- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Sets Futures Apart from Stocks and ETFs in MST After Hours Trading

Image Source: pexels

You notice big differences between futures and stocks or ETFs when you look at after hours trading. Futures let you trade almost all day, while stocks and ETFs only offer limited trading hours. If you live in a mountain time zone, you get more flexibility with futures. You can stay active when others cannot. Many people ask, when do after hours trading end mst? For stocks and ETFs, it ends at 6:00 p.m., but futures keep moving. This gives you more ways to manage risk and react to news.

Key Takeaways

- Futures let you trade almost 24 hours a day, giving you more chances to react to news and manage risk than stocks or ETFs.

- Stocks and ETFs have limited trading hours, with after hours ending at 6:00 p.m. MST, so you must wait until the next day to trade after that time.

- Trading futures requires a special margin account and a higher minimum deposit, while stocks and ETFs need only a standard brokerage account with lower deposits.

- Futures markets usually have stronger liquidity and tighter spreads after hours, helping you enter and exit trades more easily than stocks or ETFs.

- If you want flexibility and fast action outside regular hours, futures suit you best; if you prefer simplicity and lower risk, stocks and ETFs work well.

Trading Hours MST

Image Source: unsplash

Futures

You can trade futures almost any time you want. Futures trading hours run nearly 24 hours a day, six days a week. This means you do not have to wait for the regular stock market hours to open. If you live in the mountain time zone, you can react to global news or price changes at night or early in the morning. Futures markets open on Sunday at 4:00 p.m. MST and close on Friday at 3:00 p.m. MST, with a short break each day from 3:00 p.m. to 4:00 p.m. MST. This schedule gives you more flexibility than stocks or ETFs. You can manage your trades when others cannot. Many traders like this because they can adjust their positions almost any time.

Note: Futures trading hours let you respond to events that happen outside the usual U.S. business day.

Stocks

Stocks have much shorter trading hours. The main session for stocks runs from 7:30 a.m. to 2:00 p.m. MST. After hours trading for stocks starts at 2:00 p.m. and ends at 6:00 p.m. MST. You cannot buy or sell stocks outside these times. If you want to trade before the market opens, you can use pre-market trading, which usually starts at 5:00 a.m. MST. However, most people find the after hours trading window more useful. You need to plan your trades around these set times. If big news breaks after 6:00 p.m. MST, you must wait until the next session.

ETFs

ETFs follow the same trading hours as stocks. You can trade ETFs during the main session from 7:30 a.m. to 2:00 p.m. MST. After hours trading for ETFs also runs from 2:00 p.m. to 6:00 p.m. MST. Pre-market trading for ETFs starts at 5:00 a.m. MST. Like stocks, you cannot trade ETFs outside these windows. This limited access can make it hard to react quickly to news or price changes that happen overnight. You may miss out on opportunities if you only trade ETFs.

| Asset Class | Main Session (MST) | Pre-Market Trading (MST) | After Hours Trading (MST) | Nearly 24-Hour Access |

|---|---|---|---|---|

| Futures | 4:00 p.m. Sun - 3:00 p.m. Fri | N/A | N/A | Yes |

| Stocks | 7:30 a.m. - 2:00 p.m. | 5:00 a.m. - 7:30 a.m. | 2:00 p.m. - 6:00 p.m. | No |

| ETFs | 7:30 a.m. - 2:00 p.m. | 5:00 a.m. - 7:30 a.m. | 2:00 p.m. - 6:00 p.m. | No |

When Do After Hours Trading End MST

You might wonder, when do after hours trading end mst? For both stocks and ETFs, after hours trading ends at 6:00 p.m. MST. This rule stays the same every trading day. If you want to trade after this time, you must wait until pre-market trading starts at 5:00 a.m. MST the next day. Futures do not have this limit. You can keep trading futures almost all night and early morning. This difference matters if you want to manage risk or take action when news breaks late. When do after hours trading end mst? Always remember, for stocks and ETFs, it is 6:00 p.m. MST. For futures, you have nearly 24-hour access, so you do not face the same cutoff.

Tip: If you need to trade outside regular hours, futures give you more options than stocks or ETFs. When do after hours trading end mst? For most assets, it is 6:00 p.m. MST, but futures keep going.

After Hours Trading Access

Platforms

You need the right platform to trade after hours. Most online brokers let you trade stocks and ETFs during after hours trading. Some popular platforms include TD Ameritrade, E*TRADE, and Charles Schwab. These platforms offer access to both regular and extended-hours trading. If you want to trade futures, you need a broker that supports futures markets. Examples include Interactive Brokers and NinjaTrader. Futures platforms often give you more tools for risk management and order types. You should check if your broker allows after hours trading for the asset you want.

