- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Places to Get Great Exchange Rates in London

Image Source: pexels

You want the best places to exchange currency in London, right? You can skip the high markups at airport kiosks and go for trusted names like Travelex, Eurochange, Thomas Exchange Global, Victoria Street FX, and Ace-FX. These places give you some of the best exchange rates in London, often much closer to the real interbank rates than what you’ll find at banks or airports. For example, airport kiosks can charge up to 10% above market rates, while these best places only add a small fee. If you wonder where to exchange money safely and get value, these are top recommendations. You’ll see a quick table next to help you choose where to exchange money and where to get the best exchange rates for your travel money.

Key Takeaways

- Choose trusted currency exchange shops in London like Thomas Exchange Global, Victoria Street FX, and Ace-FX for better rates and no hidden fees.

- Avoid airport and hotel kiosks because they charge high fees and poor exchange rates that reduce your money’s value.

- Use online tools to check the mid-market rate before exchanging money to spot the best deals and avoid hidden costs.

- Consider travel money cards or bank-owned ATMs with no fees for safe, convenient, and cost-effective currency exchange.

- Always bring photo ID for large transactions and compare rates and fees from different providers to keep more money for your trip.

Quick Comparison of Best Places

Top Exchange Providers Table

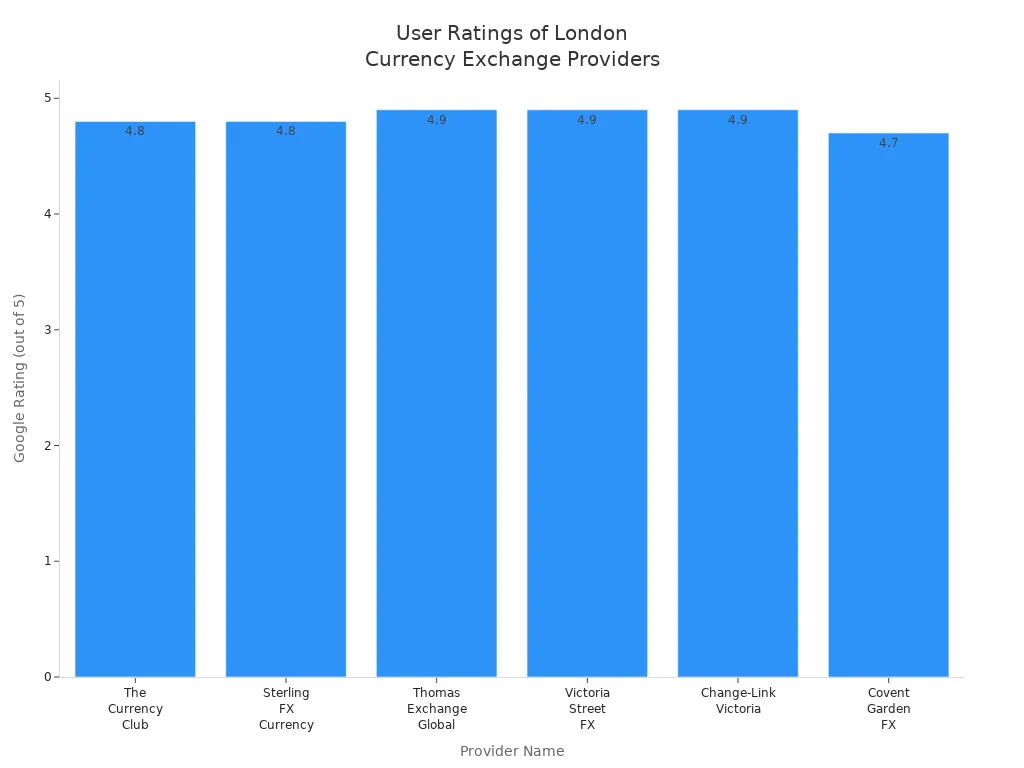

When you want to exchange money in London, you have many choices. Some places offer better rates and lower fees than others. You should always compare the options before you decide where to exchange your currency. Here’s a handy table to help you see the top providers in London. This table shows their location, hours, commission or fees, and user ratings. Most of these providers have high ratings, so you can feel confident about your choice.

