- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Remitly fees and transfer process for India step by step

Image Source: unsplash

When you use Remitly for sending money from the USA to India, you pay both a transfer fee and an exchange rate markup. Remitly fees change based on how much you send and how fast you want the money to arrive. For some transfers over $500 paid by bank account, Remitly may waive the fee, but you still face an exchange rate markup between 0.5% and 3.0% above the mid-market rate. Compared to other providers, Remitly fees and exchange rates can be higher, which means you might not get the best value when you send money to India. You should always check both the fee and the exchange rate before sending money, so you know the real cost of your money transfer.

Key Takeaways

- Remitly charges a flat fee of $3.99 for transfers under $1,000 and no fee for transfers $1,000 or more, but always includes a small exchange rate markup.

- You can choose Express for fast transfers that arrive in minutes with higher fees or Economy for slower transfers that take 3-5 days with lower fees.

- Payment methods like bank transfer cost less but take longer, while debit or credit cards speed up transfers but may add extra fees.

- Remitly shows all fees and exchange rates before you send money, helping you avoid surprises and make smart choices.

- To save money, send larger amounts at once, pick slower transfer speeds if possible, and compare Remitly’s rates with other services.

Remitly fees overview

Image Source: pexels

Flat fees

When you send money to India with Remitly, you pay a flat fee based on the amount you transfer. Remitly fees are easy to understand because they use a simple structure. If you send less than $1,000, you pay a $3.99 transaction fee. If you send $1,000 or more, Remitly does not charge a transfer fee. This makes it easier for you to plan your international money transfer.

Here is a table that shows the current flat fees for sending money from the USA to India:

| Transfer Amount Range | Flat Fee Charged by Remitly |

|---|---|

| Up to $999 | $3.99 |

| $1,000 to $30,000 | $0.00 (no fee) |

You can see the fee before you confirm your transfer. Remitly provides this information upfront, so you know exactly what you will pay.

Exchange rates

Remitly sets its exchange rates by starting with the mid-market rate and then adding a small markup. This markup is usually about 0.5% above the mid-market rate. The mid-market rate is the rate banks use when they trade currencies. When you use Remitly, you get a rate that is a little less favorable than this benchmark. The markup is not shown as a separate transaction fee, but it is part of the exchange rate you receive.

For example, if the mid-market rate for USD to INR is 83.00, Remitly might offer you a rate of 82.58. This means you get slightly fewer rupees for each dollar you send. While this markup is lower than the industry average of 3%, it still affects the total amount your recipient gets. Remitly fees include both the flat fee and the exchange rate markup, so you should always check both before sending money.

Tip: Always compare the exchange rate Remitly offers with the mid-market rate. This helps you understand the real cost of your international money transfers.

Payment methods

Remitly gives you several ways to pay for your transfer. You can use a bank account, debit card, or credit card. The payment method you choose can affect the transaction fee and the speed of your transfer. For example, paying with a debit or credit card may cost more than using a bank account, but it can make your transfer faster.

Remitly also lets you choose between Express and Economy delivery. Express transfers arrive quickly but may have higher fees. Economy transfers take longer but usually cost less. You see all fees and exchange rates before you confirm your transfer, which helps you make an informed choice.

- Remitly and Wise both show transfer fees before you confirm, so you see costs upfront.

- Remitly offers flexible fees based on payment method, amount, and speed.

- Wise uses the mid-market rate with no markup, so costs are more predictable.

- Remitly sometimes includes fees in the exchange rate and may offer special rates for new users.

- Remitly provides a clear fee breakdown and real-time tracking, making it easier for you to follow your transfer.

Remitly fees can change depending on how you pay and how fast you want the money to arrive. Always review the total cost before you send money. This helps you avoid surprises and choose the best option for your needs. Remitly stands out among remittance services for its transparency, but you should compare it with other providers to find the best deal for your international money transfer.

Transfer costs to India explained

Amount-based fees

You pay different transaction fees when you send money to India with Remitly. The amount you send decides how much you pay. If you send less than $1,000, Remitly charges a $3.99 transaction fee. If you send $1,000 or more, you do not pay a transfer fee. This rule helps you save money when you send larger amounts.

Remitly also gives new users their first transfer free. You can use this offer to try the service without paying a transaction fee. Always check the latest fee details before you send money. Remitly updates its fees from time to time.

Here is a quick look at the current fee structure:

| Amount Sent (USD) | Transaction Fee (USD) |

|---|---|

| $1 - $999 | $3.99 |

| $1,000+ | $0.00 |

Note: The transaction fee does not include the exchange rate markup. You should always check the total cost before you send money.

