- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Buying Property in Portugal as a Foreigner Made Simple

Image Source: pexels

Yes, you can buy property in Portugal as a foreigner. Portugal welcomes international buyers, with foreign investors responsible for 81% of the country’s real estate investments last year. The process stands out for its clear steps and transparency. You need to get a tax number (NIF), find your property, complete legal checks, sign contracts, and register your ownership.

Portugal offers you a straightforward experience, with predictable timelines and well-defined costs. You can feel confident as you start your buying property journey in Portugal.

Key Takeaways

- Foreigners can buy property in Portugal without nationality or residency restrictions, making it accessible and fair for all buyers.

- Getting a Portuguese tax number (NIF) and opening a local bank account are essential first steps to start your property purchase.

- Work with a lawyer and a trusted real estate agent to avoid legal issues and hidden risks during the buying process.

- Be prepared for extra costs like transfer tax (IMT), stamp duty, notary, registration, and legal fees to budget accurately.

- Popular regions like Lisbon, Porto, Algarve, and the Silver Coast offer diverse property options and strong investment potential.

Foreigners Buying Property: Restrictions

No Nationality Limits

You do not face any nationality-based restrictions when it comes to foreigners buying property in Portugal. The country welcomes buyers from all over the world. You can buy land, a house, or even commercial property, no matter where you come from. Portugal allows foreign property ownership for both EU and non-EU citizens. You do not need to live in Portugal or have citizenship to own property.

Portugal’s laws make foreigners buying property simple and fair. You have the same rights as Portuguese nationals. The only rare exceptions involve countries under international sanctions. For most people, these do not apply.

- Portugal does not impose nationality-based restrictions on property ownership.

- Both EU and non-EU citizens can buy property.

- You do not need to be a resident or citizen.

- Property ownership rights are separate from visa or residency rights.

This open approach makes foreigners buying property in Portugal attractive and accessible. You can invest, live, or rent out your property with confidence.

NIF Requirement

When you start the process of foreigners buying property in Portugal, you must get a NIF (Número de Identificação Fiscal). This is a tax identification number. The NIF is essential for all property transactions. You need it to open a bank account, sign contracts, and pay for your property.

The Portuguese tax authority issues the NIF. Both residents and non-residents can get one. If you do not live in Portugal, you can appoint a fiscal representative to help you. Without a NIF, you cannot complete the steps needed for foreigners buying property.

The NIF does not make you a tax resident. It only helps you follow the law and manage your property. You also need a NIF to set up utilities and handle other legal matters. This rule applies to all foreigners buying property, no matter your nationality.

Tip: Start your NIF application early. This will help you avoid delays in your property purchase.

Foreigners buying property in Portugal find the process clear and straightforward. The NIF requirement ensures that every buyer follows the same rules, making foreign property ownership safe and legal.

Buy Property in Portugal as a Foreigner: Process

Image Source: pexels

Buying property in Portugal as a foreigner follows a clear path. This step-by-step guide will help you understand each part of the property acquisition process. You will see how to move from getting your tax number to registering your new home. Legal guidance and careful checks are important at every stage.

Get a NIF

The first step in the property purchase process is to get a Portuguese tax identification number, called a NIF. You need this number for all property transactions in Portugal.

How to get a NIF:

- Visit the nearest Finanças office in Portugal. Arrive early to avoid long waits.

- Bring your passport or EU ID card and proof of address from your home country, such as a recent bank statement.

- If you are not in Portugal, you can appoint a fiscal representative to help you apply.

- Submit your documents at the counter. Staff usually speak basic English.

- Receive your NIF on the spot, printed on an A4 sheet.

Note: EU/EEA residents can get a NIF for free in person. Others may pay a small fee (about $11 USD, based on current exchange rates).

You must have a NIF before you can open a bank account or start buying property in Portugal.

Open a Bank Account

After you get your NIF, you need to open a Portuguese bank account. Sellers and agencies often require payments from a Portuguese IBAN.

