- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Simple Steps to Obtain an FHA Loan for Your Next Home

Image Source: pexels

You can apply for an fha loan with confidence, even if you feel unsure about the home buying process. FHA loans help many first-time buyers qualify more easily. In the most recent year, over 793,000 people secured an fha loan in the United States. To start, check your eligibility, then find a lender, gather the needed documents, apply for an fha loan, and complete the closing steps. The process remains clear and manageable for most buyers.

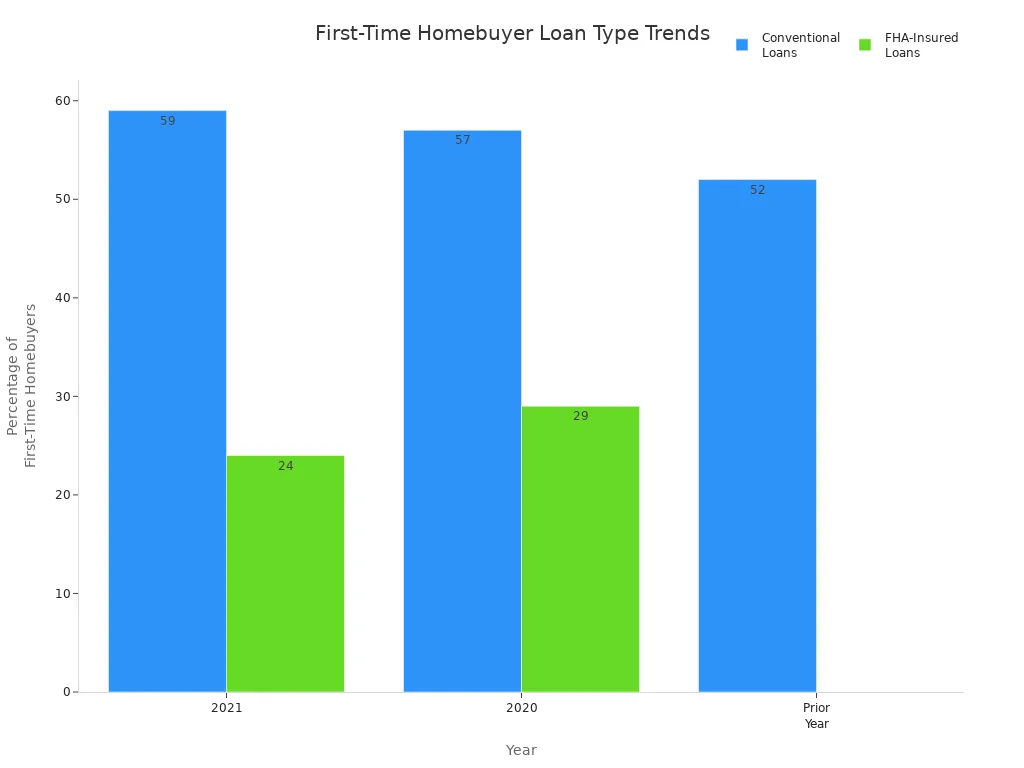

| Loan Type | Percentage of First-Time Homebuyers (2021) | Percentage of First-Time Homebuyers (2020) |

|---|---|---|

| Conventional Loans | 59% | 57% |

| FHA-Insured Loans | 24% | 29% |

Key Takeaways

- FHA loans help many first-time buyers qualify with lower down payments and flexible credit rules.

- You can qualify for an FHA loan with a credit score as low as 500, but a higher score means better terms.

- FHA loans allow higher debt-to-income ratios and accept gift money for down payments.

- Start by finding an FHA-approved lender, compare offers, and gather all required documents before applying.

- The FHA loan process includes appraisal, underwriting, and closing, usually taking 30 to 45 days.

FHA Loan Basics

Image Source: pexels

What Is an FHA Loan

You may wonder what makes an FHA loan different from other home loans. An FHA loan is a type of mortgage insured by the Federal Housing Administration, which is part of the U.S. Department of Housing and Urban Development. The FHA does not lend money directly. Instead, it insures loans made by FHA-approved lenders. This insurance protects lenders if you cannot repay your loan. Because of this, lenders can offer FHA loans to people who may not meet the strict guidelines for conventional home loans. The FHA program helps you buy a home with a lower down payment and more flexible credit requirements. You pay for this insurance through mortgage insurance premiums, which support the FHA program and make homeownership possible for more people.

