- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

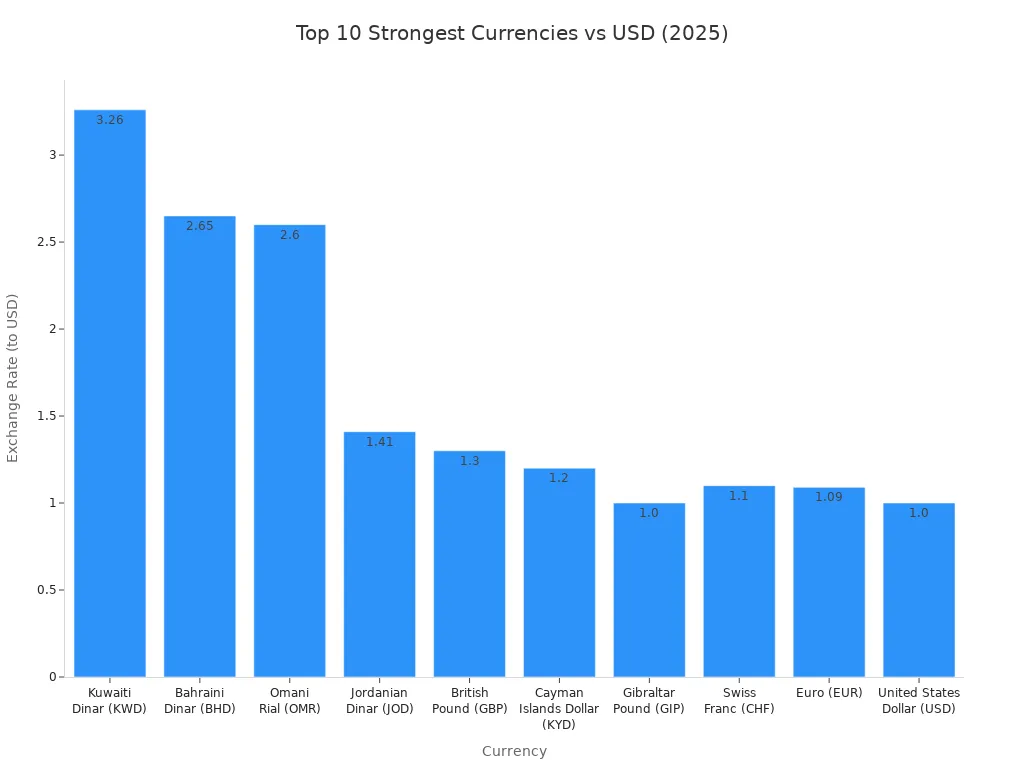

Top 10 Strongest Currencies in the World Right Now

Image Source: pexels

You may wonder which currencies top the charts in 2025. The strongest currencies include the Kuwaiti dinar, Bahraini dinar, and Omani rial, all with high values against the US dollar. Middle Eastern currencies dominate this list due to strong oil exports and stable economies. If you travel or invest, knowing the most valuable currencies helps you plan better. The table below shows the top 10 strongest currencies, including the swiss franc and euro, ranked by their USD value.

| Rank | Currency Name | Abbreviation | Approximate USD Exchange Rate (2025) |

|---|---|---|---|

| 1 | Kuwaiti Dinar | KWD | 1 KWD = 3.27 USD |

| 2 | Bahraini Dinar | BHD | ~2.65 USD |

| 3 | Omani Rial | OMR | ~2.60 USD |

| 4 | Jordanian Dinar | JOD | ~1.41 USD |

| 5 | British Pound Sterling | GBP | ~1.37 USD |

| 6 | Gibraltar Pound | GIP | ~1.37 USD |

| 7 | Falkland Islands Pound | FKP | N/A |

| 8 | Cayman Islands Dollar | KYD | ~1.20 USD |

| 9 | Swiss Franc | CHF | ~1.26 USD |

| 10 | Euro | EUR | ~1.18 USD |

You can see that the strongest currency in the world remains the Kuwaiti dinar. These strongest global currencies often appear in the top 35 highest currencies, while the singapore dollar also ranks high among international currencies.

Key Takeaways

- The Kuwaiti dinar is the strongest currency in 2025, valued at about 3.27 USD, mainly due to Kuwait’s oil wealth and stable economy.

- Middle Eastern currencies dominate the top rankings because of large oil exports and currency pegs to the US dollar, which keep their values stable.

- Strong currencies benefit travelers by increasing their buying power abroad, making goods and services cheaper in many countries.

- Currency strength depends on factors like economic stability, low inflation, high interest rates, political stability, and trade balances.