| Provider Name | Address | Typical Hours | Commission/Fees | Google Rating |

|---|---|---|---|---|

| The Currency Club | 50 Harrowby St, London | Mon-Fri: 9am-6pm | Spread only, no fee | 4.8 |

| Sterling FX Currency Exchange | 105 Edgware Rd, London | Mon-Fri: 9am-6pm | Spread only, no fee | 4.8 |

| Thomas Exchange Global Strand | 402 Strand, London | Mon-Fri: 9am-6pm | Spread only, no fee | 4.9 |

| Victoria Street FX | 185 Victoria St, London | Mon-Fri: 9am-6pm | Spread only, no fee | 4.9 |

| Change-Link Victoria | 330 Vauxhall Bridge Rd, London | Mon-Fri: 9am-6pm | Spread only, no fee | 4.9 |

| Covent Garden FX | 30 Jubilee Market Hall, London | Mon-Sat: 10am-6pm | Spread only, no fee | 4.7 |

Tip: Most exchange providers in London do not charge a separate commission. Instead, they include their fee in the exchange rates. Always check the mid-market rate online before you exchange your money. This helps you spot the best deal.

You can find these currency exchange shops in busy parts of London, like Oxford Street, Victoria, and Covent Garden. Many open during regular business hours, but some locations near train stations or airports may open earlier or close later. Airport exchange counters offer convenience, but their rates are usually worse than what you get in the city.

When you compare providers, look at both the exchange rates and any hidden fees. Some shops show a great rate but add a fee at the counter. Others, like The Currency Club and Thomas Exchange Global, keep things simple and transparent. You can also use travel money cards, such as the Wise Multi-Currency Card, which use live mid-market rates and clear fees. This can save you time and money, especially if you want to avoid carrying a lot of cash.

If you want to get the most value for your currency in London, always compare rates, check for hidden fees, and choose a provider with a strong reputation. This way, you keep more of your money for your trip.

Best Places to Exchange Currency in London

Image Source: unsplash

Travelex

You probably know Travelex as one of the most recognized names for currency exchange in London. You can find their counters in busy spots like Oxford Street, major train stations, and shopping centers. Travelex offers a wide range of currencies and lets you order online for in-store pickup. This makes it easy if you want to lock in a rate before you travel. Travelex does not always have the lowest rates, but you get convenience and security. You can also use their ATMs for quick access to cash. If you want to exchange currency in London without hassle, Travelex is a safe choice, especially if you value convenience over the absolute best rates.

Eurochange

Eurochange stands out as one of the best places to exchange currency in London. You can find their branches in central locations, including shopping malls and busy streets. Eurochange offers competitive rates for popular currencies like the euro (about 1.1353 USD) and the US dollar (about 1.3329 USD). You need to reserve or buy online to guarantee these rates, since in-store rates may be lower. You can order between $125 and $3,100, and there are no extra fees for using your debit or credit card. If you order more than $750, you get free home delivery. Many travelers like Eurochange because you can collect your money in-store or have it delivered. If you want to know where to exchange money with good rates and no hidden fees, Eurochange is a top pick.

| Currency | Online Rate (USD) | In-Store Rate (USD) | Order Range (USD) | Delivery Fee |

|---|---|---|---|---|

| Euro | 1.1353 | Varies | $125 - $3,100 | Free over $750, $7 otherwise |

| US Dollar | 1.3329 | Varies | $125 - $3,100 | Free over $750, $7 otherwise |

Note: Always check the online rate before you visit. You get the best deal when you reserve ahead.

Thomas Exchange Global

Thomas Exchange Global is one of the best places to exchange currency in London if you want great rates and a wide choice of currencies. You can find more than 11 branches across the city. Thomas Exchange Global offers rates like 1.1828 USD for the euro and 1.3062 USD for the US dollar. They do not charge commission, and you can choose from over 120 currencies. Many travelers say they get the best exchange rates in London here. You can order online and pick up your money in-store, and the rate stays the same until the end of the day. Thomas Exchange Global also offers next-day delivery by Royal Mail if you want your money sent to your home. If you wonder where to exchange money with strong customer reviews and reliable service, this is a top choice.

| Provider | Euro Rate (USD) | USD Rate (USD) | Commission | Currencies | Customer Reviews |

|---|---|---|---|---|---|

| Thomas Exchange Global | 1.1828 | 1.3062 | None | 120+ | High satisfaction, top-rated |

