- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exiting Your Timeshare Contract Made Simple

Image Source: pexels

You might feel stuck with your timeshare, wondering how hard is it to get out of a timeshare and searching for real solutions. Many owners want to exit your contract for reasons like misrepresentation, financial hardship, health issues, rising fees, or even trouble booking dates. These challenges push you to seek relief and explore common methods for exiting your timeshare. Here are some of the most frequent reasons people want to exit their contract:

- Misrepresentation during the sales presentation

- Financial hardship

- Health issues preventing usage

- Significant fee increases

- Breach of contract by the resort

- Fraudulent practices

- Death of a co-owner

You can take the first step toward financial relief by learning about safe, legal solutions. Acting fast may open up more methods and help you avoid scams. The right exit strategy can help you exit your contract and finally get out of a timeshare. Use these solutions to take the first step toward financial relief.

Key Takeaways

- Read your timeshare contract carefully to find exit clauses and the rescission period, which lets you cancel quickly without penalty.

- Use the rescission period by sending a written cancellation letter on time, following contract instructions, and keeping proof of delivery.

- Ask your resort about deed-back, surrender, or buyback programs to return your timeshare and stop future fees if you qualify.

- Selling or gifting your timeshare can help you exit, but expect low resale values and follow resort transfer rules carefully.

- Avoid scams by working with trusted professionals, never paying high upfront fees, and always verifying company credentials before acting.

Review Your Timeshare Contract

Image Source: pexels

Before you do anything else, grab your timeshare agreement and read it carefully. You want to know exactly what you signed up for. Every timeshare is different, so your contract holds the answers to many questions about cancellation and exit options.

Understand Exit Clauses

Start by looking for any exit clauses in your timeshare agreement. These sections explain how you can leave your timeshare and what steps you need to take. Some contracts list specific grounds for cancellation, like misrepresentation or breach of contract. Others may have strict rules about when and how you can cancel. Make a list of all deadlines, fees, and requirements you find. If you see words like “deed-back” or “surrender,” highlight them. These might offer a way out if you meet certain conditions.

Tip: Write down any contact information or addresses listed for sending a cancellation notice. You may need this soon.

Identify the Rescission Period

Now, focus on the rescission section. Most timeshare contracts include a rescission period, also called a cooling off period. This is a short window after you sign when you can cancel your timeshare without penalty. The length of the rescission period depends on where you bought your timeshare. In many places, the cooling off period lasts from three days up to fifteen days. Some states or countries give you even more time. The rescission period usually starts when you get all your contract documents, not just when you sign.

You must act fast if you want to use the rescission period. Most timeshare agreements require you to send a written cancellation notice within the cooling off period. If you miss this window, you may lose your right to cancel without penalty. Always check your contract for the exact number of days and follow the instructions for sending your notice.

Note: The law says timeshare companies must clearly tell you about your rescission rights. They cannot take these rights away or hide them in fine print.

Cancel a Timeshare Contract During Rescission

The rescission period gives you the fastest and safest way to exit your timeshare. If you act during this cooling off window, you can cancel a timeshare contract without penalty. Many states require a rescission period that lasts from three to fifteen days. The countdown usually starts when you sign the contract or receive all your documents. State laws protect your right to rescind, and resorts cannot take this right away. Up to 15% of buyers use this option, so you are not alone if you want to walk away.

Write a Cancellation Letter

You need to write a timeshare cancellation letter to start the rescission process. This letter must follow some rules to be legally valid. Here is what you should include:

- Your full legal name as it appears on the contract

- Your current mailing address, phone number, and email

- The name of the timeshare company or resort

- Details about your timeshare: contract number, purchase date, property description, and membership ID if you have one

- A clear statement that you want to cancel the contract under your rescission rights

- Instructions for a refund, including the amount paid and how you want to receive it

- A request for written confirmation of your cancellation

- Copies of important documents, like your purchase agreement and proof of payment

- The date and your signature (and the signature of any co-owner)

Tip: Double-check your contract for the exact address and delivery method required for your cancellation letter. Missing this step can cause problems.

