- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

10 Leading No Foreign Transaction Fee Credit Cards for Global Shoppers

Image Source: pexels

Looking for the best no foreign transaction fee credit cards? Here are the top 10 picks for global shoppers:

- Chase Sapphire Preferred® Card – Best for travel rewards and flexible points.

- Wells Fargo Autograph® Card – Best for no annual fee and bonus categories.

- Capital One Venture Rewards Credit Card – Best for easy miles on every purchase.

- Bank of America Travel Rewards Credit Card – Best for simple travel rewards with no annual fee.

- American Express® Gold Card – Best for dining and grocery rewards.

- Fidelity® Rewards Visa Signature® Card – Best for flat-rate cash back.

- Capital One SavorOne Cash Rewards Credit Card – Best for dining and entertainment cash back.

- U.S. Bank Altitude® Go Visa Signature® Card – Best for rewards on dining and streaming.

- Ramp Business Credit Card – Best for business owners seeking smart expense tools.

- The Business Platinum Card® from American Express – Best for premium business travel perks.

Major credit card issuers usually charge foreign transaction fees between 1% and 3% on international purchases. These fees add up fast, especially if you love to shop or travel abroad. By choosing one of the best no foreign transaction fee credit cards, you can avoid these charges and keep more money in your pocket.

| Scenario | Amount Spent | Foreign Transaction Fee Rate | Total Fees Paid | Potential Annual Savings with No-Fee Card |

|---|---|---|---|---|

| Purchases abroad using typical card | $4,000 | 3% | $120 | $120 |

| Purchases abroad using no-fee card | $4,000 | 0% | $0 | $120 |

Key Takeaways

- No foreign transaction fee credit cards save you 1% to 3% on every international purchase, helping you keep more money when you travel or shop abroad.

- Many of these cards offer rewards like travel points, cash back, and special perks such as travel insurance and fraud protection to add extra value.

- Choose a card that matches your spending habits and travel style, whether you want simple cash back, travel rewards, or business benefits.

- Pay in the local currency and notify your card issuer before traveling to avoid extra fees and prevent your card from being blocked.

- Using no foreign transaction fee cards wisely, like carrying a backup card and maximizing rewards on travel and dining, makes your international trips smoother and more rewarding.

Why Choose a No Foreign Transaction Fee Credit Card?

Image Source: pexels

The Cost of Foreign Transaction Fees

When you shop or travel internationally, many credit cards add a fee to every purchase you make in a foreign currency. This fee usually ranges from 1% to 3% of the total amount. Even if you only spend a little, these fees add up fast. For example, if you spend $1,000 on your trip, you could pay $30 just in extra charges.

| Step | Description | Impact on Total Cost |

|---|---|---|

| 1 | You buy something in a foreign currency | The base price of your purchase |

| 2 | The bank converts the amount to USD, sometimes with a markup | The cost may go up |

| 3 | The card adds a 1%-3% foreign transaction fee | You pay even more |

| 4 | Your bill shows the converted amount plus the fee | Your total expense increases |

If you travel often or shop online from international stores, these fees can take a big bite out of your budget. Choosing a no foreign transaction fee credit card helps you avoid these extra costs and keeps your money working for you.

Benefits for International Shoppers

You get more than just savings when you use no foreign transaction fee credit cards. These cards offer several advantages that make international spending easier and safer:

- You avoid the 2-3% extra charge on every foreign purchase, so your money goes further.

- Many no foreign transaction fee credit cards come with rewards programs, like travel points or cash back, which add value to every purchase.

- You get better security, including EMV chip technology and fraud protection, which is important when shopping abroad.

- Some cards offer extra perks, such as 24/7 concierge services, travel insurance, and even cell phone protection.

- Businesses can save on travel, meals, and hotels by using cards with no foreign transaction fees.

- You can find cards with no annual fee or low interest rates, making them a smart choice for many shoppers.

