- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Step-by-Step Guide to Sending Money to Turkey from the USA

Image Source: pexels

You can send money to Turkey from the USA in 2025 by following a clear process. First, choose the best method for sending money to Turkey, such as a bank transfer or an online service. Make sure you understand the rules for sending money internationally. Prepare your documents and check all costs before you send money to Turkey. Always follow both US and Turkish regulations during the process. Compare your options to keep sending money to Turkey safe and affordable.

Key Takeaways

- Choose the best method to send money to Turkey, such as bank transfers, online services, or cash pickup, based on speed and recipient preference.

- Prepare all required documents, including your ID and recipient details, to avoid delays and meet legal requirements.

- Compare fees and exchange rates carefully to save money; services like Wise offer low fees and fair rates.

- Follow US and Turkish regulations closely, especially for transfers over $1,000 or $10,000, to stay compliant and avoid penalties.

- Track your transfer using the reference number and confirm receipt with your recipient to ensure the money arrives safely.

Sending Money to Turkey: Methods

Image Source: unsplash

When you want to send money to Turkey, you have several options. Each method has its own benefits and drawbacks. Choosing the best way to send money depends on your needs, how fast you want the transfer, and how your recipient wants to receive the funds. As of late 2024, you cannot use USPS international money orders for new transfers to Turkey. Instead, you can use bank transfers, online transfer services, or cash pickup providers.

Bank Transfers

Bank transfers remain a popular choice for sending money to Turkey. You can use an international wire transfer through your bank. This method uses the SWIFT network, which connects banks worldwide. It offers strong security and high transfer limits. However, you may face high fees and longer processing times. International wire transfers usually take between 1 and 5 business days to clear. Some banks offer same-day transfers for an extra fee. If you use a service like Western Union for a bank transfer to Turkey, the money can arrive in as little as one banking day when you use an IBAN.

| Method | Description | Pros | Cons |

|---|---|---|---|

| SWIFT | Secure messaging between banks for international wire transfer | High limits, secure | High fees, slow |

| Bank Transfer | Electronic payment from one bank account to another | Good value, secure | Slower than card payments |

Online Transfer Services

Online transfer services give you a fast and easy way to send money to Turkey. These remittance services include Wise, Payoneer, MoneyGram, and Ria Money Transfer. You can use their websites or mobile apps to send money. Many services let you pay with a debit card, credit card, or direct debit from your bank account. Wise is known for clear pricing and fair exchange rates. Payoneer works well for freelancers and businesses. MoneyGram and Ria offer both online and in-person options. Most online services have daily transfer limits between $1,000 and $10,000. You may need to verify your identity for larger amounts. Business accounts can send higher amounts but require more documents.

| Service Name | Ways to Send | Ways to Receive | Transfer Limits | Features |

|---|---|---|---|---|

| Wise | Online, App | Bank Deposit | Varies | Transparent fees, fast delivery |

| Payoneer | Online | Bank Deposit | Business-focused | Multi-currency, platform links |

| MoneyGram | Online, App, In-person | Cash Pickup, Bank | Up to $5,000 | Loyalty rewards, bill pay |

| Ria | Online, App, In-person | Cash Pickup, Bank | Up to $10,000 | IBAN calculator, tracking app |

Cash Pickup Options

Cash pickup options help if your recipient does not have a bank account in Turkey. Remittance services like Western Union, MoneyGram, Remitly, and WorldRemit let you send money for cash pickup at many locations. Your recipient can visit a partner bank or agent location to collect the funds. Major banks in Turkey, such as Akbank, Garanti Bank, and HSBC, support cash pickups. To collect the money, your recipient must show a valid photo ID, the transaction reference number, and make sure their name matches the sender’s details. Cash pickup services usually have lower transfer limits, making them best for smaller amounts. These services offer fast delivery, sometimes within minutes.

Tip: Always check the identification requirements for cash pickup in Turkey. Your recipient must bring a valid ID and the correct reference number.

International Money Transfer Regulations

Image Source: unsplash

Understanding international money transfer laws is important when you send money to Turkey. Both the United States and Turkey have rules and restrictions that affect how you move funds. These money transfer laws help protect you, your recipient, and the financial system from illegal activities.