Here is a simple template you can use:

[Date]

To: [Timeshare Company Name]

[Company Address]

Subject: Notice of Rescission – Timeshare Contract #[Contract Number]

Dear [Company Name],

I am writing to exercise my right to rescind my timeshare contract, signed on [Purchase Date], for [Property Description]. Please consider this letter as my formal notice to cancel the contract within the legal rescission period.

Please confirm the cancellation in writing and process a refund of all payments made. I have attached copies of my contract and payment records.

Sincerely,

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email]

[Signature]

Submit and Follow Up

How you send your cancellation letter matters. You must follow the instructions in your contract and state law. The best way to send your letter is by certified mail with return receipt requested. This gives you proof that the timeshare company received your letter on time. Courier services like FedEx also work if they provide tracking and require a signature. Regular mail is not recommended because you cannot prove delivery.

| Delivery Method | Tracking | Proof of Delivery | Recommended Use |

|---|---|---|---|

| Certified Mail (with return receipt requested) | Yes | Yes | Best for proof of delivery and legal protection |

| Courier Service | Yes | Yes | Good alternative with tracking and signature |

| Regular Mail | No | No | Not recommended |

After you send your letter, keep all receipts, tracking numbers, and copies of your letter. If you do not get a written confirmation of your cancellation within a week, follow up with the timeshare company. You can call, email, or send another letter. Always keep records of every contact. If you still do not get a response, you may want to talk to a lawyer who knows about timeshare law.

Note: Timely and proper delivery of your cancellation notice is critical. If you miss the rescission deadline or use the wrong address, you may lose your right to cancel.

By following these steps, you can use the rescission period to exit your timeshare quickly and safely. Acting fast and keeping good records will help you avoid problems and make sure your cancellation is successful.

Contact the Resort to Exit Your Contract

Sometimes, the fastest way to exit your contract is to go straight to the source. Many resorts offer programs that help you give a timeshare back to the resort or surrender your timeshare. These solutions can save you time and stress if you qualify. Let’s look at your options and what you need to know before you ask the resort to take it back.

Deed-Back and Surrender Options

You might hear the terms “deed-back” or “surrender” when you talk to your timeshare company. These options let you give a timeshare back to the resort and walk away from future payments. Not every resort offers these solutions, but most major developers have some kind of program.

Before you can use a deed-back or surrender program, you need to meet certain requirements. Resorts want to make sure you are in good standing before they let you exit your contract. Here’s what you usually need:

- Your timeshare must be fully paid off. You cannot have any mortgage left.

- You must be current on all maintenance fees.

- There should be no legal disputes about your timeshare.

- Some resorts ask for proof of financial hardship.

- You need to provide documents like proof of ownership, your ID, and a written request.

- Some programs charge a fee, but many are free if you meet all the rules.

- The resort decides if they will accept your request, even if you meet every requirement.

Most resorts want you to be up to date on payments and fees. If you owe money, they will likely say no. You also need to fill out forms and send in paperwork. Sometimes, the process feels slow, but it is worth it if you want to exit your contract without extra trouble.

Tip: Always ask your resort for a list of requirements and fees before you start. Get everything in writing so you know what to expect.

If you qualify, these options can be a simple way to surrender your timeshare and stop future bills. But remember, acceptance is not guaranteed. The resort has the final say.

Resort Buyback Programs

Some resorts offer buyback programs as another way to exit your contract. These programs let you sell your timeshare back to the company, but they work differently from deed-back options. Resorts usually run these programs quietly and only accept certain timeshares.

