- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

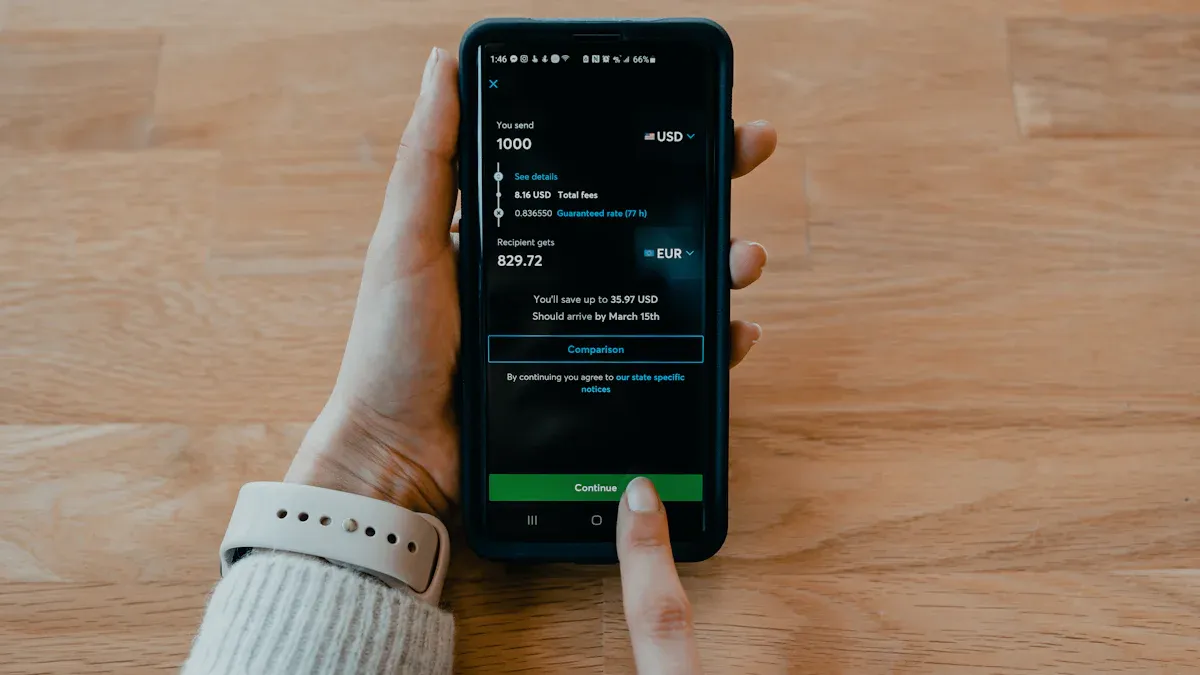

ACH Debit Explained for Beginners

Image Source: unsplash

You may have seen the term ach debit on your bank statement and wondered what it means. Ach debit is a way to electronically withdraw funds from your bank account. Many people use ach debit to pay bills or make a payment for subscriptions. The automated clearing house, or ach, handles these debit transactions between banks. When you use ach debit, you allow a company to pull money directly from your account. This payment method helps you manage regular expenses and avoid missing due dates.

Key Takeaways

- ACH debit lets companies pull money directly from your bank account to pay bills or subscriptions automatically.

- You must give clear permission before any ACH debit happens, and you can stop payments anytime by contacting the company and your bank.

- ACH debit payments usually take one to three business days to process, but some can settle the same day if sent early.

- Using ACH debit saves money on fees and helps avoid late payments by automating regular bills and subscriptions.

- Always check your bank statements for unauthorized ACH debits and report any suspicious activity to protect your money.

What Is ACH Debit?

Image Source: pexels

ACH Debit Definition

You may wonder what an ACH debit really means. ACH debit is a type of electronic payment that lets you allow a business or organization to pull money directly from your bank account. The ACH network, which stands for Automated Clearing House, handles these transactions. When you set up an ACH debit, you give permission for a company to take funds from your account. This process does not use a card. Instead, it uses your bank account and routing numbers. The automated clearing house moves the money between banks safely and efficiently. You often see ACH debit used for regular payments, such as bills or subscriptions. The ACH network processes millions of these transactions every day in the United States.

