- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stripe and PayPal Head to Head Comparing Features, Costs, and Ease of Use

Image Source: pexels

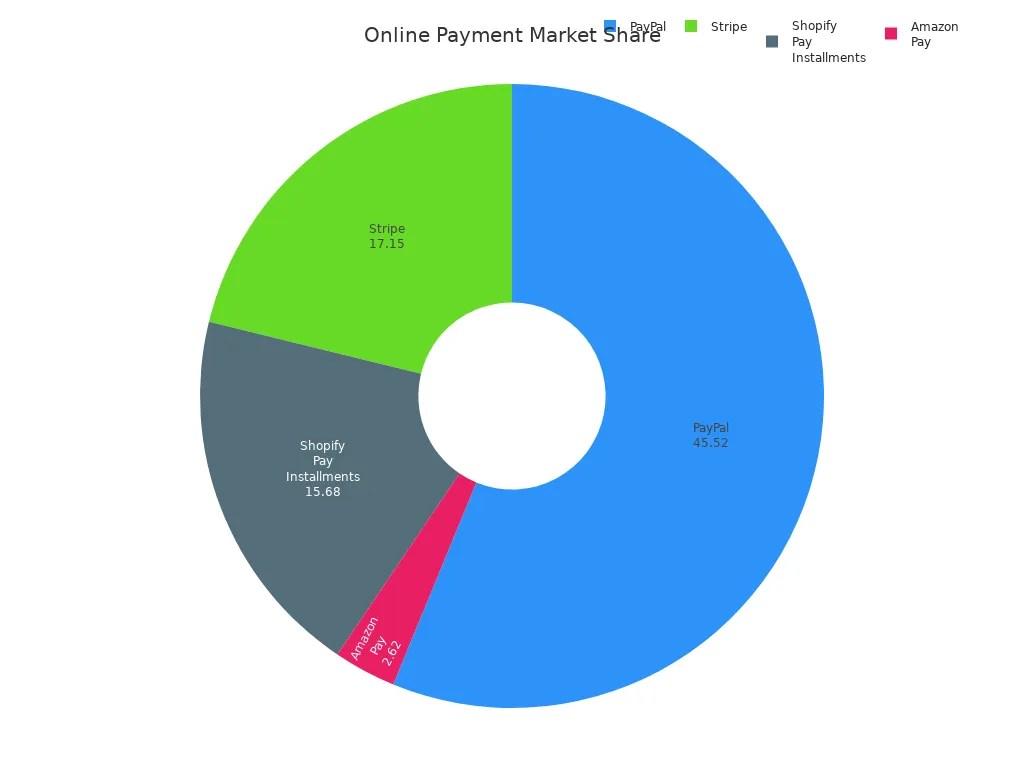

If you want the most recognized payment processor, PayPal leads the market with over 45% share, while Stripe follows at about 17%. Stripe vs PayPal often comes down to your business needs. Stripe offers more payment methods and deeper customization, but requires some technical skill. PayPal stands out for ease of use and fast setup. Both processors support strong security and global payments, but Stripe has simpler fees and more features for developers.

| Company Name | Market Share (%) |

|---|---|

| PayPal | 45.52 |

| Stripe | 17.15 |

| Shopify Pay | 15.68 |

| Amazon Pay | 2.62 |

Key Takeaways

- Stripe offers more payment options and customization but needs technical skills to set up and use effectively.

- PayPal is easy to start with, ideal for small businesses and freelancers, and supports many countries and currencies.

- Stripe usually has simpler and lower fees, especially for international payments and advanced features, while PayPal’s fees can be higher and more complex.

- Both Stripe and PayPal provide strong security and fraud protection, but Stripe includes FDIC insurance and 24/7 customer support.

- Choose Stripe if you want control, scalability, and developer tools; choose PayPal for quick setup, ease of use, and broad global reach.