Here’s a quick look at how some major buyback programs work:

| Aspect | Marriott Vacation Club Buyback | Marriott Deed-Back/Surrender | Wyndham Ovation Program |

|---|---|---|---|

| How It Works | Buys back select deeded weeks at certain resorts. Offers last 7 days. Closing takes 90-120 days. | For owners in hardship or default. No money paid, but you get out of future fees. | Lets owners exit without extra costs. Only accepts high-demand weeks. |

| Who Qualifies | Only some deeded weeks. No buybacks for some years. Focus on popular resorts. | Owners in hardship or default. Not widely advertised. | Selective. Only takes desirable weeks at top resorts. |

| Money Involved | Offers are much lower than resale value. Example: $10,200 offer vs $22,326 resale. | No money paid to you. Just relief from future payments. | No extra costs, but not all timeshares accepted. |

| How Public | Not advertised. Found by user groups. | Not advertised. Resort decides who qualifies. | Public, but still selective. |

| Acceptance Rate | Not published. Very selective. | Only for hardship cases. | Thousands helped, but no exact numbers. |

You can see that these programs are very selective. Resorts usually want only high-demand or valuable timeshares. If your week is not at a popular resort, you may not get an offer. Even if you do, the price will likely be much lower than what you paid or what you see on the resale market.

Note: Acceptance is never guaranteed. Even if you meet all the rules, the resort can still say no.

If you want to try these solutions, contact your timeshare company and ask about all your options. Ask if you can give a timeshare back to the resort, surrender your timeshare, or use a buyback program. Make sure you understand the rules, fees, and what happens if your request is denied. These steps can help you exit your contract with less stress and fewer surprises.

Get Rid of a Timeshare: Sell, Transfer, or Gift

Sometimes, you just want to get rid of a timeshare as quickly as possible. If you missed the rescission period and the resort will not take it back, you still have a few methods left. Selling, transferring, or gifting your timeshare are common methods for exiting your timeshare. Each option has its own steps and challenges, so you need to know what to expect before you start.

Sell on the Resale Market

You might think selling your timeshare will help you recover some money. In reality, most timeshares lose value right after you buy them, much like a new car. The average original price for a timeshare is about $23,000, but resale prices are almost always much lower. There is no set resale value, and prices change based on location, season, brand, and demand. You will need to research similar listings to find a fair price.

Many people try to sell on platforms like eBay or timeshare resale websites. Here are some things you should know:

- eBay and other resale sites have thousands of timeshares listed, often at very low prices.

- The market is crowded, and most listings do not get any bids, even at rock-bottom prices.

- Transfer rules and resort policies can make the sale process slow and confusing.

- Some resale companies and brokers charge upfront fees but do not guarantee a sale.

Note: The resale market is tough. Most sellers struggle to find buyers, and you may end up listing your timeshare for just a few dollars to get rid of a timeshare.

Transfer or Gift to Others

If selling does not work, you can try to transfer or gift your timeshare to someone else. This method can help you get rid of a timeshare, but the new owner must accept all the contract obligations, including maintenance fees and rules. You can transfer to a friend, family member, or even a stranger, but you must follow the resort’s transfer process.

Here are some steps to follow:

- Contact your resort to ask about transfer rules and paperwork.

- Make sure the new owner understands all costs and responsibilities.

- Complete the transfer forms and pay any required fees.

- Get written confirmation from the resort once the transfer is done.

Tip: Always be honest with the new owner about the costs and rules. Surprises can cause problems later.

Selling, transferring, or gifting are options if you want to get rid of a timeshare, but each method comes with its own risks and challenges. Make sure you understand the process and set realistic expectations before you start.

Professional Help to Get Out of a Timeshare

Image Source: pexels

Sometimes, you need extra help to get out of a timeshare. If you feel stuck or worry about how hard is it to get out of a timeshare, you might look for professional solutions. Two main options are hiring a timeshare attorney or working with timeshare exit companies. Each has pros and cons, so let’s break it down.

Timeshare Attorneys

When you use an attorney, you get legal expertise. Timeshare attorneys know contract law and can spot loopholes or mistakes in your agreement. They help with tough cases, like when the rescission period has passed or if you believe there was fraud. Most lawyers charge between $150 and $500 per hour, or a flat fee from $3,000 to $7,000. This can seem expensive, but you get strong legal support and a better chance of a real cancellation.

