- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

10 Business Bank Accounts Every Startup Should Know About

Image Source: unsplash

Choosing the right bank account for your start-up can make or break your journey as a founder. Research shows that about 38% of start-ups fail because of financial problems, like poor cash management services or not using the best business bank accounts for their needs. When you pick from the best banks for startups, you get more than just a place to keep your money. You unlock business banking platform tools, free business checking, and business lines of credit that help you grow. The best business bank accounts and business bank accounts for start-ups offer features designed for startup founders who want smooth startup banking and easy business banking services. With so many options, from startup accounts to business checking accounts and business savings accounts, you need to focus on what matters most for your business. The right choice in bank accounts for startups, like those offered by the best startup banks and startup banking platforms, gives startup founders access to free business checking, business lines of credit, and cash management services. Financial institutions now create business bank accounts for start-ups that support your unique needs, from free business checking to business lines of credit and even startup business loans. As a startup founder, you deserve a startup business account that grows with you.

Key Takeaways

- Choosing the right business bank account helps your startup manage money better and supports growth.

- Look for accounts with free business checking, low fees, and useful tools like cash management and software integrations.

- Digital-first banks offer easy online access, fast setup, and helpful features for remote teams and tech startups.

- Keep personal and business finances separate by opening a dedicated business bank account to avoid tax and legal issues.

- Compare fees, transaction limits, and extra services before picking a bank to find the best fit for your startup’s needs.

Best Business Bank Accounts for Startups

Image Source: pexels

Choosing the best business bank accounts for your start-up can feel overwhelming. You want a bank account that fits your needs, supports your growth, and gives you the right tools. Many startup founders look for free business checking, easy integrations, and strong cash management services. Let’s explore the top 10 business bank accounts for start-ups in 2025. Each one offers something special for early-stage and growing companies.

