- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Avoiding Hidden Charges When Using Foreign ATMs for Currency Exchange

Image Source: pexels

You can avoid hidden charges and poor exchange rates by making smart choices when using ATMs abroad. Pick trusted bank ATMs, skip dynamic currency conversion, use cards with low or no fees, and plan your withdrawals ahead. These steps are simple, yet they add up fast. For example, using certain cards that reimburse ATM fees can save you hundreds of dollars a year. If you avoid high-fee airport kiosks, you might keep an extra $50 to $100 in your pocket per trip. When you pay attention to these details while traveling abroad, you make your money go further.

Key Takeaways

- Use bank-affiliated ATMs instead of independent ones to avoid high fees and scams.

- Always choose to withdraw cash in the local currency to get better exchange rates and avoid extra charges.

- Plan your withdrawals by taking out larger amounts less often to reduce fixed fees and save money.

- Pick cards or banks that waive or refund foreign ATM fees to keep more of your money while traveling.

- Protect your card and PIN by using ATMs in safe locations, covering your PIN, and watching for suspicious activity.

ATM Fees Abroad

Image Source: pexels

When you use ATMs abroad, you often face several types of fees. These charges can add up quickly if you do not pay attention. Let’s break down the main fees you might see when making foreign ATM withdrawals.

International ATM Fees

You usually pay international ATM fees every time you take out cash from a foreign ATM. Your bank charges these fees for using an ATM outside your home country. Most major US banks, like Bank of America, Wells Fargo, and Citibank, charge a flat fee plus a percentage of your withdrawal. For example, Bank of America adds a $5 fee and a 3% transaction fee to each withdrawal. Wells Fargo and Citibank have similar fee structures. Some banks, such as USAA, do not charge an ATM usage fee but still add a 1% currency conversion fee.

Here’s a quick look at what you might pay:

| Bank | Foreign ATM Withdrawal Fee | Foreign Transaction Fee |

|---|---|---|

| Bank of America | $5 | 3% |

| Wells Fargo | $5 | 3% |

| Chase | $5 | 3% |

| Citibank | $2.50 | 3% |

| U.S. Bank | $2.50 | 2%-3% |

| PNC Bank | $5 | 3% |

| Capital One | $2 | 3% |

| TD Bank | $3 | None |

| BB&T | $5 | 3% |

| SunTrust | $5 | 3% |

Let’s say you withdraw $60 from a foreign ATM using Bank of America. You pay a $5 fee plus 3% of $60, which is $1.80. That’s $6.80 in fees, and this does not include any extra charges from the ATM provider.

Tip: Some banks waive international ATM fees if you keep a high balance or use partner ATMs. Always check your bank’s policy before you travel.

Foreign ATM Operator Fees

Besides your bank’s charges, the ATM owner can also add a fee. This is called the ATM provider fee. You see this fee on the ATM screen before you finish your transaction. The amount depends on the country, the ATM network, and whether you use a bank or an independent ATM.

Bank-owned ATMs usually charge less than independent operators. For example, in Australia, you might pay nothing at rediATM, $2 at ANZ Bank, or $7.50 at National Bank of Australia. In Europe, some banks offer free withdrawals, while others charge up to €6.95 (about $7.50 USD). In South America, fees can range from free to several dollars, depending on the bank.

| Country | Example Providers and Fees (Foreign Card Withdrawals) |

|---|---|

| Albania | Union Bank: $3.80; Credins Bank: $7.10 (Mastercard); Tirana Bank: $7.60; Raiffeisen Bank: fees vary |

| Andorra | Andbank, Morabanc, Credit Andorra: free (Mastercard) |

| Argentina | Banco de Lá Nacion/Link: $0.30 (max $46); Badesco: $0.34 (Mastercard/Visa); Banco Patagonia/EB: $0.53 (max $8) |

| Armenia | Unibank Armenia: free |

| Australia | rediATM: free; ANZ Bank: $2; Westpac: $4; National Bank of Australia (NAB): $7.50; Commonwealth Bank: $7.50 |

| Austria | Austrian Anadi Bank: free; Bank Austria/Unicredit: $7.50 (Mastercard); Bankhaus Carl Spangler: free (Visa); Bawag: free (Mastercard) |

You can see that fees change a lot from country to country. Independent ATMs, like Euronet or Travelex, often charge higher fees than bank ATMs. Always check the fee before you accept the withdrawal.