Express vs Economy

Remitly gives you two main delivery speeds: Express and Economy. Each option has its own transaction fee and delivery time. You can choose the one that fits your needs.

- Express: This option sends money fast. Your recipient can get the money in minutes. You pay a higher transaction fee for this speed. If you use a debit card or credit card, the transfer happens quickly, but the cost goes up.

- Economy: This option takes longer. Your recipient may get the money in three to five business days. You pay a lower transaction fee. If you use a bank account, you save money, but the transfer takes more time.

Here is a table to help you compare:

| Delivery Speed | Payment Method | Typical Fee | Delivery Time |

|---|---|---|---|

| Express | Debit/Credit Card | Higher | Minutes |

| Economy | Bank Account | Lower | 3-5 business days |

You should pick Express if you need to send money fast. Choose Economy if you want to save on transaction fees.

Delivery options

Remitly offers several ways for your recipient to get the money. You can choose the delivery option that works best for your family or friends in India.

- Bank deposit: Remitly sends money directly to your recipient’s bank account. Many people use this option for international money transfers because it is safe and easy.

- Cash pickup: Your recipient can pick up cash at a partner location. Remitly works with many banks and agents in India. This option is helpful if your recipient does not have a bank account.

- Mobile wallet: Some people use mobile wallets to receive money. Remitly supports this option in some cases.

Each delivery option may have its own transaction fee or limit. You should check the details before you send money. Some options may cost more or take longer.

Tip: Always review the delivery options and their costs. This helps you avoid extra charges and choose the best way to send money.

Remitly makes it easy to see all transfer costs to India before you confirm your transfer. You can compare the transaction fee, delivery speed, and delivery method. This helps you make smart choices and avoid surprises. Many remittance services offer similar features, but Remitly stands out for its clear fee structure and flexible options for international money transfer.

How to send money to India

Image Source: pexels

Account setup

To start sending money, you need to create a Remitly account. Visit the Remitly website or download the app. You enter your email address and set a password. Remitly may ask for your phone number to help keep your account secure. If you already have an account, you can log in with your details.

Tip: Use a strong password and keep your login information safe. This helps protect your money and personal data.

Remitly may also ask you to verify your identity. You might need to upload a photo ID or answer some questions. This step follows regulations and keeps your transfers secure.

Entering recipient details

After you set up your account, you enter the recipient’s information. You need to provide the recipient’s full name as it appears on their bank account or ID. For bank deposits, you enter the bank name, account number, and IFSC code. If you want to send money to a UPI ID or mobile wallet, you enter those details instead.

You can save recipient details for future transfers. This makes sending money to India faster next time.

Note: Double-check all recipient information. Mistakes can delay your transfer or send money to the wrong person.

Confirm and send

Once you enter the recipient’s details, you follow these steps to confirm and send money to India securely:

- Choose your payment method, such as bank transfer, debit card, or credit card.

- Review the exchange rate, fees, and the total amount your recipient will get.

- Complete any required identity verification steps if prompted.

- Confirm the transaction to start the transfer.

- Track your transfer in real time until your recipient receives the funds.

Remitly shows you all costs before you send money. You can see the delivery time and track the status online. This process helps you stay informed and confident when sending money.

Money transfer process step by step

Choose transfer speed

When you start a money transfer with Remitly, you first pick how fast you want the money to arrive. Remitly gives you two main choices: Express and Economy. Express delivers funds within minutes, which is helpful if your recipient needs money right away. Economy takes 3 to 5 business days but costs less. The speed you choose affects both the fee and the exchange rate you get.

Here is a table to help you compare:

| Transfer Speed | Delivery Time | Cost Impact | Exchange Rate Impact |

|---|---|---|---|

| Express | Minutes | Higher fees | Less favorable rate |

| Economy | 3-5 business days | Lower fees | More favorable rate |

Tip: If you want to save money, choose Economy. If you need to send money to india quickly, pick Express, but expect higher fees.

Select payment and delivery

After you choose the speed, you select how to pay and how your recipient will get the money. Remitly lets you pay by bank transfer, debit card, or credit card. Bank transfers usually have lower fees, while card payments cost more but can be faster.

You also pick the delivery method. Your recipient can get a bank deposit, cash pickup, or mobile wallet transfer. Bank deposits are direct and simple. Cash pickup works well if your recipient does not have a bank account. Mobile wallets add flexibility for some users.

| Aspect | Options Available | Influence on Transfer Process |

|---|---|---|

| Payment Methods | Bank transfer, Debit/Credit card | Bank transfer is cheaper, cards are faster but cost more |

| Delivery Methods | Bank deposit, Cash pickup, Mobile wallet | Bank deposit is direct, cash pickup offers physical access |

Note: Always check the fees and delivery times for each option before sending money.

