- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Online Bank Accounts for Hassle-Free Opening

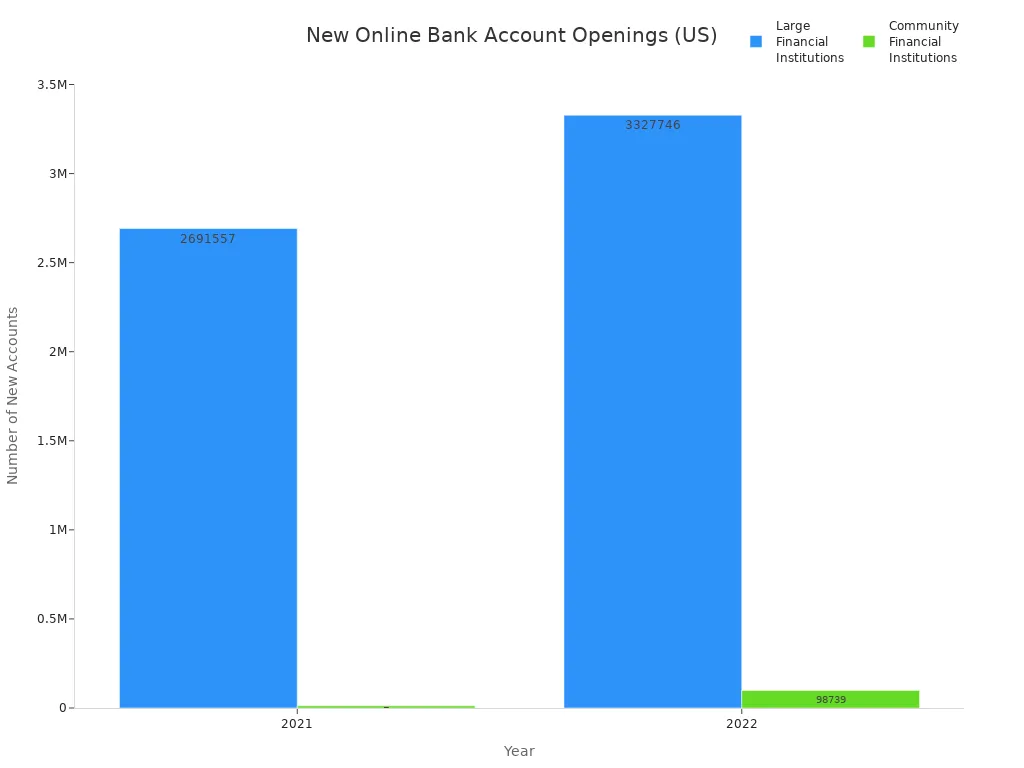

Image Source: pexels

You want an account that’s easy to open and stress-free. The easiest bank accounts include SoFi, Chime, Ally, Capital One 360, and Varo. These banks stand out because you can open an account online with no credit check or monthly fees, and you get easy approval. SoFi is often called best for simple account opening and best for easy approval with low requirements. Many people choose these easy bank accounts. In 2022, 3.4 million new customers opened online accounts in the U.S.

Key Takeaways

- You can open many online bank accounts quickly with no credit check, no monthly fees, and no minimum deposit.

- Top easy accounts like Chime and SoFi offer instant virtual cards and fast approval, letting you use your money right away.

- Most online banks provide large ATM networks and helpful digital tools to manage your money anytime from your phone.

- Prepare your ID and personal information before applying to speed up approval and avoid delays.

- Choose banks with strong security and good customer support to keep your money safe and get help when needed.

Easiest Bank Accounts List

Image Source: pexels

Top Picks

You want to open a bank account online without any hassle. Here are the easiest bank accounts you can open in 2024. These options are best for fast applications and let you skip the paperwork and long waits. You can open most of these accounts in just a few minutes, right from your phone or computer.