Common Uses

You use ACH debit for many types of payments. The most common use is for automatic bill payments. For example, you can pay your rent, utilities, or internet service each month using ACH debit. Many people also use ACH debit for subscriptions, such as streaming services or gym memberships. When you shop online, some websites let you pay with an ACH debit instead of a card. Businesses use ACH debit to collect payments from customers, too. The automated clearing house supports several types of ACH transactions, each with its own purpose.

Here are some of the main types of ACH debit payments:

| ACH Debit Payment Type | Description |

|---|---|

| PPD (Prearranged Payment and Deposit) | Used for recurring or single payments like utilities, rent, or mortgages. |

| WEB (Internet-initiated) | Payments authorized online or through mobile apps. |

| TEL (Telephone-initiated) | Payments you authorize over the phone. |

| ARC (Accounts Receivable) | Converts mailed paper checks into ACH debits. |

| BOC (Back Office Conversion) | Converts checks presented in person at a payment location. |

| POP (Point of Purchase) | Converts checks at the store register into ACH debits. |

| RCK (Re-presented Check) | Used when a check bounces due to insufficient funds. |

| CCD (Corporate Credit or Debit) | Used for business-to-business payments. |

| CTX (Corporate Trade Exchange) | Used for business payments with detailed invoice data. |

You can see that ACH debit covers a wide range of payment needs. The automated clearing house makes these transactions possible, whether you pay a bill, shop online, or send money to a business.

Tip: Setting up ACH debit for your regular bills can help you avoid late fees and missed payments.

ACH Debit on Bank Statements

When you check your bank statement, you may notice several ACH debit transactions. Banks label these payments using special codes called Standard Entry Class (SEC) codes. These codes help you understand the type of ACH transaction and where it came from. Some common codes you might see include:

- PPD: Used for bill payments and direct deposits.

- WEB: Used for payments you start online.

- CCD: Used for business-to-business payments.

- ARC: Used when a company converts your mailed check into an ACH debit.

You may also see the name of the company or service next to the code. This helps you track your spending and spot any unauthorized ACH debit activity. Always review your bank statement for unfamiliar ACH transactions. If you see something you do not recognize, contact your bank right away.

How ACH Debit Payment Works

Image Source: unsplash

Authorization Process

Before any ach debit payment can begin, you must give clear permission. This step protects both you and the business. The ach network requires a strict process to make sure your authorization is valid and secure. Here is how you authorize an ach debit:

- You provide your consent. You can do this in writing, online, or even over the phone. For recurring payments by phone, you must give both verbal and written permission. The company may record your verbal approval.

- The business keeps a record of your authorization. They must store this evidence, such as a signed form or audio recording, for at least two years after your authorization ends.

- You give your bank account number, routing number, and account type. This information helps the ach network identify your account.

- The authorization form must show the payment amount, how often the debit will happen, and when it will start.

- The form must also explain how you can cancel or stop the ach debit. You should know how to revoke your permission at any time.

- The business gives you a copy of your authorization. They keep the original for their records.

- If the payment terms change, the business must tell you in advance—usually at least 10 days before the change.

Note: Always read the authorization form carefully. Make sure you understand the amount, timing, and how to stop the ach debit payment if needed.

Transaction Flow

Once you authorize an ach debit, the payment moves through several steps in the ach network. Each step involves a different party. Here is a table that shows who does what during the ach debit process:

| Entity | Role in ACH Debit Payment Flow |

|---|---|

| Originator | Starts the ach debit by getting your authorization and sending payment instructions. |

| Originating Depository Financial Institution (ODFI) | Receives payment instructions from the originator and sends them to the ach operator. |

| ACH Operator | Processes batches of ach entries, clears, and settles transactions between banks. |

| Receiving Depository Financial Institution (RDFI) | Gets the ach entry from the ach operator and posts the debit to your account. |

| Receiver | You, the account holder, who authorizes the debit and whose account is debited. |

| Third-Party Sender (optional) | Sends ach entries for the originator if there is no direct agreement with the ODFI. |

| Third-Party Service Provider (optional) | Helps with ach network tasks, such as file creation or transmission, for any party in the process. |

Here is how the ach debit payment flows step by step:

- You, as the receiver, give authorization to the business (originator) to make a payment.