Tip: Always pay in the local currency when you use your card abroad. This helps you avoid hidden conversion fees and get the best exchange rate.

With a credit card with no foreign transaction fees, you can shop, dine, and explore the world without worrying about surprise charges. You also enjoy peace of mind, knowing your card is designed for international use and offers strong protections.

Best No Foreign Transaction Fee Credit Cards Overview

Top 10 Cards at a Glance

You want the best no foreign transaction fee credit cards for your travels and shopping. Here’s a quick look at the top 10 options. Each card stands out for a special reason, so you can find the one that fits your needs.

- Chase Sapphire Preferred® Card – Great for travel rewards and flexible points.

- Wells Fargo Autograph® Card – Best if you want no annual fee and bonus categories.

- Capital One Venture Rewards Credit Card – Best for earning miles on every purchase.

- Bank of America Travel Rewards Credit Card – Best for simple travel rewards with no annual fee.

- American Express® Gold Card – Best for dining and grocery rewards.

- Fidelity® Rewards Visa Signature® Card – Best for flat-rate cash back.

- Capital One SavorOne Cash Rewards Credit Card – Best for dining and entertainment cash back.

- U.S. Bank Altitude® Go Visa Signature® Card – Best for rewards on dining and streaming.

- Ramp Business Credit Card – Best for business owners who want smart expense tools.

- The Business Platinum Card® from American Express – Best for premium business travel perks.

Note: All these credit cards without foreign transaction fees help you save money when you shop or travel outside the United States.

Key Features Summary

When you look for the best no foreign transaction fee credit cards, you want to know what makes them stand out. Here are the main things you should check before you choose:

| Criterion | What It Means for You |

|---|---|

| Annual Percentage Rate (APR) | This is the interest rate you pay if you do not pay your balance in full. It covers purchases, balance transfers, and cash advances. |

| Intro Bonus | Many cards give you a welcome bonus if you spend a certain amount in the first few months. This can be a great way to earn extra rewards. |

| Rewards Structure | Some cards give you points or cash back for every dollar you spend. Others give more rewards for things like dining, gas, or travel. Pick the one that matches your spending. |

| Annual Fee | Some cards charge a yearly fee. Make sure the rewards and perks are worth it for you. |

| Fraud Protection | These cards keep your money safe from unauthorized charges. You get more security than with cash or debit cards. |

| Travel Rewards | Many of the best cards help you earn points or miles for travel. You can use these to save on flights, hotels, or future trips. |

| Credit Score | Your credit score can affect which cards you can get, but you still have options even if your score is not perfect. |

If you want the best experience, look for a card that matches your lifestyle. Some cards work better for travel, while others are best for cash back or business use. The best no foreign transaction fee credit cards give you strong rewards, good protection, and help you avoid extra charges when you shop around the world.

No Foreign Transaction Fee Credit Cards Comparison

Annual Fees

When you look for the best no foreign transaction fee credit cards, you will notice that annual fees can range from $0 to several hundred dollars. Some cards, like the Bank of America Travel Rewards and Wells Fargo Autograph, have no annual fee. Others, such as the American Express Gold Card or The Business Platinum Card from American Express, charge higher fees but offer more perks. Here’s a quick table to help you compare:

| Credit Card Name | Annual Fee |

|---|---|

| Chase Sapphire Preferred® Card | $95 |

| Wells Fargo Autograph® Card | $0 |

| Capital One Venture Rewards | $95 |

| Bank of America Travel Rewards | $0 |

| American Express Gold | $250 |

| Fidelity Rewards Visa Signature | $0 |

| Capital One SavorOne | $0 |

| U.S. Bank Altitude Go | $0 |

| Ramp Business Credit Card | $0 |

| The Business Platinum Card from Amex | $695 |

You can see that the best no foreign transaction fee credit cards offer options for every budget. If you want the best for frequent international travel, you might choose a card with a higher fee for more travel rewards.