US Rules and Limits

You must follow several money transfer laws in the United States when you send funds abroad. These rules set limits, require documentation, and help prevent illegal activity.

| Regulation/Agency | Description | Key Requirements/Notes |

|---|---|---|

| Electronic Fund Transfer Act (EFTA) | Governs wire transfers and electronic payments in the US to protect consumers. | Applies to all electronic fund transfers including international wires. |

| Foreign Account Tax Compliance Act (FATCA) | Regulates American taxpayers holding money in foreign bank accounts. | Ensures tax compliance for US persons with foreign financial assets. |

| Consumer Financial Protection Bureau (CFPB) | Oversees international transfers from the US over $15 to ensure transparency and fair practices. | Regulates transfers above $15 to protect consumers and promote fair financial practices. |

| IRS Reporting Requirements | Transfers of $10,000 or more must be reported to the IRS by banks or financial institutions. | Banks may request additional information about source of funds, recipient identity, and transfer purpose. |

You need to know about the $1,000 documentation threshold. If you send $1,000 or more in a single international wire transfer, your bank or transfer service must collect and keep information about you and your recipient. This includes your name, address, the amount, the date, and payment instructions. If you make the payment in person and do not have an account, you must show your ID. These wire transfer regulations help law enforcement track suspicious activity and prevent crimes like money laundering.

If you send more than $10,000 in a single international money transfer, your bank must report the transaction to the IRS. Here are the main points:

- Financial institutions must report international wire transfers exceeding $10,000 to the IRS under the Bank Secrecy Act.

- You must file a Foreign Bank Account Report (FBAR) if your foreign accounts go over $10,000 at any time during the year.

- The IRS requires you to report foreign accounts and assets on your tax return to avoid penalties.

- Banks may ask for extra documents for transfers over $10,000.

- Not following these rules can lead to large fines or even jail time.

You should always check for restrictions when sending money. These rules protect you and help keep the financial system safe.

Turkish Requirements

Turkey also has money transfer laws and restrictions for people receiving funds from abroad. You can send money in US dollars or other foreign currencies, but each bank or transfer company may support different currencies. Most banks in Turkey do not set a strict upper limit for personal international wire transfer, but transfers over $50,000 must be reported to the Turkish Revenue Administration. Banks may ask for documents to show where the money came from and why you are sending it.

| Transfer Method | Currency Type | Limit/Requirement | Notes |

|---|---|---|---|

| Bank Transfer | TRY / Foreign Currency | No explicit upper limit; transfers over USD 50,000 must be reported to TRA | Banks may require detailed documentation and justification for large transfers |

If you send more than $50,000 in a single online transfer to a Turkish bank account, the bank must report the transaction to government authorities within 30 days. Banks and other financial companies will check your documents and may ask for proof of the source and purpose of your funds. These steps help Turkey follow international money transfer laws and prevent illegal activity.

Turkey does not have restrictions on bringing money into the country, but you must declare physical cash over $5,000 at the border. The Central Bank of the Republic of Turkey tracks all large international money transfers for balance of payments. If you use a transfer service, you may pay extra fees or taxes on incoming funds. Some banks require the recipient to have an account, while others allow cash pickup.

In 2025, Turkey introduced new restrictions for cryptocurrency transfers. If you use crypto to send money, you face daily and monthly limits, waiting periods, and strict identity checks. These new money transfer laws aim to stop money laundering and keep the financial system safe.

Note: Always check the latest international wire transfer limits and restrictions before you send money to Turkey. Rules can change, and banks may update their requirements.

Requirements to Send Money to Turkey

When you send money to Turkey, you must prepare certain documents and information. These requirements help banks and transfer services follow the law and keep your transfer safe. You should gather all details before starting your transfer to avoid delays.

Sender Identification

You must prove your identity when sending money to Turkey. This step protects you and helps prevent fraud. Most services and banks ask for a government-issued ID. If you send $1,000 USD or more, you must provide extra details. Some services, like PayPal or Western Union, may ask for proof of where your money comes from.

