- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

ACH Meaning and How It Works for Businesses and Individuals

Image Source: unsplash

ACH stands for automated clearing house. You may see ach meaning come up when you handle payments like payroll, bill payments, or direct deposits. Understanding ach meaning helps you track how your money moves safely between accounts. ACH lets you send or receive payments without using cash or checks. Many businesses use ach to pay employees through direct deposits. Individuals rely on ach meaning for simple, secure payments every day.

Key Takeaways

- ACH is an electronic system that moves money safely between U.S. banks for payroll, bills, and direct deposits.

- ACH payments process in batches and usually take 1 to 3 business days, with a faster same-day option available for a fee.

- There are two main ACH types: credits push money out, and debits pull money in with your permission.

- ACH payments cost less than wire transfers or checks and help businesses and individuals save time and money.

- To use ACH safely, verify payment details, monitor accounts for fraud, and follow security best practices.

ACH Meaning

Image Source: pexels

What Is ACH?

You may wonder what ACH really means when you see it on your bank statement or hear about it at work. ACH stands for automated clearing house. This system moves money electronically between banks in the United States. When you use direct deposit for your paycheck or pay a bill online, you use the automated clearing house system.

Nacha, the group that manages the ACH network, describes it as a system with many parts. These include banks that send and receive payments, special operators that clear and settle transactions, and service providers that help process payments. The Federal Reserve explains that all banks in the ACH network follow rules set by Nacha. Nacha is not a government agency, but it creates the rules that keep the system safe and fair.

The automated clearing house system is the backbone of electronic payments in the U.S. You use it for payroll, bill payments, and even tax refunds. The ach meaning goes beyond just moving money. It connects people, businesses, and government agencies through a trusted network.

ACH Network Overview

The ach network covers more than 10,000 financial institutions across the country. This wide reach means you can send or receive payments almost anywhere in the United States. The ach network works like a digital post office. Banks act as post offices, sending and receiving payment instructions. Special operators, like the Federal Reserve and the Electronic Payments Network, sort and deliver these instructions in batches.

Tip: The ach network does not move cash directly between banks. Instead, it settles payments by adjusting account balances at the Federal Reserve.

Here is a table that shows the main parts of an ACH file:

| ACH File Component | Description |

|---|---|

| File Header Record | Starts the ACH file; includes routing number, timestamp, originating bank and company name |

| Batch Header Record | Starts a batch within the file; groups transactions with similar attributes |

| Entry Detail Record | Contains individual transaction details |

| Addenda Record | Provides additional information related to an Entry Detail Record |

| Batch Control Record | Ends a batch; summarizes batch information |

| File Control Record | Ends the ACH file; summarizes the entire file |

The ach network uses this structure to process millions of payments every day. Nacha manages the rules and keeps the system running smoothly. The two main operators, FedACH and the Electronic Payments Network, handle the clearing and settlement of payments. Transactions move in batches, which helps the system work efficiently.

- Nacha manages the ach network and sets the rules.

- The Federal Reserve and Electronic Payments Network operate the system.

- Banks send and receive payment instructions like post offices.

- The ach network processes payments in batches, not one by one.

- Over 10,000 banks and credit unions use the ach network.

When you understand ach meaning, you see how the automated clearing house system supports your daily financial life. It makes payments faster, safer, and more reliable for everyone.

How ACH Works

Image Source: unsplash

How ACH Payments Work

You use ACH payments every time you send money electronically between banks in the United States. The ACH network handles millions of these payments each day. Understanding how ACH payments work helps you see why they are so popular for payroll, bill payments, and direct deposits.

ACH payments move through a series of steps. Here is a simple breakdown of how ACH payment processing works:

- You or your business start an ACH payment by giving instructions to your bank. This bank is called the Originating Depository Financial Institution (ODFI).

- The ODFI collects payment instructions from many customers and groups them into a batch.

- The ODFI sends this batch to an ACH Operator, such as the Federal Reserve or The Clearing House.

- The ACH Operator sorts the payments and sends them to the correct Receiving Depository Financial Institution (RDFI), which is the bank of the person or business receiving the money.

- The RDFI posts the funds to the receiver’s account, completing the ACH transfer.

