- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram in 2025 What You Need to Know About Fees, Pros and Cons, and Alternatives

Image Source: unsplash

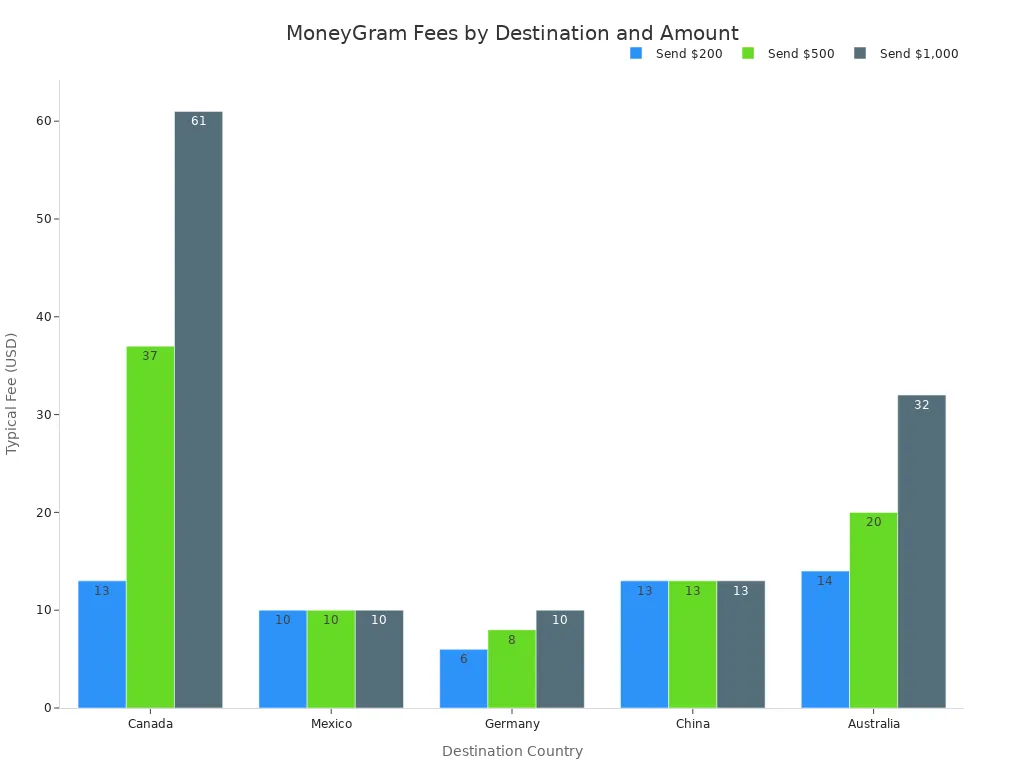

MoneyGram gives you access to over 200 countries and territories, making it one of the largest global money transfer networks in 2025. You can send money through the app, website, or at physical locations. Most people use MoneyGram to support family with essentials like food or school fees. Transfer fees and exchange rates change based on where you send money and how you pay. For example, sending $200 to Canada costs about $13, while sending to Mexico costs $10.

| Destination | Sending $200 | Sending $500 | Sending $1,000 |

|---|---|---|---|

| Canada | Around $13 | Around $37 | Around $61 |

| Mexico | Around $10 | Around $10 | Around $10 |

| Germany | Around $6 | Around $8 | Around $10 |

| China | Around $13 | Around $13 | Around $13 |

| Australia | Around $14 | Around $20 | Around $32 |

You get reliable service and global cash pickup, but you should always check the total cost before you send money. Some users choose alternatives like PayPal for digital transfers. Use the MoneyGram overview to see if it meets your needs.

Key Takeaways

- MoneyGram lets you send money to over 200 countries with options like cash pickup, bank deposit, or mobile wallet.

- Transfer fees and exchange rates vary by destination, payment method, and delivery option, so always check the total cost before sending.

- MoneyGram offers fast transfers, often within minutes, and has a large network of agent locations for easy cash pickup.

- The service uses strong security measures to protect your money and personal information, but watch out for common scams.

- Compare MoneyGram with alternatives like Wise, Western Union, and Xoom to find the best fees, speed, and convenience for your needs.

MoneyGram Overview

What Is MoneyGram?

