- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Place to Order Checks That Save You Money

Image Source: pexels

You want the best place to order checks that save you money. Online providers like Walmart Checks and Super Value Checks offer some of the lowest prices. When you compare these to banks, you often see a big difference. Deluxe client data shows you might spend nearly $10 more per order when you use self-service channels, especially if you add custom options. Even though banks like those in Hong Kong can be convenient and sometimes offer free checks for first orders, their regular prices usually stay higher than online options. You should always weigh price, security, and convenience to find the best place for your checks.

Key Takeaways

- Ordering checks online saves you money compared to banks, with prices as low as a few cents per check.

- Choose providers that offer strong security features like watermarks, encryption, and fraud protection to keep your checks safe.

- Look for easy online ordering, fast shipping, and good customer support to make buying checks simple and stress-free.

- Use promo codes and buy in bulk to get the best deals and avoid hidden fees by checking the final price before paying.

- Prepare your bank and personal information before ordering to avoid mistakes and track your order for peace of mind.

Best Place to Order Checks Online

Image Source: unsplash

Quick Overview

You want to find the best place to order checks online. Many non-bank providers offer you better prices, more choices, and strong security. Here are some of the top options you should consider:

- Walmart Checks: You get low prices, many designs, and fast shipping.

- Costco Checks: You enjoy member discounts, high security, and easy reordering.

- Super Value Checks: You save money with some of the cheapest checks online.

- Checks Unlimited: You find a wide range of styles and a satisfaction guarantee.

- Sam’s Club Checks: You benefit from bulk pricing and secure features.

- Bradford Exchange Checks: You choose from unique designs and get fraud protection.

- Carousel Checks: You customize your checks and pay less per check in larger orders.

- Vistaprint: You create custom checks with your logo or business details.

- Current Catalog: You pick from fun, colorful designs at affordable prices.

- OrderMyChecks.com: You reorder checks quickly and track your order online.

- Discover, Schwab, Ally: Some online banks offer free or discounted checks with your account.

You can see that these providers focus on price, security, and convenience. Many offer guarantees, fast shipping, and easy online ordering. You can compare their features to find the best fit for your needs.

Tip: Always check for satisfaction guarantees and return policies. Some providers, like Checksforless.com, offer a 100% satisfaction guarantee and a 90-day return policy.

Here is a table that shows how top online check providers stand out in affordability, security, and convenience:

| Aspect | What You Get |

|---|---|

| Affordability | Lowest price guarantee, deep discounts for bulk orders, no hidden fees, free imprinting, and transparent pricing. |

| Security | ID LOCK, double verification, encrypted servers, daily security checks, compliance with Check 21 and CPSA, no permanent storage of credit card info, BBB Online member. |

| Convenience | Fast production, same-day or overnight shipping, easy online ordering, compatibility with accounting software, customizable checks, order tracking. |

| Guarantees | 100% satisfaction, 90-day returns, financial institution compatibility, security safeguards. |

Why Order Checks Online

You save money when you order checks online. The cost of ordering checks from online providers is much lower than from banks. For example, you pay only 5 to 24 cents per single check online, while banks like those in Hong Kong charge 38 to 65 cents per check. Duplicate checks cost 8 to 31 cents online, but banks charge 43 to 74 cents. This means you can save about 30 to 40 cents per check.

Ordering checks online is not just about price. You also get more choices and better service. You can pick from many designs, colors, and custom options. You can order cheap checks in bulk and get discounts. Many sites let you track your order and reorder with one click. You do not have to visit a bank or fill out paper forms.

Non-bank providers make it easy for you to order checks online. They use secure websites with encryption and daily security checks. You get peace of mind because your personal and payment information stays safe. Many providers follow strict rules, like Check 21 and CPSA, to protect you from fraud.

You also get more value from online providers. Many offer free imprinting, free logos, and no hidden fees. Some even promise to beat any competitor’s price by 10%. You can find the best place to order checks online by comparing these features.

