- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Key Information and Complete Guide to Opening an Account with Hang Seng Bank for Those Under 18

Image Source: pexels

Do you want to help your child open an account with Hang Seng Bank in Hong Kong? As long as you are a parent or guardian, accompany them in person, and prepare the relevant documents, you can proceed with the process. Hang Seng Bank offers Family+ and Integrated Accounts for minors, with no minimum balance requirement and no service fees. Don’t forget to book an appointment at a branch in advance; student proof and address proof are also important.

Common questions include:

- What documents are needed?

- How to prove student status?

- What are the requirements for opening an account with Hang Seng Bank?

- How many children can a guardian open accounts for simultaneously?

Key Takeaways

- Students under 18 can apply for a Family+ or Integrated Account with Hang Seng Bank, with no minimum balance or service fees, making it convenient for learning financial management.

- Account opening requires a parent or guardian to accompany and prepare identification, student proof, and address proof to ensure complete documentation.

- It is recommended to book an appointment at a branch via the official website or app in advance to save waiting time and select the “minor account opening” service.

- A guardian can open accounts for up to four children simultaneously and has partial management authority to ensure fund safety.

- After turning 18, you need to visit a branch in person to upgrade to an adult account, gaining access to more banking services and higher withdrawal limits.

Eligibility Requirements

Age Requirements

Do you want to know at what age you can open an account with Hang Seng Bank? As long as you are under 18, you can apply for accounts designed specifically for teenagers. Hang Seng Bank currently offers Family+ Accounts and Integrated Accounts, both suitable for students and teenagers. You don’t need to worry about minimum balance or service fees. These accounts are mainly for students under 18, allowing you to start learning financial management early.

Student Status

If you are a student, you need to prove your student status when opening an account. You can prepare a student ID, a proof of enrollment letter issued by the school, or a recent report card. These documents can prove you are currently attending school. Hang Seng Bank will offer exclusive account benefits based on your student status. If you are an international student, you can also prepare relevant student proof, and as long as the documents are complete, the application will proceed smoothly.

Guardian Accompaniment

When opening an account, you must be accompanied by a parent or guardian. This is one of the requirements for opening an account with Hang Seng Bank. Each parent can open accounts for up to four children or grandchildren simultaneously. If you have siblings, you can go to the branch together to process the applications. The guardian needs to bring identification and address proof so the bank can verify the information. If you and your guardian prepare all the documents, the account opening process will be faster and smoother.

Hang Seng Bank Account Opening Requirements

Do you want to smoothly complete the Hang Seng Bank account opening requirements? As long as you prepare all the documents in advance, the account opening process will be very simple. Here, I will guide you step-by-step on what documents to bring and what to do in special circumstances.

Required Documents

You and your guardian need to bring the following documents. These are the most basic parts of Hang Seng Bank’s account opening requirements:

- Applicant’s (i.e., your) identification documents

- Hong Kong Identity Card (if available)

- Birth certificate (if you do not yet have an ID card)

- Guardian’s identification

- Hong Kong Identity Card or passport

- Guardian’s address proof

- Utility bill, bank statement, or government letter from the last three months

Reminder: If you and your guardian are not permanent Hong Kong residents, you may also need to bring a passport and entry proof.

You can refer to the table below for a quick check:

| Document Type | Applicant Needs to Bring | Guardian Needs to Bring |

|---|---|---|

| Identification | ✔️ | ✔️ |

| Birth Certificate | ✔️ | |

| Address Proof | ✔️ | |

| Student Proof | ✔️ |

Student Proof

Hang Seng Bank’s account opening requirements include providing proof of student status. You can choose one of the following:

- Valid student ID

- Proof of enrollment letter issued by the school

- Recent report card

If you are an international student, remember to bring your international school student ID or related proof. School letters should preferably have the school’s stamp to allow the bank to verify information more quickly.

It is recommended to request proof documents from your school in advance to avoid delays due to missing documents during account opening.

Address Proof

The guardian needs to provide address proof, which is an essential step in Hang Seng Bank’s account opening requirements. You can use the following documents:

- Utility bill (water or electricity) from the last three months

- Bank statement

- Government-issued letter

If you live with your guardian, their address proof can represent your address. If you are a boarding student, request a proof of residence or related letter from your school.

