- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wire Transfers Made Simple: A Step-by-Step Overview

Image Source: unsplash

A wire transfer is an electronic transfer of funds between banks or credit unions, ensuring secure movement of money for you. When you send a wire transfer, you use secure networks such as SWIFT or Fedwire. You can send money both within your country and internationally. Many banks, including Hong Kong banks, now offer user-friendly platforms that make wire transfers faster and easier. Recent upgrades in technology have improved security and speed, so you can trust the process for important payments.

| Trend | Description |

|---|---|

| Enhanced Speed | Wire transfers now process more quickly. |

| Improved Security | Stronger protocols keep your funds safe. |

Key Takeaways

- Wire transfers move money quickly and safely between banks, ideal for large or urgent payments.

- Domestic wire transfers cost less and arrive faster than international ones, which need extra details and take longer.

- Always double-check recipient information before sending, since wire transfers cannot be reversed.

- Wire transfers use strong security steps to protect your money, but stay alert to avoid scams.

- Compare wire transfers with ACH and payment apps to choose the best method for your needs.

What Is a Wire Transfer?

Image Source: pexels

Key Features

A wire transfer lets you send money quickly and securely from your bank account to another person’s account. You can use this service for urgent payments, large sums, or when you need to move money across borders. Many banks, including Hong Kong banks, offer wire payments through online platforms, mobile apps, or in-branch services.

Here are some key features that set a wire transfer apart from other ways to send money:

- You get fast processing, often within 24 hours for domestic transfers.

- Banks use secure networks like SWIFT or Fedwire to protect your funds.

- You can send large amounts, which makes wire transfers ideal for big purchases or business deals.

- Wire transfers usually cost between $15 and $50 USD, depending on the bank and whether the transfer is local or international.

- Once you send a wire transfer, you cannot reverse it. This gives you a clear record and reduces the risk of disputes.

- Wire transfers work well for both local and international account holders.

Tip: Always double-check the recipient’s details before you send a bank wire. This helps you avoid mistakes, since the process cannot be undone.

Domestic vs. International

You can choose between a domestic wire transfer and an international wire transfer, depending on where you want to send your money. Each type has its own process, cost, and speed.

| Aspect | Domestic Wire Transfer | International Wire Transfer |

|---|---|---|

| Where Money Goes | Within the same country | To a different country |

| Cost | $15–$30 USD, usually lower | $30–$50+ USD, higher due to currency exchange and extra checks |

| Processing Time | Same day or next business day | 1–5 business days, sometimes longer |

| Currency Conversion | Not needed, stays in local currency | Needed, uses bank exchange rates |

| Regulations | Fewer, only local banking rules | More, includes anti-money laundering and ID checks |

Banks handle a domestic wire transfer with fewer steps. You only need the recipient’s account and routing numbers. For an international wire transfer, you must provide more details, such as SWIFT or IBAN codes, and sometimes explain the reason for the transfer. Hong Kong banks, for example, follow strict rules for international payments to protect against fraud.

If you need to send money to an international account, expect extra paperwork and a longer wait. International transfers may also involve several banks before the money reaches the final account.

How Does a Wire Transfer Work?

The Process Step-by-Step

You might wonder, how does a wire transfer work when you need to send money quickly and safely? The wire transfer process follows a clear set of steps. Each step helps you avoid mistakes and ensures your money reaches the right person. Here is a simple guide you can follow:

- Choose a wire transfer provider. You can use your bank, a credit union, or a financial service company.

- Check the fees for the remittance transfer. Some providers charge more for international wire payments, so review the costs before you start.

- Gather all the required information about the recipient and their bank. This includes the recipient’s name, address, account number, and the bank’s details.

- Fill out the wire transfer form. Double-check every detail to prevent errors. Mistakes can delay the process or cause the transfer to fail.

- Submit your request. You can do this online, through a mobile app, or at a bank branch.

- Keep your receipt as proof. For international remittance transfers, ask for an MT-103 document if you need to track the payment.

Tip: Always double-check the recipient’s details before you send money. A small error can cause big problems.

