- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Zelle Safety 101 for Everyday Users

Image Source: unsplash

You might wonder, is zelle safe for your daily money transfers? Zelle safety remains a top priority for banks and users alike. You can trust Zelle for quick and secure payments when you send money to friends or family. Always remember to pay it safe—only use Zelle with people you know. Zelle safety depends on your actions. Never share your details with strangers, and stay alert to any unusual requests.

Key Takeaways

- Always send money only to people you know and trust to keep your payments safe.

- Double-check the recipient’s email or phone number before sending money because Zelle transfers are instant and cannot be reversed.

- Use strong passwords and enable two-factor authentication to protect your Zelle account from unauthorized access.

- Be alert to common scams like phishing, impersonation, and fake sales, and never share your codes or passwords with anyone.

- If you suspect fraud or make a mistake, contact your bank immediately and report the scam to help protect your money.

How Zelle Works

Image Source: unsplash

What Is Zelle

Zelle is a digital payment service that helps you send and receive money quickly. You can use zelle through your bank’s mobile app or online banking. Many banks in the United States, including large ones and smaller community banks, offer zelle as a built-in feature. You do not need to download a separate app if your bank already supports zelle.

When you enroll, you link your email address or U.S. mobile number to your bank account. Zelle uses this information to connect you with other users. Your sensitive bank details stay private during every transaction. Zelle works only with U.S.-based banks, so you cannot use it for international transfers.

Tip: Always use your main email or phone number when enrolling in zelle. This helps friends and family find you easily.

Sending and Receiving Money

You can send money with zelle in just a few steps. Here is how the process usually works:

- Open your bank’s mobile app or website.

- Find the zelle option, usually under “Send Money.”

- Enter the recipient’s email address or U.S. mobile number.

- Type in the amount you want to send.

- Review the details and confirm the payment.

The money usually arrives in the recipient’s account within minutes if they already use zelle. If the recipient is not enrolled, they get a notification to sign up. Once they enroll, the money transfers to their account. If they do not enroll within 14 days, the payment returns to you.

To receive money, you do not need to do anything if you are already enrolled. If not, follow the link in the notification and complete the enrollment steps. After that, the money will appear in your account.

Note: Zelle transfers are fast and free. Always double-check the recipient’s information before sending money.

Is Zelle Safe

You may ask yourself, is zelle safe for your daily money transfers? Many people use zelle every day, so understanding zelle safety is important. Let’s look at the features that help protect your money and the risks to using zelle that you should know about.

Zelle Safety Features

Zelle uses several tools to keep your transactions secure. You can feel confident when you use zelle with people you trust. Here are some of the main safety features:

- Authentication and monitoring systems check for unusual activity on your account.

- Many banks offer extra security, such as Face ID or Touch ID, to log in.

- Zelle does not share your bank account details during transfers. Only your email address or U.S. mobile number links to your account.

- Banks like M&T Bank send alerts if they notice suspicious activity with zelle.

- You receive education about common scams, such as fake texts or emails pretending to be from your bank.

- Zelle encourages you to report any fraud and stay alert to suspicious messages.

Tip: Always double-check the recipient’s information before sending money. Zelle transfers happen quickly, so mistakes are hard to fix.

Recent banking reports show that zelle safety measures work well. In 2023, over 99.95% of the 2.9 billion transfers on zelle happened without any reports of fraud or scams. This means unauthorized transactions are very rare. Zelle also has fewer disputed transactions than other peer-to-peer payment services.

