- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Travel Credit Cards for Last-Minute Getaways

Image Source: pexels

Here are the best travel credit cards for last-minute getaways: Chase Sapphire Preferred, Chase Sapphire Reserve, Capital One Venture X, American Express Gold Card, Bilt Mastercard, Bank of America Travel Rewards, and Discover it Miles. You get instant card numbers, fast approval, and flexible rewards, making these travel credit cards perfect for spontaneous trips. With last-minute travel on the rise—44% of leisure travelers now book at the last minute—you can grab the right travel credit card and start traveling whenever you want.

Key Takeaways

- Choose travel credit cards that offer instant or virtual card numbers to book trips immediately after approval.

- Look for cards with fast approval processes so you can secure last-minute deals without delay.

- Pick cards with flexible rewards that let you use points for flights, hotels, or cash back without blackout dates.

- Use travel credit cards with perks like lounge access, travel credits, and no foreign transaction fees to save money and enjoy smoother trips.

- Follow tips like keeping a good credit score and using rewards portals to earn and redeem points quickly for spontaneous travel.

Key Features

Instant Access

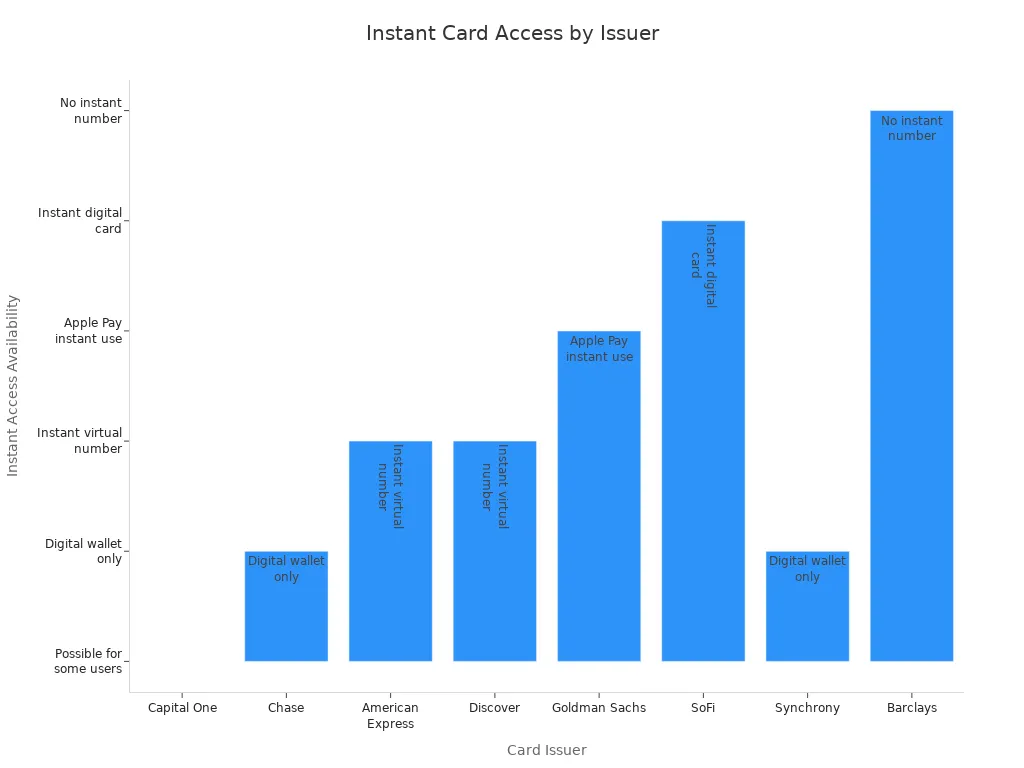

You want to book a trip and go right away. Some travel credit cards let you use your card number instantly after approval. This means you can start booking flights or hotels without waiting for the physical card to arrive. Many issuers now offer instant virtual card numbers or let you add your card to a digital wallet. Here’s a quick look at how fast you can get access:

| Issuer | Instant Access Availability | Method of Access | Notes |

|---|---|---|---|

| Capital One | Possible for eligible users | Mobile app | Not all get instant access |

| Chase | Add to digital wallets instantly | Digital wallet | May not provide full card number |

| American Express | Virtual card number upon instant approval | App | Use right after approval |

| Discover | Virtual card number if eligible | App or digital wallet | Instant decision and virtual card available |

| Goldman Sachs | Instant use with Apple Pay | Apple Pay | Physical card optional |

| SoFi | Instant digital card access | App | Physical card arrives in about 10 days |

| Synchrony | Instant use in digital wallets/apps | PayPal/Venmo Card | Use limited to digital wallets/apps |

| Barclays | No instant card number | Spending limits only | No instant card number provided |

You can often meet welcome bonus requirements and start earning rewards right away.

