- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wire Transfer Fees in the US and Internationally

Image Source: unsplash

You will usually pay between $15 and $30 for outgoing wire transfer fees within the United States, while international wire transfers often cost $35 to $50 or more. Some banks charge up to $65 for international transfers, but a few may waive fees for certain account holders.

| Fee Type | Typical Fee Range (USD) |

|---|---|

| Outgoing Domestic | $15 - $30 |

| Incoming Domestic | $0 - $15 |

| Outgoing International | $35 - $50 |

| Incoming International | $0 - $30 |

Understanding wire transfer fees helps you choose the best way to send money and avoid paying more than you need. Fees change based on your bank, the type of wire transfer, and the method you use.

Key Takeaways

- Wire transfer fees vary widely, with domestic outgoing transfers costing about $15 to $30 and international outgoing transfers ranging from $35 to $50 or more.

- Sending wire transfers online usually costs less than doing them in person at a bank branch, so choose online transfers to save money and time.

- Premium bank accounts often offer reduced or waived wire transfer fees, so check if your account qualifies for discounts or special benefits.

- International wire transfers include extra costs like currency conversion fees and charges from intermediary banks, making them more expensive than domestic transfers.

- Consider alternatives like ACH transfers, peer-to-peer payment apps, or money transfer services to avoid high wire transfer fees and get better exchange rates.

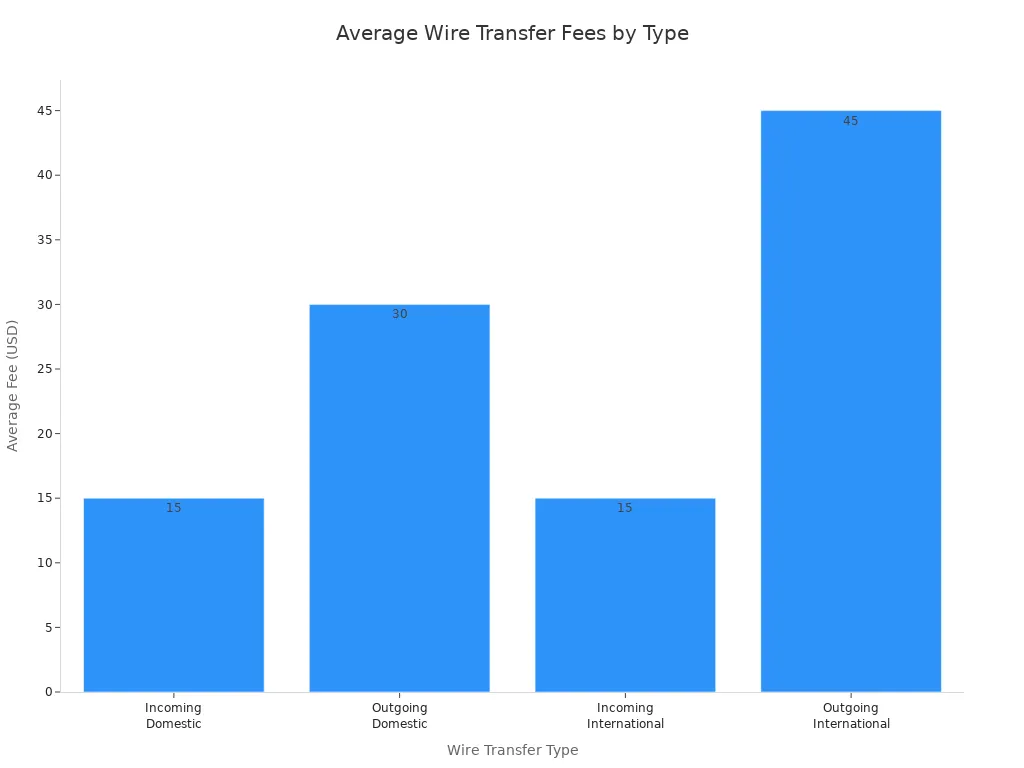

Average Wire Transfer Fees

Domestic Wire Transfer Fees

When you send money within the United States, you will notice that domestic wire transfer fees can vary by bank and transfer type. Most banks charge you a fee for sending money, while receiving money often costs less or nothing at all. Based on recent data from major U.S. banks, the average fee for incoming domestic wire transfers is about $13. Outgoing domestic wire transfer fees usually range from $22 to $29. Some banks may charge as much as $40 for sending money, but others keep the cost closer to $25. You may find that some banks waive incoming fees, especially if you have a premium account.

Tip: Always check your bank’s fee schedule before sending a wire transfer. Some banks offer lower fees for online transfers or for certain account holders.

Domestic wire transfers are often faster than other methods, but you pay for that speed and security. If you send money in person at a branch, you might pay more than if you use online banking. For example, some banks charge $30 for in-branch transfers but only $20 for online transfers. These differences make it important for you to compare options before choosing how to send your money.

