- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What You Need to Know About PNC Bank Before Opening an Account

Image Source: pexels

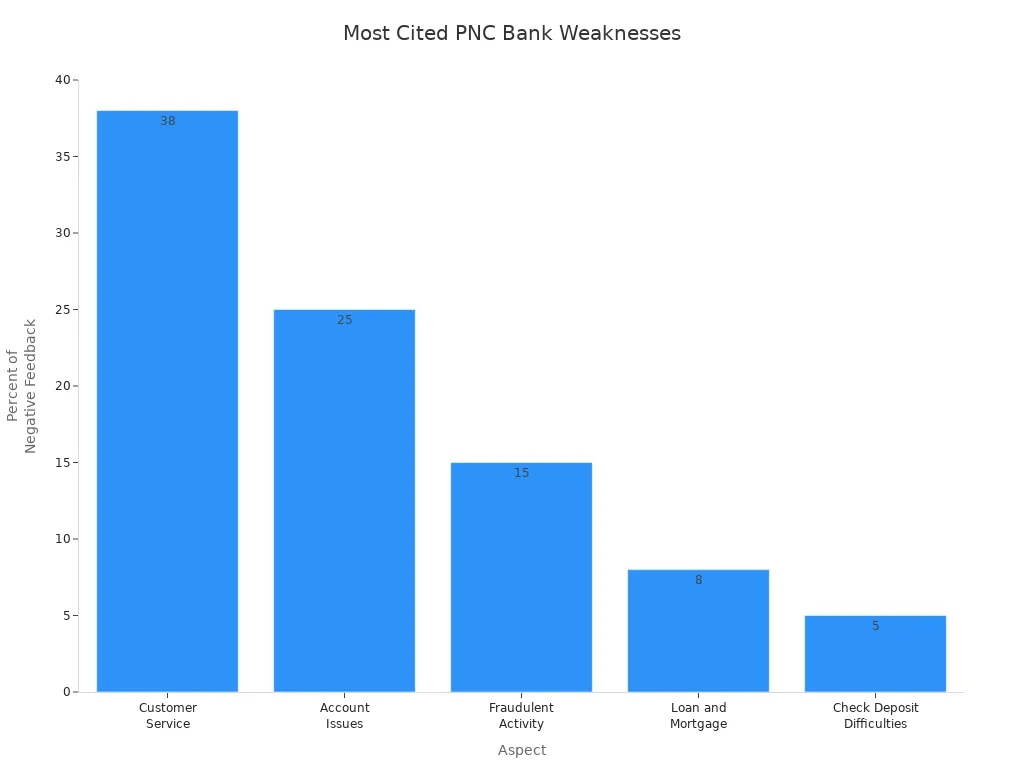

Thinking about opening an account at PNC Bank? You’re not alone, but only 2% of U.S. households use PNC as their main bank, according to a 2024 Statista survey. PNC Bank stands out with its large branch network, handy digital tools, Virtual Wallet, and ATM fee reimbursements. Still, you’ll want to watch for fees and mixed customer service. Here’s a quick look at what customers say:

| Aspect | Common Weaknesses |

|---|---|

| Customer Service | Rude staff, unhelpful support |

| Fees | Charges for check cashing, account fees |

| Fraud Handling | Poor scam response |

If you value lots of locations and digital features, PNC may fit your style. Before you decide, think about your own banking habits and needs. For a deeper dive, check out this PNC Bank Review.

Key Takeaways

- PNC Bank offers a large branch network and strong digital tools like the Virtual Wallet to help you manage money easily.

- You can avoid most monthly fees by keeping a minimum balance or setting up direct deposit on your account.

- PNC suits modern families, small business owners, and people who want personalized financial planning and wellness programs.

- Be aware that PNC’s fees, like overdraft charges, can be higher than average, so check fee details before opening an account.

- Customer service experiences vary by location; try visiting branches or reading reviews to find the best support near you.

Is PNC Bank the Best Choice for You?

Who Benefits Most from PNC

You might wonder if PNC is the best choice for you. The answer depends on your needs and how you like to manage your money. PNC Bank offers a wide range of accounts and services that fit many different people. If you want a bank with strong digital tools, a big branch network, and special programs, PNC could be a good fit.

