- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Revolut in the USA for Everyday Spending

Image Source: unsplash

You can use Revolut in the USA for everyday spending, whether you shop, travel, or just want to manage your money better. To open a Revolut account, you need to:

- Provide a valid mobile phone number and email.

- Share your full name, date of birth, address, and citizenship.

- Present a government-issued ID and upload a selfie with it.

- Complete setup in the Revolut app.

Here’s what you get when you use Revolut in the USA:

| Benefits | Limitations |

|---|---|

| Great currency exchange rates, no typical bank fees | Monthly fees for premium plans |

| Hold multiple currencies for easy travel spending | Higher exchange markups on weekends |

| Fee-free ATM withdrawals up to $1,200/month | Extra fees for some exotic currencies |

You can use Revolut for secure, flexible spending, but always check the fees and limits before you use Revolut in the USA.

Key Takeaways

- You can open a Revolut account in the USA quickly by providing your ID, phone number, and email through the app.

- Revolut offers great exchange rates, multiple currencies, and fee-free ATM withdrawals up to your plan’s limit.

- Use your Revolut card for fast, secure payments in stores, online, and at ATMs across the USA.

- Keep fees low by paying in USD, using free ATM limits, and exchanging currency on weekdays.

- Revolut’s app lets you control your cards, get instant spending alerts, and freeze cards if lost or stolen.

Get Started with Revolut in the USA

Image Source: unsplash

Account Setup

You can set up your Revolut account in the USA in just a few steps. First, download the Revolut app from the iOS App Store or Google Play Store. Once you open the app, you will start the signup process. You do not need to wait in line or fill out paperwork. Here is what you need to do:

- Enter your phone number and email address.

- Fill in your full name, date of birth, and your address in the USA.

- Choose your account plan. You can pick Standard (free), Premium, or Metal.

- Take a photo of your government-issued ID, like a passport.

- Upload a selfie for facial recognition.

- Set up your security details, such as a password and two-factor authentication.

- Fund your account by linking a bank card or using a bank transfer.

- Get your virtual card right away. You can also order a physical card if you want.

You can start to use Revolut for spending online or in stores as soon as your account is active.

Eligibility

You can open a Revolut account in the USA if you are at least 18 years old and live in an area where Revolut operates. This includes US citizens, students, visitors, and temporary workers. If you are a student from another country, you do not need a Social Security Number or ITIN. You only need a government-issued ID and a valid US visa. This makes it easy for students and visitors to use Revolut while staying in the USA.

Note: Over 2.5 million visa holders in the USA can now use Revolut for everyday spending, travel, and sending money abroad.

Verification

After you sign up, Revolut will ask you to verify your identity. You need to upload a photo of your ID and a selfie. Most people finish this step in one business day. Sometimes, it can take up to seven business days. You will get a notification in the app and by email when your account is ready. You can check your verification status anytime on the app’s Home screen.

Add Funds and Manage Currencies

Add Funds

You can add money to your Revolut account in the USA in a few easy ways. The most popular method is linking your US bank account and sending an ACH transfer. Just use the “add money” feature in the Revolut app to get the details you need. Many people also use a US debit card for instant top-ups, but there are usually limits on how much you can add this way. Apple Pay is another option, though it works best for smaller amounts. Some banks, like CapitalOne, work well with Revolut’s routing number, but not all banks do. If you want to avoid delays, start the transfer from your bank’s app instead of pulling funds from Revolut.

