- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Explaining Dividend Taxation in the US

Image Source: pexels

You pay tax when you receive dividends from stocks or mutual funds. The way you see dividends taxed depends on whether you get qualified or ordinary dividends. The IRS treats qualified dividends taxed at lower rates, while ordinary dividends taxed at your regular income tax rate. Your income level also affects how much dividend tax you owe. Dividend taxation in the United States can seem complex because you see us dividends taxed in different ways. You need to know the rules to understand your own dividend tax bill.

Key Takeaways

- Dividends come from company profits and can be taxed as qualified or ordinary, with qualified dividends taxed at lower rates.

- To get lower tax rates on dividends, you must hold the stock for a specific period and meet IRS rules about the dividend source.

- You must report all dividend income on IRS Form 1099-DIV and include it on your tax return to avoid penalties.

- Tax-advantaged accounts like Roth IRAs help you reduce or delay dividend taxes, letting your investments grow more efficiently.

- Using strategies like holding stocks longer, tax-loss harvesting, and placing investments in the right accounts can lower your dividend tax bill.

How Are US Dividends Taxed

Image Source: unsplash

What Are Dividends

You receive dividends when a company shares its profits with you as a shareholder. The IRS defines dividends as payments that can include cash, stock, or even property. Most often, you see dividends paid in cash, but sometimes companies give you extra shares or other assets. These payments usually come from the company’s earnings and profits. If a company pays you more than its earnings, the extra amount is not taxed as a dividend. Instead, it reduces your investment’s cost basis, and any amount above that becomes a capital gain.

The IRS recognizes several types of dividends. Here is a table showing the most common types you might encounter:

| Dividend Type | Description |

|---|---|

| Ordinary Dividend | Cash or assets paid to all shareholders, usually from profits. |

| Preferred Dividend | Paid to holders of preferred stock, often at a fixed rate. |

| Cumulative Dividend | Unpaid preferred dividends that add up until paid. |

| Noncumulative Dividend | Preferred dividends that do not accumulate if unpaid. |

| Participating Dividend | Preferred dividends that may increase if the company does well. |

| Nonparticipating Dividend | Preferred dividends that never exceed a set rate. |

| Stock Dividend | Extra shares given instead of cash, usually a small percentage of your holdings. |

| Liquidating Dividend | Payments that return your original investment, not profits. |

| Special (Extraordinary) Dividend | One-time, larger-than-usual payment. |

| Paid-in-Kind Dividend | Additional shares given instead of cash, matching the dividend’s value. |

| Scrip Dividend | Promissory notes given instead of cash, to be paid later. |

You need to know how dividends are taxed because the IRS treats each type differently. For example, most cash dividends count as ordinary or qualified dividends, but liquidating dividends do not. You report most dividends on Form 1099-DIV if you receive $10 or more in a year.

When you receive dividend income, you must follow a process to figure out your tax. Here are the main steps:

- Classify the dividend as qualified or ordinary based on IRS rules.

- Check if you held the stock for more than 60 days around the ex-dividend date.

- Make sure your holding period includes the ex-dividend date.

- Use the correct tax rate: ordinary income rates for ordinary dividends, and long-term capital gains rates for qualified dividends.

- Add extra taxes if you have high income, such as the net investment income tax.

- Report your dividend income using IRS forms like Form 1099-DIV.

Tip: Always keep your dividend statements and check your holding periods. This helps you know how dividends are taxed and avoid mistakes on your tax return.

Why Companies Pay Dividends

Companies pay dividends for several reasons. When you receive a dividend payment, you get a share of the company’s profits. Many companies pay dividends to reward loyal shareholders and attract new investors. Here are some main reasons companies choose to pay dividends:

- Dividends give you steady returns. Many companies increase their payouts each year, which can help your investment grow over time.

- Dividends show that a company is financially healthy. A company must have real cash flow to pay dividends, so a long history of payments can signal strength.

- Dividends can lower your investment risk. When the stock market drops, dividend payments can help offset your losses.

- Qualified dividends are taxed at lower rates than regular income. This gives you a tax advantage, especially if you are in a higher tax bracket.

- Dividends help protect your money from inflation. Regular payments can keep your investment’s value growing faster than rising prices.

When a company announces a dividend increase, you often see the stock price rise. This happens because investors view higher dividends as a sign of good financial health. On the other hand, if a company cuts its dividend, the stock price may fall. Investors react strongly to dividend news because it signals what the company expects for the future.