Banks use secure systems to verify your information and protect your funds. They use automated platforms and multi-factor checks to prevent fraud. If you change any wire instructions, banks will review them carefully to stop scams. Hong Kong banks, for example, use encrypted communication and strict verification steps to keep your remittance transfer safe.

Required Information

You need to provide specific details for a successful wire transfer. The information you need depends on the country and the type of remittance transfer. For most wire payments, banks ask for the recipient’s full name, address, account number, and the bank’s name and address. For international transfers, you also need the SWIFT or BIC code, and sometimes an IBAN or CLABE number. Some countries require extra details, such as tax IDs or payment reasons.

| Country | Common Required Information | Additional Country-Specific Requirements |

|---|---|---|

| Argentina | Full beneficiary name and address, 22-digit CBU account, bank name, address, SWIFT ID, purpose of payment | 11-digit beneficiary tax ID (CUIT or CUIL), beneficiary contact name and phone number, indication if payment is salary/payroll |

| Australia | Full beneficiary name, address, account number, bank name, address, SWIFT ID, purpose of payment | Beneficiary bank’s 6-digit local clearing (BSB) code |

| Japan | Full beneficiary name, address, account number, bank name, address, SWIFT ID, purpose of payment | Bank branch name (optional) |

| Kenya | Full beneficiary name, address, account number, bank name, address, SWIFT ID, purpose of payment | 5-digit transit code (branch code) of beneficiary bank |

| Mexico | 18-digit CLABE number, full beneficiary name and address, bank name, address, SWIFT ID, purpose of payment | N/A |

Banks must also verify your identity. You will need to show a government-issued ID, such as a passport. For large remittance transfers, banks may ask for your taxpayer identification number or other documents. These steps help banks follow legal rules and keep the process secure.

Note: If you do not provide the correct information, your wire transfer may be delayed or rejected. Always check with your bank for the latest requirements.

Methods: Online, Mobile, In-Branch

You can start a wire transfer in several ways. Each method offers different benefits, so you can choose what works best for you.

- Online Banking: Many people use online banking to send a wire transfer. You log in to your bank’s website, enter the recipient’s details, and follow the prompts. Hong Kong banks, for example, offer secure online portals for wire payments.

- Mobile App: You can use your bank’s mobile app to send money. This method is fast and easy. You can save recipient information for future remittance transfers. Some banks require you to enroll and accept terms before you use this feature.

- In-Branch: If you prefer face-to-face service, visit your local bank branch. A staff member will help you fill out the wire transfer form and answer your questions. This method is helpful if you are sending money for the first time or need extra support.

- Phone or Batch Processing: Some banks let you start a wire transfer by phone or through batch processing. This is useful for businesses that need to send many payments at once.

Banks use strong security measures for every method. They use two-factor authentication, secure codes, and device checks to protect your money. If you have questions or run into problems, your bank can help you resolve issues like rejected transfers or technical errors.

Tip: Always ask your bank about their process and security steps before sending money. This helps you avoid delays and keeps your remittance transfer safe.

Wire Transfer Cost and Speed

Fees for Domestic and International

You may notice that wire transfer cost depends on where you send your money. If you send funds within the United States, most banks charge between $15 and $30 for outgoing transfers. Incoming transfers usually cost less, often between $0 and $20. Some banks, like Alliant Credit Union and Ally Bank, do not charge for incoming wires. Credit unions often have lower fees than big banks. Here is a table showing typical bank fees for domestic wire transfers:

| Institution | Outgoing Domestic Wire Fee | Incoming Domestic Wire Fee |

|---|---|---|

| Average Market Fee | $23 | $6 |

| Bank of America | $30 | Free for qualifying accounts |

| Capital One Bank | $30 | Free |

| Wells Fargo | $30 | $15 |

| USAA | $20 | Free |

| TD Bank | $30 | $15 |

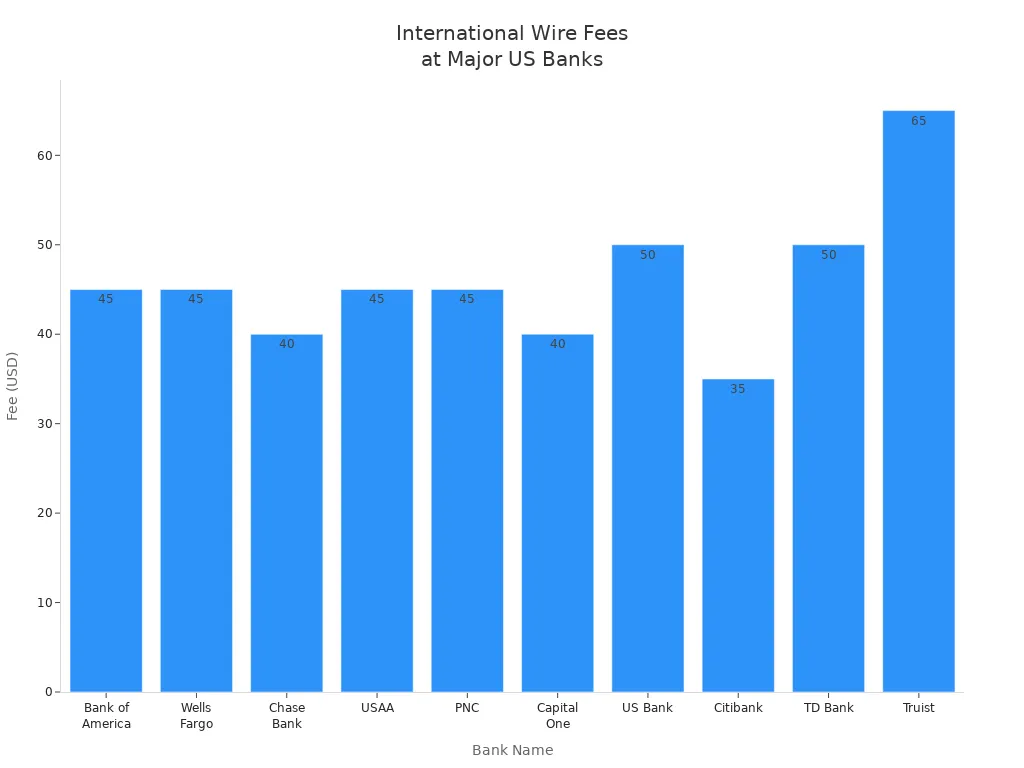

When you send money to another country, the wire transfer cost increases. Outgoing international wires often range from $25 to $65. For example, Bank of America and Wells Fargo both charge around $45 for international wires. Some banks add extra costs for currency exchange. Here is a table with international wire fees:

| Bank Name | Outgoing International Wire Fee (USD) |

|---|---|

| Bank of America | Around $45 |

| Wells Fargo | Around $45 (USD), $35 (foreign currency) |

| Chase Bank | $40 (USD), $5 (foreign currency) |

| USAA | $45 |

| TD Bank | $50 |

| Truist | Up to $65 |

Note: International transfers may also include hidden fees from intermediary banks or exchange rate markups.

How Fast Are Wire Transfers?

You may wonder, how fast are wire transfers? Domestic wire transfers often finish within 24 hours if you send them before the bank’s cut-off time. Some banks can move money between accounts at the same institution in just a few hours. International wire transfers usually take 1 to 5 business days. The time depends on the countries, banking systems, and if currency conversion is needed. Sometimes, transfers to certain countries can take up to three weeks.

- Domestic wires: Usually same day or next business day.

- International wires: 1–5 business days, sometimes longer.

- Transfers between accounts at the same bank: Often less than 24 hours.

Tip: Sending your wire early in the day helps avoid delays.

Factors Affecting Cost and Speed

Many things can change the wire transfer cost and speed. Here are the main factors:

- Type of transfer: International wires cost more and take longer than domestic ones.

- Intermediary banks: More banks in the process can add fees and slow things down.

- Currency exchange: If you need to convert money, banks may charge extra and take more time.

- Cut-off times: Each bank sets a daily deadline for processing wires. Sending after this time means your transfer waits until the next business day.

- Verification checks: Banks use anti-fraud steps and must follow rules like anti-money laundering (AML) and know your customer (KYC). These checks can delay your transfer.

