- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

HSBC Stock Price Peaks and Historical Comparison with Financial Crises

Image Source: unsplash

HSBC’s historical stock price peaks are often closely linked to the timing of global financial crises. In 2007, HSBC Holdings’ stock price once surpassed 152.8 HKD, but following the 2008 global financial crisis, the stock price plummeted to around 15 HKD, a decline of nearly 90%. In 2009, the stock price again fell below 30 HKD, demonstrating the profound impact of the financial crisis on Hong Kong banks. In 2020, under the impact of the pandemic, HSBC’s stock price experienced sharp fluctuations again, reflecting the direct influence of changes in the international financial environment on the stock prices of major banks.

Key Points

- HSBC’s stock price peaks often occur before and after global financial crises, reflecting market optimism and hidden risks in the economy.

- During financial crises, HSBC’s stock price experiences sharp fluctuations, and investors should avoid panic selling and maintain rational judgment.

- HSBC enhances market confidence and long-term competitiveness through stable dividend policies, diversified operations, and digital transformation.

- Investing in HSBC requires attention to global economic trends, geopolitical developments, and regulatory policy changes, while adopting a diversified investment strategy to mitigate risks.

- In the future, HSBC’s stock price is expected to reach new highs due to Asian economic growth and digital transformation, and investors should closely monitor related developments.

HSBC Stock Price Historical Highs and Major Events

Image Source: pexels

1997 Asian Financial Crisis

In 1997, the Asian financial crisis swept through Southeast Asia. HSBC’s stock price historical high briefly reached a peak in the first half of that year, approximately USD 12.5 (calculated at the exchange rate at the time). At that time, Hong Kong’s banking industry faced capital outflows and pressure on the HKD exchange rate. As a regional leading bank, HSBC demonstrated strong capital strength, but shaken market confidence led to a significant subsequent decline in its stock price.

Experts point out that HSBC actively maintained its dividend policy at the time to stabilize investor confidence, but geopolitical tensions and currency devaluations in multiple Asian countries still exerted pressure on HSBC’s historical stock price highs.

2007 Financial Crisis Peak

In 2007, amidst global economic prosperity, HSBC’s stock price historical high set a new record, reaching a peak of USD 19.5. During this period, HSBC actively expanded its international operations and conducted several large-scale acquisitions.

- The U.S. subprime mortgage crisis began to emerge, but the market largely ignored potential risks.

- HSBC maintained stable dividends, attracting long-term investors.

- Money laundering allegations and regulatory pressures began to surface, creating potential impacts on the stock price.

After the 2008 financial crisis erupted, HSBC’s stock price historical high quickly became a thing of the past, with the stock price plummeting, reflecting the fragility of the global financial system.

2018 Rebound and Volatility

In 2018, with global economic recovery, HSBC’s stock price historical high rebounded to around USD 10.8.

- The U.S. Federal Reserve raised interest rates, intensifying global capital flows.

- U.S.-China trade tensions escalated, increasing geopolitical risks.

- HSBC actively adjusted its Asian business structure, strengthening its presence in Hong Kong and China markets.

Nevertheless, money laundering allegations and regulatory fines occasionally arose, creating pressure on HSBC’s stock price historical highs. The dividend policy remained a key factor in attracting investors, but market volatility noticeably increased.

2025 New High

According to market forecasts, HSBC’s stock price historical high is expected to surpass USD 21 in 2025.

- The global economy is gradually recovering, with strong economic momentum in the Asian region.

- HSBC is actively promoting digital transformation, improving operational efficiency.

- Geopolitical risks persist, but enhanced corporate governance and compliance capabilities boost market confidence.

Investors should closely monitor HSBC’s dividend policy, changes in the regulatory environment, and volatility in international financial markets, as these factors will continue to influence the performance of HSBC’s stock price historical highs.

Economic Environment and Corporate Strategy

Global Economic Background

Whenever HSBC’s stock price reaches a peak, the global economic environment undergoes significant changes. Before the 1997 Asian financial crisis, the Asian region experienced rapid economic growth, with capital flowing into emerging markets. In 2007, global economic prosperity and a low-interest-rate environment drove asset price increases. The U.S. Federal Reserve maintained low interest rates, and capital poured into Hong Kong and Asian markets. In 2018, the U.S. began raising interest rates, intensifying global capital flows and increasing geopolitical risks. In 2025, the market expects a global economic recovery, with strong economic momentum in Asia and rapid development in the digital economy.

Changes in the international economic environment directly impact HSBC’s performance and stock price.