Currency Exchange

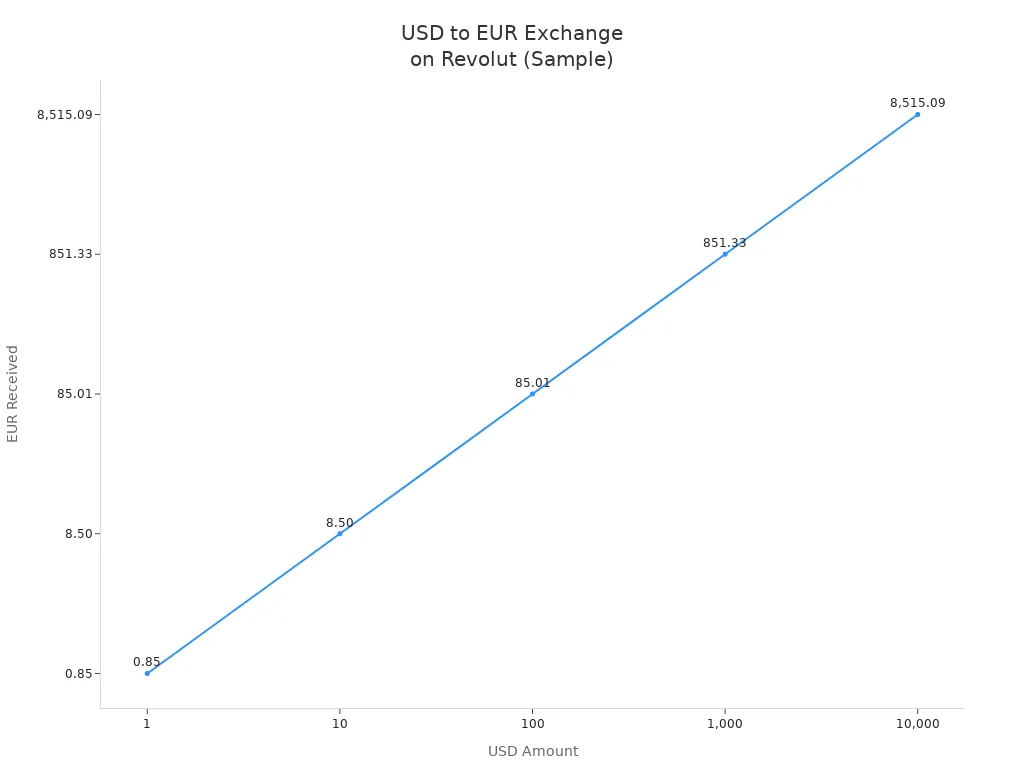

Revolut makes it simple to exchange usd to other currencies right in the app. You can swap usd for euros, pounds, or any of the 36 supported currencies. The app shows you the current revolut exchange rate before you confirm. During weekdays, you get rates close to the mid-market rate, which means you save money compared to many banks. If you exchange more than $1,000 in a month on the Standard plan, you pay a 0.5% fee. On weekends, there’s an extra 1% fee for all exchanges because markets are closed. Here’s a quick look at how much you get when you exchange usd to euros:

| USD Amount | EUR Received |

|---|---|

| 1 | 0.85 |

| 10 | 8.50 |

| 100 | 85.01 |

| 1,000 | 851.33 |

| 10,000 | 8,515.09 |

Hold Multiple Currencies

With Revolut, you can hold and manage balances in usd, euros, pounds, and more. Just tap the “add new” option under your balance and pick the currency you want. You can open accounts for up to 36 currencies and spend in over 150 countries. If you travel or shop online, this helps you avoid extra fees. You can even exchange gbp to usd or any other pair with a few taps. Revolut-to-Revolut transfers are instant and free, so sending money to friends is easy. If you often need to exchange large amounts, consider a Premium or Metal plan for higher fee-free limits.

Use Revolut Card for Everyday Spending

Image Source: unsplash

In-Store Card Use

You can use your Revolut card in the USA almost everywhere that accepts Visa or Mastercard. Most stores, restaurants, and gas stations will take your card. When you pay, you can swipe, insert, or tap your card for contactless payments. Many people like contactless payments because they are fast and secure. Just hold your card near the payment terminal, and you are done.

If you want to use your phone, you can add your Revolut card to Apple Pay or Google Pay. This lets you pay with your phone or smartwatch. You do not need to carry your physical card everywhere. You can also use your virtual card in the app for extra security. Virtual cards work just like physical cards, but you can lock or unlock them anytime.

Tip: If you ever lose your card, open the Revolut app and freeze it right away. You can unfreeze it later if you find it.

Online Purchases

Shopping online with your Revolut card in the USA is easy. You can use your card number, expiration date, and CVV to pay on most websites. Many people use Revolut for online spending because it gives instant spending notifications. You see every transaction in real time, so you always know where your money goes.

Revolut offers virtual cards for online shopping. These cards have different numbers from your main card. You can create a disposable virtual card for one-time purchases. After you use it, the card details disappear. This helps protect you from fraud and keeps your main card safe.

Note: You can lock your virtual card without affecting your physical card. This gives you more control over your spending and security.

ATM Withdrawals

You can use your Revolut card in the USA to get cash at thousands of ATMs. Revolut partners with a network of over 55,000 in-network ATMs where you pay no extra fees up to your monthly limit. If you use an out-of-network ATM, you can still withdraw cash, but fees may apply after you reach your plan’s free limit.