- Weekends and holidays: Banks do not process wires on weekends or public holidays.

Note: Using the same bank for both sender and receiver can save you time and money.

How Safe Are Wire Transfers?

You may wonder, how safe are wire transfers? Banks design the process with high security in mind. When you send money, you use a system that includes many safeguards. These protections help keep your funds and personal information safe from fraud and unauthorized access.

Security Measures

Banks use several layers of security to protect your wire transfers. Here are some of the most important steps:

- Banks create and review cybersecurity policies often.

- Employees learn how to spot wire fraud and email scams.

- Sensitive information travels through encrypted email.

- Two-factor authentication protects your account access.

- Banks check your wire transfer habits and verify unusual requests.

- Staff confirm wire requests by calling known phone numbers.

- Dual control means two people must approve large transfers.

- Hong Kong banks use secure online platforms with strong passwords and user IDs.

- Banks use artificial intelligence to spot suspicious activity.

- Regular security audits help find and fix weak spots.

Note: These security measures make wire transfers one of the safest ways to move money, especially for large amounts.

Common Scams

Even with strong security, you should stay alert for scams. Scammers use tricks to get you to send money. Some of the most common wire transfer scams include:

- Fake buyers send counterfeit checks and ask you to wire money for shipping.

- Fake sellers post ads and request wire payments for items that do not exist.

- Scammers claim you won a lottery and ask for wire fees to claim your prize.

- Someone pretends to be a relative in trouble and asks for urgent money.

- Advance-fee loan scams require you to wire money before you get a loan.

- Secret shopper and work-at-home scams involve fake checks and wire requests.

- Nigerian fund-transfer scams promise large sums if you pay fees upfront.

Tip: Never wire money to someone you do not know or trust. Always check the story before you send funds.

Tips for Safe Transfers

You can take steps to protect yourself and address safety concerns. Follow these tips to keep your wire transfers secure:

- Always call the recipient using a phone number you already have on file.

- Confirm the identity of the person requesting the transfer with at least two pieces of information.

- Use secure online banking platforms for every wire transfer.

- Require a second person’s approval for large transfers.

- Keep records of all verification steps.

- Report any suspicious activity to your bank right away.

- Train yourself and others to spot new fraud tactics.

- Use strong passwords and update them often.

- Never rush a wire transfer, even if someone pressures you.

Remember: The process works best when you stay alert and follow all verification steps. If you have questions about how safe are wire transfers, ask your bank for more details about their security protocols.

Wire Transfer vs. Other Methods

Image Source: pexels

ACH Transfers

You may use ACH transfers for routine payments. ACH stands for Automated Clearing House. This system moves money between banks in the United States. ACH transfers usually take 1 to 3 business days. Some banks offer same-day ACH for an extra fee. The cost is low, often just a few cents per transaction. You might use ACH for payroll, bill payments, or recurring transfers. Wire transfers, in contrast, process faster and are better for large, urgent payments. Here is a quick comparison:

| Aspect | ACH Transfers | Wire Transfers |

|---|---|---|

| Speed | 1–3 business days | Same day (if sent before cutoff); international wires may take longer |

| Cost | Low (cents per transaction) | Higher ($20–$50 USD or more) |

| Use Case | Recurring, small payments | Large, one-time, urgent, or international payments |

Tip: Use ACH for regular, small payments. Choose a wire transfer service for urgent or high-value transfers.

Payment Apps

Payment apps like PayPal, Venmo, Cash App, and Zelle® offer easy ways to send money. These apps have lower transaction limits than wire transfers. For example, PayPal allows up to $60,000 USD per transaction for verified users. Venmo and Cash App have weekly limits under $10,000 USD. Payment apps use encryption and two-factor authentication. However, protections for personal payments are limited. If you send money to the wrong person, you may not get it back. Wire transfer alternatives like these work well for small, everyday payments but may not suit large or urgent transfers.

