- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best online payment pros and cons you should know

Image Source: unsplash

You have many online payment services to choose from when selecting payment solutions for your business. The best online payment options include Stripe, PayPal, Alipay, Apple Pay, and Google Pay, each with a strong global presence. Many businesses also turn to UPI for India, Pix in Brazil, and M-PESA across Africa. The table below shows leading online payment services by global transaction volume or user base in 2024. Choosing the right payment options can increase customer satisfaction and boost conversion rates, making these online payment services some of the best online payment solutions available.

| Payment Provider / Platform | Key Metric(s) | Description / Notes |

|---|---|---|

| Stripe | $1 trillion+ total payment volume (2023) | Leading global payment processor |

| PayPal | Includes Venmo with 90M+ active US users | Broad ecosystem, high conversion rates |

| Alipay | Widely used digital wallet | Major player in Asia and globally |

| Apple Pay | Widely used digital wallet | Popular on Apple devices |

| Google Pay | Widely used digital wallet | Integrated with Google ecosystem |

| UPI (India) | 84% of e-transactions in India | Dominates Indian market |

| Pix (Brazil) | 40% share in Brazilian e-commerce | Rapid growth in Brazil |

| M-PESA (Africa) | Over 90% penetration in Kenya | Leading mobile wallet in Africa |

| Mercado Pago (Latin America) | Significant market share | Popular in Latin America |

Key Takeaways

- Choosing the right online payment gateway boosts sales by making checkout easy and secure for customers.

- Popular payment options like PayPal, Stripe, and Square fit different business needs and offer unique features.

- Secure payment gateways protect customer data and build trust, reducing cart abandonment.

- Compare fees, features, and global reach to find a payment gateway that matches your business size and location.

- Using multiple payment methods and clear pricing helps improve customer satisfaction and grow your business.

Why Payment Gateways Matter

Business Impact

Payment gateways play a key role in your business growth. They help you manage online payment processing and shape how customers see your brand. When you use a reliable payment gateway, you can increase your revenue and reduce cart abandonment. Here are some ways payment gateways drive business results:

- Show clear pricing during the shopping journey. This helps customers avoid surprises at checkout and lowers the chance they will leave their carts.

- Display estimated shipping costs early. Customers can make better decisions and feel more confident about buying.

- Break down all fees, such as product price, shipping, taxes, and extra services. This reduces sticker shock and encourages customers to finish their purchases.

- Offer free shipping thresholds. Customers may add more items to reach the minimum, which increases your average order value.

- Use price guarantees or matching policies. These build trust and help customers feel safe from hidden charges.

- Communicate return policies and any fees upfront. This increases customer confidence and makes them more likely to buy.

- Provide real-time tax calculations and currency conversions for international shoppers. This reduces confusion and helps customers complete their orders.

With these features, payment gateways support your business goals and help you create a smooth online payment processing experience.

Customer Experience

A strong payment gateway also shapes the customer checkout experience. You want your customers to feel safe and comfortable when they pay. Good payment gateways can help you build trust and encourage repeat purchases.

- Secure payment gateways protect sensitive data with encryption and follow strict standards like PCI-DSS and GDPR.

- Trust signals, such as SSL certificates and well-known payment logos, make customers feel safer.

- One-click payments let customers buy faster and can boost repeat purchases by up to 70%.

- If a payment fails, instant feedback and alternate payment options help customers try again instead of leaving.

- Simple checkout steps, clear progress bars, and local payment methods make the process easy and familiar.

- Fraud prevention tools keep your customers safe while making sure the process stays smooth.

- Studies show that about 69% of carts are abandoned, often because of payment friction. Improving payment gateway security and usability can lower this number and increase your sales.

- Over half of shoppers will not finish a purchase if they do not trust the site, so secure and transparent payment gateways are essential.

When you choose the right payment gateway, you improve both your business results and your customers’ experience with online payment processing.

Best Online Payment Systems

Image Source: unsplash

When you look for the best online payment systems, you find many options. Each payment processor offers unique features and benefits. You want to choose the right payment solutions for your business needs. The most popular online payment services include PayPal, Stripe, Square, Authorize.Net, Adyen, Shopify Payments, Clover, PayPal Braintree, Google Pay, Amazon Pay, Helcim, 2Checkout, Fiserv/First Data, and WorldPay.