You may know MoneyGram as a leading money transfer company with a long history. The moneygram overview shows that this service connects people in over 200 countries and territories. You can use MoneyGram to send money to family, pay for services, or support friends. Many people choose this money transfer platform because it offers both digital and in-person options. You do not need a bank account to use MoneyGram. A valid photo ID is enough for most transfers.

MoneyGram stands out among money transfer services for several reasons:

- You can send money for cash pickup, bank deposit, or even mobile wallet delivery.

- The service is available at thousands of locations, many with extended or 24/7 hours.

- Transfers for cash pickup are often instant, so your recipient gets funds quickly.

- Security is a priority, with strong encryption and identity checks.

- Customer service is available in multiple languages.

Tip: If you want to send money to someone who does not have a bank account, MoneyGram can help you reach them almost anywhere in the world.

How MoneyGram Works

The moneygram overview would not be complete without explaining how the process works. You can use MoneyGram online, through the app, or at a physical location. Each method is simple and user-friendly.

Here is a typical process for a MoneyGram international transfer:

- Register or log in to your MoneyGram account.

- Enter your recipient’s details.

- Specify the amount you want to send in USD.

- Select a delivery method, such as cash pickup or bank transfer.

- Choose your payment method, like a debit card.

- Review all details, including fees and exchange rates, then confirm and send.

If you use the MoneyGram app, you start by downloading it, creating a profile, and verifying your identity. For in-person transfers, visit a MoneyGram agent with your ID and the money in USD. You can also set up the transfer online and pay in cash at an agent location within 24 hours.

MoneyGram makes it easy to send money almost anywhere. The moneygram overview highlights that you can choose the method that fits your needs, whether you want speed, convenience, or global reach.

MoneyGram Fees

Image Source: pexels

Fee Structure

When you use MoneyGram, you pay different fees depending on how you send money and where it goes. MoneyGram fees change based on the amount you send, the payment method you choose, and the delivery option for your recipient. For example, sending money for cash pickup often costs more than sending to a bank account. If you pay with a debit or credit card, the transfer fees are usually higher than if you pay from your bank account. MoneyGram also lets you pay in cash at agent locations, but the transaction fee can still vary by country.

Transfer fees for MoneyGram can range from $0 to $15 for smaller amounts, but they may reach up to $100 for large transfers. The exact transaction fee depends on the destination country and the delivery method. For example, sending $200 to Mexico might cost $10, while sending the same amount to Australia could cost $14. International transfer fees are usually higher than domestic ones because they include extra costs like currency exchange and bank charges. You should always check the MoneyGram fee estimator tool on their website or app before you send money. This tool helps you see the total cost, including all transfer fees and exchange rates, before you confirm your transaction.

Note: MoneyGram fees and exchange rates can change without notice. Always review the latest information before you complete your transaction.

Payment Methods and Costs

MoneyGram gives you several ways to pay for your transfer. You can use a debit card, credit card, bank account, or even cash at a MoneyGram agent. Each payment method comes with its own set of costs. Paying with a debit or credit card is fast, but you will pay higher transfer fees. If you use a credit card, your card issuer may also charge you a cash advance fee and interest, which adds to the total transaction fee. Bank account transfers usually have lower fees, but they may take longer to process.

The delivery method you choose also affects the cost. Cash pickup is popular because it is fast and available in many countries, but it often comes with higher international transfer fees. Bank deposit and mobile wallet transfers may have lower fees, but not all countries support these options. The transfer amount, payment type, and pickup location all play a role in the final cost. For example, sending money to China for cash pickup may cost more than sending to a Hong Kong bank account.

Here is a quick overview of how payment and delivery methods affect MoneyGram fees:

| Payment Method | Typical Fee Range | Speed | Extra Costs |

|---|---|---|---|

| Debit Card | $5 - $15 | Minutes | Higher transfer fees |

| Credit Card | $5 - $20 | Minutes | Card issuer cash advance fees |

| Bank Account | $0 - $10 | 1-3 days | Lower transfer fees |

| Cash at Agent | $5 - $15 | Minutes | Varies by location |

Tip: Always compare the total cost, including both transfer fees and exchange rates, before choosing your payment method.

Exchange Rates

When you send money with MoneyGram, you also pay for currency conversion. MoneyGram sets its own exchange rates, which are usually less favorable than the mid-market rate you see on financial news sites. The difference between the MoneyGram rate and the real market rate is called the exchange rate markup. This markup can range from 1% to 5%, depending on the currency and the delivery method. For example, if you send $500 to Europe, you might get an exchange rate of 1 USD = 0.9067 EUR, while the real market rate is 1 USD = 0.91085 EUR. This means you get less money in the recipient’s currency.