Here are some groups who often find PNC Bank the best choice for you:

- Modern families: PNC understands that families come in all shapes and sizes. They offer wealth planning that fits many family types.

- Families of wealth: If you have a lot of assets, PNC Bank gives you personal credit, cash management, and private banking.

- Employees and employers: PNC helps companies and workers with financial wellness programs. These programs can help you save for emergencies or retirement. Many workers say these benefits help them feel more secure and want to stay with their employer.

- Individuals with disabilities: PNC Bank offers the ABLEnow program. This account lets you save up to $19,000 USD each year without losing important benefits like Medicaid or SSI. You can use this money for qualified expenses and still keep your support.

- Small business owners: If you run a business, PNC has checking accounts and other services just for you.

Here’s a quick look at how PNC Bank matches different needs:

| Demographic Group | Description / Needs | PNC Bank Offering / Benefit |

|---|---|---|

| Modern Families | Diverse family structures | Wealth planning for all family types |

| Families of Wealth | High net worth, asset management | Private banking, cash management, personalized credit |

| Employees and Employers | Financial wellness, retirement planning | Wellness programs, retirement planning, employee benefits |

| Individuals with Disabilities | Need to save without losing benefits | ABLEnow program for tax-advantaged savings |

| Small Business Owners | Business banking solutions | Business checking accounts and tailored services |

PNC Bank also stands out if you like using digital tools. The Virtual Wallet product gives you a way to manage your money, set goals, and track spending all in one place. If you are a student or a parent, PNC offers special accounts for kids and students. You can also find credit cards for different needs, like cash back or travel rewards.

If you live in the East Coast or Midwest, you will find many PNC branches and ATMs. States like Florida, New York, Illinois, Ohio, and Michigan have lots of locations. This makes it easy to get help in person or use an ATM without extra fees.

Tip: If you want a bank that helps you plan for the future and gives you lots of ways to manage your money, PNC could be the best choice for you.

Who Might Prefer Other Banks

PNC Bank is not always the best choice for you. Some people find that other banks fit their needs better. Here are some reasons you might want to look elsewhere:

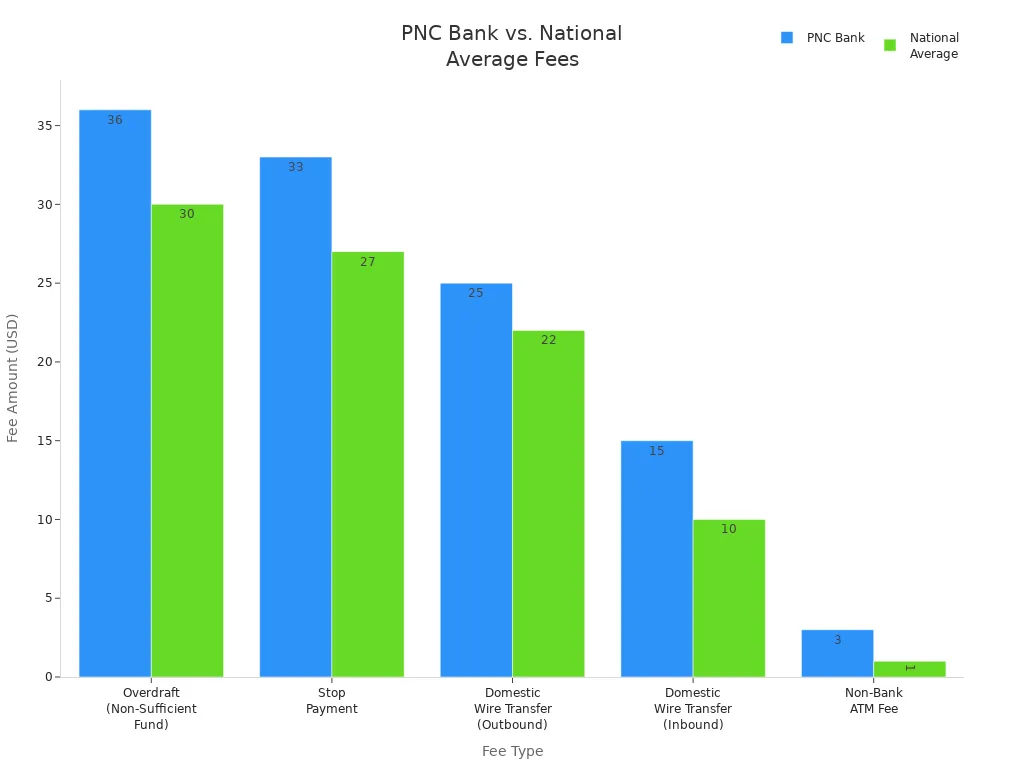

- You worry about fees. PNC charges $36 USD for each overdraft, which is higher than the national average of $30 USD. Other fees, like stop payments and wire transfers, also cost more than at many banks.

- You want higher interest rates. PNC Bank gives better rates to people with bigger balances. If you keep less money in your account, you might earn less than at other banks.

- You need a bank with branches everywhere. PNC Bank has most of its locations in 19 states. If you live outside these areas, you might have trouble finding a branch or ATM.

- You care a lot about customer service. Some people say PNC Bank’s customer service is not great. On Trustpilot, PNC Bank has a rating of 2.1 out of 5. Many reviews mention problems with fees and support.

- You want lower or no fees. Some banks offer free checking or higher APYs. If you want to save on fees or earn more interest, you might find a better fit at another bank.

Here’s a chart that shows how PNC Bank’s fees compare to the national average:

You can see that PNC charges more for many common services. If you use these services often, the costs can add up fast.

Some people also want more from their bank’s digital tools or want to bank with a company that has branches all over the country. If you travel a lot or move often, you might want a bank with a bigger network.

Note: If you want the lowest fees, the highest interest, or a branch in every state, PNC Bank may not be the best choice for you.

PNC Bank Review

Overview of PNC

When you start your search for a new bank, you want to know the story behind it. This pnc bank review gives you a quick look at how pnc grew into one of the largest banks in the United States. The roots of pnc bank go back more than 170 years. The bank you see today formed in 1983, but its history started much earlier. Here’s a timeline that shows the key moments:

| Year | Event Description |

|---|---|

| 1847 | Tradesman National Bank of Philadelphia established, marking one of PNC’s earliest predecessor institutions. |

| 1852 | Pittsburgh Trust and Savings opened by James Laughlin and B.F. Jones, another key predecessor institution. |

| 1959 | Pittsburgh Trust and Savings incorporated as Pittsburgh National Bank. |

| 1964 | Tradesman National Bank renamed Provident National Corp. after acquisitions and name changes. |

| 1983 | Formation of PNC Financial Corporation through the merger of Pittsburgh National Corp. and Provident National Corp., marking the official founding year of PNC Bank as it is known today. |

You can see that pnc bank has a long history. The official start came in 1983, but the bank’s story began in the 1800s. This pnc bank review shows that pnc has deep roots and a lot of experience.

Reputation and Reach

You probably want to know how big pnc is and where you can find it. This pnc bank review covers the size and reach of the bank. Pnc bank has a strong presence in the United States. You can find over 2,600 branches and more than 9,500 ATMs across the country.

| Metric | Number |

|---|---|

| Branches | 2,629 |

| ATMs | 9,523 |

If you live in the East or Midwest, you will likely see a pnc branch nearby. The bank keeps growing and adding new locations. Many people trust pnc because of its long history and wide network. When you read a review about pnc bank, you will see that customers like the easy access to branches and ATMs.

Note: If you want a bank with a long history and a big network, pnc bank stands out. This pnc bank review shows that you can count on pnc for both experience and reach.

