- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Do Citibank's Time Deposit Rates Compare with Other Banks? Professional Comparison and Analysis

Image Source: unsplash

Do you want to understand Citibank’s market positioning for time deposit rates in HKD (approximately 2.20%) and USD (approximately 3.8%)? Compared to Fubon, Hang Seng, HSBC, and Standard Chartered, Citibank’s time deposits are notably competitive in USD rates, though some banks offer higher rates. You can also find special promotions for new funds or VIP clients. If you value stability, flexibility, and promotional offers, Citibank’s time deposits are a worthy option to consider.

Key Points

- Citibank’s time deposits are competitive in USD rates, with stable and above-average HKD rates, suitable for those seeking steady returns.

- Citibank offers diverse time deposit plans, including regular deposits, Citi Plus, and Citigold, catering to different client needs.

- New clients, new funds, and VIP clients can enjoy rate enhancements and exclusive promotions, boosting deposit returns.

- Before applying for a time deposit, confirm the minimum deposit threshold and early withdrawal penalties to avoid liquidity constraints or interest losses.

- When choosing deposit tenors, it’s recommended to diversify across different terms to balance liquidity and maximize returns.

Rate Overview

Image Source: pexels

HKD Time Deposit Rate Comparison

If you want to compare HKD time deposit rates, you’ll find that rates at major Hong Kong banks change rapidly. According to the latest statistics, HSBC once raised its 7-day HKD time deposit rate to 1.3%, while Bank of China Hong Kong offered 1.0% for short-term promotions. However, these high rates are typically limited to short tenors or specific campaigns. When choosing, you should pay special attention to the applicable deposit term and amount.

Citibank’s time deposit rates for HKD are generally above average. For example, the recent 1-month HKD time deposit rate is around 2.20%. Foreign banks like Fubon and DBS occasionally offer promotional rates ranging from 2.3% to 2.5%. Overall, while some banks may offer higher rates in the short term, Citibank’s time deposit rates are relatively stable, making them a good option for those seeking steady returns.

According to the Hong Kong Monetary Authority’s September 2023 data, HKD time deposit amounts grew 3.4% month-on-month, exceeding HKD 9.1 trillion, indicating growing interest in time deposits. If you want to join this trend, it’s advisable to compare rates and promotions across banks.

| Bank Name | 1-Month HKD Time Deposit Rate (Annual) | 3-Month HKD Time Deposit Rate (Annual) | Remarks |

|---|---|---|---|

| Citibank | 2.20% | 2.20% | Stable, promotional offers |

| HSBC | 1.30% (short-term peak) | 1.80% | Promotional rates |

| Hang Seng | 1.50% | 2.00% | |

| Fubon Bank | 2.30% | 2.50% | Periodic promotions |

| DBS Bank | 2.20% | 2.30% | |

| Standard Chartered | 2.00% | 2.10% |

Data is based on official bank announcements, and actual rates and conditions may change at any time.

USD Time Deposit Rate Comparison

USD time deposit rates are highly competitive among Hong Kong banks. You’ll find that Citibank’s USD time deposit rate of around 3.8% is among the more competitive options in the market. Fubon Bank recently offered 3.8% for USD time deposits, while some banks even provide short-term projects with rates above 4.0%. However, these high rates often come with conditions such as new funds or VIP client status.

When checking USD time deposit rates, you should refer to each bank’s official announcements. According to ifa.ai, all USD time deposit rate data is sourced from official bank websites and updated regularly. For instance, data from August 16, 2024 comes from the websites of 41 banks in Taiwan. When choosing, be sure to confirm the latest rates and applicable conditions.

| Bank Name | 1-Month USD Time Deposit Rate (Annual) | 3-Month USD Time Deposit Rate (Annual) | Remarks |

|---|---|---|---|

| Citibank | 3.80% | 3.80% | Stable, promotional offers |

| Fubon Bank | 3.80% | 4.00% | Periodic high rates |

| DBS Bank | 3.70% | 3.90% | |

| Hang Seng | 3.60% | 3.80% | |

| HSBC | 3.50% | 3.70% | |

| Standard Chartered | 3.60% | 3.80% |

Reminder: When choosing USD time deposits, besides rates, pay attention to deposit thresholds, promotional conditions, and early withdrawal penalties. Rates fluctuate with the market, so check bank websites regularly for the latest information.

Overall, Citibank’s time deposit rates are above average for HKD and highly competitive for USD. If you prioritize stability and flexibility, Citibank’s time deposits are a worthy option. However, some banks offer higher rates during specific promotional periods, so it’s recommended to compare based on your needs.

Citibank Time Deposit Features

Image Source: pexels

Product Types

When choosing Citibank’s time deposits, you’ll find a wide variety of products. Citibank offers multiple plans tailored to different clients. You can opt for regular time deposits or exclusive plans like Citi Plus and Citigold.