Steps to open a bank account:

- Choose a bank that fits your needs. Many banks offer online services.

- Bring your NIF, valid passport or national ID, proof of address (utility bill or rental contract), and proof of income if requested.

- Some banks may ask for a Portuguese phone number for SMS activation.

- Make an initial deposit, usually between $270 and $320 USD.

- Complete the paperwork and receive your account details, including IBAN and debit card.

Non-residents can open accounts with proof of foreign address and a NIF. You can often do this remotely.

Tip: Having a local bank account makes the property acquisition process smoother and helps with utility payments later.

Find a Property

You can now start searching for your ideal property. Portugal does not have a single MLS system, so you should check several websites and agencies.

Popular ways to find property:

- Use online portals like Idealista, Imovirtual, OLX.pt, and Casa Sapo.

- Check international sites such as Green Acres, Properstar, and Kyero.

- Work with large agencies like REMAX, ERA, Engel & Völkers, and Century 21.

- Consider hiring a buyer’s agent. They offer full market access, help with negotiations, and guide you through legal steps.

Note: A buyer’s agent can help you avoid language barriers and legal issues when buying a house in Portugal.

Make an Offer

Once you find a property you like, you can make an offer. Your agent will help you negotiate the price and terms.

| Step | Action | Key Considerations |

|---|---|---|

| 1 | Make an offer through your agent | Consider market conditions and recent sales |

| 2 | Negotiate terms | Include financing contingencies if needed |

| 3 | Hire an independent lawyer | Essential for due diligence and contract review |

You should never sign any agreement or pay a deposit before your lawyer checks the property’s legal status. This protects you from hidden debts or unclear titles.

Sign Contracts

The property purchase process in Portugal uses two main contracts:

- Promissory Contract (Contrato de Promessa de Compra e Venda - CPCV):

This is a preliminary agreement. It sets the price, payment schedule, and conditions. You usually pay a deposit of 10% to 30%. If the seller withdraws, you get your deposit back. If you withdraw, you lose the deposit. - Final Sale Deed (Escritura Pública de Compra e Venda):

This is the official document that transfers ownership. You sign it before a notary. You pay the remaining balance and all taxes and fees at this stage.

Always have your lawyer review both contracts. The lawyer checks for mortgages, debts, or legal restrictions on the property.

Register Ownership

After signing the final deed, you must register your ownership. This step makes you the official owner in Portugal.

Steps to register ownership:

- Your lawyer submits the signed deed to the Land Registry (Conservatória do Registo Predial).

- Pay the property transfer tax (IMT) and stamp duty before registration.

- Provide all required documents: valid ID, NIF, proof of payment, and the signed contracts.

- The registry updates the records to show you as the new owner.

Note: Registration is the last step in the property acquisition process. Without it, you do not have full legal rights to the property.

This step-by-step guide shows you how to buy property as a foreigner in Portugal. Each stage requires careful checks and legal support. By following these steps, you can enjoy a safe and smooth experience when buying a house in Portugal.

Documents and Requirements

Identification

You need to prepare several documents before you start your property purchase in Portugal. The most important is your identification. You can use a passport, identity card, or citizen card. You must also get a Portuguese Tax Identification Number (NIF). This number is essential for all property transactions. Proof of residence is often required, especially if you plan to live in Portugal. You also need a Portuguese bank account before you buy property.

- Passport, identity card, or citizen card

- Portuguese Tax Identification Number (NIF)

- Proof of residence (such as a utility bill or rental contract)

- Portuguese bank account details

Tip: Start collecting these documents early. This will help you avoid delays during your property purchase.

Proof of Funds

You must show that you have enough money to complete the property purchase. Portuguese authorities and banks require proof of funds. You need to provide bank statements from your private bank account in your home country. These statements must come from a reputable financial institution. You also need a declaration that explains the source of your funds, such as salary, rental income, or a property sale. All payments for property must come from your Portuguese bank account. Portuguese banks will issue statements to confirm the transfer of money. The Foreigners and Borders Service (SEF) may ask for more details about your funds if needed.

