- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Need to Know About Stock Market Crash Risks in 2025

Image Source: unsplash

Will the stock market collapse in 2025? Experts remain divided, but recent economic signals raise caution.

- The U.S. economy saw GDP contract by 2.2% in Q1 2025, a level that often signals major declines.

- The S&P 500 is already down 14% from its high, though some analysts see possible recovery if conditions stabilize.

- Risk factors like inflation, tariffs, and interest rate uncertainty drive volatility and force investors to rethink strategies.

CFRA and J.P. Morgan stress the need to assess risk, diversify, and adapt portfolios. Investors should focus on balancing risk and reward as economic factors keep shifting.

Key Takeaways

- Experts see low risk of a sudden stock market crash in 2025 but warn of ongoing volatility due to inflation, tariffs, and geopolitical tensions.

- Key signals like market volatility, liquidity, and economic data help investors spot early signs of a crash and manage risk effectively.

- Inflation above target, rising tariffs, and slowing global growth, especially in China, increase the chance of market downturns and stagflation.

- Diversifying investments across asset classes, sectors, and countries remains the best way to reduce risk and protect portfolios during uncertain times.

- Staying informed, using defensive strategies, and maintaining a long-term view help investors navigate market swings and benefit from recoveries.

Will the Stock Market Collapse in 2025?

Expert Views

Many investors ask, “Will the stock market collapse in 2025?” Experts from major financial institutions do not see a high risk of a sudden crash or financial crisis next year. They point to several positive economic signals. Recent models from the Dallas Fed and Atlanta Fed predict steady economic growth, with GDP rising between 2.2% and 3.3%. This growth suggests the economy will avoid a deep recession or bear market. Experts also expect inflation to ease, moving closer to the Federal Reserve’s 2% target. Interest rates should trend lower, which can support stocks and reduce the risk of a financial crisis.

Note: Experts agree that while stocks may face volatility, the chance of a full-blown crisis or stock market crash remains low if current trends continue.

Stocks remain expensive, but earnings growth of about 9% in 2025 could support current prices. Market liquidity has improved, and volatility is lower than during past tightening cycles. These factors help reduce the risk of a sudden crash or financial crisis. Experts believe that the economy will return to long-term growth trends, supported by advances in AI and robotics.

Key Signals

Analysts use several key signals to answer the question, “Will the stock market collapse?” These signals help them spot early signs of a crash, crisis, or recession:

- Market volatility, measured by standard deviation, shows how much stocks move up or down. High volatility can signal a bear market or crisis.

- Correlation between stocks helps experts build safer portfolios. Low correlation means stocks do not all move together, which lowers risk.

- Liquidity measures, such as trading volume and bid-ask spreads, show how easy it is to buy or sell stocks. Poor liquidity can signal a coming crisis.

- Value at Risk (VaR) tells investors the worst loss they might face in a crash or financial crisis.

- Beta measures how much a stock moves compared to the whole market. High beta stocks can fall more during a bear market or recession.

- Quantitative tools like Monte Carlo simulations and stress tests help experts model possible crash scenarios and prepare for a crisis.

Authoritative sources, including Investopedia and the CFA Institute, highlight these signals as vital for managing risk. They help investors understand when the economy or stocks might face a crisis or bear market. By watching these signals, investors can better prepare for a possible stock market crash or recession in 2025.

2025 Market Crash Risks

Image Source: unsplash

Inflation & Fed Policy

Inflation stands as one of the most important risk factors for a 2025 market crash. The Federal Reserve raised its inflation forecast for 2025 to 3%, which is above its 2% target. Core inflation is expected to reach 3.1%. The Fed projects economic growth to slow to 1.4%, with unemployment rising to 4.5%. These numbers show that the economy faces persistent inflation and weaker job growth. The Fed has kept interest rates steady, signaling caution. Markets expect two rate cuts in 2025, but the Fed may only deliver one due to inflation concerns. Tariffs on steel, aluminum, and autos add to inflation, making it harder for the Fed to balance its goals. Rising inflation uncertainty and a weakening labor market increase the risk of a financial crisis or recession. If inflation stays high, stocks could face more volatility and a possible crash.

