- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Wise Safe to Use for International Money Transfers in 2025

Image Source: pexels

If you’re asking, “Is Wise safe?” for international money transfers in 2025, you’ll find reassuring answers from both users and regulators. “Is Wise safe?” is a common question, and Wise has established itself as a trusted platform for transferring money worldwide. With over 12.8 million users, Wise has earned strong trust, reflected in high ratings and positive feedback about its transfer speed and transparency. When considering, “Is Wise safe?”, it’s important to note that Wise operates under strict regulatory oversight, which helps protect your funds during every transaction. Wise also uses secure methods for each transfer, so you can feel confident when sending money.

| Metric | Statistic / User Feedback |

|---|---|

| Number of Users Globally | Over 12.8 million |

| Trustpilot Reviews | More than 250,000 reviews |

| Trustpilot Average Rating | 4.3 out of 5 |

| App Ratings | 4.8 out of 5 |

If you still wonder, “Is Wise safe?”, the answer is clear: Wise demonstrates strong security and high user satisfaction. Many people choose Wise for international money transfers because each transaction is protected and reliable. So, when you ask, “Is Wise safe?” for your next transfer, you can see the evidence that Wise takes your security seriously. Wise provides peace of mind for all your international money transfers.

Key Takeaways

- Wise is a trusted platform with over 12.8 million users and strong positive reviews for fast, clear, and secure money transfers.

- Wise follows strict global regulations and holds licenses from top authorities to protect your funds during every transfer.

- Your money stays safe with Wise because it keeps funds separate from its own and uses major banks and secure assets.

- Wise uses strong security like two-step verification, encryption, and fraud detection to keep your account and transfers safe.

- Wise offers low, transparent fees and shows the real exchange rate, helping you save money compared to many other providers.

Is Wise Safe?

Image Source: unsplash

Trust and Reputation

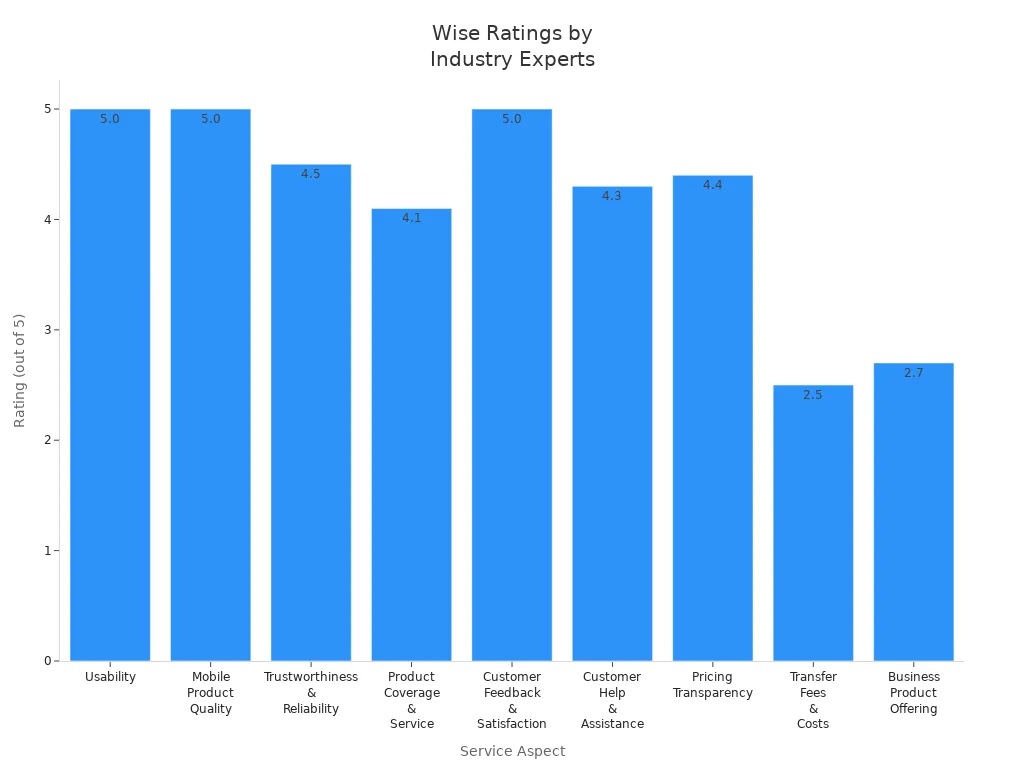

You want to know if Wise is a trustworthy choice for international money transfers. Wise has built a strong reputation in the fintech world. In June 2025, an independent fintech review highlighted Wise’s transparent fee structure and regulatory licenses in more than a dozen countries. This review pointed out that Wise’s large customer base and high transaction volume show its reliability. Wise stands out because it operates with clear rules and open practices. You can see how Wise’s reputation compares to other money transfer services in the table below.