- The originator sends your payment details to their bank (ODFI).

- The ODFI submits the ach debit to the ach operator for processing.

- The ach operator sorts and processes the payment in batches.

- Your bank (RDFI) receives the payment from the ach operator.

- Your account is debited for the payment amount.

- Sometimes, a third-party sender or service provider helps move the payment through the ach network.

This process makes sure that your ach debit payment is safe and reaches the right place.

Timing and Settlement

The ach network processes millions of payments every day. The timing of your ach debit depends on when the business starts the payment and which type of processing they choose. Most ach debit payments settle within one to two business days. Some payments can settle on the same day if the business submits them before the cutoff time, usually 3:00 PM Eastern Time.

| ACH Payment Type | Typical Settlement Time | Notes on Timing and Cutoff |

|---|---|---|

| Outgoing Next-Day ACH | 1-2 business days | Standard processing time |

| Outgoing Same-Day ACH | By end of same business day | Must be sent before 3pm EST cutoff time |

| ACH Add Funds (incoming) | 1-3 business days (up to 5 days) | Depends on sending institution and timing |

You may notice that ach debit transactions do not process on weekends or holidays. If you make a payment late in the week, it may take longer to settle. The ach network operates Monday through Friday, from 7:30 AM to 6:30 PM Eastern Time. Most ach debit payments finish processing in one or two days, but some can take up to three days if extra verification is needed.

Tip: If you need your ach debit payment to settle quickly, ask the business if they offer same-day ach processing. This can help you avoid late fees or service interruptions.

ACH Debit vs. ACH Credit

Key Differences

You may wonder how ACH debit and ACH credit differ. Both use the ACH network to move money between accounts, but they work in opposite ways. ACH credit is a “push” payment. You, as the payer, tell your bank to send money to someone else. This method is common for paying bills, sending money to friends, or receiving your salary through direct deposit. ACH debit is a “pull” payment. The payee, such as a utility company, pulls money from your account after you give permission. This method is popular for recurring payments like rent, loans, or insurance.

Here is a table to help you see the main differences:

| Aspect | ACH Credit Transaction | ACH Debit Transaction |

|---|---|---|

| Initiator | You (payer) start the payment | Payee (receiver) starts the payment |

| Direction of Funds | Money pushed from your account to payee’s account | Money pulled from your account by payee |

| Common Use Cases | One-time payments, payroll deposits | Recurring bills, loan payments, subscriptions |

| Processing Time | 1-3 business days | Usually within 1 business day |

| Security | You control when and how much to pay | Payee needs your authorization to pull funds |

ACH debit helps you automate payments and avoid missing due dates. ACH credit gives you more control over when you send money.

Note: ACH debit is often faster for recurring payments, while ACH credit is better for one-time transfers.

Control and Initiation

Control over your money is important. With ACH credit, you decide when to send money. You log in to your bank, enter the payee’s details, and push the funds. This process gives you full control and helps you avoid overdrafts.

With ACH debit, the payee starts the transaction. You must first give permission, usually by signing a form or agreeing online. After that, the payee can pull money from your account on the agreed schedule. This setup works well for regular bills, but you need to trust the payee. If you see an unauthorized ACH debit, you can dispute it with your bank.

Here is a quick comparison:

| Feature | ACH Debit | ACH Credit |

|---|---|---|

| Who Starts | Payee (receiver) | You (payer) |

| Money Flow | Pulled from your account | Pushed from your account |

| Authorization | You approve payee to pull funds | You tell bank to send funds |

ACH debit makes life easier by automating payments, but you should always check your bank statements. ACH credit puts you in charge of each payment, which can help you manage your budget.

