- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Bank of America Review Comprehensive Look at Checking and Savings

Image Source: pexels

If you want a bank with a strong online presence, Bank of America review shows you get easy access, good security, and many branches. Many reviews highlight the digital experience and wide service network. You may notice low interest rates and fees, but some customers value the service and credit card options. Bank of America review suggests you might benefit most if you need many online tools, use credit card rewards, or want reliable customer service. Many reviews mention online support, credit card offers, and service quality.

Key Takeaways

- Bank of America has a long history and a large network with nearly 4,000 branches and 15,000 ATMs, making it easy to access your money across the U.S.

- Checking accounts offer different options with ways to avoid monthly fees, especially through the Preferred Rewards program, but some fees and low interest rates still apply.

- Savings accounts have low interest rates compared to other banks, but you can avoid monthly fees by keeping a minimum balance or joining Preferred Rewards; they are best for convenience, not high earnings.

- The Bank of America mobile app and online banking provide strong digital tools, including an AI assistant, easy money management, and good security features to protect your accounts.

- Customer service is available through many channels with mostly fast phone support, but experiences vary; using digital channels during less busy times can improve your service.

Bank of America Review Overview

Image Source: pexels

Reputation and History

When you look at a bank of america review, you see a long history that shapes its trustworthiness. The bank started in 1904 as Bank of Italy. Over time, it grew into one of the largest banking institutions in the world. Here are some key moments in its history:

- 1904: Founded as Bank of Italy.

- 1959: Launched BankAmericard, the first credit card accepted nationwide. This card later became Visa.

- 2008: Acquired Merrill Lynch, which expanded its banking and investment services.

These milestones show how Bank of America has adapted to changes in the banking industry. You can see that the bank has played a big role in shaping modern banking. Many people choose Bank of America because of its long-standing reputation and focus on innovation.

Note: A strong history often helps you feel more confident about a bank’s trustworthiness.

National Presence

A bank of america review often highlights the bank’s large network. You can find about 3,903 branches and 15,000 ATMs across the United States. This makes it easy for you to access banking services almost anywhere. Bankrate.com also reports that Bank of America operates around 3,700 financial centers in 39 states and Washington, D.C. This wide reach means you can get help with your banking needs whether you live in a big city or a smaller town.