Tip: Not all platforms support every type of after hours trading. Always check the trading hours and available markets before you open an account.

Account Types

Your account type matters for after hours trading. Most brokers let you trade stocks and ETFs after hours with a standard brokerage account. You do not need a special account for pre-market trading or extended-hours trading. For futures, you need a margin account that meets certain requirements. Futures trading often needs a higher minimum deposit, sometimes around $1,500 USD or more. Some brokers may ask for more, depending on the futures contract. You should also know that futures accounts have different rules for margin and risk.

| Asset Class | Account Needed | Minimum Deposit (USD) |

|---|---|---|

| Stocks/ETFs | Standard Brokerage | $0 - $500 |

| Futures | Margin/Futures Account | $1,500+ |

Order Flexibility

Order flexibility changes between futures, stocks, and ETFs during after hours trading. You can place limit orders for stocks and ETFs, but market orders may not work outside regular trading hours. Some platforms only allow certain order types during extended-hours trading. Futures markets give you more flexibility. You can use limit, market, stop, and other advanced orders almost any time the market is open. This helps you react to price changes quickly, even at night. You get more control over your trades in futures, especially when news breaks outside normal trading hours.

Note: Always review your broker’s rules for order types during after hours trading. Some orders may not fill until the next session.

Liquidity

Image Source: pexels

Futures After Hours

You get strong liquidity in futures markets, even during late hours. Many traders around the world trade futures almost all day. This means you can often find someone to take the other side of your trade. Futures markets use central exchanges, so prices stay clear and fair. You see deep order books, which helps you enter and exit trades quickly. Even if you trade at night, you can usually get your order filled close to the price you want. This makes futures a good choice if you need to react to news or manage risk outside normal hours.

Stocks and ETFs After Hours

Liquidity drops when you trade stocks and ETFs after the main session. Fewer buyers and sellers take part in after hours trading. You may find it hard to buy or sell large amounts without moving the price. Sometimes, you wait longer for your order to fill. Prices can jump more because there are fewer trades. You might see bigger gaps between the price you want and the price you get. This can make trading riskier if you need to act fast.

Spreads and Execution

You should know that spreads and execution change a lot after hours. Research shows that after hours trading often has wider bid-ask spreads and higher price swings. Here are some key points:

- Bid-ask spreads for popular stocks almost double after hours compared to regular sessions.

- Small trades can move prices more, making it harder to get the price you expect.

- Brokerage firms often require you to use limit orders to protect you from big price changes.

- Even with lower commissions, the cost of trading can rise because of wide spreads.

- After hours markets have fewer participants, so you may not get your order filled right away.

Note: Wider spreads and lower liquidity can make after hours trading more expensive and less predictable.

