- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Travel Insurance Australia Guide for Smart Travelers

Image Source: unsplash

You want the best travel insurance for peace of mind. The best travel insurance can protect you from unexpected costs on your trip. You will find that choosing the right plan saves you money and stress. Many Australians pay between $130 USD and $460 USD per year for single travelers, but families may spend up to $790 USD or more. Prices change based on your age, destination, and how long you travel. The best travel insurance in Australia gives you clear coverage and fast claims. You deserve the best value and protection for every journey.

Key Takeaways

- Compare travel insurance providers to find plans that fit your trip and budget.

- Look for coverage that includes emergency medical care, trip cancellation, and lost luggage.

- Check policy details for exclusions like pre-existing conditions and risky activities.

- Buy travel insurance soon after booking to get better cancellation protection.

- Use online tools and read customer reviews to choose reliable providers with good service.

Best Travel Insurance in Australia

Image Source: unsplash

Top Providers

You have many choices when looking for the best travel insurance in Australia. Some travel insurance providers stand out because they serve many travelers and offer strong coverage. Here are the most popular options:

- Allianz Australia Limited

- Cover-More

- NIB

- 1Cover

- Fast Cover

- RAC

- Bupa

- Travel Insurance Direct

- Tick

- WorldTrips

Other global companies like AIG Australia Ltd and Suncorp Group also have a strong presence. These travel insurance providers have built trust with Australian travelers by offering reliable service and a wide range of plans.

Why They Stand Out

You want the best travel insurance for your needs. The best providers offer more than just basic coverage. They give you peace of mind with features that make your trip safer and easier.

- Flexible policy options: Choose from single trip, annual multi-trip, domestic, or inbound plans.

- High cover limits: Some plans offer unlimited medical coverage, up to $25,000 for luggage, and $5 million for liability.

- Add-ons: You can add coverage for adventure sports, business equipment, or rental vehicle excess.

- Mobile app: Manage your policy and get real-time travel alerts on your phone.

- 24/7 global emergency assistance: Get help anytime, anywhere.

- Support for all ages: Some providers cover travelers up to 99 years old.

- Family benefits: Many plans cover dependent children at no extra cost.

- COVID-19 coverage: Many policies now include medical and travel costs related to COVID-19.

- Pre-existing conditions: Some providers automatically cover over 40 pre-existing conditions.

