolio for a stock market crash. These strategies help you protect your investments, manage risk, and stay ready for whatever the market brings.

What to Do When the Market’s Crashing

Image Source: pexels

When you see the headlines screaming about a stock market crash, it’s easy to feel nervous. You might wonder what to do when the market’s crashing and how to protect your investments. The truth is, your actions during these moments matter more than you think. Let’s walk through the best ways to keep your cool and make smart choices when the market drops.

Avoid Panic Selling

Panic selling is one of the biggest mistakes investors make during a stock market crash. When prices fall fast, your first instinct might be to sell everything and run. But acting on fear can hurt your long-term results.

- Financial experts say that people who understand investing are less likely to panic sell. They know that markets go up and down, and they don’t let emotions take over.

- Behavioral finance studies show that panic selling often happens because of loss aversion and overreaction to bad news. People want to avoid losses so much that they sell at the worst time.

- Research also finds that people who stay calm and keep their emotions in check are better at handling a crash. They don’t let fear push them into bad decisions.

- If you sell during a stock market correction, you might miss the recovery. History shows that markets often bounce back, and those who panic sell usually lose out on gains.

- Studies from around the world, including Japan, show that people with higher financial literacy are less likely to panic sell. But being overconfident can actually make things worse, so it’s important to stay humble and informed.

Tip: If you feel the urge to sell, take a step back. Remind yourself of your plan. Talk to a trusted financial advisor if you need help staying calm.

Panic selling leads to suboptimal outcomes. Many investors who sell during a crash never get back in, missing out on the rebound and hurting their long-term wealth. Staying disciplined helps you avoid these costly mistakes.

Stick to Your Plan

When the market gets rough, your plan becomes your anchor. A solid plan keeps you focused on your goals, not your fears. You made your plan for a reason—don’t throw it away just because the market is down.

Behavioral finance research shows that people often make bad choices during market drops because of emotional biases like loss aversion and herd mentality. If you have a plan with clear rules for buying and selling, you’re less likely to make impulsive moves. Financial advisors can help you review your investments and stick to your plan, even when things get tough.

Morgan Stanley looked at nearly 120,000 investors during the 2020 COVID market crash. They found that 93% of people with a plan were on track to meet their goals before the crash. Even after a 34% drop, more than three-quarters stayed on track. Their plan helped them avoid panic selling and focus on long-term goals. Even if their investments fell by 16%, their chances of reaching their goals dropped by only 2%. Small changes, like saving a bit more or spending less, helped them recover without selling at a loss.

Callout: Your plan is your guide. It helps you avoid emotional decisions and keeps you moving toward your goals, even during a stock market crash.

Other studies show that sticking to your plan during a stock market correction pays off. If you try to time the market, you might miss the best days. Missing just the 10 best days since 1950 could cut your long-term growth in half. After the worst days, the market often rebounds with strong returns. Staying invested and following your plan helps you capture these gains.

Wealth advisors agree: keep your plan steady, stay invested, and look for chances to add to your investments when prices are low. This strategy helps you protect your investments and build wealth over time.

Practice Dollar-Cost Averaging

Dollar-cost averaging is a simple but powerful strategy for investing during a stock market crash. With this plan, you invest a fixed amount of money at regular intervals, no matter what the market is doing. This approach takes the guesswork out of investing and helps you avoid emotional decisions.

A real-world example comes from the 2008 financial crisis. Investors who kept putting money into the market during the downturn bought shares at lower prices. When the market recovered, they saw big gains. By spreading out your investments, you lower your average purchase price and reduce the risk of buying at the wrong time.

A study of U.S. stock market data from 1967 to 2018 found that adjusting your dollar-cost averaging plan based on economic conditions can improve your results. Investing more during good times and less during recessions helped reduce risk and boost returns. This strategy works well for ordinary investors who want to build wealth steadily, even when the market is volatile.

Note: Dollar-cost averaging helps you stick to your plan and avoid trying to time the market. It’s a great way to keep investing during uncertain times.

By investing a set amount regularly, you buy more shares when prices are low and fewer when prices are high. This lowers your average cost and helps you stay on track with your plan. Research shows that this strategy reduces the impact of market swings and helps you build wealth over time.

If you want to know what to do when the market’s crashing, remember these three steps: avoid panic selling, stick to your plan, and use dollar-cost averaging. These strategies help you protect your investments, stay calm, and keep moving toward your goals—even during a stock market crash.

Risk Management Strategies for Investments

Managing market risk is one of the smartest things you can do for your investments. When you use the right strategy, you can lower downside risk and keep your portfolio steady during a stock market crash. Let’s look at three simple ways to control investment risk and protect your money.

Rebalance Regularly

You want your portfolio to match your goals and risk tolerance. Over time, some investments grow faster than others. This can change your mix and increase market risk without you noticing. Rebalancing means you adjust your investments back to your target mix. You might sell some assets that have grown a lot and buy more of those that have dropped.

- Rebalancing helps you avoid putting too much money in one area.

- It keeps your portfolio from drifting into higher risk.

- You stay on track with your plan, even when markets move up or down.