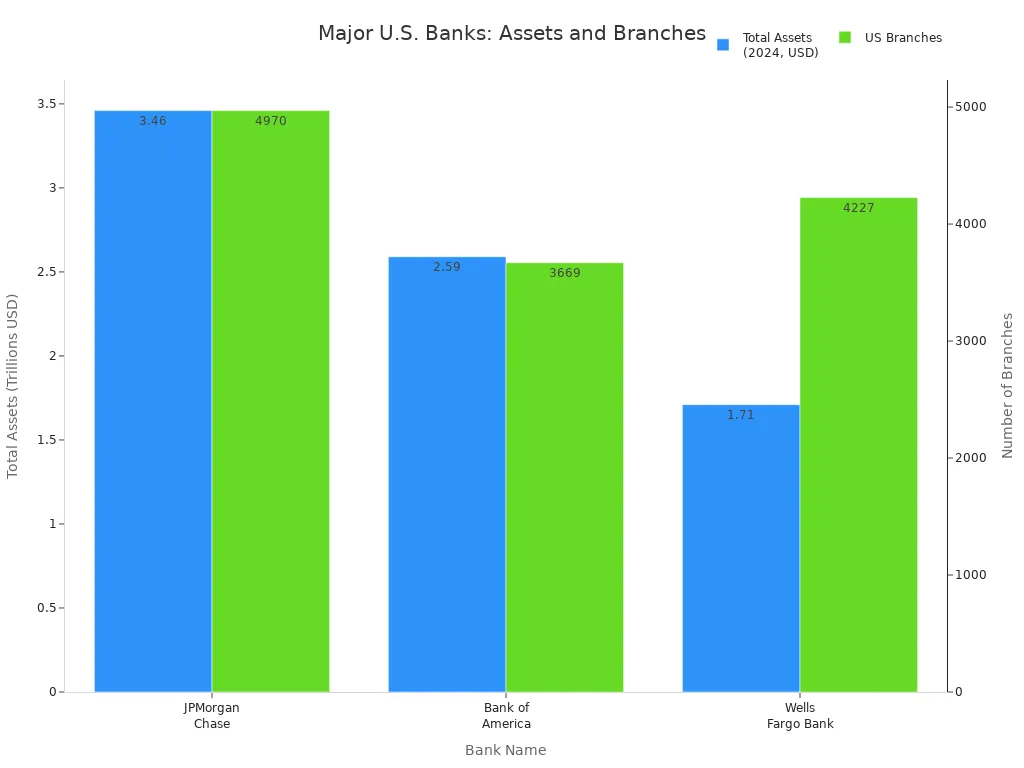

The following table shows how Bank of America compares to other major U.S. banks:

| Bank Name | Total Assets (2024) | Domestic Assets | Number of US Branches | Foreign Branches |

|---|---|---|---|---|

| JPMorgan Chase | $3.46 trillion | $2.66 trillion | 4,970 | 32 |

| Bank of America | $2.59 trillion | $2.44 trillion | 3,669 | 21 |

| Wells Fargo Bank | $1.71 trillion | $1.68 trillion | 4,227 | 10 |

When you read a bank of america review, you will notice that the bank’s size and reach make it a top choice for many people. Its strong presence helps you manage your banking easily, whether you need to visit a branch or use an ATM. This wide network supports millions of customers and shows why Bank of America remains a leader in the banking world.

Checking Accounts Review

Features

You can choose from three main types of checking accounts at Bank of America. Each account has its own features, such as minimum deposit requirements, monthly fees, and overdraft policies. The Advantage SafeBalance Banking account helps you avoid overdraft fees by declining transactions that would overdraw your balance. The Advantage Plus Banking account gives you more flexibility with check writing and overdraft options. The Advantage Relationship Banking account offers higher transaction limits and extra perks for those who keep larger balances.

Bank of America also offers the Preferred Rewards program. This program rewards you for keeping higher balances across your eligible accounts. You can move up through Gold, Platinum, Platinum Honors, and Diamond tiers. Each tier gives you more benefits, such as fee waivers, higher interest rates, and bonuses. If you qualify, you can enjoy extra perks that help you save on banking fees and get more value from your checking accounts.

To open a checking account, you usually need to provide identification and a minimum deposit. If you want to join the Preferred Rewards for Business program, you must have an active business checking account and keep a combined average daily balance of at least $20,000 USD over three months. The program is open to small business clients and those with certain analyzed checking accounts. You can enroll after meeting the balance requirements.

Bank of America checking accounts come with digital banking tools. You can use the mobile app or online banking to manage your money, pay bills, and transfer funds. The bank also offers integration with credit cards, loans, and investment accounts, making it easy to handle all your finances in one place.

Fees

Bank of America charges several types of bank fees for checking accounts. You may see monthly maintenance fees, ATM fees, and overdraft fees. The monthly maintenance fee depends on the account type. You can avoid this fee by meeting certain requirements, such as setting up qualifying direct deposits or keeping a minimum balance. Linking eligible accounts, like savings or investment accounts, can also help you avoid monthly fees.

If you use an ATM outside the Bank of America network, you will pay non-Bank of America ATM fees. The ATM operator may also charge you an extra fee. Overdraft fees apply when your transactions exceed your available balance. However, the Advantage SafeBalance Banking account does not charge overdraft fees. It simply declines transactions that would overdraw your account. You can also use Balance Connect, which links backup accounts to cover overdrafts.