- Regular Time Deposit: Suitable for those seeking stable returns, with deposit tenors ranging from 1 month to 12 months.

- Citi Plus Time Deposit: If you’re a younger client or new customer, you can enjoy exclusive rate enhancements.

- Citigold Time Deposit: If you’re a high-net-worth client, the Citigold plan offers higher rates and exclusive wealth management services.

- Interest Booster Program: You can participate in the Interest Booster campaign for short-term rate enhancements.

Reminder: When choosing a product, assess your financial planning and liquidity needs to select the most suitable time deposit plan.

Promotional Conditions

Citibank’s time deposits frequently offer various promotions. If you’re a new client or depositing new funds, you can usually enjoy rate enhancements.

- New Client Program: If you open an account or deposit new funds for the first time, the bank offers higher time deposit rates.

- New Funds Promotion: If you transfer funds from another bank, Citibank’s time deposits provide additional rate rewards.

- Citi Plus Exclusive: If you use Citi Plus digital wealth management services, you can participate in exclusive time deposit campaigns.

- Citigold VIP Enhancement: If you become a Citigold client, the bank offers VIP rate enhancements for large deposits.

| Promotion Type | Eligible Clients | Main Benefits |

|---|---|---|

| New Client Program | First-time account holders | Rate enhancement, gifts, or cashback |

| New Funds Promotion | Clients transferring new funds | Rate increase of 0.1%–0.3% |

| Citi Plus Exclusive | Digital wealth management users | Exclusive time deposit rates, lucky draw events |

| Citigold VIP Enhancement | High-net-worth clients | VIP exclusive high rates, wealth management advisors |

When participating in promotions, confirm the campaign period, applicable conditions, and rate details. Some promotions are limited to short terms or specific amounts.

Deposit Thresholds

When applying for Citibank’s time deposits, you need to be aware of deposit thresholds.

- Minimum Deposit Amount: Regular time deposits typically require a minimum of USD 50,000, while some promotional programs may require USD 80,000.

- Maximum Deposit Limit: Some campaigns set a maximum deposit cap, usually USD 500,000 or higher.

- Rate Update Frequency: Citibank’s time deposit rates adjust weekly or monthly based on market conditions. You should check the official website regularly for the latest rates.

It’s recommended to confirm whether your funds meet the threshold and understand early withdrawal penalties before depositing to avoid unnecessary losses.

If you value diverse products, flexible promotions, and clear thresholds, Citibank’s time deposits are a great choice for your financial planning.