Note: Always compare the cost of ordering checks, security features, and convenience before you choose a provider. You can save money and get the checks you need without hassle.

Comparison

Price

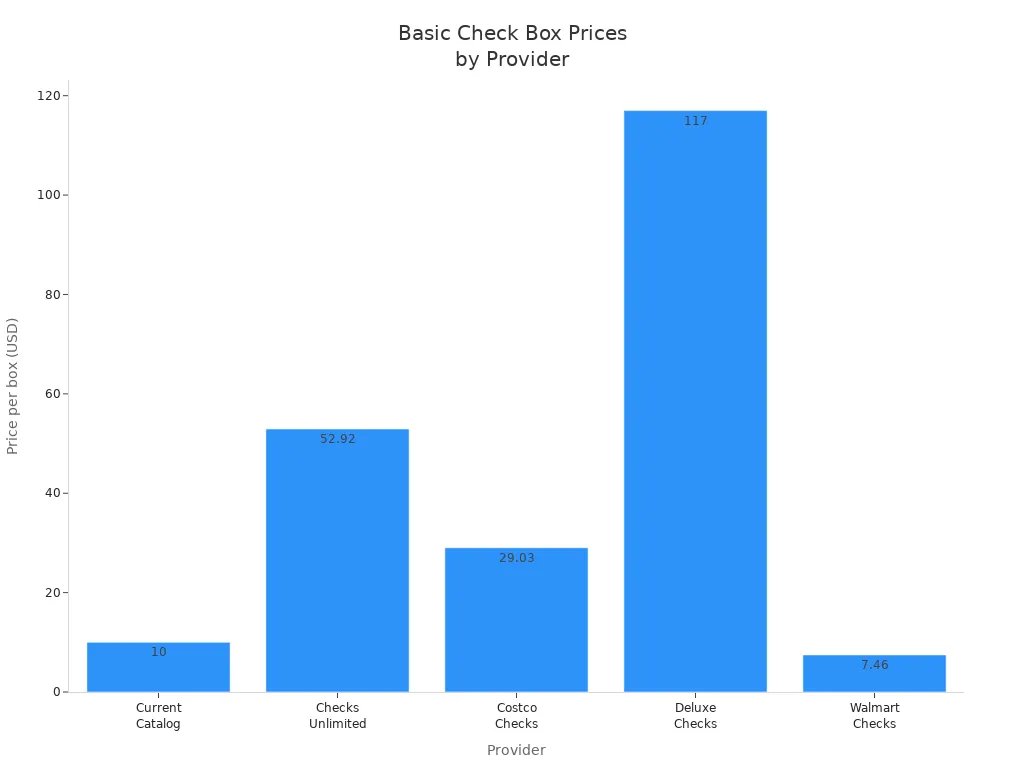

You want to save money when you order checks. The cost of ordering checks can change a lot depending on where you shop. Some online providers offer basic checks for less than $10 per box. Others charge much more. For example, Walmart checks start at $7.46 for 150 checks. CurrentCatalog has many options under $10. Costco Checks start at $29.03 for 200 business checks if you are a Gold Star member. Deluxe Checks can cost $117 for 400 checks. You can even find subscription services like OnlineCheckWriter.com, which charges $49.99 per year for unlimited check printing.

Here is a table to help you compare prices:

| Provider | Price Range / Cost | Quantity / Notes |

|---|---|---|

| CurrentCatalog | $0.00 to above $15.00 per box | Many options under $10 |

| Checks Unlimited | $52.92 for one box (basic blue checks) | Business checks at $5.99 per box |

| Costco Checks | Starting at $29.03 | 200 single business checks (Gold Star) |

| Deluxe Checks | $117 | 400 checks |

| Walmart Checks | Starting at $7.46 | 150 checks |

| OnlineCheckWriter.com | $49.99 per year subscription | Unlimited check printing |

You can see that Walmart and CurrentCatalog offer some of the lowest prices for checks. If you want to save the most, compare prices before you buy.