- Investors and travelers should watch exchange rates and use strategies like diversification and hedging to manage currency risks effectively.

Strongest Currencies: 2025 Rankings

Image Source: pexels

Currency Table

You may want to know which currencies lead the world in value. The top 10 strongest currencies in 2025 show a clear pattern. Middle Eastern currencies dominate the strong currency list, with the kuwaiti dinar at the top. The british pound sterling and the united states dollar also remain important. The table below shows the official ISO codes, exchange rates, and key factors for each currency.

| Rank | Currency Name | ISO Code | Exchange Rate (to USD) | Strength Factors |

|---|---|---|---|---|

| 1 | Kuwaiti Dinar | KWD | 1 KWD = 3.26 USD | Oil reserves, stable economy, fiscal policies |

| 2 | Bahraini Dinar | BHD | 1 BHD = 2.65 USD | Oil exports, USD peg, banking, tourism |

| 3 | Omani Rial | OMR | 1 OMR = 2.60 USD | Oil exports, diversified economy, USD peg |

| 4 | Jordanian Dinar | JOD | 1 JOD = 1.41 USD | Services, manufacturing, USD peg |

| 5 | British Pound Sterling | GBP | 1 GBP = 1.30 USD | Financial hub, stable politics, diverse economy |

| 6 | Gibraltar Pound | GIP | 1 GIP = 1.00 USD | Pegged to GBP, shipping services |

| 7 | Cayman Islands Dollar | KYD | 1 KYD = 1.20 USD | Tax haven, strong financial sector |

| 8 | Swiss Franc | CHF | 1 CHF = 1.10 USD | Political stability, low inflation, banking |

| 9 | Euro | EUR | 1 EUR = 1.09 USD | Economic power, Eurozone support |

| 10 | United States Dollar | USD | 1 USD = 1 USD | Global reserve, most traded currency |

Exchange Rates Overview

You see that the exchange rates reflect the real value of each currency against the usd. The kuwaiti dinar leads the top 10 currencies, followed by the bahraini dinar and omani rial. The british pound sterling and the euro also hold high positions. The united states dollar stays strong as the global reserve and remains the most traded currency. The singapore dollar, while not in the top 10 strongest currencies, often appears among the highest currencies in Asia.

When you look at the ranking, you notice that several factors shape the strongest currencies. These include:

- Economic stability and confidence in the country

- High interest rates that attract foreign investment

- Positive trade balances

- Low inflation rates

- Political stability and strong financial infrastructure

- Resource wealth, such as oil reserves

- Currency pegs to the usd or british pound

The top 10 strongest currencies have shown little change in recent years. The kuwaiti dinar, bahraini dinar, and omani rial have kept their places due to oil wealth and stable policies. The british pound and united states dollar have faced some volatility, but they remain key players. You can use this information to compare exchange rates, plan travel, or make investment decisions. The singapore dollar continues to gain attention for its stability and growth in the region.

What Makes a Currency Strong?

Key Factors

You may wonder why some currencies stand out as the strongest in the world. Several important factors shape currency strength and help you understand why certain currencies hold more value than others.

- High interest rates often attract foreign investment, which increases demand for a strong currency.

- Low inflation helps maintain purchasing power, supporting currency strength.

- Political and economic stability make investors feel confident, so they choose to hold assets in those currencies.

- Trade balances matter. When a country exports more than it imports, demand for its currency rises.

- Government policies, such as setting interest rates or managing national debt, play a big role in currency strength.

- Exchange rate systems, like floating or fixed rates, affect how currencies move in the global market.

- Global events, such as elections or natural disasters, can quickly change how investors view a currency.

- New technology, including digital currencies, also shapes how people use and value money.

You see these factors working together in the world’s top currencies. For example, the U.S. dollar remains strong because of high interest rates and steady economic growth. Central banks, like those in Switzerland or the United Kingdom, use monetary policy to keep inflation low and support their strong currency.

Economic Stability

Economic stability stands at the heart of currency strength. When a country shows steady growth and low inflation, you notice its currency often becomes more valuable. Investors look for safe places to put their money, so they choose stable economies with strong currency performance.

Oil-based economies, especially in the Middle East, offer a clear example. Countries like Kuwait and Bahrain have large oil reserves and strong fiscal policies. They peg their currencies to the U.S. dollar, which helps anchor inflation and keep their currencies stable. This peg system reduces risk and supports long-term economic performance, even when oil prices change.

You also see that governments with low national debt and large financial reserves can protect their currency during tough times. By keeping inflation under control and building trust, these countries maintain currency strength. When you travel or invest, you benefit from the stability and value of these strong currencies.