Here is what you usually need:

- Government-issued ID (passport, driver’s license, or state ID)

- Proof of address (utility bill or bank statement)

- For transfers of $1,000 USD or more: your date of birth and sometimes a bank statement or pay slip

- For online transfers: credit card or bank account information

- For large transfers: signatures from both you and the recipient

Note: Always check the required documents for wire transfers with your chosen provider. Some may ask for more details, especially for large amounts.

Recipient Information

You must give complete and correct information about the person in Turkey who will receive the money. This helps make sure the funds reach the right person without problems. The details you need depend on how your recipient will get the money.

You should collect:

- Full name (as shown on their ID)

- Mobile number

- Email address

- Address

- Bank account number and IBAN (for bank transfers)

- Government-issued ID number (sometimes needed for online services)

- Purpose of the transfer (for larger amounts)

If your recipient will pick up cash, they must show a valid photo ID and the transaction reference number. The name you provide must match their ID exactly.

Tip: Double-check all recipient details before you send money to Turkey. Mistakes can delay the transfer or cause it to fail.

Source of Funds

Banks and transfer services in Turkey want to know where your money comes from, especially for large transfers. This step helps stop illegal activity and keeps your transfer legal. You may need to show documents that prove the source of your funds.

Common proofs include:

- Bank statements

- Pay slips or employment contracts

- Tax returns

- Sale agreements or property deeds (if selling assets)

- Probate documents (for inheritance)

- Investment account statements or stock certificates

- Wallet transfer screenshots and exchange confirmations (for cryptocurrency)

- Legal justification letters or compliance records

Here is a table showing common sources of funds and what you may need to show:

| Source of Funds | Common Proofs Requested |

|---|---|

| Salaries and Wages | Pay slips, employment contracts, bank statements |

| Business Revenues | Financial statements, tax returns, bank statements |

| Sale of Assets | Sale agreements, property deeds, bank statements |

| Inheritances | Wills, probate documents, bank statements |

| Investments | Investment account statements, stock certificates, dividends |

| Cryptocurrency | Wallet screenshots, exchange confirmations, tax records |

If you send a large amount to Turkey, the bank or service may ask for more documents. This helps them follow Turkish and international rules. Always keep your documents ready to avoid delays.

Note: Turkish banks, MASAK, and immigration authorities may check your documents to make sure your money is legal and tax compliant.