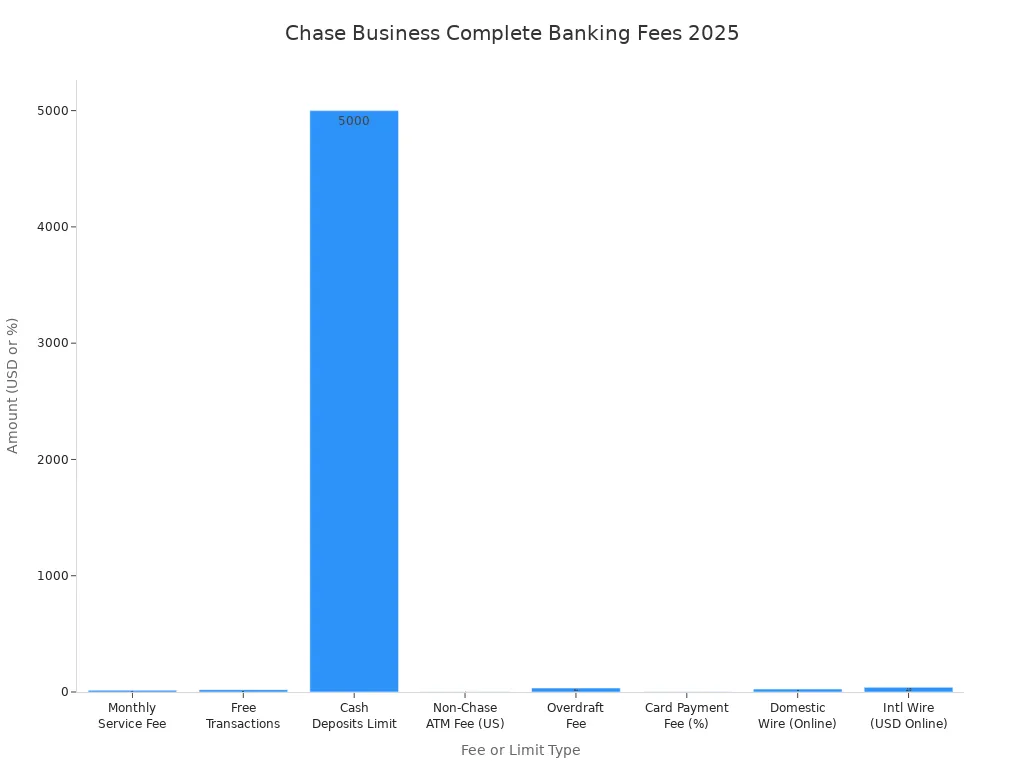

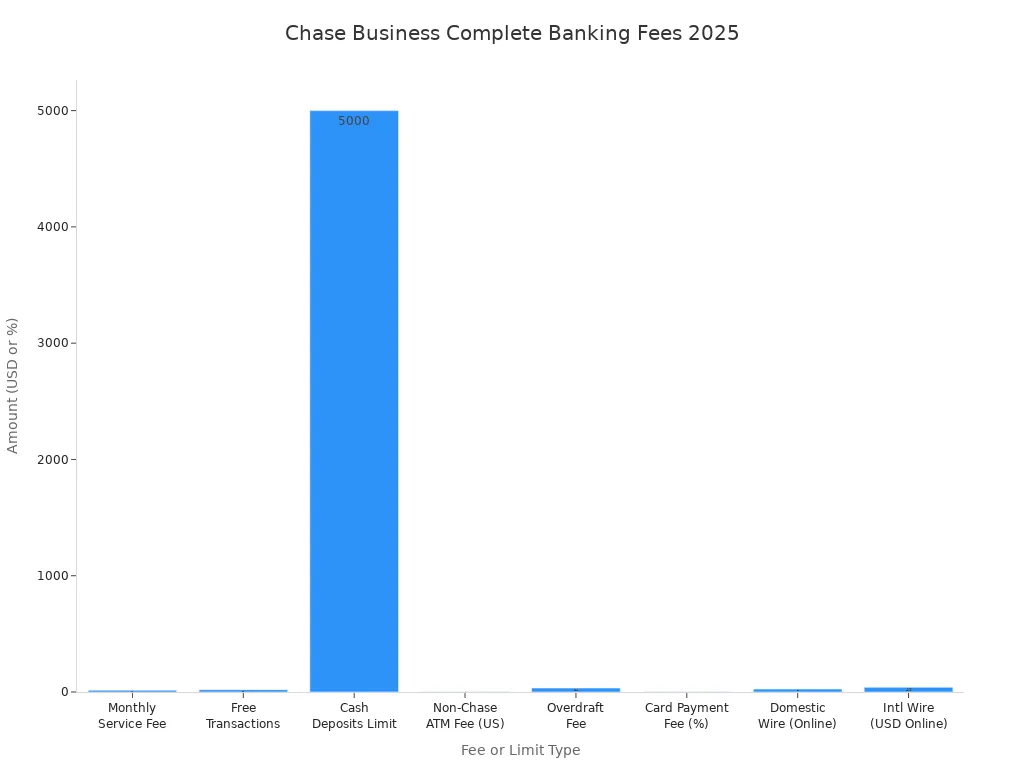

Chase Business Complete Banking

Chase stands out as one of the best banks for startups. You get a full-service business banking platform with both online and in-person support. Chase offers free business checking for the first 20 transactions each month. If you keep a $2,000 minimum daily balance or meet other criteria, you can avoid the $15 monthly fee. You can deposit up to $5,000 in cash each month for free. After that, you pay $2.50 for every $1,000. Chase also gives you access to business lines of credit, business savings accounts, and a wide network of ATMs. Many startup founders choose Chase for its strong reputation and easy access to business banking services.

| Fee/Limit Type | Details |

|---|---|

| Monthly Service Fee | $15; waivable by meeting one of several criteria (e.g., $2,000 minimum daily balance, $2,000 in eligible deposits, linked Chase accounts, military status) |

| Free Transactions | 20 free transactions per month; fees apply beyond this limit |

| Cash Deposits | Up to $5,000 in-branch cash deposits free; fees apply above this limit |

Mercury Business Bank Account

Mercury is a favorite among tech-focused startup founders. You get a digital-first business banking platform with no monthly fees, no minimum balances, and no transaction fees. Mercury supports free business checking and business savings accounts. You can open your bank account online in less than a week. Mercury offers advanced cash management services, including high-yield Treasury accounts with up to 5.42% annual returns. You also get access to business lines of credit and venture debt, which help you grow without giving up equity. Mercury’s integrations with QuickBooks and other tools make it easy to manage your finances. The platform is remote-friendly, so your team can work from anywhere.