Stripe vs PayPal Overview

Image Source: pexels

Key Differences

When you compare Stripe vs PayPal, you see clear differences in how each payment processor serves businesses. Stripe gives you more control over your payment experience. You can customize payment forms, integrate with many third-party tools, and support over 135 currencies. Stripe works best if you have developer resources and want to tailor your payment processing systems to your brand.

PayPal, on the other hand, focuses on simplicity. You can set up PayPal quickly without any coding skills. This makes PayPal a favorite for small businesses, freelancers, and anyone who wants to start accepting payments fast. PayPal supports over 200 countries and more than 25 currencies, so you can reach customers almost anywhere. However, PayPal offers fewer customization options than Stripe.

Stripe charges a flat rate of 2.9% + $0.30 per transaction in the United States, with a 3.9% fee for international cards and a 1% currency conversion fee. PayPal’s fees are more complex, usually ranging from 2.9% + $0.30 to 4.4% + a fixed fee for international payments. PayPal also charges a higher instant payout fee and a $20 chargeback fee, while Stripe’s chargeback fee is $15.

Stripe’s developer-friendly approach lets you build advanced payment solutions. You can create custom checkouts, automate revenue, and even offer embedded finance. PayPal’s plug-and-play buttons and all-in-one platform make it easy for you to start, but you get less flexibility.

Note: Stripe supports more payment methods, including digital wallets, bank debits, and even crypto integrations. PayPal covers the basics, like credit cards and digital wallets, but does not offer as many options for global bank transfers.

Quick Comparison

Here is a table that summarizes the main differences between these two payment processing platforms:

| Feature | Stripe | PayPal |

|---|---|---|

| Setup | Requires technical integration; developer-friendly; customizable | Quick and easy setup; no coding needed; ideal for beginners and small businesses |

| Pricing | 2.9% + $0.30 (US); 3.9% + fixed fee (international); 1% currency conversion; $15 chargeback fee; 1% instant payout fee | 2.9% + $0.30 (US); 4.4% + fixed fee (international); 3-4% currency conversion; $20 chargeback fee; 1.75% instant payout fee |

| Customization | Highly customizable via APIs; full control over checkout experience | Less customizable; plug-and-play with standard payment buttons |

| International Support | Supports 135+ currencies in 45+ countries; many payment methods | Supports 25+ currencies in 200+ countries; fewer payment method options |

| Business Fit | Best for businesses with technical resources seeking scalable, customizable, and cost-effective global payment solutions | Best for individuals, freelancers, and small businesses prioritizing ease of use and buyer protection |

Stripe vs PayPal is not just about features or fees. You need to consider your business type and technical skills. If you run a large business or want to scale globally with advanced payment options, Stripe gives you the flexibility and control you need. Stripe also works well if you want to maximize your payment options and improve conversion rates.

If you are a small business owner, freelancer, or just starting with online payment processing, PayPal is the easier choice. You can set up PayPal in minutes, accept payments from almost anywhere, and benefit from strong buyer protection. PayPal’s brand recognition also helps build trust with your customers.

Some businesses use both payment processors to offer more choices to their customers. However, managing two payment processing platforms can increase complexity and costs, so this approach works best for larger companies with more resources.

Features

Image Source: unsplash

Payment Methods

You want your customers to have choices at checkout. Stripe supports a wide range of payment methods, including credit cards, debit cards, Apple Pay, Google Pay, bank debits, and even some cryptocurrencies. Stripe also lets you accept recurring payments for subscriptions or memberships. PayPal covers major credit cards, PayPal balance, and digital wallets. You can use PayPal for recurring payments, but you get fewer options for global bank transfers. Both Stripe and PayPal offer integrated checkout solutions that help you add payment buttons or forms to your website. Stripe’s checkout supports over 135 currencies, while PayPal supports more than 25 currencies.

Customization

Stripe gives you more control over the checkout experience. You can use Stripe’s APIs to design custom payment forms that match your brand. Stripe’s features let you build advanced e-commerce features, such as one-click checkout and recurring payments. PayPal offers standard payment buttons and a simple integrated checkout, which works well if you want a fast setup. You get less flexibility with PayPal, but you can still add recurring payments and basic customization.

