- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Chase Business Account Honest Review for 2025

Image Source: pexels

You want a business account that delivers reliability and flexibility. The chase business account stands out in 2025 for its accessibility and robust features. With chase, you gain access to a vast ATM and branch network, 24/7 customer service, and business perks through chase business complete banking.

Here’s what you can expect:

- Pros:

- No minimum opening deposit.

- Wide ATM and branch access.

- Overdraft protection and relationship perks.

- Cons:

- Monthly service fees ($15–$95, waivers possible).

- High overdraft and transaction fees.

- Wire transfer and out-of-network ATM charges.

chase has a strong reputation for supporting business owners with comprehensive account options.

Key Takeaways

- Chase business accounts offer wide branch and ATM access plus strong digital tools, making banking easy and flexible for many business types.

- You can choose from three account options that fit small, growing, or large businesses, each with different fees and transaction limits.

- Monthly fees can be waived by keeping minimum balances or using Chase payment tools, helping you save money if you meet the requirements.

- Chase supports business growth with payment solutions, credit-building, and helpful resources, but watch for extra fees on transactions and cash deposits.

- If you want in-person service and integrated payment features, Chase is a top choice; if low fees or high interest matter more, consider comparing other banks.

Is Chase Business Account Worth It?

Quick Verdict

You want a business account that supports your growth and daily operations. Chase stands out as a strong choice for many business owners in 2025. You benefit from a wide network of branches and ATMs, which makes banking convenient if you need in-person service. Chase offers several business checking options, each designed for different business sizes and needs. You can access digital tools, payment solutions, and business support resources. Many business owners choose Chase because it helps them manage payments, separate business and personal finances, and build business credit. If you want the best overall business account for flexibility and access, Chase deserves your attention.

However, you should consider the costs. Chase business account fees can add up if you do not meet the requirements for waivers. Some business owners report challenges with customer service and low interest rates. If you value digital-first features or want to avoid monthly fees, you may want to compare Chase with other banks.

Note: Chase business checking is especially valuable if you need both physical branch access and integrated payment tools. You can open an account online or in person, and you may qualify for fee waivers by maintaining a minimum balance or using Chase payment solutions.

Pros and Cons

You should weigh the main reasons business owners choose or avoid a Chase business account:

Why business owners choose Chase:

- You get access to one of the largest national branch and ATM networks, which helps if you need to deposit cash or speak with a banker.

- Chase provides built-in payment tools like QuickAccept®, making it easy to accept card payments and send invoices.

- You can qualify for flexible fee waivers by keeping a minimum balance, using your Chase business debit card, or receiving deposits through QuickAccept®.

- Chase offers multiple account types, including Business Complete Checking, Performance Business Checking, and Platinum Business Checking, so you can find the right fit for your business.

- You can use business credit cards with cashback bonuses and access additional products like savings accounts and retirement plans.

- Chase supports you with educational resources, coaching, and business management tools.

Why some business owners avoid Chase:

- You may face monthly fees if you do not keep a $1,500 minimum daily balance or meet other waiver criteria.

- Transaction fees apply if you exceed 100 transactions per month, not counting electronic deposits.

- Cash deposit limits can lead to extra fees if your business handles more than $5,000 in cash deposits each month.

- Chase business accounts offer low or no interest rates compared to some competitors.

- Some customers report mixed experiences with customer service, including long hold times and slow responses.

- Out-of-network ATM fees are not reimbursed, which can add up if you use non-Chase ATMs.

- You may experience long holds on large deposits or issues with fraud transaction handling.

Key advantages for small businesses:

- You simplify tax preparation by keeping all business income and expenses in one place.

- You protect your personal liability and identity by separating business and personal finances.

- You meet legal requirements for certain business structures, such as LLCs and corporations.

- You can accept credit card payments directly, which improves customer convenience.

- You start building business credit, which helps you secure financing in the future.

- You maintain professionalism and clear financial management by using a dedicated business account.

Chase gives you a strong mix of convenience, flexibility, and business support. If you want a reliable account with broad access and integrated payment tools, Chase is a top contender. If you prioritize low fees or high interest rates, you may want to explore other options.