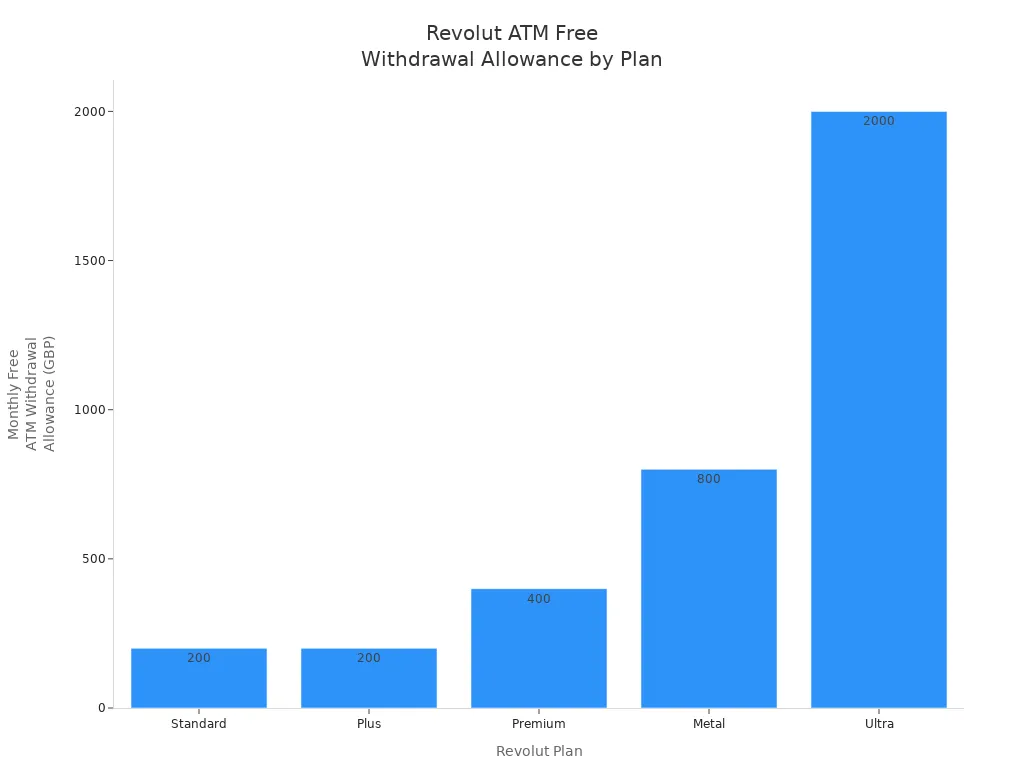

Here is a quick look at the monthly ATM withdrawal limits and fees for different Revolut plans:

| Plan | Monthly Free ATM Withdrawal Allowance (USD) | Fee Beyond Free Limit | In-Network ATM Access |

|---|---|---|---|

| Standard | Lower than $1,200 | Fair usage fees apply | 55,000+ ATMs, zero fees |

| Premium | Lower than $1,200 | Fair usage fees apply | 55,000+ ATMs, zero fees |

| Metal | Up to $1,200 | Fair usage fees after $1,200/month | 55,000+ ATMs, zero fees |

You can withdraw up to $1,200 per month with the Metal plan before fees start. Standard and Premium plans have lower limits. If you go over your free limit, you pay a small fee for each withdrawal. Some ATMs may charge their own operator fee, so check the ATM screen before you take out cash.

Note: The daily withdrawal limit is $3,000. Always check your app for your current limit and any fees.

Travel Money Card Features and Security Tips

When you use Revolut card in the USA, you get strong security features. You can freeze or unfreeze your card instantly in the app. If you see a transaction you do not recognize, lock your card and contact support. Revolut sends you spending notifications for every purchase or withdrawal. This helps you spot any problems right away.

Here are some security features you get with your Revolut card in the USA:

- Freeze and unfreeze your card in seconds using the app.

- Get instant spending notifications for every transaction.

- Use virtual cards for online shopping and lock them anytime.

- Create disposable virtual cards for one-time purchases.

- Set up multi-factor authentication with PIN, biometrics, and one-time passcodes.

- Review suspicious activity alerts in the app.

- Report lost or stolen devices and cards quickly.

- Change your passcode after reporting a lost device for extra safety.

You can use Revolut for everyday spending, travel, and online shopping with peace of mind. The app gives you control over your card and your money, so you always feel secure.

Fees, Limits, and Tips

Card Fees

When you use your Revolut card in the USA, you get a clear fee structure. You pay no fee for regular purchases in USD. If you spend in another currency, Revolut gives you a great exchange rate, but you may see a small fee if you go over your monthly limit. For ATM withdrawals, you can use in-network ATMs for free up to your plan’s limit. Out-of-network ATMs or going over your free limit means a 2% fee. Some ATMs may also charge their own operator fee, which you will see on the screen before you finish your withdrawal.