| Aspect | Wise Rating | Comparison / Notes |

|---|---|---|

| Usability | 5.0 / 5 | Highest rating, excels in ease of use |

| Mobile Product Quality | 5.0 / 5 | Highly rated iOS and Android apps |

| Trustworthiness & Reliability | 4.5 / 5 | Fully licensed (FCA, FinCEN), $4 billion monthly transfers, backed by top VCs |

| Product Coverage & Service | 4.1 / 5 | Services in 43 sending and 71 receiving countries |

| Customer Feedback & Satisfaction | 5.0 / 5 | Reflects strong user approval |

| Customer Help & Assistance | 4.3 / 5 | Good support services |

| Pricing Transparency | 4.4 / 5 | Clear fees, no hidden charges |

| Transfer Fees & Costs | 2.5 / 5 | Acceptable, competitive especially for medium/high-value transfers |

| Business Product Offering | 2.7 / 5 | Slightly lower than some competitors |

| Comparison with OFX | OFX rated 4.5/5 | Wise excels in usability and customer satisfaction; OFX stronger in business offerings |

Industry experts see Wise as a reliable, transparent, and user-friendly money transfer service. Wise’s high ratings for usability and customer satisfaction make it a top choice for people who want to transfer money internationally. Wise’s strong position in the market comes from its focus on clear pricing and secure transfers.

You can trust Wise because it holds licenses from major regulators like the FCA in the UK and FinCEN in the US. Wise processes over $4 billion in transfers each month. This scale shows that many people rely on Wise for sending money across borders. Wise’s reputation for reliability and transparency gives you confidence when you need to send money or transfer funds.

Customer Experiences

When you look at customer reviews, you see that Wise users often praise the service for its speed and transparency. Many people say that Wise makes it easy to send money and track each transfer. You can find over 250,000 reviews on Trustpilot, with an average rating of 4.3 out of 5. These reviews show that Wise delivers on its promise of secure transfers and clear fees.

You might notice that Wise’s mobile apps get high marks for quality. Users find the apps simple to use when they want to send money or check the status of a transfer. Wise’s customer support also receives good feedback. People appreciate quick answers and helpful advice when they have questions about a transfer or need help with sending money.

Note: Wise’s strong reputation comes from both expert analysis and real customer experiences. You can feel confident using Wise for international money transfers because so many people trust the service and share positive reviews.

Wise’s focus on transparency, security, and customer satisfaction makes it a leading choice for anyone who needs to transfer money internationally. You can rely on Wise for your next money transfer, knowing that millions of users and industry experts support its reputation.

Wise Regulation

Global Oversight

When you use Wise for a money transfer, you benefit from strong global oversight. Wise operates under strict regulation in every region where it offers money transfer services. This oversight helps protect you when you send money or use Wise for international money transfers. Wise holds licenses from top financial authorities. You can see how Wise is regulated in major markets in the table below:

| Country/Region | Regulatory Authority(ies) | License/Registration Details |

|---|---|---|

| United Kingdom | Financial Conduct Authority (FCA) | Wise Payments Limited authorized as Electronic Money Institution (EMI), Reg. No. 900507; Wise Assets Limited authorized for investment activities, Reg. No. 839689 |

| European Union (Belgium & EEA) | National Bank of Belgium | Wise Europe SA authorized as Payment Institution, Reg. No. 0713629988, with passporting rights across EEA |

| United States | Financial Crimes Enforcement Network (FinCEN); State Money Transmitter Authorities; Office of the Comptroller of Currency (via partner bank) | Wise US Inc. registered with FinCEN, holds multiple state money transmitter licenses; partner bank supervised by OCC |

| Australia | Australian Securities and Investments Commission (ASIC); Australian Prudential Regulation Authority (APRA) | Wise Australia Pty Ltd holds Australian Financial Services Licence (AFSL 513764) and APRA Authorised Deposit-taking Institution (ADI) license; Wise Australia Investments Pty Ltd holds AFSL 545411 |

Wise must meet many licensing requirements in each region. You will find that Wise registers its business in every state where it operates in the US. This process includes paperwork, fees, and compliance with tax and employment laws. Wise also follows local rules for money transfer services, which helps keep your transfers safe.