- Bank statements from your home country

- Declaration of the source of funds

- Portuguese bank statements showing the transfer

- All payments must come from your Portuguese bank account

Legal Representation

You do not have to hire a lawyer to buy property in Portugal, but it is highly recommended. A real estate lawyer can help you avoid risks and protect your interests. Your lawyer will check the property’s legal status, review contracts, and make sure you follow property ownership laws in Portugal. Lawyers also help with tax obligations, registration, and communication with notaries. If you cannot be in Portugal, your lawyer can act for you with a Power of Attorney. This support makes foreign property ownership safer and more efficient.

- Lawyers conduct due diligence and check property legitimacy

- They review and draft contracts

- They protect you from fraud and legal disputes

- Lawyers help with registration and tax compliance

- They offer remote support and translation if needed

Note: Hiring a lawyer gives you peace of mind during your property purchase. You avoid many common mistakes and legal issues.

Costs and Taxes When Buying Property

When you start buying property in Portugal, you need to understand the main costs and taxes. These expenses affect your total budget and help you plan your property purchase with confidence.

IMT (Transfer Tax)

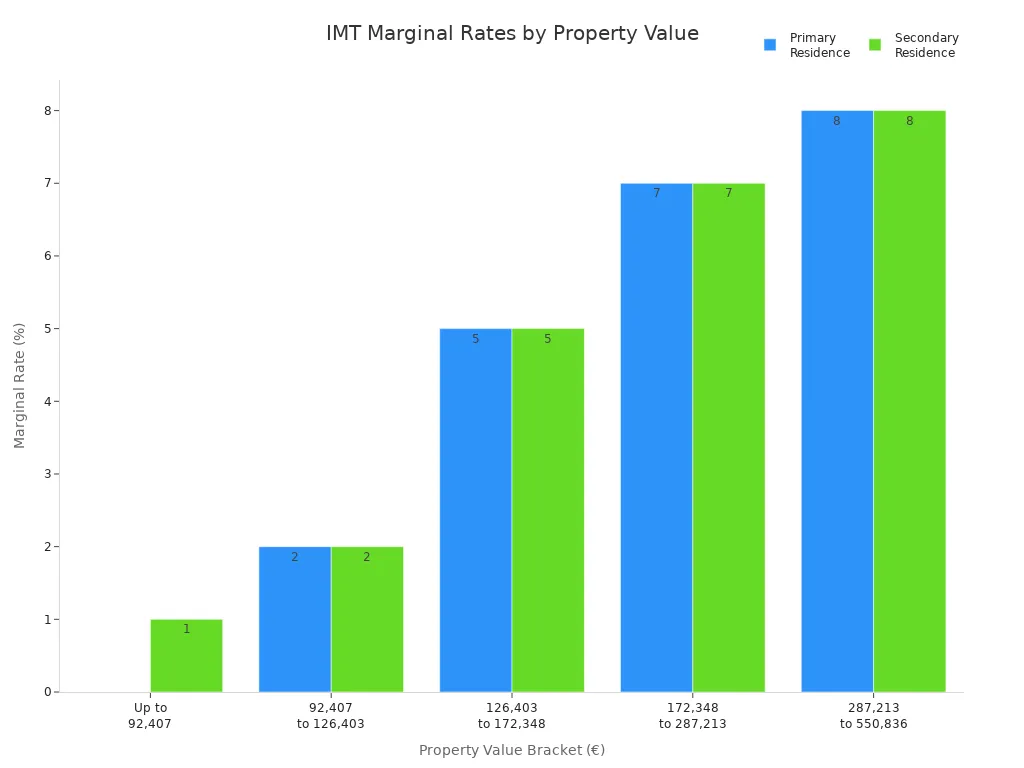

IMT stands for Imposto Municipal sobre Transmissões. This is a transfer tax you pay when you buy property in Portugal. The rate depends on the type of property, its value, and if you plan to live there. For primary residences, rates start at 0% and go up to 7.5%. Secondary residences have similar brackets but start at 1%. You calculate IMT using the higher value between the purchase price and the taxable value.