Tip: Mercury gives you virtual and physical debit cards, automated bill pay, and custom permissions for your team. This makes expense management simple for busy startup founders.

Brex Business Account

Brex is built for fast-growing startups that want automation and flexibility. You get free business checking with no monthly fees or minimums. Brex connects with QuickBooks, Xero, NetSuite, and payroll systems like Gusto and Deel. You can automate bill payments, track expenses in real time, and use AI-powered tools for easy reconciliation. Brex also offers business lines of credit and startup-specific credit cards with rewards on common expenses. The platform supports API access, so you can build custom payment solutions. Many startup founders love Brex for its seamless integrations and strong cash management services.

- Brex integrates with:

- QuickBooks Online, Xero, NetSuite

- Payroll tools like Gusto, Rippling, Deel

- Slack for fast notifications

- Zapier for no-code automation

Bluevine Business Checking

Bluevine is one of the best startup banks for free business checking. You pay no monthly fees and get unlimited transactions. Bluevine offers high interest rates on your balance—up to 3.7% APY for Premier accounts. You can open sub-accounts to organize your money for taxes, payroll, or expenses. Bluevine supports integrations with QuickBooks and provides business lines of credit and invoice factoring. There are no overdraft fees, and you can use over 37,000 fee-free ATMs. Bluevine is great for startups that want to earn interest and keep costs low.

| Plan Name | APY (Annual Percentage Yield) | Balance Cap for Interest | Overdraft Fees | Monthly Fees | Additional Notes |

|---|---|---|---|---|---|

| Standard | 1.5% | Up to $250,000 | None | None | Earn interest by spending $500+/month with Bluevine debit or cashback Mastercard |

| Plus | 2.7% | Up to $250,000 | None | First month free, then waived if minimum balance maintained | |

| Premier | 3.7% | Up to $3,000,000 | None | First month free, then waived if minimum balance maintained |

Rho Business Banking

Rho gives you a business banking platform that combines banking, corporate cards, and cash management services. You get free business checking, no monthly fees, and unlimited transactions. Rho offers automated bill pay, real-time expense tracking, and flexible approval workflows. You can invest extra cash in U.S. Treasury Bills for higher returns. Rho integrates with QuickBooks, Xero, and NetSuite, making it easy to sync your bank account with your accounting software. Many startup founders use Rho to manage business lines of credit and keep their finances organized.

- Rho features:

- Unlimited virtual and physical cards with spending controls

- Fee-free international wires and same-day transfers

- Automated invoice and payment processing

- Built-in security with two-factor authentication

Bank of America Business Advantage

Bank of America is a trusted choice for many start-up founders. You get a full suite of business banking services, including free business checking if you meet certain conditions. To avoid monthly fees, you can keep a minimum balance or use your business debit card for $500 in purchases each month. Bank of America offers business lines of credit, business savings accounts, and tools like Cash Flow Monitor and Erica, the virtual assistant. You can integrate your bank account with QuickBooks and use Zelle for fast payments. The bank supports both in-person and digital banking, which helps you stay flexible.

- To open an account, you need to:

- Be a U.S. resident and own at least 25% of the business or be an authorized officer

- Submit required documents within 11 days

- Authorize a credit check

PNC Business Checking

PNC is one of the best banks for startups that want flexible options. You can open a bank account with as little as $100. PNC offers several business checking accounts, each with waivable monthly fees. For example, you can avoid the $12 fee by keeping a $500 average monthly balance or using a linked credit card. PNC gives you access to free business checking, business lines of credit, and strong online and mobile banking features. Many startup founders like PNC for its easy-to-use digital tools and competitive fees.

Note: PNC’s fee waiver options are flexible, and you can choose the account that fits your business size and needs.

Truist Business Checking

Truist supports remote teams with a modern business banking platform. You get free business checking, fast onboarding, and a unified online banking experience. Truist uses cloud technology for quick account opening and e-signatures. You can pay vendors and employees using Zelle, wire transfers, or ACH payments. The Business Admin feature lets you manage team access and permissions. Truist also offers fraud monitoring and mobile check deposit, so you can handle your finances from anywhere. Many startup founders choose Truist for its digital-first approach and strong support for distributed teams.