Here’s what you should check before hiring a lawyer:

- Make sure the attorney is licensed in your state. Check the state bar association.

- Look for experience with timeshare cases and a good track record.

- Read reviews from past clients on trusted sites.

- Ask about fees and make sure everything is clear.

- Avoid anyone who promises a quick fix or guaranteed results.

Tip: A good attorney will explain your options, answer your questions, and never pressure you to sign up right away.

Exit Companies and Scams

Timeshare exit companies offer solutions that sound easy, but you need to be careful. Many companies promise to get out of a timeshare for a fee, often starting at $5,000. Some only send demand letters and do not provide real legal help. Others may tell you to stop paying fees, which can hurt your credit.

| Aspect | Timeshare Attorney | Timeshare Exit Company |

|---|---|---|

| Cost Structure | $150-$500/hour or $3,000-$7,000 flat fee | Starts at $5,000, can be much higher |

| Services Provided | Legal advice, contract review, negotiation | Demand letters, less legal support |

| Outcome Reliability | More reliable, legally grounded | Risky, sometimes ineffective |

| Risks | Higher cost | Scams, credit damage, false promises |

You must watch out for common scams to avoid. Some warning signs include:

- High upfront fees or pressure to act fast

- Promises of guaranteed cancellation

- Fake reviews or websites

- Requests for wire transfers or complex paperwork

Note: Real solutions do not require you to rush or pay huge fees upfront. Always research the company, check for a real business history, and read honest reviews.

If you want a safe exit strategy, take your time, ask questions, and trust your instincts. Getting out of a timeshare is possible, but you need to avoid scams and choose the right help.

Costs, Risks, and What to Avoid

Typical Fees and Savings

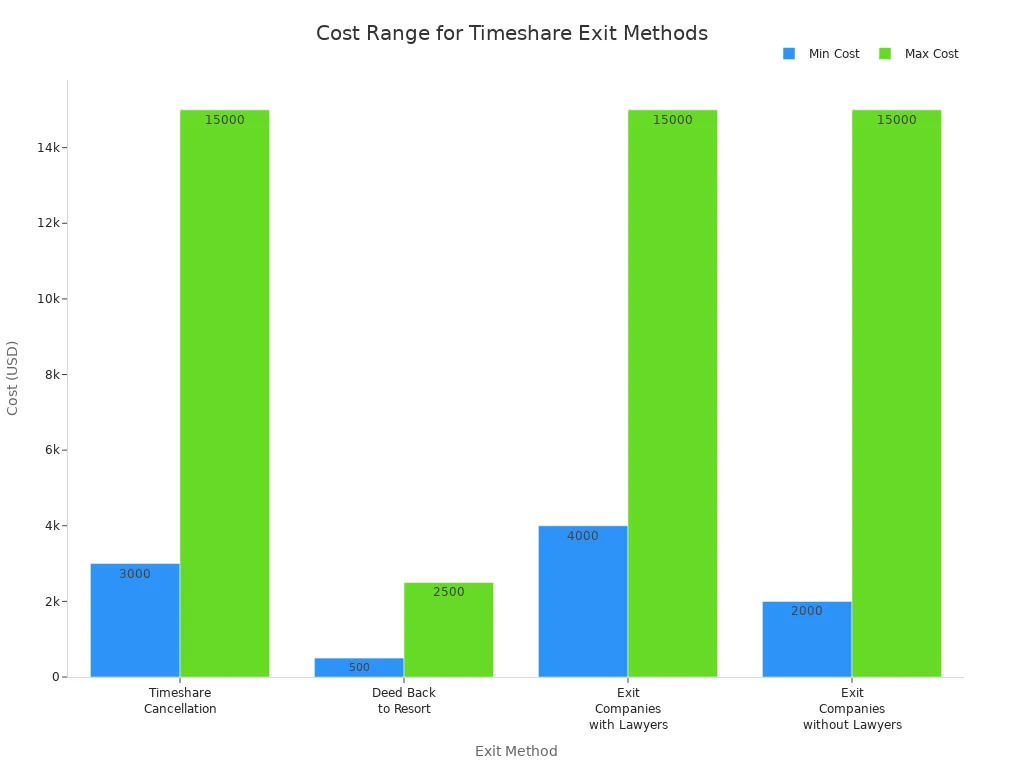

When you look at the costs to get out of a timeshare, you might feel overwhelmed. Professional exit services usually charge between $3,000 and $8,000, but some cases can reach $12,000 or more. Here’s a quick look at what you might pay:

| Exit Method | Cost Range (USD) |

|---|---|

| Timeshare Cancellation (general) | $3,000 - $15,000 |

| Deed Back to Resort | $500 - $2,500 |

| Exit Companies with Lawyers | $4,000 - $15,000 |

| Exit Companies without Lawyers | $2,000 - $15,000 |

You might pay a one-time fee, but you gain relief from endless maintenance fees, property taxes, and special assessments. These costs often rise every year. By exiting, you can save thousands of dollars over time and finally feel relief from ongoing bills.

Risks of Stopping Payments

You may wonder what happens if you stop paying your timeshare. If you miss payments, the resort can charge late fees and interest. Your debt grows quickly. The company may send your account to collections or even start foreclosure. This can hurt your credit score and lead to court cases, wage garnishment, or bank levies. Maintenance fees average over $1,200 each year and usually increase. If you ask yourself what happens if you stop paying your timeshare, know that you risk losing the property and facing more financial trouble. Always talk to a professional before you stop making payments.

Do’s and Don’ts

Here are some best practices and common mistakes to help you exit your timeshare safely:

Do’s:

- Read your contract carefully and know your rights.

- Use the rescission period if you just bought your timeshare.

- Contact your resort about deed-back or buyback programs.

- Work with trusted, licensed professionals.

- Keep up with all payments until your exit is official.

Don’ts:

- Don’t miss the legal cancellation window.

- Don’t trust verbal promises—get everything in writing.

- Don’t fall for scams or pay high upfront fees to unknown companies.

- Don’t ignore state laws or contract details.

- Don’t stop paying fees without legal advice.

Tip: Stay patient and persistent. Exiting a timeshare takes time, but following these steps can help you avoid costly mistakes and find real relief.

You have several legal ways to get out of a timeshare. The most effective steps include using the rescission period, deed-back programs, and working with trusted professionals. Act fast—some states give you only a few days to cancel.

Watch out for scams and always check with groups like ACA Group, Centerstone Group, or the Coalition for Responsible Exit. Use this guide as your checklist to exit your contract safely.

FAQ

How long does it take to exit a timeshare contract?

The timeline depends on your method. Using the rescission period can take just a few days. Resort programs or legal help may take several months. Always ask for an estimated timeline before you start.

Will exiting my timeshare hurt my credit score?

If you follow the contract and pay all fees, your credit score should stay safe. Missing payments or defaulting can lower your score. Always check with a professional before you stop paying.

Can I sell my timeshare for a profit?

Most timeshares lose value after purchase. You will likely sell for much less than you paid. Here’s a quick comparison:

| Original Price | Typical Resale Value |

|---|---|

| $23,000 | $1 - $5,000 |

What should I do if I suspect a timeshare exit scam?

Stop communication right away. Report the company to the Federal Trade Commission or your state attorney general. Never send money or personal details to anyone who pressures you or makes big promises.

After learning how to exit your timeshare contract simply, BiyaPay can help you manage cross-border payments more efficiently. With real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ digital currencies, remittance fees as low as 0.5%, and coverage across over 200 countries and regions with same-day remittance delivery, BiyaPay offers a flexible payment solution. Additionally, BiyaPay’s Easy Card supports convenient payments on eBay, Amazon, PayPal, and more, simplifying your transactions. Experience these benefits now to address your financial needs with ease! BiyaPay makes your cross-border payments smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.