Exchange rates and transfer fees can change by country, payment method, and even the time of day. Cash pickup payments often have worse exchange rates than bank account transfers. MoneyGram’s exchange rates are generally higher than those offered by digital-first competitors like Paysend, Remitly, and Ria. These companies often provide lower fees and more transparent rates. However, MoneyGram remains popular because of its global reach and reliable cash pickup service.

Note: Always check the exchange rate offered by MoneyGram before you confirm your transaction. Compare it to the mid-market rate to see how much you are really paying for currency conversion.

MoneyGram fees and exchange rates can add up quickly, especially for large transfers or frequent transactions. You should always compare the total cost with other providers to make sure you get the best deal for your needs.

Pros and Cons

Advantages

When you look at the pros of using moneygram, you see many reasons why people choose this service. You can send money almost anywhere in the world. The process is simple, and you can use the website, app, or visit an agent. Many users say the customer service is helpful and quick to respond. Here are some of the main pros:

- You can send money online or in person, making it easy for you to choose what works best.

- Transfers are often fast. Sometimes, your recipient gets the money in just 10 minutes.

- Moneygram has about 347,000 agent locations in more than 200 countries, so you can reach people in many places.

- You have many delivery options, such as cash pickup, bank deposit, mobile wallet, or even home delivery.

- The mobile app lets you send money anytime and anywhere.

- The MoneyGram Plus Rewards program gives you discounts on fees after several transfers.

You can see how moneygram compares to other services in terms of global reach:

| Service | Number of Agent Locations |

|---|---|

| Western Union | Over 500,000 |

| MoneyGram | Approximately 347,000 |

Tip: If you need to send money to a country with few banking options, moneygram’s large network is a big advantage.

Disadvantages

You should also consider the cons before you use moneygram. Some users report high or unexpected fees, which can make sending money expensive. The exchange rates often include a markup, so your recipient may get less money than expected. Here are some common cons:

- Fees can be high and sometimes hard to predict, especially for instant or cash pickup transfers.

- Exchange rates are less favorable than the real market rate, so you lose some value.

- Some users have faced delays in transfers or even canceled transactions without refunds.

- Moneygram has received complaints about not delivering funds on time and not giving clear information about transfer times.

- The service is not accredited by the Better Business Bureau and has a low rating there.

Note: Always check the total cost, including both fees and exchange rates, before you send money. This helps you avoid surprises and make the best choice.

How to Send Money

Online and App Transfers

You can send money online or through the MoneyGram app in just a few steps. This method is fast and convenient if you want to send money abroad or to someone in your own country. Here is how you can send money online:

- Create or log in to your MoneyGram account on the website or app.

- Enter the recipient’s details, including their full name and location.

- Choose the amount you want to transfer and select the delivery method, such as cash pickup, bank deposit, or mobile wallet.

- Pick your payment method. You can use a debit card, credit card, or bank account.

- Review the transfer details, including fees and exchange rates, before you confirm.

- Complete the transfer. You will get a reference number to share with your recipient.

You can send money online to over 200 countries and territories. The MoneyGram app lists all supported countries and payout currencies. Always check which currencies are available for your recipient’s country before you send money.

In-Person Transfers

If you prefer to send money in person, you can visit a MoneyGram agent location. Follow these steps for a smooth money transfer:

- Find a nearby MoneyGram agent.

- Bring your valid ID, the recipient’s full name, their location, and the amount you want to send, including fees.

- If you want to send money to a bank account, bring the recipient’s bank name and account number. For a mobile wallet, bring their mobile number with the international dial code.

- Fill out the send form at the agent location.

- Pay the amount plus the transaction fee.

- Keep your receipt and share the 8-digit reference number with your recipient.

MoneyGram supports sending money to many countries, but you should always check with the local agent for available currencies and services.

Delivery Options

MoneyGram offers several delivery options for your transfer:

- Cash pickup at thousands of agent locations worldwide. Your recipient needs a valid photo ID and the reference number to collect the funds.

- Bank deposit, where the money goes directly into the recipient’s bank account. This option depends on the country and the bank, such as Hong Kong banks.

- Mobile wallet transfer, which lets your recipient get money on their phone. They receive a text notification and can deposit the funds into their bank account or debit card.