Fast Approval

When you need to travel soon, waiting for approval can be stressful. Many travel credit cards offer instant or same-day approval if you qualify. You fill out an online application, and you get a decision in minutes. If approved, you can use your card details immediately for urgent bookings. This quick process helps you grab last-minute deals before they disappear.

Flexible Rewards

You want rewards that work for you, not against you. Flexible rewards programs let you use points or miles for flights, hotels, or even cash back. Some programs allow you to transfer points to many airline or hotel partners. This gives you more options when booking last-minute trips. Here are some features you should look for:

- Transfer points to different airlines and hotels

- Redeem points for travel, gift cards, or statement credits

- Combine points from multiple cards for bigger rewards

- No blackout dates or restrictions on redemptions

Flexible rewards make it easier to find the best deals and book what you want, when you want.

Travel Perks

Travel credit cards come packed with perks and benefits that make last-minute trips smoother. You might get airport lounge access, free checked bags, or priority boarding. Some cards offer annual travel credits, automatic hotel elite status, or fee credits for Global Entry or TSA PreCheck. You also avoid foreign transaction fees, which saves you money abroad. Travel insurance protections, like trip cancellation or baggage coverage, give you peace of mind.

Tip: Urban hotels and budget airlines often have the best last-minute deals. If you stay flexible with your dates and destinations, you can unlock even more savings and perks.

Best Travel Credit Cards

Image Source: pexels

When you want to book a trip at the last minute, you need a travel credit card that works fast and gives you great value. Here are the best travel credit cards for last-minute getaways, each with unique features to help you travel now and save money.

Chase Sapphire Preferred

You want a card that gets you approved quickly and lets you start booking right away. With the Chase Sapphire Preferred, you can often get an approval decision in minutes if your application is complete. Sometimes, you may need to wait for a manual review, but most people get their card number instantly for digital wallet use. If you need the physical card, Chase offers expedited shipping so you can get it in 1-2 business days.

This card stands out for last-minute travel because you earn 2X points on travel and dining. When you redeem through Chase Ultimate Rewards, you get a 25% bonus, making your points go further. You can transfer points to top airline and hotel partners, which gives you more options when flights or hotels are almost sold out. The card also includes travel insurance, trip cancellation coverage, and no foreign transaction fees. If your plans change, you have protection for non-refundable expenses. You also get travel assistance to help you find last-minute flights or fix booking problems. The welcome bonus is strong, and you can use your points for almost any travel need. Many experts rank this as one of the best travel credit cards for flexibility and value.

Chase Sapphire Reserve

If you want premium benefits and fast access, the Chase Sapphire Reserve is a top choice. You may get instant approval, but sometimes Chase needs to review your application. If approved, you can get your card shipped in 48 hours with free expedited delivery. This helps you start booking travel almost right away.

The Chase Sapphire Reserve gives you a $300 annual travel credit that covers many travel expenses, including last-minute flights. You earn 3X points on a wide range of travel purchases, so you rack up points quickly even if you book at the last minute. The card also gives you monthly Lyft credits, which help with airport rides or getting around your destination. You get complimentary airport lounge access, including Priority Pass and Chase Sapphire Lounges, so you can relax before your flight. The flexible travel credit and ride-sharing credits make it easy to adapt to changing plans. You can transfer points to airline and hotel partners or use them through Chase Ultimate Rewards for maximum value. The sign-up bonus is high, and the card offers strong travel protections, making it one of the best travel credit cards for urgent trips.

Tip: If you travel often or want luxury perks, the Chase Sapphire Reserve can save you money and make your trip smoother, even when you book at the last minute.

Capital One Venture X

You need a card that lets you use your rewards right away. The Capital One Venture X lets you redeem miles instantly for travel booked through the Capital One portal. You get 1 cent per mile, and you can use your miles for flights, hotels, or vacation rentals. There are no blackout dates, so you can book last-minute stays at premium hotels or vacation rentals. You can also transfer miles to airline and hotel partners if you find a good deal.

