- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

No Foreign Transaction Fee UK Credit Cards You Should Know About

Image Source: pexels

If you want to save money on your next trip, you need to check out the best no foreign transaction fee credit cards in the UK. These cards help you avoid hidden charges when you shop or travel abroad. Some of the best credit cards include Wise, Barclaycard Rewards, Halifax Clarity, and Starling. You get real value with travel credit cards that offer no foreign transaction fee and extra rewards. Picking the best travel credit card means more savings and less stress. With the best no foreign transaction fee credit cards, you keep more of your money when using your credit card overseas. Travel credit cards make spending abroad easy.

Key Takeaways

- No foreign transaction fee credit cards save you money by avoiding extra charges on purchases made abroad or in foreign currencies.

- Many top UK credit cards like Wise, Barclaycard Rewards, and Halifax Clarity offer no foreign transaction fees and no annual fees, making travel spending easier and cheaper.

- Choose a card based on your travel habits, rewards preferences, and fees to get the best value and perks for your trips.

- Always inform your card provider before traveling and pay in the local currency to avoid hidden fees and blocked transactions.

- Use your travel credit card wisely by limiting cash withdrawals, using touchless payments, and taking advantage of security features for safe spending abroad.

No Foreign Transaction Fee Credit Cards

Image Source: unsplash

What They Are

When you travel or shop online in another country, your credit card often adds extra charges. These are called foreign transaction fees. Most UK credit cards charge a fee between 1% and 3% every time you buy something in a different currency or through a foreign bank. This fee covers currency conversion and other costs. For example, if you spend $200 USD, a 2% fee means you pay an extra $4 USD, depending on the exchange rate.

A no foreign transaction fee credit card works differently. This type of credit card does not add the usual 1% to 3% surcharge on purchases made in foreign currencies. You can use your card abroad or for international online shopping without worrying about these extra costs. Some cards even skip the annual fee, so you save even more. Always check the card’s terms and conditions to make sure you really get no foreign transaction fee.

Tip: Look for the section about fees in your credit card agreement. Not all cards are the same, and some may still charge hidden costs.

Why They Matter

You might wonder why no foreign transaction fee credit cards are such a big deal. Here’s why: foreign transaction fees add up fast. Every time you swipe your card overseas, you pay more than the price tag shows. Over a week-long trip, these fees can turn into a big chunk of your travel budget.

Let’s see how much these fees can cost you:

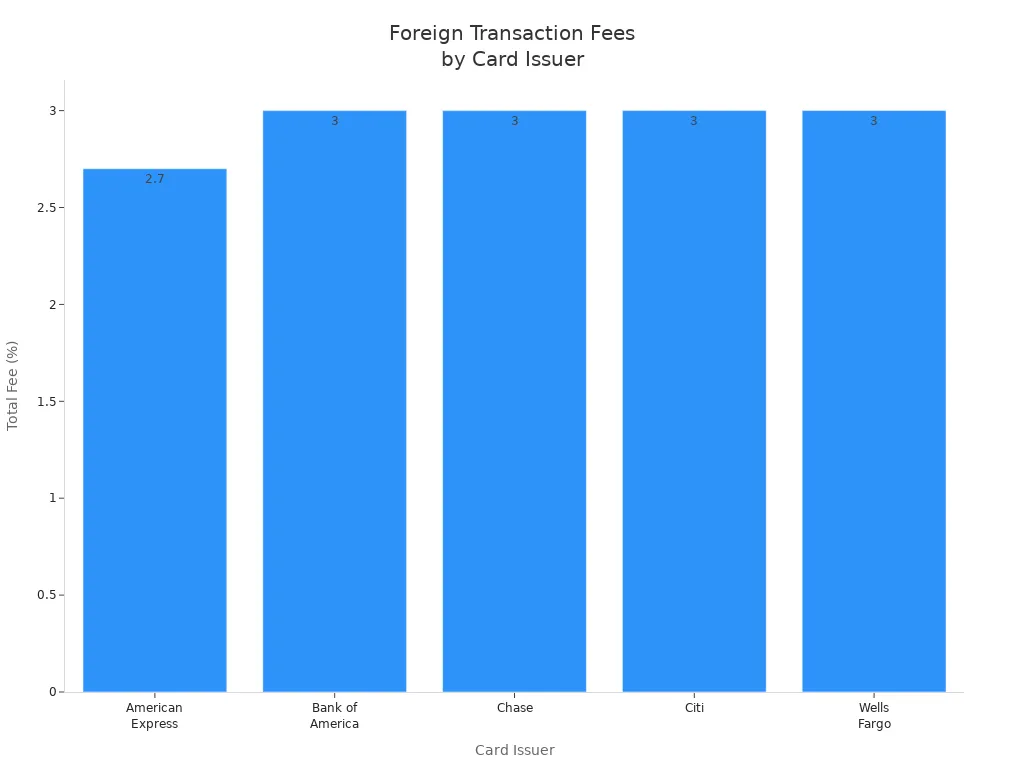

| Card Issuer | Issuer Fee | Network Fee | Total Fee (%) |

|---|---|---|---|

| American Express | 2.7% | – | 2.7% |

| Bank of America | 2% | 1% | 3% |

| Chase | 2% | 1% | 3% |

| Citi | 2% | 1% | 3% |

| Wells Fargo | 2% | 1% | 3% |

A $150 USD purchase with a 3% fee means you pay $4.50 USD extra. If you travel often or shop online from other countries, these fees can really add up.

No foreign transaction fee credit cards help you avoid these extra charges. You keep more of your money for things you actually want. You also get peace of mind, knowing you won’t see surprise fees on your statement. If you want to save money and travel smarter, picking a credit card with no foreign transaction fees is a smart move.

Best No Foreign Transaction Fee Credit Cards

Quick Comparison Table

You want to find the best credit cards for travel. Here’s a quick look at some of the top choices. This table helps you compare the main features side by side.

| Credit Card | No Foreign Transaction Fees | Annual Fee (USD) | Rewards/Perks | Welcome Offer | No Annual Fee Card | Touchless Payment |

|---|---|---|---|---|---|---|

| Wise | Yes | $0 | Real exchange rates, easy app | No | Yes | Yes |

| Barclaycard Rewards | Yes | $0 | Cashback on all spending | Yes | Yes | Yes |

| Halifax Clarity | Yes | $0 | No fees on cash withdrawals abroad | No | Yes | Yes |

| NatWest Travel | Yes | $0 | Travel rewards, easy eligibility | Yes | Yes | Yes |

| Santander All in One | Yes | $42 | Cashback, extra travel perks | Yes | No | Yes |

| Zopa | Yes | $0 | Simple rewards, flexible limits | No | Yes | Yes |

| 118 118 Money | Yes | $0 | No late fees, easy approval | No | Yes | Yes |

| Capital One Venture | Yes | $95 | 2 miles per $1, travel insurance | Yes | No | Yes |

| RBS Reward Black | Yes | $336 | Premium travel perks, lounge access | Yes | No | Yes |

| Amex Gold | Yes | $250 | Strong travel rewards, airport lounge access | Yes | No | Yes |

| Starling | Yes | $0 | No fees, easy app, instant notifications | No | Yes | Yes |

| Revolut | Yes | $0-$180 | Multi-currency, budgeting tools | Yes | Yes | Yes |

Tip: Always check if your credit card offers touchless payment. It makes spending in the UK much easier.

Key Features and Benefits

You want a credit card that saves you money and gives you perks. The best credit cards with no foreign transaction fees do just that. You avoid extra charges when you travel or shop online. Many cards, like Wise and Barclaycard Rewards, have no annual fee. Some, like Capital One Venture and Amex Gold, charge an annual fee but give you strong travel rewards and a welcome offer.

You can earn points or cashback on every purchase. Some cards, like the Chase Sapphire Reserve, offer travel perks such as airport lounge access, travel insurance, and a welcome offer. If you want a no annual fee card, look at Wise, Halifax Clarity, or Starling. These cards are easy to use and have simple approval rules.

You also get peace of mind. Many cards include travel insurance, fraud protection, and instant spending alerts. You can use touchless payment for fast and safe transactions. If you want the best no foreign transaction fee credit cards, compare the welcome offer, annual fee, and rewards. Pick the card that matches your travel style and spending habits.

Best Travel Credit Card Reviews

Wise Card

You want a card that makes spending abroad simple and cheap. The Wise Card stands out for its low-cost approach. You get mid-market exchange rates, which means you avoid hidden markups that banks often add. You pay a one-time fee of about $9 USD to order the physical card. There are no monthly or annual fees, so you keep more of your money.

Main Benefits:

- You pay in any currency with no foreign transaction fees.

