- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Consejos para Transferir Dinero Desde México a Estados Unidos

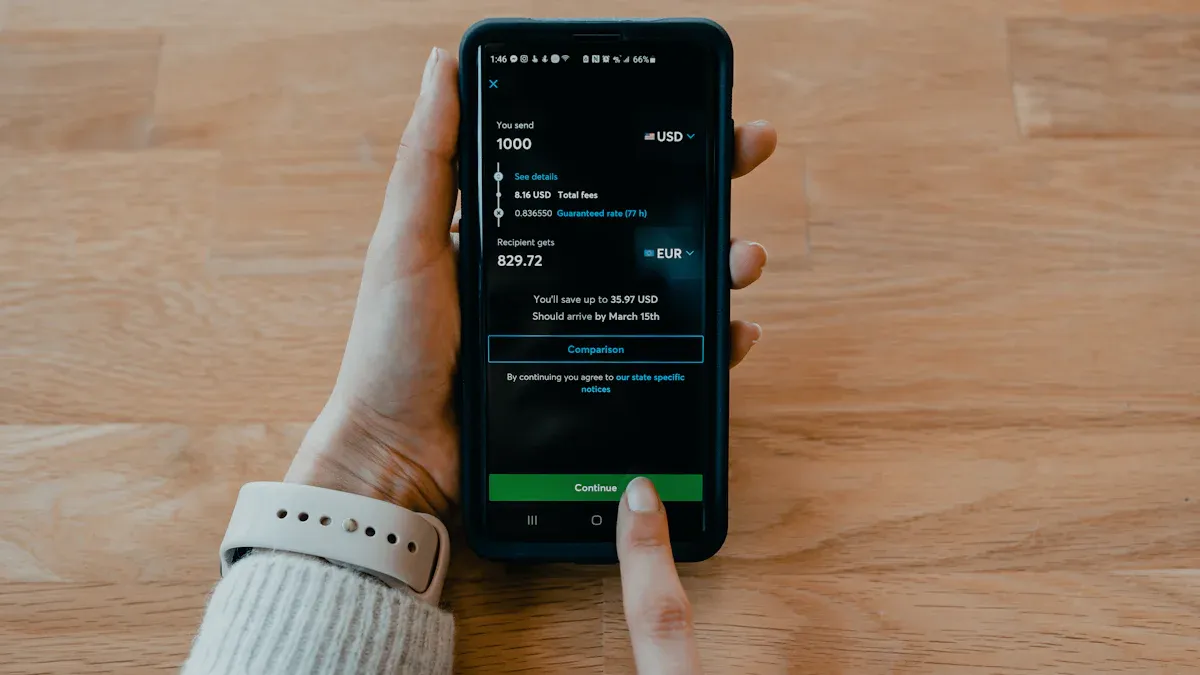

Image Source: unsplash

If you want the safest, fastest, and most affordable way to send money from Mexico to the United States, you need to look at your own priorities first. Some people care most about speed and choose online services or cash pickups that deliver funds within minutes, even if fees run higher. Others focus on saving money by comparing providers, checking both transfer fees and exchange rates, or waiting for better rates before Transferring Money. Always double-check recipient details to avoid mistakes. Your best method depends on what matters most—speed, cost, or convenience.

Key Takeaways

- Choose your money transfer method based on what matters most: speed, cost, or convenience.

- Compare fees and exchange rates from banks, money transfer services, and online apps to save money.

- Always provide accurate recipient details and valid ID to avoid delays or errors.

- Use trusted providers like Western Union, MoneyGram, and Wise for safe and fast transfers.

- Track your transfer with the reference number and contact customer support quickly if problems arise.

Transferring Money Methods

Image Source: unsplash

When you start Transferring Money from Mexico to the United States, you have several options. Each method comes with its own requirements, fees, and speeds. Let’s break down the main choices so you can pick what works best for you.

Bank Transfers

If you already have a bank account, you might consider sending money through a bank transfer. This method feels familiar and secure, but it often costs more and takes longer. Banks usually charge higher fees, sometimes between $10 and $35 USD, and may add hidden exchange rate markups. Transfers can take three to five business days to reach the recipient. You will need your official ID and the recipient’s bank details. Most banks require both you and the recipient to have accounts.