This card gives you access to luxury hotel collections and vacation rentals, which is great when you need a place to stay on short notice. You earn bonus miles on bookings through the portal, and you can use your miles for a wide range of travel needs. The sign-up bonus is generous, and you get airport lounge access, travel credits, and strong travel protections. If you want flexibility and fast rewards, this card is a smart pick for last-minute travel.

American Express Gold Card

When you want to book a trip right now, the American Express Gold Card makes it easy. If you qualify, you get instant access to your real card number after approval. You can use it online or add it to your digital wallet, so you do not have to wait for the physical card. The card usually arrives in 5-7 days, but you can get it faster with expedited shipping.

The American Express Gold Card gives you American Express Membership Rewards points, which you can transfer to over 20 airline and hotel partners. This makes it easy to find last-minute flights or hotel rooms. You get a $100 hotel credit for stays of two nights or more, which helps with last-minute hotel costs. The card has no foreign transaction fees, so you save money when you travel abroad. You also get baggage insurance, car rental coverage, and 24/7 emergency help with the Premium Global Assist Hotline. Monthly Uber Cash and dining credits help cover meals and rides during your trip. The sign-up bonus is strong, and the card offers flexible rewards and travel protections, making it a favorite for urgent travel needs.

Bilt Mastercard

If you want to earn points on rent and use them for travel, the Bilt Mastercard is a unique choice. You can get approved quickly, sometimes in just five minutes. Once approved, you get your full card number in the Bilt Rewards app and can add it to Apple Pay or Google Pay for instant use. The physical card usually arrives in three days.

You earn points on rent payments with no fees, and you can transfer those points to top airline and hotel partners. This gives you flexibility when booking last-minute flights or hotels. The card has no annual fee and offers travel protections like trip cancellation and interruption coverage. You also get cell phone protection and access to exclusive events. The sign-up bonus activates after you receive and activate your physical card. If you want to use your rent payments for travel, this card is a smart way to earn rewards fast.

Bank of America Travel Rewards

You want a simple card with flexible rewards for last-minute trips. The Bank of America Travel Rewards card gives you a flat 1.5 points per dollar on every purchase, so you do not have to track categories. You can redeem points as statement credits for travel purchases made up to 12 months ago, which is helpful if you book a trip on short notice.

This card has no annual fee and no foreign transaction fees, making it cost-effective for both domestic and international travel. You get Visa Signature benefits like concierge service, lost luggage reimbursement, and emergency help. If you are a Preferred Rewards member, you can boost your points by up to 75%. The sign-up bonus and 0% intro APR for 15 months help you manage travel expenses. This card is a great choice if you want flexibility and easy rewards for spontaneous travel.

Discover it Miles

If you want to start using your card right away, Discover it Miles can give you instant approval and a virtual card number for immediate use. Sometimes, approval takes up to 30 days, but many people get a decision in 60 seconds. You can use your virtual card in a digital wallet before the physical card arrives.

You earn 1.5 miles per dollar on all purchases, and you can redeem miles for travel purchases made within 180 days. At the end of your first year, Discover matches all the miles you earned, doubling your rewards. The card has no foreign transaction fees and a 0% intro APR for 15 months. You get 24/7 U.S.-based customer service, which is helpful if you run into problems while traveling. The card does not offer airport lounge access or advanced travel protections, but it is a solid choice for earning miles and booking last-minute trips.

Note: If you want more travel perks like airport lounge access or premium travel insurance, you may want to look at cards like the chase sapphire reserve or the american express platinum.

Travel Credit Card Rewards

Earning Points

You want to earn points fast so you can book your next trip. Travel rewards cards give you many ways to boost your travel points earning. Here are some of the best ways to rack up points quickly:

- Open a new travel rewards card and meet the spending requirement for a big welcome bonus.

- Use your card for bonus categories like dining, groceries, gas, and streaming services.

- Shop through online portals linked to your card, such as Chase’s Shop Through Chase or Rakuten.

- Refer friends or family to your card and get referral bonuses.

- Ask your card company for a retention offer before you renew your card.

