- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Should you consider Trump Media stock after its 2025 losses

Image Source: pexels

Trump Media faces tough questions after its 2025 losses. Many investors worry about the sharp drop in value and the risks shown in trump stock news. Some see the recent financial results as a warning sign. Others point to the company’s cash reserves and stock buyback as reasons for hope. Still, the investment case for trump media depends on how much risk someone can accept. Investors should compare trump media with other options before making a choice.

Key Takeaways

- Trump Media faced big losses in 2025 but holds strong cash reserves of about $3 billion, giving it room to invest and manage risks.

- The company relies mostly on Truth Social for revenue, which is risky because user growth and advertising income remain low compared to competitors.

- Stock price dropped sharply over the past year, showing high volatility influenced by political news and social media trends.

- Trump Media is exploring new ventures like cryptocurrency and fintech, which could help diversify income if successful.

- Investors should weigh the high risks and ongoing losses against potential growth, and consider their own risk tolerance before investing.

Trump Stock News

Image Source: pexels

2025 Highlights

Trump stock news dominated headlines throughout 2025. The year began with a surge in optimism after the November 2024 election, but the mood quickly shifted. Trump media & technology group experienced a dramatic drop in share price, falling nearly 50% since the election and 56% since President Trump took office. The company reported $821,000 in revenue and a $32 million loss for Q1 2025. Despite these losses, Truth Social’s daily active users more than doubled to 359,000 in May, though this number remains far below competitors like X and Threads.

The company announced a $400 million stock buyback plan and pivoted toward cryptocurrency investments, including a $2.5 billion bitcoin treasury and a bitcoin ETF. Investor sentiment remained mixed. Many investors expressed skepticism about the company’s fundamentals and dilution of shares, while others saw potential in Trump’s political influence and the company’s $3 billion cash reserves. Experts like Steve Sosnick described the stock as expensive and money-losing, yet noted its ability to defy conventional metrics. Matthew Tuttle pointed to the crypto strategy as a key move, given doubts about Truth Social’s growth.

| Aspect | Details |

|---|---|

| Stock Performance | Trump Media stock dropped nearly 50% since November 2024 election; 56% decline since Trump took office in 2025 |

| Revenue & Losses | $821,000 revenue in Q1 2025; $32 million loss in Q1 2025 |

| User Base | Truth Social daily active users doubled (+106%) to 359,000 in May 2025; still much smaller than competitors (X: 131.9M, Threads: 112.9M, Reddit: 66.2M, Bluesky: ~3.6M) |

| Strategic Moves | Large stock buyback plan announced ($400 million); pivot to cryptocurrency investments including bitcoin ETF and $2.5 billion bitcoin treasury |

| Investor Sentiment | Skepticism due to poor fundamentals and diluted shares; cautious optimism tied to Trump’s political influence and large cash reserves ($3 billion) |

| Expert Opinions | Steve Sosnick: stock expensive and money-losing but defies conventional metrics; Matthew Tuttle: skeptical of growth in Truth Social, sees crypto push as key strategy |

| Political Context | Trump’s return to White House increased initial hype; Trump transferred stake to revocable trust managed by Donald Trump Jr.; crypto moves align with Trump’s pro-crypto stance |

Major Events and Volatility

Trump stock news in 2025 reflected extreme market swings. The share price saw sharp declines during periods of heightened volatility. In early April, the VIX index spiked by 30.8 points, reaching the 99.9th percentile of historical changes. The S&P 500 dropped 12.9% in the same week, while the 10-year Treasury yield jumped by 47 basis points. These moves matched the scale of past financial crises, such as 2008 and the COVID-19 pandemic in 2020.

| Indicator | Date Range | Size of Change | Historical Percentile |

|---|---|---|---|

| VIX | Apr 2-8, 2025 | +30.8 | 99.9th percentile |

| VIX | Mar 5-10, 2025 | +5.9 | 98.1th percentile |

| VIX | Feb 20-27, 2025 | +5.5 | 96.5th percentile |

| S&P 500 | Apr 2-8, 2025 | -12.9 | 99.9th percentile |

| S&P 500 | Mar 5-11, 2025 | -4.7 | 97.9th percentile |

| S&P 500 | Apr 14-21, 2025 | -4.7 | 97.8th percentile |

| 10-Year Treasury Yield | Apr 4-11, 2025 | +47 basis points | 99.8th percentile |

| 10-Year Treasury Yield | Jan 2-10, 2025 | +20 basis points | 93.6th percentile |

| 10-Year Treasury Yield | Feb 5-12, 2025 | +19 basis points | 93.4th percentile |

Financial reports from major banks noted that aggressive tariff announcements and geopolitical tensions, including a minor war between India and Pakistan, fueled uncertainty. These events contributed to the exceptional volatility seen in trump stock news. The magnitude of these swings placed 2025 among the most turbulent years for markets in recent history. Investors tracked trump media closely, as each new headline had the potential to move the share price sharply.