- Inflation expectations for 2025:

- Short-term: 3.6%

- Medium-term: 3.2%

- Long-term: 2.7%

- Labor market outlook:

- Slower job growth

- Higher unemployment claims

- Tariffs remain elevated, adding to inflation pressures

Tariffs & Trade Tensions

Tariffs and trade tensions have returned as major risk factors for the 2025 market crash. The U.S. has proposed a 20% tariff on all imports from China and 25% tariffs on aluminum and steel from several countries. Additional tariffs are planned for imports from Canada, Mexico, and the EU. These measures raise costs for businesses and consumers, disrupt supply chains, and increase inflation. The 2025 CFO Survey shows that over 30% of firms now see trade and tariffs as their top business concern, up from just 8.3% before. History shows that tariffs can cause significant losses. For example, the 2018-19 tariffs led to $51 billion in losses for consumers and firms, with job losses in industries dependent on imports. Firms now respond by diversifying supply chains and reducing hiring, especially in manufacturing and construction. While tariffs protect some industries, they create net costs for the broader economy and can trigger a bear market or even a financial crisis.

Geopolitical Uncertainty

Geopolitical uncertainty remains high in 2025, increasing the risk of a crash. BlackRock’s Geopolitical Risk Dashboard uses advanced models to track market attention and movement related to global events. The dashboard highlights risks such as trade protectionism, Middle East conflicts, US-China competition, cyber attacks, and regional wars. The Geopolitical Risk Index (GPR) and Economic Policy Uncertainty (EPU) indices also show elevated uncertainty. These indices track news coverage and policy changes across the U.S., China, India, Brazil, and Europe. High uncertainty can lead to sudden drops in stocks and higher volatility. Investors must watch these signals closely, as geopolitical shocks can quickly trigger a crisis or recession.

Stagflation Threat

Stagflation is a scenario where inflation stays high, economic growth slows, and unemployment rises. Recent data show core inflation at 2.8%, with GDP growth forecasts lowered to about 1.7% for 2025. Unemployment has risen to around 4.2%. The Federal Reserve has warned about increased uncertainty and the risk of stagflation. Tariffs add to inflation, while a softer labor market and cautious Fed policy increase the risk of stagflation. Economists say that while outright stagflation is unlikely, the economy could move in that direction. Tariffs raise inflation and unemployment risks, making a 2025 market crash more likely if these trends continue. Economic reports show that tariffs announced in early 2025 raised recession odds from 22% to as high as 65%, before settling at 45%. These dynamics—slowing growth, rising inflation, and higher unemployment—outline a real risk of stagflation and a possible financial crisis.