Security

You need your checks to be safe from fraud. Top online providers use strong security features to protect you. They use risk rules to block suspicious activities, such as logins from strange locations. They score each action for risk and use real-time monitoring to stop fraud fast. Many providers use machine learning to get better at spotting threats.

Here are some common security features you get:

- Customizable KYC (Know Your Customer) and KYB (Know Your Business) checks

- Transaction monitoring and fraud prevention modules

- Behavioral biometrics and AI/ML algorithms for fraud detection

- Real-time and adaptive risk scoring

- Device intelligence and identity verification

- Account takeover prevention

- Compliance with AML, PCI-DSS, and GDPR regulations

You can trust providers that use these tools to keep your checks and your money safe.

Convenience

You want ordering checks to be easy and fast. Top providers make this simple. You can order checks online in minutes. Many sites let you reorder with one click. Some offer mobile apps so you can order checks from your phone. You can track your order and get updates. Providers like Walmart and Costco Checks score high for convenience because they offer fast shipping and easy reordering.

Customer satisfaction ratings show that providers with good mobile apps and order tracking get higher scores. Features like order-ahead, loyalty programs, and self-service kiosks make the process even smoother.

Tip: Choose a provider that offers easy online ordering, fast shipping, and good customer support. This will save you time and make ordering checks stress-free.

Top Picks

Best for Price

You want to save the most money on checks. Super Value Checks gives you some of the lowest prices online. You can order a box of checks for less than $10. This provider keeps costs down by offering simple designs and bulk discounts. You do not pay hidden fees, and you get free imprinting on your checks. Many customers choose Super Value Checks because they want to order checks in large quantities and keep their spending low. If you want to stretch your budget, this is the best place to start.

Tip: Some online banks, like Firstrust Bank and Midland States Bank, offer free checks with certain checking accounts. You can get even more value if you qualify for these offers.

Best for Security

You need your checks to be safe from fraud. Laser Printer Checks leads the way with advanced security features. Their High-Security Hologram Checks use reflective foil images, heat-sensitive ink, and watermarks. You also get tamper-evident ink and scan protection. These checks include black-light visible fibers and micro printing, making them very hard to copy or alter. You can also buy security pens and tamper-evident deposit bags for extra protection. If you want peace of mind, choose Laser Printer Checks for your next order.

Checks Unlimited also offers high-security checks with holographic foil and a fraud protection program. You get identity restoration services if you ever face check fraud. These features help you feel confident when you use checks for payments.

Best for Variety

You want checks that match your style. Checks Unlimited gives you the widest variety of check designs and options. You can pick from cute checks, scenic checks, animal checks, and even Disney or MLB® checks. You can also order side tear checks, photo checks, and special edition designs. Checks Unlimited lets you add matching checkbook covers and address labels. If you want to express your personality or support your favorite team, this provider has the most choices.

Best for Customization

You want checks that stand out and show your brand or personal touch. Customily gives you unlimited ways to personalize your checks. You can use AI tools, creative effects, and live product previews. Customily lets you upload your own images, pick from free clipart, and see your design before you order. You can even connect your checks to online stores like Shopify or Etsy. If you want full control over how your checks look, Customily is the best choice.

Note: Some non-bank providers also offer satisfaction guarantees or free checks with certain accounts. GreenState Credit Union and Midland States Bank both provide satisfaction guarantees and free checks with their checking accounts.

Choosing Checks

What to Consider

You want to make the smartest choice when you order checks. Start by looking at the most important factors:

- Cost: Compare prices for checks from different providers. Some offer boxes for less than $10, while others charge much more. Always check for hidden fees.

- Security: Make sure your checks have strong security features. This keeps your money safe.

- Customization: Pick checks that match your style or business needs. Many sites let you add logos or choose fun designs.

- Shipping: Fast shipping means you get your checks when you need them. Some providers offer same-day or overnight delivery.