- You can hold and spend from multiple currency wallets. Wise gives you local bank account numbers in ten currencies.

- Free ATM withdrawals up to $250 USD per month (maximum two withdrawals). After that, you pay a small fee.

- The Wise app lets you manage your card, freeze it, and get instant notifications.

Drawbacks:

- You do not get travel perks like insurance, airport lounge access, or rewards points.

- Customer service can be slow, especially if you have a problem while traveling.

- ATM operator fees are not reimbursed.

- Some users report card declines or account suspensions due to strict compliance checks.

Fees and Limits Table:

| Service | Fee Details |

|---|---|

| Ordering a physical Wise card | One-time fee of $9 USD |

| Digital/virtual card | No fee |

| Monthly/annual subscription | No ongoing fees |

| Spending in held currency | No fee |

| Currency conversion (spending) | Starts from 0.43% fee if you spend in a currency not held |

| ATM withdrawals | Free up to $250 USD/month (max 2 withdrawals); then 1.75% + $0.65 USD per withdrawal |

| Card replacement (lost/damaged) | $3.20 USD |

| Card replacement (expired) | No fee |

You can sign up online or in the app. Wise asks for your ID and address to verify your identity. You can use the digital card right away, and the physical card arrives in a few days.

Note: Wise works best for frequent travelers, digital nomads, and expats who want to avoid foreign transaction fees and do not need premium travel perks.

Barclaycard Rewards

Barclaycard Rewards is a favorite for many travelers. You get no foreign transaction fees on purchases abroad. The card has no annual fee, so you do not pay just to keep it in your wallet. You earn cashback on all your spending, which adds up quickly if you travel often.

Barclays keeps improving its rewards program. You get unlimited cashback on airfare, hotels, and car rentals. The card supports contactless payments, making it easy to use in shops and restaurants worldwide. You can redeem your rewards flexibly, which is great if you want to use them for travel or other purchases.

Barclaycard Rewards is a strong choice if you want a no annual fee card with simple rewards and no extra charges when you travel. You do not get luxury perks, but you save money every time you use your credit card abroad.

Halifax Clarity

Halifax Clarity is a popular choice for travel credit cards. You pay no foreign transaction fees on purchases or cash withdrawals. The card is accepted at over 26 million locations worldwide. You do not pay an annual fee, so you can keep it for free.

Key Features Table:

| Feature | Details |

|---|---|

| Foreign Transaction Fees | None on purchases and cash withdrawals |

| Acceptance | Over 26 million locations worldwide |

| Annual Fees | None |

| Daily ATM Withdrawal Limit | $650 USD |

| Currency Conversion | Uses Mastercard exchange rates |

| Interest-Free Period | Up to 56 days on purchases |

| Interest on Cash Withdrawals | Interest starts immediately |

| Minimum Age Requirement | 18 years old |

| Mobile Banking | Yes |

| Additional Benefits | $6.50 USD monthly cashback for Halifax current account holders spending $390+ per month |

You get up to 56 days interest-free on purchases. If you withdraw cash, interest starts right away, so try to pay it off quickly. Halifax Clarity is great if you want a simple, reliable credit card for travel with no annual fee and no foreign transaction fees.

NatWest Travel Card

The NatWest Travel Card is designed for travelers who want cashback instead of points. You earn 1% cashback on travel expenses like flights, trains, hotels, and car rentals. You can also get up to 15% cashback at selected partner retailers.

Main Advantages:

- No foreign transaction fees on purchases abroad.

- No annual fee, so you save money every year.

- Cashback rewards on a wide range of travel categories.

- Reliable payments thanks to the Visa partnership.

You do not get luxury perks, but you get real cash back for your travel spending. This card is perfect if you want a simple, cost-effective way to earn rewards while avoiding extra fees.

Santander All in One

Santander All in One is a premium option for travelers who want extra perks. You pay no non-sterling transaction fee on purchases abroad. The card charges an annual fee of about $54 USD, but you get cashback and other benefits.

Unique Features Table:

| Feature | Details |

|---|---|

| Foreign Transaction Fee | None on purchases abroad |

| Cash Withdrawals Abroad | 3% fee (minimum $3.90 USD) |

| Interest on Purchases | Charged at the usual purchase rate |

| Interest on Cash Withdrawals | Starts immediately from withdrawal date |

| Exchange Rates | Santander Mastercard or Visa rates, no extra markup |

You get cashback on your spending and extra travel perks. If you travel often and want more than just basic features, this card could be a good fit. Just remember, cash withdrawals abroad are not free, so use your credit card for purchases, not for getting cash.