You can see how PayPal, Stripe, and Square compare in the table below:

| Payment System | Unique Strengths | Ideal Use Cases | Features | Pricing Highlights |

|---|---|---|---|---|

| PayPal | Easy to use, trusted worldwide, simple setup | Businesses with global customers, quick integration | Multi-currency, digital wallet integration, invoices, subscriptions, in-person payments | 3.49% + $0.49 (online), 2.29% + $0.09 (in-person), no monthly fees |

| Stripe | Flexible, developer-friendly, advanced tools | Custom online stores, businesses needing APIs | 135+ currencies, AI fraud detection, recurring billing, real-time dashboard | 2.9% + $0.30 (online), 2.7% + $0.05 (in-person), no monthly fees |

| Square | Simple POS, fast payouts, no chargeback fees | Small shops, mobile sellers, easy on-site payments | All-in-one POS, next-day payouts, booking software integration | 2.6% + $0.10 (in-person), no monthly fees, hardware costs |

You see that each payment processor fits different business types. PayPal works well if you want global reach and easy setup. Stripe gives you more control if you need custom features and advanced credit card processing. Square helps you if you run a small shop or need mobile payment solutions.

Many eCommerce businesses use these best online payment systems because they offer digital wallet integration, support for credit card processing, and secure payment processing services. When you offer multiple payment options, you help customers pay the way they like. This reduces cart abandonment and increases sales. Digital wallets like Google Pay and Apple Pay make checkout fast and safe. Over half of online shoppers used digital wallets in 2024.

You also find Buy Now, Pay Later services and real-time payments growing in popularity. These features help you boost order values and improve customer experience. Online payment services with strong security and easy integration help you build trust and keep customers coming back.

Tip: Choose payment processors that match your business size, sales channels, and customer needs. Look for features like digital wallet integration, strong credit card processing, and easy setup to get the best results.

Best Payment Gateway Comparison

PayPal

PayPal stands out as one of the best payment gateway options for businesses of all sizes. You can use PayPal for online payment processing, in-person sales, and digital wallet integration. PayPal offers a simple setup and a user-friendly interface. Many online payment services support PayPal, making it easy to add to your website.

| Feature / Fee Type | Details |

|---|---|

| Sending Money via Credit Card | 2.9% of transaction value + $0.30 fixed fee |

| International Transactions | 5% transaction fee (min $0.99, max $4.99) + 4% currency conversion fee |

| Cryptocurrency Transactions | $0.49 flat fee for $1-$4.99; percentage fee for $5-$10,000; 1.45% fee over $10,000 |

| Purchases & Friend Transfers | Free when using PayPal balance or bank account |

| Shopify Integration | Supports Express Checkout, automated refunds, and quick autofill checkout |

Pros:

- Easy to use and trusted by millions.

- Fast setup with no monthly fees.

- Supports many currencies and payment types.

- Strong buyer and seller protection.

Cons:

- High payment processing fees for international and currency conversion.

- Chargeback fee of $20 per dispute.

- Account holds can occur without warning.

PayPal works best if you want a global reach and a simple payment processor for your business.

Stripe

Stripe is a top choice for businesses that want flexibility and advanced features. Stripe gives you powerful APIs for custom online payment processing. You can accept payments in over 135 currencies and use tools for recurring billing and fraud prevention.

Pros:

- Seamless integration with many e-commerce platforms.

- Developer-friendly APIs for customization.

- High-level security with PCI DSS compliance.

- Subscription management and advanced analytics.

- Strong support resources and testing environments.

Cons:

- Limited to 39 countries, not available everywhere.

- Requires technical skills for setup and integration.

- Account holds and disputes can happen due to strict policies.

- Compatibility issues with older systems.

- Potential hidden costs for international transactions and add-ons.

| Pros of Using Stripe | Cons of Using Stripe |

|---|---|

| Customizable checkout experience | Learning curve for non-technical users |

| Transparent pricing | Geo-restrictions limit availability |

| Mobile payment support | Chargeback fees and rolling reserves for high-risk businesses |

Stripe is one of the best payment gateway options for businesses needing custom solutions and advanced features.

Square

Square is a popular payment processor for small businesses and in-person sales. You get free POS software, easy hardware options, and simple online payment services. Square offers clear pricing and no monthly fees for basic use.

| Feature/Aspect | Square | Stripe | PayPal |

|---|---|---|---|

| In-person transaction fees | 2.6% + $0.10 per transaction | 2.6% + $0.10 per transaction | Similar rates |

| Online transaction fees | 2.9% + $0.30 per transaction | 2.9% + $0.30 per transaction | Similar rates |

| Invoicing fees | 2.9% + $0.30 if paid by card; free if check/cash | 2.9% + $0.30 plus 4-5% surcharge on invoices | Comparable fees |

| POS Hardware & Software | Free basic POS; paid plans $0-$299/month | No hardware; developer APIs | No dedicated POS hardware |

| Multi-currency support | Not supported | 135+ currencies | 25+ currencies |

| Geographic availability | UK, USA, Japan, Australia | 39 countries | 200+ countries |

| Chargeback fees | Waived up to $250/month | $15 per chargeback | $20 per chargeback |

| User interface | Simple, user-friendly | Developer-focused | Very easy to use |

| Best suited for | Brick-and-mortar stores | Online businesses, subscriptions | Global e-commerce |

Pros:

- Simple setup and user-friendly interface.