Chase Business Checking Options

Image Source: unsplash

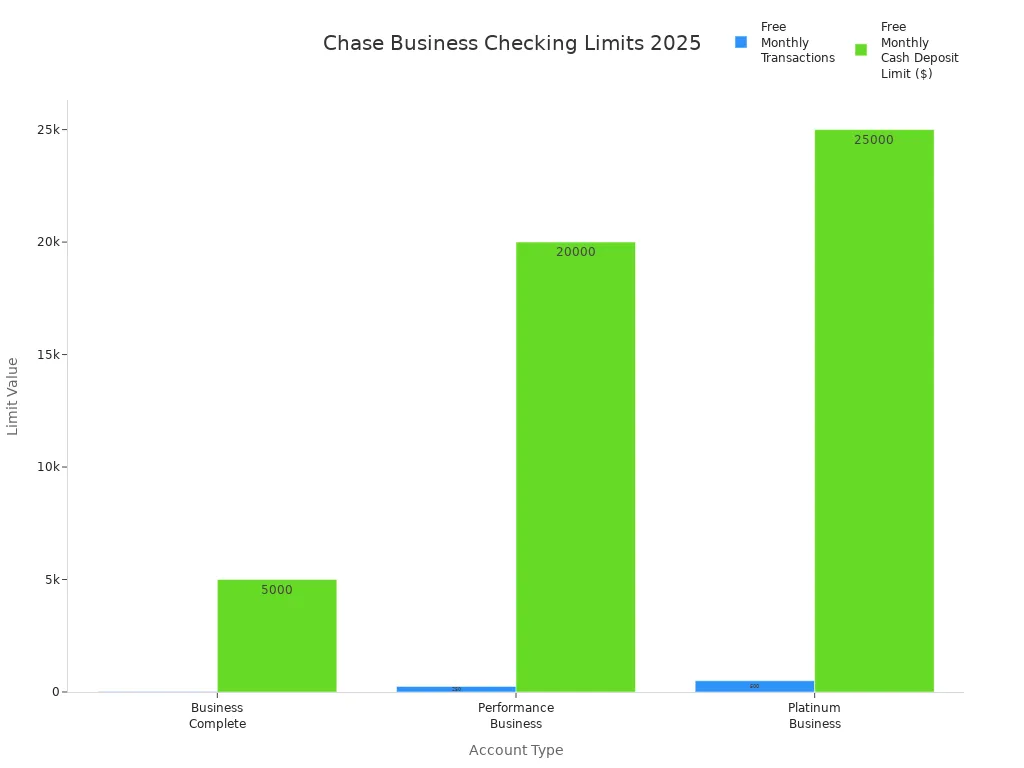

Chase offers three main business checking accounts. Each account fits a different stage of business growth. You can choose the right account based on your business size, transaction needs, and cash flow.

Chase Complete Business Checking

Chase Complete Business Checking works best for small businesses and startups. You can open this account online if you run a sole proprietorship, single-member LLC, or corporation. You need to provide your EIN, SSN, or tax ID, proof of identity, and business registration documents. This account gives you access to the Chase business complete checking account platform, which includes payment tools and digital banking. You pay a $15 monthly fee, but you can avoid it by keeping a $2,000 minimum daily balance, making $2,000 in qualifying deposits, or using a Chase Ink Business card. This account helps you manage daily transactions and accept payments easily.

Chase Performance Business Checking

Chase Performance Business Checking targets growing businesses with higher transaction volumes. You get 250 free transactions each month and unlimited free electronic deposits. The account also includes a $20,000 monthly cash deposit limit. You need the same documents as for the Chase business complete checking account. The monthly fee is $30, but you can waive it by maintaining a $35,000 combined average beginning-day balance. This account suits businesses that need more flexibility and handle more payments each month.

Chase Platinum Business Checking

Chase Platinum Business Checking is designed for large businesses with high transaction needs. You receive 500 free transactions per month and a $25,000 monthly cash deposit limit. You must provide the same documentation as with other accounts. The monthly fee is $95, but you can avoid it by keeping a $100,000 combined average beginning-day balance. This account supports businesses that process many payments and require advanced banking features.

