- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top Places to Get a Money Order in 2025

Image Source: pexels

If you wonder where to get a money order in 2025, you have plenty of choices. You can visit banks, the U.S. Postal Service, retail stores, or check-cashing services. Take a look at this quick comparison:

| Provider Type | Fees (2025) | Hours | Requirements |

|---|---|---|---|

| Banks & Credit Unions | $2 to $5 | Banking hours | May need an account |

| USPS | $2.35–$3.40 | Post office | ID needed |

| Retail Stores | Around $1 | Extended | Basic info |

| Check-Cashing | From $1, varies | Extended | Fees and limits vary |

Fees, hours, and requirements can change how you choose to get a money order.

Key Takeaways

- You can buy money orders at banks, the post office, retail stores, grocery stores, and convenience stores, each with different fees and hours.

- Retail and grocery stores usually offer the lowest fees and longer hours, while banks and the post office provide more security but may cost more.

- Always bring a valid ID, cash or debit card, and keep your receipt to track or cancel your money order if needed.

Where to Get a Money Order

Image Source: unsplash

USPS

You can always count on the post office when you want to get a money order. In 2025, every USPS location across the country offers money orders. The USPS rolled out redesigned money orders this year, so you will find them at any post office, no matter where you live. This makes the post office one of the most reliable places if you wonder where to get a money order.

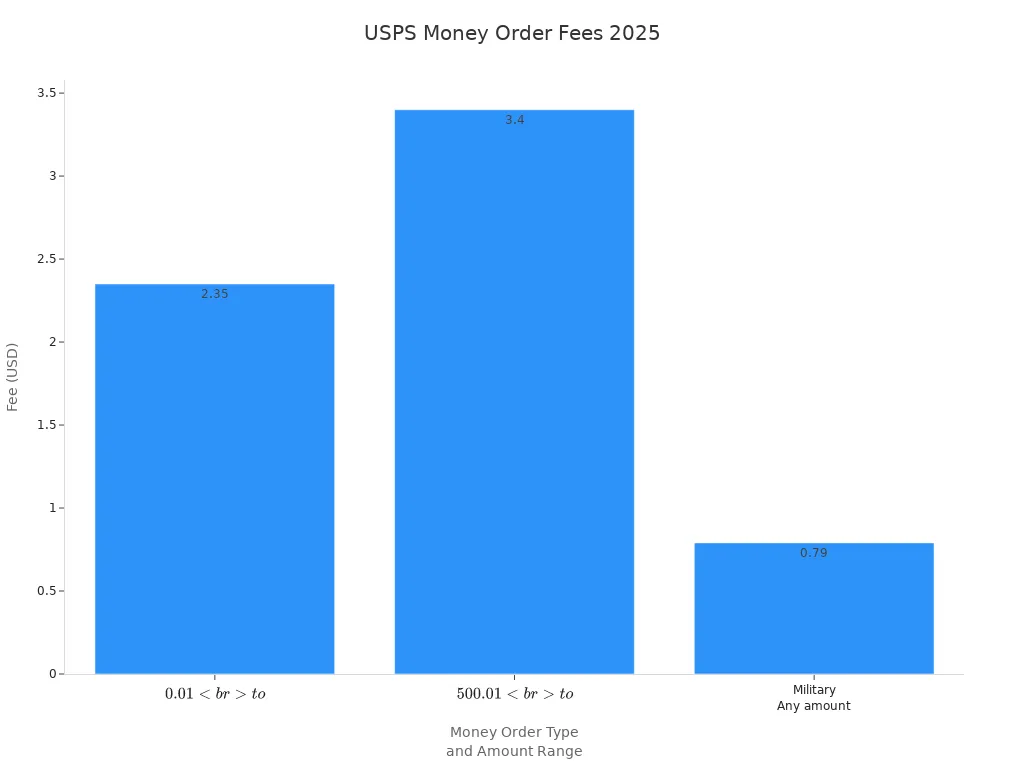

Here’s a quick look at the fees and limits for a USPS money order in 2025:

| Money Order Type | Amount Range | Fee | Maximum Limit | Additional Notes |

|---|---|---|---|---|

| Money Orders | $0.01 to $500 | $2.35 | $1,000 | Cannot send more than $1,000 in a single money order |

| Money Orders | $500.01 to $1,000 | $3.40 | $1,000 | |

| Military Money Orders | Any amount | $0.79 | N/A | Must be purchased at military facilities |

| Daily Purchase Threshold | Over $3,000 in a day | N/A | N/A | Requires Funds Transaction Report and ID |

| International Money Orders | No longer sold after | N/A | N/A | Sales stopped Oct 1, 2024; can be cashed until Sept 30, 2025 |

You can see the fee differences in this chart:

If you need a usps money order, bring your government-issued ID and enough cash or a debit card to cover the amount and the fee. The post office gives you a receipt for tracking and proof of payment. You can trust the post office for secure payments, and you do not need a bank account to use this service.