Other Banks’ Highlights

High-Rate Programs

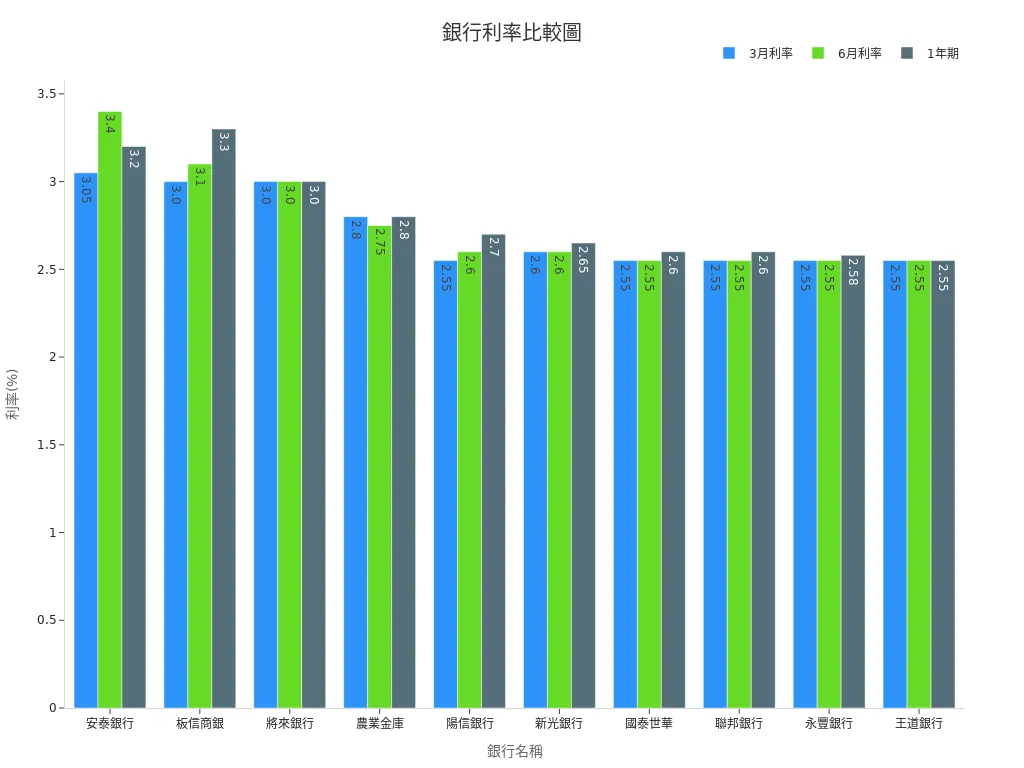

If you’re seeking higher USD time deposit rates, pay attention to high-rate programs from other banks. Fubon Bank and DBS Bank often offer USD time deposit promotions at 3.8% or even above 4.0%, especially for new funds or short-term programs. These programs typically have clear deposit tenors and amount thresholds, such as 3 months, 6 months, or 1 year, with minimum deposits starting at USD 50,000. As long as you meet the conditions, you can enjoy higher annual rates than regular time deposits.

You can refer to the table below to quickly compare USD time deposit rates across multiple banks:

| Bank Name | 3-Month Rate (%) | 6-Month Rate (%) | 1-Year Rate (%) |

|---|---|---|---|

| Entie Bank | 3.05 | 3.40 | 3.20 |

| Panchiao Commercial Bank | 3.00 | 3.10 | 3.30 |

| Next Bank | 3.00 | 3.00 | 3.00 |

| Agricultural Finance | 2.80 | 2.75 | 2.80 |

| Yangshin Bank | 2.55 | 2.60 | 2.70 |

| Shin Kong Bank | 2.60 | 2.60 | 2.65 |

| Cathay United Bank | 2.55 | 2.55 | 2.60 |

| Union Bank | 2.55 | 2.55 | 2.60 |

| SinoPac Bank | 2.55 | 2.55 | 2.58 |

| Wangdao Bank | 2.55 | 2.55 | 2.55 |

You’ll notice significant differences in USD time deposit rates across banks. Some banks offer limited-time high rates during specific periods, so regularly check their official websites.

You can also refer to the chart below to understand the distribution of time deposit rates across banks:

VIP Enhancements

If you’re a high-net-worth client, choosing VIP wealth management accounts at Hang Seng, HSBC, or Standard Chartered usually offers additional rate enhancements. These banks provide exclusive time deposit promotions for premium plans like Citigold, Premier, or Priority. For example, HSBC’s Premier clients may enjoy USD time deposit rates 0.2% to 0.3% higher than regular clients. Hang Seng and Standard Chartered also offer short-term high rates for new funds or large deposits.

As a VIP client meeting new funds or specified amount requirements, you can participate in these exclusive programs. Banks also periodically hold lucky draws or cashback promotions, providing additional benefits alongside deposits.

Reminder: When choosing VIP enhancement programs, carefully review the terms and applicable rate ranges. Promotion details and thresholds vary across banks, so compare before deciding.