- Chime Online Checking Account: No ChexSystems, no credit check, and no minimum deposit. You get a virtual debit card instantly and access to over 50,000 fee-free ATMs.

- SoFi Checking and Savings: You can open this combo account in minutes with no minimum deposit. There are no monthly fees, and you get early direct deposit and overdraft coverage.

- Ally Bank Spending Account: Open your account online or by phone in less than five minutes. There are no overdraft fees, and you get free checks and debit cards.

- Capital One 360 Checking: You can open this account online or in a branch. You get free cash deposits at CVS and Walgreens, plus a large ATM network.

- Discover Cashback Debit Account: No credit check, no monthly fees, and you earn 1% cashback on debit purchases. You can deposit cash for free at Walmart.

- Varo Bank Account: No minimum deposit, no monthly fees, and you can open your account online quickly.

- Wise Account: Great for international users. You get instant virtual debit cards (outside the U.S.), no minimum balance, and easy online setup.

- Revolut: No minimum deposit, instant virtual cards, and easy approval. You can use Apple Pay and Google Pay right away.

Tip: If you want the best for quick online setup, Chime and SoFi are top choices. They offer instant access and very few requirements.

Quick Comparison

You probably want to see how these easy bank accounts stack up. Here’s a table that compares the main features, requirements, and approval speed for each one:

| Bank Account Name | Minimum Deposit | Credit Check | Monthly Fees | Approval Speed | ATM Access / Network Size | Instant Virtual Card | Best For |

|---|---|---|---|---|---|---|---|

| Chime Online Checking | None | No | $0 | Minutes | 50,000+ fee-free ATMs | Yes | Fast applications, instant use |

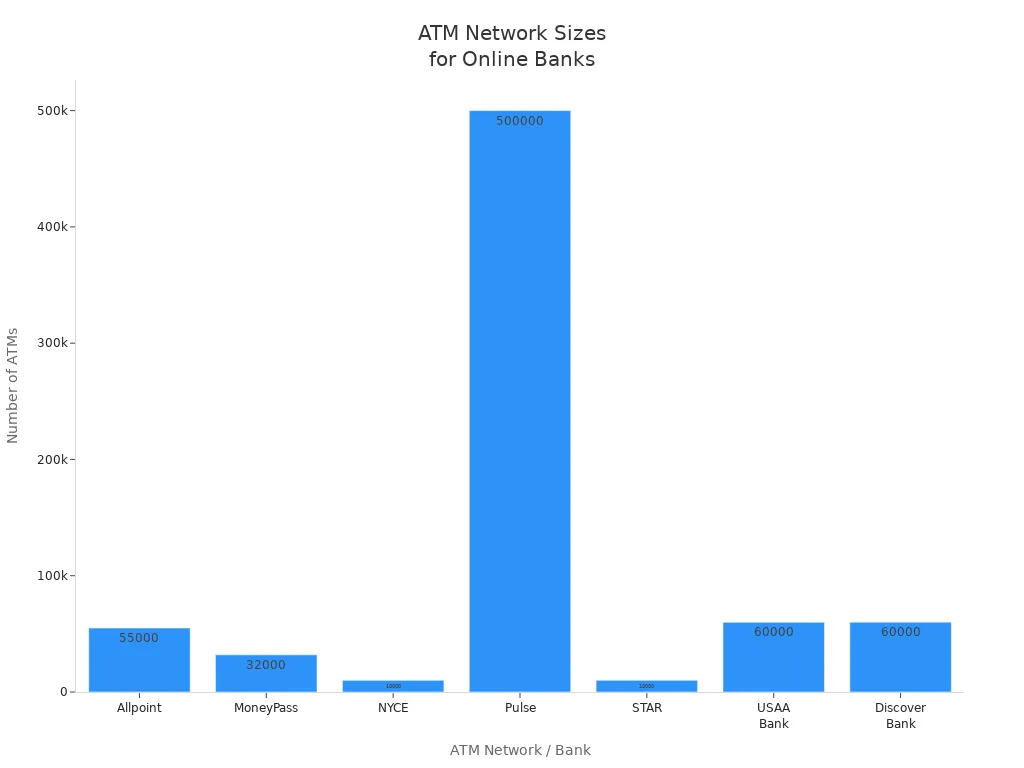

| SoFi Checking & Savings | None | No | $0 | Minutes | 55,000+ Allpoint ATMs | Yes | Fast applications, early pay |

