- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Travel Money Card Showdown Comparing Top Options for Australians Traveling Overseas

Image Source: unsplash

If you want the best travel money cards for your next overseas trip from Australia, Wise stands out in 2025. Wise lets you hold over 40 currencies and offers competitive mid-market exchange rates, making it a favorite for multi-currency travel. Other strong options include Revolut, Travelex, CommBank, Westpac, CashPassport Platinum, Citibank Plus Everyday Account, and Travel Money Oz. Australians often prefer cards with low fees, easy cash access, and strong security features. When you see travel money cards compared, look at fees, supported currencies, exchange rates, and how simple each card is to use.

- Australians value:

- Low fees and locked-in exchange rates

- Quick reloads and 24/7 support

- Security and worldwide ATM access

Choose a travel money card that matches your travel style and keeps your money safe.

Key Takeaways

- Wise Travel Card leads in 2025 with over 40 currencies, low fees, and mid-market exchange rates, making it ideal for multi-currency travelers.

- Revolut offers flexible plans, strong security, and easy app control, perfect for those who want extra features and spending limits.

- Look for travel money cards with low or no fees, good exchange rates, and wide ATM access to save money and avoid surprises abroad.

- Use your card’s app to track spending, freeze your card if lost, and always pay in local currency to avoid extra fees.

- Choose a card that fits your travel style, whether you travel often, visit many countries, or want to keep costs low.

Best Travel Money Cards in Australia 2025

Image Source: pexels

Top Pick: Wise Travel Card

You want a card that makes travel easy and saves you money. The wise debit card stands out as the best travel money card for Australians in 2025. You can hold and spend in over 40 currencies. Wise uses the mid-market exchange rate, so you avoid hidden markups. This means you get more value every time you spend or withdraw cash overseas.

Here’s what makes the wise debit card a top choice:

- You pay no monthly account fees.

- You only pay a small one-time card fee of $10 USD.

- You get two free ATM withdrawals each month up to $350 USD. After that, you pay a small fee.

- You can use the card in over 160 countries.

- The Wise app lets you freeze your card, set spending limits, and get instant alerts.

- You can use Apple Pay and Google Pay for contactless payments.

- The card uses smart conversion, so you always pay the lowest conversion fee.

- You get strong security, including two-factor authentication and 24/7 fraud monitoring.

Tip: You can order and activate your wise debit card online in minutes. Just provide your ID, load funds, and set your PIN.

Here’s a quick look at how the wise debit card compares to another popular travel money card:

| Fee Category | Westpac Travel Card Fees | Wise Debit Card Fees |

|---|---|---|

| Account Opening Fees | None | None |

| Monthly Maintenance Fee | None | None |

| Card Issuance Fees | None | $10 USD one-time fee |

| ATM Fees | Free at Westpac Group and Global Alliance ATMs; other ATMs may charge $2 USD + surcharges | Two free withdrawals globally up to $350 USD/month; fees apply beyond limit (e.g., $1.50 USD per withdrawal or 1.75% over $350) |

| Foreign Transaction Fees | None | None |

| Currency Conversion Fees | None | Fixed fee $1.50 USD + 1.75% of amount converted |

You see, the wise debit card gives you more flexibility and transparency. You can manage your money in many currencies and avoid surprise fees. That’s why so many travelers call it one of the best travel money cards available.

Runner-Up: Revolut Travel Card

If you want more features and control, the Revolut travel card is another great option. You can hold, send, and spend in over 25 currencies. The Revolut app gives you full control over your card. You can freeze it, set limits, and even create disposable virtual cards for safer online shopping.

Revolut offers three plans in Australia:

- Standard: No monthly fee, free ATM withdrawals up to $350 USD/month, no-fee currency exchange up to $2,000 USD/week.

- Premium: $9.99 USD/month, higher withdrawal and exchange limits, express card delivery, and lounge access.

- Metal: $24.99 USD/month, even higher limits, unlimited no-fee currency exchange, and 1% cashback on international card payments.

You can add your Revolut card to Apple Pay or Google Pay for easy payments. The app sends instant notifications for every transaction. You can top up your account from your Australian bank with no fees. Revolut is regulated by ASIC, so you get strong security and compliance.

Note: Revolut does not offer travel insurance for Australians yet, but you still get advanced security and spending controls.

Many travelers like Revolut for its flexible plans and strong security. The disposable virtual cards help keep your online purchases safe. You can use the card almost anywhere, making it one of the most popular travel money cards for Australians.