Cost to Transfer Money

Transfer Fees

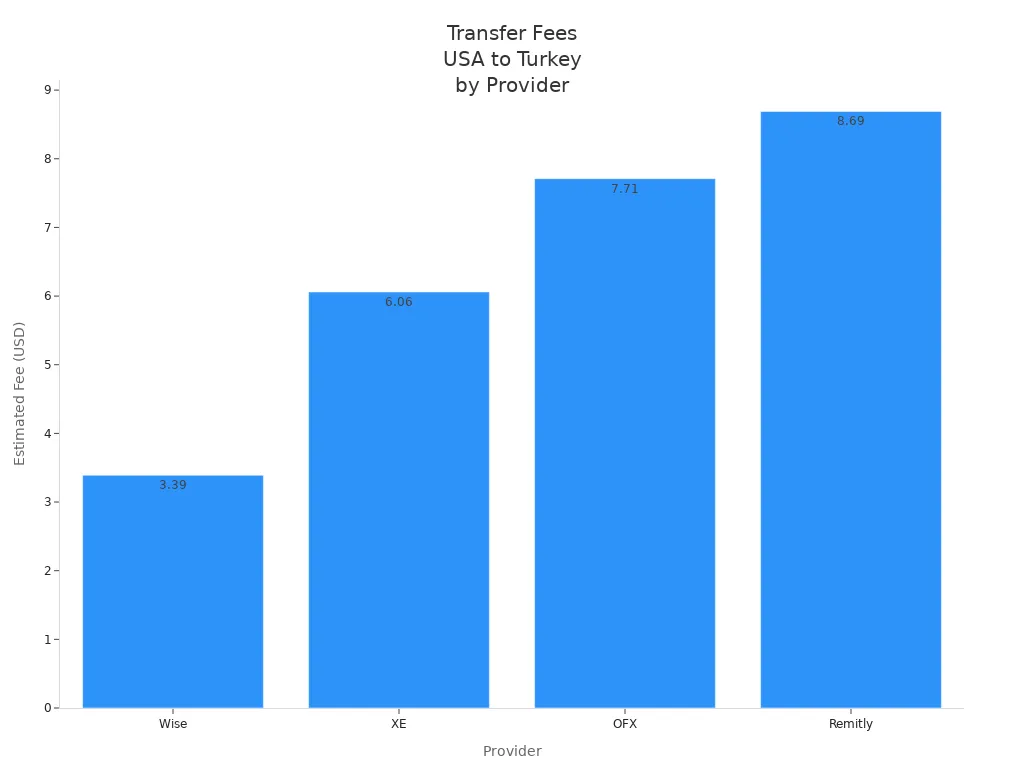

When you send money to Turkey, you will notice that each money transfer service sets its own fees. Some providers charge a flat fee, while others include the fee in the exchange rate. Wise charges a small flat fee, which makes it one of the cheapest options for sending $1,000. Other services like XE, OFX, and Remitly do not charge a direct fee but add a markup to the exchange rate. This markup increases the total costs. Here is a table that compares the estimated total fee for sending $1,000 from the USA to Turkey:

| Provider | Transfer Fee for $5,000 | Exchange Rate Markup Fee for $5,000 | Estimated Total Fee for $1,000 (scaled) |

|---|---|---|---|

| Wise | $16.95 | $0.00 | ~$3.39 |

| XE | $0.00 | $30.28 | ~$6.06 |

| OFX | $0.00 | $38.55 | ~$7.71 |

| Remitly | $0.00 | $43.45 | ~$8.69 |

You can see that Wise offers competitive fees, while other providers may appear cheaper at first but include hidden costs in the exchange rate.

Exchange Rates

The exchange rate affects how much your recipient gets in Turkey. Many providers use a weaker rate than the real mid-market rate. This difference is called an exchange rate markup. For example, Remitly uses a rate about 1.08% lower than the mid-market rate. This means you pay about $109 more on a $10,000 transfer. Wise uses the real mid-market rate, so you avoid hidden markups. Western Union and other services often add a margin to the rate, which increases your total cost to transfer money. Always check the rate before you send funds.

Ways to Save

You can save money by comparing providers and understanding all costs. Choose a money transfer service that shows you the total fee and the exchange rate before you send money to Turkey. Look for services that use the mid-market rate and have low or no markup. Some providers offer promotions for your first transfer, which can lower your costs. Always read the fine print to avoid hidden charges. If you send large amounts, check if the provider lowers the fee for bigger transfers. Planning ahead and using online services can help you get the best deal when sending money to Turkey.

Transfer Process

Step-by-Step Guide

You can follow a clear process when you want to send money to Turkey. Start by choosing the best way to send money. Think about how fast you need the transfer and how your recipient wants to receive the funds. Next, gather all the required documents. You need your government-issued ID, proof of address, and your recipient’s details. Make sure you have the correct bank account number and IBAN if you use a bank transfer.

After you collect your documents, log in to your chosen transfer service or visit your bank. Enter the amount you want to send and fill in the recipient’s information. Double-check all details before you confirm the transfer. Many services show you the total cost, including fees and the exchange rate, before you pay. This step helps you avoid surprises. Pay for the transfer using your preferred method, such as a bank account, debit card, or credit card. Keep the receipt or confirmation number. This number helps you track your transfer later.

Tip: Always review the transfer summary before you send money. Mistakes can delay the process or cause the funds to go to the wrong person.

Tracking Transfers

Tracking your transfer gives you peace of mind. When sending money internationally to Turkey, you receive a reference number after you complete the transaction. This number is important for tracking the status of your payment.

Here are the main steps to track your transfer:

- Save the Federal Reference number (fed number) you get after sending the money.

- Contact your bank or transfer service and ask for a wire trace using the fed number. Some banks may charge a fee for this service.