- Truist features:

- Online payroll services with automatic tax calculations

- Customizable roles for team members

- Real-time fraud monitoring and alerts

American Express Business Checking

American Express offers a digital-first business bank account with no monthly fees or minimum balance requirements. You earn 1.30% APY on balances up to $500,000, which is rare for business checking accounts. You get unlimited free business checking transactions and access to thousands of free ATMs. American Express gives you a welcome bonus and a free cash-flow management app called Business Blueprint. You can integrate your bank account with QuickBooks and track your finances in real time. Many technology startups pick American Express for its strong digital tools, 24/7 support, and cost-saving features.

- Main advantages:

- No overdraft fees

- 24/7 virtual customer support

- Seamless integration with business software

Novo Business Checking

Novo is a top choice for e-commerce startups and small businesses. You get free business checking with no monthly fees or minimum deposits. Novo supports integrations with QuickBooks, Stripe, Square, PayPal, Amazon, eBay, and Etsy. You can use Novo Boost to get faster access to your funds from Stripe, Square, and PayPal. Novo offers up to 20 reserve accounts to help you set aside money for taxes or big expenses. The platform gives you unlimited invoicing and a centralized view of your finances. Many startup founders love Novo for its easy integrations and cost-effective banking.

| Feature/Integration | Description |

|---|---|

| App Integrations | Connects with QuickBooks, Slack, Xero, Stripe, Square, PayPal, Amazon, eBay, Etsy, and more |

| Novo Boost | Faster access to funds from Stripe, Square, and PayPal |

| Express ACH | Same-day ACH payments for quick transfers |

| Reserve Accounts | Up to 20 reserve accounts for budgeting |

| Unlimited Invoicing | Create, send, and track invoices for free |

| Centralized Financial View | See all sales, returns, and discounts in one place |

| No Fees | No monthly fees or minimum deposits; ATM surcharge refunds |

Tip: Novo’s app marketplace helps you connect all your business tools in one place, making it easier to manage your start-up’s finances.

You have many choices when it comes to bank accounts for startups. The best business bank accounts for start-ups offer free business checking, easy integrations, and strong cash management services. Whether you want a traditional bank or a digital-first business banking platform, you can find a bank account that fits your needs. Many startup founders open more than one bank account to manage risk and keep their finances clear. Look for business lines of credit, business savings accounts, and tools that help you grow. The best startup banks and financial institutions now design business bank accounts for start-ups with your unique needs in mind.

Business Bank Account Comparison

Image Source: unsplash

Features Overview

When you look for a business bank account, you want to see what each option offers. Some accounts focus on digital tools, while others give you in-person support. Here’s a quick table to help you compare the main features of the top 10 bank accounts for startups:

| Bank Account | Digital/Traditional | Free Business Checking | Interest (APY) | Integrations & Extras |

|---|---|---|---|---|

| Chase | Traditional | Yes (limits apply) | None | QuickBooks, merchant services |

| Mercury | Digital | Yes | Up to 5.42% | QuickBooks, virtual cards |

| Brex | Digital | Yes | None | QuickBooks, payroll, API access |

| Bluevine | Digital | Yes | Up to 3.7% | QuickBooks, sub-accounts |

| Rho | Digital | Yes | None | QuickBooks, treasury tools |

| Bank of America | Traditional | Yes (with conditions) | None | QuickBooks, Zelle, virtual assistant |

| PNC | Traditional | Yes (with conditions) | None | QuickBooks, mobile banking |

| Truist | Digital | Yes | None | Payroll, fraud monitoring |

| American Express | Digital | Yes | 1.30% | QuickBooks, 24/7 support |

| Novo | Digital | Yes | None | QuickBooks, Stripe, reserve accounts |

Tip: Digital-first accounts often give you more integrations and easy access to cash management services.