Other Strong Options

You have more choices if you want to compare the best travel money cards. Here’s a quick overview of other popular travel money cards in Australia:

| Card Name | Card Type | Currencies Supported | Key Features | Fees (USD) |

|---|---|---|---|---|

| Travelex Money Card | Prepaid | 10+ | Lock in exchange rates, reload online or in-store, chip and PIN security | No issue fee, reload fees |

| CommBank Travel Card | Prepaid | 13 | 24/7 support, reload via app, emergency cash, chip and PIN, freeze card in app | No issue fee, reload fees |

| Westpac Worldwide Wallet | Prepaid | 11 | Free at Westpac ATMs, manage in app, no foreign transaction fees | No issue fee, ATM fees |

| CashPassport Platinum | Prepaid | 10 | Lock in rates, global acceptance, emergency cash, app management | Issue and reload fees |

| Citibank Plus Everyday Account | Debit | AUD only | No foreign transaction fees, free global ATM withdrawals at Citibank ATMs | No monthly fee |

| Travel Money Oz Currency Pass | Prepaid | 10 | Lock in rates, reload online, app management, emergency assistance | Issue and reload fees |

You need to be at least 18 years old and have valid ID to apply for most travel money cards. You can usually apply online, at a bank, or at a currency exchange. The process is simple: choose your card, apply, load funds, and activate it with a PIN or app.

Each card has its own strengths. The commbank travel card is popular for its strong support and easy reloads. The Travelex Money Card lets you lock in rates before you travel. The wise debit card and Revolut stand out for multi-currency use and low fees.

When you pick a travel money card, think about where you will travel, how often you need to withdraw cash, and what currencies you need. The best travel money cards give you flexibility, security, and control over your spending. You can find a card that fits your travel style and helps you save money on every trip.

Why Use Travel Money Cards Overseas

How Travel Money Cards Work

When you travel, you want a simple way to pay for things and manage your money. Travel money cards give you that control. You load money onto the card before your trip. You can choose from different foreign currencies, so you always know how much you have to spend. These cards work like debit cards. You tap, swipe, or insert them at stores, restaurants, or ATMs overseas. You can check your balance and reload funds using an app or website. If you lose your card, you can freeze it right away for safety.

Travel money cards let you lock in exchange rates before you leave Australia. This means you avoid surprises if rates change while you are spending abroad. You can also switch between currencies if you visit more than one country. Many cards support multiple foreign currencies, so you do not need to carry cash for each place you visit.

Key Benefits for Australians

You get many advantages when you use travel money cards for your next overseas adventure. Here are some reasons why travelers from Australia pick these cards:

- You lock in exchange rates before your trip, which helps you save money and avoid currency swings.

- You control your budget by loading only what you plan to spend. This makes spending abroad less stressful.

- You usually pay lower fees than with credit or debit cards. Some cards have no foreign transaction or ATM withdrawal fees.

- You manage several foreign currencies on one card. This is perfect for multi-country travel.

- You get strong security features like chip and PIN, freeze options, and emergency card replacement.

- You enjoy extra services such as free home delivery, easy online top-ups, and 24/7 global help.

Tip: Some travel money cards, like Travelex, offer competitive exchange rates and no fees for EFTPOS, ATM withdrawals, or online shopping. You can also use their app to track your spending and reload funds anytime.

Travel money cards make travel easier and safer. You get peace of mind, better control over your money, and more value when spending abroad.

Comparing Travel Money Cards: Key Factors

When you look at travel money cards compared side by side, you see big differences in fees, supported currencies, exchange rates, and how easy they are to use. Picking the right travel money card can help you save money, avoid stress, and get the most out of your trip. Let’s break down the key factors you should check before you choose.

Fees and Charges

You want to keep more of your money for your adventures, not lose it to hidden fees. Travel money cards come with different types of fees. Some cards charge you when you buy the card, reload it, or make ATM withdrawals. Others add fees for using unsupported currencies or if you leave your card unused for a while. Travel debit cards and travel credit cards have their own fee structures too.