China Slowdown

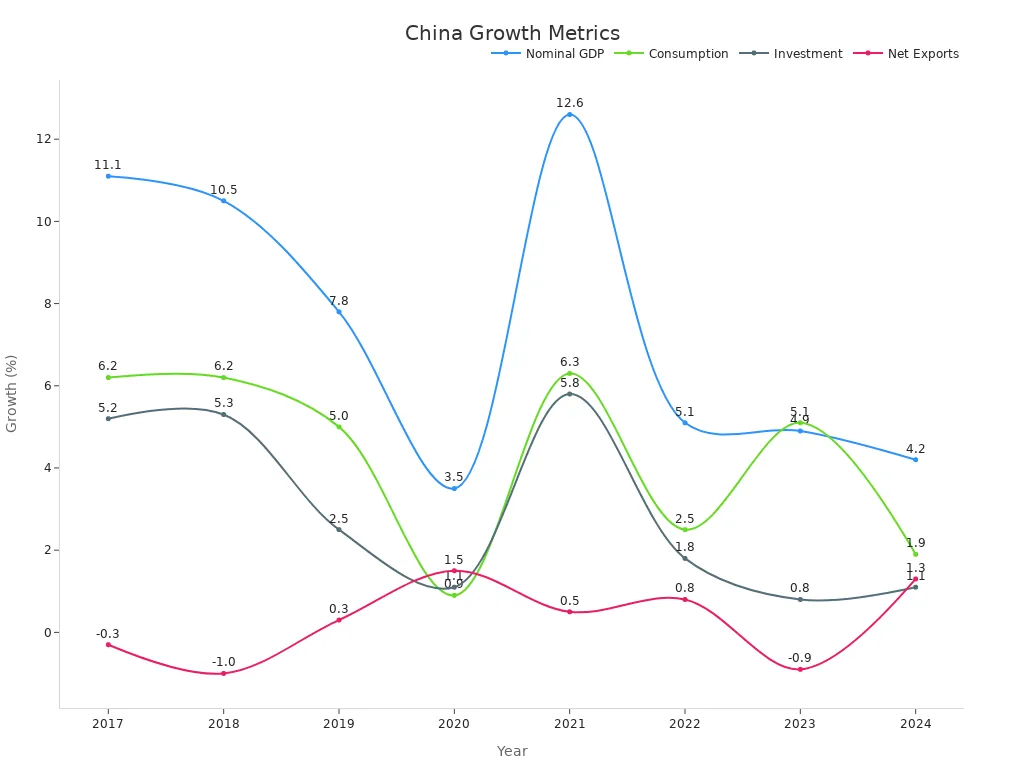

China’s economic slowdown is another key risk for the 2025 market crash. Recent analyses show China’s nominal GDP growth slowed to 4.2% in 2024, the lowest in decades outside the pandemic. Consumption and investment growth have also weakened, while net exports have become a larger part of growth. Structural problems such as a property crisis, weak household spending, rising bad loans, and limited government fiscal space have hurt China’s economy. These issues reduce global demand and can trigger a crisis in global stocks. If China’s slowdown continues, it could lead to a bear market or even a financial crisis in other countries.

AI Speculation

Speculation in artificial intelligence stocks has become a major risk for the 2025 market crash. About 78% of organizations now use AI in at least one business function, driving investor excitement. The global AI market is projected to reach $638.23 billion in 2025 and could grow to $3.68 trillion by 2034. Venture capital investment in AI hit $73.1 billion in early 2025, making up nearly 58% of all global VC deals. AI stocks show high volatility, with beta values between 1.6 and 2.2, almost double the broader market. These stocks have delivered returns nearly three times higher than the S&P 500, but this rapid growth signals strong speculation. Regulatory changes, such as the EU’s AI Act, add compliance costs and affect valuations. Investors must consider these risks, as a sudden drop in AI stocks could trigger a crash or even a financial crisis.

Political Shifts

Political shifts in the U.S., Europe, and emerging markets are closely linked to market volatility and the risk of a 2025 market crash. Changes in U.S. trade, tax, and regulatory policies drive uncertainty. Tariff policies and regulatory shifts can push the global economy toward stagflation. In early 2025, investor sentiment and factor performance changed sharply after new tariff announcements. Investors moved away from large-cap growth stocks to safer, high-dividend stocks, especially in the Euro Zone. March 2025 saw the first monthly decline in European stocks as the U.S. announced new tariffs. Political changes in emerging markets, such as India and Latin America, also affect capital flows and investment patterns. These shifts increase volatility and the risk of a bear market or financial crisis.

Unpredictable Events

Unpredictable events, often called “black swans,” can trigger a sudden crash. Quantitative models such as alpha-stable distributions, GARCH models, and VAR forecasting help estimate crash probabilities. Hawkes processes capture contagion and clustering effects, while correlation matrix eigenvalue dynamics serve as early warning signals. Crashes are defined in different ways, such as multi-year returns below -25%, daily drops of 5% or more, or falls over 10% within a year. These models use heavy tails, volatility clustering, and contagion to predict crashes and support early warning systems. Despite these tools, uncertainty remains high, and unpredictable events can still cause a sudden financial crisis or recession.

U.S. Stock Market Crash Impact

Asset Classes

A U.S. stock market crash can affect asset classes in different ways. When stocks and real estate prices fall, the collateral value that firms can offer to banks drops. This leads to less lending and lower investment, which slows the U.S. economy. For every $1 increase in collateral value, investment spending rises by about 6 cents. Financially constrained firms feel the impact of a crash twice as much as others. History shows that asset price collapses, like those in 1929, 2001, and 2006, often come before a severe crisis. The asset-price feedback loop can turn small shocks into major downturns by reducing investment and confidence.