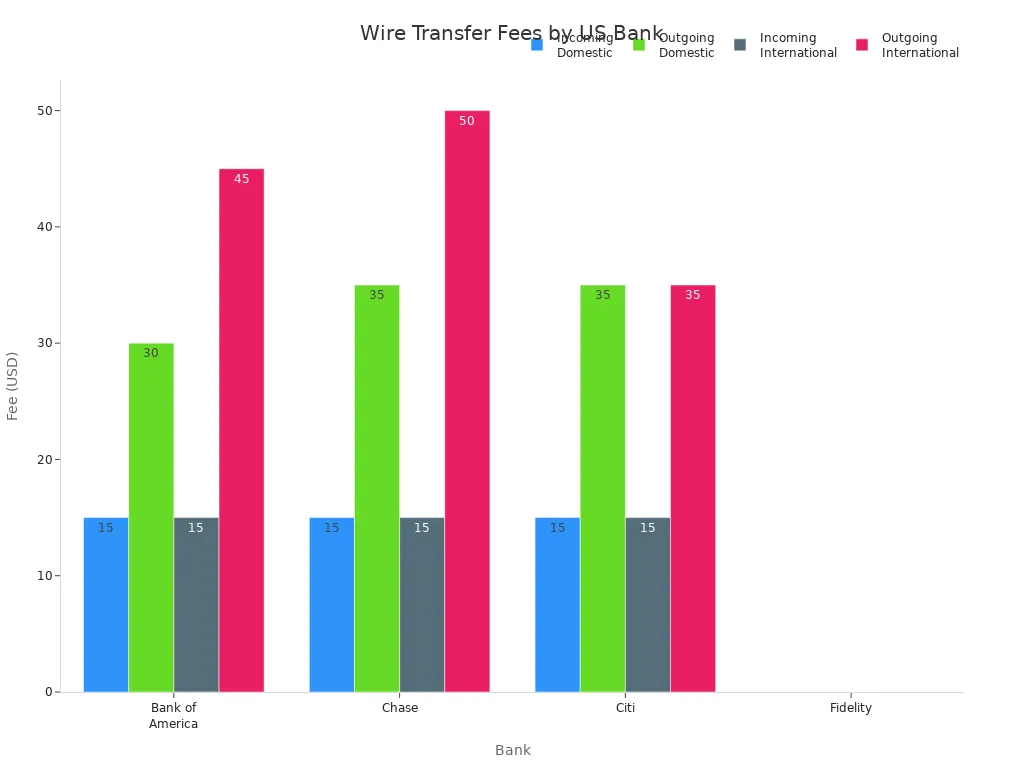

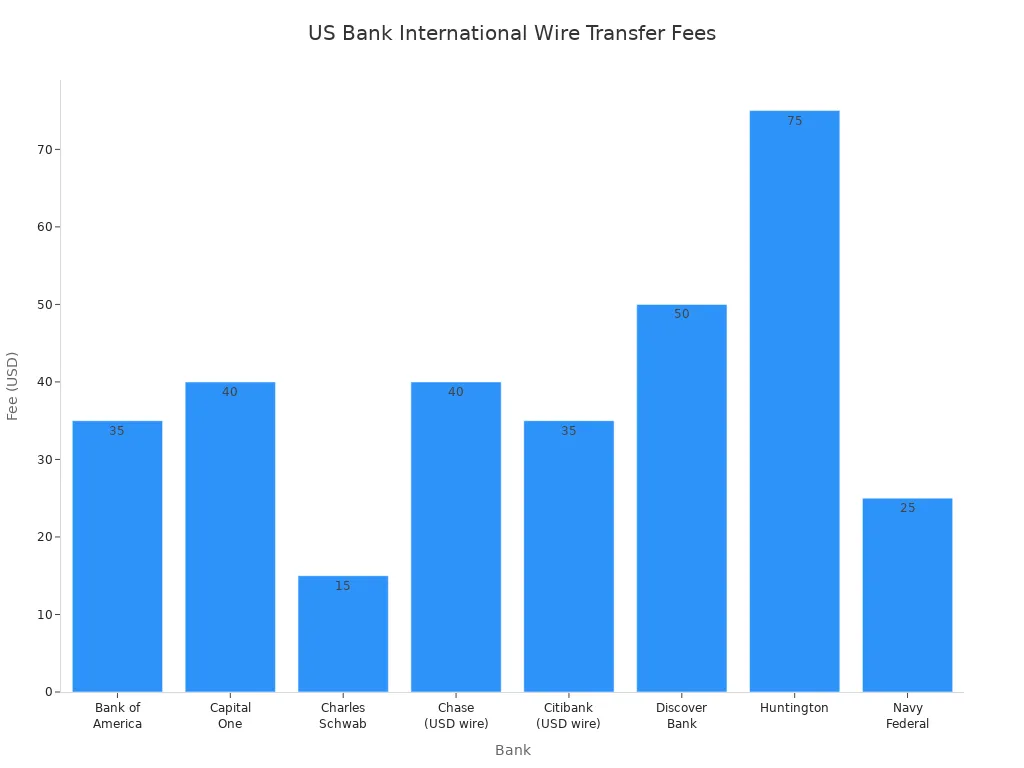

International Wire Transfer Fees

International wire transfers usually cost more than domestic transfers. The average fee for sending money abroad from the United States is about $44, according to recent surveys. However, international wire fees can range from $0 to $75, depending on your bank, the transfer method, and the destination country. Some banks, like Fidelity, do not charge a fee for outgoing international wire transfers, while others, such as Huntington, may charge up to $75.