Note: Wise is not a bank. It does not offer traditional savings accounts or securities. Wise does not have FDIC insurance itself, but it works with FDIC-insured banks in the US. If you use the interest feature, you can get FDIC insurance up to $250,000 through these partner banks.

Fund Safeguarding

Wise takes extra steps to protect your money when you use its money transfer service. Wise keeps customer funds separate from its own money. It does not lend out your money, which makes Wise different from banks. Wise holds your funds in cash deposits at reputable banks like JPMorgan Chase Bank, N.A., Citibank, and Barclays. Wise also uses secure liquid assets such as short-term government bonds and money market funds managed by BlackRock and State Street. These assets are low-risk and provide same-day liquidity, so your money stays available.

| Type of Asset | Institutions / Description |

|---|---|

| Cash Deposits & Secure Liquid Assets | Barclays Bank PLC (including government bonds and comparable guarantees) |

| Cash Deposits | Citibank N.A., JPMorgan Chase Bank, N.A., Deutsche Bank AG London, Hamburg Commercial Bank, Bank of America |

Wise spreads your funds across several top banks and assets to reduce risk. Wise follows strict rules in every country to keep your money safe during a transfer. If you use the Assets feature, Wise holds your money in a segregated account with extra protections. Wise’s approach to safeguarding funds gives you confidence when sending money or using Wise for international money transfers.

Money Transfer Security

Image Source: pexels

Encryption and Data Protection

You want your money transfer to stay safe from start to finish. Wise uses advanced encryption protocols to protect your personal and financial data every time you make a transfer. The company applies bank-level encryption, which means your information gets the same protection as it would at a major bank in Hong Kong or the United States. Wise secures your data both when you send it and when it is stored.

- Wise uses two-step verification for every account. This extra layer of security helps keep your account safe, especially when you hold money with Wise or use the Borderless account.

- The company uses biometrics and phone-based encryption to make sure only you can access your account.

- Wise sends real-time notifications for every card transaction, so you always know when a transfer happens.

- You can freeze your digital card instantly if you notice anything unusual.

Wise’s engineering teams work to improve these systems all the time. They use machine learning to spot risks and keep your transfers secure. If you change your email, Wise will require you to reauthenticate, which helps prevent unauthorized access.

Tip: Always enable two-step verification and keep your login details private to make your money transfer even safer.

Anti-Fraud Measures

Wise takes fraud prevention seriously. The company uses a fraud engine that blocks brute force attacks and keeps your card details safe. You can use digital cards for online payments, which you can block or replace right away if needed. Real-time alerts help you spot any suspicious transfer activity.

- Wise encourages you to keep your card under your control and avoid sharing your PIN or card details.

- The company offers refunds and free card replacements if you experience fraud, with most cases reviewed within 24 hours.

- Wise uses the Positive Pay system to match each transfer against approved details, stopping unauthorized payments before they go through.

Wise also follows strict financial laws in every country where it operates. About one-third of Wise’s workforce focuses on compliance and fighting financial crime. The company works with regulators to improve anti-money laundering controls, collect customer documents, and freeze accounts that do not meet requirements. Wise invests in regular reviews and upgrades to its systems, so you can trust your money transfer will stay protected.

Risks of Moving Money Overseas

When you use wise for moving money overseas, you need to understand the risks. Wise offers strong security, but some risks come from regulations, account rules, and the nature of the money transfer process.

Account Freezes

Wise must follow strict rules to prevent fraud and illegal activity. Sometimes, wise freezes accounts during a transfer. You might face a freeze if you:

- Hold large sums (over five figures) in your wise account.

- Use wise for long-term storage instead of quick money transfer.

- Show unusual or inconsistent transfer activity.

- Fail to provide documents to verify the source of funds.