- Free POS software and hardware options.

- No chargeback fees up to $250 per month.

- Fast payouts and easy invoicing.

Cons:

- No multi-currency support.

- Limited to certain countries.

- Hardware must be purchased from Square.

- Not ideal for large or global businesses.

Square is a great payment processor for small shops and mobile sellers who want easy in-person and online payment processing.

Authorize.Net

Authorize.Net is a reliable payment gateway for businesses that want strong security and flexible integration. You can connect Authorize.Net with other payment gateways like Stripe. It supports recurring billing, mobile payments, and works with many e-commerce platforms.

Pros:

- Easy integration using API keys.

- Works alongside other gateways.

- Strong security for transactions and customer data.

- Supports recurring billing and mobile payments.

Cons:

- Requires technical setup.

- Monthly gateway fee applies.

- Not as user-friendly as some competitors.

Authorize.Net fits businesses that need secure online payment services and flexible integration with other systems.

Adyen

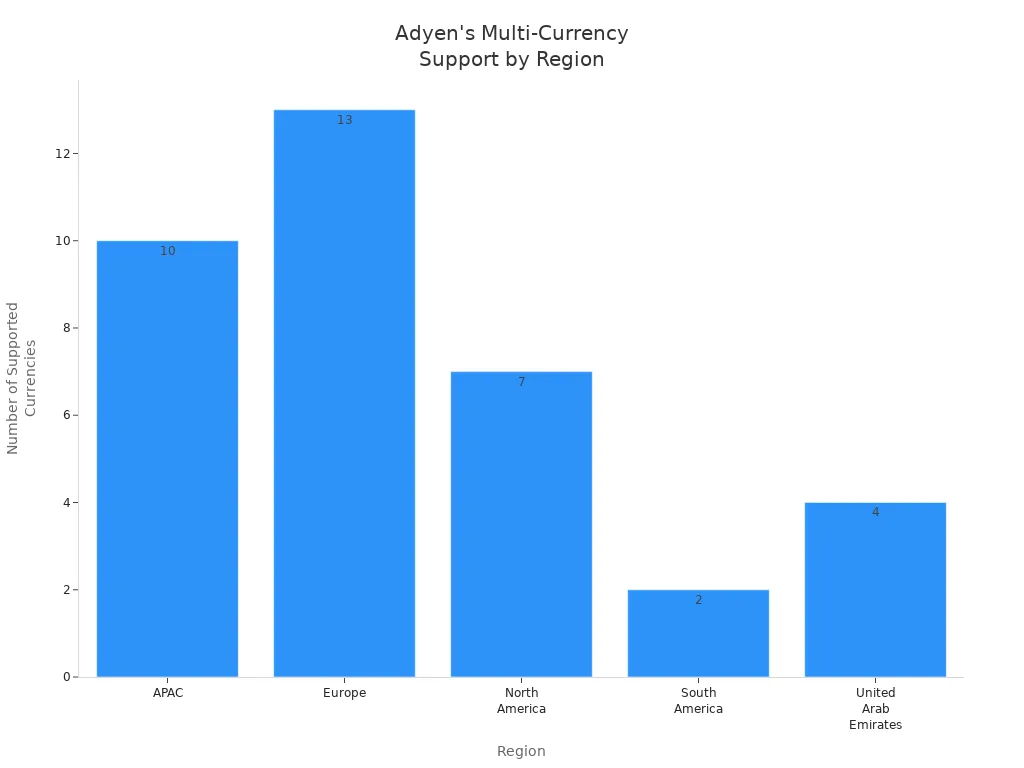

Adyen is a global payment gateway with strong multi-currency support. You can process payments in many currencies and offer local payment methods. Adyen helps you manage currency conversions and settlements, making it easy to sell worldwide.

| Region | Supported Currencies | Local and Cross-Border Payouts |

|---|---|---|

| APAC | AUD, NZD, USD, EUR, GBP, HKD, JPY, SGD, INR, MYR, THB | Yes |

| Europe | EUR, GBP, CHF, DKK, NOK, SEK, PLN, RUB, TRY, ZAR, USD, CAD, AUD | Yes |

| North America | USD, CAD, AUD, EUR, GBP, HKD, JPY | Yes |

| South America | BRL, MXN | Yes |

| UAE | AED, EUR, GBP, USD | Yes |

Pros:

- Supports many currencies and payment methods.

- Unified platform for online, mobile, and in-store payments.

- Dynamic currency conversion for customers.

- Flexible multi-currency settlements.

Cons:

- Complex setup for small businesses.

- Higher payment processing fees for low-volume merchants.