Account Options at PNC

Image Source: pexels

Checking Accounts

You have several checking account choices at pnc. If you want a simple checking account, the Virtual Wallet Spend is a good place to start. It has no minimum deposit and a $7 monthly fee, but you can avoid the fee by keeping a $500 balance or setting up direct deposit. If you want more perks, look at the Performance Spend or Performance Select accounts. These offer a 0.01% apy on balances of $2,000 or more and give you ATM fee reimbursements. Students can open a Virtual Wallet Student account with no monthly fee for up to six years.

| Account Type | apy | Minimum Deposit | Monthly Fee (if requirements not met) |

|---|---|---|---|

| Virtual Wallet Spend | None | None | $7 |

| Virtual Wallet with Performance Spend | 0.01% | None | $15 |

| Virtual Wallet with Performance Select | 0.01% | None | $25 |

| Virtual Wallet Student | None | None | No monthly fee |

All checking accounts come with a pnc Visa debit card, online banking, and overdraft protection. If you want one of the best checking accounts for digital tools and branch access, pnc bank stands out.

Savings Accounts

pnc bank offers a standard savings account with no minimum deposit to open. You only need $1 to start earning apy. The monthly service charge is $5, but you can avoid it by keeping a $300 balance, linking to a select pnc checking account, or setting up a $25 auto transfer. If you are under 18, there is no fee. The apy is low, so if you want a high-yield savings account, you may want to compare other options. Still, pnc gives you easy access to your money and simple savings options.

| Feature | Details |

|---|---|

| Minimum deposit to open | $0 |

| Minimum balance to earn interest | $1 |

| Monthly service charge | $5 (waived with $300 balance, linked account, $25 auto transfer, or under 18) |

| apy | Low (rates change, check current rates online) |

Virtual Wallet

Virtual Wallet at pnc is a package that combines three accounts: Spend (checking), Reserve (checking), and Growth (savings). You get digital tools to track spending, set goals, and see your money in one place. The Low Cash Mode feature helps you avoid overdrafts by giving you extra time to add money. You can use about 60,000 ATMs and over 2,300 branches. The apy on savings is between 0.01% and 0.04%, so it is not a high-yield savings account. If you want to manage checking and savings together, Virtual Wallet makes it easy.

Tip: Virtual Wallet is great if you want to see all your accounts in one place and use both digital and in-person banking.