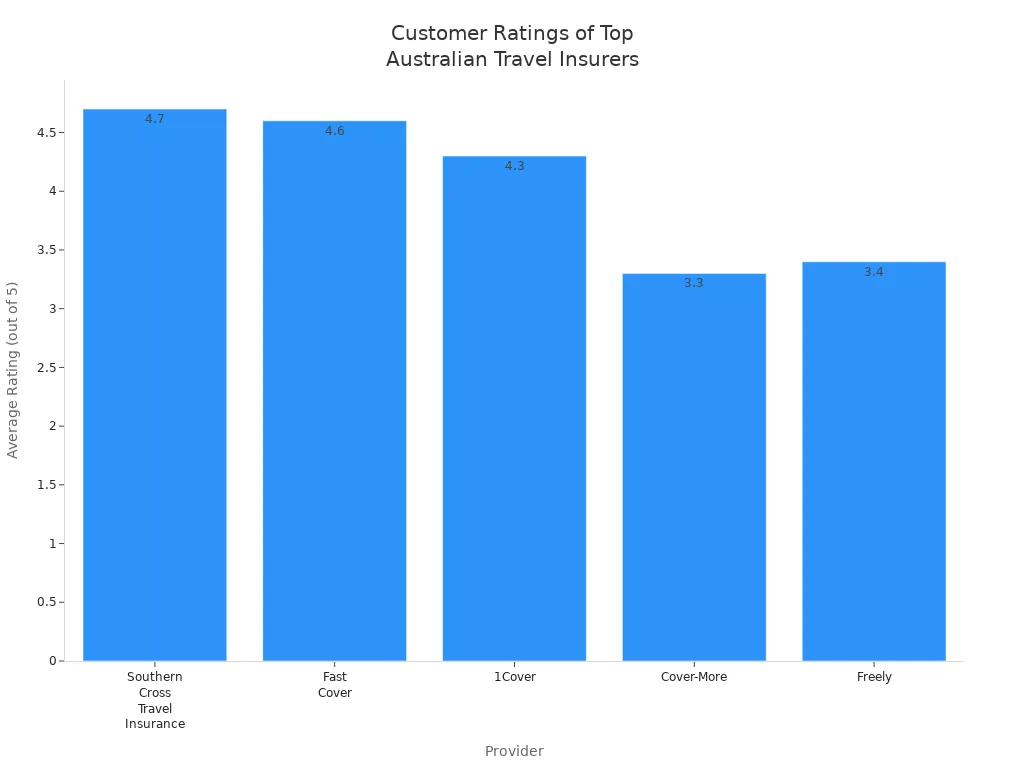

You can see how these features compare in customer satisfaction. The table below shows how travelers rate some of the best travel insurance providers:

| Provider | Average Rating (out of 5) | Number of Reviews | Positive Review % | Key Satisfaction Factors |

|---|---|---|---|---|

| Southern Cross Travel Insurance | 4.7 | 3,010 | 93% | High claim approval, excellent customer service, value for money, policy transparency, COVID-19 coverage |

| Fast Cover | 4.6 | 2,092 | 94% | Australian-based service, high customer service ratings, value for money, user-friendly process |

| 1Cover | 4.3 | 4,750 | 84% | Strong customer service, value for money, ease of use, COVID-19 medical coverage |

| Cover-More | 3.3 | 2,880 | 57% | Mixed reviews, lower customer service and value for money ratings, variable claim resolution times |

| Freely | 3.4 | 28 | 54% (5-star), 21% (1-star) | Mixed feedback on claims handling and customer service, some positive experiences |

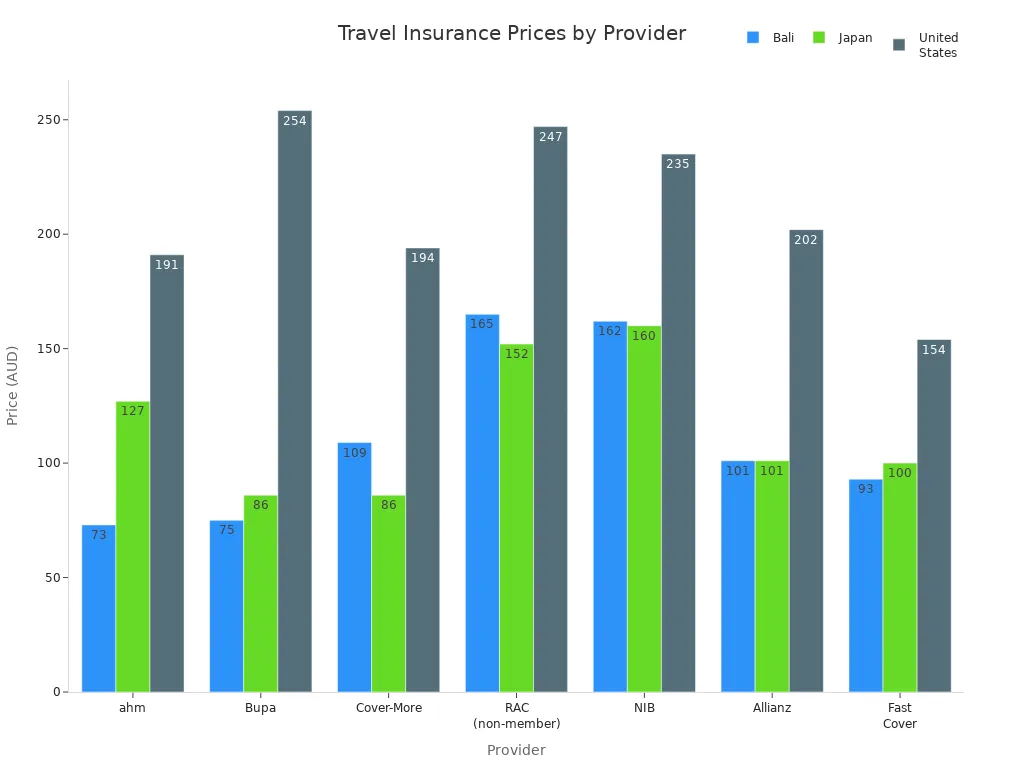

You also want to know about price. The best travel insurance does not always mean the most expensive. Prices change based on your destination, age, and coverage level. Here is a look at typical one-week travel insurance prices in USD (using an exchange rate of 1 AUD = 0.67 USD):