Here’s a quick list of what to watch for:

- International ATM fees can be flat, percentage-based, or both.

- Typical charges include a $5 overseas withdrawal fee, a 3% foreign transaction fee, and an ATM provider fee.

- Independent ATMs usually cost more than bank ATMs.

- Some cards, like the Wise Multi-Currency Card, offer free or low-fee withdrawals up to a limit.

- You should always check fees in advance and use bank ATMs when possible.

Currency Conversion Fees

When you withdraw cash in another country, you often pay currency conversion fees. Your bank or card issuer charges these fees to change your money from US dollars to the local currency. Most banks charge between 1% and 3% of the withdrawal amount as a conversion fee. This fee is separate from the international ATM fee and the ATM provider fee.

Some banks, like Bank of America, add the conversion fee to their flat withdrawal fee. Others, like USAA, only charge a 1% conversion fee but no ATM usage fee. These fees can sneak up on you, especially if you make several small withdrawals.

Let’s look at a real example. If you withdraw $100 from a foreign ATM, you might pay:

- Out-of-network fee: $3

- ATM provider fee: $4

- Foreign transaction fee (3%): $3

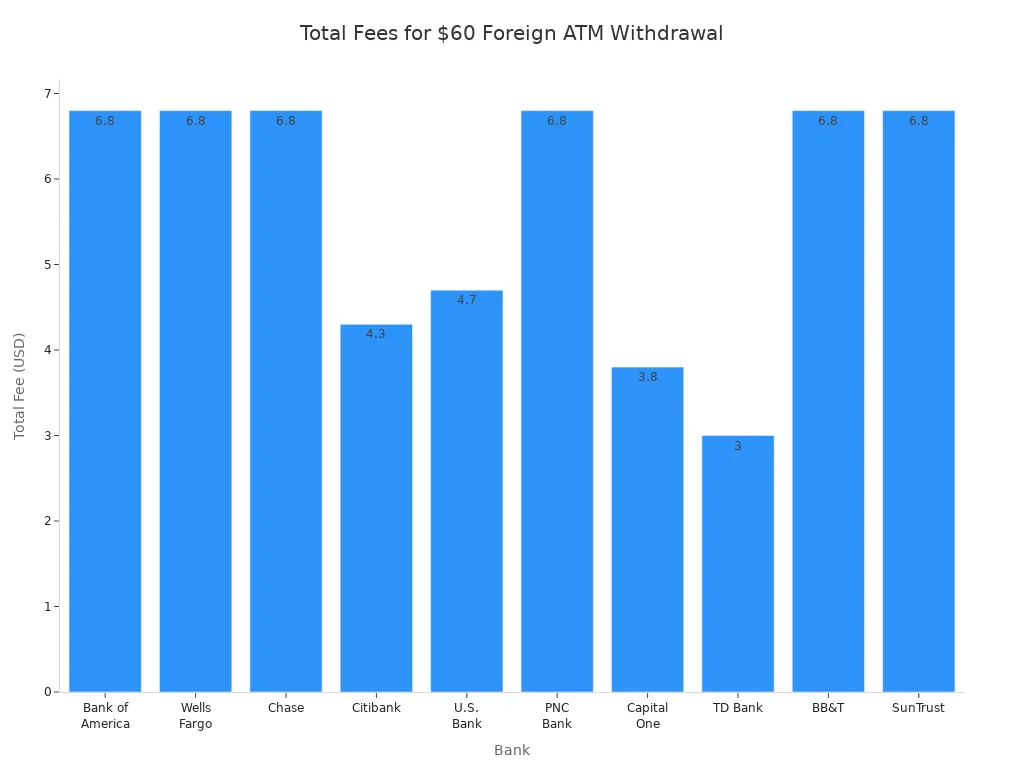

That’s $10 in total fees, or 10% of your withdrawal. Here’s a chart that shows how these fees add up for a $60 withdrawal at different banks:

Note: ATM fee structures change by region. Europe often has lower or even free ATM withdrawal fees at some banks. South America and Asia can have higher or more variable fees. Always check the rate and total cost before you withdraw.

If you want to save money, plan your withdrawals, use bank ATMs, and look for cards that offer low or no foreign transaction fees. Paying attention to these details helps you avoid hidden charges and get a better rate when using ATMs abroad.