Selection Advice

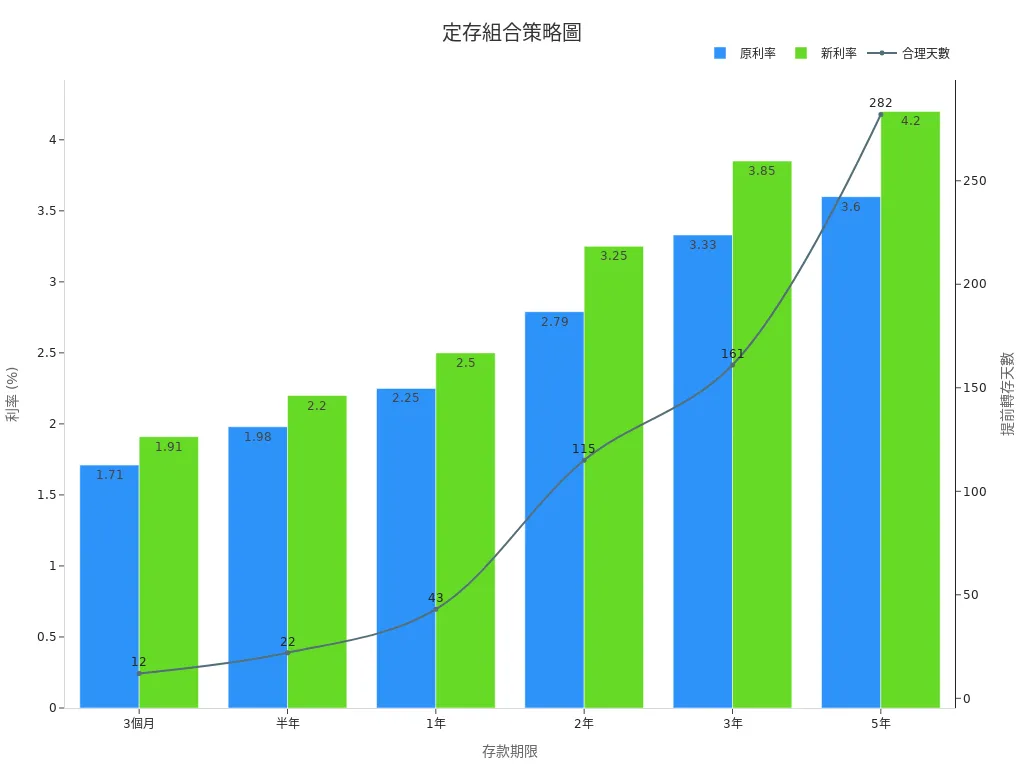

Choose Based on Needs

When selecting a time deposit, plan based on your capital size, deposit tenor, and liquidity needs. Financial experts suggest diversifying large funds across different tenors, such as 3 months, 6 months, 1 year, and 2 years, to balance flexibility and returns. This “four-way” strategy allows you to withdraw some deposits early when needed, minimizing interest losses.

| Deposit Tenor | Original Rate (%) | New Rate (%) | Maximum Reasonable Days for Early Withdrawal (Days) |

|---|---|---|---|

| 3 Months | 1.71 | 1.91 | 12 |

| 6 Months | 1.98 | 2.20 | 22 |

| 1 Year | 2.25 | 2.50 | 43 |

| 2 Years | 2.79 | 3.25 | 115 |

| 3 Years | 3.33 | 3.85 | 161 |

| 5 Years | 3.60 | 4.20 | 282 |

Refer to the table above to choose a suitable deposit combination based on your financial planning. If you value stability and flexibility, Citibank’s time deposits offer diverse tenors and promotional campaigns, ideal for staggered deposits and flexible fund adjustments.

Things to Note

When choosing a time deposit, pay attention to the following:

- Promotional rates usually have expiration dates and amount caps, so confirm campaign details before depositing.

- Early withdrawal incurs penalties, potentially leading to interest losses, so assess liquidity needs.

- Application thresholds and membership restrictions vary across banks, so read terms carefully.

- Rates fluctuate with the market, so check bank websites regularly for the latest information.

- If interest exceeds USD 20,000, be aware of health insurance supplementary premium deductions.

- Splitting deposits into batches can improve fund efficiency and reduce tax risks on high interest.

Reminder: Compare the rate differences between savings and time deposits, and use regular savings or staggered deposit strategies for more flexible fund utilization.

When choosing Citibank’s time deposits, compare rates, promotions, and deposit thresholds across Hong Kong banks. Each bank’s campaign conditions and penalties differ. Make decisions based on your financial planning and the latest market information. Regularly check bank websites for the latest rates to find the most suitable time deposit plan.

FAQ

What is the minimum threshold for Citibank’s time deposits?

When applying for Citibank’s time deposits, the minimum deposit amount is typically USD 50,000. Some promotional programs may require higher thresholds, so check the official website for the latest announcements.

How often are Citibank’s time deposit rates updated?

You’ll find that Citibank’s time deposit rates adjust based on market conditions. The bank typically updates rates weekly or monthly, so check the official website regularly.

What are the consequences of early withdrawal from Citibank’s time deposits?

If you withdraw a time deposit early, the bank may charge a penalty or reduce interest. Confirm the relevant penalties before depositing to avoid losses.

What exclusive promotions does Citibank’s time deposits offer?

You can participate in exclusive promotions for new clients, new funds, Citi Plus, or Citigold. These campaigns offer rate enhancements or cashback, catering to different needs.

How can I compare time deposit rates across different banks?

You can create a table like the one below to quickly compare time deposit rates at major Hong Kong banks:

| Bank Name | HKD Rate | USD Rate |

|---|---|---|

| Citibank | 2.20% | 3.80% |

| Fubon Bank | 2.30% | 4.00% |

| DBS Bank | 2.20% | 3.90% |

It’s recommended to check bank websites regularly for the latest rate information.

As Citibank’s fixed deposits offer stable HKD (2.20%) and USD (3.8%) yields in 2025, low rates and locked funds limit your wealth growth. BiyaPay transforms your strategy with a 5.48% annualized interest rate, outpacing traditional fixed deposits. Convert USDT to USD or HKD with real-time exchange rates for seamless multi-currency management.

With transfer fees as low as 0.5%, BiyaPay surpasses traditional providers, backed by FinCEN and FINTRAC licenses for secure investing. Sign up in minutes to stay ahead of rate fluctuations. Join BiyaPay now to boost your returns! Invest with BiyaPay today and unlock wealth-building opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.