Here’s a quick look at common fees:

| Fee/Limit Type | Details for US Users | Plan Differences (Standard, Premium, Metal) |

|---|---|---|

| Purchases in USD | No fee | All plans |

| Purchases in other currencies | No fee up to monthly limit, then 0.5% fee | Higher limits or no fee for Premium, Metal |

| ATM Withdrawals | Free up to plan limit, then 2% fee | Higher free limits for Premium, Metal |

| Currency Exchange (over limit) | 0.5% fee for Standard over $1,000/month | Premium: 0.5% over $10,000/month; Metal: no fee |

| Exchange outside market hours | 1% fee for Standard | No fee for Premium, Metal |

Spending Limits

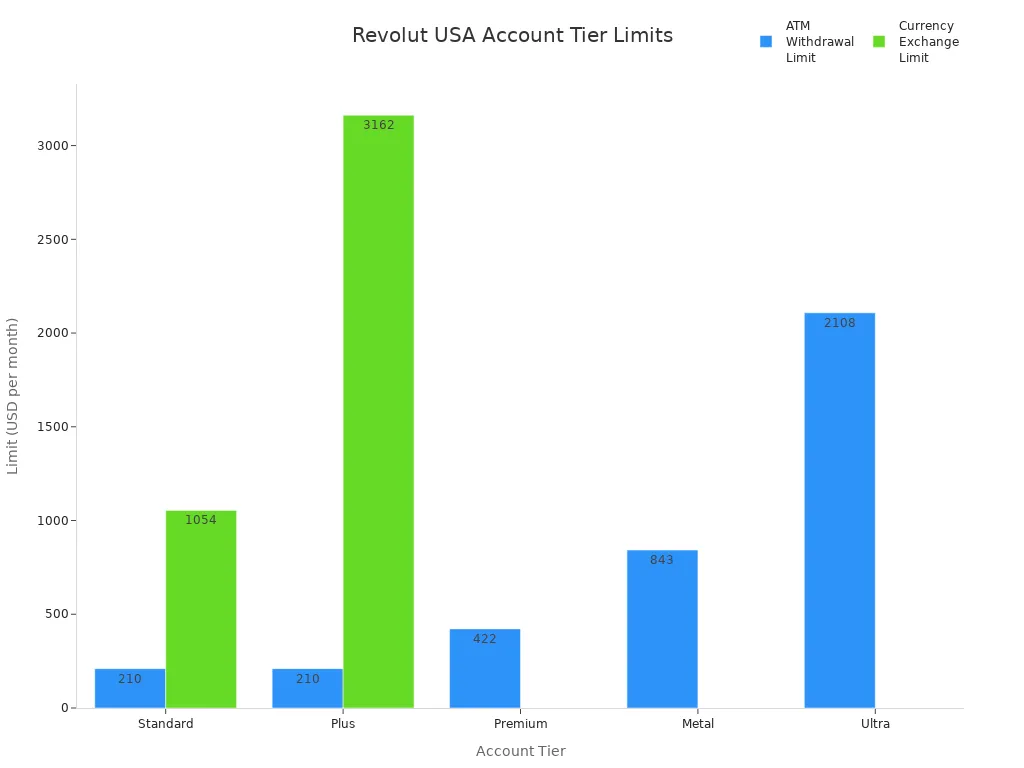

Revolut sets clear limits for spending and withdrawals based on your account tier. If you want more flexibility, you can upgrade your plan. Here’s a table that shows the main limits for each account:

| Account Tier | Monthly ATM Withdrawal Limit (Commission-Free) | Currency Exchange Limit (Commission-Free) |

|---|---|---|

| Standard | Up to approx. $210 or 5 withdrawals | Up to approx. $1,054 per month |

| Plus | Up to approx. $210 | Up to approx. $3,162 per month |

| Premium | Up to approx. $422 | No limit |

| Metal | Up to approx. $843 | No limit |

| Ultra | Up to approx. $2,108 | No limit |

You can set your own monthly spending limits for each card in the app. If you reach your limit, your card will decline new transactions until the next month. This helps you control your spending and avoid surprises.

If you need to make large transfers or withdrawals, you may need to verify your identity again or contact Revolut support.

Avoiding Extra Charges

You can keep your costs low with a few smart moves. Try these tips for low-cost spending in the usa:

- Use your free ATM withdrawal allowance each month. If you need more cash, make fewer, larger withdrawals to avoid extra fees.

- Always choose to pay or withdraw in USD. This way, you get Revolut’s best exchange rate and skip poor ATM conversion rates.