You can see the eligibility and application details for each account in the table below:

| Account Type | Eligibility & Documentation | Monthly Fee & Waiver Conditions | Application Method |

|---|---|---|---|

| Chase Complete Business Checking | EIN/FEIN/Tax ID or SSN, proof of identity, business registration or DBA certificate, deposit. | $15 fee waived by $2,000 minimum daily balance, $2,000 in card purchases or deposits, military status, or linking a Chase Private Client Checking account. | Sole proprietorships, single-member LLCs, and corporations can apply online; others in-branch. |

| Chase Performance Business Checking | Same as above. Targeted at mid-sized businesses. | $30 fee waived with $35,000 minimum combined average beginning-day balance. 250 free transactions/month, $20,000 cash deposit limit. | Application method similar to Complete Checking. |

| Chase Platinum Business Checking | Same as above. Targeted at larger businesses. | $95 fee waived with $100,000 minimum combined average beginning-day balance. 500 free transactions/month, $25,000 cash deposit limit. | Application method similar to Complete Checking. |

You can select the chase business checking account that matches your business needs. Chase supports many business structures, including LLCs, corporations, and sole proprietorships. You can start your application online for most account types, making the process simple and fast.

Key Features of Chase Business Account

Image Source: unsplash

Digital Banking Tools

You gain powerful digital banking tools with your chase business account. These features help you manage your business finances efficiently, whether you work from your office or on the go. The chase business complete banking platform gives you access to a suite of online and mobile services. You can deposit checks, transfer money, and review your account activity anytime. The table below highlights the main digital tools and their benefits:

| Digital Banking Tool | Description and Benefits |

|---|---|

| 24/7 Account Access | Manage transactions and financial issues anytime, anywhere. |

| Mobile Banking with Mobile Deposit | Deposit checks instantly using your smartphone, saving valuable time. |

| Automated Payments | Set up recurring bill payments to avoid missed deadlines. |

| Money Transfers | Move funds quickly between accounts or to others for better cash flow. |

| Loan Applications | Apply for business loans online, speeding up the financing process. |

| Purchase Capabilities via Mobile Apps | Make purchases directly through the mobile app for added convenience. |

| Access to Financial Statements | Instantly review transaction history and statements for better record keeping. |

| Integration with Budgeting Apps | Connect your account to budgeting software for improved financial planning. |

| Routine Banking Tasks Online | Order checks and update cards without visiting a branch. |

| Live and Digital Support | Get help beyond branch hours for faster problem resolution. |

These tools give you flexibility, speed, and control over your business finances.

Branch and ATM Access

You benefit from chase’s extensive branch and ATM network. With over 4,700 branches and 15,000 ATMs across the United States, you can access your account almost anywhere. Since 2021, chase has maintained a presence in all 48 contiguous states. This wide coverage means you can deposit cash, withdraw funds, or speak with a banker when you need support. The large network supports your business, whether you operate locally or travel for work.

Business Support and Perks

You receive more than just a business account with chase. The bank offers a range of business services and perks to help you grow and manage your company:

- Choose from several business checking accounts tailored to your needs.

- Access business loans, including SBA loans and lines of credit, to support expansion.

- Use business credit cards with rewards and benefits.

- Accept payments through card processing, invoicing, and payment links.

- Open business savings accounts and CDs to manage surplus funds.

- Take advantage of commercial banking and asset management for larger businesses.

- Use account management tools like Access & Security Manager and account alerts.

- Get customer support by phone or secure messaging.

- Find online resources for account setup, fraud protection, and payment solutions.

- Manage payments and inventory with chase business complete banking features.

These services and perks make it easier for you to handle daily operations and plan for future growth.

