- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money Abroad with First Convenience Bank A Complete Guide

Image Source: pexels

You can send money abroad with First Convenience Bank. The bank offers international transfer services, but you must visit certain branches in person. You cannot complete this process online or with mobile banking. Only about 10% of banks in the United States currently provide international money transfer services to customers, so this feature is not common. Make sure you know which branch to visit before planning your transfer.

Key Takeaways

- You must visit select First Convenience Bank branches in person to send money abroad; online or mobile transfers are not available.

- Bring your government-issued photo ID and all required documents to avoid delays and ensure a smooth transfer.

- Check branch locations and confirm they offer international transfer services before visiting to save time.

- Understand all fees, including wire transfer charges and currency exchange rates, to avoid surprises and save money.

- Consider alternative providers if you want faster transfers, lower fees, or the convenience of sending money online.

International Transfer Availability

In-Person Only

You can only start an international transfer at select First Convenience Bank branches. The bank does not allow you to send money abroad online or through its mobile app. You must visit a branch in person to complete the process. This rule helps the bank keep your information safe and makes sure you get help from a staff member. When you go to the branch, you can ask questions and get clear answers about your transfer.

Note: Always bring your government-issued photo ID and any documents related to your transfer. This step will help you avoid delays.

Many banks in the United States offer online transfers, but First Convenience Bank uses in-person service for extra security. If you want to send money to a country like China or to a Hong Kong bank, you must follow this in-person process.

Branch Locations

Not every First Convenience Bank branch can process an international transfer. You need to check which branches offer this service before you visit. You can find this information on the bank’s official website or by calling customer service. Some branches may have staff who speak different languages, which can help if you need support.

Here is a simple way to find a branch that handles international transfers:

- Visit the First Convenience Bank website.

- Use the branch locator tool.

- Look for branches with wire transfer services.

- Call the branch to confirm they can help with your transfer.

You should plan your visit during regular business hours. Some branches may have limited hours for wire transfers. If you have questions, the bank’s customer service team can guide you to the right location.

How to Send Money

Image Source: unsplash

Step-by-Step Guide

You must visit a First Convenience Bank branch in person to start an international transfer. The bank does not allow you to send money abroad online or through its mobile app. Here is a clear step-by-step guide to help you complete your transfer:

- Check Branch Services

Make sure the branch you plan to visit offers international transfer services. Not every branch can process these requests. You can call ahead or use the bank’s website to confirm. - Visit the Branch

Go to the selected branch during business hours. Bring your government-issued photo ID and any documents related to your transfer. - Provide Recipient Details

Give the teller all the required information about the person receiving the money. This includes the recipient’s full name, their bank account number, and the SWIFT or BIC code of their bank. If you are sending money to a Hong Kong bank, you may need extra details, such as a local bank code. - Show Supporting Documents

If you plan to send a large amount, the bank may ask for proof of where the money comes from and why you are sending it. This step follows legal rules and helps prevent fraud. - Review Fees and Rates

Ask the teller about all fees before you finish the transfer. You should know about the transfer fee, the exchange rate, and any extra charges from other banks. - Confirm and Track the Transfer

The teller will process your international transfer using the SWIFT network. Transfers usually take three to five business days to reach the recipient. Ask for tracking details so you can check the status of your transfer.

Tip: Always double-check the recipient’s information before you submit your request. Mistakes can delay your transfer or cause it to fail.

Required Information

You need to prepare several pieces of information before you visit the branch. Having everything ready will make your international transfer faster and easier. Here is a table to help you organize what you need:

| Information Needed | Description |

|---|---|

| Your Photo ID | Government-issued, such as a driver’s license or passport |

| Recipient’s Full Name | Must match the name on their bank account |

| Recipient’s Bank Account Number | The account where the money will be sent |

| Recipient Bank’s SWIFT/BIC Code | Used to identify the recipient’s bank for international transfer |

| Local Bank Details (if required) | For some countries, like Hong Kong, you may need a bank code |

| Amount to Send | The exact amount in USD |

| Purpose of Transfer | Reason for sending the money |

| Proof of Source of Funds (if large amount) | Documents showing where the money comes from |

You should also bring any other documents the bank requests. If you are unsure, call the branch before your visit.

Note: The bank uses this information to keep your transfer safe and to follow international banking rules.

