- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Are the Convenient Features of HSBC's Multi-Currency Business Debit Card? A Must-Read for SMEs

Image Source: pexels

When running an SME, you must prioritize cash flow and security. HSBC’s card supports 12 currencies, allowing spending and withdrawals without currency conversion. You can withdraw globally without fees and receive instant notifications. You can use sub-cards to manage employee expenses, improving cross-border payment efficiency, reducing costs, and ensuring safer funds.

Key Points

- HSBC’s multi-currency business debit card supports 12 major currencies, enabling businesses to handle international transactions easily, saving time and costs on currency conversion.

- The card’s automatic debit function reduces exchange rate risks, allowing businesses to focus on operations without worrying about currency exchange issues.

- No transaction fees for spending in over 60 countries worldwide, plus cashback, helping businesses reduce cross-border transaction costs.

- Supports contactless payments and free withdrawals at HSBC ATMs globally, enhancing payment efficiency and cash withdrawal convenience.

- Instant transaction notifications and sub-card management features strengthen fund security, facilitating expense control and fraud prevention.

Multi-Currency Transactions

Image Source: pexels

Supports 12 Currencies

When running a business, you often need to handle currencies from different countries. HSBC’s card supports 12 major currencies, including HKD, USD, GBP, JPY, CNY, EUR, THB, AUD, and more. These currencies cover most major global markets, making spending and withdrawals convenient locally or overseas. You no longer need to convert currencies for each transaction, saving time and costs.

Tip: The multi-currency card allows you to settle in local currencies during international procurement, travel, or supplier payments, reducing exchange rate losses.

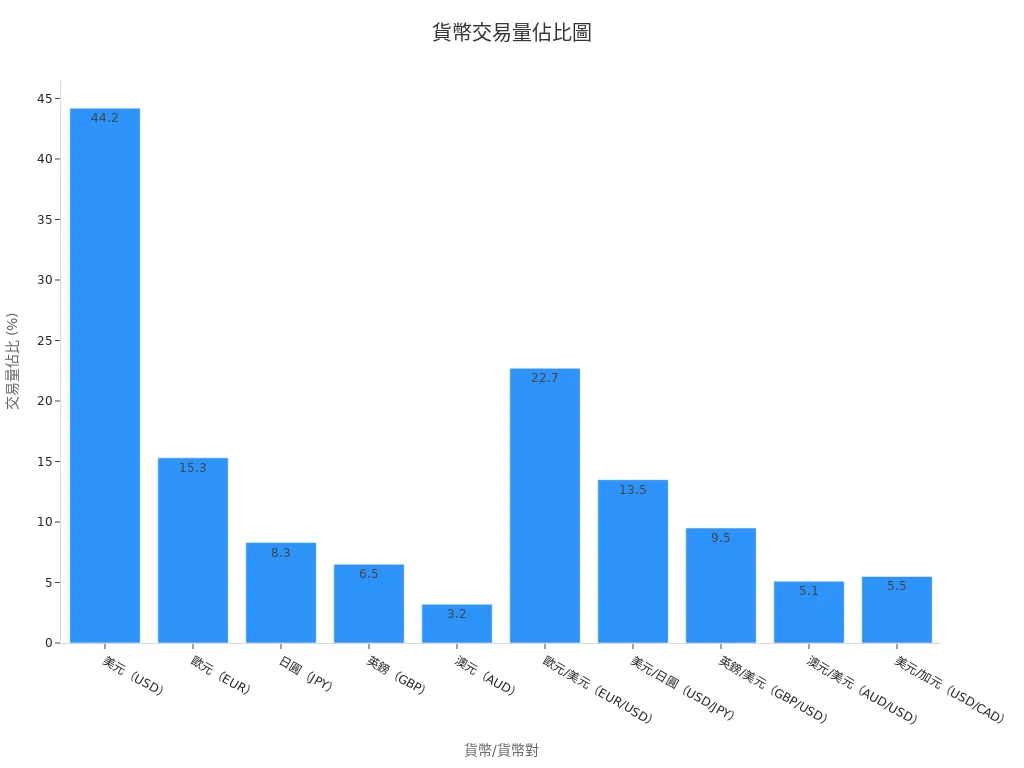

According to the 2022 BIS (Bank for International Settlements) Foreign Exchange Trading Survey, the USD accounted for 44.2% of global trading volume. EUR, JPY, GBP, and AUD also have significant market shares. You can refer to the table below for the market share of major currencies:

| Currency/Currency Pair | 2022 Trading Volume Share |

|---|---|

| USD | 44.2% |

| EUR | 15.3% |

| JPY | 8.3% |

| GBP | 6.5% |

| AUD | 3.2% |

| EUR/USD | 22.7% |

| USD/JPY | 13.5% |

| GBP/USD | 9.5% |

| AUD/USD | 5.1% |

| USD/CAD | 5.5% |

You may notice that the CNY has become increasingly important in cross-border transactions in recent years. In 2023, CNY cross-border payment and receipt volume reached 52.3 trillion yuan, surpassing the USD to become one of the major trading currencies. Below are the latest trends in CNY cross-border transactions:

- In 2023, CNY cross-border payment and receipt volume reached 52.3 trillion yuan, surpassing the USD as one of the major trading currencies.