- Customer Service: Good support helps if you have questions or problems with your checks.

Tip: Write down what matters most to you before you order. This helps you pick the best provider for your checks.

Security Features

You need checks that protect you from fraud. Look for these top security features:

- Security pantographs and microprinted signature lines stop people from copying your checks.

- SSL encryption on the website keeps your data safe during checkout.

- The system checks for strange order patterns, like mismatched shipping and billing addresses.

- Address Verification Services confirm your cardholder identity.

- Challenge questions add another layer of identity protection.

- Daily third-party security checks meet government and credit card standards.

- Providers promise not to sell or share your information unless required by law.

- No permanent storage of your credit card details.

Here is a quick table to help you compare security features:

| Security Feature | Description |

|---|---|

| Secure Website (SSL) | Protects your data during checkout and account management. |

| Order Validation | Screens orders to block unauthorized check requests. |

| Secure Check Printing | Controls who can print checks and keeps your info private. |

| Physical Check Security | Uses watermarks, holograms, and heat-sensitive ink to stop fraud. |

| Discreet Packaging & Shipping | Uses tamper-evident packaging to keep your checks safe during delivery. |

Note: Always choose checks with strong security features. This keeps your money and information safe.

Shipping and Support

You want your checks to arrive quickly and safely. Many top providers offer fast shipping, sometimes even same-day or overnight. Discreet packaging keeps your checks safe from tampering. If you need help, look for providers with high customer support ratings. For example, some companies have support teams available 24/7, so you can get help any time. Others offer detailed help centers and fast response times.

Good customer service means you get answers fast. You can solve problems with your checks quickly. Providers with high support ratings often have better reviews and happier customers.

Tip: Before you order, check the shipping options and support hours. This helps you avoid delays and get the help you need.

How to Order Checks Online

Prepare Information

You want to order checks online quickly and safely. Start by gathering all the details you need. Follow these steps:

- Write down your full name or your company name for business checks.

- Find your address and your bank’s address. You can check your existing checks for this information.

- Locate your checking account number. This is usually the second number from the left at the bottom of your checks.

- Get your bank routing number. Look for a nine-digit number on the bottom left of your checks.

- Decide the next check number to use. Pick the number after your last check.

- Make sure the website you use to order checks online shows a lock icon in the browser. This means the site is secure.

- Read customer reviews and ratings to choose a trusted seller.

- Pick checks with security features like watermarks or holograms to protect against fraud.

Tip: Preparing this information before you start will save you time and help you avoid mistakes.

Place Your Order

You can order checks online in just a few minutes. Here’s how:

- Sign in to your account on the provider’s website or app.

- Select the checking account you want to use.

- Go to the check ordering section.

- Choose how many checks you want.

- Review your order details. Double-check your name, address, and account numbers.

- Confirm and place your order.

Some providers may ask about restocking fees or shipping options. Always check the final price before you pay.

Verify and Track

After you order checks online, you should track your order and check for updates. Good providers send you confirmation emails with your order summary, shipping address, and estimated delivery date. Look for tracking links in these emails. You can follow your shipment in real time.

- Review your order details in the confirmation email.

- Watch for updates about shipping or delays.

- Contact customer support if you have questions or problems.

- Save your order number for easy reference.

Note: Tracking your checks gives you peace of mind and helps you spot any issues early.

Money-Saving Tips

Image Source: pexels

Promo Codes

You can save big on checks by using promo codes when you order online. Many top providers offer discounts like 20% to 80% off, free shipping, or bundle deals. For example, you might find a code for 20% off business checks or a deal like 2 boxes for $22. Most sites let you enter a coupon code at checkout, and you will see the discount right away. Only one code works per order, so pick the best one for your needs.

| Coupon Description | Discount Type | Expiry Date |

|---|---|---|

| 20% Off Business Checks + Free Shipping | Coupon Code | Aug 3, 2025 |

| Up to 60% Off Your Order | Coupon Code | Jul 26, 2025 |

| Up To 50% Off 4+ Boxes | Coupon Code | N/A |

| 2 Boxes for $22 + 4 Boxes for $42 | Coupon Code | Aug 11, 2025 |

| Up to 80% off sitewide | Coupon Code | Jul 26, 2025 |

| 65% Off Sitewide | Coupon Code | Aug 14, 2025 |

Tip: Always check for current promo codes before you buy checks. This simple step can help you get cheap checks and keep more money in your pocket.