Who Should Consider FHA Loans

FHA loans work well for many types of buyers. If you are a first-time homebuyer, you may find the FHA mortgage process easier to navigate. FHA loans also help if you have a lower credit score or limited savings for a down payment. Younger buyers and people from diverse backgrounds often use FHA loans because of their flexible guidelines. The FHA mortgage program also benefits those who have faced credit challenges in the past, such as bankruptcy or foreclosure. You can use FHA loans for different property types, including single-family homes, condos, and even some multifamily homes. If you want to refinance your current mortgage or need help qualifying for a new home, FHA loans can be a good choice.

| Buyer Group | Why FHA Loans Help |

|---|---|

| First-time homebuyers | Easier approval, lower down payment |

| Younger buyers | Lower average loan amounts, high approval |

| Minority groups | Flexible credit and down payment terms |

| Buyers with past credit issues | Shorter waiting periods, lenient guidelines |

FHA Loan Benefits

You gain many benefits when you choose an FHA mortgage. FHA loans require a down payment as low as 3.5% if your credit score is at least 580. If your score is between 500 and 579, you can still qualify with a 10% down payment. FHA loans accept lower credit scores than most conventional home loans. You can also have a higher debt-to-income ratio, which means you may qualify even if you have other debts. FHA guidelines allow you to use gift funds for your down payment, making it easier to buy a home. The FHA mortgage program offers competitive interest rates, even if your credit is not perfect. FHA loans also let sellers help with your closing costs, up to 6% of the purchase price. These benefits make FHA loans a popular choice for many buyers.

Note: FHA loans require mortgage insurance for all borrowers. This insurance protects the lender and supports the FHA program, but it adds to your monthly payment. You cannot remove this insurance unless you refinance into a different loan type.

| Feature | FHA Loans | Conventional Loans |

|---|---|---|

| Down Payment | As low as 3.5% | Usually 10% or more |

| Credit Score Requirement | 500-579 (10% down), 580+ (3.5% down) | Usually 620 or higher |

| Debt-to-Income Ratio | More flexible, allows higher ratios | More restrictive |

| Mortgage Insurance | Required for all FHA loans | Only required if down payment <20% |

FHA Loan Requirements

Credit Score and Down Payment

You need to meet certain credit score and down payment requirements to qualify for an FHA loan. The FHA sets a minimum credit score of 580 if you want the low 3.5% down payment. If your score falls between 500 and 579, you can still get an FHA mortgage, but you must put down at least 10%. Most lenders prefer scores of 580 or higher for the best terms. This flexibility helps many buyers who may not qualify for other home loans.

| Credit Score Range | FHA Minimum Requirement | Typical Lender Minimum | Down Payment Requirement | Notes |

|---|---|---|---|---|

| 500 - 579 | 500 | Often 580+ | 10% | Higher risk; manual review may apply |

| 580 and above | 580 | 580+ | 3.5% | Standard FHA mortgage terms |

| 620+ | N/A | 620 (some lenders) | 3.5% | May offer better rates |

| Borrower Credit Score Range | FHA Loan Minimum Down Payment | Conventional Loan Minimum Down Payment & Notes |

|---|---|---|

| 580 and above | 3.5% | 3% (stricter rules, higher scores needed) |

| 500 to 579 | 10% | 5% (if not eligible for 3% option) |

FHA loans make it easier to buy a home with less money upfront. You can also use down payment assistance programs to help cover your costs. These programs often work with FHA mortgage products.

Income and Employment

You must show steady income and employment to meet FHA loan requirements. Lenders check your job status and income to make sure you can repay your FHA mortgage. They may use recent pay stubs, tax returns, or bank statements. FHA loans allow verbal verification of employment in some cases. If you are self-employed, you need to prove your business is active and provide extra documents. Lenders want to see that your income and assets are current, usually within 60 days of your application. Down payment assistance can help if your income is limited.