- Have activity that does not match typical wise usage.

Other reasons include disputes between joint account holders, court actions, or even mistakes. Wise may ask for more documents. If you do not respond, your funds can stay frozen or your account may close. Some users report that even after sending documents, wise keeps accounts frozen for a long time. This risk is higher if you are moving money overseas in large amounts or from high-risk countries.

Note: Wise is designed for quick money transfer, not as a place to store large balances.

No Deposit Insurance

Wise does not offer deposit insurance like traditional banks. If wise or its partners fail, you could lose your money. Unlike banks in Hong Kong or the United States, wise accounts do not have FDIC insurance. This means you do not have a federal guarantee for your funds. Traditional banks protect your deposits up to a certain limit, but wise does not. Without deposit insurance, you face a higher risk when moving money overseas or holding funds in your wise account.

- Wise is not FDIC insured for US customers.

- Banks offer a safety net, but wise does not.

- This difference matters if you want extra protection for your money.

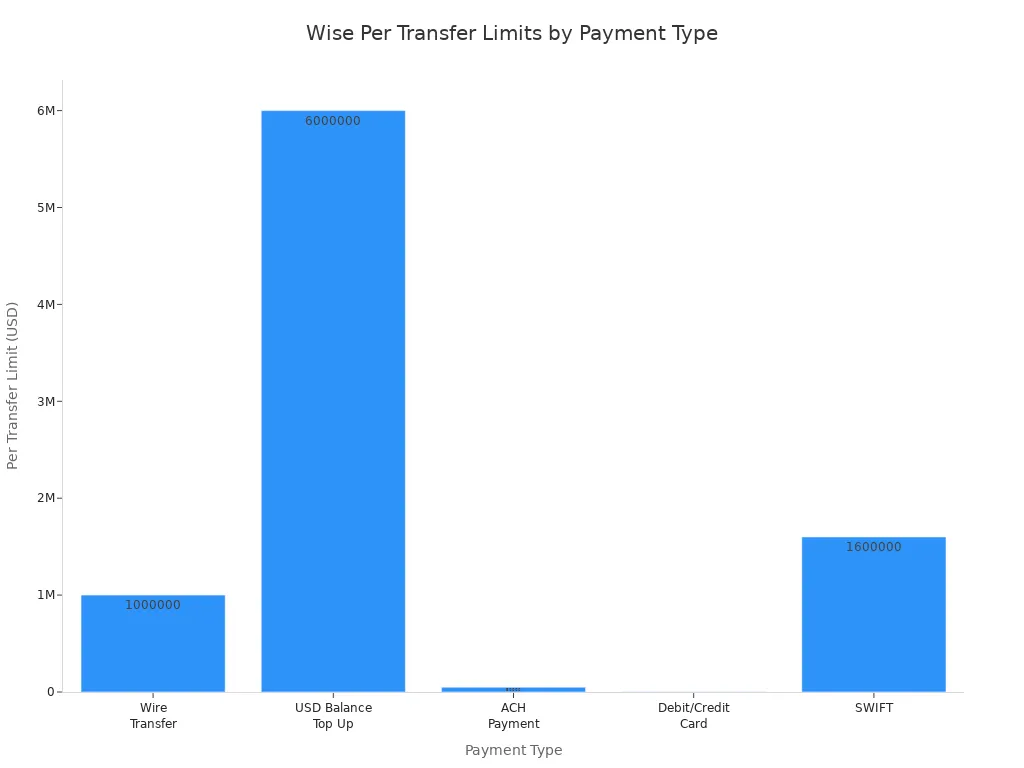

Transfer Limits

Wise sets transfer limits based on your country, payment method, and account verification. You need to know these limits before you start a money transfer. Here are some current limits for wise users in the United States:

| Payment Type | Per Transfer Limit (USD) | Daily Limit (USD) | Weekly Limit (USD) | 60-Day Limit (USD) |

|---|---|---|---|---|

| Wire Transfer | 1,000,000 | N/A | N/A | N/A |

| USD Balance Top Up | 6,000,000 | N/A | N/A | N/A |

| ACH Payment | 50,000 | 50,000 | N/A | 250,000 |

| Debit/Credit Card | 2,000 | 2,000 | 8,000 | N/A |

| SWIFT | 1,600,000 | N/A | N/A | N/A |

You can increase your transfer limits by completing more verification steps. Wise blocks transfers that exceed these limits and may ask for more information. Business accounts often have higher limits. Always check wise’s calculator for the latest transfer limits before moving money overseas.