| Provider | Bali (USD) | Japan (USD) | United States (USD) |

|---|---|---|---|

| ahm | 49 | 85 | 128 |

| Bupa | 50 | 58 | 170 |

| Cover-More | 73 | 58 | 130 |

| RAC (non-member) | 111 | 102 | 166 |

| NIB | 109 | 107 | 157 |

| Allianz | 68 | 68 | 135 |

| Fast Cover | 62 | 67 | 103 |

You can expect to pay from about $10.90 USD per day for a single traveler. The best way to save money is to compare travel insurance providers and choose the plan that fits your trip.

Tip: Always check what is included in your policy. Some plans offer the best value for families or adventure travelers, while others focus on business trips or seniors.

You may wonder if credit card travel insurance is enough. Some credit cards offer basic travel insurance if you pay for your trip with the card. This can be helpful for short trips or if you want simple coverage. However, credit card travel insurance often has lower limits and more exclusions. For the best protection, especially for long or expensive trips, you should consider a separate policy from a reliable provider.

The best travel insurance in Australia gives you strong coverage, easy claims, and good value. You can travel with confidence when you choose the best plan for your needs.

Travel Insurance Coverage

Image Source: pexels

What’s Included

When you buy travel insurance, you want to know what you get. Most travel insurance policies in Australia offer three main levels: basic, standard, and comprehensive coverage. Basic plans focus on emergency medical care. Standard plans add trip cancellation and lost luggage. Comprehensive travel insurance gives you the highest limits and extra benefits, such as COVID-19 cover.

You can expect these common features in your travel insurance:

- Emergency medical expenses, including doctor visits and hospital stays

- Medical evacuation or repatriation if you need to return home

- Trip cancellation, interruption, or travel delays

- Lost, stolen, or damaged baggage and personal belongings

- Personal liability for accidental damage or injury

- Accidental death or loss of income

- 24/7 emergency assistance

Travel insurance coverage often includes optional add-ons. You can choose adventure activities cover, ski cover, cruise cover, or rental car excess cover. These extras help protect you if you plan to ski, surf, or drive during your trip. Both single-trip and annual travel insurance policies usually include medical, cancellation, and baggage protection. You can tailor your plan to match your needs.

Tip: Domestic travel insurance does not cover medical costs, since Medicare or private health insurance applies in Australia.

Common Exclusions

Travel insurance does not cover everything. You need to know what is not included so you do not face surprises. Most travel insurance policies exclude:

- Pre-existing medical conditions unless you declare them and get approval

- Mental health conditions, unless your policy says otherwise

- High-risk or adventure activities, like skydiving or scuba diving, unless you buy extra cover

- Travel to places with government warnings

- Theft of unattended items or damage due to negligence

- Claims related to alcohol, drugs, or illegal acts

- Traveling against medical advice or to seek medical treatment

- Pregnancy-related claims, unless your policy covers them

If you have a pre-existing condition, always declare it. Some policies offer a waiver or special cover, but you must meet their rules. Not declaring your condition can lead to denied claims. Risky activities also need special cover. If you plan to ski, dive, or ride a motorcycle, check your policy for exclusions.

Note: Always read your policy documents. Understanding exclusions helps you avoid denied claims and ensures you get the right protection.

Finding the Best Travel Insurance

How to Compare Plans

You want to make sure you choose the right travel insurance for your trip. Finding the best travel insurance starts with a careful travel insurance comparison. You can follow these steps to compare travel insurance options and find the best plan for your needs:

- List your planned activities. Check if your travel insurance covers everything you want to do, such as skiing, hiking, or cruising.