Trump Media & Technology Group Fundamentals

Revenue and Losses

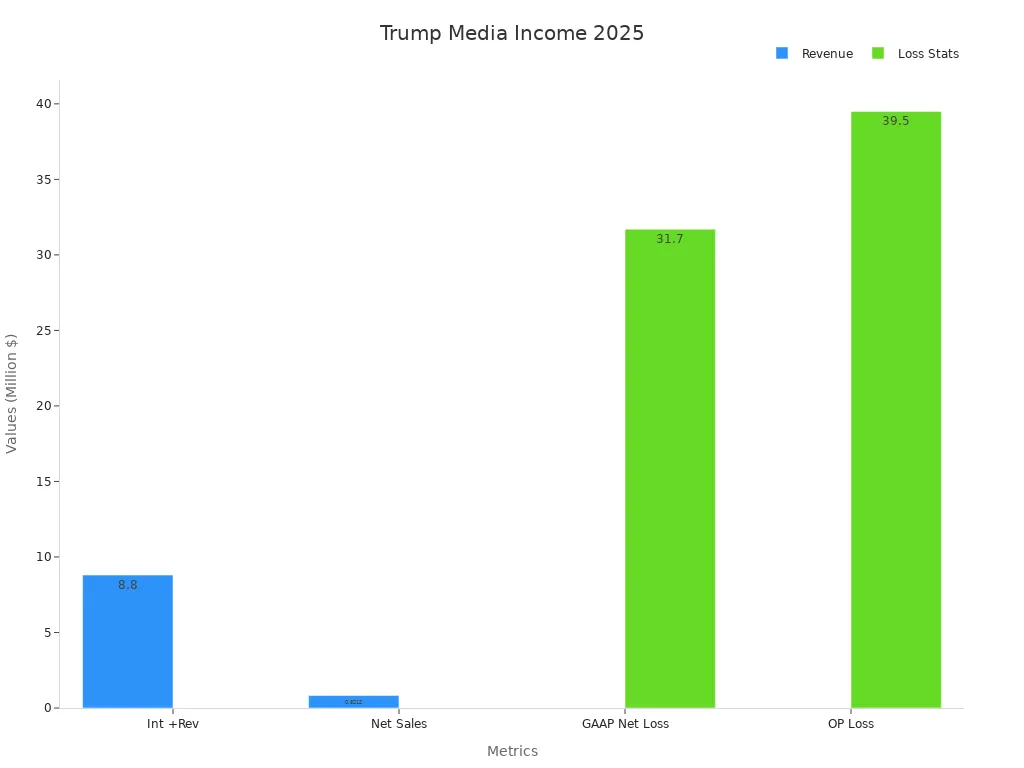

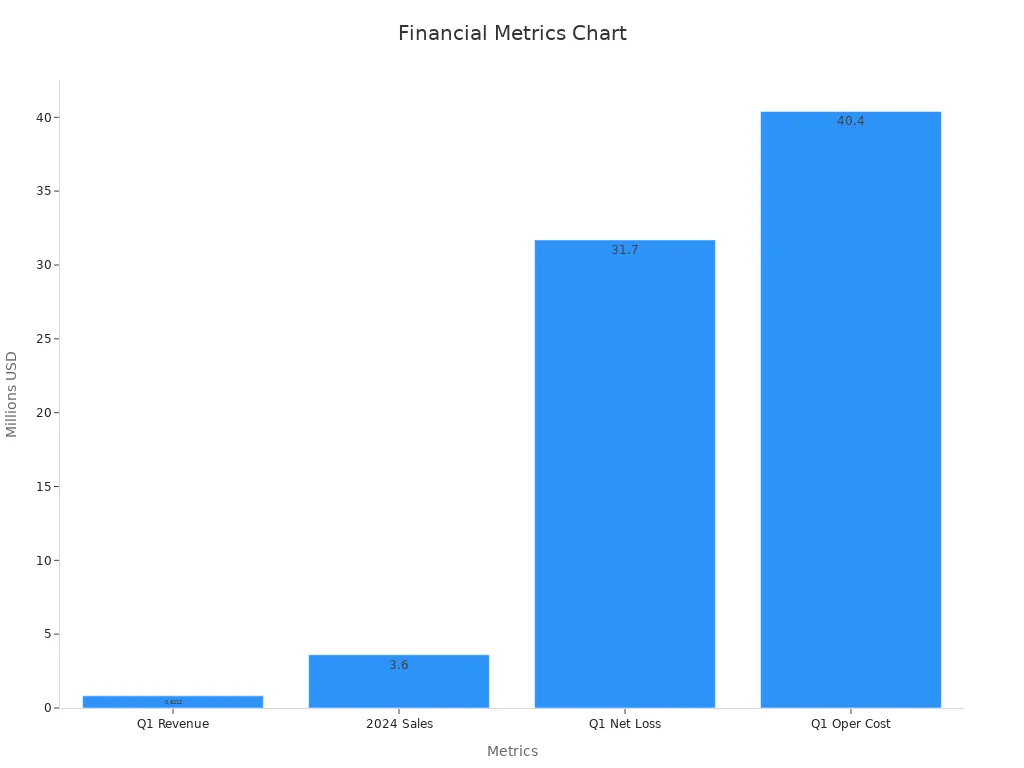

Trump Media & Technology Group reported net sales of $821,200 in Q1 2025. This figure shows a 6.6% increase compared to the same period last year. The company posted a GAAP net loss of $31.7 million, which marks a significant improvement from the $327.6 million loss in Q1 2024. Operating loss reached $39.5 million, reflecting ongoing challenges in company performance. The company continues to rely on Truth Social as its main source of revenue. Legal fees rose to $10.9 million due to merger-related disputes and reincorporation costs. Despite these expenses, the operating cash outflow remained low at $9.7 million, giving the company a long financial runway.