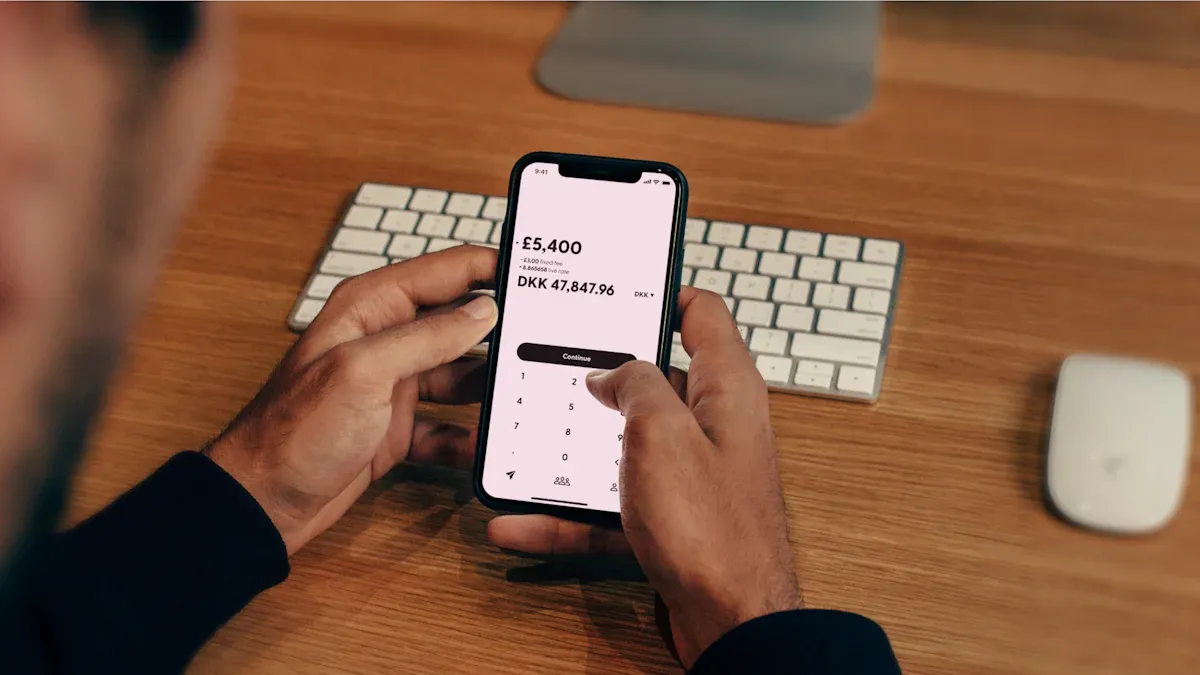

International Transfer Fees

Image Source: pexels

When you send money abroad with First Convenience Bank, you need to understand the fees involved. These costs can affect how much your recipient gets. Knowing the details helps you plan better and avoid surprises.

Outgoing Wire Fee

First Convenience Bank charges a fee for each international transfer you make. This fee covers the cost of sending your money through the SWIFT network. You pay this fee at the time you start your transfer at the branch.

- The outgoing wire fee usually ranges from $40 to $60 per transfer.

- The exact amount depends on the branch and the country you send money to.

- If you send money to a Hong Kong bank, ask the teller for the current fee.

Tip: Always ask for a receipt that shows the fee. This helps you keep track of your expenses.

Here is a quick table to help you compare possible fees:

| Transfer Destination | Outgoing Wire Fee (USD) |

|---|---|

| Hong Kong | $45 - $60 |

| China | $45 - $60 |

| United Kingdom | $40 - $55 |

Currency Charges

Besides the wire fee, you also pay currency charges. These charges come from converting your USD to the local currency of the recipient. The bank uses its own exchange rate, which may differ from the rates you see online.

- The exchange rate can change daily.

- Some banks add a margin to the rate, which means your recipient may get less money.

- If you send money to a Hong Kong bank, check the current USD to HKD rate before you transfer.

Note: Ask the teller to show you the exchange rate and the total amount your recipient will get after all charges.

You should always review both the outgoing wire fee and the currency charges before you complete your international transfer. This helps you make the best choice for your needs.

Transfer Timing

Same-Day Debit

When you start an international transfer at a First Convenience Bank branch, the bank usually removes the money from your account on the same day. This means your balance will show the debit right after you finish the process with the teller. You do not need to wait for the funds to leave your account. The bank processes your request during business hours, so transfers started late in the day may not show until the next business day. Always check your account after you complete the transfer to confirm the debit.

Note: If you begin your transfer on a weekend or a holiday, the bank will process the debit on the next business day.