Track your transfer

Once you finish sending money, Remitly helps you track your money transfer every step of the way. You get a tracking number after you start the transfer. You can log in to your Remitly account on the app or website to see real-time updates. Remitly also sends email and SMS notifications to both you and your recipient.

Here is how you can track your transfer:

- Log in to your Remitly account.

- Go to the ‘Track Your Transfer’ section.

- Enter your transaction ID if needed to see updates.

If you have questions, Remitly offers 24/7 customer support by phone, email, or live chat. This way, you always know where your money is during the transfer process.

Fee calculation and examples

Sample scenarios

You can better understand Remitly’s fees by looking at real-world examples. Suppose you want to send $500 from the USA to a bank account in India. Remitly charges a flat fee of $3.99 for this amount. The exchange rate you get will include a small margin above the mid-market rate. For example, if the mid-market rate is 83.00 INR per USD, Remitly might offer you 82.58 INR per USD. This means your recipient will get fewer rupees for each dollar you send.

Here is a table to help you see how the costs add up:

| Transfer Scenario | Transfer Fee (USD) | Exchange Rate (USD to INR) | Notes |

|---|---|---|---|

| Sending $500 to a bank account in India | $3.99 | 82.58 (example) | Rate includes a margin above mid-market |

| Sending $1,200 to a bank account in India | $0.00 | 82.58 (example) | No fee, but exchange rate margin applies |

Note: Remitly always applies an exchange rate margin, even when you do not pay a transfer fee. The exact rate appears in the app at the time of your transfer.

Checking total costs

Remitly makes it easy for you to see the total cost before you send money. After you enter the recipient’s details and choose your payment method, Remitly shows you the transaction fee and the exchange rate. You see exactly how much your recipient will get in Indian rupees. This information appears before you confirm the transfer.

You should always review these details. Remitly locks in the exchange rate for your transaction, so you know the final amount. This transparency helps you avoid surprises and make informed choices.

Tip: Always compare the exchange rate Remitly offers with the current mid-market rate. This helps you understand the real cost of your transfer and ensures your recipient gets the most value.

Hidden fees and tips

Avoiding extra charges

You want to make sure your money goes as far as possible when you send it to India. Remitly charges a $3.99 fee for transfers under $1,000 USD. This fee disappears for your first transfer or if you send $1,000 USD or more. Sometimes, Remitly offers a special exchange rate for your first transfer up to $2,999 USD. If you send more than this, you may see a higher markup on the exchange rate. Using a credit card adds an extra 3% fee, which can make your transfer more expensive. Sending larger amounts at once can help you save on fees and sometimes get a better exchange rate. Always compare Remitly’s rates with the mid-market rate to see if you are getting a good deal.

International bank transfers through the SWIFT network can also bring hidden costs. Intermediary banks may take out extra fees, so your recipient gets less money. You can avoid these charges by choosing services that do not use SWIFT for transfers to India. Some remittance services offer direct transfers that skip these extra steps and costs.

Tip: Review all fees and exchange rates before you send money. This helps you avoid surprises and ensures your recipient gets the most value.

Best practices

You can follow some simple steps to keep your costs low and your transfers smooth. Currency conversion fees can range from 1% to 3% of your transfer amount. Remitly locks in the exchange rate when you send money, so you know exactly how much your recipient will get. Always check the fee structure and exchange rate before you confirm your transfer.

Here are some best practices to follow:

- Bundle your transfers. Sending larger amounts at once reduces fixed fees.

- Choose slower transfer speeds if you do not need the money to arrive right away. Slower transfers often cost less.

- Compare exchange rates and fees with other providers before sending money.

- Pick the delivery method that fits your recipient’s needs. Options include mobile wallet, bank deposit, debit card deposit, and sometimes home delivery.

- Avoid using USD-dispensing ATMs in India. These machines often charge high withdrawal fees and offer poor exchange rates.

Note: Making smart choices about how and when you send money can help you save more and make the process easier for your recipient.

Transfer speed and limits

Delivery times

When you send money to India with Remitly, you can choose how fast your transfer arrives. Remitly offers two main speeds: Express and Economy. Express transfers usually reach your recipient in a few minutes or sometimes a few hours. This speed works well if your recipient needs money quickly. Economy transfers take longer. Your recipient may wait several hours or even a few days. The exact time depends on the delivery method you select and the payment method you use. Remitly does not give a specific average time for each speed, but you will see an estimated delivery window before you confirm your transfer. Always check this estimate so you know when your recipient can expect the money.