Integrations

Both Stripe and PayPal offer strong integration options. Stripe connects with many e-commerce platforms, accounting tools, and CRM systems. You can use Stripe’s developer tools to build custom integrations for your business. PayPal also supports integration with popular e-commerce platforms and shopping carts. You can add PayPal to your website with just a few clicks. Stripe’s integration options work well for businesses that want to automate billing, manage subscriptions, or add advanced checkout features.

Security

Security is a top priority for both Stripe and PayPal. They both meet high security standards, including PCI DSS Level 1, SOC 1 and SOC 2, GDPR, and EMVCo Level 1 and Level 2. The table below shows how each company meets key security certifications and compliance standards:

| Certification / Compliance Standard | Stripe | PayPal |

|---|---|---|

| PCI DSS Level 1 | Yes | Yes |

| SOC 1 | Yes | Yes |

| SOC 2 | Yes | Yes |

| GDPR | Yes | Yes |

| EMVCo Level 1 and Level 2 | Yes | Yes |

| ISO 27001 | No | Yes |

| FDIC Insurance | Yes | No |

| Encryption (SSL, AES-256) | Yes | Yes |

| Tokenization | Yes | Yes |

| Two-Factor Authentication (2FA) | Yes | Yes |

| Regular Security Audits | Yes | Yes |

Stripe uses data encryption and tokenization to protect payment information. Stripe also offers FDIC insurance for account holders, which covers up to $250,000 in case of bank failure. PayPal uses strong encryption and regular security audits, but does not offer FDIC insurance. Both companies use fraud detection tools and two-factor authentication to keep your payments safe. Stripe and PayPal help you meet security standards, but you must use their tools correctly to reduce risks.

Pricing

Transaction Fees

You need to understand how much you pay for each transaction. Stripe and PayPal both use flat-rate pricing for most online payments. Stripe charges 2.9% plus $0.30 for every online transaction in the United States. PayPal charges about 2.59% plus $0.49 per online transaction. These rates make it easy to predict your payment processing costs.

Stripe offers in-person payment processing through Stripe Terminal. You pay 2.7% plus $0.05 for each in-person transaction. PayPal does not offer a direct in-person payment solution like Stripe Terminal, so you may need to use a third-party device if you want to accept payments face-to-face.

International transactions cost more. Stripe adds a 1% fee for international cards and a 2% currency conversion fee. If you use an international card, Stripe may charge an extra 1.5%. PayPal charges higher rates for international payments, but the exact percentage can change. PayPal’s international fees are usually higher than Stripe’s.

Here is a table that compares the main payment processing rates for Stripe and PayPal:

| Payment Type | Stripe Fees | PayPal Fees (US) |

|---|---|---|

| Online Payments | 2.9% + $0.30 per transaction | ~2.59% + $0.49 per transaction |

| In-Person Payments | 2.7% + $0.05 per transaction (via Stripe Terminal) | N/A |

| International Transactions | Additional 1% fee on top of standard fees + 2% currency conversion fee; 1.5% extra on international card transactions | Higher than domestic; exact % not specified, but noted as slightly higher than Stripe |

Stripe also supports ACH direct debit at 0.8% per transaction, capped at $5. Wire payments cost $8 per transaction. These options help you save on payment processing fees for large transactions.

Note: Stripe and PayPal both offer simple flat-rate pricing for most online payments, but Stripe gives you more options for in-person and international transactions.

Add-On Costs

You may need extra features like fraud protection or recurring billing. Stripe includes advanced fraud protection and recurring billing at no extra cost. You do not pay monthly fees for these features. Stripe lets you use premium tools through custom integrations, which may have their own costs, but most core features come included.