Chase Business Account Fees

Monthly Fees and Waivers

You need to understand the monthly fees for each chase business account. Each account type has a set monthly fee, but you can avoid these charges by meeting certain requirements. The most common way to waive the fee is by maintaining a minimum average monthly balance. You can also qualify by using chase business complete banking features, such as accepting payments or linking other accounts.

| Chase Business Checking Account | Monthly Fee | Fee Waiver Criteria (per statement period) |

|---|---|---|

| Chase Business Complete Banking | $15 | - Maintain $2,000 minimum daily balance- $2,000 in eligible deposits via Chase QuickAccept® or other Chase Payment Solutions- $2,000 in eligible purchases with Chase Ink Business Card- Maintain linked Chase Private Client Checking℠, JPMorgan Classic Checking, or Private Client Checking Plus account- Meet Chase Military Banking requirements |

| Chase Performance Business Checking® | $30 | - Maintain $35,000 minimum average monthly balance |

| Chase Platinum Business Checking℠ | $95 | - Maintain $100,000 minimum average monthly balance |

If you keep the required minimum average monthly balance, you avoid the monthly fee. You can also use chase business complete banking tools to help meet these requirements.

Transaction and Deposit Limits

Each chase business account comes with limits on free transactions and cash deposits. If you go over these limits, you pay extra fees. The table below shows the details for each account:

| Account Type | Free Monthly Transactions | Free Monthly Cash Deposit Limit | Fee for Excess Transactions | Fee for Excess Cash Deposits |

|---|---|---|---|---|

| Chase Business Complete Checking | 20 | $5,000 | $0.40 per transaction over 20 | $2.50 per $1,000 over $5,000 |

| Chase Performance Business | 250 | $20,000 | N/A | $2.50 per $1,000 over $20,000 |

| Chase Platinum Business | 500 | $25,000 | N/A | $2.50 per $1,000 over $25,000 |

If your business handles a lot of cash or many transactions, you should choose an account with higher limits. The chase business complete banking account works well for small businesses with lower activity. For growing businesses, the Performance or Platinum accounts offer more flexibility.

Other Charges

You should watch for other fees that may apply to your chase business account. These include:

- Wire transfer fees for sending or receiving money.

- Chargeback fees if a customer disputes a payment.

- Processor, network, or interchange fees for card payments.

- Fees for cash deposits above your account’s limit.

- Out-of-network ATM fees if you use non-chase ATMs.

Tip: You can avoid many of these charges by keeping the required minimum average monthly balance and using chase business complete banking features. Always review your account agreement for the latest fee details.

Requirements to Open Chase Business Account

Eligibility

You can open a Chase business account if your company fits one of several common structures. Chase accepts applications from sole proprietorships, limited liability companies (LLCs), corporations, partnerships, and unincorporated associations. You must meet the business account requirements set by Chase. Most small businesses, startups, and established companies qualify. However, government agencies, political action committees, and campaign accounts do not meet the business account requirements.

Chase allows sole proprietorships, big corporations, and limited liability companies to open business accounts. You must provide details such as your business address, phone number, number of locations, yearly revenue, and transaction volume.

Required Documents

To meet the business account requirements, you need to gather specific documents based on your business structure. The table below outlines what you should prepare:

| Business Structure | Required Documents | Identification | Supplemental Documents |

|---|---|---|---|

| Sole Proprietorship | Assumed Name Certificate (DBA), business license | Two forms of ID (one government-issued), SSN or ITIN | Assumed Name Application, published newspaper entry |

| LLC | Articles of Organization, Certificate of Good Standing | Personal ID, EIN or SSN/ITIN | Operating Agreement, Meeting Minutes |

| Corporation | Articles of Incorporation, Certificate of Good Standing | Personal ID, EIN | Corporate Resolution, Meeting Minutes |

| Partnership | Partnership Agreement, business license | Personal ID, EIN | Amendments, Meeting Minutes |

| Unincorporated Association | Articles of Association, IRS EIN letter | Personal ID, EIN | Meeting Minutes, Letter of Authorization |

You must meet all business account requirements for your business type. Chase may ask for extra documents to verify your information.

Online Application Steps

You can complete the Chase business account application online if you meet the business account requirements. Follow these steps:

- Gather your tax identification number (SSN, ITIN, or EIN) and all required business documents.