CDs and Money Market

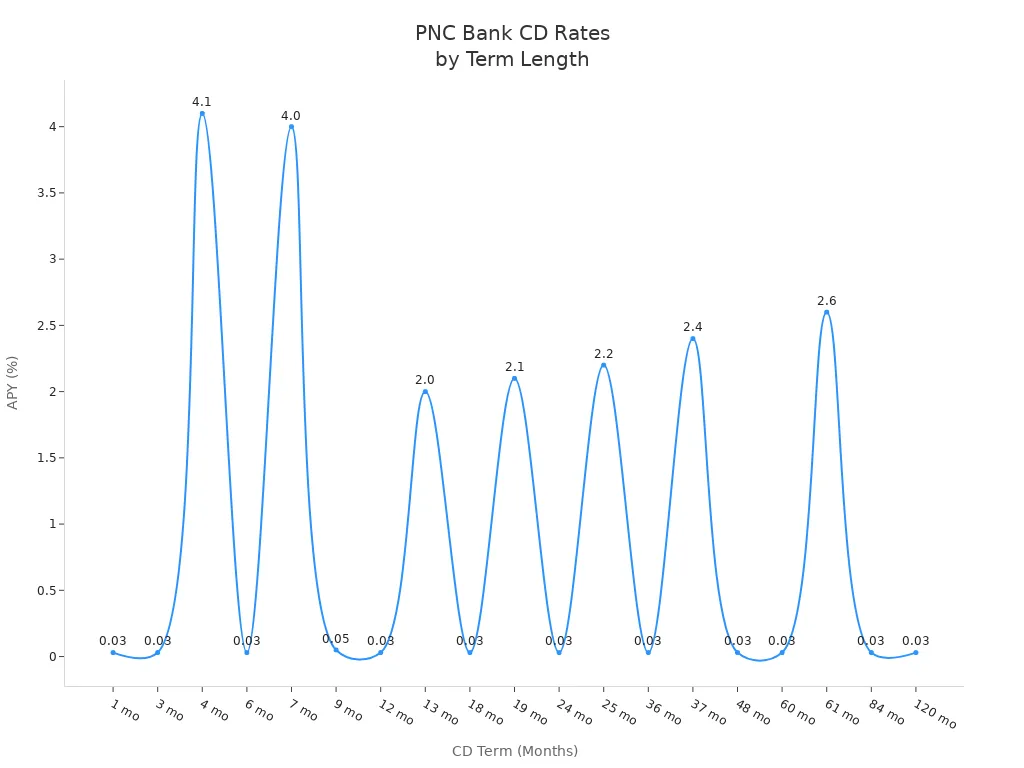

pnc offers CDs with terms from 1 month to 10 years. Standard apy rates are low, between 0.01% and 0.03%, unless you have $25,000 or more. If you want the best cd rates, look at promotional CDs. These offer much higher apy, like 4.10% for a 4-month term with a $1,000 minimum deposit. Money market accounts are also available, but the apy is not as high as some high-yield savings account options.

| CD Term (Months) | apy | Minimum Deposit |

|---|---|---|

| 4 | 4.10% | $1,000 |

| 7 | 4.00% | $1,000 |

| 61 | 2.60% | $1,000 |

| 37 | 2.40% | $1,000 |

| 25 | 2.20% | $1,000 |

| 13 | 2.00% | $1,000 |

| 9 | 0.05% | $1,000 |

| 1-120 | 0.03% | $25,000 |

If you want high-yield or the best cd rates, compare these with the best high-yield online savings accounts.

Business Accounts

pnc has business accounts for every size. Small businesses can use Business Checking for basic needs. If your business is growing, Business Checking Plus gives you more free transactions. Larger businesses can use the Treasury Enterprise Plan, which includes extra checking accounts and investment options. Monthly fees range from $20 to $50, but you can avoid them by keeping a higher balance. Specialty accounts are also available, like Non-Profit Checking and Business Interest Checking, which pays apy on balances. If you want a business account with digital tools and cash rewards, pnc makes it easy to get started.

Fees and Features

Monthly Fees

When you open an account with pnc, you will notice that monthly fees are common. Most checking accounts have a monthly service fee. For example, the Virtual Wallet Spend account charges $7 each month. You can avoid this fee if you keep at least $500 in your account or set up direct deposit. The Performance Spend and Performance Select accounts have higher monthly fees, but you can also waive them by meeting balance or deposit requirements. The standard savings account has a $5 monthly fee, but you can skip it by keeping a $300 balance or linking your checking account. These bank fees can add up if you do not meet the requirements, so always check the details before you choose an account.

Tip: Set up direct deposit or keep the minimum balance to avoid most monthly fees and charges at pnc.