Studies show that rebalancing and checking your risk tolerance often can reduce volatility during downturns. You keep your downside risk in check and avoid big surprises when markets get rough.

Use Defensive Assets

Defensive assets can help you manage market risk and protect your investments when markets fall. These include things like government bonds, gold, and stocks in sectors like healthcare or utilities. Historical data shows that Chinese sovereign bonds (hedged to USD) and US Treasuries gave positive returns during nine global equity corrections from 2004 to 2020. Defensive assets also helped top US pension plans cut losses by a third and lower portfolio volatility by 17% during tough times.

Defensive sectors like consumer staples and healthcare often hold up better than the rest of the market. Gold and US Treasuries have acted as safe havens, helping you avoid large downside risk. By adding defensive assets, you give your investments a cushion against market risk.

Set Stop-Loss Orders

Stop-loss orders are tools that help you limit downside risk. You set a price where your investment will sell automatically if it drops too far. Trailing stop-loss orders move up as prices rise, locking in gains and protecting you from big losses. Research shows that trailing stops between 15% and 20% worked better than just holding during wild markets.

Stop-loss orders help you stay disciplined and avoid emotional selling. They can also help you manage market risk by setting clear limits. Just remember, stop-losses can trigger during quick dips, so use them as part of a balanced plan.

Tip: Combine these three steps—rebalancing, using defensive assets, and setting stop-loss orders—to build a strong defense against investment risk and market risk.

Prepare for a Stock Market Crash: Key Steps

Build Emergency Cash Fund

You want to feel secure when facing a potential recession. Building an emergency cash fund gives you that safety net. This fund helps you cover unexpected expenses without selling your investments at a loss. Most experts suggest keeping three to six months of living expenses in a savings account or money market fund. These accounts keep your money safe and easy to access.

Here’s a quick look at what research says about emergency funds:

| Key Aspect | Evidence Summary |

|---|---|

| Savings Account Ownership | Strongest predictor of having emergency savings. |

| Financial Confidence | Boosts your chances of building a fund. |

| Financial Education | Alone is not enough; coaching and counseling help more. |

| Best Place for Cash | Savings accounts, money market funds, or CDs. |

| Use of Funds | Only for real emergencies, not for investing. |

Tip: Don’t use your emergency fund to buy recession-friendly investments. Keep it for true emergencies, like job loss or medical bills.

Know Your Time Horizon

Understanding your time horizon shapes your investing decisions. If you need money soon, you should keep more in cash or stable assets. If your goals are years away, you can take more risk with your portfolio. Studies show that investors who match their investments to their time horizon make better choices and avoid panic during downturns.

Long-term investors often see better results by sticking to their plan. Missing just a few of the best days in the market can cost you thousands of dollars. A thoughtful financial plan helps you stay focused on your goals and avoid emotional mistakes.

- Short-term goals: Use cash or low-risk assets.

- Long-term goals: Consider more stocks and recession-friendly investments.

Seek Professional Guidance

A financial advisor can help you build a thoughtful financial plan and keep you on track during tough times. Advisors review your portfolio, suggest changes, and help you avoid emotional decisions. Data shows that people with a plan and professional support stay on track, even during a stock market crash.

Advisors also help you balance short-term needs with long-term goals. They offer strategies like rebalancing and tax planning. Many investors say that working with an advisor gives them peace of mind and helps them avoid costly mistakes.

Note: A thoughtful financial plan, built with professional guidance, gives you the confidence to face any market challenge.

You can take smart steps to protect your money before a stock collapse. Here’s what matters most:

- Stocks can lose over 50% in a crash, but bonds and other investments often stay steady.

- Checking your investments often helps you spot risks and make changes.

- Diversifying and getting advice from a professional can lower your losses.

Stay calm, review your plan, and keep your eyes on your long-term goals. You’ve got this!

FAQ

What should you do if you feel nervous during a market crash?

Take a deep breath. Remind yourself of your long-term goals. Avoid checking your portfolio too often. If you need support, talk to a financial advisor. Staying calm helps you make better choices.

How much cash should you keep in your portfolio?

Most experts suggest keeping enough cash to cover three to six months of living expenses. This cash acts as your safety net. You can use it for emergencies or to buy investments when prices drop.

Can you protect your investments without selling everything?

Yes, you can. Diversify your assets. Add defensive investments like bonds or gold. Use stop-loss orders if you want extra protection. You do not need to sell all your stocks during a crash.

Should you invest during a stock market crash?

You can keep investing if you use dollar-cost averaging. This strategy lets you buy more shares when prices are low. Over time, this can lower your average cost. Make sure you stick to your plan and invest only what you can afford.

Safeguard your portfolio against a stock collapse with BiyaPay! Our multi-asset wallet offers fee-free USDT conversions to fiat currencies like USD, with a low 0.5% fee for overseas bank transfers, enabling swift trading of defensive stocks or ETFs during market dips. Register in just 1 minute to avoid complex overseas account setups and execute secure, real-time trades to seize low-price opportunities.

BiyaPay’s cost-effective platform supports your diversified strategy with confidence. Act now—visit BiyaPay to register and fortify your investments for any market crash!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.