Profiles of the Strongest Currencies

Kuwaiti Dinar – Strongest Currency in the World

You will find that the kuwaiti dinar stands as the strongest currency in the world. One kuwaiti dinar equals about 3.27 USD, making it the highest-valued currency on the global market. Kuwait uses this currency, and its strength comes from vast oil reserves and a stable economy. Oil exports bring in large amounts of foreign revenue. The government keeps a strong financial reserve, which helps the dinar stay stable even when oil prices change. Kuwait pegs its currency to a basket of international currencies, which includes the us dollar. This peg helps keep the exchange rate steady. The kuwaiti dinar remains one of the most valuable currencies because of these factors.

Note: Oil exports and currency pegs play a key role in the dominance of Middle Eastern currencies among the strongest currencies. The petrodollar system links oil sales to the us dollar, which supports both the kuwaiti dinar and the global demand for the usd.

Bahraini Dinar

The bahraini dinar is another top performer among the strongest currencies. One bahraini dinar equals about 2.65 USD. Bahrain uses this currency, and its value comes from several important factors:

- The bahraini dinar is pegged to the us dollar at a fixed rate, which gives you exchange rate stability.

- Bahrain earns strong export revenues from oil and natural gas.

- The country has diversified its economy into banking, finance, tourism, and telecom, which reduces risk from oil price changes.

- The Central Bank of Bahrain controls inflation and liquidity, keeping the currency stable.

- Bahrain welcomes foreign investors with low taxes and easy business rules, which strengthens the economy and the currency.

You can see that the bahraini dinar stays strong because of both oil wealth and smart economic policies.

Omani Rial

The omani rial is one of the strongest currencies in the world. One omani rial equals about 2.60 USD. Oman uses this currency, and its value comes from a mix of economic and policy strengths.

| Aspect | Details |

|---|---|

| Exchange Rate | 1 OMR = 2.6008 USD (pegged to the us dollar) |

| Political Stability | Oman is politically stable, which attracts investors. |

| Economic Growth | Recent growth from infrastructure investments boosts the omani rial. |

| Inflation Rate | Low inflation helps keep the currency strong. |

| Interest Rates | High interest rates (2.75%) attract investors looking for better returns. |

| Forex Appeal | The omani rial is popular in carry trade strategies, which increases demand and value. |

Oman’s large oil reserves and stable government support the omani rial’s high ranking. The currency peg to the usd ensures steady value, making it a reliable choice for investors and travelers.

Jordanian Dinar

The jordanian dinar is another strong currency, valued at about 1.41 USD per dinar. Jordan uses this currency, and its strength comes from several sources:

- The Central Bank of Jordan uses careful monetary policies to control the currency.

- The jordanian dinar is pegged to the us dollar, which keeps its value stable.

- Jordan receives steady foreign aid, which supports the economy.

- Remittances from Jordanians working abroad help keep the currency strong.

Jordan does not have large oil reserves, but it relies on services, tourism, and manufacturing. The fixed peg to the usd and strong financial management help the jordanian dinar remain one of the strongest currencies.

Gibraltar Pound

The gibraltar pound is valued at about 1.37 USD. Gibraltar uses this currency, and it is pegged to the british pound sterling at par. This means one gibraltar pound always equals one british pound. The gibraltar pound stays strong because Gibraltar has a stable economy focused on financial services and shipping. The peg to the british pound sterling ensures that the gibraltar pound keeps its value in line with one of the world’s most valuable currencies.

British Pound Sterling

The british pound sterling is one of the most valuable currencies, with one pound worth about 1.37 USD. The United Kingdom uses this currency, and it is known for its long history of strength. Several factors support the british pound sterling:

- The Bank of England keeps interest rates higher than many other central banks, which attracts investment.

- The UK economy shows positive signs, such as GDP growth and strong employment.

- Investors expect the Bank of England to keep rates steady, while the US Federal Reserve may lower rates.

- The pound’s high value also comes from a smaller supply of pounds compared to the us dollar.

- Political stability and strong financial services in London help the british pound sterling stay strong.

You will notice that the british pound sterling remains a key player in the global market, often trending toward the upper range against the usd.

Cayman Islands Dollar

The cayman islands dollar is valued at about 1.20 USD. The Cayman Islands use this currency, and its strength comes from a strong financial sector. The islands are known as a tax haven, with many hedge funds, investment firms, and banks. The cayman islands dollar is pegged to the usd, which keeps its value stable. The financial services industry supports the currency’s strength and makes it attractive for international business.