Note: Bank transfers work best for large amounts, but you may face limits and slower tracking.

| Aspect | Bank Transfers |

|---|---|

| Fees | $10–$35 USD + exchange markup |

| Speed | 3–5 business days |

| Requirements | ID, recipient’s bank info |

| Receiving Options | Bank account only |

Money Transfer Services

Money transfer services like Western Union, Elektra, Banco Azteca, and Xoom make Transferring Money fast and flexible. You can send cash or pay with a card, and your recipient can pick up cash or receive funds in their bank account. Fees and exchange rates vary, but you often see the total cost upfront. Transfers can arrive within minutes or up to one day. You need an ID and the recipient’s details.

| Service | Fees (USD) | Speed | Receiving Options |

|---|---|---|---|

| Western Union | From $1.99 | Minutes–1 day | Cash pickup, bank deposit |

| Xoom | Varies | Instant–1 day | Cash pickup, bank deposit |

| Remitly | From $3.99 | Minutes–5 days | Cash pickup, bank deposit |

Online Apps

Online apps like Wise, Remitly, and MoneyGram offer easy Transferring Money from your phone or computer. These apps show you fees and exchange rates before you send. Many transfers arrive instantly or within a day. You need an ID, recipient info, and sometimes a bank account or card. Some apps let your recipient pick up cash or get money in a mobile wallet.

| App Name | Fees (USD) | Speed | Security Features |

|---|---|---|---|

| Wise | From 0.33% | Instant–1 day | Two-factor authentication |

| MoneyGram | From $4.99 | Minutes–days | Fraud monitoring |

| Remitly | From $3.99 | Minutes–5 days | Delivery guarantee |

Tip: Online apps often have lower fees and faster delivery than banks. Always check the limits and security features before you send.

How to Send

Bank Transfer Steps

Sending money through a bank transfer feels secure, but you need to follow some important steps. Here’s how you can do it:

- Gather your documents. You need your official ID, your full name, address, and phone number. The bank may also ask for proof of where your money comes from. For example, if you are sending money from a property sale, bring the sales contract and bank statements. If it’s from your salary, you might need payslips or an employment contract.

- Collect the recipient’s details. Write down their full name, address, and phone number. You also need the recipient’s bank name, account number, and routing number. For international transfers, you must have the SWIFT/BIC code and sometimes the IBAN number.

- Visit your bank or use online banking. Fill out the transfer form with all the information you collected.

- Double-check every detail. Make sure the recipient’s name and bank numbers are correct. Mistakes can delay your transfer or send money to the wrong person.

- Decide how much you want to send. Some banks may ask for the reason for your transfer.

- Submit your transfer and keep your receipt. You can use this to track your money later.

Note: Banks may ask for extra documents if you send a large amount. Always check with your bank before you start.

Money Service Steps

Money transfer services like Western Union, Elektra, and Xoom make Transferring Money quick and easy. Here’s what you need to do:

- Bring your official ID. You need it to start the transfer.

- Write down the recipient’s full name as it appears on their ID. You also need their address and phone number.

- Choose how your recipient will get the money. They can pick up cash at a location or receive it in their bank account.

- Go to a service location or use the provider’s website or app.

- Fill out the transfer form. Enter the amount you want to send and pay attention to the fees.

- Check the maximum transfer limit. For example, Western Union lets you send up to $50,000 USD if your account is verified.

- Pay for your transfer. You can use cash, a debit card, or sometimes a credit card.

- Get your receipt and tracking number. Share the tracking number with your recipient so they can pick up the money.

| Provider | Maximum Single Transaction Limit (USD) |

|---|---|

| Western Union | Up to 50,000 USD |

| Xoom (PayPal) | No exact limits specified |

| MoneyGram | Varies by payment type |

| Elektra | Limits depend on location |

Tip: Always check the provider’s website for the latest limits and requirements.

App Transfer Steps

If you like using your phone or computer, online apps make sending money simple. Here’s how you can do it:

- Download the app or visit the website. Create an account if you don’t have one.

- Verify your identity. You need your ID, full name, address, and sometimes a photo.

- Add your payment method. You can link your bank account, debit card, or credit card.

- Enter the recipient’s details. You need their full name, address, and sometimes their bank account information. Some apps also ask for a valid U.S. mobile number.

- Choose how much to send. Apps like Wise let you send up to $1,000,000 USD in one transaction. PayPal allows up to $60,000 USD for verified accounts, but sometimes limits transfers to $10,000 USD each.

- Review the fees and exchange rate. Most apps show you the total cost before you send.

- Double-check all the information. Make sure everything is correct to avoid delays.