- Prepare a secondary ID, such as a credit card or utility bill.

- Go to the Chase website and select the business account that fits your needs.

- Fill out the online application with your business details and upload your documents.

- Sign in to Chase for Business Online to link your new account with your personal Chase profile.

- Download the Chase Mobile app to manage your business account on the go.

- Fund your account within 60 days using the Account Funding Hub, mobile deposit, ATM, or branch.

- Set up features like employee access, payment solutions, and fraud protection.

You may need to visit a branch if your business structure does not meet the online business account requirements. Approval usually takes about 14 days. Chase may request more information to complete your application.

Who Should Choose Chase Business Checking?

Choosing the right business account can help you manage your money and support your company’s growth. Chase offers different options for business owners at every stage. Here’s how you can decide which account fits your needs.

Best for Small Businesses

If you run a small business, such as a local bakery, freelance design studio, or online shop, you may find Chase Complete Business Checking a good fit. This account works well for businesses with lower transaction volumes and simple banking needs. You can open your account online and start managing your finances right away. Many small business owners like the easy access to Chase branches and ATMs. You also get tools to accept payments and keep your business and personal money separate. This helps you stay organized and prepare for tax season.

Tip: If you process fewer than 20 transactions per month and deposit less than $5,000 in cash, this account can save you money on fees.

Best for Growing Companies

Growing companies, such as marketing agencies, consulting firms, or retail stores with increasing sales, often need more flexibility. Chase Performance Business Checking supports your business as it expands. You get 250 free transactions each month and unlimited electronic deposits. The account allows up to $20,000 in cash deposits per month without extra fees. You also receive free incoming wires and two free outgoing wires per statement cycle. Fraud protection services and integration with tools like Zelle and QuickDeposit help you manage payments and security.

| Feature | Benefit for Growing Companies |

|---|---|

| Free Transactions | 250 per month, supporting higher activity |

| Cash Deposit Limit | $20,000 per month, no extra charge |

| Wire Transfers | Free incoming, two outgoing per cycle |

| Fraud Protection | Enhanced security for your business |

| Integration | Connects with payment and deposit tools |

You can waive the $30 monthly fee by keeping a $35,000 average daily balance. This makes the account cost-effective as your business grows.

Best for High-Volume Businesses

If you own a large company, such as a wholesale distributor, manufacturing firm, or multi-location franchise, you need an account that can handle many transactions. Chase Platinum Business Checking gives you 500 free transactions per month and up to $25,000 in cash deposits without fees. You get unlimited free incoming wires and four free outgoing wires each month. The account includes advanced cash management services, fraud protection, and access controls for your team.

| Feature | Description |

|---|---|

| Monthly Transaction Limit | 500 free transactions |

| Cash Deposit Allowance | $25,000 per month, no extra charge |

| Wire Transfers | Unlimited incoming, four outgoing free per month |

| Advanced Cash Management | Tools for reconciliation and account security |

| Access Controls | Manage user profiles and transaction limits |

You benefit from dedicated support and can waive the $95 monthly fee by maintaining a $100,000 average daily balance. This account is ideal if your business processes many payments and needs advanced banking features.