Swiss Franc

The swiss franc is one of the strongest currencies in the world, valued at about 1.26 USD. Switzerland uses this currency, and it is famous for stability and safety. The swiss franc stays strong for many reasons:

- Switzerland has a long history of fiscal responsibility and low national debt.

- The country holds large gold reserves and other hard assets.

- Switzerland is not part of the European Union, so it avoids eurozone debt problems.

- The economy is strong, with high GDP, low unemployment, and no budget deficit.

- The Swiss National Bank manages the currency carefully, keeping inflation low.

- The swiss franc is popular with investors who want security during global uncertainty.

You will see that the swiss franc is trusted worldwide and often used as a safe haven in times of crisis.

Euro

The euro (eur) is used by 20 countries in the European Union. One euro is worth about 1.18 USD. The euro is one of the most valuable currencies and is the second largest reserve currency after the united states dollar. The euro’s strength comes from:

- Widespread use across many countries, which increases its importance.

- The European Central Bank manages the euro with stable policies.

- The euro is highly liquid in global markets, with strong demand.

- The eurozone’s collective economic power supports the currency.

- Political stability and trusted central bank policies keep the euro strong.

The euro’s role in global trade and finance makes it a major player among the strongest currencies.

United States Dollar

The united states dollar is the world’s main reserve currency. One usd equals one usd by definition. The united states dollar is used in the United States and is accepted worldwide. Its strength comes from several key factors:

| Key Factors Supporting USD Strength |

|---|

| Stable US political and economic environment |

| Higher interest rates attract foreign investors |

| Robust and liquid financial markets |

| Significant foreign exchange reserves |

| Economic diversification |

| Geopolitical stability |

The united states dollar is the most traded currency and is used as the standard for valuing other currencies. Many countries peg their currencies to the usd, which helps keep their own currencies stable. The united states dollar’s global influence comes from the size and stability of the US economy, its role in international trade, and its trusted financial system.

Global Impact of Strongest Currencies

Image Source: unsplash

Trade and Investment

You see the strongest currencies shape global trade and investment in many ways. Countries with stable economies and strong currencies attract more foreign direct investment. Investors feel confident when they see low inflation and steady governments. This confidence leads to more money flowing into these countries.

- Geopolitical events, such as conflicts, can change trade routes and investment flows. For example, trade between major blocs like the U.S. and China has shifted, while countries like Mexico and Vietnam have become new trade connectors.

- Strong currencies, such as the united states dollar and euro, act as global currency powerhouses. These major reserve currencies influence trade patterns far beyond their borders.

- When a country has the highest buying power, it can import goods at lower prices. This makes imports cheaper but can make exports less competitive.

- Oil-rich countries like Kuwait and Bahrain use their strong currencies to attract investment and shape trade in their regions.

| Factor | Impact on Trade and Investment Patterns |

|---|---|

| Purchasing Power | Strong currencies buy more foreign goods, making imports cheaper and changing trade balances. |

| Economic Stability | Attracts foreign investment due to investor confidence. |

| Interest Rates | Higher rates draw in foreign capital, boosting demand for the currency. |

| Political Stability | Stable governments increase investor trust and support currency strength. |

| Global Currency Usage | USD and euro dominate global trade, shaping flows and investment beyond their own economies. |