Choosing ATMs Abroad

Image Source: pexels

Bank vs. Independent ATMs

When you travel, you will see many different ATMs. Some belong to big banks, while others are run by independent companies. You might spot independent ATMs like Euronet or Travelex in airports, train stations, or busy tourist spots. These machines look convenient, but they often come with a hidden price. Independent ATMs can charge fees as high as 15% on top of what your bank already charges. Euronet is known for charging tourists much more than local banks. Even if Travelex offers good rates online, their airport ATMs rarely match the value or safety of a real bank’s machine.

Bank-affiliated ATMs usually charge lower fees and give you a fairer exchange rate. For example, Deutsche Bank in Germany sometimes lets you take out money for free with an international card. BNP Paribas in France and Santander in Spain also keep their fees low, usually around $2 to $3 per withdrawal. These bank ATMs are more transparent about their charges, so you know what you are paying.

Here are some tips to help you spot the difference:

- Bank-affiliated ATMs are often inside bank branches or post offices.

- Independent ATMs stand alone, have flashy screens, and may not show any bank logo.

- If you see an ATM in a dark corner or crowded tourist area, check for a bank name before using it.

- Bank ATMs usually display clear fee information before you confirm your transaction.

You should avoid independent ATMs whenever possible. They not only charge higher fees but also use tricks like dynamic currency conversion, which gives you a poor exchange rate. Some travelers have lost extra money because they did not notice these hidden costs. If you want to save money and avoid surprises, stick to bank-affiliated ATMs when you need to withdraw cash from a foreign atm.

Security is another big reason to choose bank ATMs. Banks monitor their machines closely and use strong identity checks. This makes it harder for criminals to steal your information or set up scams. Independent ATMs do not always follow the same rules. Reports show that these machines can be less secure, and some travelers have faced problems like card skimming or PIN theft. You can lower your risk by using ATMs inside banks during business hours and covering your PIN when you enter it.

Finding Trusted ATMs

You want to find an ATM that is safe, easy to use, and does not charge too much. Start by looking for machines with well-known bank names. ATMs inside bank branches or reputable post offices are usually the safest. These locations have cameras, staff, and better lighting, which helps protect you from scams.

When you search for an ATM, check for network logos like Visa, PLUS, MasterCard, or Cirrus. These networks give you the widest access to your money around the world. The PLUS (Visa) network covers over 200 countries, making it the best choice for most travelers. Cirrus and Maestro, linked to MasterCard, are also common in Europe and many other places. If your card has one of these logos, you can use it at millions of ATMs abroad.

Here is a quick table to help you compare the main ATM networks:

| ATM Network / Bank | Global Coverage (Countries) | Key Features for International Travelers |

|---|---|---|

| PLUS (Visa) | 200 | Widest global access; common in US, Canada, India, Indonesia |

| Cirrus (MasterCard) | 93 | Widely available; linked to MasterCard and Maestro cards |

| Maestro (MasterCard) | Europe-focused; linked to Cirrus | Main debit brand in Europe; often co-branded with Cirrus |

| Charles Schwab (Bank) | Worldwide ATM reimbursements | No foreign ATM fees; reimburses all ATM charges globally |

| Capital One 360 (Bank) | ~70,000 ATMs globally | No ATM fees at partner networks; no foreign transaction fees |

| USAA (Bank) | Broad global surcharge reimbursements | No ATM fees in-network; reimburses out-of-network fees (up to limit) |

If you want to avoid extra fees, choose banks that reimburse ATM charges or do not add foreign transaction fees. Charles Schwab and Capital One 360 are two banks that help travelers save money by refunding ATM fees and skipping extra charges. Some fintech cards, like Revolut or Monzo, also offer low-fee or fee-free withdrawals at atms abroad.

When you use a foreign atm, always check the screen for fee warnings before you finish your transaction. If the machine asks if you want to be charged in your home currency, say no. Choose the local currency to get the best rate and avoid hidden costs.

To sum up, you can save money and stay safe by:

- Using bank-affiliated ATMs instead of independent ones.

- Looking for trusted network logos like Visa, PLUS, MasterCard, or Cirrus.

- Picking banks that refund ATM fees or offer low-cost withdrawals.

- Avoiding machines in dark or crowded tourist spots.

- Always choosing to withdraw cash in the local currency.

By following these steps, you make your money go further and keep your trip stress-free.