The Preferred Rewards program gives you more ways to save on account fees. The table below shows how the program helps you reduce banking fees and get other benefits:

| Tier | Minimum Balance (USD) | ATM Fee Waivers | Other Perks |

|---|---|---|---|

| Gold | $20,000 | - | $200 mortgage origination discount |

| Platinum | $50,000 | 1 per cycle | $400 mortgage origination discount |

| Platinum Honors | $100,000 | Unlimited | $600 mortgage origination discount |

| Diamond Honors | $1,000,000 | Unlimited | Highest perks and discounts |

Note: You can find more details about account fees and banking fees in the Personal Schedule of Fees on the Bank of America website.

Pros and Cons

You will find both advantages and disadvantages when you review Bank of America checking accounts. The table below gives a clear comparison:

| Aspect | Pros | Cons |

|---|---|---|

| Physical Presence | Nearly 4,000 branches and 16,000 ATMs for easy access | Branch numbers are declining; fewer ATMs than some online banks |

| Mobile Banking | Highly rated app with advanced features | Some users may not prefer digital banking |

| Fee Structure | Many ways to waive monthly fees, especially with Preferred Rewards | Monthly fees exist; overdraft fees still apply for some accounts |

| Interest Rates | Preferred Rewards can boost APY slightly | Interest rates are below national averages |

| Account Variety | Multiple checking accounts for different needs | Higher-tier accounts require large balances to waive fees |

| Additional Features | Integration with savings, loans, and investments | Some bank fees on savings if minimum balances are not maintained |

| Reputation & Service | Good customer service and convenience | Service quality varies by location |

Bank of America checking accounts offer strong security features. The bank monitors your accounts 24/7 for suspicious activity. You get alerts by mobile app, text, email, or phone if the bank detects possible fraud. The bank uses multi-factor authentication and encourages you to use strong passwords. You can also use tools like Trusteer Rapport for extra malware protection. The bank trains employees to protect your information and uses both physical and electronic safeguards.

You can feel confident that your money is safe. All checking accounts are FDIC insured up to $250,000 USD per depositor, per account ownership category. This insurance protects your funds if the bank fails.

Tip: Review your account activity often and keep your contact information up to date. This helps you spot fraud quickly and receive important alerts.

Savings Accounts Review

Image Source: unsplash

Features

You can open several types of savings accounts at Bank of America. The main option is the Advantage Savings account. You also have access to Certificates of Deposit (CDs) and Individual Retirement Accounts (IRAs). Each account type has different features, but most people choose the Advantage Savings account for everyday saving.

Here is a table that shows the main features:

| Feature/Aspect | Details |

|---|---|

| Account Types | Advantage Savings, CDs, IRAs |

| Minimum Opening Deposit | $100 USD (subject to change with exchange rates) |

| Monthly Maintenance Fee Waiver | Waived if you keep a minimum daily balance, link to eligible checking, join Preferred Rewards, are under 25, or pay the fee |

| Minimum Daily Balance for Fee Waiver | Amount required to waive fee (varies, check latest details) |

| Fee for Monthly Maintenance | $8 USD (can be waived) |

| Interest Accrual | Starts on the day your account is processed |

| Interest Payment | Compounded and credited monthly |

| Additional Benefits | Keep the Change® program, Preferred Rewards, mobile check deposit, automatic transfers, custom alerts, Balance Connect® overdraft protection, FDIC insurance |

| Student/Young Adult Benefits | No monthly maintenance fee if under 25; students under 24 in school get fee waiver |

You can use digital tools to manage your savings accounts. The mobile app lets you deposit checks, set up automatic transfers, and receive custom alerts. You can also link your checking and savings accounts for easy transfers. If you join Preferred Rewards, you get extra benefits, such as higher annual percentage yield and more ways to avoid fees.

Tip: If you are under 25 or a student under 24, you can avoid monthly fees on your savings accounts.