PayPal charges $10 per month for advanced fraud protection. If you want recurring billing, you pay another $10 per month. PayPal also offers premium tools with monthly fees that range from $5 to $30, depending on the service. These add-on costs can increase your total payment processing fees if you need more than basic payment options.

Here is a table that shows how Stripe and PayPal compare for add-on pricing:

| Feature | Stripe | PayPal |

|---|---|---|

| Advanced Fraud Protection | Included at no extra cost | $10 per month fee |

| Recurring Billing | Included without monthly fees | $10 per month fee |

| Premium Tools | Available via custom integrations | $5 to $30 monthly fees depending on service |

If you want to keep your payment processing rates low, Stripe may be the better choice for advanced features. PayPal’s add-on pricing can add up quickly if you need more than basic payment processing.

Refunds & Chargebacks

Refunds and chargebacks are important parts of payment processing. Stripe and PayPal both charge fees when customers dispute transactions or when you issue refunds.

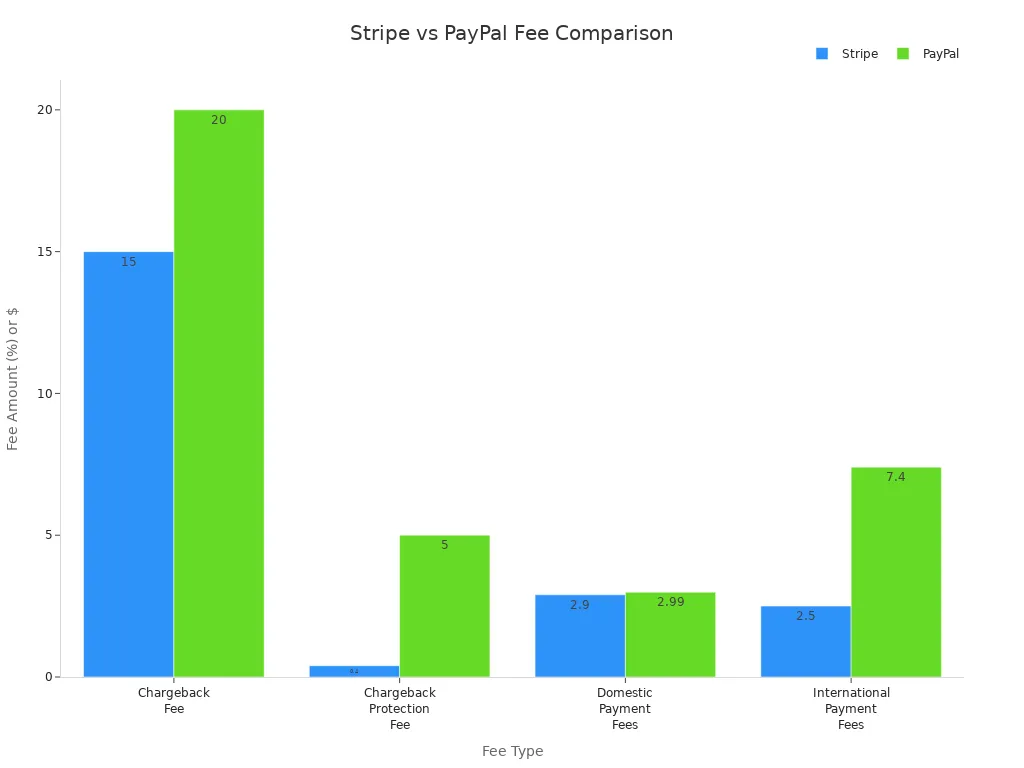

Stripe charges a $15 fee for each chargeback. This fee is not refunded, even if you win the dispute, except for businesses in Mexico. Stripe offers a Chargeback Protection program for 0.40% per transaction. This program covers fraudulent disputes and reimburses both the chargeback amount and the fee. When you issue a refund through Stripe, you do not get back the original payment processing fees (2.9% + $0.30). You lose this amount even if you refund the full payment.