Delivery Time

The time it takes for your recipient to get the money depends on several factors. Most international transfers take between three and five business days to reach the recipient’s bank. However, some transfers may take longer. Here are some reasons why delivery can be delayed:

- Currency conversion may take up to two working days.

- The countries involved can affect speed because of different banking practices.

- Transfers only happen during banking hours. Holidays and weekends can cause delays.

- Security checks for regulatory rules may add extra time.

- Incorrect information, such as the recipient’s name or SWIFT code, can slow down the process.

- Large transfer amounts may need more checks, which can delay the transfer.

- Some countries, like Hong Kong, may have slower payment systems.

- Bank policies and cut-off times decide when transfers are processed.

- Technical issues or network congestion can also cause delays.

You can help speed up your international transfer by double-checking all recipient details and starting your transfer early in the day. If you need the money to arrive quickly, ask the teller about faster options or possible delays before you begin.

Safety and Support

Security Measures

You want your money to reach the right person safely. First Convenience Bank uses strong security steps for every international transfer. The bank checks your identity each time you send money. This helps protect you from fraud and keeps your account safe. Staff may ask for your photo ID and other documents. These steps follow U.S. laws, such as the USA PATRIOT Act. Banks must watch for money laundering and other risks. They use special programs to check for suspicious activity and review large or unusual transfers.

Here are some ways the bank keeps your transfer secure:

- Staff check your ID and verify your information.

- The bank reviews transfers for signs of fraud or money laundering.

- Extra checks happen if you send money to certain countries or banks.

- The bank tracks transfers and reports anything unusual.

If your transfer gets delayed or put “On Hold,” the bank may need more information. You should contact the branch or customer service to find out what to do next.

Customer Service

If you have questions or problems with your international transfer, you can get help from First Convenience Bank’s customer service team. You can call them at 1-800-677-9801 for support. The staff can answer questions about your transfer status, fees, or any issues you face.

Here are some common questions customers ask:

- Why is my money transfer status “On Hold”?

- Why do you authenticate my identity?

- Why was my transfer put in review?

- How long does it take to review my transfer?

- Why was my transfer declined?

- Why am I getting a Payment Authorization failure message?

- How do I know my recipient received their funds?

- What is the refund policy?

- Can I cancel a transfer?

- What payment methods can I use?

Tip: If you notice a problem with your transfer, call customer service right away. Keep your receipt and tracking number handy. The bank can help you check the status or fix mistakes.

You can trust that First Convenience Bank follows strict rules for every international transfer. The bank works hard to keep your money safe and give you support when you need it.

Alternatives

Other Providers

You have many choices when sending money abroad. Some companies focus on international transfers and offer features that banks may not provide. These services often let you send money online or through an app, so you do not need to visit a branch. Here is a table to help you compare popular options:

| Alternative App | Key Features | Suitability for International Transfers |

|---|---|---|

| Remitly | Specializes in international transfers; flexible delivery options (bank deposits, cash pickup, mobile wallets); supports transfers to over 170 countries; competitive exchange rates; secure with two-factor authentication | Highly suitable; recommended for international remittances |

| PayPal | Global reach; buyer protection program; links bank accounts and credit cards; flexible payment options | Highly suitable; ideal for international transactions |

| Mural | Focus on global transactions and comprehensive financial management | Suitable for international transfers |

| Venmo | Social payment features; integration with popular apps; Venmo debit card | Less ideal for international transfers; better for casual/social payments |

| Cash App | Combines money transfer with investing; bitcoin and stock trading; instant cash-out option | Less ideal for international transfers; more for investing and social uses |

| Zelle | Integrated with many banks; very fast transfers; no fees for transactions | Primarily for transfers within the United States; not suitable for international transfers |

Some providers, such as Wise, use their own payment networks. This helps you avoid extra fees from intermediary banks and gives you faster delivery times. Wise uses the mid-market exchange rate, so you get a better deal compared to most banks.

Here is a quick comparison of fees and delivery times:

| Aspect | Wise (Alternative Provider) | Traditional Banks (e.g., First Convenience Bank) |

|---|---|---|

| Transfer Type | Local transfers avoiding SWIFT intermediaries | SWIFT payments involving multiple intermediary banks |

| Sending Transfer Fee | Transparent fees starting from 0.33% | Typically $10 to $35 per transfer |

| Intermediary Fees | None | Yes, varies depending on number of intermediaries |

| Exchange Rate Markup | None (mid-market rate used) | Yes, includes a markup on exchange rates |

| Recipient Fee | Usually none for local transfers | Varies, often $0 to $9 |

| Delivery Time | Over 60% instant, 95% within 24 hours | Usually 3 to 5 days |

When to Consider Alternatives

You may want to use an alternative provider instead of First Convenience Bank in these situations:

- You want to save money on fees, especially for smaller or frequent transfers.