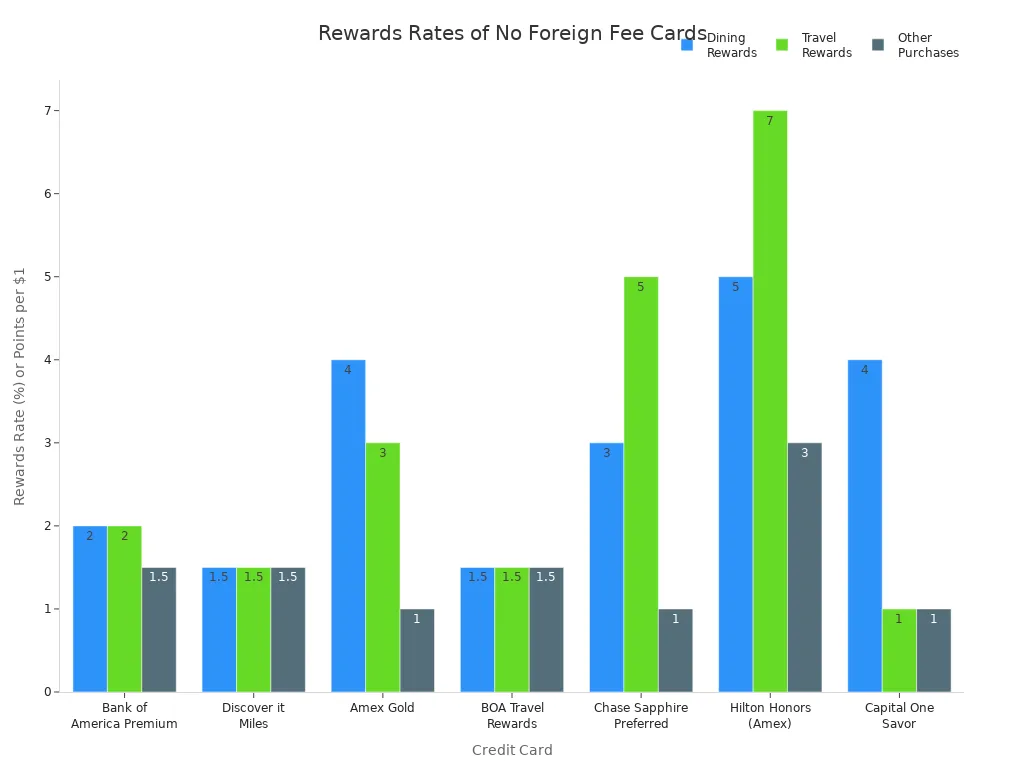

Rewards and Points

Rewards make these cards stand out. Some cards give you points for every dollar you spend, while others focus on cash back or miles. For example, the Chase Sapphire Preferred gives you 5x points on travel booked through Chase, 3x on dining, and 2x on other travel. The American Express Gold Card offers 4x points on dining and groceries. If you want simple rewards, the Fidelity Rewards Visa Signature gives you 2% cash back on every purchase.

You can pick the best card for your lifestyle. If you love travel, look for travel rewards credit cards. If you want easy cash back, choose a flat-rate card.

Welcome Bonuses

Many of the best no foreign transaction fee credit cards offer big welcome bonuses. You can earn thousands of points or miles after you meet a spending requirement. For example, the Chase Sapphire Preferred gives you 80,000 bonus points after you spend $4,000 in three months. The Capital One Venture Rewards card offers 75,000 bonus miles for the same spend. These bonuses can help you book flights, hotels, or get cash back.

Best Use Cases

You should match your card to your needs. If you travel often, premium cards with higher annual fees give you more travel rewards and perks. If you shop internationally only a few times a year, a no annual fee card is best. Business owners can benefit from cards like the Ramp Business Credit Card or The Business Platinum Card from American Express, which offer tools and rewards for business spending.