In some special cases, the bank may require additional documents. For example, for international students, dual citizenship, or when the guardian is not a parent, the bank will notify you based on the specific situation.

As long as you prepare these documents according to Hang Seng Bank’s account opening requirements, the process will be smooth. If you have any questions, it’s recommended to call the branch in advance to save time.

Account Opening Process

Image Source: pexels

Booking a Branch Appointment

Do you want to save waiting time at the branch? It’s recommended to book an appointment at a Hang Seng Bank branch via the official website or app first. This way, you can choose a time slot that suits you and avoid waiting in line. Based on the experience of other Hong Kong banks, such as KGI Bank’s digital application platform, pre-filling information can save about 20 minutes on average. Although Hang Seng Bank has not published similar data, booking in advance and preparing documents can indeed make the account opening process faster and smoother.

Reminder: When booking, remember to select the “minor account opening” service so branch staff can prepare the relevant forms in advance.

Visiting the Branch

After booking a time, you and your guardian just need to arrive at the branch on time. Remember to bring all the documents required by Hang Seng Bank, including identification, student proof, and address proof. Upon arrival, the counter staff will verify your appointment details and direct you to a designated counter. The atmosphere at the branch is usually relaxed, and the staff will guide you step-by-step, so you don’t need to worry about the process being too complicated.

Completing Forms and Review

At the counter, the branch staff will provide you and your guardian with account opening forms. You can fill them out on-site or pre-fill some information at home. The guardian will need to assist with filling out certain sections. Once completed, the bank will review all documents and information to ensure they meet Hang Seng Bank’s account opening requirements. If any documents are incomplete, the staff will remind you to provide the missing items.

Completing the Account Opening

Once all documents are verified, the branch staff will complete the account opening process for you. You will receive account details and a debit card (if applicable). Some account types also provide online banking login details. The entire process is usually not too long, and as long as you book in advance and prepare all documents, the account opening can be completed in one visit. You can immediately start using the new account to learn financial management and handle your pocket money.

Things to Note

Minimum Balance

You don’t need to worry about minimum balance issues. Hang Seng Bank’s accounts for those under 18 have no minimum balance requirement. Even if the account balance is only a few USD, the bank will not charge extra fees. This allows you to manage your pocket money with peace of mind without worrying about penalties for low balances.

Service Fees

When opening a Family+ or Integrated Account, Hang Seng Bank will not charge you service fees. Depositing, checking balances, and withdrawing money typically incur no fees. Fees may only apply in special cases (e.g., international transfers). You can check with the branch in advance to ensure no unnecessary fees are charged.

Withdrawal Limits

There are some restrictions on withdrawals. The debit card for a minor’s account has a lower daily withdrawal limit, typically not exceeding USD 500, with the exact amount subject to the bank’s announcement. This is to ensure the safety of your funds. If you need to withdraw a large amount, you can ask your guardian to assist at the branch.