- Requires technical resources for full integration.

Adyen is one of the best payment gateway choices for global businesses needing advanced multi-currency and local payment options.

Shopify Payments

Shopify Payments is built into the Shopify platform. You can set it up quickly without a separate merchant account. It supports credit card processing, Apple Pay, Google Pay, and works with Shopify POS.

| Advantages of Shopify Payments | Disadvantages of Shopify Payments |

|---|---|

| Quick and easy setup | Limited availability in some regions |

| Fully integrated with Shopify | Restrictions on certain product types |

| No extra transaction fees | $15 chargeback fee per dispute |

| Supports multiple payment options | Risk of account freezing during investigations |

Pros:

- Fast setup with no extra transaction fees.

- Seamless syncing of payments, orders, and inventory.

- Supports many payment options and digital wallet integration.

Cons:

- Not available in every country.

- Restrictions on some products.

- Chargeback fees and risk of account holds.

Shopify Payments is a top choice for Shopify store owners who want simple, integrated online payment processing.

Clover

Clover supports both online and in-person transactions. You can use Clover’s hardware for in-store sales and its gateway for online payments. Clover offers several checkout options, including simple redirects and on-site payment pages.

| Aspect | Details |

|---|---|

| In-Person Transactions | Integrated POS devices; fees start at 2.3%–2.6% + $0.10 per card-present transaction. Proprietary hardware required. |

| Online Transactions | Supports online payments with simple checkout, on-site checkout, and hosted payment pages. Online fees: 3.5% + $0.10. |

| Main Limitations | High processing fees, limited customization, extra costs for advanced features, long-term contracts, and hardware dependency. |

| Additional Considerations | No free full-featured plan; 90-day free trial. Activation requires minimum sales. |

Pros:

- Supports both online and in-person sales.

- Customizable hosted payment pages.

- Grows with your business.

Cons:

- High payment processing fees.

- Locked to Fiserv or resellers for processing.

- Limited customization and offline functionality.

- Proprietary hardware increases costs.

Clover is a good payment processor for businesses wanting all-in-one POS and online payment services, but you must consider the higher fees and hardware requirements.

PayPal Braintree

PayPal Braintree offers advanced developer tools and customization. You can use open APIs to build custom payment flows. Braintree supports many payment types, including credit card processing and digital wallets.

| Feature/Aspect | PayPal | Braintree |

|---|---|---|

| Target Demographic | Small businesses; quick setup | Businesses with development teams |

| Customization | Limited to add-ons and built-in features | Extensive customization via open API |

| Ease of Use | Simple UI; minimal technical knowledge needed | More complex UI; coding experience beneficial |

| Integration | Multiple integrations without coding | Open API for custom integrations |

Pros:

- Advanced customization for developers.

- Supports many payment types and currencies.

- Strong fraud protection and reporting tools.

Cons:

- Requires coding skills for setup.

- More complex than standard PayPal.

- Not ideal for small businesses without technical resources.

Braintree is one of the best payment gateway options for businesses needing custom integrations and advanced features.

Google Pay

Google Pay is a secure and convenient payment gateway for online businesses. You can offer Google Pay at no extra cost and improve checkout speed for your customers.

| Benefits of Google Pay for Online Businesses | Drawbacks of Google Pay for Online Businesses |

|---|---|

| Secure payment processing with tokenization | Technical issues can disrupt payments |

| No extra cost for merchants | Limited acceptance in some regions |

| Simple setup and integration | Requires NFC terminals for in-person sales |

| Supports recurring payments and refunds | Limited bank support for some users |

| Enhances customer convenience and conversion | Slow bank transfers (3-5 business days) |

| Wide compatibility with Android and iOS | Device compatibility issues |

| 24/7 support for merchants | Relies on customer’s phone for payments |

Pros:

- Strong security and fraud prevention.

- Easy integration with existing providers.

- No extra payment processing fees for merchants.

- Supports recurring payments and refunds.

Cons:

- Limited acceptance in some regions.

- Requires NFC terminals for in-person payments.

- Slow bank transfers and device compatibility issues.

Google Pay is a smart choice for businesses wanting fast, secure online payment services and digital wallet integration.

Amazon Pay

Amazon Pay lets your customers pay using their Amazon accounts. You can integrate Amazon Pay with many eCommerce platforms using preconfigured connectors. The process involves registration, API implementation, and production launch.

| Fee Type | Description |

|---|---|

| Transaction Fees | 2.9% + $0.30 per transaction in the US |

| Cross-Border Fees | Additional fees for cards issued outside the merchant’s country |

| Chargeback Fees | $20 per disputed chargeback |

| Authorization Fees | $0.30 per authorized but unsettled transaction |

| Refunds | Transaction fee returned, but not authorization fee |

Pros:

- Trusted by millions of Amazon users.