ATM Exchange Rates

Dynamic Currency Conversion

When you use a foreign atm, you might see a screen asking if you want to be charged in your home currency or the local currency. This is called Dynamic Currency Conversion (DCC). DCC lets you see the amount in your home currency right away, which can seem helpful. But here’s the catch: the atm operator sets the exchange rates for DCC, not your card issuer. These rates often include a big markup, making your withdrawal more expensive.

DCC is run by third-party companies, not your bank. They add extra fees and use a rate that is worse than what your card issuer would give you. Even though the atm shows you the exchange rate and fees, the total cost is usually much higher. Sometimes, the atm makes it look like you have to pick DCC, but you can always say no. Visa says you should never feel pressured to accept DCC. If you do not get clear information about the fees or rate, it is better to decline.

Note: DCC can make your foreign atm withdrawal cost up to 7% more than if you choose the local currency. That means you could lose almost $10 on a $100 withdrawal just by picking the wrong option.

Here is a quick table to show the difference:

| Scenario | Amount Charged (USD) | Mid-Market Rate Equivalent (USD) | Difference (USD) | Percentage Difference |

|---|---|---|---|---|

| Using Dynamic Currency Conversion (DCC) | $146.50 | $136.00 | $10.50 | 7% |

| Paying in Local Currency | $136.10 | $136.00 | $0.10 | 0.1% |

Always Choose Local Currency

You should always pick the local currency when you use a foreign atm. This simple choice helps you avoid bad exchange rates and extra fees. When you choose local currency, your card issuer handles the conversion. They use the market rate, which is almost always better than the rate from the atm operator.

Here are some things to remember:

- ATMs in tourist areas often offer DCC, but the rates are not in your favor.

- Picking your home currency means the atm operator sets the rate, which costs you more.

- Choosing local currency lets your bank or card company use their own rate, which is usually close to the real market rate.

- Most financial experts say you should always select local currency to save money.

If you want to get the best atm exchange rates, pay attention to the options on the screen. Do not rush. Take a moment to read the choices. If you see “convert to USD” or “charge in your home currency,” pick “no.” Go for the local currency every time. This way, you keep more of your money and avoid hidden charges.

Using ATMs Abroad Safely

Protecting Your Card and PIN

You want to keep your money safe when using atms abroad. Start by memorizing your PIN. Never write it down or keep it with your card. Always cover the keypad with your hand when you enter your PIN. This simple move blocks hidden cameras and prying eyes. Before you use any ATM, check for anything odd. Look for loose card slots, strange attachments, or thick keypads. These signs may mean someone has placed a skimming device to steal your card details.

Choose ATMs inside banks or hotels. These spots have better security and fewer risks. If you see people hanging around the ATM or acting strangely, pick another machine. You should also notify your bank before your trip. This helps prevent your card from being blocked and alerts your bank to possible fraud. Keep your banking apps updated and avoid public Wi-Fi when checking your accounts. Make fewer, larger withdrawals to limit your exposure to fees and risks.

Tip: Set up transaction alerts on your phone. You will know right away if someone tries to use your card without your permission.

Avoiding Scams

Scammers target travelers who are using atms abroad. They use tricks like distraction, fake help, or even fake ATMs. Here are some ways to protect yourself:

- Inspect the ATM for tampering. Look for glue, tape, or loose parts.

- Use ATMs in well-lit, busy areas or inside bank branches.

- Never accept help from strangers at the ATM. If someone offers, politely refuse.

- Shield your PIN every time you enter it.

- Watch out for distraction tactics. If someone tries to talk to you or causes a scene, stay alert and cancel your transaction if needed.

- Carry only the cash you need. Use a hidden pouch or money belt for extra safety.

- Monitor your account for any strange activity. Report anything suspicious to your bank right away.

ATM skimming is a growing problem in places like the U.S., Indonesia, and the Philippines. In the U.S., skimming incidents at bank ATMs rose by 109% in early 2023. California saw three times more cases than any other state. Europe has fewer problems because of stronger security, but you should always stay alert.

Note: Using the buddy system can help. One person withdraws cash while the other keeps watch.

By following these steps, you lower your risk and keep your money safe while using atms abroad.

Minimizing International ATM Fees

Plan Withdrawals

You can save a lot of money on transaction fees by planning your ATM visits before you travel. Every time you use a foreign ATM, you might pay a flat fee, like $5, plus a percentage of your withdrawal. If you make many small withdrawals, these costs add up fast. Instead, try to withdraw cash in larger amounts but less often. This way, you pay fewer fixed fees and keep more of your money.