Avoiding Fees

You want to avoid hidden fees when you order checks. Some sites add extra charges for shipping, customization, or even storage if you order in bulk. Always review the final price before you pay. Watch out for high shipping costs or extra fees for adding your logo or special designs. If you do not need a large number of checks, avoid bulk orders that could lead to waste and extra cost.

- Check for shipping fees before you finish your order.

- Look for free imprinting or free shipping offers.

- Choose only the features you need to keep your checks affordable.

Note: Reliable providers show all fees up front, so you never get surprised by extra costs.

Bulk Orders

Ordering checks in bulk can save you up to 75% compared to buying small packs. Online providers often offer deals like “buy three, get one free” or discounts on four or more boxes. You pay less per check and avoid running out too soon. For example, you might pay as little as $1.95 for 40 checks or $3.95 per pack. This is much cheaper than what banks in Hong Kong charge.

- Buy enough checks to last six months to a year.

- Take advantage of bundle pricing for bigger savings.

- Balance your order size with your actual needs to avoid waste.

Preventing Fraud

You must keep your checks safe from fraud. Always order checks from trusted providers who use secure websites and follow industry standards. Look for checks with security features like watermarks, microprinting, and tamper-evident ink. Use black gel ink to write checks, and never leave them in an open mailbox. Track your orders and monitor your bank account for any strange activity.

- Order checks only from reputable sellers.

- Fill out checks completely and never make them payable to cash.

- Store unused checks in a safe place and shred old or voided checks.

- Use banking alerts to track check clearances.

Tip: Strong security features and smart habits protect your money and give you peace of mind when using checks.

You deserve the best place to order checks that fit your needs and budget. Top online providers give you low prices, strong security, and easy ordering. To get the most value, follow these steps:

- Pick the best place with high ratings and secure features.

- Compare prices and check for hidden fees.

- Choose checks with strong security and review your order on arrival.

Use these tips to save money and order checks safely every time.

FAQ

Where can you find the cheapest checks online?

You can find the lowest prices at Super Value Checks and Walmart Checks. These sites often offer boxes for less than $10 USD. Always compare prices and look for promo codes to save even more.

Are online checks safe to use?

Yes, you can trust online checks if you order from secure providers. Look for features like SSL encryption, watermarks, and tamper-evident ink. Choose sites with strong security policies and high customer ratings.

Can you order checks if you bank with a Hong Kong bank?

Yes, you can order checks online for your Hong Kong bank account. You need your routing and account numbers. Many online check providers support accounts from Hong Kong bank and other international banks.

How long does it take to receive your checks?

Most online providers ship checks within 3 to 7 business days. Some offer same-day or overnight shipping for an extra fee. Track your order online for updates.

Ordering checks online saves money, but high bank fees for global payments can erode your savings. BiyaPay’s EasyCard simplifies transactions across 190+ countries with no annual fee, ideal for cost-conscious users. The BiyaPay app supports real-time conversion of 30+ fiat currencies and 200+ cryptocurrencies. BiyaPay provides transparent exchange rates, a low 0.5% remittance fee, far lower than traditional bank fees. Whether paying suppliers or using PayPal, EasyCard ensures secure, compliant transactions. Setup is quick, letting you manage finances effortlessly. Trusted by over 500,000 users, BiyaPay eliminates costly banking barriers. Ready to optimize your global payments? Sign up for BiyaPay now and save on every transfer!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.