Unique Perks

Each card has special features. Some cards offer travel insurance, airport lounge access, or cell phone protection. The Chase Sapphire Preferred gives you extra value when you redeem points for travel. The American Express Gold Card includes baggage and car rental insurance. The Ramp Business Credit Card helps you manage expenses with smart tools. You can find the best perks for your lifestyle by comparing these options.

Note: The best no foreign transaction fee credit cards help you save on every international purchase and give you valuable rewards. Always check the unique perks before you apply.

Reviews of the Best No Foreign Transaction Fee Credit Cards

Chase Sapphire Preferred® Card

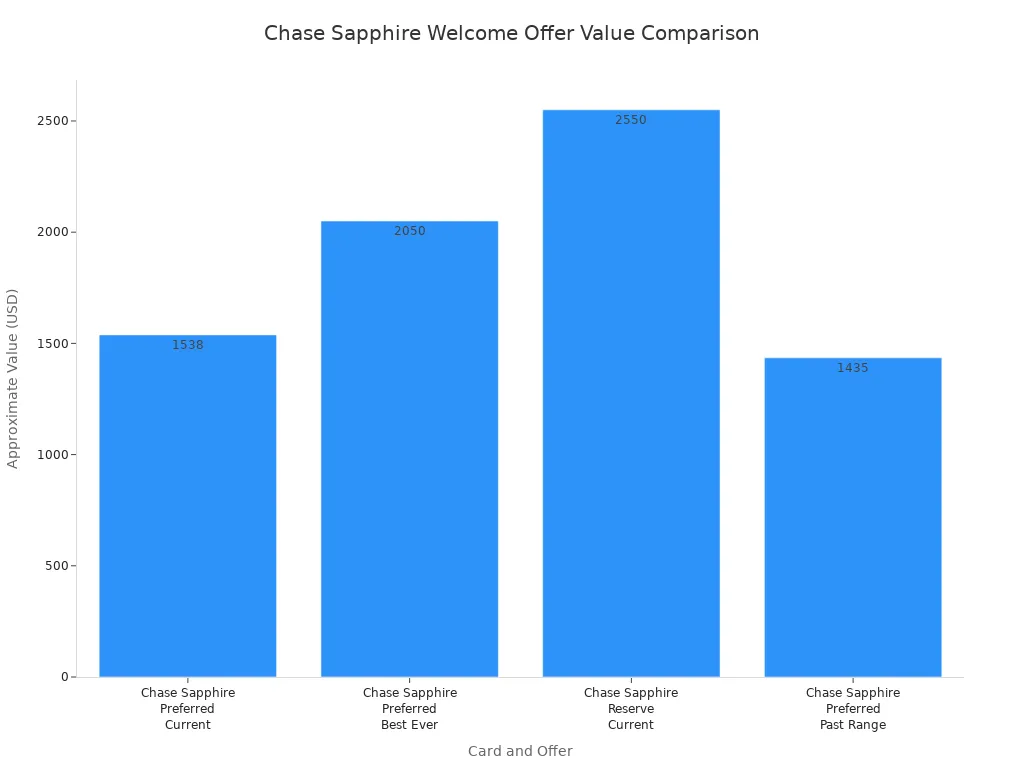

You want a card that gives you strong travel rewards and flexibility. The Chase Sapphire Preferred Card stands out as one of the best no foreign transaction fee options. Right now, you can earn 75,000 bonus points after spending $5,000 in the first three months. This bonus is worth about $1,538 when you redeem for travel through Chase. While this is a solid offer, the card has sometimes offered even higher bonuses in the past.

| Card Name | Welcome Offer Details | Spending Requirement | Approximate Value (USD) |

|---|---|---|---|

| Chase Sapphire Preferred | 75,000 points after $5,000 in 3 months (current offer) | $5,000 in 3 months | $1,538 |

| Chase Sapphire Preferred | 100,000 points after $5,000 in 3 months (highest historical) | $5,000 in 3 months | $2,050 |

The annual fee is $95. You earn 5x points on travel booked through Chase, 3x on dining, 2x on other travel, and 1x on everything else. You can transfer points to airline and hotel partners, which gives you more ways to use your rewards. The card also comes with trip cancellation insurance, rental car coverage, and no foreign transaction fee. If you want one of the best travel rewards credit cards, this card is a top pick.