Chase vs. Competitors

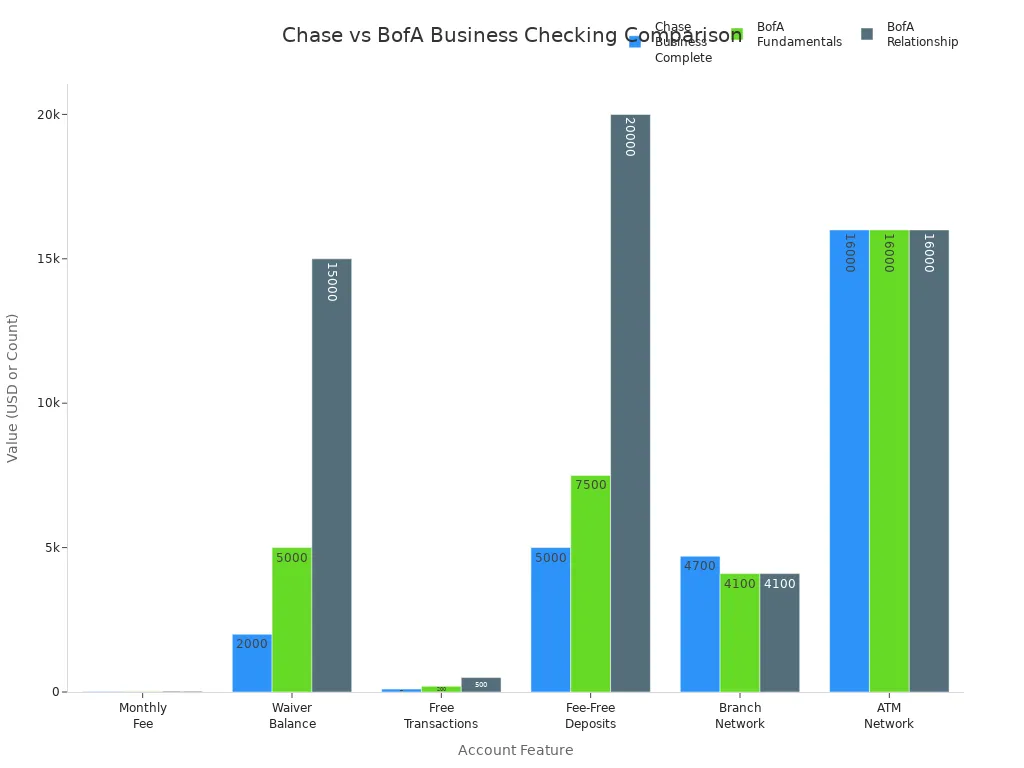

Chase vs. Bank of America

When you compare Chase and Bank of America, you notice both banks offer strong business checking options. Chase stands out with a lower monthly fee and easier waiver requirements. You only need a $2,000 minimum daily balance or qualifying card activity to avoid the $15 fee. Bank of America requires a higher balance for its waivers, starting at $5,000 for the Fundamentals account. If your business handles many transactions, Bank of America provides higher free transaction and cash deposit limits. Chase gives you a slightly larger branch network, which helps if you value in-person support.

| Feature | Chase Business Complete Banking | Bank of America Business Advantage Fundamentals / Relationship |

|---|---|---|

| Monthly Fee | $15 | $16 (Fundamentals), $29.95 (Relationship) |

| Fee Waiver Requirements | $2,000 minimum daily balance or card spending | $5,000 (Fundamentals), $15,000 (Relationship) average balance |

| Free Monthly Transactions | 100 | 200 (Fundamentals), 500 (Relationship) |

| Fee-Free Cash Deposits | $5,000 | $7,500 (Fundamentals), $20,000 (Relationship) |

| Branch Network Size | ~4,700 branches | ~4,100 branches |

| ATM Network Size | ~16,000 ATMs | ~16,000 ATMs |

Both banks deliver robust security and digital banking tools. Chase focuses on user experience and integrated digital features, while Bank of America emphasizes cash flow management and relationship-based support.