ACH Debit Transaction Types

One-Time vs. Recurring

You can use an ach debit in two main ways: as a one-time payment or as a recurring payment. When you make a one-time electronic bank payment, you give permission for a single ach debit transaction. This type of debit transaction happens only once. For example, you might pay a mechanic $12.01 for a car repair. After the payment, the business cannot take more money from your account unless you give new permission.

Recurring ach debit transactions work differently. You set up automatic debits that happen on a regular schedule. You give your authorization once, and the business keeps your bank information on file. The ach system then pulls money from your account each time a payment is due. Many people use recurring ach debit for bills, subscriptions, or loan payments. This setup helps you avoid missing payments and makes managing your money easier.

Note: Recurring ach debit payments are popular for services like streaming subscriptions or gym memberships. You do not need to remember each due date because the payment happens automatically.

Typical Examples

You see ach debit used in many parts of daily life. Here are some common examples of both one-time and recurring debit transactions:

- One-time ach debit payments:

- Paying a mechanic for a single car repair

- Making a one-time donation to a charity

- Paying a medical bill after a doctor visit

- Recurring ach debit payments:

- Monthly utility bills, such as electricity or water

- Streaming service subscriptions

- Gym memberships

- Loan or mortgage payments

- Payroll for employees (using CCD codes for business payments)

Businesses often use ach autopay to collect regular payments from customers. When you set up automatic debits, you save time and reduce the risk of late fees. The ach network supports both one-time and recurring debit transaction types, making it flexible for many needs.

| Type of ACH Debit | Example Use Case | SEC Code Used |

|---|---|---|

| One-time | Paying a mechanic $12.01 | PPD |

| Recurring | Monthly streaming subscription | PPD, CCD |

| Recurring (business) | Payroll or vendor payments | CCD |

You can choose the ach debit transaction type that fits your needs. If you want more control, use a one-time payment. If you want convenience, set up recurring automatic debits.

ACH Payment vs. Other Methods

Debit Cards

You may wonder how an ach payment compares to using a debit card. Both methods let you pay directly from your bank account, but they work differently. Debit card payments process almost instantly. You get immediate confirmation when you use your card at a store or online. This speed helps when you need fast payment verification.

ACH payments move through the ach network. They usually take one to three business days to settle. This slower speed can affect your cash flow if you need funds right away. Processing fees also differ. ACH payments often cost between $0.26 and $0.50 per transaction. Debit card payments usually charge a higher fee, often a percentage of the total amount. This difference makes ach payment a better choice for large or recurring payments.

| Aspect | ACH Debit Payments | Debit Card Payments |

|---|---|---|

| Processing Fees | $0.26 to $0.50 per transaction; lower cost | Higher fees, often a percentage |

| Processing Speed | 1-3 business days | Almost instant |

| Fund Source | Bank account | Bank account |

| Dispute Resolution | Less frequent, more complex | More frequent, structured process |

| Suitability | Large or recurring payments | Retail or immediate payments |

Tip: Use ach payment for bills or subscriptions to save on fees. Choose debit cards for quick, one-time purchases.

eChecks

You might see eChecks offered as a payment option. An eCheck works like a digital version of a paper check. You enter your bank account details, and the business processes your payment through the ach network. eChecks are best for one-time payments. They do not store your payment information for future use.

ACH debit and eCheck both use the ach system, but they have key differences. ACH debit is great for recurring payments. The business stores your information and pulls funds on a set schedule. eChecks require extra verification, so they can take up to five business days to process. Fees for eChecks are often higher, especially if a payment bounces.

| Feature | ACH Debit | eCheck |

|---|---|---|

| Payment Type | Recurring | One-time |

| Processing Time | 1-3 business days | 2-5 business days |

| Fees | Lower | Higher, extra for bounced |

| Authorization | Merchant initiates | Customer initiates |

| Info Storage | Stored for future | Not stored |

Note: Choose ach debit for regular bills. Use eChecks for single, occasional payments.

Direct Deposit

Direct deposit is another common ach payment type. You receive money directly into your bank account. Employers use direct deposit to pay salaries. The government uses it for benefits and tax refunds. With direct deposit, the payer pushes funds into your account. You do not need to take any action to receive the payment.

