- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How LLC Owners Get Paid Explained with Practical Tips

Image Source: unsplash

If you’re wondering how do llc owners get paid, you have a few options: owner’s draw, salary, and distributions. The right way to pay yourself depends on your limited liability company’s structure and tax status. Check out this quick comparison:

| LLC Structure / Tax Status | Payment Method for Members | Tax Implications |

|---|---|---|

| Single-member LLC | Owner’s draw | Self-employment tax on all earnings |

| Multi-member LLC | Owner’s draw/distributions | Self-employment tax on share of profits |

| S Corporation Election | Salary + distributions | Salary subject to payroll tax; distributions may save on self-employment tax |

| C Corporation Election | Salary + dividends | Double taxation possible |

You don’t have to feel stressed about llc owners payment. Paying yourself as an owner can be simple once you know the basics. Many owners choose a method that matches their business goals and tax needs. With clear steps, llc owners payment becomes a routine part of running your business.

Key Takeaways

- LLC owners can pay themselves using an owner’s draw, salary, or distributions depending on their LLC’s structure and tax status.

- Keeping business and personal finances separate protects your liability and simplifies taxes; always use a dedicated business account.

- If your LLC is taxed as a corporation, you can pay yourself a salary through payroll, which offers steady income and tax benefits.

- Good record-keeping and clear operating agreements help avoid confusion and keep your payments compliant with IRS rules.

- Consulting a tax professional and reviewing your compensation regularly ensures you pay yourself fairly and keep your business healthy.

LLC Structures

Image Source: pexels

Single-Member LLC

If you run a single-member LLC, you are the only owner. You can pay yourself by taking money out of the business account. This is called an owner’s draw. You do not get a paycheck like an employee. Instead, you move money from your business to your personal account. You report all profits on your personal tax return. You pay self-employment tax on the full amount. You do not need to worry about member distributions or guaranteed payments because you are the only owner.

Multi-Member LLC

When you have more than one owner, you might wonder, how do multiple owners of an llc get paid? In a multi-member LLC, the IRS treats your business as a partnership by default. Each owner gets a share of the profits. You and the other owners report your share on your personal tax returns, even if you do not take the money out. This is called pass-through taxation. You pay self-employment tax on your share. The LLC must file Form 1065 and give each owner a Schedule K-1. The operating agreement explains how profits and losses are split. Sometimes, owners get guaranteed payments for work they do, even if the business does not make a profit. These guaranteed payments are taxed as income. Member distributions can be flexible, but you must follow the rules in your agreement. If you are still asking, how do multiple owners of an llc get paid, remember: you get paid through your share of profits, guaranteed payments, or both.

Tip: Make sure your operating agreement is clear about how to split profits and handle guaranteed payments. This helps avoid confusion later.

LLC Taxed as Corporation

You can choose to have your LLC taxed as a corporation. This changes how you, as an owner, get paid. If you pick S corporation status, you can pay yourself a salary through payroll. You must also pay yourself a reasonable wage for your work. You can also take extra profits as distributions, which may lower your self-employment tax. If you choose C corporation status, you become a shareholder. You can pay yourself a salary and also get dividends. The company pays corporate tax, and you pay tax on dividends. This is called double taxation. The table below shows the main differences:

| Taxation Type | How Owners Get Paid | Tax Implications |

|---|---|---|

| Default LLC | Owner’s draw, guaranteed payments | Self-employment tax on all profits |

| S Corporation | Salary (payroll), distributions | Payroll tax on salary, possible tax savings on distributions |

| C Corporation | Salary (payroll), dividends | Corporate tax + tax on dividends (double taxation) |

You might ask, can llc members be on payroll? Yes, if your LLC is taxed as a corporation, you can put yourself on payroll and pay yourself a regular salary.

LLC Owners Payment Methods

When you run an LLC, you have a few ways to pay yourself. The method you choose depends on your LLC’s structure, tax status, and business goals. Let’s break down the main options: owner’s draw, salary, and distributions. Each method has its own rules, benefits, and things to watch out for. Understanding these options helps you make smart decisions about llc owners payment and your own compensation.