Here’s a table that shows you the typical fees for the main types of travel money cards:

| Card Type | Typical Fees and Charges |

|---|---|

| Prepaid Travel Cards | Purchase fees, reload/top-up fees, exchange rate margin on currency top-up, foreign transaction fees if spending unsupported currency, ATM fees (in Australia and overseas), cash out, close or inactivity fees. |

| Travel Debit Cards | Card delivery fees, international ATM fees, currency conversion charges. |

| Travel Credit Cards | Annual fees, cash advance fees (ATM withdrawals), foreign transaction fees, interest on unpaid balances, late payment penalties. |

Let’s look at some popular cards and their specific fees:

| Example Card | Specific Fees |

|---|---|

| Wise (Travel Debit) | 2% ATM withdrawal fee on amounts over $350 per month, mid-market exchange rate for currency conversion, 7-14 days delivery time. |

| Travelex Money Card (Prepaid) | No ATM fees overseas (Australia excluded), 2.95% ATM withdrawal fee in Australia, 5.95% currency conversion rate, $100 minimum initial load. |

| Citibank Plus Everyday Account (Bank Debit) | No international ATM or foreign transaction fees, no monthly fees, $5 account closure fee. |

| 28 Degrees Platinum Mastercard (Travel Credit) | No annual fee, no overseas purchase or currency conversion fees, 55 days interest-free on purchases, high interest rates after that, minimum credit limit $6000. |

| ANZ Frequent Flyer Platinum (Travel Credit) | $295 annual fee, 3.5% foreign transaction fee, interest and penalty fees apply. |

You can see that some cards offer the lowest fees for cash withdrawals overseas, while others may charge more for certain actions. Always check the fine print before you choose. If you want the lowest fees, Wise and Citibank Plus Everyday Account stand out.

Tip: If you plan to travel for a long time or visit many countries, pick a card with no monthly fees and low ATM withdrawal charges.

Supported Currencies

The number of foreign currencies you can hold on your travel money card matters a lot. If you visit many countries, you want a card that supports the most currencies. This way, you avoid extra conversion fees and always pay in the local money.

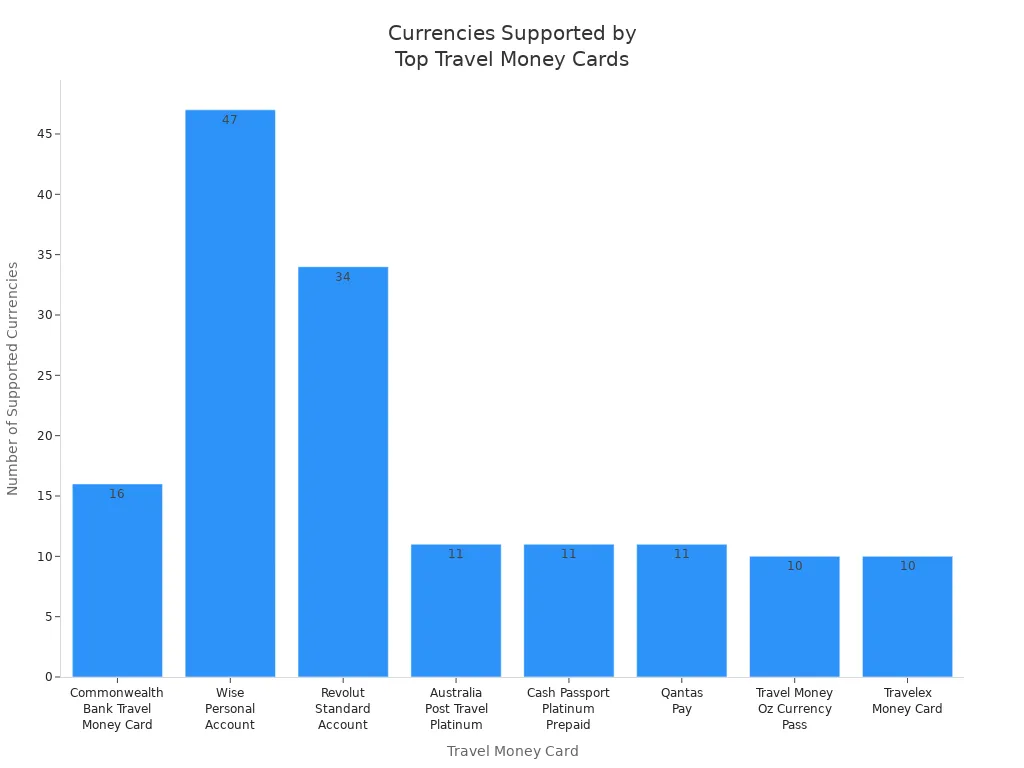

Here’s a table showing how many currencies each top travel money card supports:

| Travel Money Card Name | Number of Supported Currencies |

|---|---|

| Wise Personal Account | 47 |

| Revolut Standard Account | 34 |

| Commonwealth Bank Travel Money Card | 16 |

| Australia Post Travel Platinum Mastercard | 11 |

| Cash Passport Platinum Prepaid Currency Card | 11 |

| Qantas Pay | 11 |

| Travel Money Oz Currency Pass | 10 |

| Travelex Money Card | 10 |

If you want the travel money card supporting the most currencies, Wise is your best bet. You can hold up to 47 currencies, which is perfect for big trips. Revolut also supports many currencies, making it a strong choice for multi-country travel. The Commonwealth Bank Travel Money Card supports 16 currencies, including some unique ones like the Fijian Dollar and currencies from China, Vietnam, Indonesia, and India.

Note: If you plan to visit places with less common currencies, check if your card supports them before you go.

Exchange Rates

Exchange rates can make a big difference in how much you spend. Most travel money cards do not give you the mid-market rate. Instead, they add a small markup to the rate, which means you get a little less for your money. Some cards claim to have no fees, but they hide the cost in the exchange rate itself.

The mid-market rate is the fairest rate you can get. Wise uses this rate, so you know you are not paying hidden fees. Other cards, like Mastercard travel cards, usually add a 2.5% markup above the mid-market rate. Cash exchanges can have even bigger spreads, sometimes up to 7%.

Here’s a quick look at how different providers compare:

| Provider Type | Exchange Rate Markup / Spread | Additional Fees |

|---|---|---|

| Mastercard Travel Card | ~2.5% markup above mid-market | Foreign transaction fees 0%-3% |

| BMO Cash Exchange | 3%-7% spread between buy/sell | N/A |

You want to get as close to the mid-market rate as possible. Wise is the travel money card supporting the most currencies and also gives you the best exchange rates. Revolut also offers good rates, but may add a small markup on weekends or for less common currencies.

Callout: Always check the foreign exchange rates before you load your card. Even a small difference in exchange rates can add up if you spend a lot.

ATM Access and Usability

Easy access to your money is key when you travel. You want a card that works at most ATMs and lets you make cash withdrawals overseas without big fees. Some cards give you free ATM withdrawals up to a limit, then charge a fee after that. Others may charge every time you use an ATM.

Here are some things to look for:

- Wise gives you two free ATM withdrawals each month up to $350 USD. After that, you pay a 2% fee.

- Revolut offers free ATM withdrawals up to $350 USD per month on the Standard plan. Premium plans have higher limits.

- Travelex Money Card does not charge ATM fees overseas, but you pay a 2.95% fee if you use an ATM in Australia.

- Citibank Plus Everyday Account lets you withdraw cash at Citibank ATMs worldwide with no fees.

- Some cards, like the ANZ Frequent Flyer Platinum, charge high fees for ATM withdrawals and cash advances.

When you have travel money cards compared, you see that usability also depends on the app and support. Wise and Revolut both have easy-to-use apps. You can freeze your card, check your balance, and get instant alerts. Travelex and CommBank also offer strong support and emergency help if you lose your card.

Tip: Always check if your card charges extra for ATM withdrawals after a certain limit. Plan your cash needs so you avoid extra fees.

Travel money cards give you flexibility, security, and control. When you compare the lowest fees, the most currencies, the best exchange rates, and easy ATM access, you can find the perfect card for your trip from Australia.

Travel Money Card with Lowest Fees

When you travel, you want to keep more of your money for experiences, not for paying extra fees. Let’s look at the travel money card with the lowest fees for Australians heading overseas in 2025. Here’s how the top options stack up.

Wise Travel Card

The wise debit card stands out if you want a travel money card with the lowest fees. You pay no fees when you spend in currencies you already hold in your account. You get free ATM withdrawals up to $250 USD each month. After that, you pay a small fee. Wise uses the mid-market exchange rate, so you avoid hidden costs. You only pay a small, clear fee when you convert between currencies.

Here’s a quick look at the wise debit card fees:

| Fee Type | Fee Details |

|---|---|

| Spending held currency | No fees |

| ATM withdrawals | Free up to $250 USD/month, then small fee |

| Currency conversion | Small transparent fee at mid-market rate |

You can manage your wise debit card easily with the app. You see every fee before you pay it.