| Property Use | Value Range (USD) | Marginal Rate (%) | Deductible (USD) |

|---|---|---|---|

| Primary Residence | Up to $100,000 | 0 | 0 |

| $100,000–$137,000 | 2 | $1,000 | |

| $137,000–$187,000 | 5 | $5,000 | |

| $187,000–$312,000 | 7 | $8,500 | |

| $312,000–$600,000 | 8 | $11,500 | |

| $600,000–$1,100,000 | Flat 6% | N/A | |

| Above $1,100,000 | Flat 7.5% | N/A |

Note: IMT is paid before or at the time of the property purchase. Exemptions apply for some cases, such as properties for resale or rehabilitation.

Stamp Duty

You must also pay stamp duty, called Imposto do Selo, when you buy property in Portugal. The rate is a flat 0.8% of the purchase price. You pay this tax at the time of the property transfer. This fee applies to all property purchases, including houses, apartments, and land.

Notary and Registration

Notary and registration fees are part of every property purchase in Portugal. Notary fees usually cost about 1% of the property price. Registration fees add another 0.75% to 1%. Together, you should budget between 1.5% and 2% of the purchase price for these services. These fees cover the official paperwork and make your ownership legal.

Legal Fees

Legal fees for buying property in Portugal range from $1,100 to $2,700 USD. The cost depends on the complexity of your property purchase and the services you need. Lawyers help you check contracts, review documents, and protect your interests.

Annual Taxes

After you complete your property purchase, you pay annual property taxes. The main tax is IMI (Imposto Municipal sobre Imóveis). Rates for urban properties range from 0.3% to 0.45% of the taxable value. Rural properties are taxed at 0.8%. If your total property value is above $650,000, you may pay AIMI, an extra tax on high-value properties.

| Tax Name | Who Pays | Tax Base | Rates | Payment Schedule |

|---|---|---|---|---|

| IMI | All owners | Taxable value | 0.3%–0.45% (urban), 0.8% (rural) | Annually |

| AIMI | Owners with property over $650,000 | Value above $650,000 | 0.7%–1.5% | Annually |

Tip: Always include these taxes and fees in your budget when buying property in Portugal.

Financing for Foreigners

Mortgage Options

You can get a mortgage in Portugal even if you do not live there. Many banks offer loans to foreigners who want to buy property. Most lenders provide a loan-to-value (LTV) ratio between 60% and 70%. This means you can borrow up to 70% of the property price. You must cover the rest with your own funds. Both fixed and variable interest rates are available. Variable rates often link to the Euribor rate, while fixed rates last up to five years. Most mortgages run for 25 to 30 years. Banks check your income, debts, and expenses. They want your monthly payments to stay below 35% of your income. Life insurance is usually required, and sometimes home insurance too. If you are a retiree with a steady pension, you can also apply for a mortgage.

| Mortgage Feature | Details for Foreign Buyers in Portugal |

|---|---|

| Loan-to-Value (LTV) Ratio | 60%–70% of the purchase price |

| Minimum Deposit | At least 30% of the purchase price |

| Mortgage Term | 25–30 years |

| Interest Rates | Variable (from 3.3%) or fixed (about 4.1% for up to 5 years) |

| Insurance Requirements | Life insurance required; home insurance sometimes needed |

| Application Assessment | Based on income, debts, employment, and property value |

| Additional Costs | Taxes, notary, legal, and mortgage fees (7–10% of purchase price) |

| Eligibility | No restrictions for non-residents |

Tip: Always compare offers from several banks before choosing your mortgage.

Down Payment

When buying property in Portugal as a foreigner, you must pay a larger deposit than residents. Most banks require a down payment of at least 30% of the property price. Some lenders may ask for even more, depending on your financial situation. You cannot get a 100% mortgage if you do not have residency. Residents often pay only 10% to 20% as a down payment. The higher deposit for foreigners helps banks manage risk.