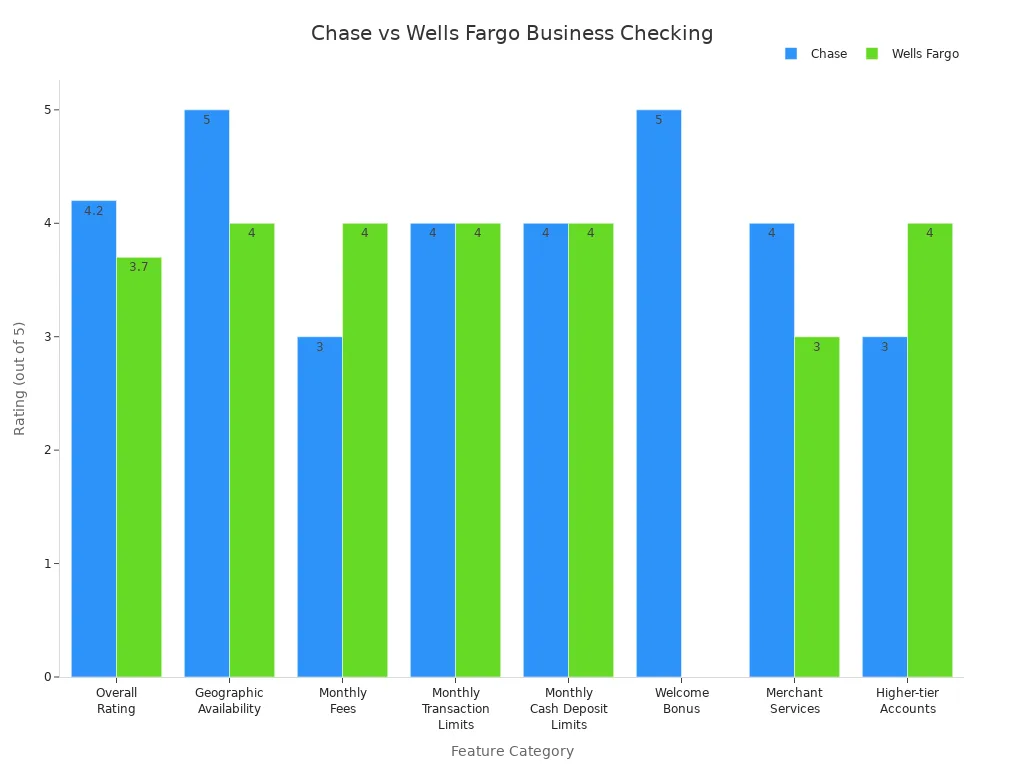

Chase vs. Wells Fargo

You may consider Wells Fargo if you want lower monthly fees and easier ways to avoid them. Wells Fargo offers more free transactions per month and a strong presence in the western United States. Chase provides a larger nationwide branch network and a $300 sign-up bonus for new business customers. If you need advanced merchant services, Chase offers QuickAccept for same-day card payment processing. Wells Fargo appeals to businesses that want to minimize fees and conduct frequent in-person transactions.

| Account Tier | Bank | Monthly Fee | Fee Waiver Requirements | Minimum Balance to Avoid Fee | Free Transactions per Month | Cash Deposit Limits | Key Features |

|---|---|---|---|---|---|---|---|

| Basic | Wells Fargo Initiate Business Checking | $10 | $500 daily balance or $1,000 average ledger | $500 | 100 | $5,000 | Card-free ATM, mobile transfers |

| Basic | Chase Complete Business Checking | $15 | $2,000 minimum balance or qualifying activity | $2,000 | 20 teller/check + unlimited debit/ATM | $5,000 | QuickAccept, online bill pay |

| Mid-Tier | Wells Fargo Navigate Business Checking | $25 | $10,000 daily or $15,000 combined balances | $10,000 | 250 | $20,000 | ATM fee reimbursement, pays interest |

| Mid-Tier | Chase Performance Business Checking | $30 | $35,000 daily balance | $35,000 | 250 | $20,000 | Check monitoring, QuickAccept |

| High-End | Wells Fargo Optimize Business Checking | $75 | Earnings allowance offsets fees | N/A | 250 | Fees apply | Treasury management |

| High-End | Chase Platinum Business Checking | $95 | $100,000 average daily balance | $50,000+ | 500 | $25,000 | Concierge service, cash management |

Chase is a better fit if you want a nationwide presence and advanced payment tools. Wells Fargo is an alternative to chase business checking if you want to keep fees low and need more free transactions.