Victoria Street FX

Victoria Street FX is another favorite among travelers looking for the best places to exchange currency in London. You find them in the Victoria Place Shopping Centre, which is easy to reach. Victoria Street FX often beats banks and grocery stores with their rates. You can order your currency online and pick it up in-store, locking in a live rate. The staff are friendly and help you get the denominations you want. You can even chat with them on WhatsApp for quick answers. There are no hidden fees, and you pay 0% commission. If you plan a large transaction, bring your photo ID. Many people say the experience is smooth and trustworthy. If you want to know where to get the best exchange rates and enjoy great service, Victoria Street FX is a smart pick.

- Competitive rates, often better than banks

- Friendly staff and fast service

- Online ordering with live rates

- No hidden fees or commission

- WhatsApp support for questions

- Convenient location in central London

Marks and Spencer (Oxford Street)

Marks and Spencer on Oxford Street offers a currency exchange service that is easy and commission-free. You can buy over 50 currencies in-store or use their Click & Collect service. There are no hidden fees, so you only pay the exchange rate. The rates in-store may differ from what you see online, so it helps to check before you go. Many travelers like Marks and Spencer because you can shop and exchange money in one stop. If you want to exchange currency in London with no extra charges, this is a reliable option.

Tip: Always compare the rate at Marks and Spencer with other currency exchange shops before you buy.

FX Currency London Ltd

FX Currency London Ltd is a smaller provider, but many travelers trust them for good rates and honest service. You can find their shop near major transport links, making it easy to stop by. FX Currency London Ltd offers a wide range of currencies and keeps their fees low. You can order online or walk in for quick service. Many people say they get better rates here than at banks or hotels. If you want to know where to exchange money with a personal touch, FX Currency London Ltd is worth a visit.

Ace-FX

Ace-FX is one of the best places to exchange currency in London, especially if you are near London Bridge or Canary Wharf. You can order your money online and pick it up at their branch, or just walk in. Ace-FX is known for good rates and fast service. Many travelers say they get more value here than at other currency exchange shops. You can also use their online calculator to check the latest rates. If you want to know where to exchange money quickly and get a fair deal, Ace-FX is a solid choice.

City Forex

City Forex offers a currency exchange service in London, but you should know a few things before you go. They accept bank transfers and cards, but they do not clearly show their fees. You will not find customer ratings or reviews for City Forex, so it is hard to know what to expect. Some travelers feel unsure about the lack of transparency. If you want to know where to exchange money with clear pricing and strong reviews, you may want to look at other options first.

Bureau de Change Locations

You will see many bureau de change counters across London. Some of the highest-rated ones include Thomas Exchange Global and Ace-FX. These places often give better rates than airport kiosks or hotels. You should avoid exchanging cash-for-cash at airports, as the rates are usually worse. Many travelers recommend using debit cards at ATMs to avoid extra fees. If you want to know where to exchange money with good rates, stick to trusted bureau de change shops in the city center. You can also order your currency online and pick it up in-store for the best deal.

- Thomas Exchange Global and Ace-FX are top-rated bureau de change locations

- Avoid airport bureau de change counters for better rates

- Use online ordering for better rates and lower fees

- ATMs can be a good option if you have a no-fee card

Note: Always check the rate and any fees before you exchange. Trusted bureau de change shops in London help you keep more of your money for your trip.

Alternative Ways to Exchange Currency in London

Image Source: unsplash

ATMs and No Fee Overseas

You can use ATMs to exchange currency in London. Many travelers like this option because it is fast and easy. Most ATMs in London charge a fee of 2% to 3% when you use an international card. Some banks, like Barclays and HSBC, offer fee-free withdrawals if you use certain cards or are part of their network. Citibank has two ATMs in central London that let you take out money with no extra charge if you are a customer. Fintech companies like Wise and Revolut also give you accounts with limited or no ATM withdrawal fees each month. If you want to save money, use bank-owned ATMs and take out larger amounts less often. Avoid using credit cards at ATMs because they cost more. This is a good way to exchange currency in London if you want quick access to cash.

Tip: Always check if your card is part of a no-fee network before you travel. This helps you avoid extra charges when you exchange money.