- Review medical coverage. Make sure your policy covers emergency medical care and support. Look for coverage that includes hospital stays, doctor visits, and medical evacuation.

- Compare prices by destination and trip length. Some travel insurance policies cost more for certain countries or longer trips. Consider if an annual plan saves you money if you travel often.

- Check trip cancellation and delay coverage. See if your policy pays for canceled flights, missed connections, or travel delays.

- Ask about policy extensions. Find out if you can extend your coverage if your return gets delayed.

- Evaluate the claims process. Choose a provider with a simple and fast claims process. Read reviews to see how quickly claims get paid.

- Look for common exclusions. Watch for exclusions like pre-existing conditions, risky activities, or travel to unsafe regions.

- Read the policy disclosure statement (PDS). Always read the PDS to avoid surprises and extra costs.

Tip: Use online tools like Insurte to compare travel insurance policies from top Australian providers. These tools let you see coverage, limits, exclusions, and prices side by side. You can also read customer reviews and get instant quotes.

You can also use the International Insurance website to compare international travel insurance plans. This helps if you need coverage for trips outside Australia or want to supplement your existing policy.

Key Factors to Consider

You need to think about several important factors when finding the best travel insurance. Each trip is different, so your travel insurance options should match your travel style and needs. Here are the key things to consider:

- Coverage for medical expenses and emergencies: Always check if your policy covers hospital stays, doctor visits, and emergency evacuation. This is the most important part of any travel insurance.

- Trip cancellation and delay protection: Make sure your plan pays for canceled trips, missed flights, or delays.

- Baggage and property coverage: Look for protection against lost, stolen, or damaged luggage.

- Type of travel insurance: Choose single-trip insurance for one-time trips, annual multi-trip insurance for frequent travel, or long-stay insurance for study or work abroad.

- Customization for your trip type: Pick a plan that fits your trip. For example, domestic travel insurance covers trips within Australia, while international travel insurance protects you overseas. Cruise travel needs special coverage for missed ports and onboard emergencies. Adventure trips require coverage for high-risk activities.

- Family and group coverage: If you travel with family, look for plans that cover children and offer higher limits for medical and baggage protection.

- Policy limits and deductibles: Check how much the policy pays for each type of claim and what you must pay out of pocket.

- Exclusions and limitations: Read the fine print to know what is not covered, such as pre-existing conditions or risky sports.

- Provider reputation and support: Choose a provider with strong customer service and a good claims record.

- Regulatory protection: Make sure your provider follows Australian regulations for transparency and consumer protection.

The table below shows how different trip types affect your travel insurance needs:

| Trip Type | Insurance Coverage Needs and Considerations |

|---|---|

| Domestic Travel | Covers medical emergencies, lost or stolen belongings, and trip interruptions within Australia. |

| Adventure Trips | Needs coverage for high-risk activities like hiking, diving, or water sports. |

| Cruise Travel | Requires special coverage for missed connections, onboard medical emergencies, and cruise-specific risks. |

| Family Trips | Needs broader coverage for medical evacuation, trip cancellation, and baggage protection for all family members. |

| International | Needs broad coverage for medical evacuation, trip cancellation, and baggage protection, often with higher coverage limits. |

Note: Always compare several travel insurance options before you buy. Use online comparison tools to get quotes and see which plan offers the best value for your trip.

Finding the best travel insurance means matching your policy to your trip. You should always review your travel insurance comparison results, read the policy details, and choose the plan that gives you the best protection and peace of mind.