Overdraft and ATM Fees

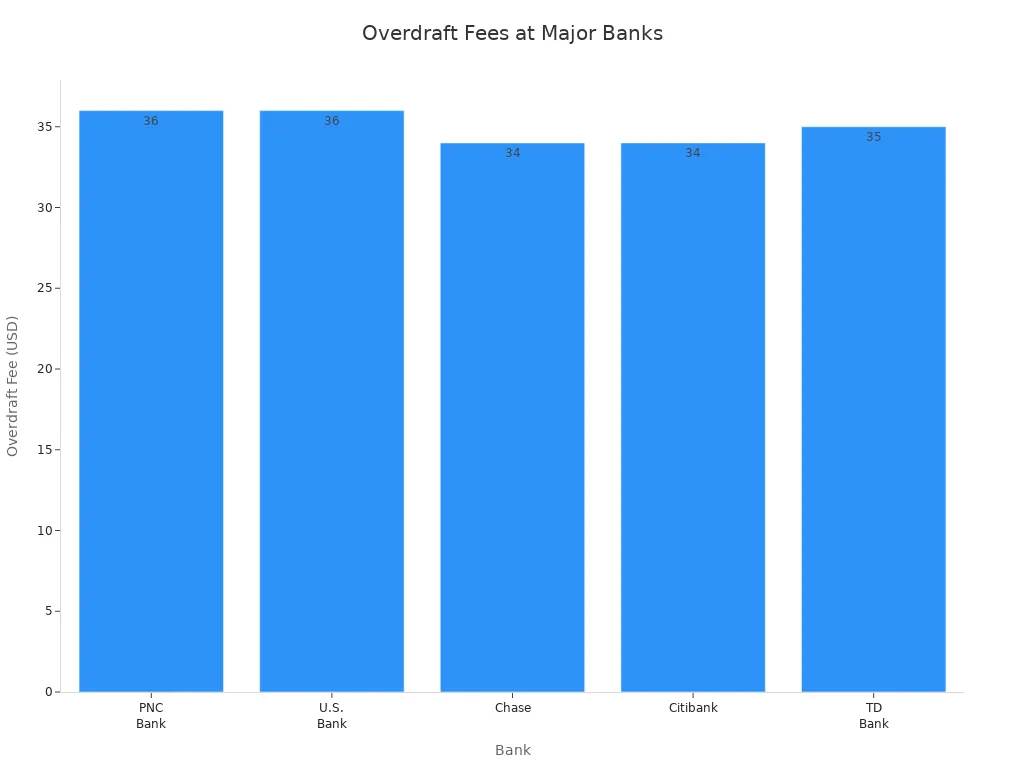

Overdraft fees at pnc bank are on the higher side. If you spend more than you have, you will pay a $36 overdraft fee. This matches U.S. Bank and is a bit more than Chase or Citibank, which charge $34. PNC allows up to four overdraft fees per day. If your negative balance is less than $5, you will not get charged. This feature helps you avoid small mistakes. The pnc atm fees can also add up, especially if you use out-of-network machines. PNC’s revenue from ATM and maintenance fees grew by 26.4% since 2019, while other banks saw smaller increases. This means you might pay more in fees at pnc than at some other banks.

If you use Performance Spend or Performance Select, you get some ATM fee reimbursements. Always check which ATMs are free to use to save money on bank fees.

Interest Rates

You might wonder about the apy and rates at pnc. The standard savings account offers an apy between 0.01% and 0.03%, which is below the national average of 0.42%. The S is for Savings account also pays 0.01% apy. If you want better rates, look at the PNC High Yield Savings account, which pays 3.95% apy. This is much higher than the national average and is a good choice if you want a high-yield savings account. PNC does not offer high apy on checking accounts, but you can find competitive interest rates on some savings products.

| Account Type | Interest Rate (APY) | Comparison to National Average (0.42% APY) |

|---|---|---|

| PNC Standard Savings Account | 0.01% to 0.03% | Below national average |

| PNC High Yield Savings® Account | 3.95% | Significantly above national average |

| PNC S is for Savings® Account | 0.01% | Below national average |

If you want high-yield options, compare the apy and rates for savings accounts at pnc with other banks. You will find that the high-yield savings account stands out for its competitive interest rates.

Digital Banking with PNC

Image Source: unsplash

Mobile App Experience

You want a bank that keeps up with your busy life. The PNC Bank mobile app helps you manage your money wherever you go. You can check balances and see transactions for checking, savings, credit cards, and loans. Paying bills is simple. You can set reminders, make one-time or recurring payments, and never miss a due date. The app lets you transfer money between your PNC accounts or even to accounts at other banks.

If you need to deposit a check, just use your phone’s camera. The app supports mobile check deposits, so you do not have to visit a branch. Card management is easy, too. You can view, lock, or unlock your debit, credit, or SmartAccess cards with a tap. Security matters, so you can sign in using Face ID or Touch ID. Sending money to friends or family is quick with Zelle.

Users give the app high marks. Many say it is easy to use and practical. On the App Store, it has a 5.0 out of 5 rating from recent reviews. This strong rating shows that PNC cares about your customer experience.

Tip: Download the app for free in English or Spanish if you use iOS 15.0 or later.

Online Tools

PNC offers more than just a mobile app. You get access to online tools that help you track your spending and reach your goals. The Money Bar shows you how much you can safely spend. Free Balance and Danger Days help you avoid overdrafts. The calendar lets you see upcoming bills and deposits. You can set savings goals and schedule automatic transfers to build your savings over time.

These digital features make it easy to stay on top of your finances. Whether you want to budget, save, or just keep an eye on your accounts, PNC gives you the tools you need for a smooth customer experience.