Owner’s Draw

An owner’s draw is the most common way to pay yourself if you have a single-member LLC or a partnership. You simply move money from your business account to your personal account. You can do this whenever you want and for any amount, as long as your business has enough cash. The IRS does not let you pay yourself as an employee unless your LLC is taxed as a corporation. By default, you use an owner’s draw for llc owners payment.

Here’s what makes an owner’s draw unique:

- You decide when and how much to take.

- No set schedule or fixed amount.

- You do not get a paycheck or have taxes withheld automatically.

- You must plan for taxes yourself.

Note: In the United States, you cannot pay yourself a salary unless your LLC elects corporate taxation. Most owners use an owner’s draw, which means you transfer profits from the business to your personal account. Always check your state’s rules for any extra requirements.

Advantages of owner’s draw:

- Flexibility to pay yourself based on business performance.

- Simple process with less paperwork.

- You can take multiple draws as needed.

Disadvantages of owner’s draw:

- No taxes withheld, so you must save for tax payments.

- Each draw reduces your business equity and available funds.

- Not ideal if you want steady income or need to show regular compensation.

- Owner’s draw does not count as a business expense, so it does not lower your taxable income.

If your business has ups and downs, an owner’s draw gives you the freedom to adjust. But you need to balance your draws with your business’s cash flow. Taking too much can leave your company short on funds for bills or growth.

Salary

If your LLC chooses to be taxed as an S corporation or C corporation, you can pay yourself as an employee. This means you get a regular paycheck, and the company withholds payroll taxes. The IRS requires you to pay yourself a “reasonable salary” for your work. This method works well if you want steady income and clear records for llc owners payment.

Here’s how to set up a salary for yourself:

- Check your LLC’s tax status. Only S corp or C corp status allows you to pay yourself as an employee.

- Review your operating agreement if you have partners. Make sure everyone agrees on payment rules.

- Set up a payroll system. You can use payroll software or hire an accountant.

- Decide on a reasonable salary. Look at what others in your role earn in your area.

- Keep good records of all payments and payroll taxes.

- File the right tax forms, like W-2s and payroll tax returns.

Tip: Paying yourself a salary helps you build retirement savings and makes it easier to budget. It also shows the IRS you are following the rules for compensation.

Benefits of paying yourself a salary:

- Regular, predictable income.

- Taxes are withheld automatically.

- Salary counts as a business expense, which can lower your company’s taxable income.

- Helps with personal budgeting and retirement planning.

Drawbacks:

- More paperwork and costs for payroll setup.

- You must pay payroll taxes.

- The IRS may review your salary to make sure it is reasonable.

If you want to pay yourself as an employee, you need to follow all payroll rules. This method works best if your business has steady profits and you want to show clear compensation for your work.

Distributions

Distributions are another way to pay yourself from your LLC’s profits. This method is common in multi-member LLCs and LLCs taxed as S corporations. Distributions usually happen after the business pays all expenses, salaries, and guaranteed payments. The amount and timing depend on your operating agreement and your share of the business.

Here’s how distributions work:

- The LLC pays any owner salaries or guaranteed payments first.

- After covering all expenses, the company calculates profits.

- Profits are split among owners based on ownership percentages or other agreed rules.

- The operating agreement should spell out how and when distributions happen.

- Each owner’s capital account tracks their share of equity and affects distribution amounts.

- You must record each distribution in your books, debiting the owner’s draw account and crediting cash.

Note: Distributions depend on your business’s cash flow and financial health. You might get paid monthly, quarterly, or at other times, depending on what works for your LLC.

Key points about distributions:

- Amounts are based on company profits and your ownership share.

- The operating agreement controls how distributions are calculated and paid.

- Distributions are not always steady, so you need to plan for personal expenses.

- You report your share of profits on your personal tax return, even if you do not take the money out.

Advantages:

- Lets you share in the company’s success.

- Flexible timing based on business needs.

- Can be tailored to each owner’s situation.

Disadvantages:

- Income may not be steady, which can make budgeting harder.

- Taking large distributions can reduce business equity and cash for future needs.

- Tax rules can be complex, especially if your LLC is taxed as a corporation.