Here is a table showing the average and range of outgoing international wire transfer fees at selected U.S. banks:

| Bank | Outgoing International Wire Transfer Fee Range (USD) |

|---|---|

| Industry Average | $44 |

| Bank of America | $0 - $45 |

| Chase | $0 - $50 |

| Citi | $0 - $35 |

| Fidelity | $0 |

| Huntington | $75 |

| PNC | $5 - $50 |

| State Employees’ Credit Union | $25 |

| TD Bank | $50 |

| Truist | $65 |

| U.S. Bank | $50 (plus up to 3% currency conversion fee) |

| Wells Fargo | $0 - $40 |

You will also find that international wire transfer fees depend on the destination country and the currency you use. For example, Chase Bank charges $50 for outgoing international wire transfers if you send money in U.S. dollars at a branch, but only $40 if you send online. If you send foreign currency online, the fee drops to $5. Incoming international wire transfers usually cost less, often around $15, but can be as high as $35 at some banks.

Banks may also add extra costs through currency conversion. Many banks apply a markup of 2% to 4% on the exchange rate, which increases the total cost of your transfer. Intermediary banks, which help move your money between countries, may charge additional fees of $10 to $30 per transfer. These extra charges can make international transfers much more expensive than they first appear.

Note: International wire transfer fees can change based on the country you send money to. Transfers to countries with strong banking systems, like the United Kingdom, often cost less. Transfers to countries with strict regulations or unstable currencies, such as Nigeria, may cost more because of higher compliance and currency risks.

Recent trends show that banks face more competition from digital money transfer services. These services often offer lower upfront fees and better exchange rates. However, traditional banks still charge higher wire transfer fees, especially for international transfers, and may add hidden costs through exchange rate markups. Some banks waive fees for large transfers or for sending foreign currency, but these offers are not common.

When you compare average wire transfer fees, you see that domestic wire transfers are usually less expensive than international transfers. Always review your bank’s policies and look for hidden costs before you send money, especially if you need to send funds overseas.

Types of Wire Transfer Fees

Outgoing vs. Incoming Fees

When you send money using a wire transfer, you will notice two main types of fees: outgoing and incoming. Outgoing wire transfers cost more because your bank must process and send the money to another bank. Incoming wire transfers usually cost less since your bank only needs to receive the funds. Most banks in the United States follow this pattern.

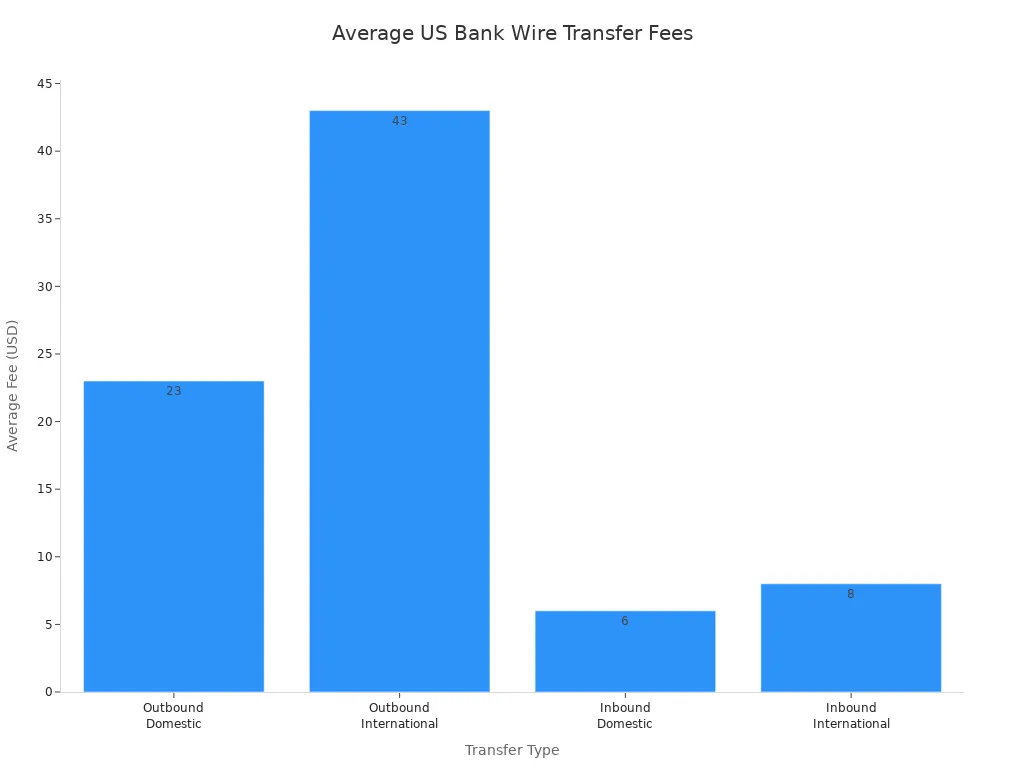

Here is a table that shows the average fees for each type of transfer:

| Transfer Type | Average Fee (USD) |

|---|---|

| Outgoing Domestic Transfer | $23 |

| Outgoing International Transfer | $43 |

| Incoming Domestic Transfer | $6 |

| Incoming International Transfer | $8 |

You can see that outgoing wire transfers, especially outgoing international transfers, have the highest costs. Incoming domestic transfers and incoming international transfers are much cheaper. Some banks even waive the incoming wire transfer fee if you receive money from another account within the same bank.

Note: Outgoing wire transfers often include extra costs, such as fees from intermediary banks or currency conversion charges for international transfers.

If you look at major banks, you will find a similar pattern. For example, Bank of America charges $30 for outgoing domestic wire transfer fees and $45 for outgoing international transfer fees. Incoming wire transfers at many banks, like Wells Fargo and Chase, cost about $15 or less.

Online vs. In-Branch Fees

You can start a wire transfer online or at a bank branch. The method you choose affects the transfer fees you pay. Online wire transfers usually cost less than in-branch transfers. Banks save money when you use online services, so they often pass those savings to you.

For example, some banks charge $30 for an in-branch wire transfer but only $20 if you do it online. This difference can help you save money, especially if you send wire transfers often. Online transfers are also faster and more convenient for most people.

Tip: Always check your bank’s website for the latest wire transfer fees. Online transfers may offer lower costs and faster service.

Wire transfer fees can also change based on the currency you use or the country you send money to. Some banks add extra charges for foreign currency transfers. If you set up regular wire transfers, you might get a discount of about $5 per transfer.

You should always compare your options before sending money. Choosing the right method can help you avoid high fees and keep more of your money.