PayPal charges a $20 fee for each chargeback. If you have chargeback protection, PayPal may waive this fee. If your account has many disputes, PayPal can increase your transaction fees up to 5% with 30 days’ notice. PayPal’s refund policy does not clearly state if you lose the original payment processing fees, but you should expect to pay the chargeback fee unless you have protection.

Here is a table that compares refund and chargeback pricing for Stripe and PayPal:

| Aspect | Stripe | PayPal |

|---|---|---|

| Chargeback Fee | $15 per chargeback; fee not reimbursed except in Mexico | $20 per chargeback; fee can be waived with chargeback protection |

| Refund Policy | Refunds do not return original transaction fees (2.9% + 30¢), merchant loses this amount | Refund fees not explicitly detailed; chargeback fees and protections discussed |

| Chargeback Protection Fee | 0.40% per transaction; covers fraudulent disputes and reimburses chargeback amount and fees | Chargeback protection available; fees can increase up to 5% per transaction if high chargeback rates |

| Domestic Payment Fees | 2.9% + 30¢ per transaction | 2.99% + fixed fee (e.g., $0.49) |

| International Payment Fees | 1.5% international fee + 1% currency conversion fee | 4.4% international fee + 3-4% currency conversion fee |

| Ease of Use | More control, custom checkout, better for growing businesses | Easier for quick payments, but more expensive internationally |

Stripe gives you more control over your payment processing and makes it easier to manage refunds and disputes. PayPal offers a simple setup and strong buyer protection, but you may pay higher fees for international transactions and chargebacks.

Tip: Always review your payment processing rates and pricing policies before choosing a provider. Stripe usually offers lower international and chargeback fees, while PayPal may be easier for quick payments but can cost more if you have many disputes.

Ease of Use

Setup

You want to start accepting payments quickly. PayPal makes this easy. You can create an account using just your email address and some basic information. There are no setup fees, and you can begin sending or receiving payments almost right away. Many small businesses and freelancers choose PayPal because it is simple and fast to get started. You do not need technical skills or help from a developer.

Stripe also offers free signup, but the process takes more time. Stripe works best for online stores and websites. You may need help from a developer to connect Stripe to your site. Some users report that Stripe’s initial setup can be challenging. You might face account reviews or need to provide extra information. Once you finish the setup, Stripe gives you powerful tools to manage your sales and payments.

Tip: If you want the fastest way to start, PayPal is the better choice. If you want more control and plan to grow your online business, Stripe is worth the extra effort.

Interface

When you use PayPal, you see a simple dashboard. You can send invoices, manage your balance, and view recent transactions. PayPal’s interface is easy to understand, even if you are new to online payments. However, the checkout process for your customers can be slow. PayPal often redirects users off your site. Customers must log in, choose a payment method, and click through several screens. This can take over 10 seconds and may cause some people to leave before finishing their purchase.

Stripe gives you a modern dashboard with many features. You can track payments, handle refunds, and see real-time analytics. Stripe’s checkout is faster and smoother. Customers enter their card details on your site and finish payment in fewer steps. You control the design and flow, which helps you keep more sales.

| Feature | Stripe | PayPal |

|---|---|---|

| Dashboard | Modern, customizable | Simple, easy to use |

| Checkout Flow | On-site, fewer steps | Off-site, multiple redirects |

| Analytics | Real-time, detailed | Basic |

Developer Tools

Stripe stands out for its developer tools. You get access to a wide range of resources, including a developer dashboard, command-line tools, and strong API documentation. Stripe supports integration with popular coding environments and offers interactive code samples. This makes Stripe a top choice if you want to build custom payment solutions or automate your business processes.

PayPal also offers integration options and a RESTful API. You can use PayPal’s demo portal and sandbox for testing. However, PayPal’s documentation is less detailed, and there are fewer tools for developers. PayPal works well if you want a simple solution without much coding.

Note: Stripe is better for businesses with technical skills or developer support. PayPal is easier for beginners who want a quick and simple setup.