- Fast checkout improves conversion rates.

- Easy integration with major eCommerce platforms.

Cons:

- Payment processing fees can add up, especially for cross-border sales.

- Chargeback and authorization fees apply.

- Not all features available in every country.

Amazon Pay is a strong payment gateway for businesses that want to boost trust and speed at checkout.

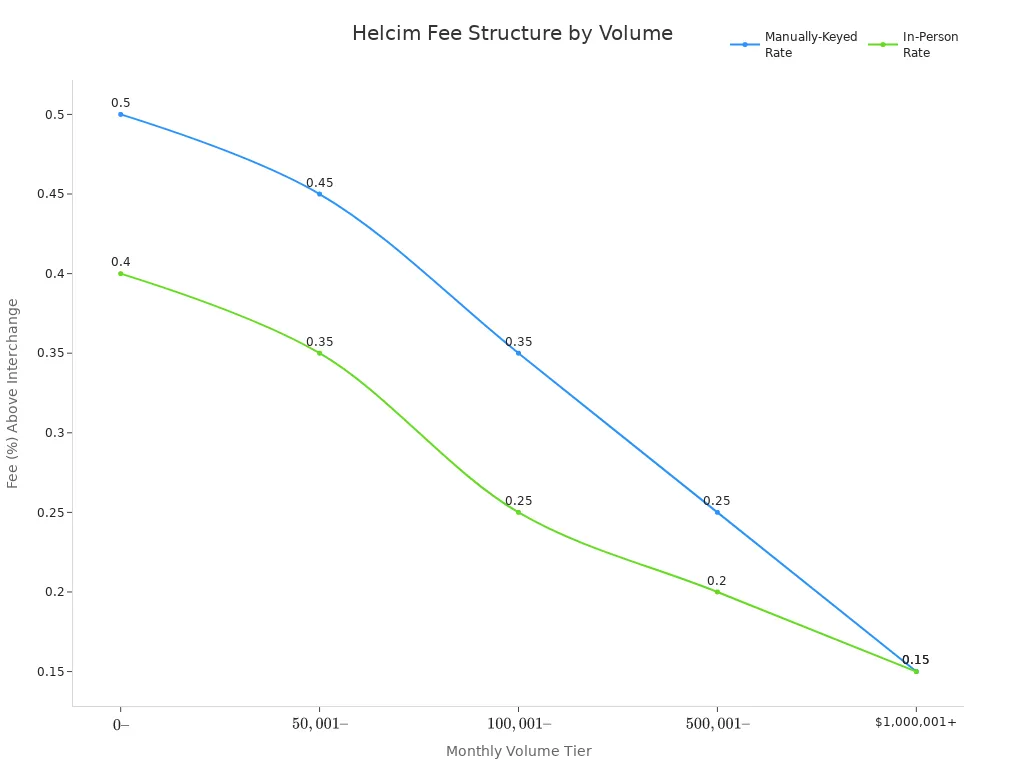

Helcim

Helcim offers transparent interchange-plus pricing and no long-term contracts. You get free invoicing, eCommerce tools, and POS software. Helcim’s payment processing fees decrease as your monthly volume grows.

| Monthly Volume | Manually-Keyed Rate (plus interchange) | In-Person Rate (plus interchange) |

|---|---|---|

| $0 – $50,000 | 0.50% + $0.25 | 0.40% + $0.08 |

| $50,001 – $100,000 | 0.45% + $0.20 | 0.35% + $0.07 |

| $100,001 – $500,000 | 0.35% + $0.20 | 0.25% + $0.07 |

| $500,001 – $1,000,000 | 0.25% + $0.15 | 0.20% + $0.06 |

| $1,000,001+ | 0.15% + $0.15 | 0.15% + $0.06 |

Pros:

- Transparent pricing with no hidden fees.

- No long-term contracts or monthly software fees.

- Free online payment tools and POS software.

- Volume discounts lower payment processing fees as you grow.

Cons:

- Can be expensive for businesses processing under $50,000 per month.

- Limited back-office integrations.

- Not ideal for high-risk merchants or small startups.

Helcim is one of the best payment gateway options for growing businesses that want clear pricing and flexible payment processing fees.

2Checkout

2Checkout is a global payment gateway that supports over 200 countries and 87 currencies. You can choose from several plans based on your business needs.

| Plan Name | Fee Structure | Notes |

|---|---|---|

| 2Sell | 3.5% + $0.35 per sale | Basic plan for global sales |

| 2Subscribe | 4.5% + $0.45 per sale | Adds subscription billing |

| 2Monetize | 6% + $0.60 per sale | All-in-one for digital goods |

| Enterprise | 1.00% - 4.99% | Custom pricing for large merchants |

| Cancellation Fee | $0 | No cancellation fees |

Pros:

- Easy setup and global reach.