Wise vs. Other Money Transfer Services

Security Comparison

You want your money to stay safe when you send money or transfer money internationally. Wise uses strong security tools to protect your transfers. Wise holds licenses from top regulators like the UK’s Financial Conduct Authority. You get protection from data encryption, two-step verification, and biometric checks. Wise uses machine learning to spot fraud and block bad transfers. Your money stays in separate accounts at big banks such as Barclays and JP Morgan Chase. Wise also has over 1,000 anti-fraud experts working around the clock to help you.

Here is a quick look at how Wise compares to Western Union, another big name in money transfer services:

| Aspect | Wise | Western Union |

|---|---|---|

| Regulatory Authority | UK’s Financial Conduct Authority | New York State Department of Financial Services |

| Security Measures | Data encryption, multi-factor authentication, machine learning fraud detection | Fraud prevention, identity verification protocols |

| Customer Fund Handling | Funds held separately with major banks (Barclays, JP Morgan Chase) | N/A |

| Customer Support | 24/7 support with 1,000+ anti-fraud specialists | N/A |

| Transparency | Upfront fee disclosure enhancing user confidence | Criticized for less transparent fees |

You see that Wise offers advanced security and clear rules. This helps you feel confident when sending money or moving money overseas.

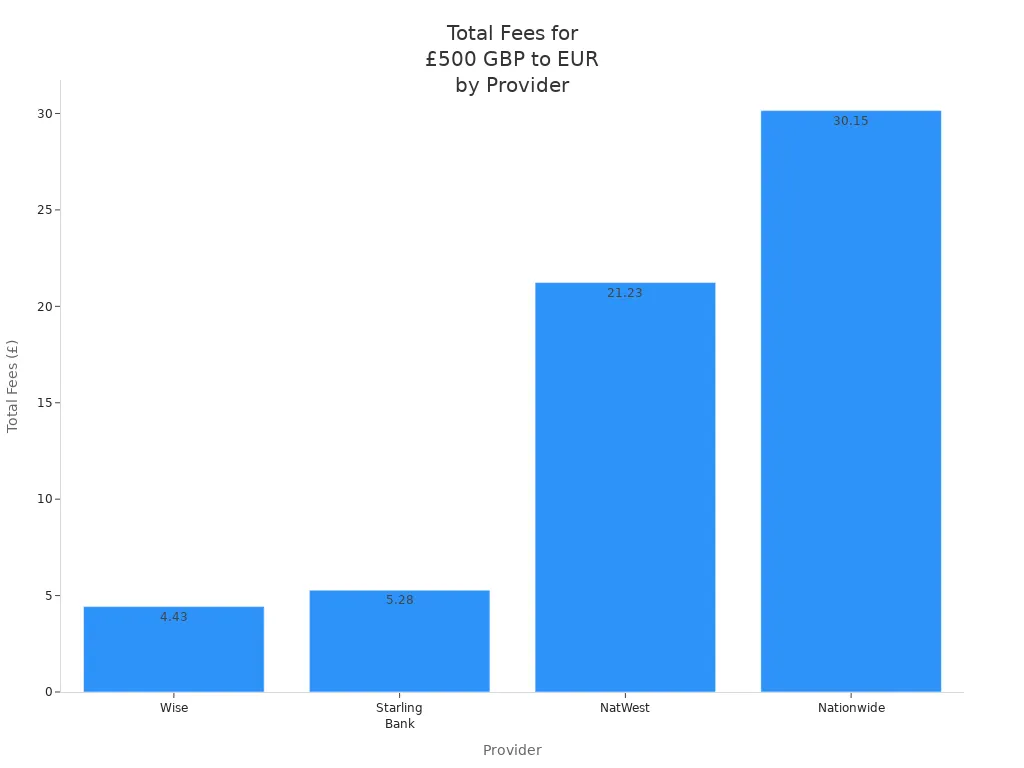

Fees and Transparency

When you compare Wise to other money transfer options, you notice that Wise keeps fees low and clear. Wise always shows you the real exchange rate, called the mid-market rate, with no hidden markups. You see the exact cost before you transfer money. Many banks and other providers add hidden fees or use poor exchange rates, which means you pay more.