- Nacha oversees the ACH network and sets the rules for all ACH transactions.

Note: Most ACH payments settle within one business day. Same Day ACH can move money even faster, but you must meet certain cutoff times and may pay a small fee.

ACH Transfer Process

ACH transfers use batch processing. This means banks collect many ACH transactions and process them together at set times during the business day. You do not see instant movement like with some other payment methods. Instead, ACH payment processing happens in cycles.

- ACH payments in the U.S. usually take 1 to 3 business days to complete.

- Banks process ACH transfers in batches, not one by one.

- If you start an ACH payment after your bank’s cutoff time, it will process the next business day.

- ACH payments do not process on weekends or federal holidays.

- Same-Day ACH is available for urgent payments, but you must submit your request before the cutoff time and may pay a fee between $1 and $10 USD.

Here is a typical timeline for ACH payment processing:

| Step | Description |

|---|---|

| Initiation | You authorize the ACH payment and provide your bank details. |

| Submission | Your bank (ODFI) collects and batches your ACH payment with others. |

| Processing | The ACH Operator sorts and routes the batch to the correct RDFI. |

| Settlement | The RDFI receives the payment and credits or debits the receiver’s account. |

| Funds Availability | The receiver can access the funds, usually within 1-3 business days. |

Tip: Early submission and correct payment details help speed up ACH payment processing. Errors or missing information can delay your ACH transfer.

Key Parties in ACH Transfers

Several key parties help ACH payments move safely and smoothly through the ACH network. Each party has a special role in ACH payment processing.

- Originator: This is you or your business. You start the ACH payment by giving instructions to your bank.

- ODFI (Originating Depository Financial Institution): Your bank acts as the ODFI. It collects your ACH payment instructions, checks for accuracy, and sends them to the ACH Operator. The ODFI must follow all ACH network rules set by Nacha.

- ACH Operator: The Federal Reserve or The Clearing House acts as the ACH Operator. It sorts and routes ACH transactions to the correct receiving banks.

- RDFI (Receiving Depository Financial Institution): The receiver’s bank is the RDFI. It receives the ACH payment and posts the funds to the receiver’s account. The RDFI must process ACH transfers quickly and respond to any issues within 48 hours.

- Nacha: Nacha manages the ACH network. It sets the rules, certifies banks, and enforces compliance to keep ACH payments safe and reliable.

Note: Nacha does not process payments itself. Instead, it makes sure all banks and operators follow the same rules for ACH transactions.

Practical Examples

You see ACH payments in action every day. Here are some real-world examples:

- Payroll: Your employer uses ACH payment processing to send your paycheck directly to your bank account. The company’s bank (ODFI) sends a batch of payroll ACH payments to the ACH Operator. The ACH Operator routes each payment to the correct RDFI, which credits your account.

- Bill Payments: You pay your utility bill online using ACH. You authorize the ACH transfer, and your bank sends the payment through the ACH network to the utility company’s bank.

- Business Debits: A gym collects monthly membership fees using ACH debits. The gym’s bank initiates the ACH transaction, and your bank processes the debit from your account.

ACH payments make it easy for you to move money safely and efficiently. The ACH network, with its batch processing and clear roles for each party, supports millions of ACH transfers every day. By understanding how ACH payments work, you can use them with confidence for both personal and business needs.

ACH Transfers Types

ACH transfers come in two main types: ACH credits and ACH debits. You use both types in daily life and business, but they work in different ways. Understanding these differences helps you choose the right ACH payment for your needs.

ACH Credits

ACH credits are “push” transactions. You, as the sender, start the transfer and push money from your account to someone else’s account. This type of ACH transfer is common for direct deposits, payroll, and business payments. When you receive your salary through ACH direct deposit, your employer pushes funds into your account. Businesses use ACH credits to pay vendors, send client payments, and move money between company accounts. Individuals use ACH credits for bill payments, peer-to-peer transfers, and moving money between checking and savings accounts.

ACH credits offer security and reliability. You control when and how much money you send. Most ACH credits settle within one to two business days, making them a cost-effective choice for direct payments and recurring transactions.