- You need faster delivery, since many providers complete transfers within 24 hours.

- You prefer to send money online or through an app, without visiting a branch.

- You plan to make recurring payments or manage payments for a business.

- You want better exchange rates, as some providers use the mid-market rate.

- You need features like multi-currency accounts or batch payments for business needs.

- You want the option to reverse a transaction if needed, which is possible with some electronic funds transfer services.

Bank wire transfers work best for large, urgent, or one-time payments. However, for regular, smaller, or less urgent transfers, alternative providers often give you more flexibility, lower costs, and greater convenience. If you send money to a Hong Kong bank or another country often, you may find these services easier and more affordable.

Tips for Saving

Reducing Costs

You can lower the cost of sending money abroad by making smart choices before you visit the bank. Start by comparing the fees at First Convenience Bank with those from other providers. Some services charge less for international transfers, especially if you send money often. Always ask the teller for a full breakdown of all fees, including any charges from intermediary banks. These hidden fees can reduce the amount your recipient gets.

Choose the right payment method to save money. Bank transfers usually cost less than credit card payments. If you send money to a Hong Kong bank, check if the recipient’s bank charges extra fees. You can also save by sending larger amounts less often. Many banks charge a flat fee per transfer, so combining smaller payments into one can help you avoid paying multiple fees.

Tip: Ask about the current exchange rate and compare it to the rates you see online. Some banks add a margin to the rate, which means your recipient may get less money.

Planning Ahead

Planning ahead helps you avoid delays and extra costs. You should prepare all your documents before you visit the branch. Bring your government-issued ID, proof of address, and any documents that show where your money comes from. This step helps you pass the bank’s checks quickly and keeps your transfer on schedule.

Follow these steps to make your transfer smooth and cost-effective:

- Prepare all required documents in advance to avoid delays during verification.

- Watch exchange rates and use tools like rate alerts to send money when rates are best.

- Understand all fees, including those from intermediary banks and currency conversion.

- Choose a provider with clear, upfront fees and strong security.

- Schedule your transfer on a business day. Avoid weekends, as rates may be worse and processing can take longer.

By planning your transfer and understanding the process, you can save money and make sure your recipient gets the funds quickly and safely.

You can use First Convenience Bank for your international transfer, but you must visit a branch and bring all required documents. Always compare fees and options before sending money abroad:

- Banks may charge hidden fees and use less favorable exchange rates.

- Comparing services helps you find the best rates, lowest fees, and fastest delivery.

- Tools like CompareRemit show you total costs and transfer speeds.

For the latest information or questions about your international transfer, use the contact options below:

| Contact Method | Details |

|---|---|

| Visit a Branch | Speak with staff during business hours |

| Customer Service | Call (800) 359-8092 |

| Contact Page | Use the bank’s official website |

FAQ

How do you find out if your branch offers international transfers?

You can check the First Convenience Bank website or call customer service. Use the branch locator tool online. Always confirm with the branch before you visit.

What documents do you need to bring for an international transfer?

Bring your government-issued photo ID, the recipient’s bank details, and proof of the source of funds if you send a large amount. Ask the branch if you need extra documents.

Can you cancel or change an international transfer after sending it?

You should contact customer service right away if you need to cancel or change your transfer. The bank may not always stop the transfer if it has already started processing.

How do you track your international transfer?

Ask the teller for a tracking number or reference code. You can call customer service with this number to check the status of your transfer.

What should you do if your recipient does not receive the money?

Contact customer service with your receipt and tracking number. The staff will help you find out what happened and guide you on the next steps.

As you navigate international transfers with First Convenience Bank, managing high fees and slow delivery can be a challenge, especially without online options. BiyaPay offers a smarter alternative for sending money abroad. With remittance fees as low as 0.5%, you keep more of your funds compared to traditional bank fees. BiyaPay supports same-day transfers to most countries and regions, ensuring your money arrives quickly. Its real-time exchange rate queries and seamless fiat-to-digital currency conversion make cross-border payments effortless. Registering is simple and secure, allowing you to send money from anywhere without visiting a branch. Save time and money on your international transfers—join BiyaPay today for fast, affordable, and reliable global payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.