Interest Rates

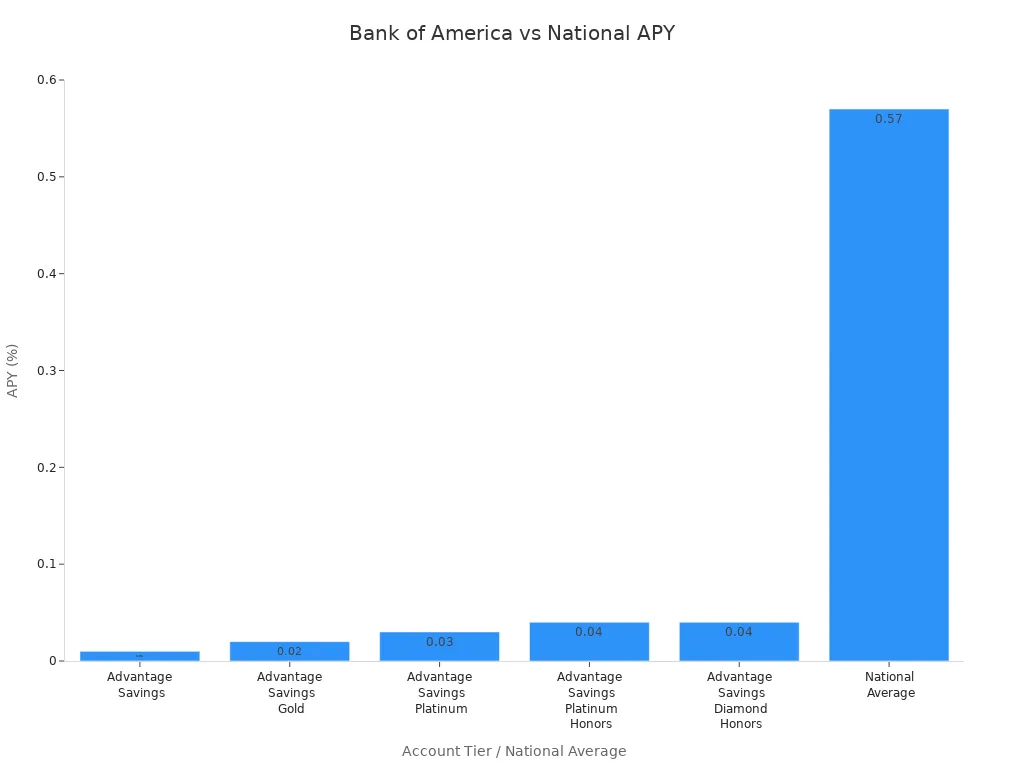

When you open a savings account at Bank of America, you should pay close attention to the annual percentage yield. The annual percentage yield, or APY, tells you how much interest you earn each year. Bank of America offers a very low annual percentage yield compared to other banks. The highest APY you can get is 0.04% if you qualify for the top Preferred Rewards tier. Most customers earn an annual percentage yield of 0.01% to 0.04%.

Here is a table that compares the APY for different account tiers:

| Account Tier | APY (%) | Minimum Deposit | Notes on Fees and Comparison |

|---|---|---|---|

| Advantage Savings | 0.01 | $100 | $8 monthly fee (waivable) |

| Advantage Savings, Gold | 0.02 | $100 | |

| Advantage Savings, Platinum | 0.03 | $100 | |

| Advantage Savings, Platinum Honors | 0.04 | $100 | |

| Advantage Savings, Diamond Honors | 0.04 | $100 | |

| National Average Savings APY | 0.57 | N/A | As of July 21, 2025 |

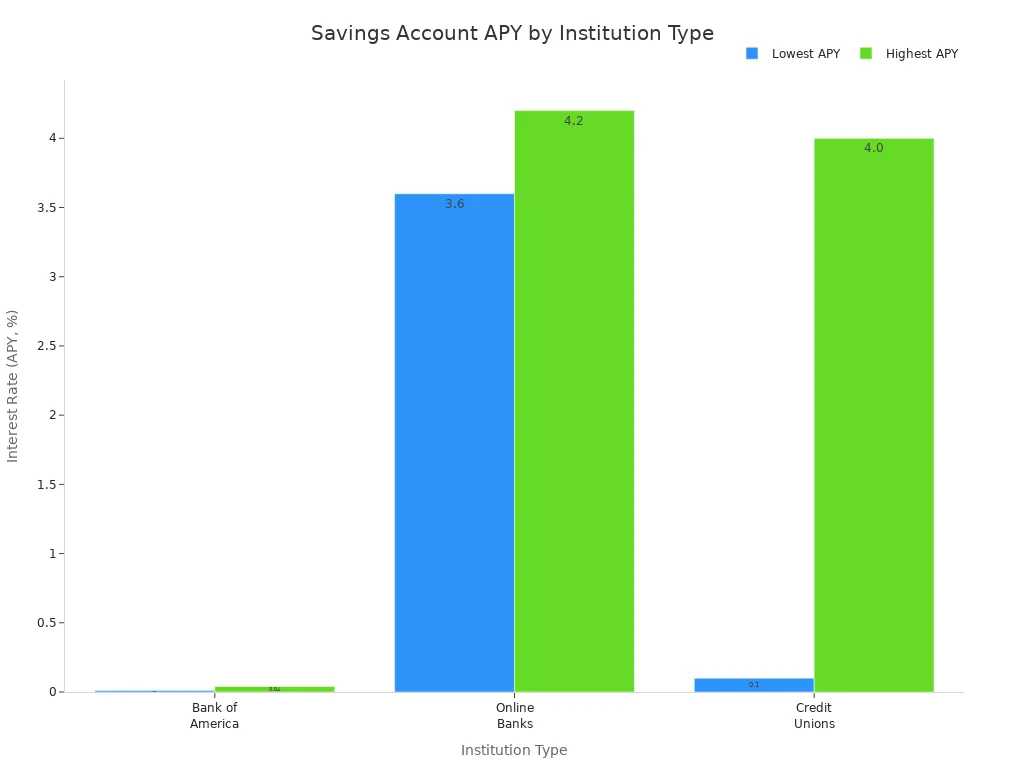

You can see that the annual percentage yield at Bank of America is much lower than the national average. Many online banks offer an annual percentage yield above 4%. Even some credit unions offer a higher annual percentage yield. The chart below shows how Bank of America compares to other banks:

You should know that the annual percentage yield at Bank of America does not change often. Even if you join Preferred Rewards, the highest annual percentage yield you can get is 0.04%. This is still far below the national average annual percentage yield of 0.57%. Online banks like Ally, Capital One 360, and Marcus by Goldman Sachs offer an annual percentage yield between 3.60% and 4.20%. Credit unions can offer an annual percentage yield from 0.10% to 4.00%.

Here is another table to help you compare:

| Institution Type | Institution Name | Interest Rate (APY) Range | Notes |

|---|---|---|---|

| Traditional Bank | Bank of America | 0.01% - 0.04% | Significantly below the national average annual percentage yield |

| Online Banks | Ally, Capital One 360, Marcus by Goldman Sachs, Synchrony, Bask Bank | 3.60% - 4.20% | High-yield savings accounts with no or low minimum balance requirements |

| Credit Unions | Alliant Credit Union, Quorum Federal Credit Union, Pentagon Federal Credit Union, others | 0.10% - 4.00% | Rates vary widely; some credit unions offer a competitive annual percentage yield |

Note: If you want to grow your money faster, you may want to look for a higher annual percentage yield at an online bank or credit union.

Fees

You need to watch out for fees when you use Bank of America savings accounts. The main fee is the $8 monthly maintenance fee. You can avoid this fee if you keep a minimum daily balance, link your account to an eligible checking account, join Preferred Rewards, or if you are under 25. If you do not meet these requirements, you will pay the fee each month.

Here are some important points about fees:

- The monthly maintenance fee is $8 USD, but you can avoid it by meeting certain requirements.