You should pay attention to us dividends because they play a big role in your total investment returns. From 1980 to 2019, about 75% of the S&P 500’s returns came from dividends. Understanding how dividends are taxed and why companies pay them helps you make better investment choices.

Qualified Dividend vs. Ordinary Dividend

Qualified Dividend Requirements

You need to know the rules for a dividend to count as a qualified dividend. The IRS sets clear requirements. If you meet these, you pay less tax on your dividend income. Here are the main rules:

- The dividend must come from a U.S. corporation or a qualified foreign company.

- You must hold the stock for more than 60 days during the 121-day period that starts 60 days before the ex-dividend date for common stock.

- For preferred stock, you must hold it for more than 90 days in a 181-day period starting 90 days before the ex-dividend date.

- The dividend cannot come from certain sources, like REITs, MLPs, or tax-exempt organizations.

- The ex-dividend date is the first day when a new buyer does not get the next dividend.

Holding period rules matter for the tax treatment of dividends. If you do not hold the stock long enough, your dividends become nonqualified. You then pay a higher tax rate. The table below shows how the holding period works:

| Aspect | Requirement | Details |

|---|---|---|

| Holding Period for Common Stock | At least 61 days | Within 121-day period starting 60 days before ex-dividend date |

| Holding Period for Preferred Stock | At least 91 days | Within 181-day period starting 90 days before ex-dividend date |

| Inclusion in Holding Period | Includes date of sale | Excludes date of purchase |

| Not Meeting Holding Period | Ordinary income tax | No lower rate for qualified dividends |

Qualified dividends get taxed at long-term capital gains rates. These rates are 0%, 15%, or 20%, based on your income. This special tax treatment of dividends can save you a lot of money.

Ordinary Dividend Tax Treatment

Ordinary dividends, also called nonqualified dividends, do not meet the IRS rules for qualified dividends. You pay tax on these at your regular income tax rate. This rate can be as high as 37%. Most taxable dividends from REITs, MLPs, and money market funds count as nonqualified. If you do not meet the holding period, your dividend tax goes up because the IRS treats your payment as ordinary income.

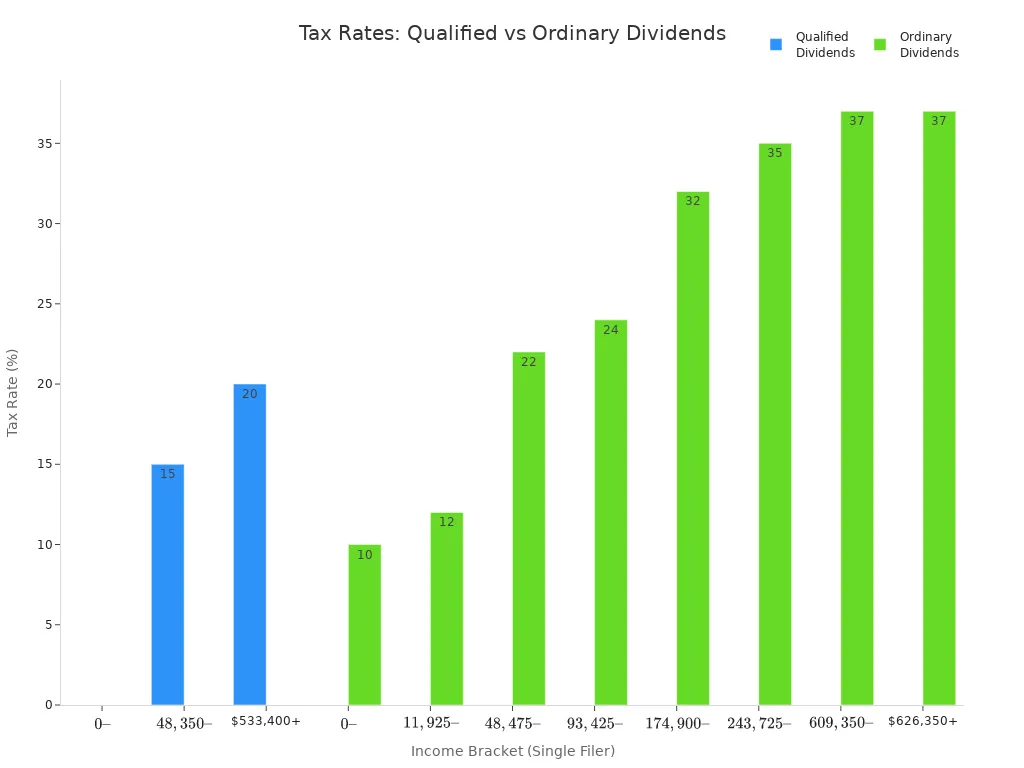

The chart below shows how much more tax you pay on ordinary dividends compared to qualified dividends:

You should always check if your dividends are qualified or nonqualified. This helps you plan for your dividend tax and avoid surprises. Remember, the tax treatment of dividends affects your total return. If you want to lower your tax, try to hold stocks long enough to get the qualified dividend rate.