Travelex Money Card

Travelex offers a travel money card with the lowest fees for many travelers. You pay no EFTPOS, ATM withdrawal, currency conversion, or online shopping fees. This makes it a strong choice if you want to avoid extra charges. Travelex supports 10 currencies and gives you free home delivery and a user-friendly app.

Here’s how Travelex compares on fees:

| Fee Type | Fee Details |

|---|---|

| EFTPOS | None |

| International ATM | None (ATM operator fees may apply) |

| Currency conversion | None |

| Online shopping | None |

You can reload your card online or in the app. You see your spending in real time.

Tip: Travelex stands out for travelers who want a simple fee structure and easy management.

Citibank Plus Everyday Account

The Citibank Plus Everyday Account is another travel money card with the lowest fees. You pay no account opening or maintenance fees. You get free international ATM withdrawals and card payments, but third-party ATM operators may charge their own fees. You only pay for special services, like international payments or requesting a statement.

Here’s a summary of Citibank Plus fees:

| Fee Type | Fee Details |

|---|---|

| Account opening | Free |

| International ATM | No Citibank fee (third-party fees may apply) |

| Card payments | No Citibank fee (third-party fees may apply) |

| International payments | $25 USD |

You can use this card for everyday spending and travel. You manage everything online.

When you compare these options, you see that Travelex and the wise debit card both offer the lowest fees for most travelers. Citibank Plus is also a strong choice if you want a bank account with global access.

Pros and Cons of Top Travel Money Cards

Wise Travel Card

You get a travel money card that keeps things simple. Wise lets you hold over 40 currencies and uses the mid-market exchange rate. You pay a one-time $10 USD card order fee, but there are no monthly fees. You enjoy two free atm withdrawals each month up to $350 USD. After that, you pay a small fee. Wise stands out for its transparent fees and easy-to-use app. Many reviews praise the clear pricing and fast support. Wise works in over 150 countries, so you can use it almost anywhere.

Pros:

- No monthly fees

- Mid-market exchange rates

- Supports 40+ currencies

- Transparent, low fees

- Strong app and security

Cons:

- $10 USD card order fee

- atm withdrawals limited to two free per month, then fees apply

Revolut Travel Card

Revolut gives you more features if you want options. You can pick from three plans, including a free plan and two paid plans with premium perks. Revolut supports over 30 currencies and offers fee-free atm withdrawals up to $350 USD per month on the free plan. You pay a 2% fee after that. You get 24/7 in-app chat support, which many users like. Reviews show high ratings for Revolut, especially for its app and customer service.

| Feature / Fee Category | Revolut (Australia) | Wise (Australia) |

|---|---|---|

| Account Opening Fee | None | None |

| Monthly Maintenance Fee | 0 USD (Standard), 9.99 USD (Premium), 24.99 USD (Metal) | None |

| Card Delivery Fee | 4.99 USD (standard delivery) | 10 USD (one-time card order fee) |

| ATM Withdrawal Fees | Free up to plan limits (350-1400 USD/month), then 2% fee | Up to 2 withdrawals/month free up to 350 USD, then 1.50 USD + 1.75% fee |

| Currency Exchange Fees | No fee within limits on weekdays; 0.5% fee beyond limits; 1% weekend fee | Low variable fees starting at 0.65% |

| Available Currencies | 30+ | 40+ |

Pros:

- Flexible plans with premium features

- Fee-free overseas spending up to limits

- 24/7 in-app support

- High customer ratings

Cons:

- Monthly fees for premium plans

- atm withdrawals limited by plan

- Currency exchange fees on weekends or above limits

Travelex Money Card

Travelex offers a travel money card with no atm withdrawal fees overseas and no fees for eftpos or online shopping. You can lock in exchange rates before you travel. Many reviews mention easy ordering and good customer service. However, some users report high fees for inactivity, loading, and currency conversion. Online reviews also mention technical issues with the app and slow customer support.