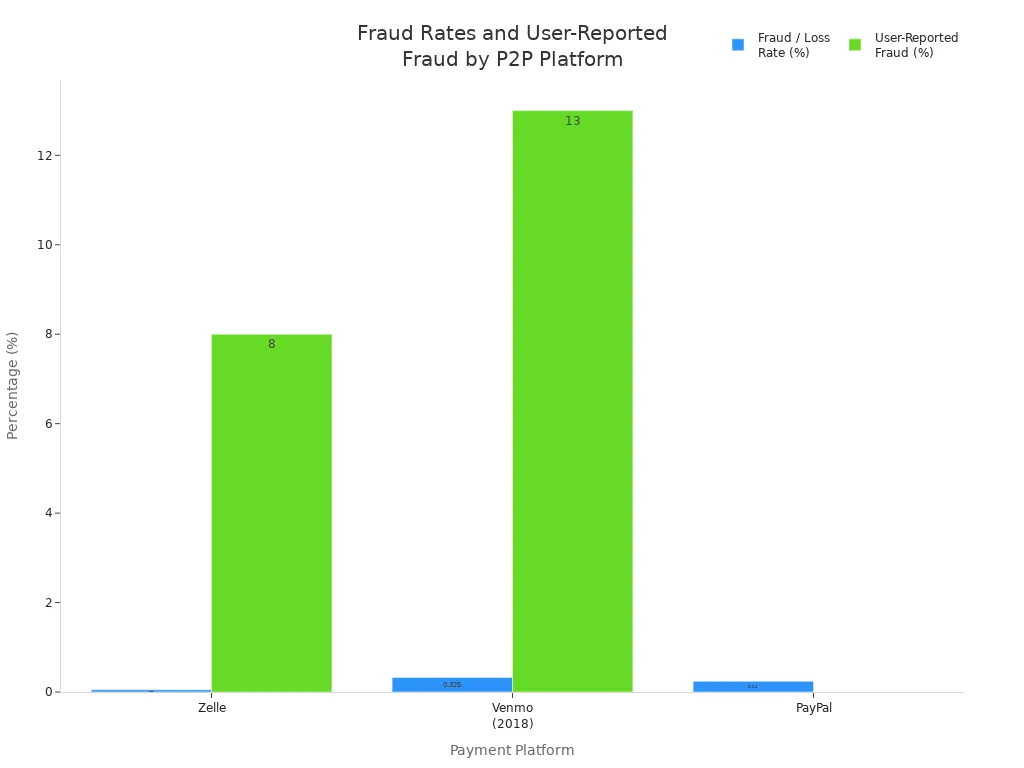

You might wonder how zelle compares to other payment apps. The table below shows how zelle’s fraud rate stacks up against Venmo and PayPal:

| Platform | Fraud Rate / Loss Rate | User-Reported Fraud Experience | Notes |

|---|---|---|---|

| Zelle | Up to 0.05% in 2023 (50% decrease from 0.1% in 2022) | 8% reported some fraud; 3% lost money to scammers; 5% sent money to wrong person; 1% unauthorized transfers | Fraud rate lower than Venmo and PayPal; transaction volume increased 28% |

| Venmo (2018) | 0.25% to 0.40% loss rate | Higher than Zelle (industry average 13%) | Internal data from 2018; loss rate includes fraudulent charges |

| PayPal | Targeted ~0.24% loss rate | Not specified | No specific recent fraud rate provided |

| Industry Avg. | N/A | 13% reported fraud experience | J.D. Power survey includes Apple Cash, Cash App, Google Pay, PayPal, Venmo |

| FTC Scam Reports | N/A | Zelle 3rd most mentioned in scam reports (20% of scam reports among payment apps) | Corresponds roughly to market share; PayPal and Cash App higher |

Security Limitations

Even with strong zelle safety features, you still face some risk to using zelle. You need to know these limits to protect yourself.

- Zelle does not offer purchase protection. If you pay someone for goods or services and they do not deliver, you cannot get your money back.

- You cannot cancel a payment once the recipient enrolls with zelle. Always confirm the recipient’s details before sending money.

- Zelle focuses on fraud prevention, but you must avoid scams. Scammers may try to trick you into sending money or giving away your login details.

- If you send money to the wrong person, zelle cannot reverse the transaction. You must contact the recipient and ask for the money back.

- Zelle is meant for sending money to people you know and trust. Using it for payments to strangers increases the risk to using zelle.