Tip: Express transfers cost more but arrive faster. Economy transfers save you money but take longer.

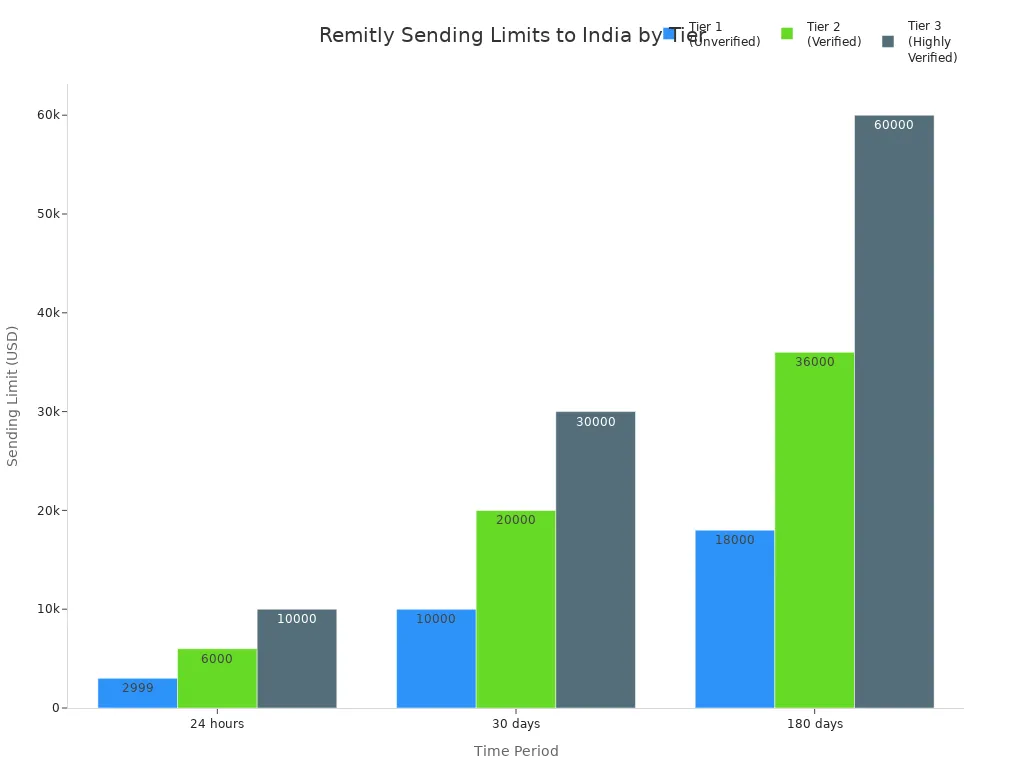

Sending limits

Remitly sets limits on how much money you can send to India. These limits depend on your verification level. If you have not verified your account, you can send up to $2,999 in 24 hours. If you complete more verification steps, your daily limit can increase to $6,000 or even $10,000. Over 30 days, you can send up to $30,000 if you reach the highest verification tier. Remitly asks for more documents as you move up each tier. You may need to provide your full Social Security Number, a government-issued photo ID, and proof of your address.

Here is a table that shows the sending limits for each verification tier:

| Time Period | Tier 1 (Unverified) | Tier 2 (Verified) | Tier 3 (Highly Verified) |

|---|---|---|---|

| 24 hours | $2,999 | $6,000 | $10,000 |

| 30 days | $10,000 | $20,000 | $30,000 |

| 180 days | $18,000 | $36,000 | $60,000 |

You can increase your limit by uploading the required documents in your Remitly account. Remitly reviews your request and responds within 48 hours. Limits may change based on your country, so always check your account for the latest information.

Note: Higher verification gives you more flexibility and security when sending larger amounts. Always keep your documents ready if you plan to send more money.

Remitly vs other money transfer services

When you choose a transfer service for sending money to India, you want to know how Remitly compares to other popular options. Here, you will see how Remitly stands against Wise, Western Union, and Xoom. Each transfer service has its own strengths, fees, and features. This comparison helps you pick the best option for your needs.

