- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stocks to Buy Under Trump That Shocked Everyone

Image Source: pexels

Nvidia, Advanced Micro Devices (AMD), Vertex Pharmaceuticals, Square, Etsy, ONEOK, gold, and small-cap stocks shocked investors as top stocks to buy under trump. Many expected energy and manufacturing to benefit from the trump administration, but few predicted such strong gains in technology and specialty sectors. The trump presidency brought high market volatility, with the stock market dropping over 20% before a fast recovery. Policy shifts and changing market sentiment helped these stocks outperform. Research shows that bank stocks rose on hopes of deregulation, while green firms lagged. Investors learned that under the trump administration, stocks to buy under trump could come from surprising places.

Key Takeaways

- Technology and small-cap stocks surprised investors by outperforming traditional sectors during the Trump presidency.

- Strong earnings growth, innovation, and adaptability helped companies like Nvidia, AMD, and Vertex Pharmaceuticals beat expectations.

- Gold acted as a safe investment, protecting wealth during market uncertainty and rising political risks.

- Policy changes such as tax cuts and deregulation created new opportunities for smaller companies and some energy firms.

- Successful investors stayed flexible, used data-driven research, and avoided following the crowd to find unexpected winners.

Selection Criteria

Performance Metrics

Investors often look at several key numbers to judge how stocks perform. During the Trump administration, total return, sector outperformance, and surprise factor stood out as the main ways to measure market performance. Total return includes both price gains and dividends. Sector outperformance means a stock or group did better than others in its category. The surprise factor shows how much a stock beat what experts expected.

The table below shows how major indexes and the S&P 500 performed during the Trump presidency:

| Index / Metric | Trump Administration Performance |

|---|---|

| Dow Jones Industrial Average (DJIA) | Increased from ~31,188 to ~43,488 (approx. +39.5%) |

| Nasdaq Composite | Surged from ~5,555 to ~13,197 (more than doubled) |

| S&P 500 total return (Trump 1st term) | Nearly 68% gain |

| Market Volatility | Significant due to tariffs and uncertainty |

Note: The S&P 500’s nearly 68% gain during the Trump presidency ranked as the fifth-best four-year term since 1980. The Nasdaq more than doubled, showing strong tech growth.

Defining “Surprise” Winners

A “surprise” winner is a stock or sector that outperformed when few expected it. Many thought energy and manufacturing would lead under Trump, but technology and small-cap stocks shocked investors with their gains. The surprise factor comes from beating both expert predictions and the broader market.

Some reasons for these surprises include:

- Policy changes, such as deregulation, that helped unexpected sectors.

- Shifts in market sentiment, which made investors favor new areas.

- Strong earnings growth in companies outside the usual favorites.

For example, small-cap stocks traded at discounts but saw earnings growth and benefited from tax cuts. Technology stocks, like Nvidia and AMD, outpaced expectations even as many focused on traditional sectors. These trends show that market performance can defy predictions, especially during times of policy change.

Top Stocks to Buy Under Trump

Image Source: pexels

Nvidia

Nvidia surprised many investors during the Trump presidency. The company started as a small player in the semiconductor industry but quickly became one of the largest. Nvidia’s data center sales grew by 427% year-over-year, even after losing most of its revenue from China due to export controls. This growth showed strong resilience. Nvidia’s next-generation AI architecture, called Blackwell, is expected to drive a new cycle of growth. Many experts believe that if export restrictions ease under Trump, Nvidia’s share price could rise by up to 25%. The company’s ability to grow despite global challenges made it one of the most unexpected stocks to buy under trump.

Lesson: Investors learned that innovation and adaptability can help companies outperform, even when facing tough trade policies.

Advanced Micro Devices

Advanced Micro Devices (AMD) became another shocker among stocks to buy under trump. The company posted extremely strong revenue growth, outpacing the S&P 500 by a wide margin. AMD’s three-year average revenue growth reached 17.8%, compared to the S&P 500’s 6.2%. The company also showed strong financial stability, with a debt-to-equity ratio of only 1.5%. However, AMD traded at high valuation multiples, reflecting high market expectations.

| Metric | AMD Value | S&P 500 Value | Interpretation |

|---|---|---|---|

| 3-Year Avg Revenue Growth | 17.8% | 6.2% | AMD shows strong growth |

| Debt-to-Equity Ratio | 1.5% | 21.5% | AMD has strong financial stability |

| Price-to-Earnings (P/E) | 87.7 | 21.3 | High valuation, high growth expected |

AMD’s rapid rise surprised many who expected traditional sectors to lead. The company’s focus on new technology and strong execution helped it stand out.

Lesson: High growth and financial strength can make a stock a winner, even if it looks expensive.