| Metric | Q1 2025 Figure | Notes/Comparison |

|---|---|---|

| Net Sales | $821,200 | 6.6% year-over-year increase |

| GAAP Net Loss | $31.7 million | Improved from $327.6M loss in Q1 2024 |

| GAAP Operating Loss | $39.5 million | Ongoing operational challenges |

| Operating Cash Outflow | $9.7 million | Low cash burn |

| Legal Fees | $10.9 million | Merger and reincorporation costs |

| Non-cash Expenses | $19.6 million | Stock-based compensation, depreciation |

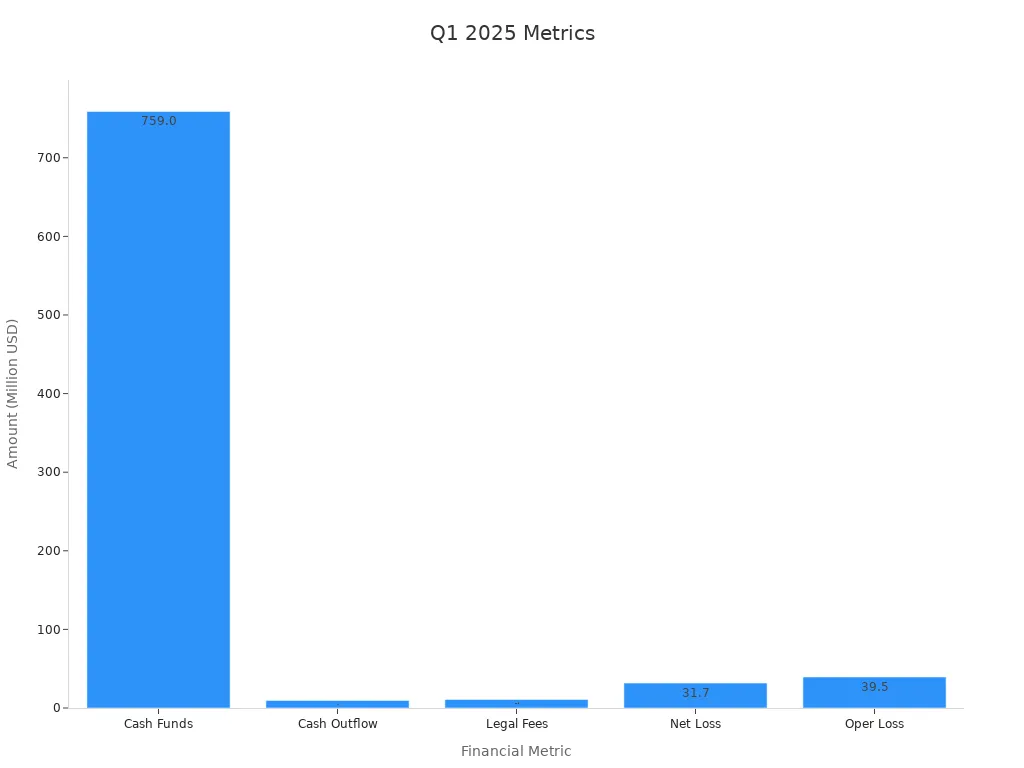

| Cash and Investments | $759.0 million | Over 20 quarters of runway |

Note: The company’s financial results show improvement, but the path to profitability remains uncertain.