Note: Nonqualified dividend income can push you into a higher tax bracket. Always review your holding periods and the source of your dividends to make sure you get the best tax treatment.

Dividend Tax Rates

Understanding dividend tax rates helps you plan your investments and avoid surprises at tax time. You pay different rates on qualified dividends and ordinary dividends. Your filing status and income level also affect how much tax you owe. Some states add their own taxes, and foreign investors face special rules.

Qualified Dividend Tax Rates

You pay lower tax rates on qualified dividends. The IRS uses the same rates as long-term capital gains. For 2025, you see three possible federal rates: 0%, 15%, or 20%. Your filing status and taxable income decide which rate applies to you.

For example, if you file as single, you pay 0% on qualified dividends if your taxable income is up to $48,350. If your income falls between $48,351 and $517,200, you pay 15%. Any amount above $517,200 gets taxed at 20%. Married couples filing jointly pay 0% up to $96,700, 15% between $96,701 and $600,050, and 20% above $600,050. Heads of household have similar brackets with slightly different numbers.

Here is a table showing the 2025 federal tax rates for qualified dividends:

| Filing Status | 0% Rate Up To | 15% Rate | 20% Rate Above |

|---|---|---|---|

| Single | $48,350 | $48,351 – $517,200 | $517,200 |

| Married Filing Jointly | $96,700 | $96,701 – $600,050 | $600,050 |

| Head of Household | $64,400 | $64,401 – $551,350 | $551,350 |

If you earn $50,000 as a single filer, you pay 15% on your qualified dividends. If you earn the same amount as a married couple filing jointly, you pay 0%. This tiered system rewards long-term investors and helps you keep more of your investment income.

Tip: Always check your filing status and taxable income before you estimate your dividend tax rates. This helps you avoid paying more tax than you need.

Ordinary Dividend Tax Rates

Ordinary dividends, also called nonqualified dividends, do not meet the IRS rules for qualified dividends. You pay tax on these at your regular income tax rate. The rates for ordinary dividends range from 10% to 37% in 2025. These rates match the brackets for your other income, such as wages or interest.

Here is a table showing the 2025 federal ordinary income tax rates, which apply to ordinary dividends:

| Tax Rate | Single (Taxable Income) | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0 – $11,600 | $0 – $23,200 | $0 – $16,550 |

| 12% | $11,601 – $47,150 | $23,201 – $94,300 | $16,551 – $63,100 |

| 22% | $47,151 – $100,525 | $94,301 – $201,050 | $63,101 – $100,500 |

| 24% | $100,526 – $191,950 | $201,051 – $383,900 | $100,501 – $191,950 |

| 32% | $191,951 – $243,725 | $383,901 – $487,450 | $191,951 – $243,700 |

| 35% | $243,726 – $609,350 | $487,451 – $731,200 | $243,701 – $609,350 |

| 37% | $609,351+ | $731,201+ | $609,351+ |

If you receive nonqualified dividends, you pay tax at these rates. For example, if your taxable income is $60,000 as a single filer, you pay 22% on your ordinary dividends. Most dividends from REITs, MLPs, and some mutual funds count as nonqualified. If you do not meet the holding period for a stock, your dividends also become nonqualified.

Note: Ordinary dividends can push you into a higher tax bracket. Always check if your dividends are qualified or nonqualified to get the best tax treatment.