| Ally Bank Spending | None | No | $0 | 5 minutes or less | Free Allpoint ATMs, $10/month ATM fee reimbursement | No | No overdraft, easy setup |

| Capital One 360 Checking | None | No | $0 | About 5 minutes | Large network, CVS/Walgreens cash deposit | No | Cash deposits, in-person help |

| Discover Cashback Debit | None | No | $0 | Minutes | 60,000+ in-network ATMs | No | Cashback, no credit check |

| Varo Bank Account | None | No | $0 | Minutes | 55,000+ Allpoint ATMs | No | No fees, easy approval |

| Wise Account | None | No | $0 | Minutes | N/A (not a bank, but global card use) | Yes (outside U.S.) | International, instant card |

| Revolut | None | No | $0 | Minutes | Global ATM access | Yes | Instant card, global use |

You can see that all these accounts have no minimum deposit and no monthly fees. Most do not require a credit check, so you can open them even if you have bad credit. Chime, SoFi, Wise, and Revolut stand out as best for fast applications and instant access to your money.

You get access to huge ATM networks with these accounts. For example, Chime, SoFi, and Varo use the Allpoint network, which has over 55,000 ATMs in the U.S. Discover gives you access to 60,000 ATMs. Capital One and Ally also offer ATM fee reimbursements, so you can use almost any ATM without worrying about extra charges.

If you want an account number or card right away, Chime, Wise (outside the U.S.), and Revolut give you instant virtual debit cards. This means you can start using your account for online shopping or mobile payments as soon as you finish signing up.

Note: Some accounts, like Simmons Bank’s Coin Checking + Savings, also have low requirements. You only need to fund the account with $0.01 within 45 days, and you can scan your ID online.

When you look for the easiest bank accounts, focus on approval speed, no credit check, and no fees. These easy bank accounts help you get started fast, even if you have no banking history or need an account today.

Account Features

Image Source: unsplash

Requirements

You want to open a bank account online without stress. Most banks make it simple, but you still need to prove who you are. Banks follow strict rules to keep your money safe and meet legal standards. You usually give your name, date of birth, address, and an identification number like your Social Security number. You also upload a photo ID, such as a driver’s license or passport. Some banks ask for a second form of ID, like a Social Security card or birth certificate. If you are under 18, you need a parent or guardian to help. For joint accounts, everyone must show ID and sign. Some banks may ask for a minimum initial deposit, but many of the best for easy approval with low requirements do not.

Tip: Always have your documents ready before you start. This helps you get easy approval and finish faster.

Approval Speed

You want your account open fast. Online-only banks give you easy approval in minutes. They use digital tools to check your information right away. You do not need to visit a branch or mail paperwork. Traditional banks sometimes ask you to bring documents to a branch, which slows things down. If you want the fastest setup, choose an online bank. You can get your account number and even a virtual card almost instantly.

- Online-only banks: easy approval, fast setup, no branch visits.

- Traditional banks: slower approval, may need in-person steps.