- Take advantage of seasonal promotions and special offers from your card issuer.

| Method | Description |

|---|---|

| Leverage Sign-Up Bonuses | Earn large point bonuses after meeting spending requirements, often enough for free flights or hotel stays. |

| Maximize Everyday Spending | Use your card for daily purchases to collect points steadily. |

| Transfer Points to Partners | Move points to airline or hotel partners for higher value, especially for last-minute flights or hotels. |

| Use Shopping and Dining Portals | Shop online through portals to earn extra points on top of your regular rewards. |

| Refer Friends and Family | Get bonus points when someone signs up using your referral link. |

| Ask for Retention Offers | Request extra points or perks to keep your card open. |

| Seasonal Promotions and Offers | Activate special deals to earn more points on travel, dining, or shopping. |

If you use these tips, you can build up credit card points fast and start traveling for free.

Redeeming for Flights

When you want to book flights at the last minute, you need flexible and fast options. Some travel rewards cards make it easy to use your points or miles for free flights. For example, Chase Sapphire Preferred lets you redeem points through the Ultimate Rewards Travel Portal, where each point is worth 1.25 cents. You can book flights directly and even earn airline miles on those bookings. Capital One Venture cards have a Purchase Eraser tool, so you can use miles to cover any travel purchase from the last 90 days. This makes it simple to get a flight without worrying about blackout dates.

American Express cards give you many choices. You can transfer points to airline partners for premium flights, sometimes getting up to 18 cents per point. This is a great way to get more value and even score business class seats. If you want free flights, using these flexible redemption options can help you get there fast.

Tip: Always check if transferring points to an airline partner gives you a better deal than booking through your card’s portal.

Booking Hotels

Booking a hotel with points can save you a lot of money, especially when prices are high. Many hotel-branded cards, like the Marriott Bonvoy Chase card or Hilton Honors American Express Card, give you free night certificates. These certificates often cover hotel stays worth $250-300 USD, which is more than the card’s annual fee. You can use them for last-minute bookings in cities like New York or London.

Some cards, such as the Capital One Venture X, give you 10x points on hotels booked through their travel portal. Flexible points systems like Chase Ultimate Rewards and American Express Membership Rewards let you transfer points to hotel partners for even more options. No-annual-fee cards, like the IHG One Rewards Traveler Credit Card or Wyndham Credit Card, also offer big bonuses and high points earning on hotel stays.

- Use free night certificates for expensive hotels.

- Transfer points to hotel partners for last-minute bookings.

- Book through your card’s portal to earn extra points and perks.

If you use all your card’s benefits, you can often find a hotel room for free, even at the last minute.

Comparison Table

Features Overview

You want to see how these travel credit cards stack up side by side. Here’s a quick table that shows the main features you care about. You can spot which card fits your last-minute travel needs best.

| Card Name | Annual Fee (USD) | Rewards Flexibility | Instant Card Number | Travel Protections |

|---|---|---|---|---|

| Chase Sapphire Preferred | $95 | High (transfer partners) | Sometimes | Strong |

| Chase Sapphire Reserve | $550 | Very High (transfer, bonus) | Sometimes | Excellent |

| Capital One Venture X | $395 | High (transfer, portal) | Possible | Excellent |

| Amex Gold Card | $250 | High (many partners) | Yes | Good |

| Bilt Mastercard | $0 | High (rent, partners) | Yes | Good |

| BoA Travel Rewards | $0 | Moderate (statement credit) | No | Basic |

| Discover it Miles | $0 | Moderate (statement credit) | Yes | Basic |

Tip: Premium cards give you more travel perks and flexible rewards. No-fee cards keep things simple and cost nothing to keep.

Approval Speed

You want a card that gets you moving fast. Most cards give you a decision in minutes if you qualify. Some cards let you use your card number right away, so you can book flights or hotels without waiting.

- Instant Approval & Access: Amex Gold Card, Bilt Mastercard, Discover it Miles

- Fast Approval, Digital Wallet Use: Chase Sapphire Preferred, Chase Sapphire Reserve, Capital One Venture X

- Standard Approval: Bank of America Travel Rewards

If you need to travel today, pick a card that offers instant access after approval.

Perks Summary

Each card brings something special to the table. Premium cards like Chase Sapphire Reserve and Capital One Venture X give you lounge access, travel credits, and elite status. You get strong travel protections, too. No-fee cards focus on easy rewards and simple redemptions. You won’t get luxury perks, but you still earn points for every dollar you spend.

- Premium Perks: Lounge access, travel credits, elite status, strong insurance

- No-Fee Simplicity: Easy rewards, no annual fee, basic travel protections

You can choose a card that matches your travel style. If you want luxury and protection, go premium. If you want to keep it simple, a no-fee card works well.