Vertex Pharmaceuticals

Vertex Pharmaceuticals became a standout in the healthcare sector during the Trump administration. The company focused on treatments for cystic fibrosis and other rare diseases. Vertex delivered strong earnings growth and outperformed many larger pharmaceutical companies. Most investors did not expect a specialty drug maker to beat the broader stock market. Vertex’s success came from its focus on innovation and its ability to bring new drugs to market quickly.

Lesson: Specialized healthcare companies can deliver big returns when they solve important medical problems.

Square

Square, now known as Block, shocked many investors with its performance during the Trump presidency. The company provided payment solutions for small businesses and individuals. Square’s stock soared as more people used digital payments. The company also expanded into new areas like cryptocurrency and small business loans. Many experts did not expect a payment company to become a top stock during this period, but Square’s focus on technology and user growth paid off.

Lesson: Companies that help people adapt to new ways of doing business can become unexpected leaders.

Etsy

Etsy became one of the most surprising stocks to buy under trump. The company saw a huge boom during the COVID-19 pandemic, with revenue jumping by 111% in 2020 and 35% in 2021. Even as gross merchandise sales fell slightly in later years, Etsy’s revenue kept growing because of better monetization. The company focused on unique, personalized products and expanded into the gifting market, which helped it stand out. Etsy’s total addressable market is very large, reaching up to USD 2 trillion when including offline sales. However, increased competition from big platforms like Amazon and Temu created new challenges. Trade policies under Trump also posed risks for the millions of small business sellers on Etsy’s platform.

- Etsy’s key growth drivers:

- Focus on unique and personalized products

- Expansion into gifting

- Large market opportunity

Lesson: A clear niche and strong brand can help a company grow, even in a tough market.

ONEOK

ONEOK surprised many investors in the energy sector. The company’s revenue grew by about 68.23% as of March 2025, far outpacing its peers. Analysts expected revenue of USD 28.92 billion for the year. Despite a small drop in earnings per share, ONEOK’s strong top-line growth and resilience impressed the market. The company’s market capitalization stayed above industry averages, showing its strong presence. Analyst opinions were mixed, but many raised their price targets, reflecting changing views on the company’s future.

Lesson: Strong revenue growth and market presence can help a company outperform, even when profits face pressure.

Gold

Gold stood out as a top-performing asset during the Trump administration. The metal’s price rose by 19.02% in the first quarter of 2025, reaching a record high above USD 3,000 per ounce. Gold provided stability and acted as a hedge against inflation and currency risk. Many investors turned to gold because they lost trust in public institutions and wanted assets with no counterparty risk. Gold’s low correlation with stocks and bonds made it a valuable addition to any investment portfolio. Expansionary fiscal policies and rising geopolitical risks under Trump increased demand for gold.

- Why gold performed well:

- Low correlation with other assets

- Hedge against inflation and political risk

- Safe haven during market volatility

Lesson: Gold can protect wealth during uncertain times and should be part of a balanced investment strategy.

Small-Cap Stocks

Small-cap stocks became unexpected winners during the Trump presidency. Many investors thought large companies would benefit most from policy changes, but small-cap stocks outperformed. Deregulation and tax cuts helped smaller companies grow earnings. These stocks often traded at discounts before the Trump administration, but strong earnings growth and a friendlier business environment led to big gains. Small-cap stocks also benefited from lighter regulations, which made it easier for them to compete.

- Key drivers for small-cap stocks:

- Tax cuts and deregulation

- Strong earnings growth

- Improved business environment

Lesson: Policy changes can create new opportunities for smaller companies, making them attractive investments.

Stock Market Trends in the Trump Administration

Image Source: pexels

Sector Winners

During the Trump administration, several sectors stood out as winners in the stock market. Financial services, energy, and industrials led the way. These sectors gained the most after Trump’s election. Investors expected benefits from tax cuts, deregulation, and trade protection. Technology, airlines, automotive, and even cryptocurrency also saw strong gains. For example, banks and energy companies posted large equity gains right after the election. However, not every sector benefited. Agribusiness lost about half its soybean market share in China to Brazil because of tariffs. The automotive sector had mixed results. While some companies gained from deregulation, others faced layoffs due to tariffs on parts and exports. Industrials enjoyed tariff protections but dealt with higher costs and trade actions. The stock market showed that policy changes could help some sectors while hurting others.

Policy Impacts

Trump’s policies had a big effect on stock market performance. After the election, the S&P 500 jumped 2.5% in one day, its best post-election gain in over a century. US Treasury yields rose quickly, and Bitcoin prices surged. The dollar also became stronger. Banks, energy, and industrials saw the largest gains because of expected tax cuts and less regulation. However, renewable energy and pharmaceuticals did not see the same positive reaction. Some companies that matched Trump’s policy goals saw returns up to 10% higher than expected. Even with these gains, the Economic Policy Uncertainty index went up. This showed that while the stock market looked strong, people still worried about tariffs, immigration, and inflation. The stock market recovery was not even across all sectors, and some gains did not match the real economy.