The following table highlights how tactical asset allocation strategies can help manage risk during a U.S. stock market crash:

| Metric | Value | Explanation |

|---|---|---|

| Annual Return | 11.27% | Shows average yearly return using tactical allocation. |

| Estimated Volatility | 6.87% | Indicates reduced risk compared to passive investing. |

| Maximum Drawdown | -29.43% | Largest loss during a crash, showing risk control. |

| Sharpe Ratio | 1.06 | Measures risk-adjusted returns, higher is better. |

Investor Types

The impact of a U.S. stock market crash varies by investor type. Retail investors often show abnormal attention and trading behavior after positive news, which can increase crash risk. Their actions can drive up stocks quickly, but also lead to sharp declines when confidence fades. Institutional investors, such as pension funds and mutual funds, use research and analysis to reduce risk. They help stabilize the market by narrowing information gaps. In over-the-counter markets and firms with high retail ownership, crash risk rises due to less information and higher volatility. Corporate governance and transparency also shape risk exposure during a crisis.

| Investor Type | Characteristics and Behavior | Associated Risk Exposure |

|---|---|---|

| Retail Investors | High attention, sentiment-driven, frequent trading | Higher crash risk, especially in markets with many retail participants |

| Institutional Investors | Analytical, research-focused, reduce information gaps | Lower crash risk, stabilize stocks |

Sentiment & Volatility

Market sentiment and volatility play a key role during a U.S. stock market crash. The Consumer Confidence Index and Fear & Greed Index track investor emotions. When confidence drops, stocks often fall and volatility rises. Social media sentiment gives real-time insight into investor mood. During the 2008 crisis, the S&P 500 lost 57%, showing how panic can drive markets lower. The COVID-19 crash saw the S&P 500 drop over 30% in weeks, reflecting widespread fear. The Volatility Index (VIX) measures expected market volatility and spikes during a crash, signaling heightened volatility and anxiety. High VIX values mean investors expect more turbulence, while low values suggest calm. Institutional investors use options to hedge risk, which is reflected in VIX movements. Monitoring sentiment and volatility helps investors understand the impact of a U.S. stock market crash and prepare for sudden changes in the U.S. economy.

Portfolio Protection Strategies

Image Source: pexels

Diversification

Diversification remains a core strategy for managing risk in 2025. Investors can lower overall risk by spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities. Research from recent crises, including the COVID-19 pandemic, shows that portfolios with a mix of U.S. stocks, international equities, bonds, and alternative assets like gold and oil experience less volatility and steadier returns. Bonds, especially U.S. Treasury Notes, often move differently from stocks and help cushion losses during downturns. Sector diversification, such as including technology and healthcare, also reduces risk when certain industries face challenges. Adjusting asset allocation based on personal risk tolerance and investment horizon helps investors stay resilient.

International Exposure

International exposure adds another layer of protection. By investing in global markets, investors reduce the impact of a downturn in any single country. Studies comparing asset classes from 2008 to 2020 highlight that gold and international mutual funds help stabilize portfolios during volatile periods. Developed markets like the United States tend to recover faster from crises, while emerging markets may face longer uncertainty. A flexible, globally aware approach allows investors to benefit from different economic cycles and policy responses, further reducing portfolio risk.

Tip: Diversifying across countries and asset classes can help investors avoid large losses if one market faces a crisis.

Defensive Moves

Defensive moves play a key role during uncertain times. Overweighting defensive sectors—such as consumer staples, health care, and utilities—provides steady dividends and recession resistance. Dividend growth investing, especially in companies with long histories of increasing payouts, has outperformed the S&P 500 during volatile years. Low-volatility ETFs and blending equities with fixed income, like bond ETFs, help reduce drawdowns. Tactical hedging with put options, inverse ETFs, or precious metals can limit losses, but investors should use these tools carefully. Maintaining some exposure during downturns allows investors to capture rebounds, as markets often recover strongly after periods of high volatility.

| Defensive Strategy | Benefit |

|---|---|

| Dividend Growth Stocks | Stable income, outperformed in 2023 |

| Low-Volatility ETFs | Smaller drawdowns in corrections |

| Bonds & Cash | Reduced portfolio volatility |

| Tactical Hedging | Limits downside during sharp declines |

Staying Informed

Staying informed helps investors make better decisions and avoid emotional reactions. Following multiple sources of news and market analysis gives a clearer picture of trends and risks. Learning from past events, such as the 2008 financial crisis, shows the value of patience and a long-term view. Investors who stay updated can spot opportunities and manage risk more effectively. Seeking professional advice and reviewing portfolios regularly ensures strategies remain aligned with personal goals and market conditions.