Fees and Costs

You want to keep costs low as a start-up. Most business bank account options offer free business checking, but some have monthly fees you can waive. Here’s a quick look at what you might pay:

| Bank Account | Monthly Fee (Waivable) | Free Transactions | Notes on Fees |

|---|---|---|---|

| Chase | $15 | 20 | Waive with $2,000 balance |

| Mercury | $0 | Unlimited | No wire/ACH fees |

| Brex | $0 | Unlimited | No transaction fees |

| Bluevine | $0 | Unlimited | Fees for cash deposits |

| Rho | $0 | Unlimited | No cash deposits |

| Bank of America | $16 | 200 | Waive with $5,000 balance |

| PNC | $12 | Varies | Waive with $500 balance |

| Truist | $0 | Unlimited | No monthly fee |

| American Express | $0 | Unlimited | No overdraft fees |

| Novo | $0 | Unlimited | ATM fee refunds |

Monthly fees for a business bank account usually range from $0 to $16. You can often avoid these fees by keeping a minimum balance or using your account for regular transactions. Online banks tend to offer unlimited free business checking and fewer extra charges.

Best-Use Cases

Not every bank account fits every start-up. You want to match your needs to the right business banking platform. Here’s a quick guide:

| Bank Account | Best For | Business Lines of Credit | Startup Founders’ Favorite Feature |

|---|---|---|---|

| Chase | In-person banking, large networks | Yes | Branch access, scalable accounts |

| Mercury | Tech startups, remote teams | Yes | Digital tools, high APY |

| Brex | High-growth SaaS, e-commerce | Yes | Integrations, business lines of credit |

| Bluevine | Startups wanting high interest | Yes | Free business checking, sub-accounts |

| Rho | Teams needing spend management | Yes | Treasury tools, unlimited transactions |

| Bank of America | Startups needing full-service banking | Yes | Cash Flow Monitor, business lines of credit |

| PNC | Flexible options, small businesses | Yes | Low opening deposit, digital tools |

| Truist | Remote teams, digital-first startups | Yes | Payroll, fraud monitoring |

| American Express | Tech startups, digital-first founders | Yes | High APY, 24/7 support |

| Novo | E-commerce, online businesses | Yes | Fast payouts, app integrations |

Note: Many financial institutions now design their business bank account products to help you grow with features like business lines of credit and free business checking. As a startup founder, you should always compare options to find the best fit for your business checking accounts and startup banking needs.

Reviews of Bank Accounts for Startups

Chase Business Complete Banking

You get a business bank account with strong branch access and digital tools. Chase gives you 20 free transactions each month and waives the $15 monthly fee if you keep a $2,000 balance. Many startup founders like the fast check deposit processing. However, you should watch for new fees as regulations change. Some common complaints include:

- New fees for services that used to be free

- Caps on late and overdraft fees

- Higher banking costs for startups

- Identity theft risks from internal staff

You might want to ask other business owners about their experiences or consider credit unions for better customer orientation.

Mercury Business Bank Account

Mercury offers a digital-first bank account with no monthly fees and easy online setup. You can open your account quickly and manage everything online. Startup founders enjoy the integrations with QuickBooks and the high-yield options for large balances. However, Mercury’s user satisfaction is lower than some competitors. You may find the interface complicated, check deposits slow, and support limited. Other banks like Brex and Rho offer faster support and more user-friendly features.

Brex Business Account

Brex gives you a business bank account with no monthly fees, unlimited transactions, and strong automation. You can earn up to 3.99% APY with their money market fund. The table below shows what startup founders like and dislike:

| Pros | Cons |

|---|---|

| No minimum deposit, no monthly fees | No physical branches |

| High interest rate, FDIC insurance | No ATM access, no cash deposits |

| Unlimited transactions, rewards credit card | Only for incorporated businesses |

You get great integrations and 24/7 support, but you cannot deposit cash.

Bluevine Business Checking

Bluevine gives you a bank account with no monthly fees and high interest rates. You can open sub-accounts and use over 37,000 ATMs. Some startup founders report slow or inconsistent customer support, especially outside weekday hours. Priority support is only for Premier Plan users.

Rho Business Banking

Rho offers a digital bank account with unlimited transactions and no monthly fees. You get accounting automation, expense management, and bill pay tools. Integrations with QuickBooks and other platforms save you time. Startup founders value these features for managing cash flow and automating finance tasks.

Bank of America Business Advantage

You get a traditional bank account with digital tools and in-person support. Bank of America waives fees if you meet balance or spending requirements. You can use business lines of credit and integrate with QuickBooks. Startup founders like the Cash Flow Monitor and virtual assistant.