- Withdraw larger sums at once to cut down on the number of transactions.

- Use global ATM alliances, such as the Bank of America Global ATM Alliance or Barclays, to access partner ATMs with lower or no extra charges.

- Choose cards that refund ATM fees, like the Charles Schwab debit card, so you can avoid repeated charges.

- Avoid making small withdrawals at airport ATMs, where fees are often higher.

Tip: Plan your cash needs for each leg of your trip. This helps you reduce atm fees and avoid running out of money in places where ATMs are hard to find.

Check Daily Limits

Before you travel, check your bank’s daily withdrawal limit. Most major banks set limits between $300 and $1,000 per day. These caps help protect your account, but they can also make it harder to get enough cash when you need it. If you try to take out more than your limit, your bank might block your card or freeze your account for security reasons.

Here’s a quick table to show typical daily limits:

| Bank Name | Daily Withdrawal Limit (USD) |

|---|---|

| HSBC (Hong Kong) | $1,000 |

| Bank of America | $1,000 |

| Citibank | $1,000 |

| Charles Schwab | $1,000 |

| Chase | $500 |

If you need more cash, contact your bank before your trip to request a higher limit. Always keep track of your withdrawals to avoid surprises. By knowing your limits and planning ahead, you can avoid extra transaction fees and keep your trip running smoothly.

Cards for Using ATMs Abroad

Multi-Currency and Low-Fee Cards

You can make your travels easier by using a multi-currency or low-fee card. These cards help you avoid high ATM charges and bad exchange rates. With a multi-currency card, you can hold and spend money in different currencies. This means you do not pay extra when you use the local money you already have on your card. Many travelers like cards such as Wise or Revolut because they offer low conversion fees and real-time spending alerts.

Here is a quick look at what these cards offer:

| Feature/Service | Description/Benefit |

|---|---|

| Hold and spend multiple currencies | Manage funds in many currencies, so you avoid extra conversions. |

| Low conversion fees | Fees start from 0.41%, which saves you money. |

| Free ATM withdrawals | First two withdrawals under $100 are free; after that, fees are low. |

| Instant transaction alerts | Get notified right away when you spend or withdraw. |

| Freeze/unfreeze card in app | Control your card’s security with one tap. |

| Wide acceptance | Use your card in over 170 countries. |

| Supports mobile payments | Pay with your phone using Apple Pay or contactless. |

You can also freeze your card if you lose it and create digital cards for online shopping. These features give you more control and safety. If you want to avoid dynamic currency conversion, always choose to pay in the local currency with your card.

Banks That Waive Fees

Some banks and fintech companies help you save even more by waiving or refunding ATM fees. You can find accounts that do not charge for foreign withdrawals or even give you back the fees other banks charge. Here are some popular options:

- Charles Schwab Bank Visa Platinum Debit Card: No foreign transaction fees and unlimited ATM fee rebates worldwide.

- Capital One 360 Checking: No foreign transaction or currency conversion fees, but ATM provider fees may still apply.

- Betterment Checking: Reimburses ATM provider fees worldwide and covers the 1% Visa currency conversion fee.

- Fidelity Cash Management Account: Refunds ATM fees at machines with Visa, Plus, or Star logos.

- USAA Classic Checking: Reimburses up to $10 per month in ATM fees; 1% foreign exchange fee applies.

- HSBC Bank Premier Checking: No ATM withdrawal fees at HSBC ATMs worldwide; foreign transaction fee waived for Premier customers with a $100,000 balance.

- Citibank Citi Priority Package: No ATM withdrawal or foreign exchange fees overseas if you keep a $30,000 balance.

Many fintech banks like Ally, Chime, SoFi, and Varo Bank also refund ATM fees or do not charge for using foreign ATMs. Always check the terms, as some banks require a minimum balance to get these benefits. If you want to avoid extra costs, pick a card or bank that fits your travel style and spending needs.

Global ATM Networks

ATM Alliances

You can save a lot of money by using global ATM alliances when you travel. These alliances are groups of banks that work together to help you avoid extra ATM fees. If you have an account with a member bank, you can use your card at partner ATMs in other countries without paying the usual ATM usage fees. This makes it much easier to get cash while you travel.