Common examples of ACH credits include:

- Payroll direct deposits from employers to employees

- Government benefits and tax refunds

- Business-to-business payments, such as paying suppliers

- Transfers between your own accounts

A table below shows the volume of ACH credit transactions compared to ACH debits:

| Transaction Type | Share by Number (2021) | Share by Value (2021) |

|---|---|---|

| Business ACH Credit | 85% | 97% |

| Business ACH Debit | 20% | 70% |

ACH credits dominate in both volume and value, especially for business payments.

ACH Debits

ACH debits are “pull” transactions. The receiver, such as a business or service provider, pulls money from your account after you give permission. You often use ACH debits for automatic bill payments, like utilities or mortgage payments. When you sign up for ACH payments for recurring bills, you authorize the company to pull funds from your account on a set schedule. ACH debits make it easy to pay for services without writing checks or remembering due dates.

To set up an ACH debit, you provide your routing and account numbers. The business then initiates the ACH transfer and pulls the payment from your account. This process is fast and usually completes within one business day.

Common ACH debit use cases include:

- Automatic utility bill payments

- Mortgage or rent payments

- Subscription services

- Business-to-business invoice payments

- Tax payments to the government

ACH debits support many payment codes, such as WEB for online payments, TEL for phone payments, and PPD for recurring consumer payments. These codes help businesses and individuals manage direct payments and automate cash flow.

ACH credits and debits differ in who starts the transaction and how funds move. ACH credits let you push money out, while ACH debits let others pull money in. Both ACH transfer types make direct payments simple, secure, and efficient for businesses and individuals.

ACH vs Other Payment Methods

ACH vs Wire Transfers

You may wonder how ach payments compare to wire transfers. Both move money between banks, but they work differently. Wire transfers process each payment individually and usually settle within one business day. This makes them a good choice for urgent or high-value payments. However, wire transfers cost much more. You often pay $35 to $50 per transaction for a wire transfer. In contrast, ach payments cost much less, usually between $0.20 and $1.50 per transaction. ACH payments use batch processing, so they take 1 to 3 business days to complete. Same Day ACH can speed up the process for an extra fee. You should use wire transfers for urgent, large, or international payments. ACH works best for routine, non-urgent, and domestic electronic payments.

| Transfer Type | Typical Speed | Notes |

|---|---|---|

| Wire Transfers | Usually within 1 business day | Processed individually and in real-time; domestic wires settle faster than international (1-5 days). |

| ACH Transfers | 1 to 3 business days traditionally | Batched and processed at scheduled intervals; Same Day ACH allows same-day processing for a premium. |

ACH vs Checks

Checks are a traditional way to make payments, but they are slower and cost more than ach payments. When you write a check, the bank must process it by hand, which takes time. Checks often cost $3 to $20 each, and you risk losing them or having them stolen. ACH payments are safer and faster. You can set up automatic ach payments for bills or payroll, and you do not need to mail anything. ACH payments also help you avoid late fees because they process on time. For most routine payments, ach is a better choice than checks.

ACH vs EFT

EFT stands for electronic funds transfer. This term covers many types of electronic money transfers, including ach payments, wire transfers, and peer-to-peer apps. ACH is a type of EFT, but not all EFTs are ach payments. Some EFTs, like Venmo or Zelle, can move money instantly. ACH payments usually take 1 to 3 days, but they cost less than most other electronic money transfer options. You should use ach payments for regular, non-urgent electronic payments, such as payroll, bill pay, and recurring transfers. Use other EFTs when you need instant transfers or when sending money outside the U.S.

Tip: ACH payments are best for routine, domestic, and cost-sensitive transactions. They help you save money and automate your electronic payments.

When to Choose ACH:

- Use ach payments for payroll, utility bills, and recurring payments.

- Choose ach when you want low fees and do not need instant processing.

- ACH is ideal for businesses that automate payroll or pay vendors on a schedule.

- Avoid ach for urgent or international payments; use wire transfers or instant EFTs instead.

ACH Pros and Cons

Benefits for Businesses

You gain many advantages when you use ach for your business. ACH payments help you save money and time. Here are some key benefits:

- ACH payments cost less than paper checks or wire transfers. You often pay only a small flat fee per transaction, which can be as low as $0.15 USD.

- Automation lets you set up recurring payments. This reduces errors and saves your staff time.