Post Office Bureaus

Post Office bureaus are easy to find in London. You can exchange currency at these locations, but the rates are not always the best. Post Office bureaus charge higher fees and markups than private providers. If you order online, you get a better rate, and buying more money at once can also help. You can pick up popular currencies like USD in just two hours at some branches. The Post Office has a refund policy if your trip gets canceled. Still, private providers and currency cards usually give you better rates and lower fees. Here is a quick look at the costs:

| Fee Type | Post Office Cost (USD) | Wise Travel Money Card Cost (USD) |

|---|---|---|

| Conversion Fee | $5.40 | $0 |

| Exchange Markup | $29.10 | $0 |

| Delivery Fee | $8.80 | $0 |

| ATM Use Fee | Up to $20 | $0 (first $250), then 2% |

Note: Post Office bureaus are convenient, but you pay more to exchange currency in London here than at most private shops.

Major Banks (HSBC, Barclays, Lloyds)

You might think about using a major bank to exchange currency in London. Banks like HSBC, Barclays, and Lloyds only offer currency exchange services to their account holders. If you do not have an account, you cannot use their currency exchange service. Even if you do, banks often charge higher fees and give you less favorable rates than specialist brokers or online platforms. For example, HSBC charges a margin fee from 1.01% to 3.51% based on how much money you exchange. Lloyds and Barclays have similar rules and do not share their rates with non-account holders. If you want to know where to exchange money with the best rates, banks are not the top choice.

ChangeGroup (Airports & Train Stations)

ChangeGroup runs many bureau de change counters at London airports and train stations. These locations are easy to find when you arrive or leave the city. The rates at ChangeGroup physical branches include a margin over the real exchange rate, sometimes as high as 20%. They also charge commission fees, usually between 1% and 3%. If you order your currency online and pick it up at a branch, you get a better rate and pay no commission. Still, using a bureau de change at the airport or train station costs more than exchanging money in the city center.

Tip: If you need to exchange currency in London at the airport, order online first and collect your money at the ChangeGroup counter to save on fees.

Travel Money Cards

Travel money cards are a smart way to manage your money in London. You load the card with USD or other currencies before your trip. These cards lock in the exchange rate, so you do not worry about changes. You can use them almost anywhere Visa or Mastercard is accepted. Wise and Revolut are popular choices for travel money in London. Here is a quick table to help you see the pros and cons:

| Aspect | Details |

|---|---|

| Pros | Locks in rates, multi-currency, safe, easy tracking |

| Cons | Possible fees, ATM limits, not always accepted |

| Fees | May include monthly, ATM, or reload fees |

| Acceptance | Widely accepted, but not everywhere |

Remember: Always pay in GBP when using your travel money card in London to avoid hidden fees.

If you want to know where to exchange money and keep things simple, travel money cards and online platforms like Wise or Revolut often give you the best rates and lowest fees. They also help you track your spending and keep your main bank account safe.

How to Choose the Best Exchange Provider

Choosing the right place to exchange money in London can save you a lot of hassle and cash. You want to keep more of your money for your trip, so it helps to know what to look for. Here are the main things you should check before you exchange currency in London.

Fees and Hidden Costs

Always ask about fees before you exchange. Some providers in London say they have “no commission,” but they might hide costs in their exchange rates. A small difference in rates can mean you lose more money than you think. Wise, for example, shows you all fees and rates upfront, so you know exactly what you pay. Many banks and some shops in London make it hard to see the real cost. You should compare the total amount you get after all fees, not just the rate on the sign.

Tip: Use online tools like Cambridge Currencies to compare live rates and see all fees side by side.

Exchange Rates and Transparency

You want the best rates when you exchange currency in London. Some providers show great rates but add hidden fees at the counter. Others, like Wise, display clear rates and fees, so you know what you get. Many shops in London do not follow strict rules about showing all costs, so you need to look closely. Transparent pricing helps you avoid surprises and keeps more money in your pocket.

- Rates and fees change between providers.

- Some shops in London hide costs in poor rates.

- Tools like Cambridge Currencies help you compare rates and fees easily.

Safety and Trust

Safety matters when you exchange money in London. Trusted providers use strong security, like data encryption and two-factor authentication, to protect your money. Companies such as Travel Cashier and GC Partners follow strict UK rules and use advanced technology to keep your information safe. They also have good customer support, so you can get help if you need it. Always choose a provider in London that follows the law and puts your safety first.