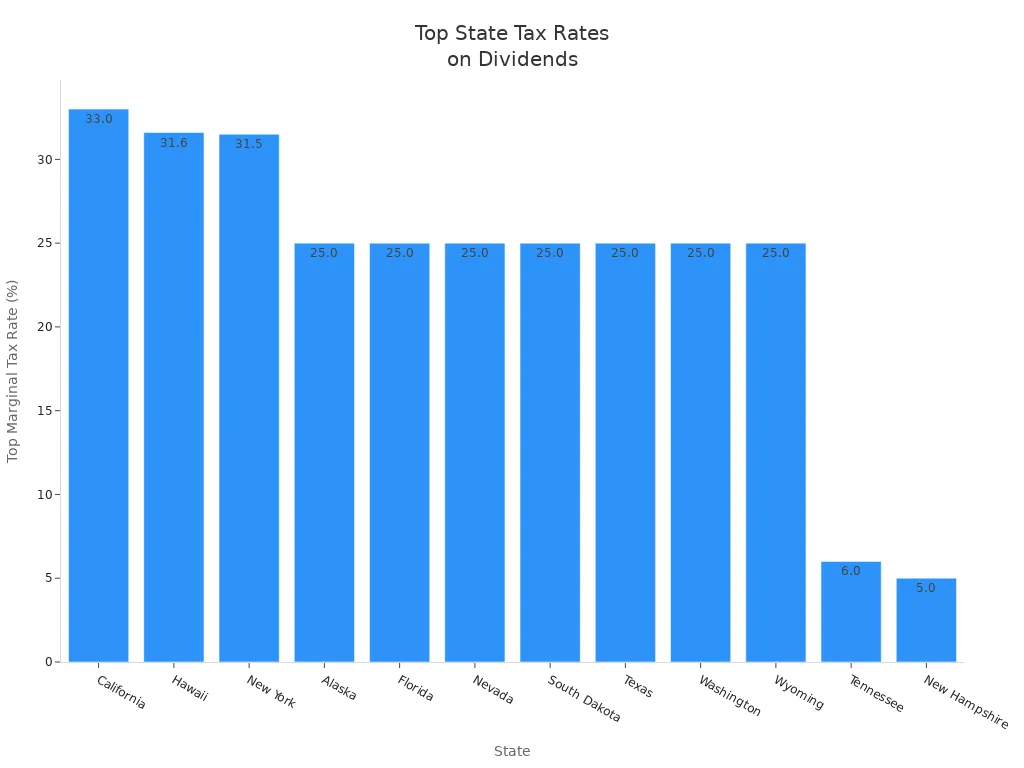

State and Foreign Dividend Tax

You may also pay state taxes on your dividends. Each state sets its own rules. Some states, like California, Hawaii, and New York, have high top marginal tax rates on dividends. Others, like Florida, Texas, and Nevada, do not tax dividends at all. The combined federal and state top marginal tax rate on dividends can reach as high as 33% in California.

Here is a table showing top marginal tax rates on dividends in major US states:

| State | Top Marginal Tax Rate on Dividends (%) | Notes |

|---|---|---|

| California | 33.0 | Highest state rate on dividends |

| Hawaii | 31.6 | Second highest |

| New York | 31.5 | Third highest |

| Alaska | 25.0 | No state income tax; federal rate only |

| Florida | 25.0 | No state income tax; federal rate only |

| Nevada | 25.0 | No state income tax; federal rate only |

| South Dakota | 25.0 | No state income tax; federal rate only |

| Texas | 25.0 | No state income tax; federal rate only |

| Washington | 25.0 | No state income tax; federal rate only |

| Wyoming | 25.0 | No state income tax; federal rate only |

| Tennessee | 6.0 | Taxes dividends specifically |

| New Hampshire | 5.0 | Taxes dividends specifically |

If you live in a state with no income tax, you only pay the federal rate. If you live in a high-tax state, your total dividend tax rates can be much higher.