Tip: The best time to apply is when the welcome bonus is higher than 75,000 points.

Wells Fargo Autograph® Card

If you want a card with no annual fee and lots of bonus categories, the Wells Fargo Autograph Card is one of the best no foreign transaction fee credit cards. You pay $0 in annual fees and $0 in foreign transaction fees. You earn 3x points on travel, restaurants, gas stations, transit, streaming, and select phone plans. All other purchases earn 1x points.

Here are some of the best features:

- No foreign transaction fees, so you save money when you travel.

- 3x points on many everyday and travel categories.

- Points are easy to redeem for travel, cash back, or gift cards.

- Travel and emergency help is available worldwide.

- Rental car coverage and cell phone protection up to $600.

- 24/7 roadside assistance and Visa Signature concierge services.

- Access to luxury hotels and extra perks.

You get a flexible card that works well for both travel and daily spending. If you want the best no annual fee card with no foreign transaction fees, this card is a smart choice.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is one of the best for global shoppers who want simple rewards. You earn 2x miles on every purchase, everywhere. When you book hotels or rental cars through Capital One Travel, you get 5x miles. There are no foreign transaction fees, so you save on every international purchase.

- Earn 2x miles on all spending, making it easy to rack up rewards.

- Get 5x miles on hotels and rental cars booked through Capital One Travel.

- Transfer miles to over a dozen airline and hotel partners.

- Redeem miles for travel with no blackout dates.

- Receive up to $100 credit for Global Entry or TSA PreCheck.

- Miles never expire and there is no cap on how many you can earn.

You pay a $95 annual fee. This card is one of the best travel card with no foreign transaction fees if you want rewards that are easy to use and valuable for travel.

Bank of America Travel Rewards Credit Card

If you want a card with no annual fee and no foreign transaction fee, the Bank of America Travel Rewards Credit Card is a great pick. You earn 1.5 points per dollar on all purchases, and 3 points per dollar on travel booked through the Bank of America Travel Center. Points never expire as long as your account stays open.

| Feature | Description |

|---|---|

| No Foreign Transaction Fees | Save 1-3% on every purchase made outside the U.S. |

| No Annual Fee | Keep more money in your pocket |

| Rewards Rate | 1.5 points per $1 on all purchases; 3x on travel booked through the portal |

| Redemption Options | Use points for statement credits on travel and dining |

| Visa Signature Benefits | Concierge, extended warranty, roadside help, lost luggage, travel support |

| Preferred Rewards Boost | Up to 75% more points for Bank of America Preferred Rewards members |

| Contactless Payments | Tap to pay for quick and secure transactions |

| Introductory APR | 0% for 15 billing cycles on purchases and balance transfers |

You can also enjoy free museum access with the “Museums on Us” program. If you want the best low interest card with no foreign transaction fees, this card is a top contender.

American Express® Gold Card

The American Express Gold Card is one of the best for food lovers and travelers. You pay no foreign transaction fee, so you can dine and shop abroad without extra charges. You earn 4x Membership Rewards points on dining worldwide, including restaurants outside the U.S., up to $50,000 per year. You also get 4x points at U.S. supermarkets (up to $25,000 per year) and 3x points on flights booked directly with airlines or through amextravel.com.

- No foreign transaction fees on purchases abroad.

- High rewards on dining and groceries.

- 3x points on flights, perfect for travel rewards.

- $250 annual fee, but you get dining credits and Uber Cash.

- Strong travel and purchase protections.

If you spend a lot on food and travel, this card gives you some of the best rewards.