Not all delivery options are available in every country. Always confirm with MoneyGram or the local agent before you send money.

Tip: Check the MoneyGram app or website for the latest list of supported countries, currencies, and delivery methods before you start your transfer.

Safety and Security

Security Features

You want your money to stay safe during every transaction. In 2024, MoneyGram faced a major cyberattack that exposed customer data and forced a temporary shutdown. After this event, MoneyGram worked with cybersecurity experts and law enforcement to recover and improve its systems. Now, you benefit from stronger security in 2025.

MoneyGram protects your personal and financial data with advanced encryption. This means your information stays private during each transaction and while stored. The company uses real-time fraud detection to spot suspicious activity quickly. Multi-factor authentication adds another layer of protection, so only you can access your account. MoneyGram follows strict industry standards like PCI DSS and completes regular audits to keep payment data secure.

You also see extra safety from MoneyGram’s partnership with Mastercard. This partnership helps make each transaction more reliable and secure. Both companies use trusted networks and strong security systems to keep your money safe. MoneyGram also teaches you how to spot scams and avoid fraud, making you a smarter user.

Tip: Always use strong passwords and never share your login details with anyone.

Scam Risks

Scammers often target people who send money online. You need to know the most common scams and how to protect yourself. Here is a table showing popular scams and how you can avoid them:

| Scam Type | Description | Prevention Measures |

|---|---|---|

| IRS Extortion Scams | Scammers pretend to be the IRS and demand payment for fake debts. | Never pay to unsolicited IRS calls; check with the real IRS. |

| Refund Scams | Fake calls promise refunds and ask for bank info. | Do not share banking info with unknown callers. |

| Disaster Relief | Scammers ask for donations after disasters using MoneyGram. | Donate only to trusted groups. |

| Lottery Scams | You are told you won a lottery but must pay fees first. | Real lotteries never ask for upfront payments. |

| Internet Purchases | Fraudsters post fake items for sale and ask for payment before delivery. | Verify sellers and never pay before you get the item. |

| Relative in Need | Scammers claim to be family needing urgent money. | Always check with your family before sending money. |

| Loan Scams | Requests for advance fees for loans via wire transfer. | Be careful with loan offers that need upfront fees. |

| Check or Money Order Scams | Fake checks are sent, and you are asked to send money before the check clears. | Wait for checks to clear before sending money. |

| Romance Scams | Scammers build fake relationships and then ask for money. | Be careful with online relationships that ask for money. |

| Elder Abuse Scams | Scammers target the elderly with fake offers and identity theft. | Elderly should get advice from trusted people and watch their accounts. |

You should always stay alert for phishing emails. MoneyGram never asks for your personal or financial information by email. Always type the MoneyGram website address directly into your browser. Watch for emails with poor grammar or suspicious links. If you think someone has stolen your information, contact your bank right away and report the issue to MoneyGram.

Note: If something feels wrong about a transaction, stop and check before you send money.

Alternatives to MoneyGram

Image Source: pexels

When you look for low-cost ways to transfer money, you find many options besides moneygram. Each service has its own strengths and weaknesses. You should compare transfer fees, speed, exchange rates, and convenience before you choose.

Wise

Wise stands out for its transparent pricing. You pay a small, clear fee and get the real mid-market exchange rate. Most transfers arrive within hours, much faster than moneygram’s usual 6 to 10 days for many currencies. Wise often saves you money, especially if you send to countries like India, Canada, or Europe. The fee comparison chart below shows Wise usually beats moneygram on both cost and speed.

Tip: Wise does not add hidden markups to exchange rates, so you always know what your recipient will get.

Western Union

Western Union is another big name in money transfer services. You find similar fees and exchange rate markups as moneygram. Both offer fast cash pickups, often within minutes. Western Union lets you send up to $50,000 with identity checks, while moneygram usually limits you to $10,000 online. Bank deposits can take longer with Western Union, sometimes up to seven days. Both services have large agent networks and support many payment methods.

Xoom

Xoom, a paypal service, lets you send money to over 130 countries. You can pay with your paypal balance, bank account, or card. Xoom’s transfer fees range from $0 to $40, which can be higher than moneygram’s flat fees. Xoom uses marked-up exchange rates, so your recipient may get less. Both xoom and moneygram offer similar transfer speeds, but moneygram supports more currencies and has more agent locations. Xoom works well if you already use paypal for other payments.