Here’s a table to show you some of the largest ATM alliances and their benefits:

| Alliance/Bank | Member Banks / Partners | Fee Benefits for Travelers |

|---|---|---|

| Global ATM Alliance | Bank of America, Barclays, BNP Paribas, Deutsche Bank, Scotiabank, Westpac | Use ATMs of other member banks without ATM fees. |

| Bank of America | TEB (Turkey), UkrSibbank (Ukraine), China Construction Bank (China) | Waives ATM fees with these banks; 3% transaction fee on non-USD withdrawals (often refundable). |

| Westpac | CIMB (Indonesia, Malaysia) | Waives ATM fees with CIMB ATMs. |

| Charles Schwab | N/A | No ATM fees worldwide; reimburses all ATM fees from other institutions monthly; no minimum deposit or fees. |

When you use an ATM from one of these alliances, you skip the out-of-network ATM fee. You also avoid the ATM operator’s fee, which can be $3 to $7 per withdrawal. Some banks, like Charles Schwab, go even further. They refund all ATM fees worldwide, so you never have to worry about finding a partner ATM.

Tip: Always check if your bank is part of an alliance before you travel. This can help you avoid surprise charges and keep more of your money.

How to Join

You do not need to sign up for anything special to use these ATM alliances. If you already have an account with a member bank, you can use your debit card at partner ATMs right away. Here’s what you need to know:

| Requirement | Explanation |

|---|---|

| Account Holder Status | You must have an account with a member bank, such as Bank of America, Barclays, BNP Paribas, Deutsche Bank, Scotiabank, Tangerine, or Westpac. |

| Usage of Alliance ATMs | Use your bank card at ATMs operated by partner banks in the alliance. |

| Fee Waivers | You get waived ATM usage fees and terminal fees, but you may still pay a currency conversion fee (usually 1%-3%). |

| ATM Locator Tools | Many banks offer ATM locator apps or websites to help you find partner ATMs. |

| Geographic Coverage | Fee waivers and partners vary by country. For example, Bank of America partners with Barclays in the UK, BNP Paribas in France, and China Construction Bank in China. |

| Special Partnerships | Some banks have extra partnerships, like Bank of America with China Construction Bank, for more fee waivers. |

You just need to use your card at the right ATM. Look for the bank logos or use your bank’s ATM locator tool. If you want the best deal, choose a bank that refunds all ATM fees, like Charles Schwab. This way, you can travel with confidence and avoid hidden charges every time you withdraw cash abroad.

You can avoid hidden charges by preparing before your trip. Start by checking your bank’s international ATM fees and finding partner banks. Always use bank-affiliated ATMs and decline dynamic currency conversion. Bring cards that waive foreign transaction fees and limit your withdrawals. Here’s a quick checklist:

- Research ATM fees and partner banks.

- Use global ATM alliances.

- Always pay in local currency.

- Withdraw larger amounts less often.

- Carry backup cards and emergency cash.

By following these steps, you make using atms abroad safer and cheaper.

FAQ

What should you do if an ATM eats your card abroad?

Stay calm. Visit the bank branch right away if it’s open. Show your passport and explain what happened. If the ATM is outside, call the number on the machine. Contact your bank to block your card and request a replacement.

Can you use a Hong Kong bank card at ATMs worldwide?

Yes, you can use most Hong Kong bank cards at ATMs with Visa, PLUS, MasterCard, or Cirrus logos. Check with your bank for international fees. Some Hong Kong banks, like HSBC, offer global accounts with lower withdrawal fees.

How do you find the best exchange rate at a foreign ATM?

Always choose to withdraw in the local currency. Decline any offer to convert to USD at the ATM. Your card issuer usually gives you a better exchange rate than the ATM operator. Check your bank’s daily rates before you travel.

What should you do if an ATM charges unexpected fees?

Tip: Always review the fee notice on the ATM screen before you confirm.

If you see a fee you did not expect, cancel the transaction. Try another bank ATM. Keep your receipts. Contact your bank if you get charged extra and ask for a refund.

When using ATMs abroad for currency exchange, avoiding hidden fees is crucial. BiyaPay offers an efficient alternative with real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery. BiyaPay helps you save more, while the Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, reducing your reliance on ATMs. Experience these benefits now to optimize your cross-border payment experience! BiyaPay enhances your travel money management efficiency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.