Customer Support

Availability

When you choose a payment processor, you want to know help is there when you need it. Stripe now offers 24/7 phone and chat support. This means you can reach out at any time, day or night, if you have questions or problems. Stripe’s support team responds quickly and helps you solve issues fast. You do not have to wait for business hours or worry about time zones.

PayPal also provides several ways to get help. You can contact PayPal by phone, chat, or email. However, PayPal’s phone and chat support are not always available 24/7. Sometimes you may need to wait for business hours or try again later. This can slow you down if you need urgent help. Both Stripe and PayPal have help centers with guides and answers to common questions. You can also find support through social media for both companies.

Tip: If you want support at any hour, Stripe gives you more consistent access. PayPal offers many options, but you may not always get instant help.

Support Channels

You have many ways to contact Stripe and PayPal. Both companies let you reach out by phone, chat, email, or through their help centers. Social media support is also available for both. Stripe stands out because its phone and chat support are always open. PayPal’s support channels work well, but sometimes you may find chat or phone lines closed.

Here is a table that shows the main support channels for Stripe and PayPal:

| Support Channel | Stripe | PayPal |

|---|---|---|

| Phone Support | 24/7 Available | Not always 24/7 |

| Chat Support | 24/7 Available | Sometimes unavailable |

| Email Support | Available | Available |

| Help Center | Available | Available |

| Social Media | Available | Available |

Stripe’s support team often helps with technical questions, setup, and troubleshooting. This is helpful if you use advanced features or need to fix payment issues fast. PayPal’s team can help you with account questions, payment problems, and security concerns. Both companies work to keep your business running smoothly, but Stripe’s round-the-clock support gives you extra peace of mind.

Business Fit

Small Businesses

You want a payment processor that fits your business size and needs. Many small businesses choose PayPal because it is easy to set up and has strong brand recognition. Over 426 million active accounts and $1.53 trillion in payment volume show how many people trust PayPal. You can accept payments quickly and offer your customers a familiar checkout experience. PayPal supports many currencies and protects both buyers and sellers. Some users report issues like unexpected account freezes and complex fees, so you should review their policies before signing up.

Stripe appeals to startups and small businesses that want more control. You get lower transaction fees, no setup or monthly costs, and a developer-friendly API. Stripe lets you customize your checkout and supports strong security. Many users praise Stripe for its seamless online payment integration and flexibility. Both Stripe and PayPal help small businesses grow by offering reliable and secure payment processing.

- Stripe works well for web-focused businesses that want customization.

- PayPal is ideal if you need fast setup and broad acceptance.

- Both platforms scale as your business grows.

E-commerce

Running an ecommerce business means you need a payment solution that matches your needs. Stripe gives you advanced features, machine learning fraud detection, and customizable reports. You can tailor your checkout and integrate with popular ecommerce platforms. Stripe usually offers lower fees for high-volume sales and supports many payment methods.

PayPal stands out for its easy setup and trusted brand. Many customers feel safe using PayPal, which can boost your sales. You get instant fund availability in your PayPal account. However, PayPal’s checkout process takes customers off your site, which can disrupt the shopping experience.

| Feature/Aspect | Stripe Advantages | Stripe Disadvantages | PayPal Advantages | PayPal Disadvantages |

|---|---|---|---|---|

| Features | Advanced, customizable, wide payment support | Extra costs for some tools, complex setup | Simple, trusted, easy setup | Less customizable, off-site checkout |

| Customer Support | 24/7 phone, chat, email, individual attention | Inconsistent support quality | Multiple channels, community forums | Not always available, variable quality |

| Pricing | Lower fees for high volume, no monthly fee | Extra fees for some features | No monthly fee, standard fees | Higher fees overall |

Stripe fits ecommerce businesses that want flexibility and control. PayPal works best if you value convenience and customer trust. Both support recurring payments and PCI compliance, so you can run your online businesses with confidence.