Banks and Credit Unions

You can also get a money order at your local bank or credit union. Most banks and credit unions offer this service to account holders, but some may help non-members too. The fees usually range from $2 to $5 per money order. For example, Affinity Federal Credit Union and Hudson Valley Credit Union both charge $3 per money order. You will need to provide your name, address, the recipient’s name and address, and your signature.

Banks and credit unions focus on security. They require you to fill out all personal information to prevent fraud. If you already have an account, the process is quick and easy. Some banks or credit unions may ask for your ID, especially if you do not have an account with them. If you want to use a financial institution you trust, this is a good choice.

Grocery Stores

Many people like to get a money order while shopping for groceries. Major grocery store chains such as Kroger, Publix, and Meijer offer money orders at their customer service desks. These stores usually use Western Union or MoneyGram as their provider. The fees are low, often between $0.65 and $1.00 per money order. Limits range from $500 to $1,000 per transaction.

| Grocery Store Chain | Money Order Fee | Limit per Money Order | Provider |

|---|---|---|---|

| Meijer | $0.65 | $500 | Western Union |

| Publix | $0.85 | $500 | Western Union |

| Kroger (and affiliates) | $0.69 - $1.00 | $500 - $1,000 | Western Union |

You can pay with cash or debit card. Grocery stores make it easy to get a money order during regular shopping hours. If you want a western union money order, these stores are a great option.

Retail Stores

Retail stores are some of the most convenient places to get a money order. Walmart stands out because you can get a walmart money order for less than $1, and the limit is $1,000 per order. Safeway, Meijer, and Publix also offer money orders, usually through Western Union. CVS does not sell traditional money orders, but some locations offer MoneyGram transfers.

| Retailer | Money Order Service | Fees | Notes |

|---|---|---|---|

| Walmart | Yes | Up to $1 | Limits $1,000 per order; fees vary by location but never exceed $1 |

| CVS Pharmacy | No (traditional money orders) | N/A | Offers MoneyGram money transfer services instead |

| Safeway | Yes (via Western Union) | Varies | Some locations only |

| Kroger | Yes | Low cost | Check local store for limits |

| Meijer | Yes | Approx. $0.65 | Available in select states; debit card accepted without extra fee |

| Publix | Yes (via Western Union) | Varies | Offers money orders and other financial services |

Retail stores let you buy a money order with cash or debit card. You do not need a bank account. These stores partner with trusted brands like Western Union and MoneyGram. You get a secure, prepaid payment method with a paper trail for tracking. If you want a walmart money order, just visit the customer service desk.

Tip: Always keep your receipt. It helps you track your payment and protects you if your money order is lost or stolen.

Convenience Stores

You can find money orders at many convenience stores in 2025. Stores like 7-Eleven and others sell money orders through Western Union or MoneyGram. Convenience stores stay open late, so you can get a money order outside regular business hours. This makes them a good choice if you need to send money in the evening or on weekends.

| Aspect | Details |

|---|---|

| Service Fees | Typically $1 to $5 per money order |

| Purchase Limit | Usually capped at $1,000 per money order |

| Additional Notes | For amounts over $1,000, multiple money orders must be purchased, each incurring separate fees |

Convenience stores are easy to find, but they may not offer the same level of security as a bank or the post office. Always fill out your money order carefully and keep your receipt.

Pharmacies

Some pharmacies, such as CVS, offer money order services, but not all locations do. If you want to get a money order at a pharmacy, you must bring a government-issued photo ID. You can pay with cash or a debit card. The process is simple, and you do not need extra forms of identification. Pharmacies make it easy to get a money order while you pick up your prescriptions or shop for other items.

Check Cashing Stores

Check cashing stores, like ACE Cash Express, Amscot, and PLS, sometimes offer money orders, but they focus more on cashing checks. Their fees are usually higher than other places. For example, ACE Cash Express charges 2% to 6% of the check amount, and Amscot charges up to 9.9%, with a $3 minimum. These stores are not the best choice if you want to get a money order at a low cost.

Amscot stands out because it does not charge an upfront fee to buy a money order. However, if the recipient cashes it at Amscot, they may pay a fee. If you lose your money order, the recovery process can take a long time, and there is a $12 cancellation fee. Always fill out the recipient’s name, your name and address, the amount, and your signature. Keep your receipt for tracking or cancellation.

Note: Check cashing stores are less common for money orders in 2025. You will find better rates and more security at the post office, a bank or credit union, or a retail store.

Best Places to Purchase

Fees

When you look at the cost to buy a money order, you will notice some big differences. Retail stores like Walmart usually offer the lowest fees, often under $1 per money order. Grocery stores also keep fees low, usually between $0.65 and $1.00. The post office charges a bit more, with fees from $2.35 to $3.40, depending on the amount. Banks and credit unions often have the highest cost to buy a money order, sometimes up to $5. If you want to save money, retail and grocery stores are some of the best places to purchase.

Limits

Most places set a maximum limit of $1,000 per money order. If you need to send more, you can buy multiple money orders, but some providers may have daily limits. For amounts over $1,000, you will need to show a government-issued ID. Minimum purchase limits are not common, so you can usually buy a money order for any amount up to the maximum.