Fidelity® Rewards Visa Signature® Card

If you want simple cash back, the Fidelity Rewards Visa Signature Card is one of the best cash back card with no foreign transaction fees. You earn unlimited 2% cash back on every purchase, including those made abroad. There are no foreign transaction fees and no annual fee.

| Card Name | Cash Back Rate | Foreign Transaction Fee | Notes on International Use |

|---|---|---|---|

| Fidelity® Rewards Visa Signature® Card | 2% unlimited | $0 | 2% cash back on all purchases, including international |

Your cash back goes straight into your eligible Fidelity account, which helps you grow your savings or investments. If you want a card that is easy to use and gives you strong rewards everywhere, this is one of the best choices.

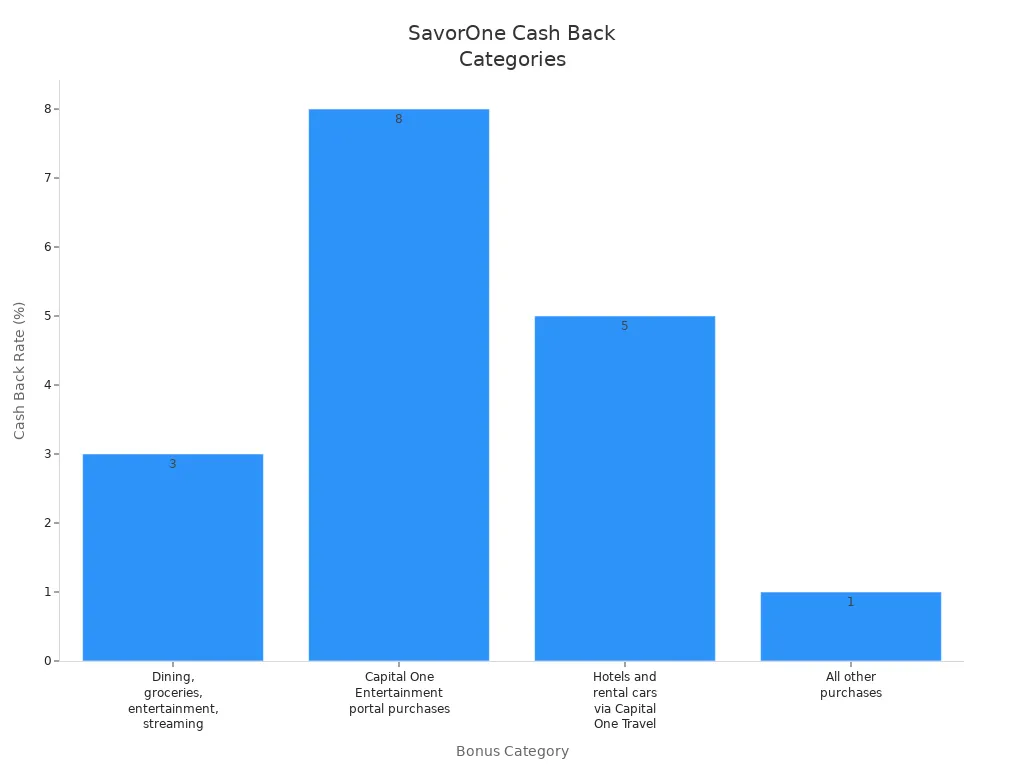

Capital One SavorOne Cash Rewards Credit Card

The Capital One SavorOne Cash Rewards Credit Card is a great pick if you love dining, entertainment, and streaming. You earn 3% cash back on dining, groceries, entertainment, and streaming services. You get 5% cash back on hotels and rental cars booked through Capital One Travel. All other purchases earn 1%. There are no foreign transaction fees, so you can use your card anywhere.

You pay no annual fee. The bonus categories work the same whether you are in the U.S. or abroad. If you want the best no annual fee card with no foreign transaction fees and strong cash back, this card is a top pick.