Bank Fee Comparison

Image Source: pexels

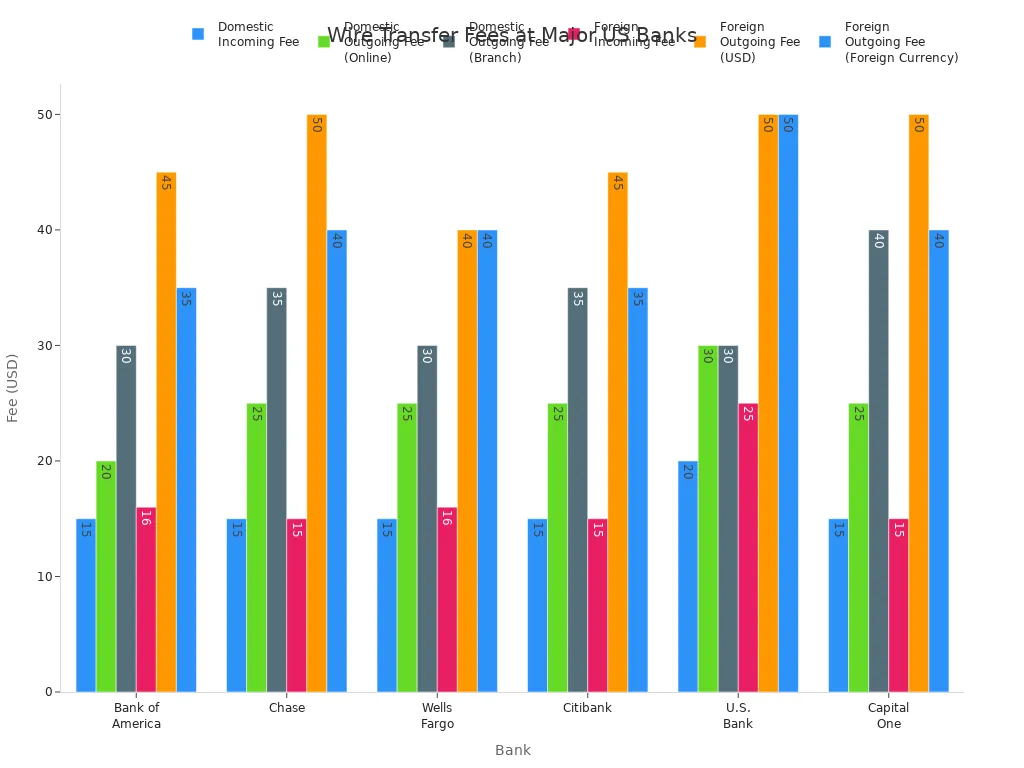

Major US Banks

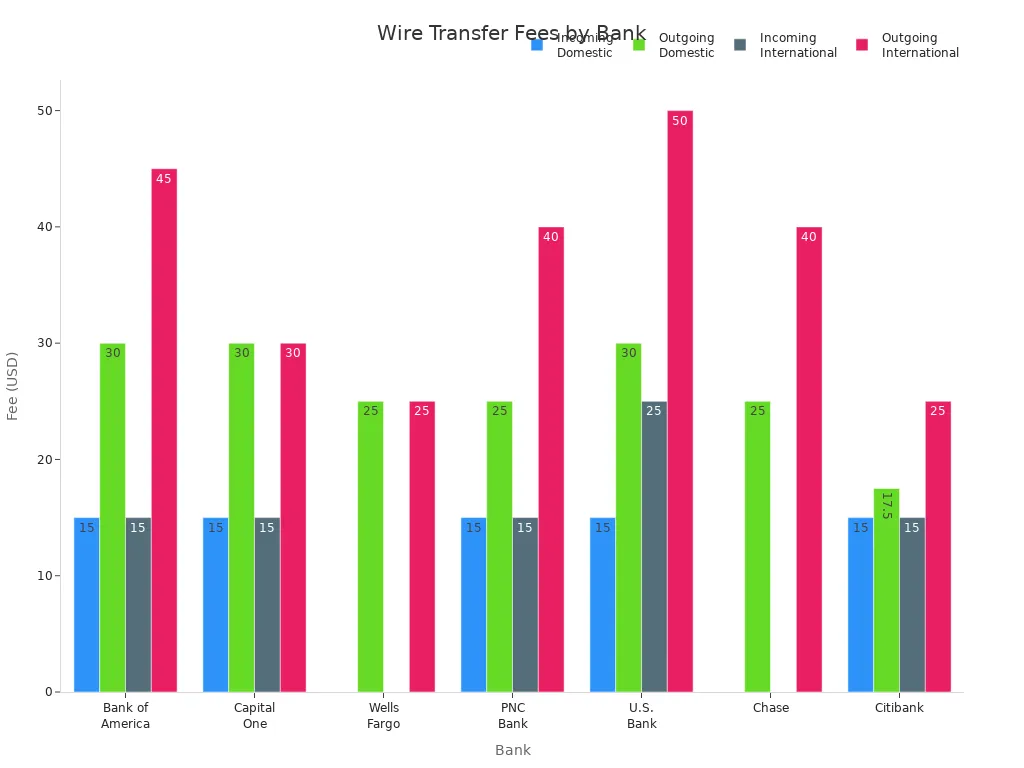

You will find that wire transfer fees can differ a lot between major US banks. Some banks charge higher fees for sending money, while others offer free transfers for certain accounts. Here is a table that shows the typical fees for both domestic and international wire transfers at some of the largest banks:

| Bank | Incoming Domestic Fee | Outgoing Domestic Fee | Incoming International Fee | Outgoing International Fee |

|---|---|---|---|---|

| Bank of America | Around $15 | Around $30 | Around $16 | $45 or $0 if sent in foreign currency |

| Chase | $0 to $15 | $25 to $35 | $0 to $15 | $0 to $50 |

| Citibank | Up to $15 | Up to $25 | Up to $15 | Up to $35 |

| Fidelity | $0 | $0 | $0 | $0 |

| Wells Fargo | $0 to $16 | $0 to $45 | Around $16 | Around $45 |

You can see that Fidelity stands out by offering free wire transfers for all types. Most other banks charge between $15 and $45 for outgoing transfers. Incoming transfers usually cost less, often $15 or less. Outgoing international transfers are the most expensive, sometimes reaching $50 or more.

Fee Policies

Each financial institution sets its own rules for wire transfer fees. You may pay less if you use online banking instead of visiting a branch. For example, Chase charges $35 for an outgoing domestic wire transfer at a branch, but only $25 if you send it online. Citibank offers even lower fees for premium account holders, with some paying as little as $17.50 for domestic transfers.

Some banks waive fees for certain accounts. Bank of America does not charge incoming wire fees for Interest Checking and Advantage Plus accounts. Wells Fargo waives incoming fees for Portfolio Plus accounts with a balance of $250,000 or more. Citibank and Capital One also offer fee waivers for premium or special accounts.

You may also notice that foreign currency transfers sometimes cost less than transfers in US dollars. For example, Bank of America charges $45 for outgoing international wires in US dollars, but only $35 if you send foreign currency. Many banks also offer discounts for repetitive transfers or for using their mobile app.

Tip: Always check if your bank offers lower transfer fees for online or mobile app transfers. You can save $5 to $10 per transfer by choosing digital options.

Some banks require you to visit a branch for international transfers, while others let you send money online or through a mobile app. This can affect how much time and money you spend on each transfer.