HSBC’s Business Strategy

HSBC has adopted diversified business strategies in different periods. In 1997, HSBC strengthened its presence in Hong Kong and Asian markets, maintaining a stable dividend policy. In 2007, HSBC actively pursued international acquisitions, including acquiring U.S. consumer finance businesses, expanding its global footprint. In 2018, HSBC adjusted its Asian business structure, focusing on China and Southeast Asian markets, and enhancing digital financial services. In 2025, HSBC is promoting digital transformation, strengthening compliance management, and improving operational efficiency.

- Actively acquiring international assets

- Strengthening presence in Asian markets

- Promoting digitalization and compliance management

Causes of Peaks

HSBC’s stock price peaks stem from multiple factors. Global economic growth drives capital inflows, boosting banking performance. HSBC’s stable dividend policy attracts long-term investors. The company actively expands international operations, increasing market share. Digital transformation and compliance management enhance market confidence.

Investors should pay attention to the global economic environment, corporate strategy adjustments, and regulatory policies, as these factors collectively influence the formation of HSBC’s stock price peaks.

Crisis Impact and Subsequent Developments

Image Source: unsplash

Stock Price Volatility

During each financial crisis, HSBC’s stock price experienced sharp fluctuations. During the 1997 Asian financial crisis, HSBC’s stock price fell from a high of approximately USD 12.5 to around USD 8, a decline of over 30%. During the 2008 financial crisis, HSBC’s stock price plummeted from a high of USD 19.5 to a low of approximately USD 5. In 2020, under the impact of the pandemic, the stock price fell below USD 6.

These data show that global financial market turmoil directly affects the market value performance of Hong Kong banks. Investors often engage in panic selling during crises, leading to sharp short-term declines in stock prices.

Ratings and Market Confidence

During financial crises, international credit rating agencies reassess HSBC’s credit ratings. During the 2008 financial crisis, some rating agencies downgraded HSBC’s long-term credit rating from “AA” to “AA-”. Such rating changes affect market confidence, leading to capital outflows.

- Downgrades increase financing costs

- Investor confidence declines, putting pressure on stock prices

- Money laundering allegations and regulatory fines exacerbate market concerns

Experts recommend that investors closely monitor the latest reports from rating agencies, as rating changes often signal future operational pressures for the company.

Long-Term Adjustments

After crises, HSBC undertakes business adjustments to restore growth. In 2009, HSBC issued new shares, raising over USD 18,000,000,000 in capital to strengthen its capital structure. After 2018, HSBC accelerated digital transformation, optimized its Asian market presence, and strengthened compliance management.

| Year | Major Adjustment Measures | Impact |

|---|---|---|

| 2009 | Issuing new shares | Improved capital adequacy ratio |

| 2018 | Digital transformation, Asia focus | Enhanced operational efficiency |

| 2020 | Strengthened compliance, cost control | Reduced risks |

These long-term adjustments help enhance HSBC’s competitiveness and gradually restore market confidence. Investors can learn from historical experience that post-crisis adjustment strategies have a critical impact on long-term stock price performance.

Historical Patterns and Investment Insights

Temporal Correlation Between Highs and Crises

There is often a clear temporal correlation between HSBC’s stock price historical highs and global financial crises. Observing past peaks in 1997, 2007, and 2020, HSBC’s stock price reached highs around major financial events. This phenomenon indicates that when market confidence is high, investors tend to push up bank stock prices. However, once the economic environment shifts, stock prices rapidly decline.

Experts believe that HSBC’s stock price historical highs often reflect market optimism about future economic prospects but also conceal potential risks. Investors who ignore economic cycle changes may enter at high points, incurring significant losses.

Investment Risks and Opportunities

Investing in major Hong Kong banks like HSBC requires evaluating both risks and opportunities.

- On the risk side, global economic fluctuations, geopolitical conflicts, and regulatory policy changes may lead to sharp stock price volatility.

- On the opportunity side, HSBC’s active promotion of digital transformation and Asian market presence could yield long-term returns if it capitalizes on economic recovery.

Investors should establish a diversified investment strategy to avoid heavy exposure at a single point in time. It is recommended to regularly review the market environment and company fundamentals, while paying attention to dividend policies and regulatory developments.

Long-term observation of historical patterns helps investors make rational judgments about entry and exit timing, reducing losses caused by market sentiment fluctuations.

HSBC’s stock price historical highs are closely related to financial crises.