Provider Comparison

Comparison Table

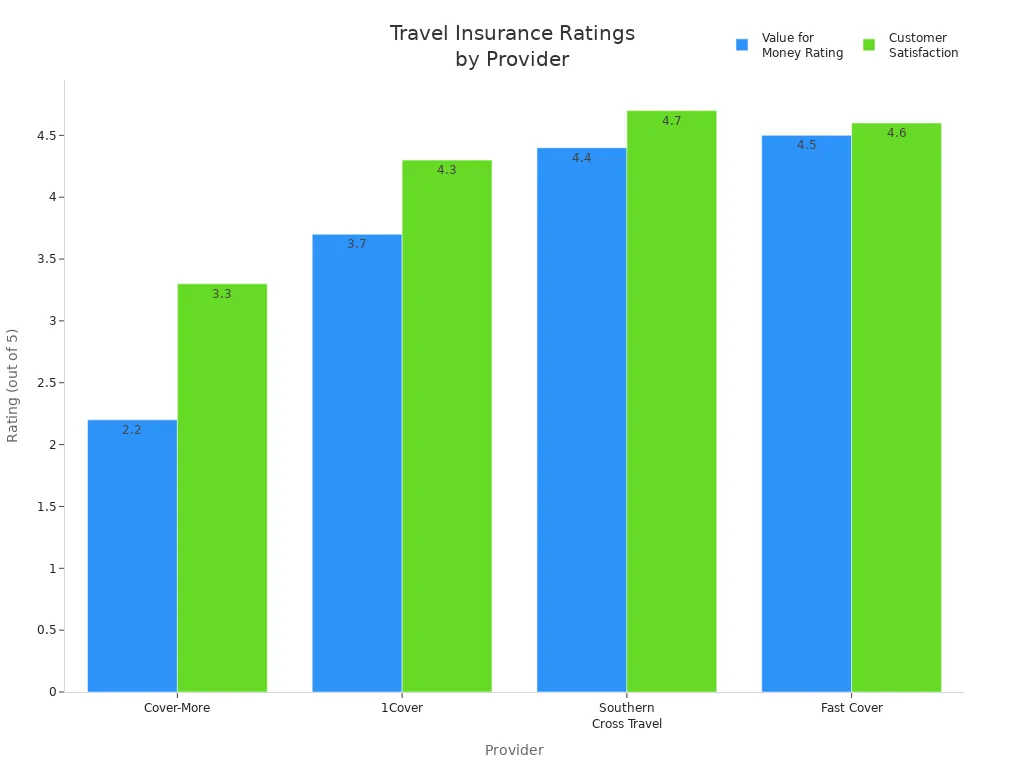

When you compare travel insurance, you want to see how each provider performs in key areas. The table below shows how four leading travel insurance providers stack up on coverage, customer satisfaction, value, and service. You can use this table to quickly spot differences and find the best fit for your trip.

| Provider | Coverage Highlights | Customer Satisfaction (Rating) | Value for Money Rating | Customer Service Rating | Notes on Premiums and Coverage Limits |

|---|---|---|---|---|---|

| Cover-More | Multiple plans (Comprehensive+, Basic), COVID-19 coverage, adventure activities | 3.3 / 5 (57% positive) | 2.2 | 2.1 | Coverage limits vary by plan; mixed reviews on value for money suggest premiums may be higher or less competitive. |

| 1Cover | Unlimited overseas medical, cancellation, luggage cover, COVID-19 medical cover | 4.3 / 5 (84% positive) | 3.7 | 3.6 | Customers find premiums cost-effective; coverage includes broad benefits with some unlimited limits. |

| Southern Cross Travel Ins. | Variety of policies including comprehensive and medical only, 96% claim approval | 4.7 / 5 (93% positive) | 4.4 | 4.4 | High satisfaction and value ratings imply competitive premiums and clear coverage limits; policy transparency noted. |

| Fast Cover | Unlimited medical assistance, covers seniors up to 89, multiple trip types | 4.6 / 5 (94% positive) | 4.5 | 4.6 | High value for money rating suggests competitive premiums; coverage includes unlimited medical assistance. |

Tip: Use this table to compare travel insurance providers before you buy. Look at both customer ratings and coverage details.

Strengths and Weaknesses

You need to know the strengths and weaknesses of each provider before you choose travel insurance. Here is a summary to help you decide:

- Allianz

- Strengths:

- Offers standalone rental car insurance, which can save you money.

- Good selection of annual plans for frequent or business travelers.

- Reputable and stable company with strong financial ratings.

- Free coverage for children under 17 on some plans.

- Accessible coverage for pre-existing conditions.

- Weaknesses:

- Medical coverage limits are lower than many competitors.

- No Cancel For Any Reason (CFAR) coverage.

- Plans can be more expensive, especially for younger travelers.