Fees

Nobody likes surprise fees. Most online banks keep things simple with no monthly fees or minimum balance rules. You may see fees for special services, like overdrafts or wire transfers. For example, some banks charge an overdraft fee if you spend more than you have. Others let you link accounts to avoid these charges. U.S. Bank lets you move money from savings for free, but may charge up to $12.50 if you use a credit account. You can avoid most fees by watching your balance and using mobile alerts.

| Fee Type | Common Cost (USD) | How to Avoid |

|---|---|---|

| Overdraft | $0–$35 | Link accounts, set alerts |

| Wire Transfer | $0–$30 | Use ACH or Zelle |

| ATM Out-of-Network | $0–$5 | Use in-network ATMs |

Accessibility

You want your bank to work for you, no matter your needs. Online banks try to make their websites and apps easy for everyone. Still, people with disabilities can face challenges. Some users have trouble with keyboard navigation, session timeouts, or screen readers. Banks that focus on accessibility help not just people with disabilities, but also older adults and those less comfortable with technology. Good digital access builds trust and keeps customers happy. U.S. law requires banks to make their services accessible, so look for banks that mention accessibility features.

Note: If you have special needs, check if your bank’s website or app works with your devices before you open an account.

Opening Steps

Preparation

Getting ready for a new online bank account is easy if you know what to expect. You want to make the application process smooth and fast. Start by gathering your personal information and documents. You will need your full name, Social Security number, date of birth, address, occupation, and contact details. Some banks also ask for your mother’s maiden name or information for your first deposit.

Here’s a quick checklist to help you prepare:

- Collect valid ID, like a driver’s license or passport.

- Find a recent utility bill or bank statement to prove your address.

- Check if you meet age or eligibility rules for your chosen account.

- Decide which bank and account type fits your needs. Some accounts are best for simple account opening, while others are best for quick online setup.

- Create a strong password and set up two-step verification for extra security.

Tip: Set up direct deposit and automatic bill payments after opening your account. This helps you get paid faster and avoid missing payments.

Application

You can start the application process right from your phone or computer. Most banks make it easy with a quick application that takes just a few minutes. If you want the best for fast applications, look for banks that let you skip paperwork and branch visits.

Follow these steps for a smooth application process:

- Choose your bank and account type.

- Fill out the online form with your personal details.

- Answer questions about your customer status and deposit amount.

- Review the legal disclosures and submit your application.

- Make your first deposit if needed. Many banks let you transfer money, use mobile deposit, or mail a check.

After you finish, download the bank’s app. You can manage your account, check balances, and make transfers from anywhere.

Verification

Banks want to keep your money safe, so they check your identity during the application process. You will upload a photo of your government ID, like a passport or driver’s license. Some banks ask you to take a selfie to match your face to your ID. This step helps prevent fraud and keeps your account secure.

Many banks use digital tools to check your information quickly. They look at your IP address, location, and even your device to make sure you are really you. Some banks may ask security questions or use two-factor authentication. If you want the best for fast applications, choose banks that use these digital checks. You can finish everything online without visiting a branch.

Note: If you have trouble with the verification step, check your documents and try again. Some banks offer support if you get stuck.

How to Choose

Security

You want your money to stay safe. Always check if your bank uses strong security features. Look for two-factor authentication, which means you need a code from your phone or email to log in. Many banks also use encryption to protect your data. Some banks send alerts if they see strange activity on your account. This helps you spot problems fast. If you lose your card, you can freeze it right from the app. Capital One 360 and Chime both let you do this. You should also create a strong password and never share it with anyone.

Tip: Choose a bank that lets you set up account alerts. This way, you know right away if something changes.

Digital Tools

You want banking to be easy and smart. Many online banks give you tools to help manage your money. For example, the Dave app lets you budget, get paid early, save money with round-ups, and even get instant cash advances with no interest. These features make it simple to track your spending and save for goals.

Here’s a quick look at some banks and apps with advanced digital tools:

| Bank/App | Key Features |

|---|---|

| Dave | Budgeting, early paycheck, round-up savings, cash advances |

| Chime | Mobile check deposit, spending alerts, savings tools |

| Varo | Mobile check deposit, budgeting, savings accounts |

| MoneyLion | Mobile banking, investing, borrowing, budgeting |

| M1 Finance | Investing, saving, mobile banking |

You can use these tools to keep your finances on track. Some apps, like YNAB and Rocket Money, help you budget and track subscriptions. Pick a bank that fits your style and needs.