Debt-to-Income Ratio

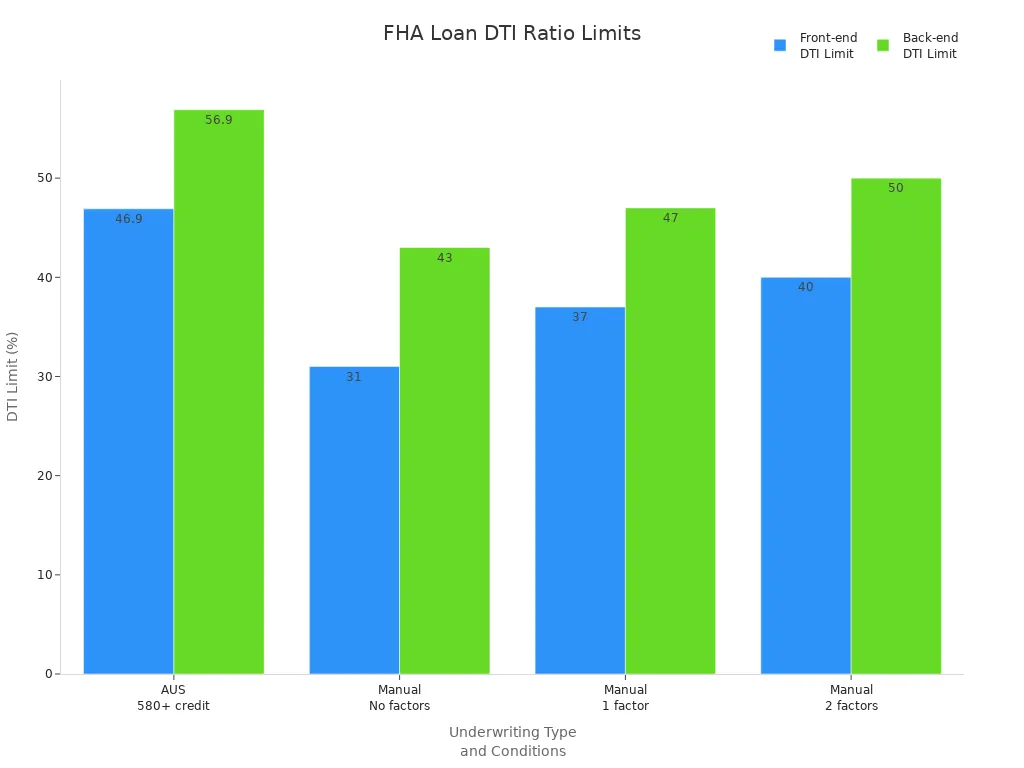

Your debt-to-income (DTI) ratio measures how much of your income goes to debts. FHA loans allow higher DTI ratios than many other home loans. Automated underwriting lets you have a front-end DTI up to 46.9% and a back-end DTI up to 56.9% if your credit score is 580 or higher. Manual underwriting uses stricter limits, but you may qualify for more if you have extra savings or a strong job history.

| Underwriting Type | Front-end DTI Limit | Back-end DTI Limit | Notes |

|---|---|---|---|

| Automated | 46.9% | 56.9% | For scores 580+ |

| Manual (no factors) | 31% | 43% | Standard |

| Manual (1 factor) | 37% | 47% | Extra savings or job history |

| Manual (2 factors) | 40% | 50% | Strong financial profile |

Property Eligibility

FHA loans only work for certain property types. You must use the home as your main residence. Eligible properties include single-family homes, condos in HUD-approved projects, and multifamily homes with up to four units. Manufactured homes qualify if they meet size and foundation rules. Fixer-uppers can use FHA 203(k) loans for repairs. Vacation homes, investment properties, and tiny homes on wheels do not qualify. The property must meet FHA mortgage safety and quality standards.

| Property Type | Eligibility Criteria and Restrictions |

|---|---|

| Single-family homes | Must be primary residence |

| Multifamily homes | Up to four units; must live in one unit |

| Condos | Must be in HUD-approved projects |

| Manufactured homes | Built after June 15, 1976; permanent foundation; meets size rules |

| Fixer-uppers | Eligible with FHA 203(k); must meet standards after repairs |

| Mixed-use properties | At least 51% residential; must be primary residence |

| Vacation homes | Not eligible |

| Investment properties | Not eligible |

| Tiny homes on wheels | Not eligible; must be on permanent foundation |

Mortgage Insurance

All FHA loans require mortgage insurance. You pay an upfront premium, usually 1.75% of your loan amount, and an annual premium added to your monthly payment. For most FHA mortgages under $726,200, the annual rate is 0.50% to 0.55%. If your down payment is less than 10%, you pay mortgage insurance for the life of the loan. If you put down 10% or more, you pay for 11 years. Mortgage insurance protects the lender and supports the FHA mortgage program. Down payment assistance can help you cover these costs.