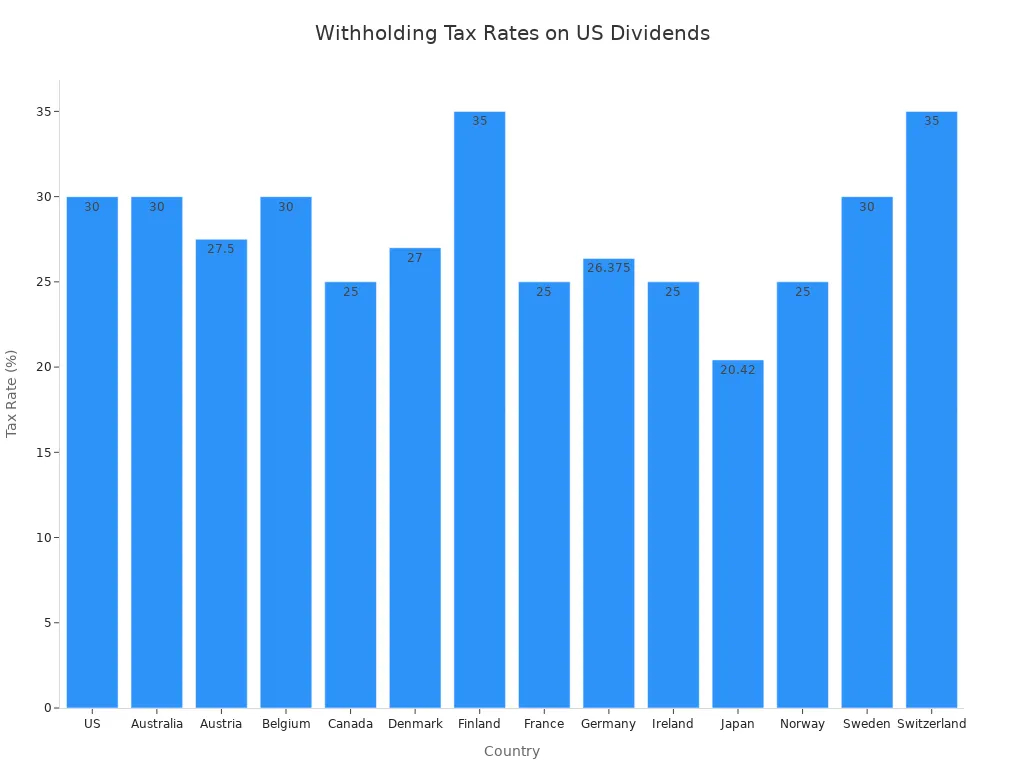

Foreign investors face another layer of tax. The US withholds 30% on dividends paid to nonresident aliens. Some countries have tax treaties with the US that lower this rate. To get the lower treaty rate, you must file Form W-8 BEN with your broker. The broker then reports your payments on Forms 1042 and 1042-S.

Here is a table showing statutory withholding tax rates on US dividends for nonresident investors by country:

| Country | Statutory Dividend Withholding Tax Rate |

|---|---|

| US | 30% |

| Australia | 30% |

| Austria | 27.5% |

| Belgium | 30% |

| Canada | 25% |

| Denmark | 27% |

| Finland | 35% |

| France | 25% |

| Germany | 26.375% |

| Ireland | 25% |

| Japan | 20.42% |

| Norway | 25% |

| Sweden | 30% |

| Switzerland | 35% |

If you invest from outside the US, always check if your country has a tax treaty. This can help you lower your dividend tax and keep more of your investment income.

Tip: State and foreign taxes can add up quickly. Always include them when you calculate your total dividend tax rates.

Reporting Dividend Income

Image Source: pexels

IRS Form 1099-DIV

When you receive dividend income, your bank or broker sends you IRS Form 1099-DIV. This form helps you report dividend income correctly on your tax return. You should check each box on the form to see what kind of income you received. Here is what you will find on Form 1099-DIV:

- Ordinary dividends appear in box 1a. You enter this amount on line 3b of Form 1040.

- Qualified dividends show up in box 1b. You enter this on line 3a of Form 1040.

- Capital gain distributions and other special payments also appear on the form.

- If your ordinary dividends are more than $1,500, or if you have dividends that belong to someone else, you must file Schedule B.

- The form comes with instructions to help you understand each box.

Tip: Always keep your Form 1099-DIV and review it for mistakes. This helps you avoid problems with the IRS.

Tax Return Reporting

You need to report dividend income on your tax return every year. If your total taxable interest and dividends go over $1,500, or if you have foreign accounts, you must use Schedule B. Schedule B has two parts. Part I covers interest income, and Part II covers dividend income. You list each dividend from your Forms 1099-DIV, showing ordinary and qualified dividends separately. After you finish Schedule B, you transfer the totals to the right lines on Form 1040. If you have foreign accounts or investments, you may need to file extra forms like Form 8938 or FBAR. Accurate reporting helps you avoid penalties and makes sure you pay the correct dividend tax.

Additional Taxes on Dividends

If you have high income, you may owe an extra tax called the Net Investment Income Tax (NIIT). This tax is 3.8% and applies if your modified adjusted gross income (MAGI) is above certain limits. For single filers, the limit is $200,000. For married couples filing jointly, it is $250,000. The NIIT covers net investment income, which includes both qualified and ordinary dividend income. You must use Form 8960 to figure out and report this tax. The NIIT is separate from other taxes, so you need to check if it applies to you each year.