- ACH improves your cash flow. You can predict when money will arrive or leave your account, making it easier to plan.

- Security is stronger with ach. Electronic processing lowers the risk of fraud and mistakes.

- ACH debit payments make billing simple. You can collect regular payments from customers without chasing them for checks.

- Setting up ach is easy. You can connect it to your accounting software and automate your payment process.

Tip: ACH helps your business handle more transactions as you grow, without adding extra work.

Benefits for Individuals

ACH also brings many benefits to you as an individual. The table below shows how ach helps with convenience, security, and cost:

| Benefit Category | How ACH Helps You |

|---|---|

| Convenience | You can set up automatic bill payments and direct deposits. No need for paper checks. |

| Security | Electronic transfers protect you from mail fraud and check theft. Banks use strong security rules. |

| Cost | ACH transfers are usually free or very low cost. You save money compared to credit cards or wire transfers. |

You can use ach for peer-to-peer payments, paying bills, or getting your paycheck. This makes managing your money easier and safer.

Drawbacks and Risks

ACH has some risks you should know about:

- Processing can take 1 to 3 business days. Sometimes, delays happen, especially if you start a payment late in the day.

- Fraud is possible. Criminals may use phishing or steal account numbers to make fake ach payments.

- Overdrafts can occur if you do not have enough money in your account when a payment is pulled.

- ACH fraud is rising. You need to watch your account and use strong passwords.

- Mistakes in account numbers or payment details can cause returns or failed payments.

Note: You can lower your risk by checking your account often and using security features like alerts and two-factor authentication.

Using ACH

Setting Up ACH Payments

You can set up ach payments easily if you follow a few steps. For individuals, how to make an ach payment starts with logging into your bank or payment platform. You add your bank account, verify your identity, and enter the payment details. Next, you choose the person or business you want to pay, enter the amount, and confirm the ach payment. For businesses, the process includes more steps:

- Choose a payment processor that fits your needs and check the cost to accept ach payments.

- Gather documents like your company address, tax ID, and owner identification.

- Fill out forms to authorize ach payment processing.

- Connect your business bank account and verify all details.

- Add vendors or customers, making sure their bank accounts are ready for ach payments.

- Start sending or receiving ach payments after approval.

Understanding the types of ach transactions, such as WEB or TEL, helps you stay compliant and avoid disputes.

Accepting ACH as a Business

If you want to know how to accept ach payments, you must follow certain rules. Businesses accepting ach payments need to use fraud detection tools, create strong security policies, and encrypt sensitive data. You must verify customer identities and check that bank accounts are valid. Always get clear authorization before processing ach payments. Make sure your payment processor follows all Nacha rules. These steps protect your business and your customers.

ACH Fees and Processing Times

The cost to accept ach payments is much lower than other payment methods. Here is a table that shows typical fees and processing times:

| Payment Method | Typical Fee Structure | Average Cost for $1,000 Payment | Processing Time |