If you have a multi-member LLC, member distributions are a key part of llc owners payment. Make sure your operating agreement is clear about how distributions work. This helps avoid confusion and keeps everyone on the same page.

How to Pay Yourself

Figuring out how to pay yourself from your LLC can feel confusing at first, but you can break it down into simple steps. Whether you want to use an owner’s draw, take distributions, or run payroll, you need to set up your accounts the right way and keep good records. Let’s walk through each method so you can pay yourself with confidence.

Setting Up Accounts

Before you pay yourself, you need the right bank accounts. Keeping your business and personal money separate is not just smart—it protects your liability and makes taxes easier.

Here’s how to set up your accounts:

- Choose the Right Bank and Account Type

Look for a bank that fits your LLC’s needs. Compare checking and savings accounts, service fees, transaction limits, interest rates, and digital banking features. Some owners prefer banks with strong online tools, while others want easy ATM access. If you do business in China or Hong Kong, you might look at banks with international services. - Gather Your Documents

You’ll need your Articles of Organization, EIN (Employer Identification Number), operating agreement, business license, and ID for anyone who can sign on the account. - Open the Business Account

Apply online or in person. Some banks require all owners or signers to be present. Submit your paperwork and make the first deposit. Check if there’s a minimum balance to avoid fees. - Keep Accounts Separate

Never mix business and personal funds. This keeps your liability protection strong and makes bookkeeping much easier. It also helps you track how to pay yourself and avoid mistakes.

Tip: Always use your business account for company expenses and your personal account for your own spending. This habit protects your LLC and keeps your records clean.

Making a Draw or Distribution

If you want to pay yourself using an owner’s draw or distributions, you need to follow a few steps. This method works for single-member LLCs, multi-member LLCs, and S corporations (for distributions).

How to Take an Owner’s Draw

- Check Your Operating Agreement

Make sure you know the rules for taking money out. Some agreements set limits or require approval. - Decide How Much to Take

Look at your business profits and cash flow. Never take more than your share of profits. - Transfer the Money

Write a check from your business account to yourself, or make a bank transfer. Always use your business account for the payment. - Record the Transaction

Log each draw in your accounting software. Debit the Owner’s Draw account and credit Cash. Add a memo with the date and reason. - Keep Documentation

Save copies of checks, bank statements, and notes for every draw. This helps if the IRS ever asks questions.

How to Take Distributions

- Calculate Profits

After paying all expenses and salaries, see what profits remain. - Follow the Operating Agreement

Distributions usually match your ownership percentage. The agreement should explain how and when to pay. - Make the Payment

Transfer funds from the business account to each owner’s personal account. Use checks or electronic transfers. - Document Everything

Record each distribution in your books. Keep a digital or paper trail with the date, amount, and who received it.

Note: Never classify an owner’s draw or distribution as a business expense. These payments come from profits, not from your company’s operating costs.

Best Practices for Documenting Draws and Distributions:

- Record every payment right away.

- Use templates or electronic logs for consistency.

- Keep separate accounts for draws and distributions.

- Set clear policies in your operating agreement.

- Review your finances often to catch mistakes early.

- Use accounting software to track equity accounts.

- Communicate payment rules with all owners.

- Keep all records in case of an audit.

If you wonder how to take money out of LLC without paying taxes, remember: you must report all profits on your tax return, even if you leave money in the business. The IRS taxes you on your share of profits, not just what you withdraw.

Running Payroll

If your LLC is taxed as an S corporation or C corporation, you must pay yourself a salary. This means you become an employee of your own business. Here’s how to pay yourself through payroll:

-

Set Up Payroll

Choose payroll software or a service that fits your needs. Popular options include Gusto, Justworks, Remote, TriNet, RUN Powered By ADP, Rippling, and Paycor. These tools help you manage payroll taxes, direct deposits, and compliance.Payroll Software Key Features Pros Cons Pricing Overview Gusto Automated payroll, tax filing, time tracking Easy payroll management, accurate time tracking Limited mobile timesheet approval, less customization Starts at $49/month + $6/person Justworks Payroll, benefits, compliance, HR support Efficient time tracking, benefits management Confusing time-off requests, no recurring reimbursements Starts at $8/month/employee + $50 base Remote Global contractor payments, compliance tools Intuitive global hiring, personalized contracts Limited ad hoc reports, integration sync issues Payroll at $29/employee/month TriNet Payroll, HR solutions, tax compliance Easy HR info access, detailed user guides Poor notifications, time tracking issues Pricing varies, PEO services RUN Powered By ADP Payroll, tax compliance, onboarding Automated payroll, onboarding tools Non-intuitive reminders, limited mobile app features Starts at $79/month + $4/employee Rippling Payroll, HR, global payroll, compliance Secure data, multi-company management Time zone confusion, no editing in transitions Starts at $8/user/month Paycor Payroll, HR, recruitment, analytics Full-service HR, automated workflows Limited report customization, time-consuming profile access Custom pricing, starts at $99/month + $6/employee -

Decide on a Reasonable Salary

Research what people in your role earn in your area. The IRS wants you to pay yourself a fair wage for your work. -

Run Payroll

Enter your salary into the payroll system. The software will calculate taxes and withholdings. You can set up direct deposit to your personal account. -

File Payroll Taxes

The payroll service will help you file the right forms, like W-2s and payroll tax returns. -

Keep Records

Save pay stubs, tax filings, and payroll reports. Good records protect you if the IRS checks your business.

Tip: Using payroll software saves time and reduces mistakes. It also helps you stay compliant with tax laws.

If you ask how to pay yourself as an S corp owner, remember you must take a salary before taking distributions. This keeps you in line with IRS rules and helps you avoid penalties.

Practical Tips for All Payment Methods:

- Always use your business account to pay yourself.

- Write clear memos on checks or transfers, like “Owner’s Draw” or “Salary.”

- Keep digital copies of all payment records.

- Review your books every month to catch errors.

- Never take more than your share of profits.

- If you wonder how to take money out of LLC without paying taxes, know that you must report all profits, even if you leave money in the business.

Paying yourself from your LLC does not have to be hard. With the right setup and habits, you can pay yourself, stay compliant, and keep your business running smoothly.

Tax Implications of Paying Yourself

Image Source: pexels

When you pay yourself from your LLC, you need to think about the tax implications. The way you take money out—whether as a draw, salary, or distribution—changes how much tax you pay and how you report your income. Let’s break down what you need to know about self-employment tax, payroll tax, and income tax.

Self-Employment Tax

If you own a single-member LLC or a multi-member LLC taxed as a partnership, you pay self-employment tax on your share of the business income. You are not considered an employee, so you do not get a paycheck with taxes taken out. Instead, you pay these taxes yourself.

- The self-employment tax rate is 15.3%. This covers 12.4% for Social Security (up to a certain income cap) and 2.9% for Medicare.

- If your income is high, you might pay an extra 0.9% Medicare tax. This applies if you earn more than $250,000 (married filing jointly) or $200,000 (single).

- You pay self-employment tax on all your net earnings from the LLC.

- You usually pay this tax through quarterly estimated payments and report it on your personal tax return.

If your LLC is taxed as an S corporation, you only pay self-employment tax on your salary, not on distributions. This can lower your total tax bill.

Payroll Tax

You might wonder, can llc members be on payroll? The answer depends on your LLC’s tax status. If your LLC is taxed as a corporation (S corp or C corp), you can put yourself on payroll and pay yourself a regular wage. The company withholds payroll taxes from your paycheck and pays employer taxes too.

- Payroll taxes include Social Security, Medicare, and unemployment taxes.

- The LLC files payroll tax forms like W-2, 941, and 940.

- Payroll taxes only apply to wages, not to distributions or dividends.

If your LLC is taxed as a partnership or sole proprietorship, you do not pay yourself through payroll. Instead, you pay self-employment tax directly on your share of the income.

Income Tax

No matter how you pay yourself, you must report your income on your federal and state tax returns. The payment method affects your taxable income and how much you owe.

- Salaries and guaranteed payments count as business expenses. They reduce your LLC’s taxable income.

- Owner’s draws and distributions do not lower the LLC’s taxable income. You pay tax on your share of profits, even if you leave money in the business.