- Supports many currencies and languages.

- Advanced recurring billing and fraud prevention.

- Good customer support and custom modules.

Cons:

- High payment processing fees, especially for small businesses.

- Complex admin panel.

- Payout delays and fund holds reported.

- No virtual terminal for most users.

2Checkout is a strong choice for businesses needing global online payment services and advanced subscription features.

WorldPay

WorldPay is a global payment processor with a presence in over 120 countries. You can accept payments in more than 120 currencies and use many local payment methods.

| Feature Category | Description |

|---|---|

| Global Presence | Operates in over 120 countries, enabling easy international payments. |

| Multi-Currency Support | Supports over 120 currencies for cross-border transactions. |

| Localized Payment Methods | Offers local bank transfers, digital wallets, and cash on delivery. |

| Omnichannel Solutions | Integrates with POS systems for online, in-store, and mobile payments. |

| Scalability | Tailored solutions for startups to large enterprises. |

| Support Services | 24/7 customer support and dedicated account managers. |

Pros:

- Wide global reach and multi-currency support.

- Many payment methods for local and international customers.

- Strong security and compliance features.

- Detailed analytics and reporting tools.

Cons:

- Payment processing fees can be high for small businesses.

- Complex setup for new users.

- Some reports of slow customer support.

WorldPay is one of the best payment gateway options for businesses that want to scale globally and need strong support for many payment types.

Ecommerce Payment Gateway Pros and Cons

Image Source: pexels

Security

You want your customers to feel safe when they pay online. Leading payment gateways protect your business and your shoppers with strong security features. These include PCI DSS compliance, SSL technology, and data encryption. You also see tokenization and multi-factor authentication used to keep information safe. Regular security audits help spot weaknesses before hackers do. Payment gateways defend against threats like phishing attacks, malware, data breaches, SQL injection, and man-in-the-middle attacks. When you choose an ecommerce payment gateway with these protections, you lower the risk of fraud and build trust with your customers.

- PCI DSS compliance keeps credit card data secure.

- SSL technology encrypts data between your site and the customer.

- Tokenization replaces card numbers with unique codes.

- Multi-factor authentication adds extra layers of protection.

Note: Security features can add complexity to setup, but they are essential for safe online transactions.

Fees

Payment processing fees have a big impact on your profit margins. You pay different fees depending on the type of transaction, card, and risk level. Most online payment gateways charge between 1.5% and 3.5% per transaction. Some also add flat fees or extra charges for international payments. You need to watch out for hidden costs like chargebacks, PCI compliance, and early termination fees. These can add up quickly and reduce your profits.

| Fee Component | Fee Structure Example | Fee Amount on $100 Transaction | Notes on Impact on Profit Margins |

|---|---|---|---|

| Payment Processor Fee | 2.9% + $0.30 | $3.20 | Flat-rate fees vary by processor (e.g., Stripe, Square) |

| Interchange Fee | 1.5% + $0.10 | $1.60 | Varies by card type and merchant category |

| Assessment Fee | 0.13% of transaction amount | $0.13 | Non-negotiable, charged by card brands |

| Total Transaction Fee | $4.93 | Can consume 25%-35% of monthly profits for businesses with 10% margin |

You can lower payment processing fees by choosing cost-effective payment gateways, negotiating rates, and encouraging debit card payments. Always review pricing before you sign up.

Integration

You want your payment gateway to work smoothly with your website or app. Integration challenges can slow you down and frustrate your customers. Common problems include security concerns, design compatibility, and technical complexity. You may also face issues with cross-border payments, compliance with local methods, and high payment processing fees.

| Challenge | Description | Suggested Solution |

|---|---|---|

| Security Concerns | Protecting sensitive financial data from fraud, cyberattacks, and breaches. | Use SSL encryption, PCI-DSS compliance, tokenization, and 3D Secure authentication. |

| Design Compatibility & UX | Payment gateway design may not match your site, causing poor user experience. | Customize payment pages, use responsive design, and support mobile-friendly options. |

| Complexity of Integration | Integrating APIs with existing systems can be difficult. | Use gateways with strong SDKs and documentation; hire experienced developers. |

| Cross-Border & Multi-Currency | Handling international payments with multiple currencies and fees. | Choose gateways supporting global transactions and local currency display. |

| Compliance with Local Methods | Supporting region-specific payment methods. | Enable multiple payment options including local methods; partner with knowledgeable developers. |

| High Transaction Fees | Fees can reduce profitability, especially with high volume or cross-border transactions. | Compare fee structures, negotiate rates, and select cost-effective gateways. |

| Slow Payment Processing | Delays in transaction confirmation can hurt customer satisfaction. | Use gateways known for fast processing and real-time fraud detection. |

| Managing Chargebacks & Disputes | Chargebacks can cause financial loss and damage reputation. | Implement fraud detection, clear dispute policies, and strong customer support. |

| Scalability Issues | Gateways may not handle increased transaction volumes efficiently. | Select scalable providers; plan for growth with experienced developers. |

| Technical Support & Documentation | Lack of support can delay issue resolution and integration. | Choose gateways with 24/7 support and comprehensive documentation. |

Tip: Choose payment gateways with easy integration, strong support, and clear documentation to avoid costly delays.