When you compare bank wire transfers, always look at both the fees and the policies. This helps you choose the best option for your needs.

Wire Transfer Cost Factors

Transfer Method

The way you send money affects how much you pay in transfer fees. If you use online banking, you usually pay less than if you visit a branch. For example, many banks charge $25 for an outgoing international wire transfer done online, but $40 if you do it in person at a branch.

| Transfer Method | Outgoing International Wire Fee (USD) |

|---|---|

| Online (Digital) | $25 |

| In-branch | $40 |

Online transfers save you time and money. In-branch transfers cost more because banks spend more resources to process them. Some banks also let you send money by phone, but these fees are often similar to in-branch rates.

Tip: Choose online transfers when possible to lower your wire transfer cost.

Amount and Destination

The amount you send and where you send it both impact the total cost. Most banks charge a flat fee, so sending a large sum of money does not always mean higher fees. However, some online services charge a percentage, which can make sending a large sum of money more expensive.

| Factor | Impact on Wire Transfer Fee |

|---|---|

| Destination Country | International transfers cost more due to extra steps, intermediary banks, and currency conversion. |

| Amount Sent | Flat fees mean cost stays the same, but percentage-based fees rise with larger amounts. |

| Intermediary Banks | More banks involved can increase total fees and reduce the amount received. |

| Currency Conversion | Extra fees and less favorable exchange rates add to the total cost. |

Transfers to some countries cost more because of extra processing or more banks involved. If you send money to a country with fewer banking connections, you may pay higher fees.

- Banks base fees on:

- Currencies involved

- Countries between which money is sent

- Transfer size

- Number of intermediary banks

Currency Conversion

When you send money in a different currency, you pay more than just the basic transfer fees. Banks set their own exchange rates, which include a markup over the real market rate. This markup, plus any currency conversion fee, increases the total cost of international wire transfers.

| Fee Type | Description |

|---|---|

| Exchange Rate Markup | Banks add a margin to the exchange rate, making the transfer more expensive. |

| Currency Conversion Fees | Extra charges for converting USD to another currency, sometimes separate from wire transfer fees. |

| Intermediary Bank Fees | Fees from banks that help move your money between countries. |

| Correspondent Bank Fees | Additional charges from banks in the transfer chain. |

For example, if you send $1,000 and the bank charges a $20 sending fee, a $15 receiving fee, and a 2% exchange rate markup, your total cost is $55. Some banks, like Chase, set their own exchange rates, which may not be as favorable as the mid-market rate. This means you get less foreign currency for your dollars.

Note: Always check the exchange rate and ask about all possible fees before sending a large sum of money overseas.

Avoid Wire Transfer Fees

You can avoid wire transfer fees or reduce them by making smart choices about how, when, and where you send money. Many banks and financial services offer ways to help you keep more of your money. Here are some practical strategies you can use.

Online Transfers

Sending a wire transfer online is often the cheapest way to move money. Banks usually charge lower fees for online or mobile banking transfers than for those done in person or over the phone. Some banks, like Bank of America and Wells Fargo, even waive certain fees if you send money online in foreign currency.

- Arrange your wire transfer through your bank’s website or mobile app to get the lowest fee.

- Check if your bank offers fee waivers for online transfers, especially for outgoing international payments.

- Use peer-to-peer payment services such as Zelle, Venmo, or PayPal for USD transfers. These services often have low or no fees.

- Consider using specialist services like Wise for international transfers. These platforms usually offer better exchange rates and lower transfer fees than traditional banks.

- Choose ACH transfers for domestic payments. ACH transfers cost less than wire transfers and work well for most situations.

Tip: Always review your account terms. Some banks give discounts or fee-free wire transfers to special account holders who use online banking.