Online Banking

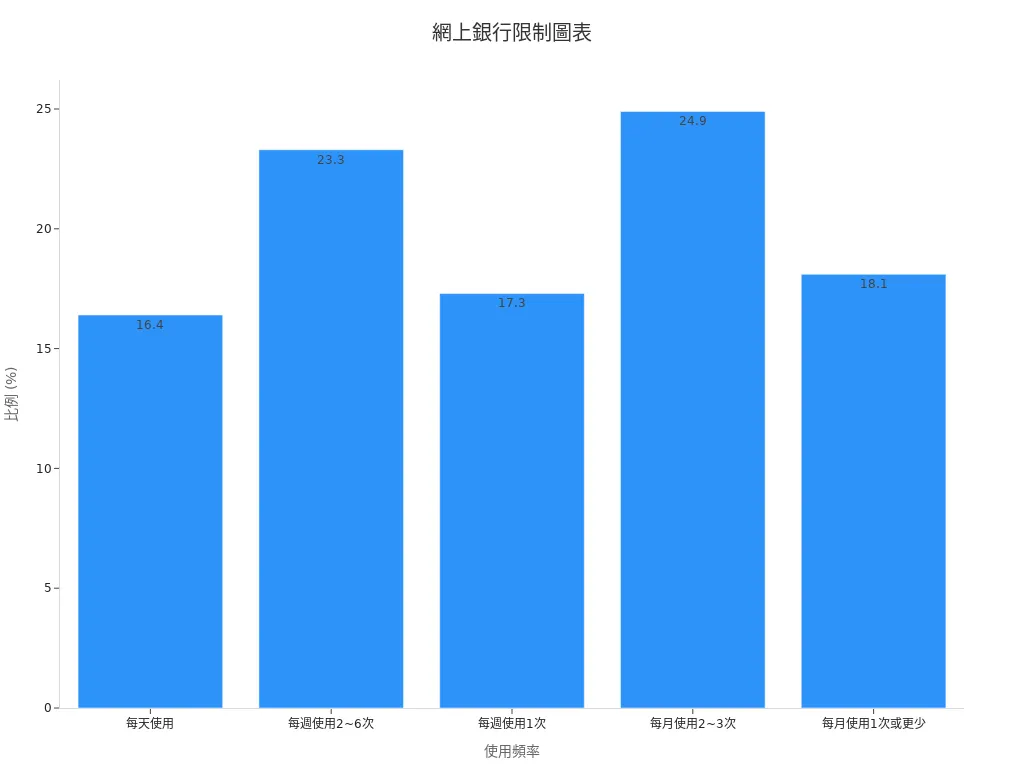

You can apply for online banking services, but the features will be limited. For example, some transfer or investment functions require guardian consent. According to surveys, the frequency distribution of young clients using online banking is as follows:

You will find that about 16.4% of young people use online banking daily, and 24.9% use it 2–3 times per month. These restrictions provide more security while you learn financial management and help avoid operational errors.

Guardian Authority

Your guardian will have partial management authority. They can help you set withdrawal limits, review account records, and even freeze the account if necessary. This ensures the safety of your funds. If you have any questions, you can ask your guardian to assist at any time.

Reminder: Once you turn 18, remember to visit the branch in person to upgrade to an adult account to access full banking services and greater autonomy.

Have you prepared all the documents? Remember to book a branch appointment and bring your guardian along. Hang Seng Bank’s accounts designed for those under 18 offer a convenient and secure financial management experience. If you have any questions, it’s recommended to contact the branch directly.

Make good use of Hang Seng Bank’s official website and customer service resources for a smoother and more secure account opening process!

FAQ

How much does it cost to open an account?

You don’t need to worry about account opening fees. Hang Seng Bank waives account opening fees for those under 18 and has no minimum balance requirement. You can open an account for free as long as you bring the required documents.

What if I don’t have a student ID?

You can ask your school to issue a proof of enrollment letter or bring a recent report card. These can prove your student status, and the bank will accept them.

Does the guardian have to be present?

Yes, the guardian must accompany you to the branch to process the application. The bank needs to verify the guardian’s information on-site to ensure your safety.

How many children can have accounts opened simultaneously?

Each guardian can open accounts for up to four children or grandchildren simultaneously. You can go to the branch with your siblings to save time and make it convenient.

Will the account automatically upgrade after turning 18?

No. After turning 18, you need to visit the branch in person to upgrade to an adult account to access more banking services and higher withdrawal limits.

A Hang Seng Bank account kickstarts your teen’s financial journey, but why not unlock global opportunities with smarter tools? BiyaPay offers YueBao and YuUBao wealth products with a 5.48% annualized yield and deposit-withdrawal flexibility, perfect for young savers seeking growth. With real-time exchange of 30+ fiat currencies (like USD, HKD) and 200+ cryptocurrencies , plus transfer fees as low as 0.5%, BiyaPay makes overseas payments like tuition a breeze.

Licensed by FinCEN (USA) and FINTRAC (Canada), it ensures top-tier security. Sign up in minutes with a beginner-friendly platform. Join BiyaPay now to manage funds effortlessly, and start today to empower your teen’s financial future with confidence!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.