- If you are a student under 24 or under 25 years old, you do not pay the monthly fee.

- You do not pay an excess withdrawal fee if your balance stays above $20,000 or if you are a Preferred Rewards member.

- The minimum opening deposit is $100 USD, which is higher than some online banks.

- Some business savings accounts require a $2,500 minimum daily balance to avoid fees.

Tip: Always check your account balance and link your savings accounts to your checking account to avoid unnecessary fees.

Pros and Cons

You should weigh the pros and cons before opening a savings account at Bank of America. Here is a list to help you decide:

Pros:

- You get access to thousands of branches and ATMs across the country.

- You have several ways to avoid monthly fees, such as keeping a minimum balance or joining Preferred Rewards.

- You do not pay an excess withdrawal fee if you keep a high balance or qualify for Preferred Rewards.

- You can use digital tools to manage your savings accounts, set up automatic transfers, and receive alerts.

- Your money is protected by FDIC insurance up to $250,000 USD per depositor, per account ownership category.

Cons:

- The annual percentage yield is very low, between 0.01% and 0.04%.

- You pay monthly fees unless you meet the requirements to waive them.

- The minimum opening deposit is $100 USD, which is higher than many online banks.

- Interest compounds monthly, not daily, so you earn less over time.

- You need a large balance to qualify for the highest annual percentage yield through Preferred Rewards.

Note: Experts say that Bank of America savings accounts are best for people who want convenience and physical access, not for those who want a high annual percentage yield.

You should also know that Bank of America takes security seriously. The bank uses many layers of protection for your savings accounts. You get multi-factor authentication, strong password requirements, and free Trusteer Rapport software to guard against malware. The mobile app sends push alerts and uses location-based security. The bank monitors your accounts for fraud and contacts you if it finds anything suspicious. You can use digital wallets with virtual cards for extra protection. Always check your account activity and respond to alerts quickly.

Digital Experience

Mobile App

You can manage your checking and savings accounts with the Bank of America highly rated app. This highly rated app gives you many tools to control your money from your phone. You can:

- Check your account balances and recent transactions

- Deposit checks using mobile check deposit

- Send and receive money

- Transfer money between accounts

- View statements and important documents

- Set alerts for account activity

- Use spending and budgeting tools

- Pay bills directly through the app

- Access cash back deals

- Find Bank of America locations near you

The highly rated app also features Erica, an AI assistant that helps you with financial questions and gives you personalized tips. Many users say this highly rated app stands out for its easy navigation and helpful features. In the 2025 J.D. Power Study, Bank of America’s mobile app scored 678 out of 1000, ranking above other major banks like PNC and Chase.

| Bank Mobile App Satisfaction Rankings (2025 J.D. Power Study) | Score (out of 1000) |

|---|---|

| Bank of America | 678 |

| PNC | 675 |

| Chase | 673 |

| Average U.S. National Banking Apps | 669 |

Online Banking

Bank of America gives you a strong online banking experience. You can set up direct deposit so your paycheck goes straight into your checking account. When you enroll in online banking, you can monitor your balances and transaction history from anywhere. You can order checks, pay bills, transfer money, and track your spending. The online system lets you set up automatic payments for recurring bills, which helps you avoid late fees. You can also set alerts to notify you about balance changes or unusual activity. Overdraft protection options are available, and you can link accounts to cover overdrafts. The online platform makes it easy to manage your accounts at any time.

Security

Bank of America uses several layers of security to protect your online and mobile banking. The bank uses industry-standard encryption to keep your data safe during transfers. Authentication protocols make sure you connect to the real Bank of America server. Data integrity checks help detect tampering and stop unsafe connections. You can use one-time authorization codes sent by text or email for extra login protection. The bank offers biometric login options, like fingerprint recognition, on the mobile app. You can also monitor your login history and receive security alerts. Always check for the lock icon in your browser and download the official app from trusted sources.