Customer Service at PNC Bank

In-Branch Support

When you walk into a PNC branch, your experience can depend a lot on the staff and location. Many customers say the employees are friendly, efficient, and patient. You might find the staff helpful and ready to answer your questions. Some people even describe the atmosphere as warm and welcoming. However, not every visit goes smoothly. Other customer reviews mention rude or unhelpful staff, especially for senior customers. Service quality can change from one branch to another, so you may want to try a few locations before deciding if PNC is right for you.

Note: Some customers praise the professionalism and knowledge of branch staff, while others report confusion about services or unresolved issues.

Online and Phone Service

You can reach PNC Bank by phone or online if you prefer not to visit a branch. The average wait time for customer service calls is about 2 minutes, which is fairly quick. Some customer reviews highlight positive experiences with efficient and knowledgeable phone support. Others mention long hold times and unhelpful responses. Online banking tools get mixed feedback. Some people like the ease of opening accounts online and using features like Zelle. Others find the online system confusing or have trouble with rewards programs. If you run into problems, you might need to call more than once to get help.

Customer Reviews

Customer reviews for PNC show a wide range of experiences. Many people say their local branch staff are helpful and give good advice. Others complain about poor customer service, grumpy employees, or broken ATMs. Complaints about fraud detection and dispute handling come up often. Some customers had trouble when PNC took over BBVA, with issues like account access and card replacements. Merchant services get very poor reviews, with reports of account closures and problems using equipment. Ratings on sites like Consumer Affairs, BBB, and Trustpilot are low, showing that customer satisfaction is a challenge for PNC. Still, some long-term customers say they are happy with the professionalism and problem resolution they receive.

Tip: If customer satisfaction is important to you, check recent customer reviews for your local branch and online services before opening an account.

PNC vs. Other Banks

PNC vs. Chase

When you look at PNC and Chase, you see some big differences. Chase has more branches across the country, so you can find one almost anywhere. PNC has a strong presence on the East Coast and Midwest, but not as many locations nationwide. If you travel a lot, Chase might be easier for you.

Let’s compare some key features:

| Feature | PNC Bank | Chase Bank |

|---|---|---|

| Branches | 2,200+ (mainly East Coast) | 4,700+ (nationwide) |

| Checking Account Fees | $7-$25/month (waived with $500+ balance) | $12-$35/month (waived with higher balances) |

| Savings APY | Up to 3.95% in select markets | 0.01% standard, higher with big balances |

| ATM Network | 60,000+ PNC and partner ATMs | 15,000+ Chase ATMs |

| Fee Waiver Conditions | Easier to waive with lower balances | Need higher balances for waivers |

You might like PNC if you want easier ways to avoid monthly fees. PNC also offers higher apy on some savings accounts, while Chase keeps apy low unless you have a lot of money. Both banks have good mobile apps and overdraft protection. If you want more branches, Chase wins. If you want better apy and lower balance requirements, PNC could be better for you.

PNC vs. Bank of America

Bank of America is another big name. You find their branches in many states, but their apy on savings is usually low. PNC gives you more options for higher apy, especially with the High Yield Savings account. Both banks charge monthly fees, but PNC makes it easier to avoid them with lower balance or direct deposit requirements.

Bank of America offers a wide range of credit cards and rewards. PNC stands out with its Virtual Wallet tools, which help you track spending and set savings goals. If you want strong digital tools and higher apy, PNC is a good pick. If you want more credit card choices and a bigger branch network, Bank of America might fit you better.

Tip: Always check the latest apy and rates before you open an account. These can change often.

PNC vs. Wells Fargo

Wells Fargo has a big branch network and lots of ATMs. Their savings apy is usually low, much like Bank of America. PNC offers a higher apy on select savings accounts, so you can earn more interest if you qualify. Both banks charge similar fees, but PNC ranks a bit higher in customer satisfaction.

Here’s a quick look at customer satisfaction scores:

| Bank | Customer Satisfaction Score |

|---|---|

| PNC Bank | 833 |

| Wells Fargo | 828 |

You might find PNC’s digital tools easier to use. Wells Fargo has more branches, but PNC gives you better rates on some products. If you want higher apy and strong online features, PNC is a solid choice. If you want more locations, Wells Fargo is hard to beat.