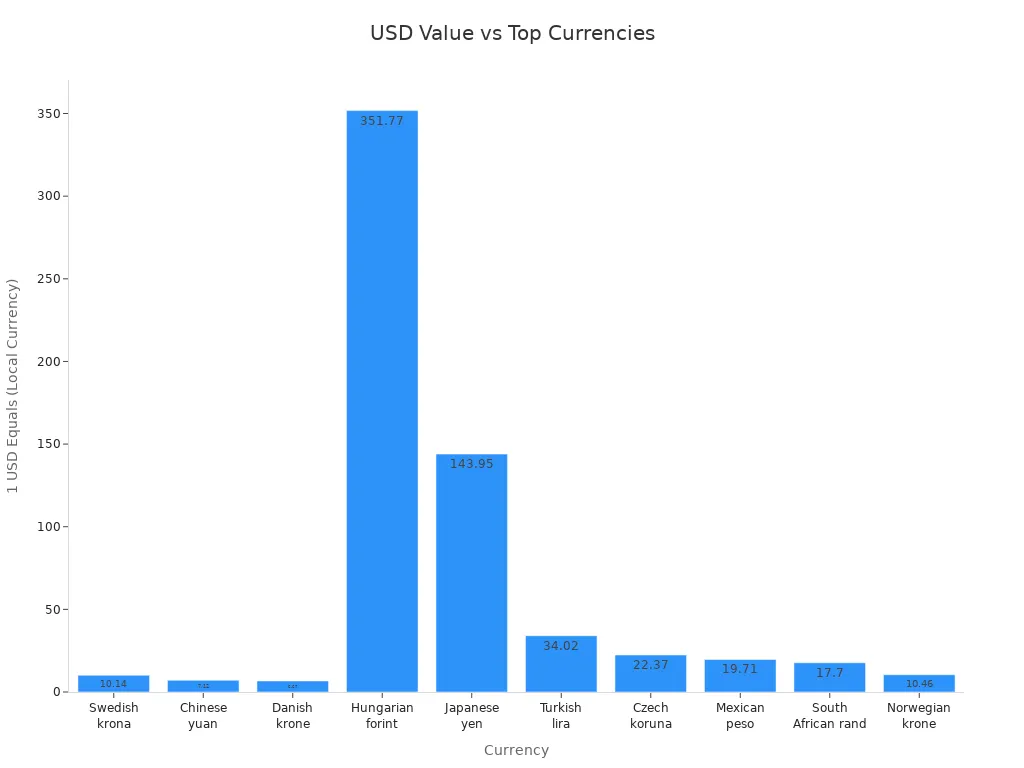

The united states dollar, in particular, affects countries with weaker local currencies. When the us dollar strengthens, currencies like the Mexican peso or Chinese renminbi often lose value. This can make exports from those countries cheaper but raises the cost of imports. Central banks may adjust their policies to keep their economies stable when the usd changes.

Travel and Purchasing Power

When you travel with a strong currency, your money goes further. For example, a strong united states dollar lets you buy more goods and services abroad. Many Americans travel to Europe when the dollar is strong against the euro or british pound. You might notice that shopping, dining, and transportation can be up to 30% cheaper in these situations.

- Flight searches to cities like Paris and London have increased as travelers take advantage of favorable exchange rates.

- A hotel room that cost $224 last year may now cost only $208 because of currency changes.

- Travelers often save hundreds of dollars on luxury goods purchased abroad compared to prices at home.

You should also watch out for the “money-illusion” effect. Sometimes, you may misjudge prices when converting foreign currencies. This can lead to overspending or underspending. Using currency conversion tools helps you make better choices and avoid mistakes.

The strength of global currency powerhouses like the usd and euro means you can enjoy higher purchasing power in many countries. However, airfare and hotel prices booked in dollars may not always drop, even when your currency is strong. Always check exchange rates and plan your spending to get the most value from your travels.

You have seen that the Kuwaiti dinar, Bahraini dinar, and Omani rial top the list of strongest currencies due to stable economies and oil wealth. When you travel, strong currencies can stretch your budget, but you should watch exchange rates and use multi-currency accounts to save on fees. Investors face currency risk, so you need to manage it with strategies like diversification and hedging. Currency rankings can change as new technologies, global events, and shifting reserves reshape the market. Staying informed helps you make smarter choices for your money.

FAQ

What is the strongest currency in the world right now?

You will find that the Kuwaiti dinar holds the top spot. One Kuwaiti dinar equals about 3.27 USD. This high value comes from Kuwait’s oil reserves and stable economy.

Why do Middle Eastern currencies rank so high?

You see Middle Eastern currencies at the top because these countries have large oil exports. They often peg their currencies to the US dollar. This practice helps keep their exchange rates stable.

How does a strong currency affect your travel plans?

A strong currency gives you more buying power abroad. You can buy more goods and services for the same amount of money. Always check exchange rates before you travel.

Can currency rankings change quickly?

Yes, currency rankings can shift. Economic events, political changes, or new government policies may cause a currency to rise or fall. You should stay updated if you plan to invest or travel.

Dealing with strong currencies like the Kuwaiti dinar (3.27 USD) often involves high transfer fees and exchange rate risks for travelers and investors. BiyaPay, authorized by U.S. and New Zealand financial regulators, offers seamless global banking with remittance fees as low as 0.5%, far below traditional bank wire costs (up to $45). It supports real-time exchange rate queries and conversions for 30+ fiat and 200+ digital currencies, ensuring transparent pricing with no hidden fees. Biya EasyCard, with no annual fee, supports payments in 190+ countries at platforms like Amazon, eBay, and PayPal, ideal for expatriates or travelers handling international shopping. With same-day transfers and simple identity verification, BiyaPay ensures fast, secure access to funds. Pair with travel insurance for comprehensive protection—join BiyaPay to simplify your global financial needs today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.