How to Get an FHA Loan

Image Source: pexels

Find FHA-Approved Lenders

You need to start your FHA loan journey by finding FHA-approved lenders. These lenders have permission from the Federal Housing Administration to offer FHA mortgage products. You can search for FHA lenders in your area using online tools, downloadable lists, or interactive maps. Many websites provide lists of loan officers who help with FHA loan application steps. You can also review top-performing lenders for the current year.

Here is an example of FHA-approved lenders in Connecticut:

| Lender Name | Address | City | State | Zip | Phone | |

|---|---|---|---|---|---|---|

| WEBSTER BANK | 200 Executive Blvd. | Southington | CT | 06489 | 888-493-2783 | lending@websterbank.com |

| WELCOME HOME MORTGAGE, LLC | 1331 Silas Deane Highway | Wethersfield | CT | 06109 | 203-215-5821 | brian@welcomehomemortgage.net |

| WILLIAM RAVEIS MORTGAGE, LLC | 7 Trap Falls Road | Shelton | CT | 06484 | 203-980-8025 | frank.kolb@raveis.com |

| WINDSOR FEDERAL S & L ASSN | 250 Broad Street | Windsor | CT | 06095 | 860-298-6160 | diannucci@windsorfederal.com |

You can also use:

- Downloadable PDF lists of FHA lenders by region

- Interactive maps to locate FHA-approved lender offices

- Lists of loan officers who help with FHA loan application

- Links to top FHA lenders for the current year

You should choose an FHA-approved lender with a good reputation and strong customer service. This step helps you start the FHA loan application process with confidence.

Compare FHA Loan Offers

You should compare FHA loan offers from at least three FHA lenders. Each lender may offer different rates, fees, and terms. Comparing these details helps you find the best deal for your FHA mortgage.

When you compare FHA loan offers, look at:

- The interest rate and the annual percentage rate (APR). The APR includes fees and gives a full picture of the loan cost.

- Closing costs. These can change from lender to lender and may affect your total cost more than a small difference in interest rates.

- Prepaid interest, third-party fees, and escrow expenses. These are listed in your loan estimate.

- The monthly payment estimate. This helps you see if the loan fits your budget.

- Balloon payments and prepayment penalties. These can affect your loan flexibility.

- Mortgage insurance costs. FHA loans require both upfront and monthly premiums.

- The loan amount and terms offered.

- Lender reputation and customer service. You can check online reviews.

- How long you plan to stay in the home. This helps you decide if paying points to lower your interest rate makes sense.

Tip: Always review loan estimates side by side. This makes it easier to spot differences in costs and terms.

Gather Required Documents

You need to gather several documents before you apply for an FHA loan. Having these ready speeds up the FHA loan application process and helps prevent delays. Lenders use these documents to check your income, assets, and credit history.

| Document Category | Examples and Details |

|---|---|

| Employment Verification | Employment history for last 2 years, offer letter or contract if you started a new job |

| Proof of Income | Pay stubs, W-2s, tax returns |

| Credit History | Credit report and credit score review |

| Proof of Assets | Bank statements (last 2 months), investment account statements, documentation of large deposits |

| Debt-to-Income Ratio | Total monthly debt payments, monthly gross income |

| Identification | Government-issued ID (driver’s license or passport), Social Security card, residency history |

| Program-Specific Documents | For FHA: Social Security card copies; for VA: Certificate of Eligibility, DD214, relative contact info |

| Other Situational Documents | Divorce decree, business tax returns, mortgage payoff documents, relocation agreements, insurance quotes |

You should prepare these documents early. Keep them organized and up to date. If you are self-employed, gather business tax returns and proof your business is active. If you use gift funds for your down payment, collect a gift letter and proof of transfer. Staying organized helps your FHA loan application process move faster.

Apply for an FHA Loan

You can now apply for an FHA loan with your chosen FHA-approved lender. The FHA loan application process includes several steps. Each step brings you closer to owning your home.

Follow these steps to complete your FHA loan application:

- Confirm you meet FHA loan requirements. Check your credit score, income, down payment, and property use.

- Choose your FHA-approved lender. Research their experience, licensing, and customer service. Ask for a Good Faith Estimate.

- Complete the FHA loan application. Fill out the Uniform Residential Loan Application and provide your financial details.

- Submit your documents. Give your lender all required paperwork, such as pay stubs, tax returns, and bank statements.

- Get preapproval. Your lender reviews your information and gives you a preapproval letter. This letter shows sellers you are a serious buyer.

- Schedule an FHA appraisal. The lender orders an appraisal to make sure the home meets FHA standards and is worth the price.