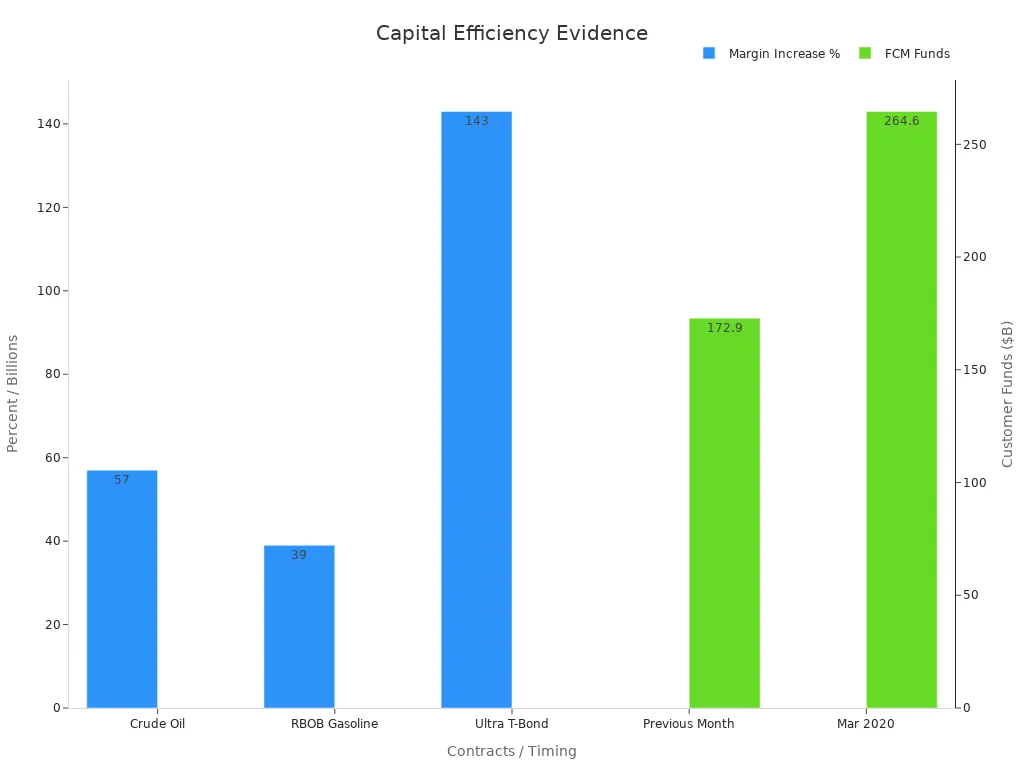

Capital Efficiency

Futures Margin

You can trade futures with much less money than you need for stocks or ETFs. Futures use margin, which means you only put up a small part of the contract’s value. This lets you control a large position with less cash. During times of high market risk, margin requirements can change quickly. For example, in March 2020, crude oil margin requirements jumped by 57%, RBOB gasoline by 39%, and ultra T-bond margins by 143%. Futures Commission Merchants (FCMs) also held more customer funds, rising from $172.9 billion to $264.6 billion in just one month—a 53% increase. These changes show how futures markets adjust to risk and help you use your capital more efficiently.

| Futures Contract | Margin Increase (%) |

|---|---|

| Crude Oil | 57% |

| RBOB Gasoline | 39% |

| Ultra T-Bond | 143% |

| FCM Customer Funds | +53% (to $264.6B) |

Note: Futures margin lets you react fast to market changes, but you must watch for sudden increases in requirements.

Stocks and ETFs Margin

When you trade stocks or ETFs, you usually need to pay for the full price or use margin with strict rules. Most brokers let you borrow up to 50% of the stock’s value. This means you need to put up at least half the money yourself. If the price drops, you might face a margin call and need to add more cash. Stocks and ETFs do not adjust margin requirements as quickly as futures. You have less flexibility to use your capital, especially during fast market moves.

- You pay more upfront for stocks and ETFs.

- Margin calls can force you to sell at a loss.

- Brokers set fixed margin rates, which rarely change overnight.

Efficiency Comparison

Futures give you more capital efficiency because you can control bigger positions with less money. You can adjust your trades quickly when the market changes. Stocks and ETFs require more cash and offer less flexibility. If you use futures, you face daily mark-to-market margin checks. This can lead to forced selling if prices fall. Stocks and ETFs let you hold positions longer, but you cannot use as much leverage.

Some traders use strategies to boost efficiency. For example, the MSTR Strategy uses debt and new shares to increase exposure to assets like Bitcoin. This approach helped achieve a BTC Yield KPI of about 14% by May 2025, with a goal of 25% for the year. This shows how financial engineering can make capital work harder for you. If you want to maximize your capital, futures offer more flexibility, but you must manage risk carefully. Stocks and ETFs provide stability, but you need more cash to trade the same size.

Costs

Commissions

You pay commissions when you trade futures, stocks, or ETFs. Each broker sets its own rates. For stocks and ETFs, many brokers now offer zero-commission trades. You can buy or sell shares without paying a fee. Some brokers, like TD Ameritrade and Charles Schwab, use this model. Futures trading usually comes with a commission per contract. The fee often ranges from $0.50 to $2.00 per side, per contract. Some brokers may also charge a clearing fee. You should always check your broker’s fee schedule before you trade.

Tip: Even if you see “zero commission,” you may still pay other costs, such as exchange or regulatory fees.

| Asset Class | Typical Commission (USD) | Notes |

|---|---|---|

| Stocks | $0 | Some brokers may charge fees |

| ETFs | $0 | Some brokers may charge fees |

| Futures | $0.50 - $2.00/contract | Plus exchange/clearing fees |

Spreads

The spread is the difference between the price you can buy and the price you can sell. You pay this cost every time you trade. In after hours trading, spreads often get wider. Stocks and ETFs can have much larger spreads after 6:00 p.m. MST. You may pay more to enter or exit a trade. Futures usually keep tighter spreads, even late at night. This happens because more people trade futures around the clock. You should always look at the spread before you place an order.

- Wider spreads mean higher trading costs.