Alert: Zelle payments are fast and final. If you send money to a scammer or make a mistake, your bank may not be able to help.

Is zelle safe? For most users, yes—especially when you follow best practices and only send money to trusted contacts. However, you must stay alert to scams and understand the risks to using zelle. Zelle safety depends on both the system’s protections and your own caution.

Common Types of Zelle Scams

Image Source: pexels

Zelle makes sending money easy, but this speed can attract scammers. You need to know the common types of Zelle scams so you can protect yourself. Many people get scammed on Zelle because they do not recognize the warning signs. In the first half of 2024, more than 41,000 Zelle scam cases were reported to the Federal Trade Commission, with losses reaching $171 million. These numbers show how important it is to understand how Zelle scams work.

Phishing Scams

Phishing scams are one of the most common types of Zelle scams. Scammers try to trick you into giving away your personal or banking information. They often send fake emails or text messages that look like they come from your bank or Zelle. These messages warn you about suspicious activity or ask you to verify your account.

You might receive a text that says, “Did you just try to send $500 with Zelle? Reply YES or NO.” If you respond, a scammer may call you, pretending to be from your bank’s fraud department. They will ask for your username and then send you a code, asking you to read it back. This code lets them reset your password and take over your account. Many people do not even know they have Zelle enabled, which makes them easy targets.

Tip: Never share your one-time codes or passwords with anyone, even if they claim to be from your bank.

Scammers use several tricks in phishing scams:

- They impersonate banks or Zelle, asking you to click on fake links.

- They pretend to be government agencies, like the IRS or Social Security.

- They send fake refund offers, claiming you need to send money to get a refund.

- They act as friends or family in urgent need of help.

- They create fake job offers that require you to pay fees using Zelle.

Scammers often use urgency, authority, and scarcity to pressure you. They want you to act fast and not think things through. Always verify any message or call by contacting your bank directly.

Impersonation Scams

Impersonation scams are another major way people get scammed on Zelle. In these scams, someone pretends to be a trusted person or organization. They might act as a bank employee, customer service agent, or even a friend or family member.

Here are some real-world examples of how Zelle scams work through impersonation:

- A scammer creates a fake customer service number or social media account. You call for help, and they ask for your details or tell you to send money.

- You get an email or text that looks like it is from Zelle or your bank. It asks you to contact a fake support channel.

- Someone pretends to be a friend or family member in trouble. They say they are stranded, in the hospital, or need bail money. They ask you to send money right away using Zelle.

- Scammers pose as lawyers or police officers, claiming a loved one needs urgent help. They insist you keep it secret and pay immediately.

Alert: Always verify the identity of anyone asking for money, even if the request seems urgent or comes from someone you know.

Impersonation scams often use emotional stories to make you act quickly. You should always double-check by calling the real person or organization using a trusted number.

Fake Sales and Offers

Fake sales and offers are some of the most common types of Zelle scams, especially on online marketplaces. Scammers pretend to sell tickets, electronics, pets, or other items. They ask you to pay with Zelle because the transfer is instant and cannot be reversed.

Here is how Zelle scams work in fake sales:

- Scammers post fake ads on sites like Facebook Marketplace or Craigslist.

- They ask for payment through Zelle, promising to ship the item after you pay.

- After you send the money, the scammer disappears. You never get the item.

- Some scammers send fake payment requests or invoices for things you never ordered.

- Others use “pending payment” tricks, saying you must pay a fee to release your purchase.

- Overpayment scams happen when a scammer claims to have sent you too much money and asks for a refund.

Note: Zelle payments are instant and irreversible. Once you send money, you cannot get it back. Zelle does not offer purchase protection like PayPal or credit cards.

Scammers take advantage of Zelle’s speed and lack of buyer protection. They pressure you to act fast, hoping you will not notice the warning signs. Always use Zelle only with people you know and trust. Never pay strangers for goods or services using Zelle.

Key facts about Zelle payments:

- Zelle payments are instant and cannot be reversed.

- Zelle does not protect you if you get scammed on Zelle by a fake seller.