Wise

Wise is a well-known transfer service for international money transfers. Wise uses the mid-market exchange rate, so you do not pay a markup. You pay a small, clear fee that starts at 0.29%. Wise often delivers money instantly or within 24 hours for most transfers. You can send up to $1,000,000, which is much higher than Remitly’s limit. Wise supports bank transfers, ACH, and card payments.

| Aspect | Wise | Remitly |

|---|---|---|

| Exchange Rates | Uses mid-market exchange rate (no markup) | Applies a markup on exchange rates |

| Fees | Transparent, starting from 0.29% | Variable fees depending on transfer speed |

| Transfer Speed | Over 50% instant, 90% within 24 hours | Express can be instant; Economy takes 3-5 days |

| Transfer Limits | Up to $1,000,000 | $25,000-$30,000 (with extra verification) |

| Payment Methods | Bank, ACH, debit/credit cards | Bank, debit/credit cards |

Wise helps you save money on large transfers because of its low fees and real exchange rates. Remitly gives you fast Express options and 24/7 support, which many users find helpful for personal remittances.

Western Union

Western Union is a global transfer service with a huge network. You can send money for cash pickup at over 500,000 locations worldwide, including India. Western Union charges higher fees and a 2-4% exchange rate markup. Fees change based on how you pay and how your recipient gets the money. Bank transfers take 1-3 days, but cash pickup is often instant.

| Aspect | Remitly | Western Union |

|---|---|---|

| Fees | Lower fees, 1-2% exchange rate markup | Higher fees, 2-4% exchange rate markup |

| Transfer Speed | Express: minutes; Economy: 3-5 days | Instant cash pickup; bank: 1-3 days |

| Accessibility | Digital-first, no physical branches | 500,000+ cash pickup locations |

| Convenience | Best for digital transfers | Best for instant cash pickup |

Western Union works well if your recipient needs cash and does not have a bank account. Remitly is better for digital transfers and lower costs.

Xoom

Xoom is another transfer service you might consider. Xoom charges higher fees than Remitly and uses marked-up exchange rates. Remitly offers both Express and Economy options, while Xoom focuses on fast transfers. Remitly often matches or beats Xoom’s speed and gives you 24/7 customer support. You also get discounts as a first-time user with Remitly.

| Feature | Remitly | Xoom |

|---|---|---|

| Fees | Lower, transparent; discounts for new users | Higher fees |

| Exchange Rates | Competitive, but with markup | Marked-up rates |

| Transfer Options | Express and Economy | Fast transfers |

| Transfer Speed | Fast; often matches or exceeds Xoom | Fast, but sometimes slower |

| Customer Support | 24/7 support | Not always available |

| First-Time Discounts | Yes | No |

If you want a transfer service with lower fees and strong support, Remitly is a good choice. Xoom may work if you need a fast money transfer, but you will likely pay more.

When you send money to India with Remitly, you face different fees based on your payment method, delivery speed, and the currencies involved. You pay a flat transfer fee, an exchange rate markup, and sometimes extra charges from banks or card issuers. Always check the total cost before sending money. This helps you avoid surprises and choose the best option for sending money.

To get started, you can sign up on Remitly, verify your identity, link a payment method, enter recipient details, pick Express or Economy, and complete your transfer.

FAQ

What is the minimum amount you can send to India with Remitly?

You can send as little as $1 USD to India with Remitly. The platform does not set a high minimum, so you can transfer small amounts if needed. Always check the current exchange rate before you send money.

Does Remitly have a maximum transfer limit for India?

Yes. Remitly sets daily and monthly limits based on your verification level. For example, you can send up to $2,999 USD in 24 hours without extra verification. Higher limits require you to provide more documents.

How long does a Remitly transfer to India take?

Express transfers usually arrive within minutes. Economy transfers can take 3 to 5 business days. The delivery time depends on your payment method and the delivery option you choose.

Can you cancel a Remitly transfer after sending?

You can cancel your transfer if Remitly has not yet delivered the money. Log in to your account, find the transfer, and select “Cancel.” If the money has already arrived, you cannot cancel the transaction.

Are there any hidden fees when sending money to India with Remitly?

Remitly shows you all fees and the exchange rate before you confirm your transfer. Some banks in India may charge a receiving fee. Always review the total cost and check with your recipient’s bank for possible extra charges.

Ordering checks online saves money, but high bank fees for global payments can diminish your savings. BiyaPay’s EasyCard simplifies transactions across 190+ countries with no annual fee, perfect for cost-conscious users. The BiyaPay app supports real-time conversion of 30+ fiat currencies and 200+ cryptocurrencies. Unlike services like Remitly, which charge up to 3% exchange rate markups and $3.99 for transfers under $1,000, BiyaPay provides transparent exchange rates, a low 0.5% remittance fee, far lower than traditional bank fees. Whether paying suppliers or using PayPal, EasyCard ensures secure, compliant transactions. Setup is quick, empowering effortless financial management. Trusted by over 500,000 users, BiyaPay eliminates costly banking barriers. Ready to optimize your global payments? Sign up for BiyaPay now and save on every transfer!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.