- Major trading counterpart countries and shares: Hong Kong 53%, Singapore 9.8%, UK 5.9%, Macau 3.8%.

- CNY cross-border payments in “Belt and Road” countries amounted to 9.1 trillion yuan, accounting for 17.4% of total CNY cross-border transactions.

- CNY accounted for 24.8% of cross-border payments in goods trade.

- Although CNY is still the fifth largest global currency, its usage frequency is growing rapidly.

When using the HSBC card, you can choose different currencies based on actual needs, flexibly responding to global market changes.

Automatic Debit

When you spend or withdraw, the HSBC card automatically deducts from your integrated financial account or business account in the corresponding currency. You don’t need to pre-convert currencies or worry about losses from exchange rate fluctuations. This automatic debit design makes international transactions more efficient.

For example, when you spend in HKD in Hong Kong, the system deducts directly from your HKD account. If you’re on a business trip in Japan and pay in JPY, the card automatically deducts from your JPY account. This reduces conversion costs and helps you better track fund flows.

Using the automatic debit function, you can focus on business operations without worrying about currency conversion or fees. This is especially helpful for SMEs with frequent international transactions.

HSBC Card Spending Benefits

No Transaction Fees

When spending overseas or locally, you dread high transaction fees. The HSBC card allows you to spend in over 60 countries worldwide without worrying about transaction fees. Simply use the card at Mastercard merchants, whether in Hong Kong, China, Southeast Asia, or other regions, to enjoy fee-free convenience. This significantly reduces additional costs per transaction for businesses with frequent international procurement or travel needs.

Tip: HSBC’s card has a denser international network than many other banks, such as Citibank, which mainly focuses on North America and parts of Asia. If you frequently transfer funds or spend in Hong Kong, China, and Southeast Asia, HSBC’s no-fee policy offers greater flexibility and cost savings.

You can leverage this advantage to allocate funds flexibly and enhance your business’s international competitiveness.

Cashback

When spending overseas, you can also enjoy cashback. For example, with the First Bank Platinum Business Travel Card, businesses can earn 1.5% cashback on overseas spending. This means for every $100 spent, you effectively pay only $98.5. The cashback is directly deducted from the company account, so employees don’t need to advance funds. For businesses with frequent overseas travel or procurement, this cashback can be substantial.

- If you have $10,000 in annual overseas travel expenses, cashback can save your company $150.

- Cashback is automatically credited, simplifying expense reporting and reducing administrative burdens.

Tip: Cashback not only saves costs but also encourages employees to use the company card, making fund flows more transparent.

By choosing the HSBC card, you enjoy no transaction fees and cashback, making every business expense more valuable.

Payment and Withdrawal Convenience

Image Source: unsplash

Contactless Payment

In daily spending, you often need fast and secure payment methods. The HSBC card supports contactless payments (NFC), allowing you to complete transactions by simply tapping the card on a reader. This contactless payment technology is widely adopted globally. In 2014, only 14 million people used contactless cards globally; by early 2019, this number grew to 644 million. You can easily use contactless payments at convenience stores, restaurants, and transportation in Hong Kong, Japan, China, and more. By 2027, it’s estimated that 36% of global payments will be completed via NFC-enabled contactless cards. This not only improves efficiency but also reduces cash contact, making transactions more hygienic and secure.

Global ATMs

You often need to withdraw cash in different countries. The HSBC card allows free withdrawals at HSBC’s global ATM network, with no overseas ATM withdrawal fees. When traveling or on business in the US, UK, Australia, Japan, or other locations, you can withdraw local currency directly at HSBC ATMs. This significantly reduces conversion and fee costs. You don’t need to worry about finding suitable ATMs or high international withdrawal fees. This is especially convenient for businesses with frequent international operations.

Digital Wallets

You can now link the HSBC card to digital wallets like Apple Pay and Google Pay for mobile payment convenience. In 2022, global digital wallet transaction volumes reached $2.1 trillion, with over 2.2 billion smartphone users choosing digital wallets for payments. Digital wallets can be used for payments, transit tickets, bill payments, membership cards, points, e-invoices, and even cryptocurrency asset management. You can use digital wallets to pay utility bills, taxes, tuition, and more. Digital wallet platforms also incorporate AI to recommend offers based on your spending behavior and use fingerprint or facial recognition for secure transactions. With just a smartphone, you can manage business funds anytime, anywhere, improving payment efficiency.

Tip: By late 2022, over 60% of consumers in Japan used mobile payments or digital wallets. If you frequently operate in Asian markets, digital wallets are an essential payment tool.

Fund Security Control

Instant Notifications

When managing business funds, you fear unauthorized spending or withdrawals. The HSBC card provides instant transaction notifications, allowing you and cardholders to receive immediate alerts via the mobile app or SMS after each transaction or withdrawal. This enables you to detect unusual transactions and take action promptly, reducing the risk of losses.