- Banks and Zelle usually do not refund money lost to scams.

- Zelle is meant for sending money to friends and family, not for buying things from strangers.

Callout: If a deal sounds too good to be true or someone pressures you to pay quickly, stop and think. Scammers rely on speed and secrecy.

By learning about these common types of Zelle scams, you can spot the warning signs and keep your money safe. Always stay alert and remember that Zelle is safest when used with people you know and trust.

Protecting Yourself from Zelle Scams

Best Practices

You can protect your money by following secure practices for using zelle. Treat every payment like cash because you cannot reverse a transaction once you send it. Always send money only to people you know and trust. Financial institutions recommend these steps for protecting yourself from zelle scams:

- Only send money to trusted contacts with verified details.

- Never send money to yourself if someone asks you to do so. This is a common scam trick.

- Be careful with urgent payment requests. Take time to check if they are real.

- Do not reply to suspicious messages about zelle transfers. Contact your bank directly if you have questions.

- Double-check the recipient’s email or phone number before sending money.

- Avoid sending money to people you have never met in person.

- Test with a small amount first if you are unsure about the recipient.

Tip: Banks usually do not refund authorized zelle payments, so always use caution.

Spotting Red Flags

Recognizing red flags helps you avoid zelle scams. Scammers often use pressure or strange requests to trick you. Watch for these warning signs:

- Requests for payment from someone you just met or have not spoken to in a long time.

- Urgent demands to send money right away.

- Messages asking you to pay with gift cards or through unusual methods.

- Unsolicited job offers or offers of financial help with little detail.

- Refusal to meet in person or quick promises of trust.

- Last-minute changes in payment instructions.

- High-pressure donation requests without proof.

- Requests for money for pets or property you cannot verify.

Alert: Always slow down and double-check before sending money. Treat zelle payments like cash.

Account Security Tips

You can make your zelle account safer by using multifactor authentication. This means you add an extra step, like a code sent to your phone, when you log in. This extra layer makes it much harder for someone else to access your account. Always enable all available security features your bank offers. Update your passwords often and never share them with anyone. Avoid using public Wi-Fi when sending money. Double-check the recipient’s information every time you use zelle. These steps play a big part in protecting yourself from zelle scams.

What to Do If You’re Scammed

Immediate Actions

If you get scammed on Zelle, act quickly to protect your money. Take these steps within the first 24 to 48 hours:

- Call your bank’s fraud department right away. Do not use the general customer service line. The fraud team can start the claim process and may help stop further loss.

- File a police report, even if the amount is small. This report gives you official proof and helps your case with the bank.

- Report the scam to the FBI’s Internet Crime Complaint Center (IC3). This step helps federal agents track the crime and may help recover your funds.

Tip: Acting fast increases your chances of getting help from your bank or law enforcement.

Reporting Fraud

Reporting a scam is important for your safety and for others. Follow these steps to make sure your case gets attention:

- Tell your bank or credit union about the scam. If you use Zelle through your bank, start there.

- Contact Zelle directly using their online complaint form or by calling 1-844-428-8542.

- Report the fraud to your local police department.

- File a complaint with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov.

- Submit a report to the Internet Crime Complaint Center (IC3). Your report helps the FBI and other agencies track Zelle scams and may help freeze stolen funds.

Note: The more details you provide in your reports, the better chance you have of getting help.

Seeking Reimbursement

You may wonder if you can get your money back after unauthorized transactions. Banks on the Zelle network must reimburse users for certain qualifying imposter scams, such as when someone pretends to be a bank or government agency. The rules for reimbursement are not public to prevent abuse, but you should always report unauthorized transactions to your bank as soon as possible. If you report within four business days, your liability stays low. Waiting longer can make it harder to get your money back.

Some users have trouble getting reimbursement, even when they act fast. If your first claim fails, ask your bank’s internal fraud department for a deeper review. You can also contact the bank’s compliance team and mention federal rules like the Electronic Fund Transfer Act. If needed, file complaints with agencies like the Consumer Financial Protection Bureau (CFPB) or the Office of the Comptroller of the Currency (OCC).