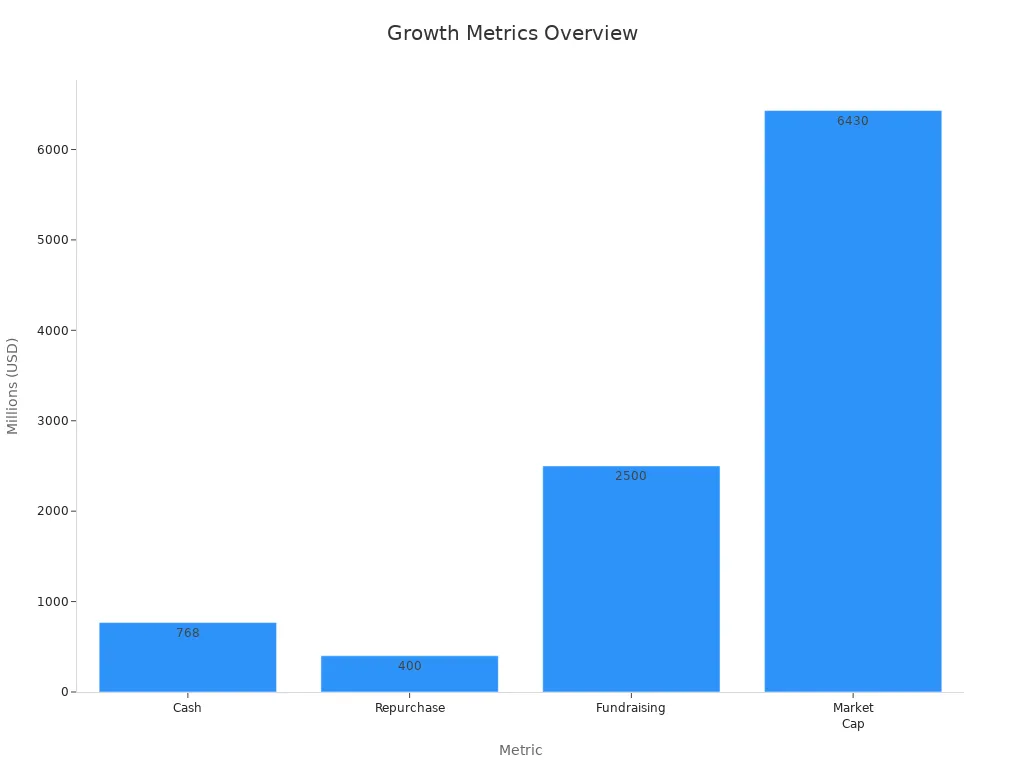

Cash Position and Buyback

Trump Media holds a strong cash reserve of about $3 billion. This financial strength allows the company to authorize a $400 million stock buyback program. The buyback takes place through open market transactions, with repurchased shares retired. Management aims to stabilize the stock price and boost shareholder confidence. CEO Devin Nunes described the buyback as a sign of trust in the company’s direction. The buyback does not affect the company’s $2.5 billion Bitcoin treasury strategy. Despite modest revenue and past losses, the large cash reserve gives trump media flexibility for future plans. The company’s reliance on Truth Social for most of its revenue remains a key risk for long-term growth.

| Aspect | Details |

|---|---|

| Cash Reserves | Approximately $3 billion on balance sheet |

| Stock Buyback Authorization | Up to $400 million approved by Board of Directors |

| Buyback Method | Open market transactions with repurchased shares retired |

| Relation to Bitcoin Strategy | Buyback funded separately; does not affect $2.5 billion Bitcoin treasury |

| Purpose of Buyback | Enhance shareholder value and potentially increase EPS |

| Management Confidence | CEO and Board express confidence in company’s strategic direction |

Current Price of Trump Media & Technology Group

Price Trends

The current price of trump media & technology group stands at $17.40 per share. Over the past year, the share price has dropped by more than 52%. In the last six months, the decline reached almost 53%, and the year-to-date loss is about 49%. The share price is now down roughly 68% from its peak last fall. Market capitalization sits near $4.8 billion, but the company reports negative earnings per share of -$0.51 and a net income loss of about $400.86 million USD. These numbers point to weak financial health and negative investor sentiment.

- The share price fell 25.96% in the last month.

- Announcements about capital raises and dilution led to brief price spikes, but these gains did not last.

- Social media promotions by Trump caused short-term jumps, sometimes up to 22% in a day, but the overall trend remains downward.

- Technical analysis shows a falling wedge pattern, which some see as a possible sign of a future reversal, but the current direction is still negative.