Support

You want help when you need it. Good banks offer support by phone, chat, or email. Some banks have 24/7 support, so you can get answers any time. Check if your bank has a helpful FAQ or a chatbot in the app. Capital One and Ally both have strong customer service. If you like talking to a real person, look for banks with live phone support. Always test the support options before you open your account. This way, you know you can get help fast if you ever have a problem.

Note: Fast and friendly support can save you time and stress. Choose a bank that makes it easy to get help.

Pros and Cons

Advantages

You get a lot of benefits when you open an online bank account. Here are some of the biggest advantages:

- No monthly fees or minimum balances: Most online banks do not charge you monthly maintenance fees. You can keep your balance low without worrying about extra charges.

- Higher interest rates: Online banks often pay you much more interest on your savings and checking accounts. Sometimes, you can earn 10 to 20 times more than with a traditional bank.

- 24/7 access: You can check your account, move money, or pay bills anytime. You do not have to wait for a branch to open.

- Modern digital tools: Online banks give you easy-to-use apps and websites. You get instant alerts, automatic expense tracking, and even budgeting tools that help you save money.

- Better security: Many online banks use biometric logins, like fingerprint or face ID, and extra verification steps. This keeps your money safe.

- Greater control: You can watch your account in real time. If you spot something wrong, you can act fast.

Tip: If you want to avoid fees and earn more on your savings, online banks are a smart choice. Many, like Chime or SoFi, make it easy to open an account and start banking right away.

Drawbacks

Online bank accounts are not perfect. You may face some challenges:

- Cash deposits can be tricky: Without branches, you might find it hard to deposit cash. You may need to use a network ATM, visit a partner retailer, or buy a money order.

- Fewer services: Many online banks only offer checking and savings accounts. You might not find loans, mortgages, or investment products like you would at a traditional bank or a Hong Kong bank.

- No personal touch: You do not get to know your banker. If you need help, you talk to a chatbot or call a support line. This can make it harder to get special help, like fee forgiveness.

- Customer service issues: Some online banks have slow response times. Automated systems can make mistakes, like freezing your account by accident. In rare cases, people have lost access to their money for weeks or even months.

Note: If you need to deposit cash often or want face-to-face service, you may want to keep a traditional bank account as a backup. Always check customer reviews before you choose an online bank.

More Easiest Bank Accounts

Credit Unions

You might want to try a credit union if you like low fees and a friendly approach. Many credit unions let you open an account online in just a few minutes. You only need a small deposit, sometimes as low as $5. You do not have to worry about annual fees on basic savings accounts. Here is a quick look at two popular choices:

| Credit Union | Account Types Offered | Online Account Opening | Minimum Balance | Fees | Notes |

|---|---|---|---|---|---|

| First Federal Credit Union | Share Savings, Checking | Yes | $5 (Savings) | No annual fees | Fast online setup, low balance needed |

| State Credit Union | Checking, Savings | Yes | None (many accts) | No fees (many accts) | Easy access, no minimum for many accounts |

You can open these accounts even if you have bad credit. Most credit unions do not check your credit for basic accounts. If you want a joint account, you and your co-owner both need to show ID and fill out the online form.

Tip: Credit unions often have better rates and more personal service than big banks.