Customer Reviews

You can learn a lot from what other people say. Look for reviews about currency exchange shops in London. Many travelers praise companies like Currency Solutions for their helpful staff, fair fees, and fast service. On Trustpilot, some providers have thousands of five-star reviews. Good reviews mean you can trust the provider with your money. If you see lots of complaints or no reviews at all, you might want to pick another place to exchange.

Note: Check reviews on trusted sites before you exchange currency in London. This helps you avoid problems and find the best service.

Tips for Exchanging Currency in London

Avoid Airport and Hotel Kiosks

When you arrive in London, you might see currency exchange kiosks at the airport or in your hotel lobby. These places look convenient, but they often give you poor value. Airport kiosks in London usually charge markups of 8 to 10 percent over the real exchange rate. If you exchange $1,000 at the airport, you might get only $820 worth of pounds. In the city center, you could get about $920 for the same amount. Hotel exchange desks also have high fees and bad rates. You can lose $50 to $100 or more just by using these services. For the best deal, wait until you reach a city center exchange office or a trusted provider.

Check the Mid-Market Rate

Before you exchange currency in London, always check the mid-market rate. This rate shows the real value between two currencies. You can use online tools like Cambridge Currencies, Wise, or Xe to see live rates. These platforms let you enter the amount you want to exchange and show you the current rate. Providers in London often add a margin or fee, so compare their rates to the mid-market rate. This helps you spot hidden costs and make smarter choices when you exchange your money.

Tip: Set up rate alerts on Wise or Xe to get notified when the exchange rate is in your favor.

Timing Your Exchange

The time you choose to exchange currency in London can affect how much you get. Exchange rates change during the day. The best rates often appear in the early morning, especially when UK economic news comes out. Overlaps between European and U.S. market hours also bring better rates because of higher trading activity. If you want to maximize your value, try to exchange your money during these busy times.

Cash vs. Card Use

You do not need to carry a lot of cash in London. Most shops, restaurants, and transport accept cards. Contactless cards and smartphone payments are popular and safe. Using a card means you often get a better exchange rate than cash. Cards also protect you if your money gets lost or stolen. Cash can help you track your spending, but it comes with risks and higher fares, especially on transport. Oyster cards and contactless cards work well for getting around London and offer fare capping and discounts. If you need to exchange cash, do it at a trusted city center provider, not at the airport.

You have many great options to exchange money in London. Shops like Thomas Exchange Global, Victoria Street FX, and Ace-FX give you strong rates and safe service. You can also use travel money cards or trusted ATMs in London for convenience. Always compare rates, check for hidden fees, and use the tips above. If you want more details, check online guides or ask at a top-rated exchange shop in London.

FAQ

What is the best way to get local currency in London?

You can get local currency in London by using a trusted exchange provider in the city center. Shops like Thomas Exchange Global or Victoria Street FX offer better rates than airport kiosks. You can also use a travel money card for easy spending.

Can I use US dollars or other foreign cash in London?

Most shops and restaurants in London do not accept US dollars or other foreign cash. You need to exchange your money for British pounds. You can do this at a currency exchange shop or by using an ATM with a no-fee card.

Are ATMs a good option for exchanging money in London?

ATMs in London can be a good choice if you have a card with low or no foreign transaction fees. Always use bank-owned ATMs for better rates. Avoid using credit cards at ATMs because they often charge higher fees.

How much cash should I bring when visiting London?

You do not need to carry a lot of cash in London. Most places accept cards, including contactless payments. Bring enough cash for small purchases or emergencies. You can always get more cash from a trusted exchange shop or ATM.

Do I need to show ID to exchange money in London?

Some currency exchange shops in London may ask for your photo ID, especially for large transactions. It is a good idea to bring your passport or another form of identification when you visit an exchange provider.

While London offers plenty of currency exchange options, high fees and opaque rates often frustrate travelers. BiyaPay delivers a superior solution: real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies with seamless flexibility, and remittance fees as low as 0.5% for efficient fund flows. Plus, its quick registration and no-overseas-account-needed US/HK stock investment features add convenience to your travel payments. Visit BiyaPay now to explore these benefits and enhance your currency exchange experience! Whether traveling in London or handling cross-border payments, opt for BiyaPay for worry-free financial management.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.