Note: The company’s revenue remains very low, at about $3.62 million USD, compared to its large losses. This weak performance weighs on stock valuation.

| Metric | Value |

|---|---|

| 1 Year Total Return | -52.63% |

| Market Capitalization | ~$3.8 billion |

| Price-to-Sales (PS) Ratio | 957.64 |

| Price to Book Value | 4.305 |

| Dividend | None |

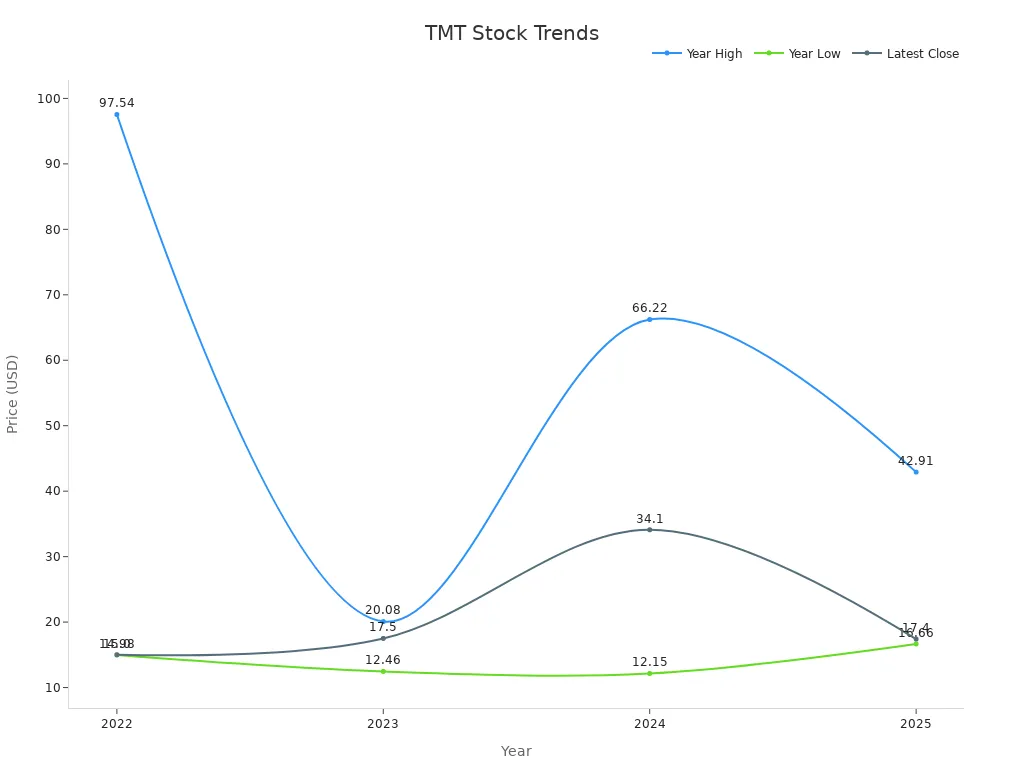

Comparison to Highs and Lows

Trump media & technology group has seen dramatic swings in its share price. The all-time high closing price reached $97.54 in March 2022. In 2025, the 52-week high was $54.68, which is more than double the current price. The 52-week low sits at $11.75, about 32% below the latest close. These numbers show high volatility and sharp declines from previous highs.

| Year | Year High | Year Low | Latest Close | Annual % Change |

|---|---|---|---|---|

| 2022 | 97.54 | 14.98 | 15.00 | -70.83% |

| 2023 | 20.08 | 12.46 | 17.50 | 16.67% |

| 2024 | 66.22 | 12.15 | 34.10 | 94.86% |

| 2025 | 42.91 | 16.66 | 17.40 | -48.97% |

The current price of trump media & technology group reflects ongoing negative revenue growth and underperformance compared to industry peers. Investors continue to watch for signs of a turnaround, but the stock valuation remains under pressure.

Risks and Concerns

Image Source: unsplash

Single Revenue Source

Trump Media depends almost entirely on advertising revenue from Truth Social. This heavy reliance creates a major risk for the company. If user growth slows or advertisers pull back, the company’s main income stream could shrink quickly.

- Advertising revenue from Truth Social makes up most of the company’s total income.

- The company reported a net loss of about $400.9 million in 2024, following another year of losses.

- The 2024 annual report highlights a limited operating history and warns about the uncertainty of reaching profitability.

- The market value dropped from nearly $8 billion at the IPO in March 2024 to about $4.5 billion by mid-March 2025.

This pattern shows how a single revenue source can make the company’s financial position unstable and vulnerable to sudden changes.