Minimizing Dividend Tax

Tax-Advantaged Accounts

You can lower your dividend tax by using tax-advantaged accounts. The most common accounts in the US are traditional IRAs, Roth IRAs, and 401(k) plans. These accounts let your investments grow without immediate tax on dividends. In a Roth IRA, your dividends grow tax-free. If you wait until age 59½ and have held the account for five years, you can withdraw both your contributions and earnings without paying tax. This makes Roth IRAs a strong choice if you think your tax rate will be higher in retirement.

Traditional IRAs and 401(k)s work differently. You do not pay tax on dividends while they stay in the account. When you take money out, you pay tax at your regular income rate. This rate can be higher than the rate for qualified dividends in a regular account. Traditional IRAs also require you to start taking money out at age 73, which can affect your tax planning. Roth IRAs do not have this rule, so you can let your dividends grow as long as you want.

Tip: Health Savings Accounts (HSAs) and 529 plans also offer tax benefits, but they are best for healthcare and education expenses, not for general dividend investing.

Tax Reduction Strategies

You have several ways to reduce your dividend tax bill. Here are some of the most effective strategies:

| Strategy | How It Helps You Save on Tax |

|---|---|

| Tax-efficient investments | Choose index funds or ETFs that pay fewer taxable dividends. |

| Asset location | Hold dividend stocks in tax-advantaged accounts. |

| Tax-loss harvesting | Sell losing investments to offset up to $3,000 of dividend income. |

| Hold investments longer | Keep stocks for over a year to get lower tax rates on dividends. |

| Avoid frequent trading | Reduce short-term gains that are taxed at higher rates. |

You can use tax-loss harvesting to lower your taxable income. If your losses are more than your gains, you can use up to $3,000 each year to offset dividend income. Any extra losses carry forward to future years. Remember, the IRS wash-sale rule says you cannot buy the same stock within 30 days before or after selling it for a loss.

If you keep your taxable income below certain levels, you may qualify for a 0% tax rate on qualified dividends. You can do this by making contributions to retirement accounts or HSAs. Placing income-generating assets in tax-deferred accounts and growth stocks in taxable accounts can also help you manage tax implications.

Note: Always check the tax rules before making changes to your investments. A financial advisor can help you find the best strategy for your situation.

You face different tax rates on dividends depending on whether they are qualified or ordinary. Qualified dividends get lower rates, while ordinary dividends can be taxed much higher.

- Dividends must meet holding period and issuer rules to qualify for lower rates.

- You report all dividend income on IRS Form 1099-DIV.

- Tax-advantaged accounts like Roth IRAs help you reduce taxes.

| Feature | Qualified Dividends (0%, 15%, 20%) | Non-Qualified Dividends (10%–37%) |

|---|---|---|

| Tax Rate | Lower, based on income | Higher, matches ordinary income |

| Holding Period | Must meet IRS rules | No special requirement |

You should review your tax situation each year. A tax professional can help you avoid mistakes and find the best strategy for your needs.

FAQ

What happens if you forget to report dividend income?

If you forget to report dividend income, the IRS may send you a notice. You could owe extra tax, interest, or a penalty. Always check your Form 1099-DIV and include all dividend amounts on your tax return.

Do you pay dividend tax if you reinvest dividends?

Yes, you pay tax on dividends even if you reinvest them. The IRS counts reinvested dividends as income. You must report them each year, just like cash dividends.

How do you know if your dividends are qualified?

You can check your Form 1099-DIV. Qualified dividends appear in box 1b. You must also meet the holding period rules. If you are unsure, ask your broker or review your account statements.

Are dividends from foreign companies taxed differently?

Yes, dividends from foreign companies may face foreign withholding tax. You might get a credit for this tax on your US return. Always check the tax treaty between the US and the company’s country.

Managing dividend income in the US can be complex with high tax rates and costly cross-border transfers for global investments. BiyaPay, authorized by U.S. and New Zealand financial regulators, simplifies international payments with remittance fees as low as 0.5%, compared to bank wire fees up to $45. It supports real-time exchange rate queries and conversions for 30+ fiat and 200+ digital currencies across 100+ countries, ensuring transparent pricing with no hidden fees. Biya EasyCard, with no annual fee, enables secure payments in 190+ countries on platforms like Amazon, eBay, and PayPal, ideal for managing investment expenses. Enjoy same-day transfers and simple verification to streamline your portfolio. Start optimizing your global investments—register now with BiyaPay!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.