Market Sentiment

Market sentiment changed often during the Trump presidency. The stock market had periods of strong rallies, like an 8% jump after Trump’s reelection. But it also faced sharp declines when worries about tariffs and the economy grew. Consumer and business confidence indexes, such as the ISM Purchasing Managers Index, were sometimes weaker than expected. Investors paid close attention to political risks, including trade tensions and possible government shutdowns. Many used strategies like phased entry into stocks and hedging to handle the ups and downs. Gold became a popular hedge, rising about 26-29% in a year. The Federal Reserve’s flexible policies also helped shape investor confidence. Overall, the stock market reflected both optimism and caution, with strong earnings and new technology driving hope, but policy uncertainty keeping investors alert.

Note: During Trump’s first term, the stock market, including the S&P 500, moved steadily upward. In the second term, the S&P 500 and Russell 2000 entered correction territory, showing how quickly market performance can change with new policies and uncertainty.

Lessons for Investors

Spotting Future Opportunities

Investors who want to find the next surprise winner need to use both data and technology. Many now use natural language processing tools to analyze financial news and market sentiment. These tools can forecast returns and often beat passive strategies. Investors also use regression analysis and predictive analytics to spot trends before others notice them. Standard deviation helps measure risk, while hypothesis testing checks if market signals are real. Companies that collect and analyze data early can spot changes in the economy and adjust quickly. This approach helps them find new investment opportunities before the crowd.

- Key methods for spotting opportunities:

- Use predictive analytics to forecast trends.

- Track volatility with standard deviation.

- Test ideas with hypothesis testing.

- Gather data from many sources for a full view.

Investors who rely on data, not just gut feelings, often make better decisions and improve their investment results.

Research and Flexibility

Research shows that flexibility is vital for success in a changing economy. Companies with flexible strategies can shift resources and adapt to new risks. For example, some funds change their asset mix when the market changes. They might buy more high-yield bonds when central banks support the market, then switch to safer assets when risks rise. This flexible approach helps investors capture value and avoid losses. Firms in China that kept cash and managed debt well could keep investing even during downturns. Flexibility lets investors respond to new information and stay ahead during the trump presidency and beyond.

Staying flexible and doing regular research helps investors manage risk and seize new chances.

Avoiding the Herd

Many investors lose money by following the crowd. Herd mentality can lead to bubbles and crashes, as seen in the dot-com bubble. People often buy because others do, not because the investment makes sense. This behavior increases risk and can cause big losses. Investors who think for themselves, seek different opinions, and check their own biases avoid these traps. Warren Buffett’s advice to be “fearful when others are greedy and greedy when others are fearful” shows the value of independent thinking. Diversifying investments and trusting personal judgment helps avoid costly mistakes.

- Benefits of avoiding herd mentality:

- Prevents groupthink and poor diversification.

- Helps spot undervalued assets early.

- Reduces risk of big losses during market swings.

Independent research and a clear plan help investors succeed, even when the economy changes quickly.