- Some competitors offer better coverage at similar prices.

- Strengths:

- Cover-More

- Strengths:

- Includes children under 17 at no extra cost.

- Generous pre-existing condition waivers.

- Good medical limits and strong customer service.

- Best for families, cruise travelers, and those with pre-existing conditions.

- Weaknesses:

- Limited coverage for adventure activities.

- Fewer options for long-term travelers.

- Mixed reviews on value for money.

- Strengths:

- NIB

- Strengths:

- Over 60 years of experience in health and travel insurance.

- Affordable and innovative solutions.

- Strong focus on technology and customer service.

- Good distribution network and group resources.

- Weaknesses:

- Smaller market share.

- Modest capital base, which can increase risk during stress scenarios.

- Some operational risks due to integration with partners.

- Strengths:

- WorldTrips

- Strengths:

- Affordable pricing for long-term travelers.

- Covers multiple countries without location updates.

- Continuous annual coverage with no trip length limits.

- COVID-19 coverage included on many plans.

- Weaknesses:

- Limited coverage for pre-existing conditions and high-risk sports.

- Claims process can take longer.

- Customer service can be hard to reach.

- Website can be glitchy.

- Strengths:

When you compare travel insurance, look at both the benefits and the drawbacks. This helps you choose the right plan for your needs. Each provider offers something unique, so match their strengths to your travel plans.

Provider Reviews

Allianz

You may know Allianz as a global leader in travel insurance. Allianz offers a wide range of plans for different types of trips. You can find options for single trips, annual coverage, and even rental car protection. Many travelers choose Allianz because of its strong financial backing and easy-to-use online claims process. You get access to 24/7 emergency help. Some customers say the medical coverage limits are lower than other providers. However, you can trust Allianz for a reliable experience.

Cover-More

Cover-More stands out as one of the most popular travel insurance brands in Australia. You can add coverage for pre-existing conditions and include children under 17 at no extra cost. Many families pick Cover-More for its flexible plans. The company offers a simple claims process and a helpful mobile app. Some reviews mention higher prices, but you get strong customer support and a wide network of partners.

NIB

NIB has over 60 years of experience in health and travel insurance. You can find affordable plans that cover both domestic and international trips. NIB uses technology to make buying and claiming easy. Many travelers like the clear policy wording and fast claim approvals. Some users say the coverage for adventure sports is limited. NIB remains a trusted choice for many Australians.

1Cover

1Cover gives you unlimited medical coverage and strong protection for lost luggage. You can buy travel insurance for single trips or multiple trips in a year. Many customers praise 1Cover for its value and easy claims process. The company also offers COVID-19 medical coverage. You get good support if you travel with family or have special needs.

Fast Cover

Fast Cover is known for covering seniors up to 89 years old. You can get unlimited medical assistance and coverage for many adventure activities. Fast Cover has high customer satisfaction ratings. Many travelers say the claims process is quick and fair. You can rely on Fast Cover for flexible travel insurance options.

RAC

RAC offers travel insurance with a focus on customer trust. The company has a customer rating of 4.48 out of 5. You can choose from several plans, including coverage for cruises and rental cars. RAC is a trusted provider in Western Australia. Many users like the clear policy details and helpful customer service.

Tick

Tick won the 2024 Canstar Award for outstanding value. You can find affordable travel insurance plans with good coverage for medical emergencies and cancellations. Tick makes the claims process simple and fast. Many customers praise Tick for its value and easy-to-understand policies.

WorldTrips

WorldTrips offers travel insurance for long-term and multi-country trips. You can get continuous coverage without trip length limits. Many digital nomads and students use WorldTrips for its flexible plans. Some users say the claims process takes longer, but you get affordable prices and COVID-19 coverage.

Tip: Always read customer reviews before you buy travel insurance. This helps you choose a provider that matches your needs.

Tips for Saving on Travel Insurance

Money-Saving Strategies

You can save money on travel insurance by using a few smart strategies. Here are some of the best ways to keep your costs low while still getting the protection you need:

- Check your credit card benefits. Some credit cards offer complimentary travel insurance. If your card includes trip cancellation, interruption, or emergency medical coverage, you may not need to buy a separate policy.