Tips for Last-Minute Use

Image Source: pexels

Getting Instant Card Numbers

You want to book your trip right away, so getting an instant card number is a game changer. Here’s how you can boost your chances of getting one:

- Keep your credit score in good shape. Most issuers look for high scores when giving instant access.

- Apply online for cards that offer instant approval. You usually get a decision in minutes.

- Choose cards that give you a virtual card number right after approval. This lets you start spending before your physical card arrives.

- Pay your bills on time and keep your credit use low. These habits help you get approved faster.

- Always check the card’s terms to make sure it offers instant virtual numbers.

- Compare different issuers. Some are faster than others.

- Once you get approved, use your virtual card for online bookings or add it to your digital wallet for in-store purchases.

Tip: If you want to grab a sign-up bonus, meeting the spending requirement with instant access can help you earn that bonus even faster.

Fast Rewards Redemption

When you need to book a flight or hotel right now, you want to use your rewards as quickly as possible. Start by logging in to your credit card or airline account. Use the rewards portal to search for flights, hotels, or car rentals. Some tools, like Google Flights or Rooms.aero, help you find available options fast. Once you spot a deal, redeem your rewards or transfer points to a travel partner. Some transfers happen instantly, but others might take a day or two. Always compare if using your card’s portal or transferring points gives you the best value. Follow the prompts to finish your booking and you’re ready to go.

Note: Using your rewards for last-minute bookings can help you save cash and still get the most out of your bonus offers.

Avoiding Pitfalls

Last-minute travel can be exciting, but it’s easy to make mistakes. Watch out for these common problems:

- Some cards charge foreign transaction fees, which can add 2-3% to every purchase. Pick a card with no foreign fees to save money.

- If you carry a balance, interest charges can wipe out your rewards. Always pay your balance in full.

- Don’t forget to use all your card’s perks, like lounge access, travel insurance, or category bonuses. These can make your trip smoother and cheaper.

- Make sure you use your points before they expire or lose value.

- If you mix points and cash, you can book even when you don’t have enough points for the full cost.

- Let your card issuer know about your travel plans. This helps avoid card blocks while you’re away.

- Read the fine print on fees, interest rates, and bonus rules so you don’t get caught off guard.

Tip: Setting a travel budget and tracking your expenses in real time can help you avoid overspending and make the most of your sign-up bonus.

You have many great choices when it comes to picking a travel credit card for last-minute trips. Each card offers unique benefits, like fast approval or flexible rewards. Think about how you like to travel and what perks matter most to you. If you want to be ready for a spontaneous getaway, apply for the right card now. Having the best card in your wallet means you can book and go anytime.

FAQ

How fast can I get a travel credit card for last-minute trips?

You can often get approved in minutes when you apply online. Some cards give you a virtual card number right away. You can use it to book flights or hotels before your physical card arrives.

Do all travel credit cards offer instant card numbers?

No, not every card gives instant access. Cards from American Express, Bilt, and Discover often provide virtual numbers. Always check the card’s details before you apply.

Can I use rewards points for same-day bookings?

Yes, you can use points for same-day flights or hotels. Many cards let you redeem points instantly through their travel portals. Some allow you to transfer points to airline or hotel partners for last-minute deals.

Are there any fees I should watch out for with last-minute travel?

Watch for foreign transaction fees, which can add 2-3% to each purchase. Pick a card with no foreign fees. Also, check for rush shipping fees if you need a physical card quickly.

For last-minute getaways, travel credit cards like Chase Sapphire Preferred or Capital One Venture X offer instant access and flexible rewards, but high annual fees ($95-$695) and foreign transaction fees (2-3%) can add up. Simplify your spontaneous trips with BiyaPay. With transfer fees as low as 0.5%—far below traditional bank fees ($20-$40)—and real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries, BiyaPay ensures cost-effective global payments. The Biya EasyCard, a virtual card with no annual fee, supports secure transactions on Amazon, eBay, and PayPal in 190+ countries, ideal for booking flights or hotels instantly. Unlike credit cards requiring spending thresholds for bonuses, BiyaPay offers same-day transfers and quick setup with ID verification, perfect for urgent travel needs. Licensed in the U.S. and New Zealand, it guarantees secure, compliant transactions. Pair BiyaPay with a no-fee card like Discover it Miles for local purchases while managing international expenses effortlessly. Join BiyaPay today to unlock seamless, low-cost financial freedom for your 2025 adventures!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.