- Non-residents usually need a 30% down payment.

- LTV for non-residents is 60%–70%.

- Residents may qualify for lower down payments.

- Some exceptions exist for buyers with high income or EU citizenship.

Note: Plan your budget to include the down payment and extra costs like taxes and fees.

Required Documents

You must prepare several documents when you apply for a mortgage in Portugal. Banks want to see proof of your identity, income, and financial stability. The list may change based on your job and where you live.

| Document Type | Examples and Details |

|---|---|

| Identification | Valid passport, Portuguese tax number (NIF) |

| Proof of Address | Utility bill, rental contract, or bank statement |

| Proof of Income | Recent pay slips, last year’s tax return, employer letter (for employees) |

| Self-Employed | Business bank statements, company financials, tax returns (last 3 years) |

| Other Income | Pension or rental income statements |

| Bank Statements | Last 3 months from your main bank |

| Property Documents | Purchase agreement, land register, energy certificate |

| Insurance | Proof of life insurance (often required) |

Start collecting these documents early. This will help you avoid delays when buying property in Portugal.

Where to Buy in Portugal

Image Source: unsplash

Popular Regions

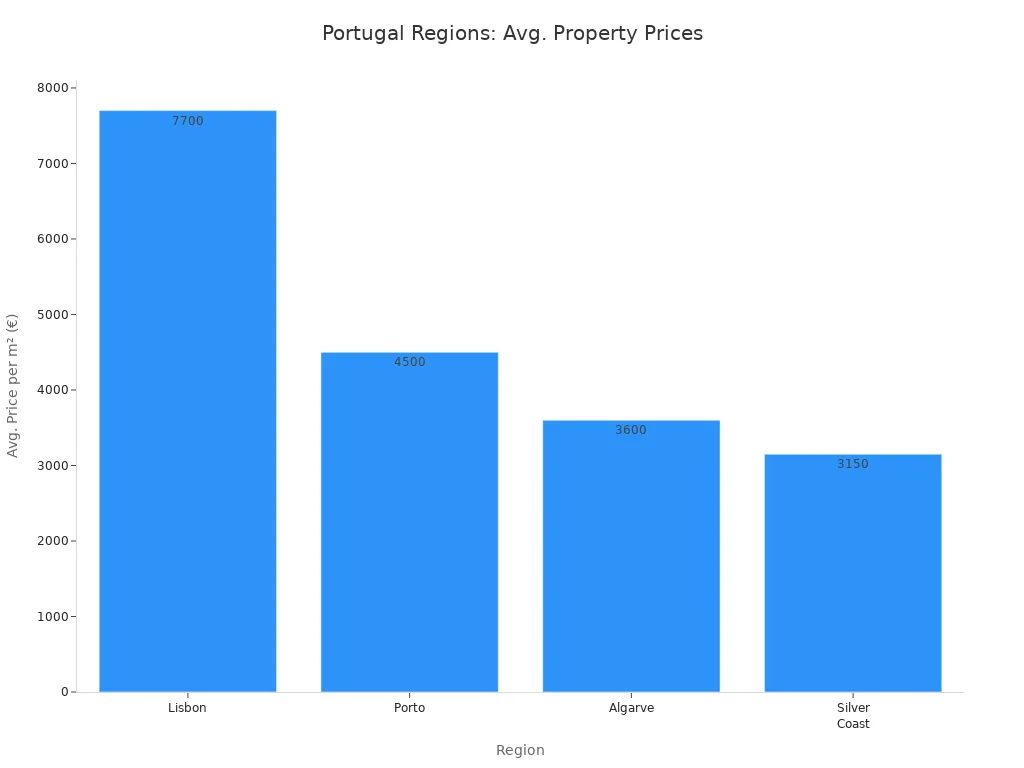

You can find some of the best areas to buy property in Portugal by looking at the most popular regions among foreign buyers. The Algarve stands out for its sunny weather, beautiful beaches, and active lifestyle. You will see over 300 days of sunshine each year. The region offers golf courses, hiking, and water sports. Many expats, especially retirees, choose the Algarve because of its friendly community and tax benefits.