Remitly

Remitly gives you flexible transfer fees, starting as low as $0. Remitly applies a fixed margin to exchange rates, which can make the total cost higher. You can send up to $20,000, double moneygram’s usual online limit. Remitly’s app is easy to use, and transfers are fast. However, moneygram has a bigger cash pickup network, which helps if your recipient needs cash.

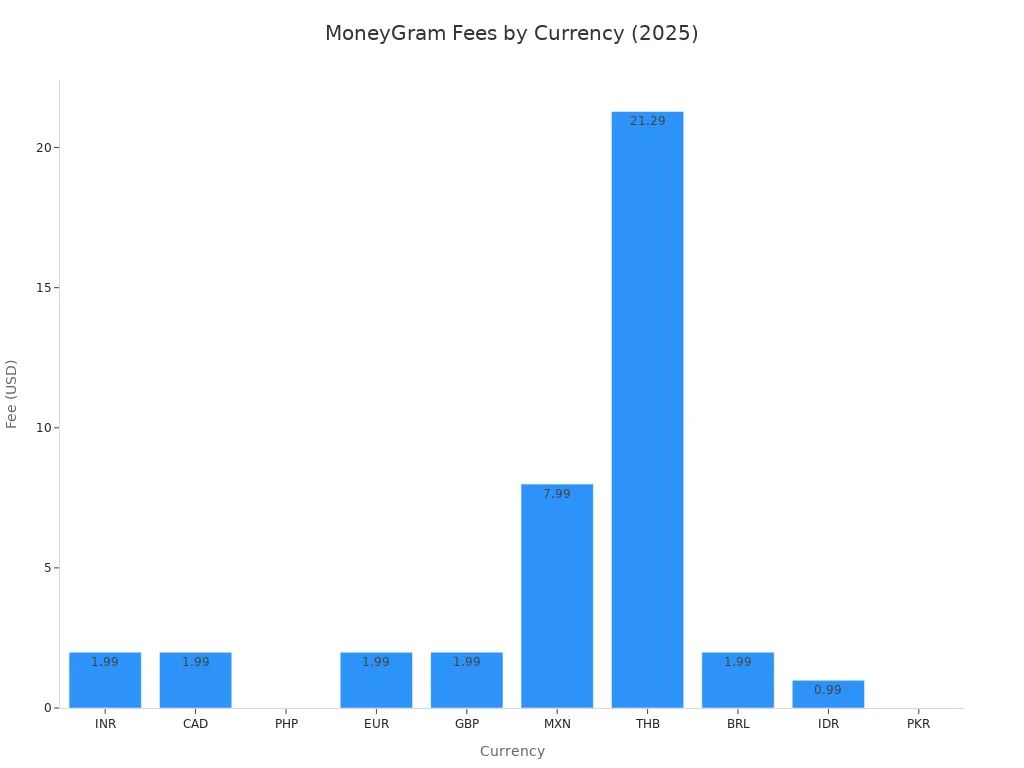

WorldRemit

WorldRemit offers low fees, often starting at $1.99. You get competitive exchange rates, with a smaller margin than moneygram. Transfers can be instant or take up to two days. WorldRemit covers over 130 countries, fewer than moneygram, but supports many payout options like cash pickup, bank deposit, and mobile wallet.

Ria

Ria is another strong choice for sending money. Fees start at $1.00, and transfers can arrive in minutes or up to four days. Ria’s exchange rates vary, but you often pay less than with moneygram. Ria covers 165 countries and has a broad delivery network, though its online service is not available everywhere.

Fee and Speed Comparison

You can see how these services compare in the table below:

| Provider | Fees | Speed | Exchange Rates | Convenience |

|---|---|---|---|---|

| MoneyGram | Higher, varies | Minutes to days | Less competitive | 350,000+ agents, cash, bank, mobile, in-person |

| Wise | Low, transparent | Hours to 2 days | Mid-market, best | Online/app, clear pricing |

| Western Union | Variable, can be high | Minutes to days | Margin adds cost | 550,000+ agents, trusted, many payment options |

| Xoom | $0-$40, variable | 1-10 days | Marked-up | Paypal, bank, card, 130+ countries |

| Remitly | $0-$3.99 | 1-10 days | Fixed margin | App, up to $20,000, smaller cash network |

| WorldRemit | $1.99-$3.99 | Instant to 2 days | Low margin | 130+ countries, many payout options |

| Ria | $1.00+, variable | Minutes to 4 days | Variable | 165+ countries, broad delivery network |

Note: Always check the latest transfer fees and exchange rates before you send money. Each provider updates their prices often.