Ongoing Losses

Trump Media continues to post large losses. The company’s financial statements show negative results across several key metrics.

| Metric | Value |

|---|---|

| Net Loss (last 12 months) | $-104.99 million |

| Loss Per Share | -$0.52 |

| Operating Income | -$124.64 million |

| Operating Cash Flow | -$61.40 million |

| Free Cash Flow | -$66.44 million |

| Return on Equity (ROE) | -19.06% |

| Return on Assets (ROA) | -13.06% |

| Return on Invested Capital (ROIC) | -13.37% |

| 52-Week Stock Price Change | -55.67% |

The company expects these losses to continue as it invests in technology and business development. Auditors have warned about the risk of not being able to continue as a going concern. This ongoing negative trend puts pressure on the company’s financial health and stock price.

Regulatory and Market Risks

Trump Media faces a complex regulatory environment. State-level privacy laws and changing economic policies create uncertainty for digital advertising. The company also requested the SEC to investigate large short positions, raising concerns about possible stock manipulation.

Market analysts describe the environment as unstable, with volatility driven by unpredictable policymaking and social media-driven trading. The stock price often reacts sharply to political news and trading activity. For example, shares dropped nearly 7% to $13.73 on the first day insiders could sell, and the price can swing 10% or more after major political events.

Note: Real-time sentiment on platforms like Twitter can move the stock before financial results are released, making risk management even more challenging.

Potential Upside

Cash Reserves

Trump Media holds a strong cash position. As of early 2025, the company reports cash reserves between $759 million and $777 million USD. This financial buffer gives the company flexibility to weather losses and invest in new projects. The board has authorized up to $400 million USD for share repurchases. This move signals management’s confidence and may help support the stock price during periods of volatility.

| Metric/Opportunity | Details |

|---|---|

| Cash Reserves | $759M–$777M USD as of early 2025 |

| Share Repurchase Authorization | Up to $400M USD for buybacks |

| Convertible Notes & Fundraising | $2.5B USD raised, including 0% convertible senior notes due 2028 |

| Market Capitalization | $6.43B USD as of February 2025 |

The company’s fundraising efforts, including $2.5 billion USD in convertible notes, further strengthen its capital base. These resources allow Trump Media to pursue growth even as it faces ongoing losses.

New Ventures

Trump Media seeks to expand beyond social media. The company has announced plans for crypto ventures and fintech products. Through the Truth.Fi platform, Trump Media aims to offer blockchain ETFs and other financial services. Partnerships with firms like Crypto.com show a commitment to innovation. Management also explores mergers and acquisitions to diversify revenue streams and drive future growth.

Note: New ventures could open up additional income sources, but success depends on execution and market acceptance.

Brand and User Growth

The Trump brand remains a powerful asset. Truth Social reached 9 million sign-ups by early 2024, showing user growth potential. Daily active users more than doubled in 2025, although the platform still trails major competitors. Technical indicators suggest the stock may be near breakout points, with increased trading volume after major announcements.

- The company’s market presence and brand recognition attract attention.

- Active exploration of mergers and acquisitions could boost user numbers and expand the business.

While these positives offer hope, Trump Media still faces risks. The company relies on a single revenue source and has not yet achieved profitability. Investors should weigh the upside against these ongoing challenges.

DJT Stock Price Prediction

Analyst Targets

Analysts have released a wide range of djt stock price prediction figures for 2025 and beyond. The current share price stands at $17.40 as of late June 2025. Some forecasts suggest a steady climb, with monthly predictions rising from $39 in January to $56 by December. Long-term analyst targets show even more dramatic growth. By early 2026, average price targets reach $270, and by 2029, some estimates exceed $920. These numbers represent a potential increase of over 1,400% in just a few years. Technical analysis provides mixed signals. The 3-month MACD shows a buy signal, but moving averages point to a negative short-term outlook. Most analysts expect the stock to trade between $14.85 and $24.31 over the next three months, with daily swings of about 6%. The djt stock price prediction remains highly volatile, and support levels near $17.32 may attract buyers.

Note: The djt stock price prediction for 2025 reflects both optimism about new ventures and caution due to recent losses.

Bull and Bear Scenarios

The djt stock price prediction depends on several factors. Investors see both bullish and bearish paths for the stock.

- Bullish Scenario:

- Economic optimism among Trump supporters could boost demand.

- Pro-growth policies may help cyclical industries outperform.

- A successful launch of new crypto and fintech products could drive revenue higher.

- The company’s strong cash reserves provide a safety net for expansion.

- Bearish Scenario:

- Weak technical indicators, such as declining Advance-Decline Lines, signal caution.

- Commodity ratios remain flat, showing little global economic strength.

- If new ventures fail or user growth stalls, the stock could face more losses.

- High valuations and ongoing volatility may limit upside.