Pros:

- No atm withdrawal fees overseas

- Lock in exchange rates

- Easy to reload and manage online

Cons:

- Multiple fees (inactivity, loading, conversion)

- Poor customer service in some reviews

- Technical problems with the app

CommBank Travel Money Card

The commbank travel card lets you lock in exchange rates and pay no transaction fees when you spend in preloaded currencies. You pay no account maintenance fees. You can hold up to 16 currencies. You get two physical cards for backup. Some online reviews mention confusion about which exchange rate applies and a lack of fee transparency. Many users praise the customer service.

| Strengths | Weaknesses |

|---|---|

| No transaction fees in preloaded currencies | Limited to 16 currencies |

| No account maintenance fees | Exchange rates include a margin |

| Two physical cards | Confusing exchange rate rules |

| No atm withdrawal fees in Australia | |

| Lock in exchange rates | |

| Age eligibility 14+ |

Pros:

- No fees for atm withdrawals in Australia

- Lock in rates before travel

- Good customer service

Cons:

- Only 16 currencies supported

- Less favorable exchange rates

- Confusing fee structure in some cases

Westpac Worldwide Wallet

Westpac Worldwide Wallet helps you save on atm withdrawals by waiving fees overseas. You can manage your card online or in the app. You pay no card issue fee. However, Westpac’s exchange rates are not as strong as some fintech travel money cards. Some users report longer wait times for customer service compared to app-based providers.

Pros:

- No atm withdrawal fees overseas

- Easy online management

- No card issue fee

Cons:

- Less competitive exchange rates

- Customer service can be slow

CashPassport Platinum

CashPassport Platinum gives you control over your travel money card. You can lock in fixed exchange rates and hold 11 currencies. You get free access to airport lounges if your flight is delayed and free global WiFi. There are no initial fees, and you can manage your card online. You pay a 2.95% fee for atm withdrawals in Australia. You must load at least $100 USD.

| Feature/Benefit | Description |

|---|---|

| Fixed Exchange Rate | Lock in rates when loading funds |

| Lounge Access | Free if flight delayed 2+ hours |

| Free Global WiFi | Boingo service |

| 24/7 Support | Yes |

| ATM Withdrawal Fees | 2.95% in Australia; other fees apply |

Pros:

- Lock in rates

- Lounge and WiFi perks

- No card issue fee

Cons:

- atm withdrawals have fees in some cases

- Minimum load required

Travel Money Oz Card

Travel Money Oz Card supports 10 currencies and offers Mastercard Zero Liability protection. You get 24/7 customer support and can manage your card online. Reviews show a TrustScore of 3.9 out of 5, with users liking the smooth process and competitive rates. You pay some atm withdrawal fees. Online reviews suggest satisfaction is good, but not as high as Travelex.

| Card Name | TrustScore | Reviews | Highlights |

|---|---|---|---|

| Travel Money Oz | 3.9 | 6,292 | Smooth process, competitive rates |

| Travelex | 4.5 | 18,400 | Good service, easy ordering |

Pros:

- Competitive rates

- 24/7 support

- Easy ordering

Cons:

- atm withdrawals have fees

- Slightly lower customer satisfaction than Travelex

Tips for Using Travel Money Cards Overseas

Image Source: pexels

Choosing the Right Card

Picking the best card for your trip can save you money and stress. You want a card that matches your travel plans and spending habits. Look for travel money cards that do not charge foreign transaction fees. Wise and Revolut are good choices because they let you hold different currencies and avoid extra costs on international payments. Always check if the card supports the countries you plan to visit. If you travel to many places, a multi-currency card helps you spend like a local and avoid conversion fees.

Tip: Compare the number of supported currencies and ATM withdrawal fees before you decide. Cards with free or low-cost withdrawals, like Wise, can help you save more during your trip.

Managing Your Card Abroad

You need to keep your money safe and easy to use while you travel. Use your card provider’s app to track your spending and check your balance often. Many travel money cards let you freeze or unfreeze your card in seconds if you lose it. Always pay in the local currency when you shop or eat out. This helps you avoid poor exchange rates and hidden fees. Try to use ATMs from major banks to reduce withdrawal charges. If you use a prepaid card, load enough money before you leave and top up as needed.

- Use digital wallets or mobile apps for quick and secure payments.

- Set up alerts for every transaction to spot any suspicious activity.

- Keep your bank’s contact details handy in case you need help fast.

Avoiding Common Pitfalls

You can avoid most problems by planning ahead. Here are some smart ways to dodge hidden fees and hassles:

- Always choose to pay in the local currency to skip dynamic currency conversion fees.

- Make larger withdrawals instead of many small ones to cut down on fixed ATM fees.

- Avoid exchanging money at airports or busy tourist spots, where rates are worse.

- Check your card’s policy for inactivity or reload fees.

- Monitor your account for any strange charges and report them right away.