U.S. Bank Altitude® Go Visa Signature® Card

You want a card that rewards your everyday spending and travel. The U.S. Bank Altitude Go Visa Signature Card gives you 4x points on dining, 2x on groceries, gas, and streaming, and 1x on everything else. There are no foreign transaction fees and no annual fee. You also get a $15 annual streaming credit. This card is a good choice if you want to earn rewards on both travel and daily expenses.

Ramp Business Credit Card

If you run a business and want to save on international spending, the Ramp Business Credit Card is one of the best no foreign transaction fee options. You pay $0 in annual fees and $0 in foreign transaction fees. You get 1.5% cash back on every purchase, everywhere. The card offers travel and emergency help, rental car coverage, purchase security, and extended warranty protection.

| Business-Specific Benefit for International Transactions | Description |

|---|---|

| $0 Foreign Transaction Fees | No extra cost for purchases outside the U.S. |

| Travel and Emergency Assistance Services | 24/7 support worldwide |

| Auto Rental Collision Damage Waiver | Coverage for theft or damage on rental cars abroad |

| Purchase Security | Protection for stolen or damaged items bought internationally |

| Extended Warranty Protection | Extra warranty on eligible business purchases |

Ramp also gives you smart expense tools to help manage your business spending. If you want the best for business travel and purchases, this card is a strong pick.

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is the best choice for business travelers who want premium perks. You pay no foreign transaction fee, so you save on every purchase abroad. The annual fee is $695, but you get airport lounge access, travel credits, and strong travel insurance. You also earn 5x points on flights and prepaid hotels booked through amextravel.com.

This card helps you avoid the typical 1.57% fee that many other credit cards charge for international purchases. If you travel often for work and want luxury benefits, this is one of the best no foreign transaction fee credit cards for business.

How to Choose the Right Credit Card with No Foreign Transaction Fees

Match Card Features to Your Travel Style

Finding the best credit cards starts with knowing your travel style. Do you travel often or just once in a while? Here’s how you can match card features to your needs:

- Look at rewards styles. Some cards give you the same rewards on every purchase, while others offer bonus points for travel, dining, or rotating categories.

- Decide if you want cash back, flexible points, or co-branded rewards with airlines or hotels.

- Think about how you use your card. If you want simple rewards, flat-rate cards work best. If you want to maximize travel rewards, you might use more than one card.

- If you travel a lot, a travel credit card with no foreign fees is best for frequent international travel.

- Check for perks like free checked bags, hotel upgrades, or travel protection.

Tip: Frequent flyers and hotel loyalists often get the most value from co-branded cards, while flexible travelers prefer general travel cards.

Consider Spending Habits and Rewards

Your spending habits help you pick the best card. If you spend most on travel, dining, or streaming, choose a card that gives extra rewards in those areas. Some cards offer flat-rate cash back, while others give more points for certain purchases. If you run a business, look for cards that reward software, advertising, or international payments. Using more than one card can help you earn the best rewards and have a backup for international trips.

Weigh Annual Fees vs. Benefits

Not all no foreign transaction fee credit cards have the same annual fee. Some cards charge $0, while others cost $95 or more. Cards with higher fees usually offer bigger welcome bonuses, better travel rewards, and perks like travel credits. The best cards for frequent travelers often have a $95 annual fee, but you can earn that back with rewards and bonuses. If you travel less, a no-fee card may be best.

| Annual Fee (USD) | Typical Benefits | Best For |

|---|---|---|

| $0 | Basic rewards, fewer perks | Occasional travelers |

| $95 | Welcome bonus, higher rewards, some travel perks | Frequent travelers |

| $400+ | Luxury perks, lounge access, big travel credits | Big spenders, business travelers |

Card Acceptance and International Support

You want a card that works everywhere. The best credit card with no foreign transaction fees should be widely accepted and offer strong support when you travel. Look for cards from major networks like Visa or Mastercard, which work in most countries. Check for 24/7 customer service and travel help. Some cards also offer virtual card numbers for safer online shopping and better fraud protection.