- S corps and C corps must pay a reasonable salary to owners. The IRS checks to make sure the salary matches what others earn in similar jobs.

- C corporations face double taxation. The company pays tax on profits, and you pay tax again on dividends.

- Pass-through entities like partnerships and sole proprietorships only pay tax once, on your personal return.

Tip: Always keep good records of how you pay yourself. This helps you stay on top of your taxable income and avoid surprises at tax time.

How Much to Pay Yourself

Factors to Consider

When you decide how much to pay yourself as an LLC owner, you need to look at several things. Start with your business profits and cash flow. If your company makes steady income, you can pay yourself more. If your profits change each month, you might want to take less to keep your business safe. Always check your industry’s average pay for owners. This helps you set a reasonable salary and avoid problems with the IRS.

Here are some key factors to think about:

- Market research on what owners in your industry earn

- Your business’s annual profits and cash flow

- How much money you need to cover personal expenses

- The need to keep money in the business for growth or emergencies

- Tax treatment of different payment methods

- Keeping business and personal finances separate

- Good records for all owner compensation

You can also look at this table to see what matters most:

| Factor | Explanation |

|---|---|

| Reasonable Salary | Use industry standards and your role to set pay. |

| Business Profits | Make sure profits can support your compensation. |

| Cash Flow | Only pay yourself if your business has enough cash. |

| Reinvestment Needs | Save some profits for future growth. |

| Tax Implications | Know how each payment method affects your taxes. |

| Documentation | Keep records of every payment. |

| Professional Advice | Ask an accountant or advisor for help. |

Reasonable Compensation

The IRS wants you to pay yourself a reasonable salary if you work in your business, especially if your LLC is taxed as an S corporation. Reasonable compensation means your pay matches what others earn for similar work in your area. You should look at your duties, experience, business size, and how much time you spend working. If you pay yourself too little, the IRS may reclassify your distributions as wages and charge extra taxes.

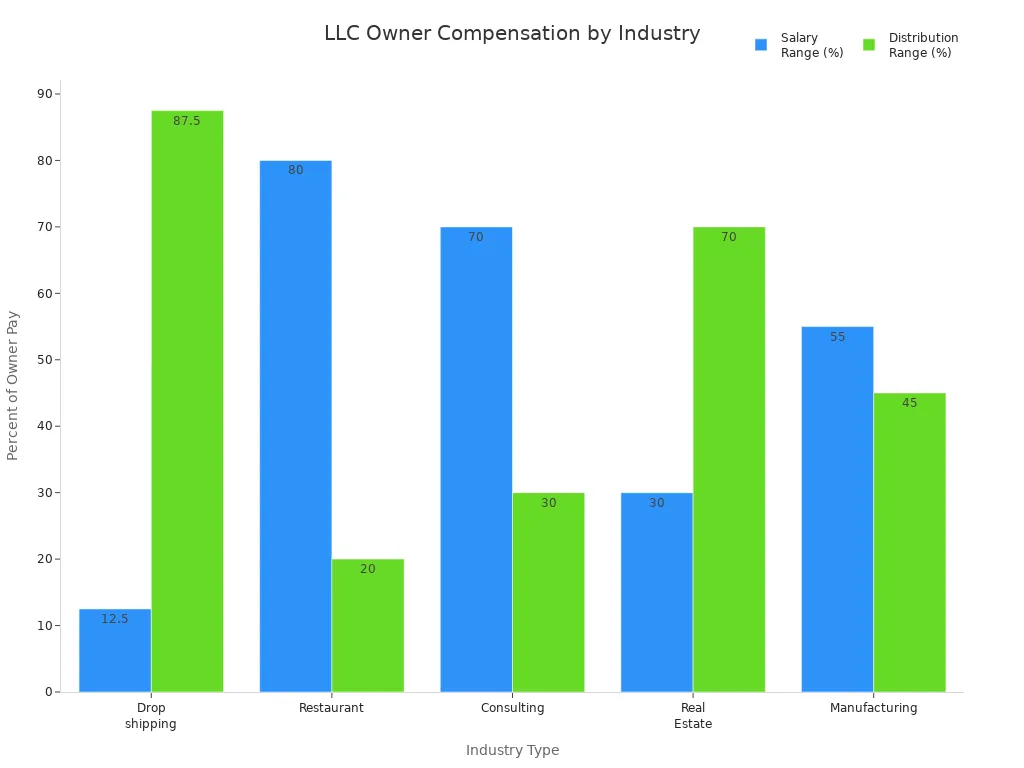

You can use industry benchmarks to guide your decision. For example, owners in restaurants often take 75-85% of their income as salary, while those in drop shipping take only 10-15%. Here’s a quick look:

| Industry Type | Salary Range | Distribution Range | Key Considerations |

|---|---|---|---|

| Drop shipping | 10-15% | 85-90% | Minimal day-to-day involvement |

| Restaurant | 75-85% | 15-25% | High hands-on management |

| Consulting | 65-75% | 25-35% | Revenue tied to client work |

| Real Estate | 25-35% | 65-75% | Income from investments |

| Manufacturing | 50-60% | 40-50% | Mix of oversight and profits |

Tip: Review your reasonable compensation every year. Your duties and business profits can change, so your pay should too.

Practical Tips

You want to find the best way to pay yourself and keep your business healthy. Here are some tips to help you:

- Pay yourself enough to cover your needs, but do not take so much that your business struggles.

- Use a three-account system: one for business operations, one for taxes, and one for your pay.

- Set aside money during high-income months to cover low-income periods.

- Always separate business and personal funds.

- Keep detailed records of every payment you make to yourself.

- Talk to a tax professional or accountant to make sure your compensation plan fits your business and tax goals.

- If you run an S corporation, pay yourself a reasonable salary before taking extra profits as distributions.

Note: The best way to pay yourself depends on your business structure, profits, and personal needs. Stay flexible and review your compensation plan often.

Common Mistakes to Avoid

As an LLC owner, you want to avoid common mistakes that can cause big problems for your business and your personal finances. Let’s look at the top issues you should watch out for.

Mixing Funds

Mixing your business and personal money is one of the biggest mistakes you can make. If you use your business account to pay for personal things, you risk losing your liability protection. This means your personal assets could be at risk if someone sues your business. It also makes your accounting messy and can lead to missed tax deductions or even IRS audits. You might even face legal trouble if someone thinks you used company money for yourself.

Tip: Always keep a separate business bank account. Use a dedicated business credit card for company expenses. Many owners in China and Hong Kong choose banks with strong business services to help keep things separate.

Here are some problems that come from mixing funds:

- You lose track of your business’s true profits.

- The IRS may see this as a red flag and audit your business.

- You could face penalties, interest, or even legal action.

Incorrect Payment Method

Using the wrong way to pay yourself can cause tax headaches and legal risks. For example, if you pay yourself a salary when your LLC is not taxed as a corporation, you could misclassify your income. This mistake can lead to extra taxes, missed deductions, or even loss of your LLC’s liability protection. Courts may “pierce the corporate veil” if you do not follow the right payment rules, putting your personal assets at risk.

Note: Always check your LLC’s tax status before choosing how to pay yourself. Update your operating agreement if your payment method changes.

Poor Documentation

If you do not keep good records of your payments, you could face IRS audits or lose valuable tax deductions. The IRS wants to see clear proof of every payment you make to yourself. Missing receipts, unclear bank transfers, or poor bookkeeping can all cause trouble. You might lose deductions or get hit with penalties and interest.

- Keep copies of checks, bank statements, and payment memos.

- Use accounting software to track every owner’s draw, salary, or distribution.

- Save all records for at least seven years.

Keeping your business and personal finances separate and documenting every payment helps protect your LLC and keeps you out of trouble with the IRS.

Best Practices for LLC Owners Payment

Record-Keeping

Good record-keeping helps you stay organized and protects your LLC. Accountants recommend a few simple steps to keep your business on track:

- Open separate business and personal accounts. This keeps your finances clear and protects your LLC’s legal status.

- Use a general ledger to track all business earnings and expenses, including every payment you make to yourself.

- Save all documents—receipts, bank statements, invoices, bills, proofs of payment, and tax returns.