PNC Business Checking

PNC gives you flexible bank account options with low opening deposits. You can avoid monthly fees by keeping a $500 balance. Digital tools and mobile banking make it easy for startup founders to manage money.

Truist Business Checking

Truist supports remote teams with a digital bank account. You get free checking, fast onboarding, and payroll tools. Fraud monitoring and mobile check deposit help you stay secure.

American Express Business Checking

You get a digital-first bank account with no monthly fees and 1.30% APY. Most transactions are free, but outgoing wire transfers cost $25. You cannot deposit cash. You earn rewards on your debit card, but if you need free wire transfers or cash deposits, you may want to look at other options.

Novo Business Checking

Novo gives you a bank account with no monthly fees and strong integrations. You can connect with QuickBooks, Xero, Shopify, Stripe, PayPal, and more. Startup founders use Novo to manage income, expenses, and team communication efficiently.

How to Choose the Best Bank Account

Key Criteria

When you look for a bank account for your startup, you want to focus on what matters most. Financial advisors suggest these five key things to check:

- Connectivity with other banks and accounting systems. This lets you link your bank account to tools like QuickBooks for easy tracking.

- Money movement options. Make sure you can send and receive money using ACH, wire, or real-time payments.

- User permissions. You should be able to set different access levels for your team to keep your money safe.

- Spend controls. Good bank accounts let you set spending limits for employees or vendors.

- Interest on balances. Some banks pay you interest, which helps your money grow while it sits in your account.

Tip: Always check if the bank offers deposit protection, like FDIC insurance, to keep your funds safe.

Matching Features to Startup Needs

Every startup is different. You need a bank account that matches your business style and growth plans. Here are some ways to find the right fit:

- Think about how often you handle cash and how many transactions you make. If you need to visit a branch, a traditional bank may work best. If you work online, a digital bank account could save you time.

- Compare fees, minimum balances, and transaction limits. This helps you avoid extra costs and keeps your cash flow smooth.

- Look for features like interest-earning accounts, cash management tools, and software integrations. These can make your daily work easier.

- If you work with global clients or suppliers, check if the bank supports international payments.

- Make sure the bank has good mobile banking and customer support. Fast help matters when you run into problems.

- Choose a bank that can grow with you. Some banks offer extra products like credit cards and loans as your business expands.

Mistakes to Avoid

Many startup founders make the mistake of mixing personal and business money in one account. This makes taxes and audits hard and can cause problems with investors. Always open a separate business bank account and use it for all business expenses. If you use personal funds for your business, keep clear records. This helps you build business credit, keeps your legal protection strong, and shows banks and investors that you run a serious business.

Choosing the right business bank account helps your startup grow and stay organized. You should think about what matters most for your business. Look at fees, features, and support. Every startup has different needs. Take time to review the list above. Compare your options. Pick the bank account that fits your goals best.

Remember, the right choice now can make your financial life much easier later.

FAQ

What documents do you need to open a business bank account?

You usually need your business registration, employer identification number, and personal ID. Some banks may ask for your business plan or proof of address. Always check with your chosen bank for their full list.

Can you open a business bank account online?

Yes, many banks let you open a business bank account online. You upload your documents and fill out forms on their website. Some banks approve your application in just a few days.

Do business bank accounts offer startup-specific credit cards?

Some business bank accounts give you access to startup-specific credit cards. These cards help you manage expenses and build business credit. Check if your bank offers this feature before you apply.

Are there fees for business bank accounts?

Some banks charge monthly fees, but you can often avoid them by keeping a minimum balance. Many digital banks offer free business checking with no monthly fees. Always read the fee schedule before you choose.

Can you use your business bank account for international payments?

Yes, most business bank accounts support international payments. You can send and receive money in USD or other currencies. Some banks offer better exchange rates or lower fees for global transfers.

As startups expand globally, high remittance fees and cumbersome currency conversions often pose significant challenges, especially with traditional bank accounts that come with hidden costs and slow cross-border services. BiyaPay offers the ideal solution: real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies with seamless flexibility, and remittance fees as low as 0.5% for efficient fund flows. Plus, its quick registration and no-overseas-account-needed investment features make entering the US and Hong Kong stock markets effortless. Visit BiyaPay now to experience these benefits and kickstart your global financial journey! Register today and unlock seamless cross-border payments by visiting BiyaPay!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.