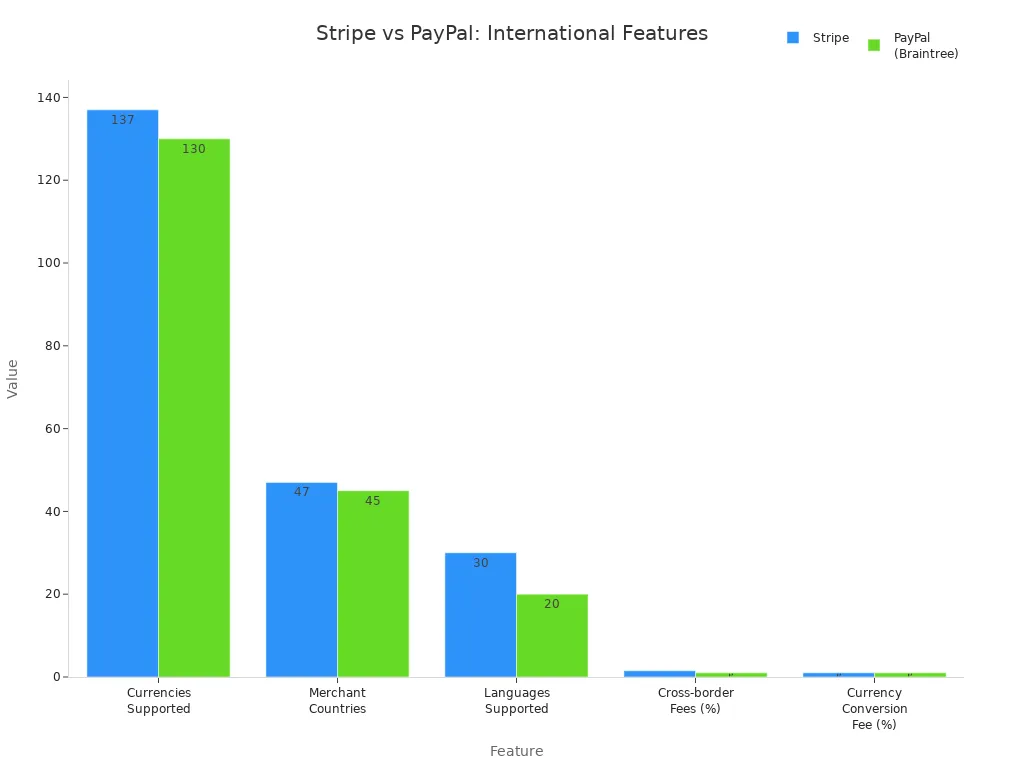

International

If you sell to customers around the world, you need strong international support. Stripe lets you accept payments in 137 currencies and supports 47 merchant countries. You get 30+ language options and transparent cross-border fees. Stripe charges a 1.5% cross-border fee and a 1% currency conversion fee. PayPal, through Braintree, supports over 130 currencies and 45 merchant countries, with 20+ languages. PayPal’s cross-border fee is 1%, and the currency conversion fee is also 1%.

Stripe and PayPal both help online businesses reach global customers. Stripe offers more currencies and languages, while PayPal covers more countries. You should compare their fee structures and supported features to find the best fit for your ecommerce goals.

Choosing a Payment Processor

Stripe

When you want flexibility and control, Stripe stands out as a strong choice. You can use Stripe if you need to accept many types of payments, such as one-time, subscription, or marketplace payments. Stripe gives you a developer-friendly API and clear documentation. This helps you save time if you have technical skills or a development team. You can customize your checkout and connect Stripe with many tools, including accounting, marketing, and CRM platforms.

Stripe supports over 135 currencies and works in more than 40 countries. You can use Stripe Atlas if you want to expand your business internationally. Stripe also offers advanced security features, such as tokenization and two-factor authentication. You get powerful automation, easy invoice generation, and a clean dashboard. Stripe lets you export your customer card data if you ever need to switch providers. You can rely on 24/7 customer support, which is helpful if you run into problems at any hour.