Callout: Always keep records of your reports and follow up with your bank. Timely reporting gives you the best chance for reimbursement.

Protect Yourself When Using Zelle

Double-Check Recipients

You can protect yourself when using zelle by always double-checking recipient details before sending money. Zelle payments move fast and cannot be canceled once the recipient is enrolled. If you send money to the wrong person, you may not get it back. Take your time and do not let anyone rush you. Scammers often pressure you to act quickly so you make mistakes.

Here are steps you should follow every time you send money:

- Confirm the recipient’s phone number or email address is correct.

- Check that the name shown matches the person you want to pay.

- If you receive a payment request from someone you do not know, verify their identity using another method, like a phone call or text.

- Be careful with unexpected requests, even if they seem to come from friends or family.

- If you feel unsure, consider using another payment method.

Tip: Treat every Zelle payment like cash. Once you send it, you cannot reverse it.

Banks and Zelle send alerts if they notice something unusual. Legitimate companies will never ask you to send money through Zelle by surprise call or text. Always stay alert and protect yourself when using zelle.

Avoiding Public Wi-Fi

You should avoid using public Wi-Fi when you access your bank or send money with Zelle. Public Wi-Fi networks are not secure. Hackers can watch what you do and steal your information, such as passwords or account numbers. This puts your money and personal data at risk.

- Never use Zelle or do online banking on public Wi-Fi at places like airports, cafes, or hotels.

- Wait until you have a secure, private connection at home or use your mobile data.

- Turn on two-factor authentication and set up alerts for your bank account. These steps help protect yourself when using zelle.

- Do not share codes or passwords with anyone, even if they claim to be from your bank.

Alert: Scammers use public Wi-Fi to launch phishing attacks. They may pretend to be your bank and ask for your information. Always check the website address and never click on suspicious links.

By following these steps, you can protect yourself when using zelle and keep your money safe from scams and mistakes.

You can keep your money safe by following a few simple steps.

- Treat every payment like cash—once you send it, you cannot get it back.

- Only send money to people you know and trust, and always double-check recipient details.

- Use strong passwords and turn on two-factor authentication.

- If you notice anything suspicious, contact your bank right away.

Most users feel confident in the platform’s security, but your caution makes the biggest difference. Share these tips with friends and family, and always stay alert for scams.

FAQ

How fast does Zelle transfer money?

You usually see the money in minutes. If the recipient uses Zelle, the transfer happens almost instantly. If not, they must enroll first. After that, the money moves quickly.

Can you use Zelle for international transfers?

No, you cannot use Zelle for international transfers. Zelle only works with U.S.-based banks. You must use another service for sending money outside the United States.

What should you do if you send money to the wrong person?

Act fast. Contact your bank and the recipient right away. Zelle cannot reverse the payment. Your bank may help, but you must rely on the recipient to return the money.

Does Zelle charge any fees for sending money?

Most banks, including Hong Kong banks, do not charge fees for Zelle transfers. Always check with your bank to confirm. Zelle itself does not add extra charges.

While Zelle excels for quick, secure domestic transfers, its limitation to U.S.-based banks leaves international payments out of reach. For seamless global transactions, consider BiyaPay. BiyaPay offers a robust solution for cross-border needs, allowing you to exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time market rates. With transfer fees as low as 0.5%, it’s a cost-effective alternative to traditional banking methods like SWIFT, which often charge hefty fees. Whether you’re sending money abroad, investing in U.S. or Hong Kong stocks, or managing digital assets, BiyaPay’s intuitive platform ensures fast, secure transactions. Registration takes just minutes, requiring only basic identity verification—no complex processes. Plus, its global reach covers 100+ countries, making it ideal for remittances, investments, or international purchases. Say goodbye to high fees and limited options. Join BiyaPay today to unlock affordable, reliable global financial solutions tailored to your needs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.