| Payment Method | Transaction Limits | User Protections |

|---|---|---|

| Wire Transfer | Higher limits | Stronger bank protections, but higher fees |

| PayPal | Up to $60,000 USD | Buyer protection for goods/services |

| Venmo | Up to $6,999.99 USD/week | Limited for personal payments |

| Cash App | Up to $10,000 USD/7 days | Limited for personal payments |

| Zelle® | $500–$3,500 USD/day | Treated like cash, limited purchase protection |

Money Transfer Services

Money transfer services like Western Union help you send funds quickly, even across borders. These services often deliver money within one business day, especially for cash pick-up or wallet app options. Fees vary based on the amount, destination, and delivery method. For example, a Western Union international transfer may cost more than an ACH transfer but can be faster than some international wire transfers. You can use a money transfer service when you need speed and flexibility, especially if the recipient does not have a bank account.

| Transfer Type | Typical Fees (USD) | Delivery Time |

|---|---|---|

| Wire Transfer | $20–$50 | Same day to 5 business days |

| Western Union | Varies by service | Often within one business day |

| ACH Transfer | Low (cents per transfer) | 2–3 business days |

Pros and Cons

You should weigh the pros and cons of each money transferring service before choosing. Wire transfers offer speed and security for large or urgent payments. They cost more and cannot be reversed. ACH transfers and payment apps are cheaper and better for small, routine payments, but they process slower and have lower limits. Money transfer services provide fast delivery and flexibility, but fees can add up.

- Wire Transfer Pros: Fast, secure, high limits, good for large or international payments.

- Wire Transfer Cons: High fees, irreversible, needs exact recipient details.

- Wire Transfer Alternatives Pros: Lower cost, easy for recurring or small payments, some can reverse transactions.

- Wire Transfer Alternatives Cons: Slower, lower limits, limited international reach.

Note: Always check the details and fees before you choose a money transfer method. Pick the option that fits your needs best.

Wire transfers give you a fast, secure way to send money, especially for large or urgent payments. Fees range from $15–$80 USD, and transfers can take from one to five days. Always:

- Double-check recipient details like name, account number, and SWIFT or IBAN codes.

- Review all fees and exchange rates before sending.

- Use trusted banks, such as Hong Kong banks, and secure channels.

Tip: Choose wire transfers for speed and tracking, but consider ACH for smaller, less urgent payments. When you follow best practices, wire transfers remain simple and effective.

FAQ

How do you track a wire transfer?

You can track your wire transfer by asking your bank for a reference number or an MT-103 document. Many banks, including Hong Kong banks, let you check the status online or by calling customer service.

What happens if you enter the wrong recipient details?

If you enter the wrong details, your wire transfer may fail or go to the wrong person. You cannot reverse a wire transfer. Always double-check the recipient’s name, account number, and SWIFT or IBAN code before sending.

Can you cancel a wire transfer after sending it?

You usually cannot cancel a wire transfer once your bank processes it. Some banks may help if you act quickly and the money has not left the bank. Contact your bank right away if you need to stop a transfer.

Are there limits on how much money you can send by wire transfer?

Yes, banks set limits for wire transfers. Limits depend on your bank, account type, and the country. For example, some Hong Kong banks allow you to send up to $100,000 USD per day. Always check your bank’s policy before sending large amounts.

Navigating wire transfers can be daunting, with high fees, complex requirements, and delays in international payments. For a smarter, more cost-effective solution, explore BiyaPay. BiyaPay streamlines global transfers with fees as low as 0.5%, significantly undercutting traditional bank charges of $25-$65. Its real-time exchange rate transparency ensures you get the best value when converting over 30 fiat currencies or 200+ cryptocurrencies, perfect for cross-border needs like remittances or investments. Unlike standard wire transfers, which may take days, BiyaPay often delivers funds same-day, covering 100+ countries with ease. The platform’s intuitive design allows registration in minutes, requiring only basic identity verification—no cumbersome paperwork. Backed by robust security and regulatory compliance, including U.S. and New Zealand licenses, BiyaPay ensures your funds are safe. Whether you’re sending money abroad or managing multi-currency transactions, BiyaPay simplifies the process while saving you time and money. Take control of your global payments and join BiyaPay today for fast, affordable, and secure transfers tailored to your needs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.