Pros and Cons of PNC Bank

Advantages

You get a lot of benefits when you choose pnc for your banking needs. Here are some of the top reasons people like this bank:

- PNC understands that people have different financial goals and stress at every stage of life. Their services help you manage money whether you are just starting out or planning for retirement.

- The bank offers financial wellness programs for employees. These programs can boost your productivity and help you feel more secure at work.

- PNC’s Organizational Financial Wellness team creates benefits that fit many generations. You can find help with student debt, saving for the future, or handling daily expenses.

- You get access to personalized wealth management. PNC uses nearly 160 years of experience to guide you with a steady approach.

- The bank takes time to learn about your goals. You can work with advisors who help you build a plan that fits your needs.

- PNC puts a strong focus on security and privacy. Your money and information stay protected.

- You can reach customer support for loans, mortgages, and even hardship services.

- There are many banking products to help you spend, save, and grow your money. You can also find special promotions and some of the best bonuses & promotions if you qualify.

Note: PNC stands out for its focus on financial wellness and its wide range of services for both individuals and businesses.

Drawbacks

You should also know about the downsides before you open an account. Some of the most common complaints include high fees and lower interest rates.

| Account Type | Monthly Fee (USD) | How to Waive Fee |

|---|---|---|

| Basic Virtual Wallet | $7 | $500 direct deposit/month, $500 balance, or age 62+ |

| Virtual Wallet with Performance Spend | $15 | $2,000 direct deposit, $2,000 balance, or $10,000 combined deposits |

| Virtual Wallet with Performance Select | $25 | $5,000 direct deposit, $5,000 balance, or $25,000 combined deposits/investments |

- You may face a $36 overdraft fee, and this can happen more than once per day if you are not careful.

- Many accounts pay lower interest rates than other banks, so your savings might not grow as fast.

- You might pay extra for card replacement or expedited service.

- Some customers say the fees add up quickly if you do not meet the requirements to waive them.

Tip: Always check the latest account details and fee schedules before you sign up.

You get a bank with strong digital tools, a wide branch network, and helpful budgeting features. Many people like the Virtual Wallet for easy spending and saving. Some customers praise friendly staff, but others mention high fees and slow support.

If you want to open an account, gather your ID and personal details. Think about your habits and compare fees, rates, and services before you decide.

FAQ

How can you avoid monthly fees at PNC Bank?

You can skip most monthly fees by keeping a minimum balance or setting up direct deposit. For example, keep at least $500 in your checking account or use direct deposit to meet the requirements.

Does PNC Bank offer free ATM access?

Yes, you get free access to PNC ATMs. If you use an out-of-network ATM, some accounts like Performance Spend or Performance Select will reimburse your fees. Always check which ATMs are in the network.

Can you open a PNC account online?

You can open most PNC accounts online. Just visit the PNC website, pick your account, and follow the steps. You will need your ID and some personal details.

What is PNC’s Virtual Wallet?

Virtual Wallet combines checking and savings in one place. You can track spending, set savings goals, and use digital tools to manage your money. It helps you see your full financial picture.

Does PNC Bank have good digital banking tools?

PNC offers a strong mobile app and online banking. You can check balances, pay bills, transfer money, and deposit checks with your phone. Many users say the app is easy to use and reliable.

Choosing a bank like PNC involves weighing fees, digital tools, and accessibility, but managing international transactions or subscriptions can add complexity with high fees and unclear exchange rates. Whether you’re a small business owner paying overseas vendors or a family managing global subscriptions, BiyaPay offers the Biya EasyCard, enabling seamless payments across 190+ countries in over 40 local currencies with fees as low as 0.5%. Perfect for covering PNC’s ATM fees or international transfers, BiyaPay supports real-time exchange rate queries and conversions for 30+ fiat and 200+ digital currencies, all with transparent pricing and no hidden costs. Register in minutes to simplify your financial management, from cross-border payments to subscription renewals. Take control of your banking expenses—join BiyaPay today for cost-effective, global financial flexibility.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.