Here is a table showing how much it costs to send $650 USD (converted from £500 GBP) to Europe using different providers:

| Provider | Transfer Fee (USD) | Exchange Rate Quality | Total Fees (USD, including hidden) |

|---|---|---|---|

| Wise | $5.60 | Mid-market rate, no hidden fees | $5.60 |

| Starling Bank | $2.90 | Hidden fees ($3.70) | $6.60 |

| NatWest | $0 | Hidden fees ($26.60) | $26.60 |

| Nationwide | $25.10 | Hidden fees ($12.70) | $37.80 |

Wise also gives you a fee calculator. You can check the cost before you send money. This helps you make smart choices about international currency exchange and secure transfers.

- Wise charges low fees starting from 0.43%. You always see the full cost.

- Wise uses the mid-market rate, so more money reaches your recipient.

- Other providers may claim low fees but add extra costs in the exchange rate.

When to Use Alternatives

Sometimes, you may want to use a different money transfer service. Wise works best for most international money transfers, but other services fit special needs. Here are some cases where you might choose another provider:

| Alternative | Best Scenario | Key Points |

|---|---|---|

| OFX | Large transfers over $1,000 USD | No transfer fees, but exchange rate markup applies |

| Western Union | When you need cash pick-up or bank transfers are hard | Higher fees, strong agent network |

| Remitly | Fast, urgent transfers or cash collection | Variable fees, express option available |

| Revolut | Small, regular transfers | Flexible plans, limited support |

| InstaReM | Business transfers or Asian countries | Low fees, fast transfers, loyalty program |

Tip: If you need to send money for business, InstaReM offers higher limits and special features. For urgent transfers, Remitly can deliver money in minutes. Western Union is best when your recipient needs cash and does not have a bank account.

You have many money transfer options. Wise gives you secure transfers, low fees, and clear rules. For special needs, you can pick the best money transfer service for your situation.

You can trust Wise for secure transfers when you need to transfer money internationally in 2025. Wise follows strict regulation, uses two-step verification, and holds top security certifications. The table below highlights key safety features:

| Security Feature | Details |

|---|---|

| Two-step verification | Protects every transfer |

| Regulatory compliance | Licensed by FCA, FinCEN, and others |

| Segregated client funds | Held at major banks, separate from Wise funds |

| Real-time monitoring | Detects fraud and suspicious transfers |

- Use Wise for moving money overseas if you want low fees and fast transfers.

- Monitor exchange rates before you transfer money.

- Consider your needs and risk tolerance when choosing money transfer services.

Wise stands out as a reliable fintech for international money transfers, backed by strong reviews and expert trust.

FAQ

How does Wise keep my money transfer secure?

You get secure transfers with Wise through two-step verification, encryption, and real-time monitoring. Wise uses advanced technology to protect your information. You can trust Wise to keep your money safe when you transfer money internationally or send money to friends and family.

What should I do if Wise asks for more verification?

Wise may ask for extra verification to follow regulation and prevent fraud. You should provide the requested documents quickly. This step helps Wise confirm your identity and keep your transfers safe. You can contact Wise support if you have questions about the process.

Can I use Wise for large international money transfers?

You can use Wise for large international money transfers, but there are limits based on your country and payment method. Wise sets these limits to follow regulation and keep your transfers secure. Always check Wise’s website for the latest transfer limits before moving money overseas.

How do Wise fees compare to other money transfer services?

Wise shows you all fees up front and uses the real exchange rate for international currency exchange. Many money transfer services add hidden costs. Wise’s transparent pricing helps you save money when you transfer or send money overseas.

Wise offers secure, low-cost international money transfers, but for those seeking even lower fees and faster global transactions, BiyaPay is a compelling alternative. With remittance fees as low as 0.5%, BiyaPay undercuts many competitors, including Wise. It supports same-day remittances with same-day arrival in most countries, ensuring quick, secure access to your funds. Real-time exchange rate queries and seamless fiat-to-digital currency conversion simplify cross-border payments. Register quickly and securely without branch visits, ideal for frequent travelers or remote workers. Enhance your transfer experience—sign up for BiyaPay today for cost-effective, reliable global payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.