- Go through underwriting. The lender reviews your documents and credit for final approval.

- Sign your loan documents. Pay closing costs and fees. Once you finish this step, you receive the keys to your new home.

The FHA loan application process usually takes 30 to 45 days from start to finish. The timeline depends on how quickly you submit documents and how busy your lender is. You can speed up the process by staying organized and responding quickly to requests.

Note: FHA loans have more flexible approval criteria than conventional loans. The average FHA borrower has a lower credit score, a higher loan-to-value ratio, and a higher debt-to-income ratio. This means you have a better chance of approval if you do not meet strict conventional loan standards.

You should apply for an FHA loan as soon as you have your documents ready. Preapproval helps you shop for homes with confidence. The FHA loan application process is clear and manageable when you follow these steps.

FHA Loan Process

Appraisal and Underwriting

You start the fha loan process with an appraisal. The lender schedules an appointment with an FHA-approved appraiser. The appraiser visits the property and checks if it meets FHA standards for safety, structure, and value. The appraisal report goes to your lender. The report must show that the home is safe, has working utilities, and meets local building codes. Common problems include peeling paint, broken handrails, or non-working water systems. If the appraiser finds issues, you or the seller must fix them before you move forward.

After the appraisal, your loan enters underwriting. The underwriter reviews your income, job history, credit, and the appraisal report. The process includes checking your pay stubs, tax returns, and bank statements. The underwriter uses both automated and manual reviews to decide if you qualify. Sometimes, the underwriter asks for more documents or explanations. You help the process by responding quickly and keeping your paperwork ready.

Approval and Closing

When you meet all requirements, you reach fha loan approval. The lender gives you a Closing Disclosure. This document lists your loan amount, interest rate, monthly payment, and all closing costs. You should check that these match your earlier Loan Estimate. At closing, you sign the final papers and pay fees. These fees include origination charges, taxes, insurance, and the appraisal cost, which usually ranges from $300 to $600 USD. You also pay your first year’s homeowner insurance and set up an escrow account for taxes and insurance. The lender can close the loan without waiting for FHA review, which speeds up the process. After closing, you get the keys to your new home.

Homebuyer Education

Many buyers benefit from homebuyer education during the fha loan process. Some programs require you to complete a class, especially if you use down payment assistance. These classes teach you about mortgages, budgeting, and home maintenance. You learn how to save for a down payment, choose the right loan, and avoid foreclosure. The classes also cover how to work with real estate agents and plan for repairs. If you use an FHA Home Equity Conversion Mortgage, you must take a HUD-approved counseling session. Even if not required, education helps you feel confident as you finish the process.

You can achieve homeownership with FHA loans by following a simple process. Start by checking your eligibility, then find an FHA-approved lender. Gather your documents early to speed up the process. Most buyers benefit when they apply for an FHA loan and complete preapproval before searching for a home. When you apply for an FHA loan, you gain access to flexible credit and down payment options. Apply for an FHA loan, respond quickly to lender requests, and apply for an FHA loan as soon as you are ready. Apply for an FHA loan to take the first step toward your new home. Apply for an FHA loan today and experience a smoother path to homeownership.

FAQ

What credit score do you need for an FHA loan?

You need a credit score of at least 580 for a 3.5% down payment. If your score is between 500 and 579, you can still qualify, but you must put down 10%.

Can you use gift money for your FHA loan down payment?

Yes, you can use gift money for your down payment. The person giving the gift must write a letter stating the money is a gift, not a loan.

How long does it take to get approved for an FHA loan?

Most FHA loans close within 30 to 45 days. You can speed up the process by preparing your documents and responding quickly to your lender’s requests.

What types of properties qualify for FHA loans?

You can buy a single-family home, a condo in a HUD-approved project, or a multifamily home with up to four units. You must live in one of the units as your main home.

Do FHA loans require mortgage insurance?

Yes, you must pay both an upfront and an annual mortgage insurance premium. The upfront fee is usually 1.75% of your loan amount. The annual premium gets added to your monthly payment.

When applying for an FHA loan to purchase a home, cross-border payment needs may require efficient currency conversion support. BiyaPay offers an ideal solution with real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery. Its quick registration, no-overseas-account-needed US/HK stock investment features, and the launched Easy Card service (offering fee-free global payments and instant cash withdrawals) enhance your home-buying fund management. Experience these benefits now to optimize your FHA loan payment process! Whether covering a down payment or handling cross-border transactions, BiyaPay boosts your financial efficiency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.