Zopa Credit Card

Zopa Credit Card is a modern choice for tech-savvy travelers. You pay no fees on overseas spending, which helps you avoid foreign transaction fees. The card charges a $3.90 USD fee for ATM withdrawals abroad, which is higher than some competitors. The interest rate is also higher than many other travel credit cards.

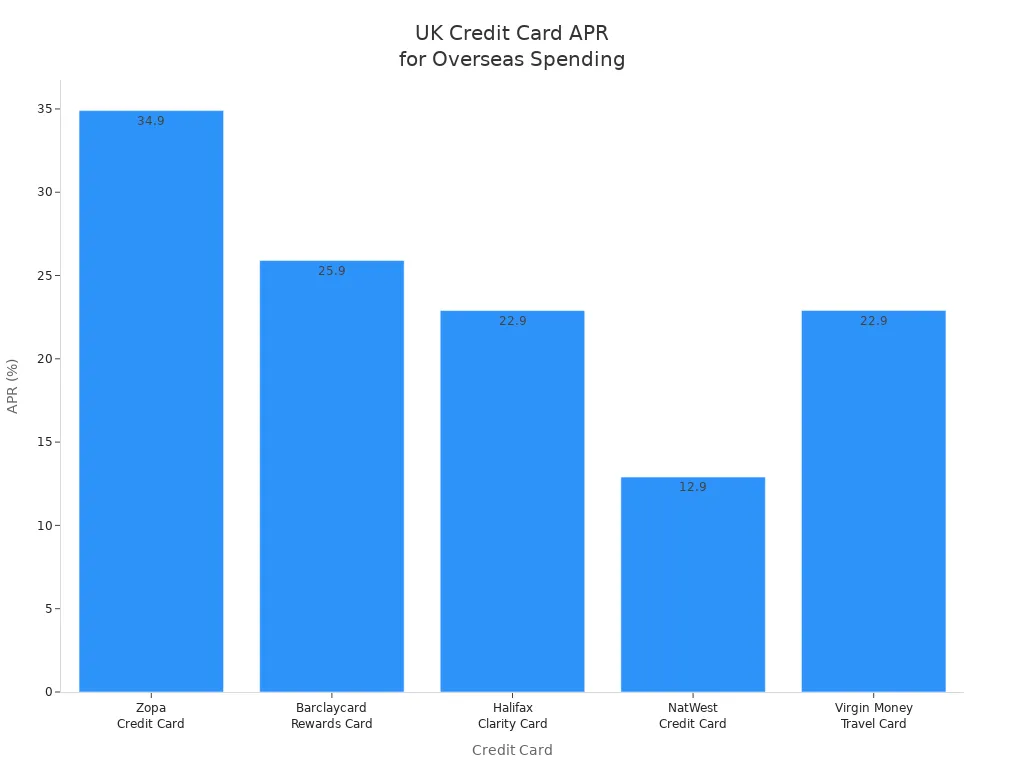

| Card | Overseas Spending Fees | ATM Withdrawal Fees | Interest Rate (APR) | Exchange Rates Type |

|---|---|---|---|---|

| Zopa Credit Card | No fees | $3.90 USD | 34.9% | Visa rates with markup |

| Barclaycard Rewards | No fees | Free | 25.9% | Visa rates with markup |

| Halifax Clarity | No fees | Free | 22.9% | Mastercard rates with markup |

| NatWest Credit Card | No fees | 3% fee | 12.9% | Mastercard rates with markup |

| Virgin Money Travel Card | No fees | 3% fee | 22.9% | Mastercard rates with markup |

| Wise Travel Card (debit) | No fees | Free up to $250 USD (max 2 withdrawals) | None (debit card) | Mid-market rate (no markup) |

Zopa offers app features like Credit Cushion and easy card management. If you want a digital-first experience and do not mind higher interest rates, this card could work for you. Avoid using it for cash withdrawals to keep costs down.

118 118 Money Card

The 118 118 Money Card is known for its simple approach. You pay no foreign transaction fees on purchases abroad. The card has no annual fee, so you do not pay just to keep it. You also avoid late fees, which is rare among credit cards.

This card is easy to get if you have a limited credit history. It is a good choice if you want a basic travel credit card with no annual fee and no extra charges when you spend overseas. You do not get rewards or travel perks, but you get peace of mind with clear, simple fees.