Many Hong Kong banks have adopted AI technology, combining instant notifications to enhance fund security. For example, E.Sun Bank uses AI models and APIs to quickly calculate fraud probability and instantly notify customers via app and SMS. This approach prevented fraud losses of up to $885 million in 2024, averaging about $73 million monthly. Banks also continuously monitor accounts to prevent fund leakage and collaborate with police to block fraudulent calls, handling approximately $6.94 million. You can see that instant notifications significantly enhance business fund security and reduce fraud losses.

Tip: If you notice any unusual notifications, contact the bank immediately to proactively protect company funds.

Sub-Card Management

You often need to allocate budgets for employee travel or procurement. The HSBC card supports multi-currency sub-cards, allowing you to issue cards to different employees and set spending limits and permissions based on their roles. You can:

- Specify available currencies and maximum spending amounts for each sub-card.

- Adjust or freeze sub-cards anytime to prevent misuse.

- Check each employee’s spending details in real-time via the app.

This allows you to effectively control company expenses and avoid budget overruns. The sub-card management feature also makes expense reporting more transparent, improving fund utilization efficiency. You no longer need to worry about employees misusing funds, ensuring greater security for business funds.

Application and Use

Online Application

When you want to apply for an HSBC card, you can do so directly through the HSBC app. The process is simple, requiring just a few steps:

- Download and log into the HSBC app.

- Select “Apply for Multi-Currency Business Debit Card.”

- Fill in basic company and responsible person information.

- Upload required documents, such as company registration proof and responsible person’s ID.

- Confirm application details online and submit.

You don’t need to visit a branch or prepare cumbersome paper documents. The application process is completely free, with no annual fees. Simply prepare basic company information and responsible person’s documents to complete the application quickly. Many Hong Kong banks offer similar online application services, but HSBC’s process is particularly streamlined, ideal for SME owners.

Tip: You can check application progress anytime in the app, and upon approval, the card will be mailed to your company’s registered address.

Applicable Scenarios

Once you receive the HSBC card, you can use it flexibly in various business scenarios. Below are common use cases:

- International Procurement: When paying suppliers in the US, Europe, or Japan, you can settle directly in local currencies, reducing exchange rate losses.

- Travel Expenses: Employees on business trips to Singapore, the UK, or elsewhere can use the card for transportation, accommodation, and dining, conveniently and securely.

- Supplier Payments: You can pay suppliers in China, Thailand, or other regions, improving cash flow efficiency.

- Daily Operations: Use it for utility bills, office rent, or purchasing office supplies, simplifying accounting management.

| Scenario | Key Benefits | Example Countries/Regions |

|---|---|---|

| International Procurement | Direct multi-currency settlement | US, Japan, Europe |

| Travel Expenses | No fees, instant notifications | Singapore, UK |

| Supplier Payments | Improved cash flow efficiency | China, Thailand |

| Daily Operations | Simplified accounting, transparent spending | Hong Kong, Australia |

You can allocate sub-cards to different employees based on company needs and set spending limits. This not only improves fund management efficiency but also allows real-time tracking of every expense.

By choosing HSBC’s multi-currency business debit card, you can manage multiple currencies simultaneously. You enjoy no transaction fees, global withdrawals, and instant notifications. These features help you reduce international transaction costs and enhance fund security. If you run an SME and want to strengthen international competitiveness, this card is an ideal choice.

FAQ

Does the HSBC Multi-Currency Business Debit Card have annual or application fees?

You can apply for this card completely free. You don’t need to pay annual or application fees. Simply prepare basic company information and responsible person’s documents to apply online.

How many currencies can I manage simultaneously?

You can manage 12 major currencies simultaneously. When spending or withdrawing, the system automatically deducts from the corresponding currency account without manual conversion.

Are there fees for overseas withdrawals?

You don’t pay any overseas withdrawal fees when using HSBC ATMs globally. You can withdraw local currency directly, saving costs.

Can sub-cards have spending limits?

You can set spending limits and permissions for each sub-card. You can adjust or freeze sub-cards in real-time to ensure company fund security.

What should I do if the card is lost?

If you lose your card, immediately report it via the HSBC app or customer service hotline. The bank will assist in deactivating the card to protect company funds.

The HSBC Business Debit Mastercard streamlines SME expenses with 12-currency support, fee-free transactions, and instant notifications, but traditional remittances often face high fees and settlement delays. BiyaPay empowers your business with a single account for trading US/HK stocks, cryptocurrencies, and cost-efficient remittances. With transfer fees as low as 0.5%, BiyaPay outperforms traditional banks’ 1–2% or flat fees, offering same-day settlement to markets like Hong Kong and the US. Convert USDT to USD, HKD, or other currencies at real-time rates to minimize remittance and transaction costs.

Backed by FinCEN and FINTRAC licenses with instant notifications, BiyaPay ensures secure, transparent operations. Sign up in minutes to streamline global payments. Join BiyaPay now to enhance payment efficiency! Trade and remit with BiyaPay today to boost your SME’s global competitiveness!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.