Here is a table to help you compare important factors:

| Factor | Stripe Highlights |

|---|---|

| Transaction Fees | Simple pricing model, better for mid to large businesses |

| Micropayment Handling | Less ideal for micropayments |

| Integrations | Extensive, including CRMs, marketing, accounting, mobile payments |

| Reporting Tools | Advanced reporting with SQL query customization |

| Customer Experience | On-site payment, seamless checkout experience |

| Developer-friendliness | Developer-first, highly customizable |

| Data Portability | Allows exporting card data to other processors |

| Support | 24/7 responsive customer support |

Tip: Stripe works best if you want to scale your business, automate payments, and create a custom checkout experience.

PayPal

If you want a payment processor that is easy to set up, PayPal is a great option. You can start accepting payments with just a few steps. PayPal works well for small businesses, freelancers, and anyone who needs a simple solution. You do not need coding skills to use PayPal. You can access your funds instantly, and you can transfer money to your bank in two to four days.

PayPal supports over 200 countries and more than 25 currencies. This makes it a good choice if you want to reach customers around the world. PayPal is strong in handling micropayments, especially for transactions under $10. You can use PayPal’s free or paid card readers if you sell in person. PayPal redirects your customers off your site for payment, which some users find less smooth.

Here is a table to help you see how PayPal compares:

| Factor | PayPal Highlights |

|---|---|

| Transaction Fees | Suitable for micropayments (under $10) |

| Micropayment Handling | Strong in micropayments |

| Integrations | Limited CRM integrations |

| Reporting Tools | Basic reporting |

| Customer Experience | Redirects customers off-site for payment |

| Developer-friendliness | User-friendly, no coding needed |

| Access to Funds | Instant access to funds, 2-4 days to transfer to bank |

| Support for Card Readers | Offers free and paid card readers, integrates with POS systems |

Note: PayPal is best if you want a fast, beginner-friendly setup and strong global reach, especially for small transactions.

Choosing the right payment processor depends on your business goals. Stripe works best if you want advanced features, strong international support, and custom integrations. PayPal offers easy setup and is popular with small businesses. Both provide strong security. Review your needs before deciding. You can test both platforms to see which fits your workflow.

| Business Need | Stripe | PayPal |

|---|---|---|

| Customization & Scalability | Excellent | Limited |

| Quick Setup | Requires technical effort | Very easy |

| International Payments | Strong support | Broad reach |

| Micropayments | Custom rates | Slightly better for small |

FAQ

How fast can you start accepting payments with Stripe or PayPal?

You can start with PayPal in minutes. Stripe setup takes longer because you may need to connect it to your website. Both let you accept payments as soon as your account is verified.

Which platform is better for selling to customers outside the United States?

Stripe supports over 135 currencies and works in more than 40 countries. PayPal covers over 200 countries and more than 25 currencies. You should check each platform’s supported countries and fees before choosing.

Do Stripe and PayPal keep your payments secure?

Both Stripe and PayPal use strong encryption and fraud detection tools. They meet top security standards, such as PCI DSS Level 1. You can trust both platforms to protect your payment data.

Can you use both Stripe and PayPal on the same website?

Yes, you can offer both Stripe and PayPal at checkout. This gives your customers more choices. Some businesses use both to increase sales and reach more buyers.

Tip: Using both payment processors can help you serve more customers, but it may add extra work for your team.

Stripe and PayPal offer robust payment processing, but high fees and setup complexities can hinder global transactions. BiyaPay simplifies cross-border payments with remittance fees as low as 0.5%, outperforming many competitors. It supports same-day remittances with same-day arrival in most countries, ensuring fast, secure fund access. Real-time exchange rate queries and seamless fiat-to-digital currency conversion enhance efficiency. Register quickly and securely without branch visits, ideal for businesses and freelancers. Streamline your payments—sign up for BiyaPay today for cost-effective, reliable global transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.