Capital One

Capital One helps you avoid foreign transaction fees when you travel. You do not pay extra charges on purchases abroad. Some ATM operators may charge their own fees, so watch out for that. If you use your credit card for cash withdrawals, you may pay a cash advance fee.

Tips for Using Capital One Abroad:

- Always pay in the local currency to avoid poor exchange rates.

- Tell Capital One about your travel plans to prevent your card from being blocked.

- Carry a backup card for extra security.

Capital One is a solid choice if you want to avoid foreign transaction fees and want a card that works almost everywhere. It is best for travelers who want a simple, reliable credit card for spending abroad.

RBS Reward Black

RBS Reward Black is a premium travel credit card with extra perks. You get no foreign transaction fees on purchases abroad. The card offers premium travel benefits like airport lounge access and travel insurance. The annual fee is higher, around $432 USD, so it suits frequent travelers who want luxury perks.

Eligibility:

- You must be a UK resident.

- Additional cardholders must be at least 18 years old.

- You need to provide photo ID for identity verification.

- The application includes a credit check.

This card is best if you travel often and want premium benefits. If you do not travel much, the high annual fee may not be worth it.

Amex Gold

Amex Gold is a favorite among travel credit cards. You earn Membership Rewards points on almost all your spending. You can redeem these points for flights, hotels, and other rewards. The card comes with a welcome offer, which gives you bonus points if you meet the spending requirement in the first few months.

Travel Benefits:

- Worldwide travel protection, including medical assistance and expenses.

- Coverage for trip cancellation, postponement, and cutting short a trip.

- Protection for personal belongings, money, and travel documents.

- Help for travel inconveniences and personal accidents.

- 24/7 Global Assist emergency helpline for medical and legal emergencies.

- Legal assistance and compensation.

You need to enroll for travel protection, and some exclusions apply. The annual fee is about $300 USD, but the welcome offer and travel perks can make it worth it if you travel often. Amex Gold is best for travelers who want rewards, protection, and a strong welcome offer.

How to Choose the Best Credit Cards

Travel Habits

When you pick a credit card for travel, your habits matter a lot. Start by thinking about how often you travel and where you go. Some people take one big trip each year, while others travel every month. Your travel frequency helps you decide if a card with an annual fee makes sense. If you travel a lot, you might get more value from a travel rewards card with extra perks.

Ask yourself these questions:

- Do you visit the same country or different places each time?

- Do you spend more on flights, hotels, or shopping?

- Do you need benefits like airport lounge access or car insurance for rentals?

- How important is fraud protection or quick card replacement when you travel?

You should also look at the card’s fees, including membership and monthly maintenance fees. Make sure the benefits, like travel rewards or cashback, are worth more than what you pay. Some cards offer extra value, such as car insurance or travel protection, which can save you money and stress.

Tip: Try to match your card’s features to your travel style. If you only travel once a year, a no annual fee card may be best.

Rewards and Fees

Comparing rewards and fees helps you find the best deal. Each credit card has its own way of giving points or cashback. Some cards give you more points for travel spending, while others reward you for groceries or gas. Check how you earn and use points. Some cards let you transfer points to many airlines, but others have fewer partners.

Here’s what you should look for:

- How do you earn points or cashback on different purchases?

- Does the card offer a welcome offer or bonus for new users?

- Are there extra perks like travel insurance or car rental coverage?

- What are the foreign transaction and purchase fees?

- Does the card have a high APR or cash withdrawal fee?

- Can you use your points for flights, hotels, or other rewards?

A good travel credit card helps you avoid extra costs and gives you rewards that fit your spending. Always check for annual fees and minimum spending rules. Try to pay your balance in full after your trip to avoid high interest.

Eligibility and Application

Before you apply for a credit card, check if you meet the requirements. Some cards need a good credit score or a certain income. Others are easier to get, even if you have a short credit history. Look at the application steps and what documents you need, like photo ID or proof of address.

You should also think about how fast you need the card. Some banks approve you in minutes, while others take longer. Make sure you understand the terms, including any fees or spending limits. If you want a travel rewards card, check if you qualify for the welcome offer.

Note: Always read the fine print before you apply. This helps you avoid surprises and pick the right card for your needs.

Tips for Using Travel Credit Cards Abroad

Image Source: pexels

Maximizing Benefits

You want to get the most out of your travel credit cards when you go abroad. Here are some smart ways to do that:

- Use a credit card with no foreign transaction fees for all your international purchases. This helps you save money every time you spend.