Lisbon attracts you if you want city life. The city has seen big changes with new buildings, better roads, and more tourists. Neighborhoods like Estrela and Lapa are great for families and young professionals. Alfama, with its old streets, draws tourists and investors who want holiday rentals. Lisbon’s tech scene and digital nomad community help keep the property market strong. Rental yields often stay above 5%, and property prices in Portugal’s capital are among the highest.

Porto gives you a mix of history and coastal living. The city is famous for its old buildings and riverside views. Many people visit Porto for its culture and food. The Silver Coast is another good choice. You get lower property prices in Portugal, clean beaches, and the chance for your property to grow in value.

Here is a quick look at average prices and reasons why these regions are popular:

| Region | Average Price per m² (approx.) | Reasons for Popularity |

|---|---|---|

| Lisbon | ~$8,300 USD | Urban appeal, booming tech scene, high rental demand from digital nomads and young professionals |

| Porto | ~$4,900 USD | Historical charm, coastal city, strong tourism and rental opportunities |

| Algarve | $2,700 - $5,100 USD | Luxury villas, stunning beaches, excellent climate, active lifestyle, large expat community, retirees |

| Silver Coast | $2,700 - $4,100 USD | Affordable alternative to Algarve, pristine beaches, potential for future property appreciation |

These regions attract buyers because of tourism, rental yields, a stable economy, and a lively property market. You also benefit from cultural events and strong expat networks.

Property Types

You have many choices when you enter the property market in Portugal. The law lets you buy land, apartments, houses, or even commercial spaces. Most foreign buyers choose full ownership, called freehold. You can find many types of homes in the best areas to buy property.

- Detached houses (casas or moradias) give you space and privacy. These homes often have yards or patios.

- Semi-detached houses (casa geminada) share a wall with another house but still offer comfort.

- Condominiums (condomínios) are apartments with shared pools, gyms, or gardens.

- Rustic houses or farms (quintas) are perfect if you want a rural lifestyle. Some are close to towns.

- Land (terreno) lets you build your dream home.

You will see that most foreign buyers look for apartments, detached or semi-detached houses, and luxury villas. The Algarve has many high-end villas in places like Vale do Lobo and Vilamoura. Lisbon and Porto offer city apartments and historic homes. You can also buy land if you want to build. The property market in Portugal gives you many options to match your needs and budget.

Golden Visa and Residency

Golden Visa Changes

The golden visa programme in Portugal has changed a lot since October 2023. You cannot use real estate purchases to qualify for the golden visa anymore. This includes residential, commercial, and rehabilitation properties. The government made these changes to help with housing affordability and to stop real estate speculation.

Here is what you need to know about the new rules:

- Real estate investments, including the popular €280,000 and €500,000 property routes, no longer qualify for the golden visa.

- You cannot use property purchases in any region of Portugal to get residency through this program.

- The government now wants investments that help economic growth, job creation, and innovation.

- You can still qualify by investing in funds, starting a business, donating to cultural projects, or supporting research and development.

- The golden visa programme continues, but you must choose a route other than real estate.

Note: If you plan to buy property in Portugal, you need to look at other ways to get residency. The golden visa no longer supports property buyers.

Other Visa Options

You still have several ways to live in Portugal if you want to buy property or stay long-term. These options do not require large investments in real estate.

- D7 Visa: This visa works well for retirees, digital nomads, and people with passive income like pensions or rental income. You need to show steady income and have health insurance. The D7 visa allows you to bring your family and does not require a big upfront investment.

- D2 Visa (Entrepreneur Visa): If you want to start or run a business in Portugal, this visa is for you. You need a business plan and enough funds to support your idea.

- Digital Nomad Visa: This visa is for remote workers who have a job with a foreign company. You must show a professional link and a minimum monthly income of about $3,040 USD.