Customer Reviews

Service Quality

When you read reviews about Bank of America, you see a mix of opinions on service quality. Many reviews mention that you can find branches and ATMs almost everywhere, which makes daily banking easy. Some customers say they like the convenience and the wide range of credit card options. You may notice that reviews often highlight the digital tools, such as the mobile app and online banking, as strong points for customer satisfaction.

However, reviews also point out some issues. Some customers report long wait times at branches or on the phone. Others mention that customer service can feel rushed or impersonal, especially during busy hours. Reviews sometimes mention that resolving problems with credit card accounts or fees can take time. You may find that customer experience varies by location and time of day. Some reviews praise helpful staff, while others describe less positive service.

Tip: If you want the best customer service, try to visit branches during less busy hours or use digital channels for faster help.

Support Options

Bank of America gives you many ways to reach customer support. You can call the main customer service number at (800) 432-1000. If you are outside the United States, you can use (315) 724-4022. Phone support usually answers within 1 to 10 minutes during business hours. You can also get help through social media platforms like Facebook, Instagram, X, LinkedIn, TikTok, and YouTube. Social media support responds in a few hours to a day, depending on your question.

Here is a table that shows the main support channels and their details:

| Support Channel | Description & Contact Details | Average Response Time | Availability Hours (Eastern Time) |

|---|---|---|---|

| Phone Support | (800) 432-1000; International: (315) 724-4022 | 1 to 10 minutes during business hours | Mon-Fri: 8 a.m. - 11 p.m.; Sat-Sun: 8 a.m. - 8 p.m. |

| Social Media | Facebook, Instagram, X, LinkedIn, TikTok, YouTube | Few hours to a day | Mon-Fri: 8 a.m. - 9 p.m.; Sat: 8 a.m. - 8 p.m.; Sun: 8 a.m. - 5 p.m. |

| holly.clientcare@bofa.com | Not specified | N/A | |

| Chat Support | Available on the website | Not specified | N/A |

| Online Banking | ‘Contact Us’ link in Help and Support menu | Not specified | N/A |

| Executive Contacts | Emails for senior executives for escalations | Not specified | N/A |

| Mailing Address | PO Box 25118, Tampa, FL 33622–5118 | N/A | N/A |

You can also use chat support on the website or send an email to the head of customer care. Some reviews say that chat and email support can be slower than phone or social media. If you have a serious issue, you can contact executive staff or use the mailing address for formal complaints. Reviews suggest that using multiple support channels can improve your customer experience and satisfaction.

Note: Reviews show that customer support response times are usually fast by phone but may be slower by email or chat. Try different channels to find the best service for your needs.

Comparison to Other Banks

Strengths

When you look at reviews and ratings, you see that Bank of America stands out for its size and digital tools. You can find almost 4,000 branches and over 15,000 ATMs, which gives you easy access to your money. Many reviews mention that Bank of America has 59 million digital users, showing that people trust its online and mobile banking. The bank also holds the top spot in U.S. consumer deposits, with $1.2 trillion USD. You get a wide range of financial products, including checking, savings, and credit card options. The bank serves 69 million consumer and small business clients, so you join a large network.

Bank of America has been rated as North America’s Most Innovative Bank in 2025. You can use award-winning digital banking and get personalized wealth management through Merrill. The bank also works with 95% of the U.S. Fortune 1,000 companies. If you want to manage both personal and business finances, you find many options here. Reviews often highlight the strong credit card rewards and the ability to link your credit card to your checking or savings account. You also see that the bank invests in communities and supports economic mobility.

Here is a table comparing Bank of America to other major banks:

| Bank | Monthly Fees | Savings APY | CD APY | Overdraft Policy | Unique Strengths |

|---|---|---|---|---|---|

| Bank of America | $4.95–$25 | ~0.01% | Up to 4% | $10 overdraft; Balance Assist loan; SafeBalance | Largest deposit base, digital tools, credit card variety |

| Chase | Up to $25 | ~0.01% | Up to 4% | $34 overdraft; grace period | Large branch network, credit card offers |

| Wells Fargo | $5–$35 | ~0.01% | N/A | 24-hour grace, Clear Access Banking | Lower fees, more waivers |

| Citibank | N/A | N/A | N/A | No overdraft fees | No overdraft, global reach |

Tip: If you want a bank with strong digital tools and many credit card choices, Bank of America is highly rated in reviews.