Market sentiment often shifts quickly, especially around political events. Social media activity and partisan views can drive sharp price moves. The djt stock price prediction reflects this uncertainty, with a wide range of possible outcomes. Investors should watch for changes in user growth, regulatory news, and the success of new business lines when making any prediction.

Investment Decision

Risk-Reward Balance

Trump Media presents a unique risk-reward profile for investors. The company holds significant cash reserves and has launched a large stock buyback, which can support the share price during periods of volatility. However, the business continues to post large losses and relies almost entirely on advertising revenue from Truth Social. The lack of revenue diversification increases the risk, especially if user growth slows or advertisers reduce spending.

Market volatility remains a defining feature of Trump Media stock. Research shows that political statements, especially those related to foreign policy or trade, can trigger sharp but short-lived swings in the stock price. This pattern adds uncertainty to any investment prediction and makes risk management more challenging. Investors must consider that the stock often reacts to news and social media sentiment rather than company fundamentals.

Professional risk assessment tools can help investors evaluate Trump Media’s risk profile. These include:

- Correlation analysis using copula models to capture extreme market events.

- Position-based risk measurement systems that track exposures in real time.

- Simulation tools for scenario analysis and stress testing.

- Volatility measures such as skewness, kurtosis, and maximum drawdown.

- Benchmarking frameworks like public market equivalent (PME) analysis.

- Ongoing risk monitoring with dashboards and risk thresholds.

These models provide a deeper understanding of potential outcomes and help validate the investment decision against market alternatives.

Investors should weigh the potential for a turnaround against the ongoing losses and high volatility. For those seeking long-term investment potential, Trump Media may appeal only to those with a high risk tolerance and a belief in the company’s ability to diversify and grow.

Alternatives

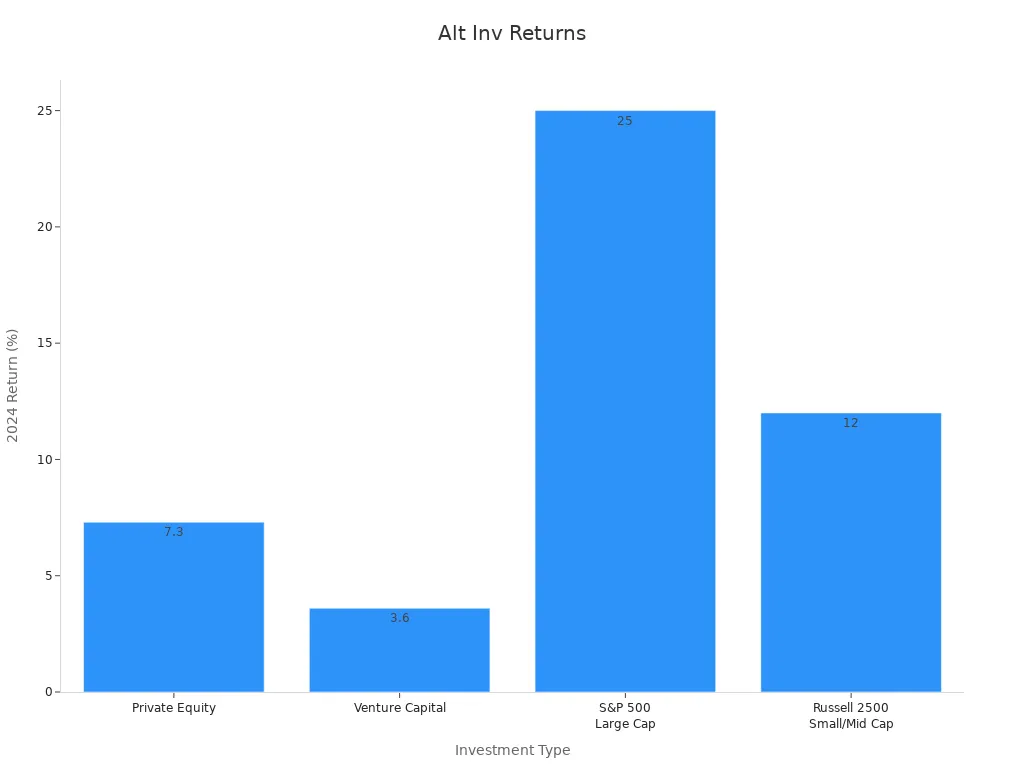

Investors looking for growth or stability have several alternatives to Trump Media. The table below compares the 2024 performance of major asset classes:

| Investment Type | 2024 Return (%) | Comparison to Public Markets | Outlook / Notes |