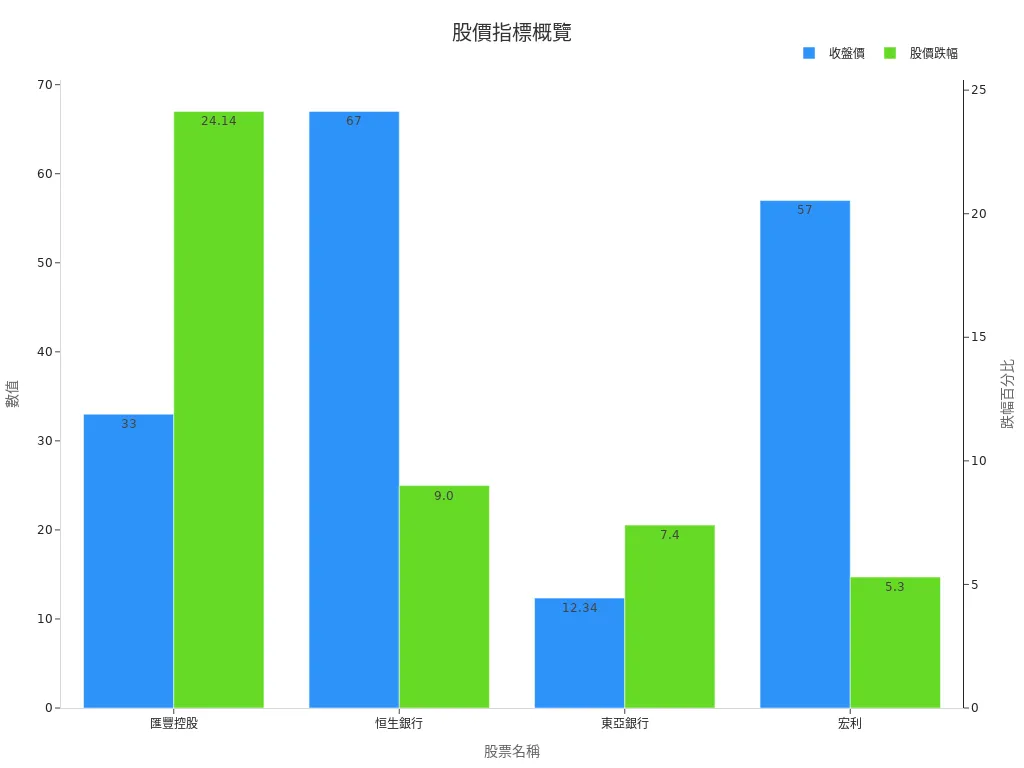

- After 2008, HSBC Holdings experienced a single-day maximum decline of 24.14%, with net interest margins narrowing and market confidence weakening.

- The stock price once fell from 37 HKD to 33 HKD, with a market value evaporation of approximately USD 1,300,000,000, reflecting pressure on financial stocks.

Investors should continue to monitor changes in the global financial environment and corporate strategy adjustments, rationally assessing potential risks to make informed decisions when HSBC’s stock price historical highs emerge in the future.

FAQ

Why is HSBC’s stock price closely related to global financial crises?

As a global bank, HSBC operates in multiple countries. Whenever international financial markets experience turmoil, changes in capital flows and market confidence directly impact HSBC’s stock price.

What are the main risks of investing in HSBC stock?

- Global economic fluctuations

- Geopolitical conflicts

- Regulatory policy changes

- Exchange rate fluctuations

These factors may lead to sharp volatility in HSBC’s stock price.

How does HSBC’s dividend policy affect its stock price?

A stable dividend policy attracts long-term investors. When the company maintains high cash dividends, market confidence increases, and stock price performance is generally more stable.

How does HSBC adjust its business strategy during financial crises?

HSBC issues new shares, strengthens its capital structure, and accelerates digital transformation. The company also focuses on Asian markets, improving operational efficiency and reducing risks.

Will HSBC’s stock price have the opportunity to reach new highs in the future?

Market forecasts suggest that HSBC’s stock price could surpass USD 21 in 2025. Asian economic growth, digital transformation, and enhanced compliance management will be the main drivers.

HSBC’s stock price has faced dramatic swings, plummeting from USD 19.5 in 2007 to USD 5 in 2008 and below USD 6 in 2020, driven by financial crises and market volatility. BiyaPay empowers you to navigate these challenges with a single account for trading US/HK stocks and cryptocurrencies, no offshore accounts needed. Convert USDT to USD or HKD with real-time exchange rates, with transfer fees as low as 0.5%, outperforming traditional brokers.

Backed by FinCEN and FINTRAC licenses, BiyaPay ensures secure trading. Sign up in minutes to seize market opportunities. Join BiyaPay now to enhance your investment strategy! Trade with BiyaPay today and stay ahead of market shifts!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.