ACH debit works in the opposite way. The business or payee pulls money from your account after you give permission. You use ach debit for paying bills or subscriptions. Direct deposit only adds money to your account, while ach debit withdraws money.

- Direct deposit sends money into your account, like payroll or benefits.

- ACH debit pulls money out, often for bills or services.

- Direct deposit is always a credit transaction.

- ACH payment covers both credits and debits.

Tip: Use direct deposit to receive payments quickly and safely. Use ach debit to automate your regular outgoing payments.

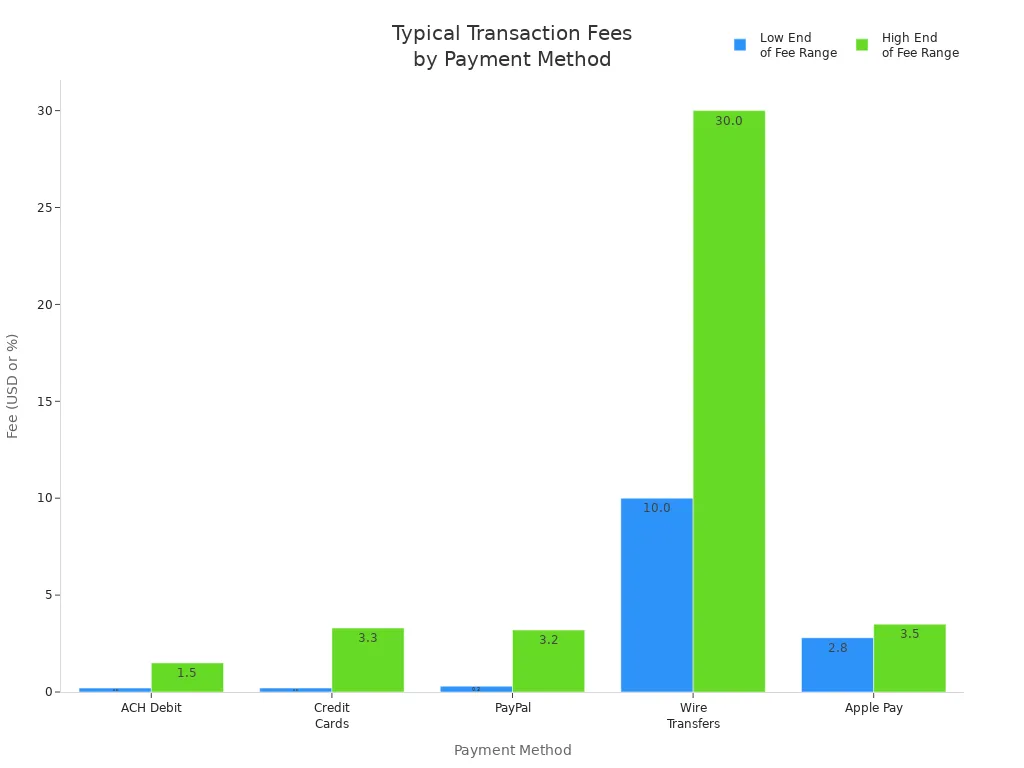

Pros and Cons of ACH Debit

Advantages

You gain several benefits when you use ach debit for your payments and subscriptions. Many people choose this method because it is simple, secure, and cost-effective. Here are some main advantages:

- You pay lower fees. Ach debit usually costs between $0.20 and $1.50 per transaction, much less than credit cards or PayPal.

- You can automate your payments. This helps you avoid late fees and saves you time.

- Ach debit works well for recurring payments, such as utilities or mortgages. The system pulls funds directly from your account, so you do not have to remember each due date.

- You get better cash flow management. Predictable schedules make it easier to plan your budget.

- The ach network uses strong security rules, making your transactions safer than using paper checks.

- Fewer payment failures happen with ach debit. Direct bank account links mean fewer problems with expired cards.

- You help the environment by eliminating paper checks and reducing manual errors.