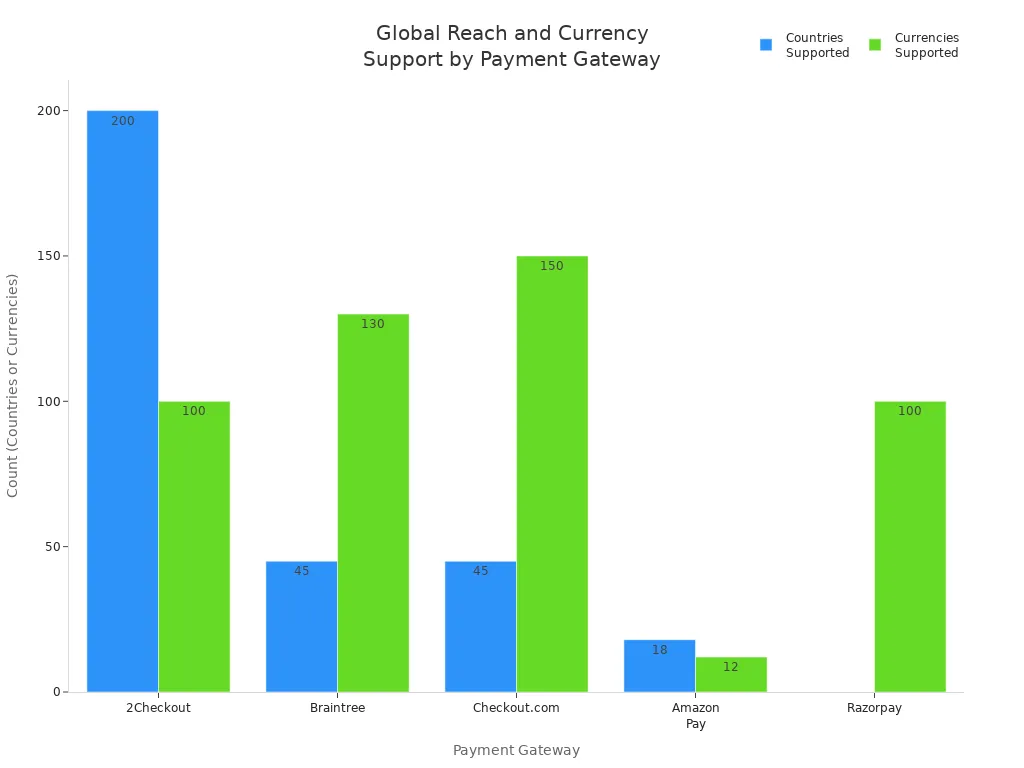

Global Reach

If you want to sell worldwide, you need a payment gateway with broad global reach and multi-currency support. Some gateways, like 2Checkout and Braintree, support over 100 currencies and operate in many countries. Razorpay stands out for its advanced fraud detection, easy integration, and compliance with international rules. These features help you handle cross-border payments and give your customers a smooth experience, no matter where they live.

You should always check the pricing for global transactions. Some gateways add cross-border fees or higher payment processing fees for international cards. Compare pricing and features to find the best fit for your business goals.

Payment Gateways Comparison Table

When you compare payment gateways, a clear table helps you see the differences quickly. You can match each provider to your business needs by looking at their features, fees, and global reach. This side-by-side view makes it easier to spot which gateway fits your goals, whether you want simple setup, strong security, or support for many countries.

| Payment Gateway | Supported Currencies | Supported Countries | Fee Structure | Key Features | Pros | Cons |

|---|---|---|---|---|---|---|

| PayPal | 25 | 200+ | From 3.4% + $0.30 per transaction; monthly fees for advanced plans | Hosted and integrated options, global reach, strong support | Easy to use, trusted, wide reach | Higher fees, currency conversion costs |

| Stripe | 135+ | 39 | 2.9% + $0.30 per transaction | Advanced API, many currencies, developer tools | Flexible, great for custom sites | Not available everywhere, needs tech skills |

| Square | 6 | 6 | 2.9% + $0.30 per transaction; no setup fees | POS integration, hardware, easy checkout | Simple for small shops, fast setup | Limited countries, fewer currencies |

| 2Checkout | 100+ | 180 | Starts at 3.5% + $0.35 per transaction | Global payment methods, recurring billing | Wide reach, many payment types | Higher fees, payout limits |

| Authorize.Net | 10+ | 30+ | Setup fee + 2.9% + $0.30 per transaction | Fraud detection, recurring payments, 24/7 support | Strong security, good support | Setup fee, technical setup needed |

| Braintree | 130+ | 45+ | 2.9% + $0.30 per transaction; +1% for foreign currency | Mobile SDKs, marketplace payouts, part of PayPal | Customizable, supports many currencies | Extra fee for foreign currency, complex for beginners |