Regional Banks

Regional banks give you the best of both worlds. You get online banking with the option to visit a branch if you need help. Some regional banks, like Capital One 360, let you open an account online in about five minutes. You pay no monthly fees and can use thousands of ATMs for free. Here is a table to help you compare:

| Bank Name | Online Opening Speed | Fees and Features | Notes |

|---|---|---|---|

| Capital One 360 Checking | ~5 minutes | Low fees, free cash deposits, 70,000+ ATMs | In-person help available |

| Ally Bank Spending Account | 5 minutes or less | No monthly fees, no overdraft fees, ATM fee refunds | No branches, debit card by mail |

| Chime Online Checking | Easy sign-up | No monthly fees, 50,000+ ATMs, SpotMe overdraft | No in-person service |

| Discover Cashback Debit | Online application | No monthly fees, 1% cashback, free cash at Walmart | Large ATM network |

| SoFi Checking & Savings | Quick online | No fees, high APY, 55,000+ ATMs, early paycheck | Hybrid account, perks with direct dep. |

If you have bad credit, Chime, SoFi, and Discover do not require a credit check. SoFi also lets you open a joint account online with no minimum deposit.

Nonresident Options

If you live outside the U.S. or do not have a Social Security number, you still have choices. Wise makes it easy for nonresidents to open an account online. You get a virtual debit card right away and can hold money in many currencies. Revolut is another good pick for fast online setup and instant cards. Both work well for people who need to send or receive money across borders.

Note: Wise and Revolut do not require a U.S. address or credit history. You can open an account with just your passport and proof of address from your home country.

Some banks and credit unions also help people with no credit or bad credit. Chime, Varo, and Go2Bank do not check your credit and offer instant approval. If you want to open a joint account, SoFi makes it simple with no fees or minimums.

You have many easy options, whether you want a credit union, a regional bank, or an account as a nonresident. Just pick the one that fits your needs and start banking today.

You have plenty of choices when it comes to the easiest bank accounts. These accounts stand out because you can open them with just a few documents and a small deposit—usually under $25. You get low or no fees, wide access across the U.S., and helpful features like mobile banking and ATM access.

- Open accounts quickly with minimal paperwork.

- Enjoy no monthly fees and easy access to your money.

- Manage bills, transfers, and alerts right from your phone.

| Feature | Why It Matters for You |

|---|---|

| Bill Pay | Pay bills on time, avoid late fees |

| Account Alerts | Stay updated on your balance and safety |

| Customer Support | Get help whenever you need it |

Pick the account that fits your needs best. Use the steps above to open your account, and check the comparison and FAQ sections for extra tips before you decide.

FAQ

Can you open an online bank account if you have bad credit?

Yes, you can. Many online banks like Chime and Varo do not check your credit. You just need to show your ID and basic information. You can get approved even if your credit score is low.

How fast can you start using your new account?

Most online banks give you access within minutes. You can see your account number right away. Some banks, like Chime and Wise, offer instant virtual debit cards. You can start using your money for online shopping or payments almost immediately.

Do you need a Social Security number to open an account?

Most U.S. banks ask for a Social Security number. If you do not have one, you can try Wise or Revolut. These banks let you open accounts with a passport and proof of address from your home country.

Can you open a joint account online?

Yes, you can. Banks like SoFi and Ally let you open joint accounts online. Both people need to provide their information and ID. You both sign up together and get access to the same account.

What if you want to open an account from outside the U.S.?

You have options. Wise and Revolut work well for people living outside the U.S. You can open an account with your passport and proof of address. You do not need a U.S. address or credit history.

Online banks like Chime and SoFi offer hassle-free account opening with no fees and instant virtual cards, but their U.S.-centric focus limits global usability. For seamless international banking in 2025, choose BiyaPay. With transfer fees as low as 0.5%, BiyaPay outshines traditional banks’ costly wire transfers, offering real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. The Biya EasyCard, a virtual card with no annual fee, supports secure payments on Amazon, eBay, and PayPal in 190+ countries, ideal for expats or travelers shopping online. Unlike Chime’s U.S.-only ATMs or Wise’s non-U.S. virtual cards, BiyaPay provides same-day transfers and quick setup with ID verification, ensuring instant access. Licensed in the U.S. and New Zealand, it guarantees secure, compliant transactions. Pair BiyaPay with a local bank like Ally for domestic needs while managing global finances effortlessly. Join BiyaPay today for fast, affordable, and borderless banking!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.