Here is a table comparing fees for different payment methods:

| Payment Method | Fee Structure | Typical Fee Range | Key Advantages |

|---|---|---|---|

| ACH Debit | Flat fee per transaction | $0.20 - $1.50 | Low cost, secure, great for recurring payments |

| Credit Cards | Percentage + fixed fee | 2% - 3% + $0.20 - $0.30 | Instant, rewards, good for small purchases |

| PayPal | Percentage + fixed fee | ~2.9% + $0.30 | Easy online, widely accepted |

| Wire Transfer | Flat fee, higher than ACH | $10 or more | Fast for large sums |

| Apple Pay | Card processing fees | ~2.8% - 3.5% | Convenient, depends on card fees |

Tip: Businesses that switch from credit card fees to ach debit can save thousands of dollars each year.

Disadvantages

You should also know the drawbacks of using ach debit. While this method is safe and affordable, it does have some limits:

- Ach debit payments can take one to three business days to settle. This is slower than wire transfers or debit cards.

- If you enter the wrong account or routing number, your payment may fail or get delayed.

- Ach debit only works with U.S. bank accounts. You cannot use it for international transfers.

- Banks set transaction limits. You may not be able to send large amounts in one payment.

- If your account does not have enough money, you may face non-sufficient funds (NSF) fees, which can be $25 to $35.

- Fraud can happen if someone gets your account information. You must watch your account for unauthorized debits.

- Same-day ach debit is not always available at every bank.

Note: Always check your account balance before you schedule an ach debit payment.

Safety Tips

You can protect yourself when you use ach debit for your payments. Follow these steps to keep your money safe:

- Double-check your bank account and routing numbers before you authorize any debit.

- Monitor your account often. Look for any payments you do not recognize.

- Keep records of all your ach debit authorizations. Save receipts and emails.

- Review your recurring payments every few months. Make sure you still want each debit.

- Use ach debit blocks if your bank offers them. These blocks stop unauthorized debits before they happen.

- Know your rights. You can cancel an ach debit authorization at any time by contacting your bank and the business.

- Report any suspicious activity right away. Federal law protects you if you report fraud within 60 days.

Tip: Ask your bank about ach debit blocks. These tools let you control which companies can pull money from your account.

ACH debit offers a secure and convenient way to manage payments. You benefit from strong encryption, fraud detection tools, and protections under federal laws. To stay safe, always use ACH authorization forms, monitor your account for unusual activity, and never share your bank details over unsecured networks. Only authorize payments to trusted parties and review your statements regularly. If you spot an unauthorized transaction, contact your bank right away. With these habits, you can use ach debit confidently for your everyday payments.

FAQ

What should you do if you see an unauthorized ACH debit on your account?

You should contact your bank right away. Ask them to investigate the transaction. Most banks can reverse unauthorized debits if you report them within 60 days. Always check your statements to spot problems early.

Can you stop a recurring ACH debit payment?

Yes, you can stop a recurring ACH debit. Contact the business first and ask them to cancel the payment. Then, tell your bank to block future debits from that company. Keep records of your requests for your protection.

How long does it take for an ACH debit to process?

Most ACH debit payments process in one to three business days. Some banks offer same-day processing if you submit your payment early. Payments do not process on weekends or holidays, so plan your payments ahead of time.

Is ACH debit safe to use for paying bills?

ACH debit uses strong security rules. Banks and the ACH network protect your information with encryption and fraud detection. You should only give your bank details to trusted companies. Always review your account for unusual activity.

Where can you find more answers to common ACH debit questions?

You can check your bank’s website or ask their customer service team. Many banks have an ach debit faq page online. You can also visit the official ACH network website for more information.

While ACH debit simplifies bill payments, high fees and the complexity of cross-border transactions can complicate your financial management. BiyaPay offers a better alternative: real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies with seamless flexibility, and remittance fees as low as 0.5% for efficient fund flows. Plus, its quick registration and no-overseas-account-needed US/HK stock investment features add versatility to your global payment needs. Visit BiyaPay now to explore these benefits and streamline your payment process! For hassle-free bill payments or international transfers, start with BiyaPay today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.