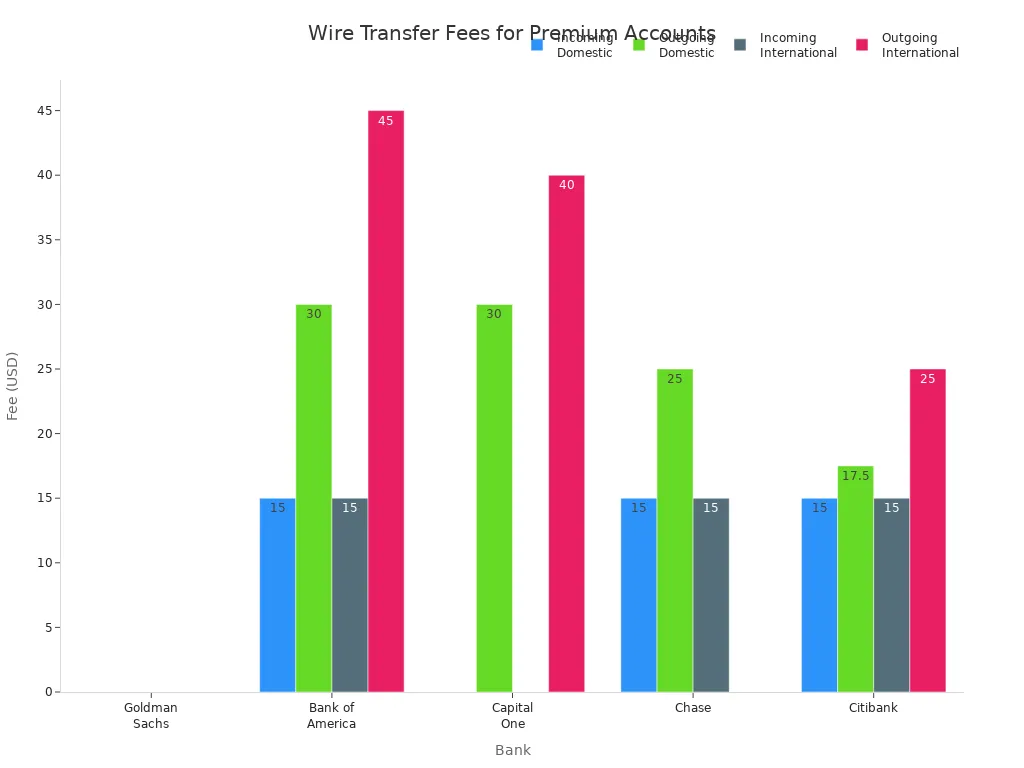

Premium Accounts

Many banks reward customers who keep higher balances or use special account types. Premium or special accounts often come with reduced or waived wire transfer fees. If you send money often, upgrading your account can save you a lot.

| Bank | Premium Account Type / Condition | Incoming Domestic Fee | Outgoing Domestic Fee | Incoming International Fee | Outgoing International Fee |

|---|---|---|---|---|---|

| Goldman Sachs | Marcus savings accounts | $0 | $0 | $0 | $0 |

| Bank of America | Preferred Rewards members | $0 (waived) | $30 | $0 (waived) | $45 |

| Capital One | Certain account types | $0 (waived) | $30 | $0 (waived) | $40 |

| Chase | Waived for select accounts or online transfers | $0 (waived) | $25-$35 (waived) | $0 (waived) | $0-$50 (waived) |

| Citibank | Waived for certain account types | $0 (waived) | $17.50-$25 (waived) | $0 (waived) | $25-$35 (waived) |

- Ask your bank if you qualify for a premium account or special membership.

- Look for accounts that offer fee-free wire transfers as a benefit.

- Some banks, like Wells Fargo, offer fee waivers for certain accounts. Always check your bank’s fee schedule for details.

- If you send money often, negotiate with your bank for lower fees or discounts.

Note: Multi-currency accounts can help you avoid international wire transfer fees by letting you move money between currencies inside the same bank. Watch out for maintenance fees or minimum balance rules.

Timing and Amount

The timing of your wire transfer can affect both the speed and the cost. Banks process transfers only during business hours, and most have a daily cutoff time, usually around 5:00 PM ET. If you send money after this time, your transfer will process the next business day, which can cause delays.

- Send your wire transfer before the bank’s cutoff time to avoid delays.

- Some banks offer discounts or waive fees if you set up recurring transfers.

- Credit unions often charge lower transfer fees than big banks. You may pay as little as $22 for outgoing transfers and nothing for incoming ones.

- The amount you send usually does not change the fee, since most banks charge a flat rate. However, some online services charge a percentage, so sending a large amount may cost more.

Tip: If you send wire transfers often or in large amounts, ask your bank about discounts for frequent or high-volume transfers.

You can also avoid wire transfer fees by choosing alternative payment methods:

- Use ACH transfers or Global ACH (eCheck) for domestic and some international payments.

- Try peer-to-peer apps like Zelle, Venmo, or Cash App for fast, low-cost transfers.

- Consider using blockchain-based payment systems or online neobanks for international payments.

- For business, you can negotiate with the payee to cover the transfer fees or include them in your pricing.

By comparing your options and planning ahead, you can avoid wire transfer fees and keep more of your money.

Wire Transfer Alternatives

Image Source: pexels

When you want to send money, you have more choices than just a wire transfer. Many people now use other methods that can save money and offer more convenience. Here are some of the most popular alternatives.

ACH Transfers

ACH (Automated Clearing House) transfers help you move money between banks in the United States. You can use ACH for paying bills, sending money to friends, or making business payments. ACH transfers cost less than wire transfers. Many banks do not charge for incoming ACH payments, and outgoing ACH fees are usually low, sometimes about 1% up to $10 per transaction. However, ACH transfers take longer, often 1 to 5 business days, because banks process them in batches. Same-day ACH is faster but still not as quick as a wire transfer.

| Transfer Type | Domestic Outgoing Fee | Domestic Incoming Fee | Speed | Typical Use Case |

|---|---|---|---|---|

| ACH Transfer | Minimal or free | Usually free | 1-5 business days | Everyday payments, payroll, bills |

| Wire Transfer | Average $26 | $10-$20 | Same day/immediate | Large, urgent, or international wires |

Tip: Use ACH transfers for routine payments when you do not need the money to arrive right away.