- Confirm and send your transfer. The app will give you a receipt and tracking number.

| App Name | Maximum Single Transaction Limit (USD) |

|---|---|

| Wise | Up to 1,000,000 USD |

| PayPal | Up to 60,000 USD (verified accounts) |

| Comun app | 10,000 USD per transfer per day |

| Majority app | No specified maximum |

Note: Some apps may ask for extra documents if you send large amounts or if your transfer looks unusual.

Requirements

When you send money from Mexico to the United States, you need to meet some important requirements. These rules help keep your transfer safe and legal. Let’s look at what you need before you start.

Identification

You always need to show who you are when you send money. Most banks and money transfer services will ask for your official ID. This could be your passport, voter ID, or driver’s license. If you use an app, you might need to upload a photo of your ID and take a selfie for extra security.

Note: U.S. and Mexican laws require providers to check your identity. This helps prevent money laundering and fraud. If you send more than $10,000 USD, the provider must report your transfer to the IRS. This rule comes from the Electronic Fund Transfer Act and other U.S. laws. If you do not follow these rules, you could face fines or delays.

Recipient Details

You must give clear and correct information about the person who will get the money. Write their full name exactly as it appears on their ID. You also need their address and phone number. Some services may ask for extra details if you send a large amount.

- Double-check the spelling of the recipient’s name.

- Make sure the address matches their ID.

- Give a working phone number so the provider can contact them if needed.

Mexican banks also collect identification from recipients, especially for non-customer transactions. This helps them follow anti-money laundering rules.

Account Info

If you send money to a bank account, you need the recipient’s account details. This usually includes:

| Required Info | Description |

|---|---|

| Bank Name | The name of the recipient’s bank |

| Account Number | The recipient’s bank account number |

| Routing/SWIFT/BIC | Codes for international transfers |

| Sometimes IBAN | For some banks, especially in Europe |

For cash pickups, you may not need account numbers, but you still need the recipient’s ID details. Mexican rules limit cash deposits in U.S. dollars, so many people use wire transfers or apps instead. U.S. banks and apps also watch for unusual activity and may ask for more documents if something looks suspicious.

Tip: Always check the latest requirements with your provider. Rules can change, and missing information can delay your transfer.

Fees and Rates

Image Source: pexels

When you send money from Mexico to the United States, you want to know exactly how much it will cost and how long it will take. Let’s break down the main things you need to check before Transferring Money.