- Job Seeker Visa: This visa lets you stay in Portugal for up to 120 days while you look for a job. You do not need a job offer to apply.

Tip: The D7 visa is a popular choice for people who want to buy property and live in Portugal without a large investment. It offers flexibility and family reunification.

These visa options make it possible for you to enjoy life in Portugal, even after the golden visa changes.

Common Pitfalls for Foreigners Buying Property

When you start buying property in Portugal, you may face some common pitfalls. Knowing these risks helps you avoid costly mistakes and ensures a smooth property purchase.

Hidden Costs

Many buyers overlook extra expenses beyond the property price. You should prepare for these hidden costs:

- Notary fees: You pay a fixed fee of about $165 USD for the transaction. You also pay 0.75% to 1% of the property’s cadastral value for deed registration.

- Registration fees: These are required to officially register your property in the land registry.

- Legal fees: Hiring a lawyer protects your interests and ensures contracts are clear.

- Currency exchange and wire transfer fees: Transferring money from abroad can cost more due to exchange rate changes and bank charges.

- Ongoing property taxes: As a homeowner, you pay annual taxes based on your property’s value.

Tip: Always ask for a full breakdown of all costs before you commit to a property purchase.

Legal Issues

Legal problems can delay or even block your property purchase in Portugal. Common issues include unclear property boundaries, missing documents, or unregistered extensions. Sometimes, sellers use informal agreements that are not legally binding. You may also face tax misunderstandings or delays in transferring ownership.

To avoid these problems:

- Hire an independent Portuguese lawyer for due diligence and contract review.

- Make sure all contracts are notarized and legally binding.

- Follow up with the land registry and tax authorities after signing the deed.

- Inspect the property before final handover to check for damages or discrepancies.

Note: Professional help is the best way to protect yourself from legal risks in the property market.

Agent Selection

Choosing the right real estate agent is key when buying property in Portugal. Use these steps to find a reputable agent:

- Check that the agent is licensed by official bodies such as AMI or AMEDI.

- Look for agents with experience helping foreign buyers.

- Review their professionalism and client feedback.

- Prefer agents who offer extra services like legal support and document translation.

- Confirm their fees are fair and reflect the value provided.

A good agent will communicate clearly, explain legal terms, and guide you through the property market.

Buying property in Portugal as a foreigner can be simple when you prepare well. You should gather your documents, understand the process, and work with trusted professionals. Legal and real estate experts help you avoid mistakes and protect your interests. Property ownership in Portugal gives you access to a vibrant culture, stable investment, and a high quality of life.

Stay informed and seek advice. You can enjoy a smooth property journey in Portugal.

FAQ

Can you buy property in Portugal without living there?

Yes, you can buy property in Portugal even if you do not live there. You do not need to be a resident or citizen. You only need a Portuguese tax number (NIF) and a local bank account.

Do you need a lawyer to buy property in Portugal?

You do not need a lawyer by law, but hiring one protects your interests. A lawyer checks contracts, reviews property documents, and helps you avoid legal problems. Most foreign buyers choose to work with a lawyer.

How long does it take to buy property in Portugal?

The process usually takes 1 to 3 months. You get your NIF, open a bank account, find a property, sign contracts, and register ownership. Delays can happen if documents are missing or if legal checks take longer.

Can you get a mortgage in Portugal as a foreigner?

Yes, you can get a mortgage in Portugal as a foreigner. Most banks offer loans up to 70% of the property price. You need to show proof of income, identification, and a down payment of at least 30%.

What taxes do you pay when buying property in Portugal?

You pay IMT (transfer tax), stamp duty, notary, and registration fees. After buying, you pay annual property taxes like IMI. The rates depend on the property value and location. Always include these costs in your budget.

After simplifying the process of buying property in Portugal as a foreigner, BiyaPay can help you manage cross-border payments more efficiently. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay offers a flexible payment solution. Additionally, BiyaPay’s Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, simplifying your transactions. Experience these benefits now to successfully complete your property purchase in Portugal! BiyaPay makes your cross-border payments smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.