|---|---|---|---|

| Private Equity | 7.3 | Underperformed large-cap S&P 500 (25%) and small/mid-cap Russell 2500 (12%) | Headwinds from trade policy uncertainty and prolonged higher interest rates may delay investments and reduce cash flows. |

| Venture Capital | 3.6 | Modest returns, improved from -3% in 2023 | Faces ongoing headwinds but shows some recovery. |

| Private Credit | N/A | Lagged public markets despite increased fundraising | Economic uncertainty impacts investment pace. |

| Hedge Funds | N/A | Poor alpha generation year-to-date | Potential opportunities exist amid macroeconomic and political changes. |

| Commercial Real Estate | N/A | Outlook optimistic, especially residential sector | Relatively immune to tariffs, seen as a modest gain opportunity. |

| Public Markets (S&P 500 large-cap) | 25 | Benchmark for comparison | Strong performance relative to alternatives. |

| Public Markets (Russell 2500 small/mid-cap) | 12 | Benchmark for comparison | Moderate performance relative to alternatives. |

Public markets, especially the S&P 500, delivered strong returns in 2024. Private equity and venture capital lagged behind, affected by policy uncertainty and higher interest rates. Commercial real estate, particularly in the residential sector, showed resilience and modest gains. Hedge funds and private credit struggled to outperform public benchmarks.

Investors who prefer lower volatility and more predictable returns may find public market indices or real estate more attractive. Those seeking higher growth can consider venture capital or private equity, but these options come with their own risks and require careful analysis.

When making an investment decision, investors should use robust risk models and compare the risk-reward balance of Trump Media to these alternatives. The choice depends on individual risk tolerance, investment goals, and belief in the company’s ability to deliver on its prediction for future growth.

Trump Media stock remains highly speculative after its 2025 losses. The company posted $821,200 in Q1 revenue, but 93% came from a single customer. Net losses reached $31.7 million, and operating costs stayed high. The balance sheet shows strong cash reserves, yet the stock trades at an elevated price-to-sales ratio. New products have not generated income. High volatility and political risk persist.

| Evidence Aspect | Details |

|---|---|

| Q1 Revenue (Truth Social) | $821,200, a 7% increase from prior year |

| 2024 Sales | $3.6 million, a 12% year-over-year decline |

| Q1 Net Loss | $31.7 million |

| Q1 Operating Costs | $40.4 million |

| Balance Sheet | Assets: $918.9 million; Liabilities: $27.2 million; Cash & equivalents: $759 million |

| Revenue Concentration | 93% of revenue from a single customer, posing significant risk |

| Financial Reporting Concerns | Material weakness in internal controls; lack of experienced accounting personnel |

| Stock Valuation (Price-to-Sales) | Elevated P/S ratio despite >50% drop from 52-week high, indicating overvaluation |

| Product Revenue Outlook | New products Truth+ and Truth.Fi not yet generating income, critical for future growth |

| Stock Price Volatility & Risks | High volatility and political dependence add to risk profile |

Investors with low risk tolerance may want to avoid this stock. Those who accept high risk and believe in future growth could consider a small position. Each investor should match decisions to personal goals and risk appetite.

FAQ

What makes Trump Media stock so volatile?

Trump Media stock reacts quickly to political news and social media trends. High trading volume and speculation drive large price swings. Investors should expect sudden changes in value, especially during major events.

Does Trump Media pay dividends?

Trump Media does not pay dividends. The company reinvests available cash into operations, buybacks, and new ventures. Investors seeking regular income may want to consider other stocks with established dividend policies.

How does Trump Media compare to other tech stocks?

Trump Media trades at a much higher price-to-sales ratio than most tech peers. The company relies on a single revenue source and posts ongoing losses. Many established tech firms show stronger revenue growth and more stable earnings.

What are the main risks for investors?

Key risks include heavy reliance on Truth Social, ongoing net losses, and regulatory scrutiny. The stock also faces high short interest and frequent price manipulation concerns. Investors should use caution and review risk models before investing.

Are there safer alternatives to Trump Media stock?

Yes. Investors can consider public market indices like the S&P 500, which showed strong returns in 2024. Real estate and established tech companies may offer more stability and predictable growth than Trump Media.

Concerned about Trump Media’s volatility? Diversify wisely with BiyaPay, a platform for trading US/HK stocks and cryptocurrencies in one account, no offshore accounts required. Convert USDT to USD or HKD for stock investments with real-time exchange rates, ensuring a seamless and transparent process.

BiyaPay’s transfer fees are as low as 0.5%, far surpassing traditional providers, backed by FinCEN (USA) and FINTRAC (Canada) licenses for secure trading. Sign up in minutes with a beginner-friendly interface. Join BiyaPay now to balance your portfolio! Start with BiyaPay today to explore new market possibilities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.