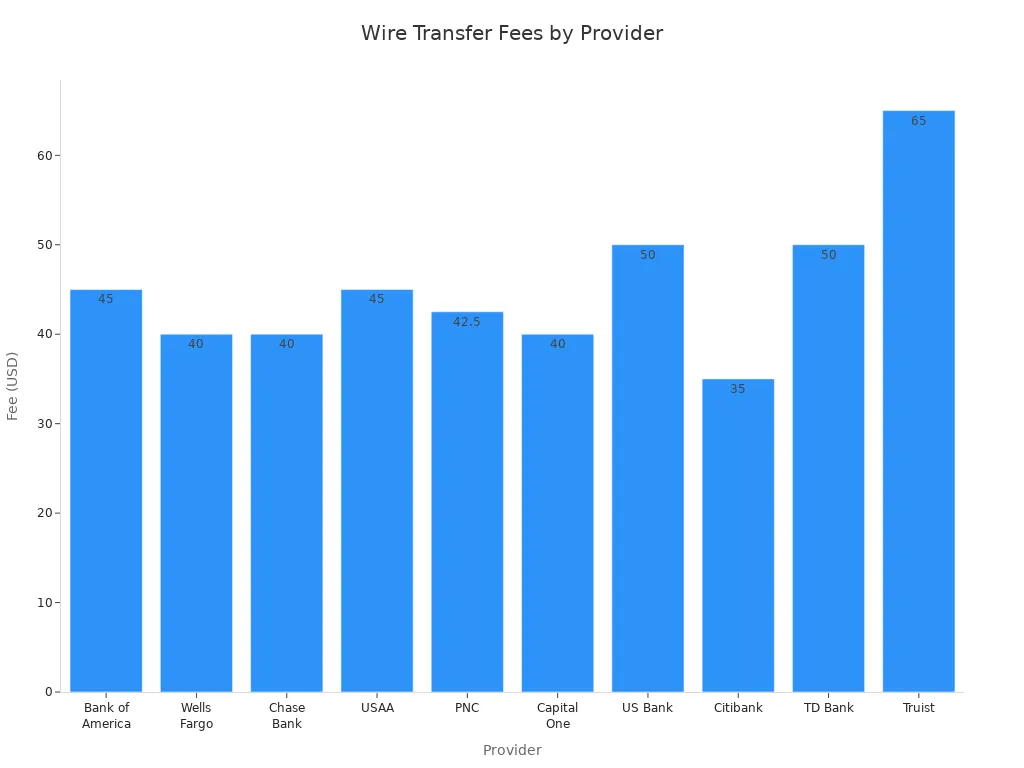

Transfer Fees

Transfer fees can change a lot depending on the provider you choose. Banks usually charge higher fees for sending money internationally. For example, major US banks can charge between $35 and $65 for each transfer. Here’s a quick look at what some banks charge:

| Provider | Outgoing International Wire Transfer Fee (USD) |

|---|---|

| Bank of America | $45 |

| Wells Fargo | $35 - $45 |

| Chase Bank | $40 |

| USAA | $45 |

| PNC | $40 - $45 |

| Capital One | $40 |

| US Bank | $50 |

| Citibank | $35 |

| TD Bank | $50 |

| Truist | $65 |

Online money transfer services often charge much less. Some apps even let you send money for free between accounts, or offer discounts if you use a premium plan. Always check if there are extra fees for sending money on weekends or for large amounts.

Exchange Rates

The exchange rate tells you how many US dollars your Mexican pesos will get. Providers often add a small fee to the real exchange rate, which can increase your total cost by about 4%. Banks usually have less competitive rates than online services. Online apps show you the exchange rate before you send, so you know exactly what your recipient will get.

Tip: Always compare the exchange rates and total costs between providers. Even a small difference in the rate can make a big impact if you send large amounts.

Delivery Times

How fast your money arrives depends on the method you pick. Banks can take three to five days to complete a transfer. Online services usually deliver money much faster—sometimes in just a few minutes or hours. Here’s a quick comparison:

| Aspect | Traditional Banks | Online Money Transfer Services |

|---|---|---|

| Cost | Higher fees, less competitive exchange rates | Lower fees, better exchange rates |

| Speed | Slower transfers, often several days via SWIFT | Faster transfers, often minutes to hours |

| User Satisfaction | Preferred for security and personal service | Favored for convenience, speed, and transparency |

| Transparency | Less transparent fee structures and exchange rates | More transparent fees and exchange rate margins |

| Ideal Use Cases | Large transfers, users valuing face-to-face help | Smaller, frequent transfers, tech-savvy users |

You can save money and time by choosing an online service, especially for smaller or frequent transfers. Always check the delivery time before you send, so your recipient knows when to expect the money.

Security Tips

Avoiding Scams

You want your money to reach your loved ones safely. Scammers often target people sending money from Mexico to the United States. They use tricks to steal your funds or personal information. Watch out for these common scams:

- Fake companies promise to send your money, then disappear after you pay.

- Lottery or sweepstakes scams send you fake checks and ask you to wire back fees.

- Overpayment scams involve fake checks and requests to wire back the extra amount.

- Relationship scams where someone pretends to be a loved one needing urgent help.

- Mystery shopper scams ask you to deposit fake checks and wire money.

- Online sellers who insist on money transfers only.

Stay alert for these warning signs:

- Urgent or secretive requests for money.

- Requests to wire money to strangers or people you have not met in person.

- Messages with poor spelling or grammar.

- Being asked to deposit a check and wire money back.

- Requests for confirmation codes or money transfer numbers.

Remember: Sending money by wire is like sending cash. Once it’s gone, you usually cannot get it back.

Safe Providers

Choosing a safe provider helps protect your money. Many well-known companies follow strict rules in both Mexico and the United States. You can trust these providers when you use them as directed:

- Western Union, MoneyGram, Ria, PayPal, Viamericas, Xoom, Wells Fargo ExpressSend, Remitly, WorldRemit, XE, and Wise.

- Wise stands out for transparent fees and real exchange rates.

- Remitly and WorldRemit offer speed and convenience.

- Western Union has a strong reputation and a large network.

Always check that your provider is fully authorized and regulated in both countries. Read customer reviews and the terms before you send money. Compare several providers to find the best mix of safety, fees, and features.

Communication

You can keep your transfer details safe by following a few simple steps:

- Never click on links in emails or texts about money transfers. Go straight to the official website or app.

- If you send money to a new person, call or securely message them using a trusted number to confirm their bank details.

- For large transfers, send a small test amount first to make sure everything works.