Choosing the Best Way to Send Money

When to Use MoneyGram

You should use moneygram when you need to send money quickly to someone who needs cash. MoneyGram has a large network of agent locations, so your recipient can pick up cash in many countries. This service works well if your recipient does not have a bank account or needs funds right away. You can also choose moneygram if you want to pay in cash at a local agent. Many people trust moneygram for urgent transfers because it offers strong security and reliable customer support.

Here are some situations where moneygram is a good choice:

- Your recipient needs cash pickup in a remote area.

- You want to send money to a country with limited banking options.

- You need to transfer funds outside regular banking hours.

- You value in-person customer service and support.

MoneyGram also helps if you want to send money to places where online-only services do not operate. The company follows strict rules to keep your money safe and uses real-time fraud detection.

When to Choose an Alternative

You may want to choose another provider if you want lower fees or better exchange rates. Many online services, like Wise or WorldRemit, show you all costs upfront and use the real market exchange rate. These services work best if your recipient has a bank account or mobile wallet. They often deliver money faster for bank transfers and cost less than moneygram.

Consider these factors when you compare providers:

| Factor | Why It Matters |

|---|---|

| Security | Protects your funds and personal information |

| Speed | Gets money to your recipient quickly |

| Transparency | Shows all fees and exchange rates before you pay |

| Accessibility | Offers cash pickup or bank deposit options |

| Customer Support | Helps solve problems fast |

| Cost | Affects how much your recipient receives |

| Suitability | Matches your needs and your recipient’s needs |

If you want to send money for less, Wise and WorldRemit offer low, clear fees and fast delivery to many countries. Ria is a good choice for cash pickups with lower costs in some regions. Always check the total cost and delivery time before you decide.

Tip: Compare the total amount your recipient will get after all fees and exchange rates. This helps you choose the best way to send money for your needs.

You see that moneygram gives you strong global reach and fast cash pickup. You may pay higher fees than some other services. Always compare moneygram with paypal and xoom before you send money. Paypal lets you send money online and works well for digital payments. Xoom, a paypal service, helps you send money to many countries. You should check the latest reviews for moneygram, paypal, and xoom. Visit the official websites for moneygram, paypal, and xoom to get up-to-date fees and rates.

Remember to compare moneygram, paypal, and xoom for the best deal every time.

FAQ

How long does a MoneyGram transfer take?

Most MoneyGram transfers arrive within minutes. Some bank deposits or mobile wallet transfers may take up to three days. Always check the estimated delivery time before you send money.

Can you cancel a MoneyGram transfer after sending?

You can cancel a transfer if the recipient has not picked up the money. Log in to your MoneyGram account or visit an agent location. Refunds usually return to your original payment method.

What documents do you need to send money with MoneyGram?

You need a valid photo ID, such as a passport or driver’s license. For bank transfers, you also need the recipient’s bank details. Hong Kong banks often require the recipient’s full name and account number.

Does MoneyGram have a transfer limit?

Yes. MoneyGram usually lets you send up to $10,000 USD per online transfer. Limits may change based on your location, payment method, and the destination country. Check the MoneyGram website for the latest limits.

MoneyGram’s vast network and fast cash pickups make it a reliable choice for sending money to over 200 countries, but its high fees (e.g., $13 for $200 to Canada) and exchange rate markups can erode value. For a more cost-effective solution, consider BiyaPay. BiyaPay offers transfer fees as low as 0.5%, significantly undercutting MoneyGram’s $10-$61 fees for $200-$1,000 transfers. With real-time exchange rate transparency, you can convert 30+ fiat currencies and 200+ cryptocurrencies across 100+ countries, ideal for travel, family support, or online purchases from places like China. BiyaPay’s same-day transfers and quick registration (minutes with simple ID verification) ensure convenience without compromising speed. Secured by U.S. and New Zealand financial licenses, your transactions are safe and reliable. Unlike MoneyGram’s variable costs and hidden markups, BiyaPay’s transparent pricing ensures your recipient gets more. Whether funding a vacation or sending money home, BiyaPay delivers a smarter, cheaper, and faster way to transfer money globally in 2025.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.