- Watch the ATM screen for any extra operator fees before you finish your withdrawal.

- Exchange currency during weekdays. Revolut adds a 1% fee for exchanges on weekends.

- Prefer card payments over cash. Most stores in the USA accept card payments, and you avoid ATM fees.

- If you travel or spend a lot, consider upgrading to Premium or Metal for higher limits and fewer fees.

Tip: Keep an eye on your app for instant spending alerts. This helps you spot any fees or issues right away.

With these tips, you can enjoy easy, low-cost spending in the usa using your Revolut card for shopping, travel, and everyday needs.

Alternatives and Extra Features

Other Payment Options

Sometimes, you might want to use something other than your Revolut card. For example, if you shop online and want faster payments or lower costs, you can try digital wallets, bank transfers, or buy now pay later (BNPL) services. These options work well when you want more choices or better security. Many online stores in the USA offer several payment methods to help you check out quickly and avoid cart abandonment.

Here’s a quick look at some popular payment options and when they work best:

| Alternative Payment Method | Key Features | Best Use Cases | Pros | Cons |

|---|---|---|---|---|

| PayPal | Instant payments, global reach | Online shopping, fast transfers | Easy to use, works worldwide | Higher fees for some transfers |

| Payoneer | Local accounts, contractor payments | Freelancers, global businesses | Supports many currencies | Inactivity fees |

| Remitly | Small remittances, cash pickup | Sending money abroad | Many payout options | Limits on transfer size |

| OFX | Bank transfers, good rates | Large international transfers | Low exchange rates | Only bank transfers |

| Revolut | Multi-currency, cashback | Travel, shopping, crypto | Many features, easy to use | Monthly fees for some plans |

If you want to save money or need a special feature, try a different payment method for that purchase.

Travel Tools

When you travel, you want your money to work everywhere. Revolut gives you tools that help you spend, save, and stay safe. You can use your card in over 150 countries without worrying about foreign transaction fees. The app lets you exchange money at great rates and track your spending in real time.

Revolut stands out for travelers because you get:

- Travel insurance and airport lounge access with some plans.

- Cashback on purchases when you use your card abroad.

- Disposable virtual cards for safer online shopping.

- Smart budgeting tools that show where your money goes.

- Spending analytics that help you set goals and block unwanted payments.

You can see your spending by category, get alerts for subscriptions, and compare your habits over time. These features help you avoid overspending and keep your travel budget on track. While some perks have limits for US users, you still get more travel features than with most other digital banks.

You can start using Revolut in the usa by following these steps:

- Download the app and sign up.

- Add money to your account.

- Choose your card and start spending in the usa.

- Manage your cards and use them for shopping, travel, or online payments.

Revolut gives you great exchange rates and easy spending, but you should watch for these limits:

| Plan | Monthly Fee | Exchange Limit | ATM Limit |

|---|---|---|---|

| Standard | $0.00 | $10,000/month | $1,200/month |

| Premium | $9.99 | $10,000/month | $800/month |

| Metal | $16.99 | $10,000/month | $800/month |

- Revolut raised free ATM withdrawals in the usa to $1,200 per month.

- You can now create up to five Junior accounts for kids.

- Fee-free international transfers are available for up to 10 per month.

Stay updated on new features and fee changes in the app to get the most from your usa spending.

FAQ

Can you use Revolut in the USA if you are not a US citizen?

Yes, you can. If you have a valid US address and a government-issued ID, you can open a Revolut account. Many students and visitors use Revolut while staying in the USA.

How do you add money to your Revolut account from a US bank?

You can link your US bank account in the Revolut app. Use ACH transfer or a debit card to add funds. Most transfers complete within one business day.

What should you do if your Revolut card gets lost or stolen?

Open the Revolut app and freeze your card right away. You can order a replacement card in the app. If you see any strange charges, contact Revolut support for help.

Are there any hidden fees when spending in the USA with Revolut?

Revolut does not charge hidden fees for spending in USD. You pay no fee for regular purchases. Watch for ATM operator fees and check your app for any alerts about extra charges.

Using Revolut in the USA offers low-cost, flexible spending, but international transactions can still incur fees and complexities, especially for cross-border payments. BiyaPay provides an alternative with remittance fees as low as 0.5%, outpacing many digital banking fees. It supports same-day transfers to most countries, ensuring fast, secure access to your funds. Real-time exchange rate queries and seamless fiat-to-digital currency conversion simplify global payments. Register quickly and securely without branch visits, perfect for managing international expenses. Maximize your savings and streamline your transactions—sign up for BiyaPay today for cost-effective, reliable global spending.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.