|---|---|---|---|

| ACH Transfer | Flat fee $0.20–$1.50 | $0.75–$3 | 1–3 business days |

| Credit Card | 2.5%–3.5% + $0.10–$0.30 | $25–$35 | Instant |

| Wire Transfer | Flat fee $25–$50 | $25–$50 | Same day |

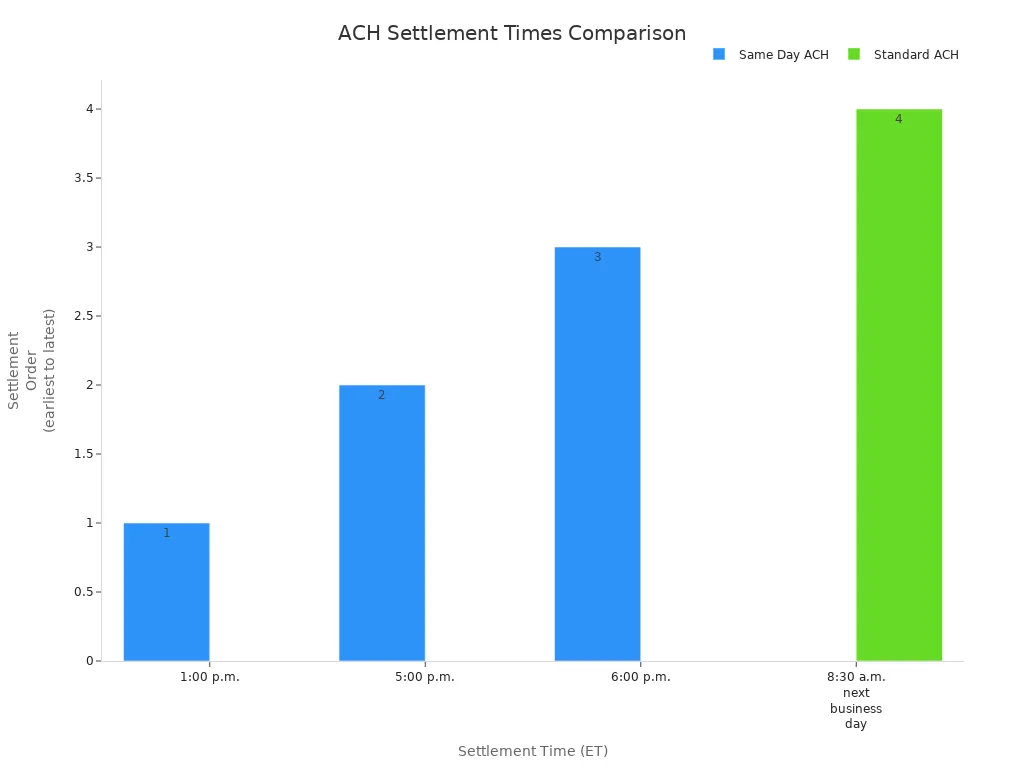

Same-day ach payments settle faster but may cost $1 to $10 more. Standard ach payments usually take 1 to 3 business days. The chart below shows how same-day ach and standard ach payments compare:

Security and Error Handling

You must protect ach payments from fraud and errors. Use multi-factor authentication, set up transaction alerts, and educate your staff about scams. Encrypt all banking data and limit access to sensitive information. If an ach payment fails, banks send a return code that explains the reason, such as insufficient funds or wrong account details. You should review the code, fix the problem, and only retry the payment if you are sure the issue is solved. Automated systems can help catch errors early and reduce the number of rejected ach transactions. Always monitor your accounts and update security policies to keep ach payment processing safe.

You now understand how ach helps you manage payments with lower fees, better security, and faster cash flow. Many businesses and individuals choose ach for payroll, bill payments, and recurring transfers because it is reliable and easy to use.

- ACH offers cost savings, predictable settlement times, and broad access across U.S. banks.

- You can find guides, toolkits, and banking support to help you get started with ach payments.

Explore these resources to make your payments safer and more efficient.

FAQ

What information do you need to send an ACH payment?

You need the recipient’s name, bank routing number, and account number. Some banks may ask for the payment amount and a memo. Always double-check these details before you send money.

How safe are ACH payments?

ACH payments use strong security rules. Banks use encryption and monitor for fraud. You should check your account often and use alerts to spot any problems early.

Can you use ACH for international payments?

You cannot use ACH for direct international payments. ACH only works for banks in the United States. For global transfers, you should use wire transfers or other services.

What happens if you enter the wrong account number?

If you enter the wrong account number, your payment may fail or go to the wrong person. Contact your bank right away. Banks can try to recover the funds, but success is not guaranteed.

ACH payments offer low-cost, secure transfers for U.S.-based payroll and bills, but their 1-3 day processing and U.S.-only scope limit global flexibility. For a faster, borderless alternative in 2025, choose BiyaPay. With transfer fees as low as 0.5%, BiyaPay outshines traditional bank wire transfers, providing real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. The Biya EasyCard, a no-annual-fee virtual card, supports seamless payments on Amazon, eBay, and PayPal in 190+ countries, ideal for businesses paying international vendors or individuals shopping globally. Unlike ACH’s batch processing, BiyaPay offers same-day transfers and quick setup with ID verification, ensuring instant access. Licensed in the U.S. and New Zealand, it guarantees secure, compliant transactions. Use BiyaPay alongside ACH for domestic needs to unlock global financial freedom. Join BiyaPay today to simplify your worldwide payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.