- Buy travel insurance soon after booking. When you purchase your policy early, you get coverage for cancellations and interruptions right away. This helps you avoid missing out on important protection.

- Customize your coverage. Choose only the coverage you need. If you do not plan to ski or try adventure sports, skip those add-ons. Lowering your cancellation cover limit can also reduce your premium.

- Match your policy to your trip. Pay only for coverage that fits your itinerary. For example, if you travel within Australia, domestic travel insurance may be enough.

- Compare travel insurance deals online. Use online tools to compare providers and policies. This helps you find affordable travel insurance deals that match your needs.

- Read the policy details. Make sure you understand what is included and what is not. Avoid paying for coverage you do not need.

Tip: Always compare at least three travel insurance providers before you buy. This gives you a better chance of finding the best value.

Common Mistakes to Avoid

Many travelers make mistakes when buying travel insurance. You can avoid these common pitfalls:

- Underinsuring your trip. If you choose the cheapest policy, you may not get enough coverage for medical emergencies or cancellations.

- Missing the fine print. Some policies have exclusions that can surprise you. Always read the policy documents carefully.

- Not declaring pre-existing conditions. If you do not tell your provider about your health conditions, your claim may be denied.

- Ignoring policy limits. Check the maximum amounts for medical, baggage, and cancellation coverage.

- Forgetting to check travel insurance deals. You might miss out on discounts or special offers if you do not compare options.

Note: Taking time to review your travel insurance options helps you avoid costly mistakes and ensures you get the right protection for your trip.

You can find the best travel insurance by following a few simple steps. Start by comparing travel insurance providers and reading customer reviews. Make sure your travel insurance covers medical emergencies, adventure activities, and trip cancellations. Look for plans that protect you from natural disasters and lost luggage. Use online tools to match your travel insurance to your trip. Remember these key points:

- Choose travel insurance with at least $100,000 for emergency medical and $250,000 for evacuation.

- Pick policies that cover adventure sports and natural disasters.

- Protect your trip investment with cancellation coverage.

- Check for lost or delayed luggage benefits.

- Understand exclusions to avoid surprises.

- Travel insurance costs about 4% to 10% of your trip, but it can save you thousands.

Smart planning gives you peace of mind. With the right travel insurance, you travel with confidence and get the best value for your journey.

FAQ

What does travel insurance cover?

Travel insurance covers emergency medical care, trip cancellations, lost luggage, and personal liability. You can add extra coverage for adventure sports or rental cars. Always check your policy for details.

How much does travel insurance cost in Australia?

You usually pay between $10.90 and $20 USD per day for a single traveler. The price depends on your age, destination, and trip length. Use an exchange rate of 1 AUD = 0.67 USD for estimates.

Can you buy travel insurance after booking your trip?

Yes, you can buy travel insurance after booking. You get more benefits if you buy soon after booking. Early purchase gives you better cancellation and interruption coverage.

Does travel insurance cover COVID-19?

Most Australian travel insurance plans now include COVID-19 coverage. You get protection for medical costs and trip cancellations due to COVID-19. Always read your policy to see what is included.

Is credit card travel insurance enough?

Credit card travel insurance gives you basic coverage. You may not get high limits or coverage for all activities. For long or expensive trips, you should consider a separate policy for better protection.

While top travel insurance providers like Cover-More and Allianz protect against medical emergencies and trip cancellations, managing payments abroad can still be costly and complex. BiyaPay simplifies your travel finances with secure, same-day international transfers and remittance fees as low as 0.5%. Supporting real-time exchange rate queries for 30+ fiat and 200+ digital currencies, BiyaPay ensures transparent pricing with no hidden costs. The Biya EasyCard enhances your travel experience, enabling hassle-free payments in 190+ countries with 40+ local currencies, including Amazon, eBay, and PayPal, all with no annual fee. For example, use it to pay for a Netflix subscription or buy souvenirs on eBay while traveling, without worrying about high conversion fees. Complement your travel insurance with BiyaPay’s global convenience—register in minutes at BiyaPay for secure, cost-effective transactions on your next adventure.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.