- Be careful if someone asks you to change wire instructions after you have received them, especially for big purchases.

Tip: Always double-check details before you send money. Careful communication keeps your transfer safe.

Saving Money

Compare Providers

You can save a lot of money by comparing different money transfer providers before you send funds. Each provider offers different exchange rates, fees, and transfer speeds. Some services, like RemitAnalyst, let you compare real-time rates and fees from many companies. This platform even predicts future exchange rates, so you can plan your transfer for the best time. Wise also has a comparison tool that shows you hidden fees and exchange rate markups. These tools help you see which provider gives you the most money for your pesos and which one delivers the fastest.

- Find the best exchange rate and lowest fee.

- Check if the provider shows all costs upfront.

- Sort by speed or total amount received.

- Use platforms that redirect you to the provider’s site for easy completion.

Tip: Reading reviews and using comparison tools can help you avoid surprises and make smarter choices when Transferring Money.

Timing Transfers

Exchange rates change every day. The amount your recipient gets can go up or down based on market trends, inflation, or even political news. If you watch the rates and send money when they are higher, your recipient will get more dollars. Some platforms use machine learning to predict when rates might improve. You can also set alerts to notify you when rates reach a certain level.

Here are some tips for timing your transfer:

- Monitor exchange rates regularly.

- Try sending money mid-month or on Mondays, when fees and delays are often lower.

- Avoid sending at the end or start of the month, as banks are busier and may charge more.

- Don’t wait too long for a perfect rate—acting when rates are good is usually better than waiting.

Avoid Hidden Charges

Hidden charges can eat into the money your recipient gets. Always check for these extra costs:

| Hidden Charge Type | Description | Impact/Example |

|---|---|---|

| Marked-Up Exchange Rates | Providers add a markup to the real rate. | Can cost you up to 5% extra on large transfers. |

| Intermediary Bank Fees | Third-party banks may take a cut during the transfer. | Amount received may be less than expected. |

| Recipient Fees | The receiving bank may charge to accept the funds. | Varies by bank. |

| Payment Method Fees | Extra charges for using cash, card, or store payments. | Increases total cost. |

| Cash Pickup Fees | Fees at payout locations for cash collection. | Reduces the final amount received. |

Always read the fine print and choose services that show all fees upfront. This way, you avoid surprises and make sure your recipient gets the full amount.

If Problems Happen

Tracking Transfers

Sometimes, money transfers do not arrive as quickly as you expect. You can track your transfer to see where it is and what might be causing a delay. Most services give you a unique reference number when you send money. You can use this number to check the status online, in an app, or by calling customer support.

- Every transfer creates a reference number, sometimes called a Federal Reference number or fed number.

- You can track your transfer on the provider’s website, app, or by contacting their support team.

- Some services, like Wise, send you notifications when your transfer is complete.

- For SWIFT transfers, you can ask for an MT103 document to trace your payment.

- Both you and your recipient can use the reference number to check the status.

Delays can happen for many reasons: errors in recipient details, bank holidays, weekends, currency conversion, or time zone differences. Always double-check all information before sending.

Customer Support

If you have a problem, you can reach out to customer support for help. Most major money transfer providers offer several ways to get assistance:

| Support Channel Type | Number of Providers Offering |

|---|---|

| Online Support | 52 |

| Phone Support (Business Hours) | 32 |

| 24/7 Live Representative Support | 23 |

You can usually find help through online chat, email, or by calling a support number. Some services even offer 24/7 live help. The Federal Reserve’s Directo a México service also has a FAQ page and contact list for more support. Always keep your transaction details handy when you contact support.

Recovering Funds

If your transfer goes to the wrong person or fails, act quickly. Here are the steps you should take:

- Contact your provider’s support team with your receipt and all transaction details.

- The provider will investigate and may charge a processing fee to recall the transfer.

- If an error is found, the provider must refund your money or send it to the correct recipient, usually within one business day.

- If you gave the wrong information, the provider should fix the error or refund you within three business days after their investigation.

- Providers must also refund any fees or taxes charged if the transfer failed.

- Recovery is not always guaranteed, so always check details before sending.

Keep all receipts and confirmation numbers. Quick action gives you the best chance to recover your money if something goes wrong.