Chase vs. Online Banks

Online banks attract many business owners with no monthly fees, higher free transaction limits, and easy online account opening. You may find these banks appealing if you run a digital-first business or want to avoid minimum balance requirements. However, online banks often lack physical branches and have lower cash deposit limits. Chase gives you a full-service experience with 4,700+ branches and 16,000 ATMs, higher cash deposit allowances, and advanced international banking services. You also get robust digital tools, including mobile check deposit, real-time alerts, and fraud protection.

| Feature Category | Chase Business Checking | Leading Online Business Bank (American Express) |

|---|---|---|

| Pricing Structure | Monthly fees $15-$95, waivable | No monthly fees, no minimum balance |

| Digital Features | Mobile app, real-time alerts, Zelle, fraud protection | Streamlined platform, virtual cards, QuickBooks integration |

| Physical Presence | 4,700+ branches, 16,000 ATMs | Digital only, MoneyPass ATM network |

| International Services | Advanced, multi-currency support | Basic transfers, focus on U.S. |

| Security & Fraud Protection | Customizable fraud monitoring | Real-time fraud detection, mobile wallet security |

If you need in-person support, higher cash deposit limits, or international services, Chase remains a strong choice. If you want lower fees and do not need branch access, an online bank can be a practical alternative to chase business checking.

Recap: Pros and Cons

When you consider a Chase business account, you see both strengths and weaknesses. Many business owners choose Chase for its wide branch network and strong digital tools. You can manage your business finances with ease, whether you visit a branch or use the mobile app. The account offers flexible fee waivers, which help you avoid monthly charges if you meet certain requirements. You also benefit from higher cash deposit limits, making this account a good fit for businesses that handle a lot of cash.

However, you should watch for some drawbacks. If you do not meet the waiver conditions, you pay a monthly fee. The number of free teller transactions is lower than some competitors, and extra transactions cost $0.40 each. Some users report inconsistent customer support and unexpected account closures. If you run a small business and want to keep costs low, you may find the fees less attractive.

Here is a clear summary of the main pros and cons:

| Aspect | Pros | Cons |

|---|---|---|

| Branch Access | Nationwide availability, helpful for multi-state businesses | N/A |

| Monthly Fee | $15 fee with easy waiver options | Fee applies if waiver not met |

| Cash Deposit Limits | Higher free cash deposit limit ($5,000/month) | Fees for deposits over the limit ($2.50 per $1,000) |

| Free Teller Transactions | 20 free per month | Lower than some banks; $0.40 per extra transaction |

| Customer Support | Multiple channels, generally good | Some reports of inconsistent support and account closures |

| Mobile App | Highly rated on iOS, strong integration | Slightly lower Android rating |

| Business Features | Robust tools like QuickAccept® | N/A |

| Suitability | Good for cash-heavy or multi-location businesses | Cost-conscious or smaller businesses may prefer other options |

Note: You should review your business needs before opening a Chase account. The right choice depends on your transaction volume, cash handling, and need for in-person banking.

You gain a reliable partner with a chase business account in 2025. Chase stands out for its digital banking tools, strong branch network, and flexible account options. Small and growing businesses benefit from easy online banking, while larger companies appreciate higher transaction limits. You should review your transaction needs and compare account tiers before opening an account. Start by gathering your business documents and applying online or at a branch for a smooth setup.

FAQ

How long does it take to open a Chase business account?

You can complete your application online in about 15 minutes. Chase usually reviews and approves your account within 14 business days. If you need to provide extra documents, the process may take longer.

Can you open a Chase business account online?

Yes, you can open most Chase business accounts online. You need to upload your business documents and identification. Some business types, such as partnerships, may need to visit a branch.

What is the minimum deposit for a Chase business account?

Chase does not require a minimum opening deposit for business checking accounts. You can fund your account after approval using a transfer, mobile deposit, or cash at a branch.

Does Chase offer business account bonuses?

Chase often provides sign-up bonuses for new business checking customers. You may need to meet requirements, such as making qualifying deposits or completing transactions. Check the Chase website for the latest offers and eligibility details.

Can you link your Chase business and personal accounts?

You can link your Chase business and personal accounts for easier management. This allows you to transfer funds, view balances, and manage both accounts from one online dashboard. You keep your business and personal finances separate for better organization.

After exploring the Chase business account in 2025, BiyaPay can help you manage cross-border payments more efficiently. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay offers a flexible payment solution. Additionally, BiyaPay’s Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, simplifying your transactions. Experience these benefits now to optimize your financial management! BiyaPay makes your cross-border payments smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.