A comparison table like this lets you see important details at a glance. You can check which gateways offer the features you need, such as recurring payments or easy integration. This helps you avoid hidden costs and choose the best payment gateway for your business.

You should always review the fee structure and supported countries before you decide. Some gateways work better for small businesses, while others support more currencies or offer advanced features for growing companies.

How to Choose the Best Online Payment

Business Size

Your business size shapes which payment solutions fit best. Small businesses often need simple, cost-effective options with easy setup. You might prefer flat-rate pricing and user-friendly systems. Large enterprises usually require advanced features, custom integrations, and scalable platforms. They often choose interchange-plus pricing to save on high transaction volumes. The table below shows how needs differ:

| Aspect | Small Businesses | Large Enterprises |

|---|---|---|

| Pricing Models | Flat-rate or subscription for predictability | Interchange-plus for lower fees at scale |

| Security Features | Basic PCI DSS, encryption, fraud detection | Advanced AI fraud tools, full PCI compliance |

| Integration | Easy with e-commerce and POS | Deep integration with CRM, accounting, APIs |

Tip: Match your business size to the right payment gateway for better efficiency and cost control.

Location

Where you operate affects your payment gateway choice. Different regions have unique payment preferences and rules. In North America, credit cards and digital wallets are popular. In Europe, you must follow strong customer authentication rules. Asia favors mobile payments, while Latin America and Africa have local methods like Boleto Bancário and M-PESA. Some gateways only work in certain countries. You should check if your options support the payment methods your customers use most.

- Local payment preferences and regulations matter.

- Multi-currency support helps if you sell internationally.

- Some gateways limit service to specific regions.

Transaction Volume

Your monthly transaction volume guides which payment gateway works best. If you process fewer than 500 transactions each month, simple provider-hosted pages may suit you. As your volume grows, you may need branded or self-hosted pages for better control and lower costs. High-volume businesses often need custom gateways to handle large numbers of payments without delays or extra fees. Always check if your gateway can scale with your growth.

- Up to 500 transactions/month: Basic, manual options.

- 500–100,000/month: Branded or self-hosted pages.

- Over 100,000/month: Custom or in-house gateways.

Industry Needs

Each industry has special requirements for payment gateways. Retailers need support for many payment methods and fast processing. Subscription businesses look for recurring billing and analytics. Restaurants want mobile and POS integration. You should also consider security, cost structure, and customer support. Look for payment solutions that offer easy integration, strong fraud protection, and features that match your business model.

- Integration with your current systems

- Security and PCI DSS compliance

- Support for multiple currencies and payment types

- Fast processing and reliable customer support

Note: Choosing the right options helps you serve your customers better and supports your business growth.

You have many choices when picking the best online payment system. Each option has strong points and some drawbacks. You should look at your business needs, customer habits, and future plans. Make a list of features, fees, and support for each provider. Compare them side by side. This helps you find the best online payment solution for your business.

FAQ

What is a payment gateway?

A payment gateway lets you accept payments online. It connects your website to banks and payment networks. You use it to process credit cards, digital wallets, and other payment types safely.

How do payment gateway fees work?

You pay a fee for each transaction. Some gateways charge a flat rate, while others use a percentage. Here is a quick example:

| Transaction Amount | Fee (2.9% + $0.30) | Total Fee (USD) |

|---|---|---|

| $100 | $2.90 + $0.30 | $3.20 |

Can you use more than one payment gateway?

Yes, you can use multiple gateways. This gives your customers more ways to pay. It also helps if one gateway has issues. You can switch to another quickly.

How do you keep online payments secure?

You keep payments safe by using gateways with PCI DSS compliance, SSL encryption, and fraud detection. Always update your software. Teach your team about online safety. This protects your business and your customers.

While online payment systems offer convenience for your business, high fees and complex cross-border transactions can hinder growth. BiyaPay presents an efficient alternative: real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies with seamless flexibility, and remittance fees as low as 0.5% for cost-effective payments. Plus, its quick registration and no-overseas-account-needed US/HK stock investment features meet your global needs. Visit BiyaPay now to explore these benefits and enhance your payment process! For local or international transactions, opt for BiyaPay to boost your business competitiveness.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.