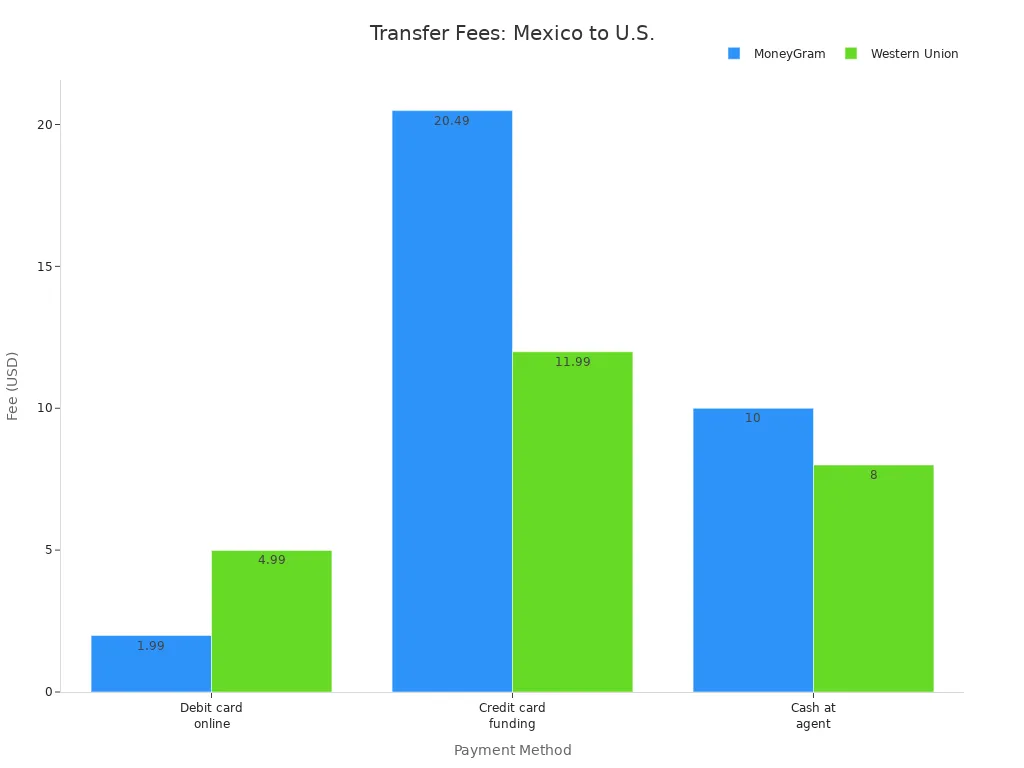

You have many safe and fast options for sending money from Mexico to the United States. Trusted services like MoneyGram and Western Union offer strong security, wide access, and quick transfers. Check out the table below to compare their fees and features:

| Aspect | MoneyGram | Western Union |

|---|---|---|

| Safety | Fraud protection, encryption, monitoring | Fraud protection, encryption, monitoring |

| Fees (debit card) | $1.99 | $4.99 |

| Fees (credit card) | $20.49 | $11.99 |

| Fees (cash at agent) | $10 | $8 |

| Speed | Minutes to hours | Minutes to 7 days |

| Limits | $10,000/30 days | $50,000 (verified) |

Always compare providers, watch for hidden fees, and double-check recipient details. Use secure apps or agents, and follow safety tips. If you have questions, review the FAQs for answers about exchange rates, taxes, and account options.

FAQ

How much money can you send from Mexico to the United States at once?

Most services let you send up to $10,000 USD per transfer. Some apps, like Wise, allow higher limits if you verify your identity. Always check your provider’s rules before sending large amounts.

What documents do you need to send money?

You need a valid ID, such as a passport or driver’s license. Some providers may ask for proof of address or the source of your funds. Always have your recipient’s full name and bank details ready.

How long does a transfer usually take?

Bank transfers can take three to five business days. Online apps and money transfer services often deliver money within minutes or a few hours. Check the estimated delivery time before you send.

Can you cancel or change a transfer after sending?

You can sometimes cancel or change a transfer if it has not been completed. Contact your provider’s customer support right away. If the money has already been picked up or deposited, you cannot reverse it.

What should you do if your recipient does not get the money?

First, track your transfer using the reference number. If there is a delay, contact customer support with your transaction details. Most providers will help you find out what happened and fix the problem.

When sending money from Mexico to the United States, hidden fees and slow delivery times can quickly add up. With BiyaPay, you get real-time exchange rates for both fiat and digital currencies, international remittance fees as low as 0.5%, and same-day transfers across most countries and regions. On top of that, registration is quick and secure, so you can start transferring without delays.

Make your cross-border transfers faster, cheaper, and more transparent—sign up today at BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.