- Tight spreads help you save money.

After Hours Trading Fees

Some brokers charge extra fees for after hours trading. You may see a small surcharge per trade. This fee covers the extra risk and lower liquidity during these times. Not all brokers charge this fee, but you should check before you trade. Futures brokers rarely add extra fees for trading at night. Stock and ETF brokers may add a fee of $0.005 to $0.01 per share for after hours trades. Always read your broker’s fee schedule.

Note: Fees can change. Always review your broker’s latest pricing before you trade after hours.

Pros and Cons

Futures

Futures give you almost full-day access to the markets. You can trade during most hours, even when stocks and ETFs are closed. This flexibility helps you react to news and manage risk at any time. Futures markets often have strong liquidity, so you can enter or exit trades quickly. You also use margin, which lets you control large positions with less cash.

However, futures trading can be complex. Academic studies show that investor sentiment can make prices more volatile and increase trading costs. You may see bigger price swings and wider spreads, especially during market stress. High fees and the need to pick skilled managers can lower your returns. Some managed futures strategies are simple, but others seem complicated. Liquidity can drop if many traders try to exit at once.

Note: Futures can offer high returns and diversification, but you must watch for higher costs and sudden changes in market conditions.

Stocks and ETFs

Stocks and ETFs have set trading hours. You can only trade during the main session or after hours trading, which ends at 6:00 p.m. MST. This schedule limits your ability to react to late news. Liquidity drops after the main session, so you may face wider spreads and slower order fills. Most brokers offer zero commissions, which helps lower your costs.

Stocks and ETFs are easier to understand and manage. You do not need to worry about sudden margin changes. However, you need more cash to trade the same size as futures. After hours trading for stocks and ETFs can be risky because of low liquidity and bigger price gaps.

| Asset Type | Pros | Cons |

|---|---|---|

| Futures | Nearly 24-hour access, strong liquidity, margin efficiency | Higher complexity, volatile prices, higher fees |

| Stocks & ETFs | Simpler to manage, zero commissions, familiar products | Limited trading hours, low after hours liquidity |

Best Fit for MST Traders

If you want to trade outside regular hours, futures may fit you best. Research shows that markets with longer trading hours and high liquidity, like Bitcoin and futures, help you get better prices and more information. You can adjust your portfolio at any time, which is important if you live in the MST zone. Stocks and ETFs work well if you prefer simple products and do not need to trade late. You should choose based on your need for flexibility, your comfort with risk, and your trading style.

Tip: If you value continuous access and fast execution, futures offer more options for MST traders. If you want lower risk and easy management, stocks and ETFs may suit you better.

You see clear differences in trading hours, liquidity, and access between futures, stocks, and ETFs. Futures let you trade almost 24 hours, while stocks and ETFs have set windows. If you want to react to news at any time, futures may fit you best. Use this table to compare your options:

| Asset | Trading Hours | Liquidity | After Hours Access |

|---|---|---|---|

| Futures | Nearly 24/6 | High | Yes |

| Stocks/ETFs | Limited | Lower after hours | Yes (until 6:00 p.m. MST) |

- Review your trading style and risk tolerance.

- Try platforms like Interactive Brokers for reliable after hours trading.

- Stay informed with resources like the tastylive newsletter for real-time ideas.

FAQ

What is the main advantage of trading futures after hours in MST?

You get nearly 24-hour access to futures markets. This lets you react to news and price changes any time, even when stocks and ETFs are not trading.

Can you trade stocks or ETFs after 6:00 p.m. MST?

No, you cannot. After hours trading for stocks and ETFs ends at 6:00 p.m. MST. You must wait until pre-market trading starts at 5:00 a.m. MST the next day.

Do you need a special account to trade futures after hours?

Yes, you need a margin or futures account. Most brokers require a minimum deposit, often around $1,500 USD. Always check your broker’s rules before you start.

Are trading costs higher after hours?

Note: You may pay higher costs after hours because spreads get wider and liquidity drops. Some brokers also charge extra fees for after hours trades. Always review your broker’s fee schedule.

Elevate your trading strategy with BiyaPay! Our multi-asset wallet enables fee-free USDT conversions to fiat currencies like USD, with a 0.5% fee for overseas bank transfers, empowering you to trade US/HK stocks swiftly in response to market news. Register in 1 minute to bypass complex overseas account setups, with futures support coming soon.

BiyaPay’s secure, cost-effective platform keeps you agile in dynamic markets. Take control—visit BiyaPay to register and optimize your trades today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.