Tips for Using No Foreign Transaction Fee Credit Cards Abroad

Image Source: unsplash

Best Practices for International Use

Traveling with the right credit cards can make your trip smoother and help you save money. Here are some best practices you should follow when using your card abroad:

- Always choose credit cards that clearly state they have no foreign transaction fees. This helps you avoid paying extra charges, sometimes up to 5% on every purchase.

- Pay in the local currency whenever possible. Merchants may offer to convert the price to USD, but this often leads to higher costs due to dynamic currency conversion.

- Notify your card issuer before you leave for your trip. This step helps prevent your card from being blocked for suspected fraud.

- Use chip-enabled cards for better security at international merchants.

- Keep a backup payment method, like a second card or some cash, in case your main card is not accepted.

- Carry a list of your card numbers and the issuer’s contact information. If you lose your card, you can quickly get help.

- Use bank ATMs for cash withdrawals. Avoid currency exchange kiosks, which often charge higher fees.

Tip: Use your card for big expenses like hotels and car rentals. This way, you get more protections and can earn more travel rewards.

Maximizing Rewards and Redemptions

You want to get the most out of your credit cards while traveling. Here are some ways to focus on maximizing travel rewards:

- Use your no foreign transaction fee card for travel and dining purchases. These categories often give you higher points or miles.

- Always pay in the local currency to avoid extra fees and get better exchange rates.

- Carry more than one card. Some merchants may only accept certain networks, like Visa or Mastercard.

- Learn about your card’s travel rewards benefits, such as airport lounge access or travel insurance. These perks can add value to your trip.

- Redeem your points or miles for flights, hotels, or experiences that give you the best value.

Note: Notifying your bank before you travel can help you avoid frozen accounts and missed opportunities for maximizing travel rewards.

Avoiding Common Pitfalls

Even with the best credit cards, you can run into problems if you are not careful. Here are some common mistakes and how to avoid them:

- Forgetting to check if your card charges foreign transaction fees. Always double-check before you travel.

- Paying in USD instead of the local currency. This can lead to hidden fees and poor exchange rates.

- Not knowing your card’s acceptance in the country you visit. Some places may not take certain cards.

- Failing to bring a backup payment method. If your card gets blocked or lost, you need another way to pay.

- Ignoring your card’s travel rewards features. You might miss out on valuable perks like insurance or bonus points.

Stay alert and plan ahead. This way, you can enjoy your international trip and focus on maximizing travel rewards every step of the way.

You want to keep more money in your pocket when you shop or travel. Picking the best no foreign transaction fee credit card helps you save every time. Use the comparison table to spot the best features and rewards. Read the reviews to find the best fit for your travel style. The best card for you depends on how you spend and where you go. Choose the best option and enjoy the best value on every international purchase. Apply now to get the best rewards and perks for your next trip.

FAQ

What is a foreign transaction fee?

A foreign transaction fee is a charge your credit card company adds when you buy something in a currency other than USD. This fee usually ranges from 1% to 3% of your purchase amount.

Can I use these cards in China and other countries?

Yes, you can use these cards in China and most other countries. Just make sure the merchant accepts your card’s network, like Visa or Mastercard. Always pay in the local currency for the best exchange rate.

Do no foreign transaction fee cards have higher interest rates?

Not always. Some cards have rates similar to regular cards. You should check the card’s terms before you apply. Paying your balance in full each month helps you avoid interest charges.

Will I still earn rewards on international purchases?

Yes, you will earn rewards on purchases made outside the United States. Many cards even offer bonus points or cash back for travel and dining abroad. Check your card’s rewards program for details.

After exploring no foreign transaction fee credit cards, BiyaPay can help you manage cross-border payments more efficiently. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay offers a flexible payment solution. Additionally, BiyaPay’s Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, simplifying your transactions. Experience these benefits now to enhance your financial management! BiyaPay makes your cross-border payments smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.