- If your recipient in Turkey has not received the funds, give them the fed number, the sender’s bank SWIFT code, the expected arrival date, and the amount sent.

- The recipient can provide these details to their bank in Turkey to help locate the transfer.

- For transfers using the SWIFT network, you can request an MT103 document. This document shows the payment’s journey.

- Sometimes, banks in Turkey hold funds for a day or two before posting them to the recipient’s account.

- If the transfer cannot be found, the sender should ask their bank to start a wire trace.

Note: Always keep your transaction details safe. They help you resolve any issues quickly if your transfer faces delays.

Confirm Receipt

Verifying Delivery

You want to make sure your recipient in Turkey receives the money you send. The most direct way is to ask your recipient to check their bank account. If the funds appear in their account, this confirms the transfer is complete. For cash pickups, your recipient can visit a UPT service location in Turkey. They need to bring a valid ID and the reference number you provided. When the agent gives them the cash, this serves as proof that the transfer worked. Some services process transfers quickly, so your recipient may get the money within minutes. While some providers do not send automatic SMS or email notifications, you can always ask your recipient to confirm once they have the funds.

Tip: Always keep your transaction reference number. This helps both you and your recipient track the transfer if needed.

Troubleshooting Issues

Sometimes, problems can happen when you send money to Turkey. Here are the most common issues and steps you can take to solve them:

- The recipient does not receive the funds, even though you completed the transfer.

- Delays occur because of banking compliance checks or anti-money laundering rules.

- The transfer cannot go through because of sanctions or restrictions on certain banking systems.

- The recipient uses a non-traditional bank, which may cause extra complications.

If you face any of these problems, follow these steps:

- Collect all documents, such as receipts, reference numbers, and any messages from your transfer service.

- Contact your provider and ask them to trace the transfer. They can find out where the money is held or blocked.

- Ask your recipient to check with their bank in Turkey. Sometimes, banks need more documents before they release the funds.

- If you do not get help, you can contact Turkey’s Banking Regulation and Supervision Agency (BDDK) for support.

- Keep your communication polite and save all records. This helps avoid misunderstandings.

- If the issue continues, you may need legal help or mediation.

Note: Delays can happen because of international banking rules. Sometimes, banks may refund or cancel a transfer without warning. Your recipient may also need to fill out forms to meet anti-money laundering requirements.

When sending money to Turkey, you should follow a clear process to keep your transfer safe and cost-effective.

- Gather all required documents and double-check recipient details, including IBAN and SWIFT codes.

- Compare fees, exchange rates, and transfer times across providers.

- Choose secure payment methods and keep all confirmation numbers.

- Monitor your transfer and contact support if issues arise.

Always follow regulations and prepare documents in advance. Careful planning helps you send money to Turkey smoothly and avoid delays.

FAQ

How long does it take to send money to Turkey from the USA?

Most transfers arrive within 1 to 5 business days. Some online services deliver funds in minutes. Bank transfers may take longer, especially if you send money on weekends or holidays.

What information do you need to send money to a Turkish bank account?

You need the recipient’s full name, bank name, account number, and IBAN. Some banks also ask for the recipient’s address and phone number. Always double-check these details before you send money.

Are there limits on how much money you can send to Turkey?

Yes. Most online services set daily limits between $1,000 and $10,000. Transfers over $10,000 require IRS reporting. Turkish banks report transfers above $50,000 to authorities. Always check your provider’s limits before you send large amounts.

How do you get the best exchange rate when sending money to Turkey?

Compare providers before you send money. Choose services that use the real mid-market exchange rate. Watch for hidden fees in the rate. Wise and similar platforms often offer better rates than traditional banks.

When sending money abroad, delays and hidden fees often create frustration. With BiyaPay, you can transfer funds to Turkey—or nearly any country worldwide—with real-time exchange rates, fees as low as 0.5%, and same-day delivery in most cases. BiyaPay covers the majority of countries and regions, ensuring your money arrives quickly and securely without the long wait of traditional bank wires.

Start making fast, affordable transfers today—sign up now at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.