Note: If you use travel money cards wisely, you keep more money for experiences and less for fees. Stay informed about any changes from your card provider so you never get caught off guard.

Which Travel Money Card Suits Your Needs?

For Frequent Travelers

If you travel often, you want a card that works everywhere and gives you rewards. Some cards stand out for people who are always on the move:

- The Chase Reserve Credit Card gives you triple points on travel spending, no international transaction fees, and access to airport lounges worldwide.

- The Charles Schwab Travel Debit Card removes foreign transaction and ATM withdrawal fees. It even reimburses fees from other banks, which helps if you use ATMs a lot.

- Wise Multi-Currency Card and Revolut Travel Card both support the most currencies and work in over 175 countries. You get real-time exchange rates and low conversion fees.

- Many travelers use a mix of the Chase Reserve Credit Card for rewards and the Charles Schwab Travel Debit Card for cash access.

You can also look for cards with contactless payment features. These make it easy to pay quickly and safely in many places.

Tip: If you want the most flexibility, try using two cards together. One for earning rewards, and one for easy cash withdrawals.

For Multi-Currency Use

Do you visit several countries on one trip? You need a card that lets you hold and spend in multiple currencies. The Travelex Money Card is a top pick for this. You can load up to 10 different currencies on one card. This helps you avoid extra conversion fees and lets you lock in exchange rates before you leave.

Travelex also gives you:

- No EFTPOS or international ATM withdrawal fees (except some ATM operator fees)

- Free home delivery and a simple online top-up system

- A mobile app that makes it easy to manage your money

You get peace of mind because you know your rates and fees before you travel. Travelex also offers strong customer support and regular promotions to help you save.

For Budget Travelers

If you want to save money on every trip, look for cards with the lowest fees and the most currencies supported. Wise Multi-Currency Card is a favorite for budget travelers. You pay no monthly fees, get free ATM withdrawals up to a set limit, and always see the real exchange rate. Revolut Travel Card is another good choice. It gives you a fully app-based experience, budgeting tools, and free ATM withdrawals up to certain limits.

Here’s a quick table to help you compare:

| Card Name | Best For | Key Benefit |

|---|---|---|

| Wise Multi-Currency Card | Budget Travelers | Low fees, most currencies |

| Revolut Travel Card | Budget Travelers | App-based, free ATM withdrawals |

| Travelex Money Card | Multi-Currency Use | Locked rates, easy reloads |

You can keep more of your money for experiences when you pick a card that matches your travel style.

You have many travel money card options for your next trip. Wise stands out as the best choice for Australians in 2025. You should always check reviews before you decide. Your travel habits matter, so think about where you go and how you spend. Online reviews can help you spot hidden fees or problems. To get the most value, compare rates in USD and look for cards with low fees. Check for the latest offers and read more reviews before you apply.

FAQ

What makes the best travel money cards for Australians traveling overseas?

You want the best travel money cards to save on fees and get great exchange rates. These cards let you hold multiple currencies, make cash withdrawals overseas, and manage your spending abroad. Many popular travel money cards also offer strong security and easy app management.

How do travel money cards compare to using a regular debit card overseas?

When you use travel money cards compared to regular debit cards, you often pay lower fees and get better foreign exchange rates. Travel money cards support more foreign currencies and help you avoid extra charges on atm withdrawals or spending abroad.

Which travel money card has the lowest fees for cash withdrawals overseas?

The wise debit card stands out as a travel money card with the lowest fees for cash withdrawals overseas. You get two free atm withdrawals each month up to $350 USD. After that, you pay a small fee. Always check online reviews for the latest updates.

Can I use one travel money card for the most currencies on my trip?

Yes, you can. The travel money card supporting the most currencies is the wise debit card. You can hold and spend in over 40 foreign currencies. This makes it easy to manage your money if you visit several countries on one trip.

As you plan your overseas adventures with the best travel money cards, minimizing fees and ensuring fast, secure transactions is essential. High remittance costs and unfavorable exchange rates can cut into your travel budget. BiyaPay offers a smart solution with remittance fees as low as 0.5%, outshining many travel card fees. Supporting same-day transfers to most countries, BiyaPay ensures your funds are ready when you need them. Its real-time exchange rate queries and seamless fiat-to-digital currency conversion simplify multi-currency spending. Registering is quick and secure, with no need for in-person visits. Maximize your travel funds and enjoy seamless payments—sign up for BiyaPay today for cost-effective, reliable global transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.