Weaknesses

You should also consider the weaknesses that reviews and ratings reveal. Bank of America savings accounts pay very low interest rates, usually around 0.01% APY. Online banks often pay over 4% APY, so you earn much less here. Monthly maintenance fees are common, such as $12 USD for checking and $8 USD for savings. Reviews show that these fees can be hard to avoid unless you keep a high balance or join Preferred Rewards. Many online banks do not charge these fees.

You pay $2.50 USD for each out-of-network ATM use in the U.S. and $5.00 USD internationally. Online banks often reimburse these fees. The savings account limits you to six withdrawals per month, with a $10 USD fee for extra withdrawals. Reviews point out that this is more restrictive than many online banks. You also need a large balance to get the best credit card rewards or to waive fees. Many reviews and ratings say that Bank of America checking and savings accounts are not the best choice if you want high yields or low fees.

Note: If you want higher interest rates, fewer fees, and more flexible withdrawal rules, you may want to look at online banks instead of Bank of America.

You get strong digital tools, many branches, and solid security with Bank of America. You may pay higher fees and earn less interest. The right account depends on your needs. Use the table below to see which account fits you best:

| Account Type | Best Suited For | Monthly Fee (Waivable) |

|---|---|---|

| SafeBalance Banking® | Students, basic needs, low fees | $4.95 |

| Advantage Plus Banking® | Direct deposit, check writing | $12 |

| Advantage Relationship Banking® | High balances, interest, more perks | $25 |

| Advantage Savings Account | Regular savers, fee waivers possible | $8 |

Think about your habits and what you want from a bank before you decide.

If you want to open an account, follow these steps:

- Pick the account that matches your needs.

- Check if you meet the requirements.

- Gather your documents.

- Apply online or at a branch.

- Make the minimum deposit.

FAQ

What do you need to open a Bank of America checking or savings account?

You need a government-issued photo ID, your Social Security number, and a minimum opening deposit. You can apply online or visit a branch. Make sure you have your contact information ready.

How can you avoid monthly fees on Bank of America accounts?

You can avoid monthly fees by keeping a minimum daily balance, setting up direct deposit, joining Preferred Rewards, or linking eligible accounts. Students and young adults may also qualify for fee waivers.

Are Bank of America accounts FDIC insured?

Yes. Your checking and savings accounts have FDIC insurance up to $250,000 per depositor, per account ownership category. This insurance protects your money if the bank fails.

Can you access your Bank of America accounts internationally?

You can use online banking and the mobile app from anywhere. You can also use your debit card at international ATMs, but you may pay extra fees. Always notify the bank before traveling.

Bank of America’s extensive branch network and digital tools, like the Erica AI assistant, offer convenience, but its low savings APY (0.01%–0.04%) and monthly fees ($4.95–$25) can burden cost-conscious users. For a seamless, global banking alternative in 2025, choose BiyaPay. With transfer fees as low as 0.5%, BiyaPay undercuts traditional banks’ costly wire transfers, providing real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. The Biya EasyCard, a no-annual-fee virtual card, enables secure payments on Amazon, eBay, and PayPal in 190+ countries, perfect for expats or travelers managing international purchases. Unlike Bank of America’s fee-heavy accounts, BiyaPay offers same-day transfers and quick setup with ID verification, ensuring instant access. Licensed in the U.S. and New Zealand, it guarantees secure, compliant transactions. Complement Bank of America’s local ATM access with BiyaPay for borderless financial freedom. Join BiyaPay today to simplify your global banking needs!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.