Lessons from Past Crashes

Recovery Patterns

Stock markets have shown strong recovery patterns after major crashes. After the dot-com bubble burst in 2000, the S&P 500 took about five years to regain its previous high. The 2008 global financial crisis caused a sharp drop, but the market recovered within four years. In 2020, the COVID-19 crash led to a rapid decline, but stocks rebounded in less than a year. These examples show that markets can recover, even after severe downturns.

Investors who stayed invested during these periods often saw their portfolios regain value. Selling during a crash can lock in losses. Holding a diversified portfolio and maintaining discipline helps investors benefit from eventual rebounds. Market history suggests that patience and a long-term view support better outcomes.

Note: Recovery times can vary, but markets have always bounced back from past crashes. Investors who avoid panic and stick to their plans often see the best results.

Diversification Benefits

Diversification remains a key lesson from past crashes. By spreading investments across sectors and countries, investors can reduce risk. Studies of US stock prices from 2000 to 2020, which include the dot-com bubble, the 2008 crisis, and the COVID-19 crash, confirm this benefit. Researchers found that holding 30–40 stocks from nine sectors still provided significant risk reduction, even during turbulent times.

| Aspect | Evidence Summary |

|---|---|

| Data Period | 20 years of US stock prices (2000–2020), including major crises |

| Key Findings | Diversification across 30–40 stocks from 9 sectors provides significant risk mitigation |

| Practical Implication | Sector-based diversification remains effective outside peak crisis periods |

International diversification also plays a vital role. Analysis of 27 years of global stock data shows that investing across countries offers even greater protection than focusing on different industries. This approach helps manage risks like market swings, political changes, and inflation.

| Aspect | Evidence Summary |

|---|---|

| Data Period | 27 years of international stock data, covering major crises |

| Key Finding | International diversification outperforms industrial diversification in risk mitigation |

| Risks Mitigated | Market risk, political risk, inflation risk |

Diversification does not eliminate all losses, but it helps investors weather downturns and recover faster. A well-diversified portfolio remains one of the most effective tools for managing risk during uncertain times.

Investors face several risks in 2025 that could impact portfolios:

- Tariff uncertainty may impact sectors like Europe’s auto industry.

- Geopolitical tensions and policy shifts can cause short-term volatility and impact global markets.

- U.S. fiscal concerns and inflation trends continue to impact investment decisions.

Proactive risk management, including diversification and structured notes, helps reduce the impact of market swings. Investors should review portfolios, consult professionals, and stay alert to changing conditions.

FAQ

What are the main warning signs of a stock market crash in 2025?

Investors watch for rising volatility, sharp drops in liquidity, and sudden changes in economic data. High inflation, unexpected policy shifts, and negative earnings reports also serve as early warning signals.

How can investors protect their portfolios from a potential crash?

They can diversify across asset classes, add international exposure, and use defensive sectors. Regular portfolio reviews and staying informed about market trends help reduce risk.

Will AI stocks remain risky in 2025?

AI stocks show high volatility and strong speculation. Regulatory changes and rapid growth increase risk. Investors should monitor these stocks closely and avoid overconcentration.

How does China’s slowdown affect global markets?

China’s slower growth reduces global demand and impacts export-driven companies. Weakness in China can trigger declines in commodity prices and affect multinational firms listed in the U.S.

Should investors sell all stocks if a crash seems likely?

Experts do not recommend selling all stocks. Maintaining a diversified portfolio and focusing on long-term goals helps investors manage downturns and benefit from eventual recoveries.

Navigate 2025 stock market crash risks with BiyaPay! Our multi-asset wallet provides fee-free USDT conversions to fiat currencies like USD, with only a 0.5% fee for overseas bank transfers, enabling rapid trading of defensive or international stocks during volatile markets. Sign up in just 1 minute to bypass cumbersome overseas account setups and execute secure, real-time trades to adapt to sudden shifts.

BiyaPay’s efficient platform empowers your risk management strategy. Join today—visit BiyaPay to register and stay resilient in uncertain times!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.