Peer-to-Peer Apps

Peer-to-peer payment apps make sending money easy and fast. You can use a payment app like Venmo, Zelle, or PayPal to pay friends, split bills, or shop online. These apps work well for small amounts and do not require bank account numbers. Most peer-to-peer payment apps charge little or no fee for standard transfers. For example, Venmo and Zelle do not charge for sending money from your bank account. PayPal lets you send money for free if you use your PayPal balance or linked bank account, but charges 2.9% plus $0.30 for credit or debit card payments.

| App | Fees | Transfer Limits (U.S.) |

|---|---|---|

| Venmo | No fee for bank/debit; 3% for credit cards | Up to $60,000/week (verified) |

| Zelle | No fees | Limits set by your bank |

| PayPal | Free with bank/PayPal balance; 2.9% + $0.30 card | Up to $10,000/transaction (verified) |

Note: Instant transfers on these apps may cost extra, usually a small percentage of the amount.

International Services

If you need to send money overseas, you can use a money transfer service instead of a traditional bank. Companies like Wise, Western Union, and Remitly offer fast and flexible options for international transfers. These money transfer services often have lower fees and better exchange rates than banks. Wise uses the mid-market exchange rate and charges a small, clear fee, starting around 0.43%. Remitly and Western Union set their own rates and fees, which can change based on the country, amount, and payment method. Some services let you send money for cash pickup, while others deposit funds directly into a bank account.

| Provider | Transfer Fees | Exchange Rate Policy | Speed | Notes |

|---|---|---|---|---|

| Wise | From 0.43% per transfer | Mid-market, no markup | Most under 24 hours | Transparent, cost-effective |

| Remitly | Varies, often $3.99+ | Markup on exchange rate | Minutes to 3-5 days | Cash pickup, promotional first transfer |

| Western Union | Varies by method | Markup on exchange rate | Instant to 2 days | Large agent network, less transparent |

Tip: Always compare the total cost, including fees and exchange rates, before choosing a money transfer app or service for international transfers.

You face different costs when you send money by wire transfer. Outgoing and international transfers usually cost more, as shown in the table below.

| Wire Transfer Type | Average Fee (USD) |

|---|---|

| Incoming Domestic | $15 |

| Outgoing Domestic | $30 |

| Incoming International | $15 |

| Outgoing International | $45 |

You can save money by checking your bank’s fee schedule and exploring options like online transfers or digital payment services. Always review all possible transfer fees and compare alternatives before you send money.

FAQ

What are the main types of wire transfer fees you might pay?

You may pay outgoing wire transfer fees when you send money and incoming wire transfer fees when you receive funds. Outgoing wire transfers usually cost more than incoming wire transfers. Some banks offer fee-free wire transfers for certain accounts or online transfers.

How can you avoid wire transfer fees at your bank?

You can avoid wire transfer fees by using online banking, choosing premium accounts, or sending money with a peer-to-peer payment app. Some financial institutions offer fee-free wire transfers for large sum of money or for specific account types.

Why do international wire transfers cost more than domestic transfers?

International wire transfers cost more because they involve extra steps, such as currency conversion and intermediary banks. International wire fees also include exchange rate markups. Domestic wire transfer fees are usually lower since the money stays within the United States.

What is the average wire transfer fee for sending money abroad?

The average wire transfer fee for outgoing international transfer is about $44 USD. Some banks charge up to $75 USD, while others may offer lower rates. Always check the wire transfer cost and compare money transfer services before sending funds.

Are there alternatives to traditional bank wire transfers?

Yes, you can use a money transfer service, a payment app, or peer-to-peer payment apps for both domestic transfers and international transfers. These options often have lower transfer fees and faster delivery than traditional bank wire transfers.

Navigating wire transfers can be daunting, with high fees, complex requirements, and delays in international payments. For a smarter, more cost-effective solution, explore BiyaPay. BiyaPay offers transfer fees as low as 0.5%, significantly undercutting traditional bank charges of $35-$50. Its real-time exchange rate transparency ensures you get the best value when converting over 30 fiat currencies or 200+ cryptocurrencies, ideal for cross-border needs like remittances or investments. Unlike standard wire transfers, which may take days, BiyaPay often delivers funds same-day, covering 100+ countries with ease. The platform’s intuitive design allows registration in minutes, requiring only basic identity verification—no cumbersome paperwork. Backed by robust security and regulatory compliance, including U.S. and New Zealand licenses, BiyaPay ensures your funds are safe. Whether you’re sending money abroad or managing multi-currency transactions, BiyaPay simplifies the process while saving you time and money. Take control of your global payments and join BiyaPay today for fast, affordable, and secure transfers tailored to your needs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.