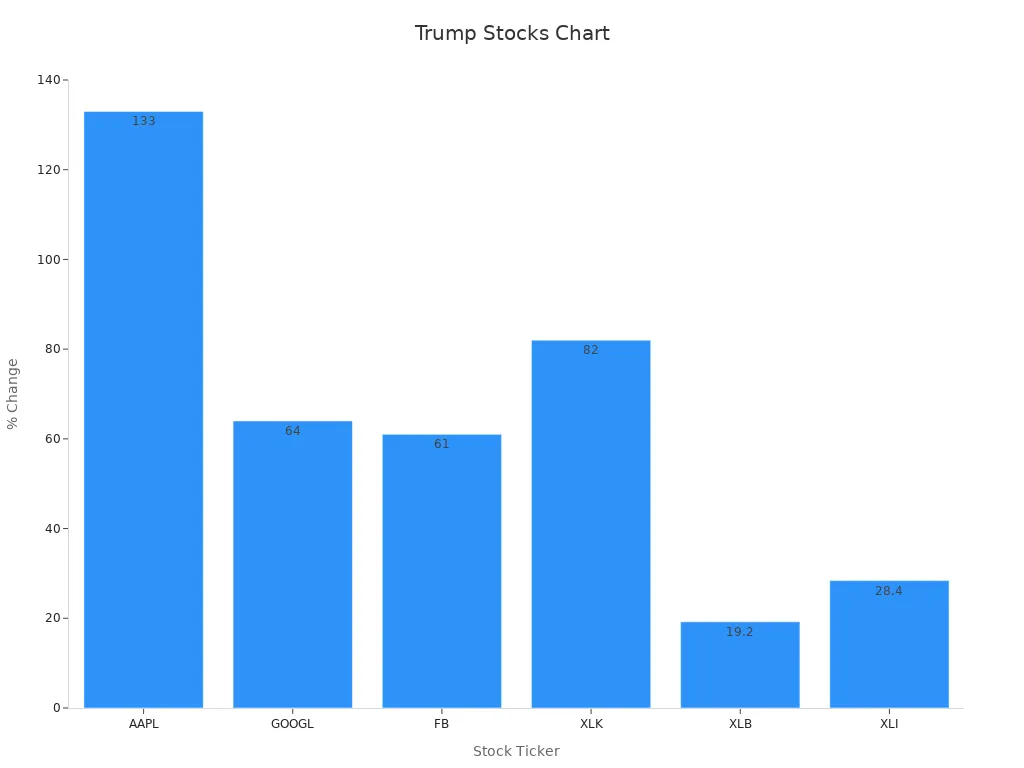

The table below shows how technology stocks, like AMD and Apple, led gains during the administration. Materials and industrials also performed well, while energy and automakers lagged.

| Category | Performance / Key Data Points |

|---|---|

| Top 10 S&P 500 Stocks under Trump | 7 are in the tech sector; 5 of these tech stocks are California-based companies |

| Apple (AAPL) | Stock price up 133%; now the most valuable S&P 500 company |

| Alphabet (GOOGL) | Stock price up 64% since inauguration |

| Facebook (FB) | Stock price up 61% since inauguration |

| Advanced Micro Devices (AMD) | Stock price up 342%; top Trump winner; EPS expected to rise 77% in 2020; IBD Composite Rating of 87 |

| Technology Select Sector SPDR ETF (XLK) | Up 82% since inauguration; outperformed all other sectors and the overall S&P 500 gain of 42% |

| Materials Select Sector SPDR Fund (XLB) | Up 19.2% since inauguration |

| Industrial Select Sector SPDR ETF (XLI) | Up 28.4% since inauguration |

| Energy Sector | 4 of the 10 worst performing S&P 500 stocks; Cimarex Energy down 63%; EPS expected to fall 44% in 2019 |

| U.S. Automakers | General Motors up 0.4%; Ford down 23.8%; Ford EPS expected to fall nearly 5% in 2019 |

| Amazon.com (AMZN) | Stock price up over 120%; profit expected to increase over 30% in 2020; despite being a frequent Trump target |

Investors learned to focus on fundamentals, use scenario-based strategies, and watch for policy changes.

- US equities outperformed with strong earnings growth.

- Gold helped hedge against risk.

- Monitoring credit spreads and volatility proved important.

Staying alert and using research-driven strategies helps investors find new winners in any market.

FAQ

What made technology stocks outperform during the Trump administration?

Technology stocks grew because companies like Nvidia and AMD introduced new products. Investors saw strong earnings and high demand for digital services. Policy changes also helped these companies. Many experts did not expect technology to lead, but innovation drove their success.

Why did gold become a top-performing asset?

Gold prices rose because investors wanted safety during uncertain times. Many worried about inflation and political risks. Gold does not move the same way as stocks or bonds. It helped protect wealth when markets became unstable.

How did small-cap stocks benefit from Trump-era policies?

Small-cap stocks gained from tax cuts and less regulation. These changes made it easier for smaller companies to grow. Investors saw strong earnings from these businesses. Many did not expect small companies to outperform large ones.

Did all energy companies perform well under Trump?

Not all energy companies saw gains. ONEOK performed well, but many others struggled. Some faced lower profits because of changing oil prices and trade policies. The energy sector had mixed results, with winners and losers.

What can investors learn from these surprise winners?

Investors learned to research carefully and stay flexible. Surprising winners often come from unexpected places. Using data and watching for policy changes helps. Independent thinking and avoiding the herd can lead to better investment choices.

The Trump presidency has reshaped markets, with unexpected winners like Nvidia, AMD, and gold outpacing traditional sectors. BiyaPay empowers you to capitalize on these surprises by trading US and HK stocks alongside cryptocurrencies in one account, no offshore accounts required. Convert USDT to USD or HKD with real-time exchange rates to chase high-growth stocks or hedge with crypto.

With transfer fees as low as 0.5%, BiyaPay surpasses traditional providers, offering cost-effective access to volatile markets. Backed by FinCEN and FINTRAC licenses, it ensures secure trading. Sign up in minutes to stay agile in a shifting economy. Join BiyaPay now to seize unexpected opportunities! Trade with BiyaPay today and ride the market’s surprises!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.