- Pick an accounting method that fits your business. You can choose cash or accrual accounting.

- Try accounting software or hire a bookkeeper. This makes tracking easier and helps you avoid mistakes.

- Reconcile your accounts often. Check your records against your bank statements every month.

If you use a Hong Kong bank for your LLC, look for one that offers strong online tools. This makes it easier to download statements and keep your records up to date.

Tip: Keeping good records helps you file taxes faster and keeps your LLC safe if you ever face an audit.

Working with Professionals

You do not have to handle everything alone. Working with a CPA or tax professional brings many benefits:

- They help you calculate and pay estimated taxes, so you avoid IRS penalties.

- Professionals guide you on documenting your pay, which is important for S corp owners.

- They give you advice on choosing the right tax setup and handling complex payments.

- Many offer services that combine bookkeeping, payroll, and tax prep, making your life easier.

- Accountants help you manage your budget and cash flow, so your business stays healthy.

- They know the rules for payroll deductions and reporting, which keeps you accurate and efficient.

- If you ever face an IRS audit, a CPA can defend your payment practices.

Note: Always check a CPA’s credentials and reviews before you hire them.

Staying Compliant

You must follow certain rules when you pay yourself from your LLC. Missing a step can lead to tax or legal trouble. Here is a quick guide:

| Compliance Requirement | Explanation |

|---|---|

| Tax Classification Consideration | Decide if your LLC is taxed as a partnership, S corp, or C corp. This affects how you pay yourself and your taxes. |

| Payroll Tax Compliance for LLCs Taxed as Corporations | If you pay yourself a salary, you must withhold and pay payroll taxes like Social Security and Medicare. |

| Partnership Filing Obligations | Multi-member LLCs must file partnership returns and give each member a Schedule K-1. |

| Employee Withholding Obligations | If you have employees, you must withhold federal taxes and file the right forms. |

| State Tax Compliance | States may have extra taxes or rules. Always check your state’s requirements. |

Staying compliant keeps your LLC safe and helps you avoid costly mistakes. If you ever feel unsure, reach out to a professional for help.

You have several ways to pay yourself as an LLC owner, like member draws or guaranteed payments. Picking the right method matters for taxes and smooth business operations.

- Keep your operating agreement clear about profit sharing and decision-making.

- Always separate business and personal accounts for easy record-keeping.

- Consult a tax expert to avoid mistakes and plan for the future.

Tip: Set a regular payment schedule and track everything. With the right habits, paying yourself from your LLC becomes simple and stress-free.

FAQ

How often can you pay yourself from your LLC?

You can pay yourself as often as your business cash flow allows. Many owners choose weekly, biweekly, or monthly payments. Just make sure you keep good records and do not take more than your share of profits.

Do you need to pay taxes every time you take a draw?

No, you do not pay taxes each time you take a draw. You pay taxes on your share of the LLC’s profits, not on each withdrawal. The IRS taxes you based on your business income for the year.

Can you pay yourself if your LLC has no profits?

You should not pay yourself if your LLC has no profits. Taking money out when your business loses money can hurt your company. Always check your cash flow before making a payment to yourself.

What happens if you mix business and personal funds?

Mixing funds can cause big problems. You might lose your liability protection. The IRS may audit your business. Always use separate accounts for your LLC and your personal money.

Paying yourself as an LLC owner—via owner’s draw, salary, or distributions—requires careful planning to align with your tax status and maintain compliance. Separate business and personal accounts to protect your liability, as mixing funds risks IRS audits. For streamlined financial management in 2025, explore BiyaPay. BiyaPay offers transfer fees as low as 0.5%, significantly less than traditional bank fees ($20-$50), with real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. Its Biya EasyCard, a virtual payment card with no annual fee, supports platforms like eBay and PayPal, perfect for business expenses or international supplier payments. Whether funding your LLC’s operations or transferring profits globally, BiyaPay ensures same-day transfers and quick registration with simple ID verification. Backed by U.S. and New Zealand financial licenses, it guarantees secure transactions. Simplify your LLC payments and focus on growth. Join BiyaPay today to elevate your financial efficiency in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.