- Tell your card issuer about your travel plans before you leave. This step helps you avoid blocked transactions or fraud alerts.

- Always pay in the local currency. If a shop asks if you want to pay in USD or the local money, pick the local option. This way, you skip extra conversion fees.

- Make sure you know your PIN and how to use chip-and-PIN technology. Many places outside the UK require a PIN for credit card payments.

- Use your credit card for big expenses like hotels and car rentals. You can earn rewards and keep track of your spending.

- Limit cash withdrawals. Try to use your card for most purchases and only get cash for small things.

Tip: Plan your cash needs before your trip. Carry less cash to stay safe, but keep enough for small shops or emergencies.

Avoiding Extra Charges

Extra fees can sneak up on you if you are not careful. Watch out for these common mistakes:

- Not checking if your card charges non-sterling transaction fees. Some cards add up to 3% per purchase.

- Paying in pounds instead of the local currency. This mistake leads to dynamic currency conversion fees, which cost more.

- Using the wrong card in your mobile wallet. Make sure you pick your travel credit card as the main card in Apple Pay or Google Pay.

- Withdrawing cash from ATMs with your credit card. Many cards charge extra for this, so use cash only when needed.

- Making purchases in foreign currencies without a multi-currency card. This can lead to higher fees.

Note: Always read your card’s terms before you travel. This helps you avoid surprise charges.

Security and Protection

Staying safe with your credit card abroad is important. Many travel credit cards offer strong security features:

| Security Feature | What It Does |

|---|---|

| Chip and PIN | Requires a PIN for payments, making it harder for thieves to use your card. |

| Anti-fraud monitoring | Alerts you if there is suspicious activity on your account. |

| Section 75 protection | Covers purchases between $125 USD and $37,500 USD if something goes wrong. |

| Free text alerts | Sends you instant messages about spending and possible fraud. |

| Easy card freezing | Lets you freeze or unfreeze your card in the app if it is lost or stolen. |

You should also link your card to your current mobile number. This way, you get fraud alerts fast. Carry more than one card in case one gets blocked or lost. Many digital banks let you control where your card works, so you can turn off foreign transactions when you do not need them.

Choosing the best credit cards for travel helps you save money and avoid stress. You get perks like cashback, travel rewards, and strong security. Before you apply, compare your options, check if your card works at your destination, and carry a backup card. Download your card issuer’s app for easy account management. Always keep some local currency on hand for emergencies. With the right card, you travel smarter and spend less.

FAQ

What is a foreign transaction fee?

A foreign transaction fee is a charge your credit card company adds when you buy something in a currency other than USD. Most cards add 1% to 3% to each purchase. You can avoid this fee with the right card.

Can I use these cards for online shopping from China?

Yes, you can use these cards for online shopping from China or any other country. You will not pay extra fees for currency conversion. Just make sure the website accepts your card network, like Visa or Mastercard.

Do I need to tell my bank before traveling?

You should tell your bank or card provider before you travel. This step helps prevent your card from being blocked for suspicious activity. Many banks, like Hong Kong banks, let you set travel alerts in their apps.

Are there any hidden fees I should watch out for?

Some cards charge fees for cash withdrawals or late payments. Always check the card’s terms. For example, ATM withdrawals may cost extra, even if purchases do not. Use the table below to compare common fees:

| Fee Type | Possible Charge (USD) |

|---|---|

| Cash Withdrawal | $3.90 or more |

| Late Payment | $25 or more |

| Replacement Card | $3.20 |

No foreign transaction fee UK credit cards like Halifax Clarity and Wise save you from costly 2-3% charges abroad, but managing international payments can still be expensive with traditional bank transfers. For a smarter solution, explore BiyaPay. BiyaPay offers transfer fees as low as 0.5%, far below bank wire fees of $20-$50. With real-time exchange rate transparency, you can convert 30+ fiat currencies or 200+ cryptocurrencies, perfect for travel expenses or sending money to family overseas. Covering 100+ countries with same-day transfers, BiyaPay ensures speed and value. Registration takes minutes with simple identity verification, ideal for urgent needs. Secured by U.S. and New Zealand financial licenses, your transactions stay safe. Whether paying for a European getaway or shopping online from China, BiyaPay simplifies global payments. Join BiyaPay today for low-cost, secure, and efficient transfers tailored to your travels!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.