Requirements

To purchase a money order, you usually need to bring cash or a debit card. Some places, like Western Union, require a valid government-issued ID, especially for larger amounts. Banks and credit unions may ask for your account information. At retail and grocery stores, you just need basic info and payment. Always check what your provider needs before you go.

Tip: Bring your ID and know the amount you want to send. This will make the process faster.

Hours

Retail stores and grocery stores offer the most flexible hours. Many stay open late and on weekends, so you can buy a money order when it fits your schedule. The post office and banks have more limited hours, usually closing in the early evening and on Sundays. If you need to buy money orders outside regular business hours, retail and convenience stores are your best bet.

How to Get a Money Order

Steps

Getting a money order is simple if you follow the right steps. Here’s what you need to do at most banks, grocery stores, or retail locations:

- Visit your chosen provider in person. Online purchases are not available.

- Tell the clerk the amount you want to send. Most places let you send up to $1,000 per money order.

- Pay for the money order using cash or a debit card. Some stores accept coins, but most do not take credit cards or personal checks.

- Write the recipient’s name in the “PAY TO THE ORDER OF” section. Double-check the spelling.

- Fill in your full name and current address.

- Sign the front of the money order. The back is for the person who receives it.

- Add a memo if you want to note what the payment is for, like “rent” or “utilities.”

- Keep the receipt. This helps you track the money order or cancel it if needed.

Tip: Always fill out the money order completely before you leave the counter. This keeps your payment safe.

What to Bring

Before you go to buy a money order, make sure you have everything you need:

- A valid photo ID, such as a driver’s license or passport.

- Enough cash or a debit card to cover the amount and the fee.

- The exact name and address of the person or business you want to send a money order to.

- Your own name and address.

- A pen to fill out the form, if you want to use your own.

Some places may ask for extra information if you send a money order for a large amount. Always check with your provider before you go. Keeping your receipt is important for tracking or canceling your payment later.

Alternatives to Money Orders

Image Source: pexels

Sometimes, a money order is not the best fit for your needs. You might want to send a larger payment or need faster delivery. In these cases, you can look at other options. Two of the most popular alternatives in 2025 are cashier’s checks and digital payment apps.

Cashier’s Checks

If you need to send a big payment, a cashier’s check can help. Banks and credit unions issue these checks. You can use them for things like buying a car or making a down payment on a house. Cashier’s checks cost more than a money order, but they offer extra security and higher limits. Here’s a quick comparison:

| Feature | Money Orders | Cashier’s Checks |

|---|---|---|

| Issuer | Post offices, stores, banks | Banks and credit unions only |

| Maximum Amount | Around $1,000 | Much higher, no set limit |

| Cost | Usually under $5 | $5 to $20 or more |

| Security Features | Basic | Advanced, bank-backed |

| Best For | Small payments | Large, secure transactions |

You should pick a cashier’s check when you need to send a large amount or want extra peace of mind. If you do not have a bank account, a money order is still a good choice for smaller payments.

Digital Payment Apps

You can also use digital payment apps instead of a money order. These apps let you send money quickly from your phone or computer. Popular choices in 2025 include Apple Pay, Google Wallet, Venmo, PayPal, Cash App, and Zelle. Each app has its own features, fees, and limits.

| App | Typical Fees | Speed | Notes |

|---|---|---|---|

| Venmo | Free (bank), 3% (credit card) | Instant to minutes | Easy for friends and family |

| Cash App | 0.5%-1.75% instant transfer | Instant to 1-3 days | Bitcoin option available |

| Apple Pay | Free (regular), 1.5% instant | Up to 30 minutes | Apple devices only |

| Zelle | Free | Minutes | Bank-to-bank, high security |

Digital payment apps work well for fast, everyday transfers. You do not need to fill out forms or visit a store. If you want to avoid paper and save time, these apps are a smart alternative.

You have many choices for secure payments. Retailers and grocery stores offer low fees and long hours. Banks provide extra security. If you need to send more than $1,000 or want extra trust, look at this quick comparison:

| Feature | Money Orders | Cashier’s Checks | Bank Drafts |

|---|---|---|---|

| Limit | $1,000 | No limit | No limit |

| Trust | Secure | Most trusted | Guaranteed |

| Account Needed | No | Yes | Yes |

Pick what fits your needs best.

FAQ

Can you buy a money order online in 2025?

You cannot buy a money order online. You need to visit a store, bank, or post office in person to get one.

What happens if you lose your money order?

If you lose your money order, keep your receipt. Go back to where you bought it. They can help you track or cancel it.

Do you need a bank account to get a money order?

You do not need a bank account. You can buy a money order with cash or a debit card at many stores or the post office.

When obtaining a money order in 2025, cross-border payment needs may require efficient currency conversion support. BiyaPay offers an ideal solution with real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery. Its quick registration, no-overseas-account-needed US/HK stock investment features, and the launched Easy Card (supporting convenient payments on eBay, Amazon, PayPal, and more) enhance your payment flexibility. Experience these benefits now to optimize your money order acquisition and cross-border payment experience! Whether handling daily transactions or international remittances, BiyaPay boosts your financial efficiency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.