- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Find Out How to Track Your Ria Money Transfers Online and More!

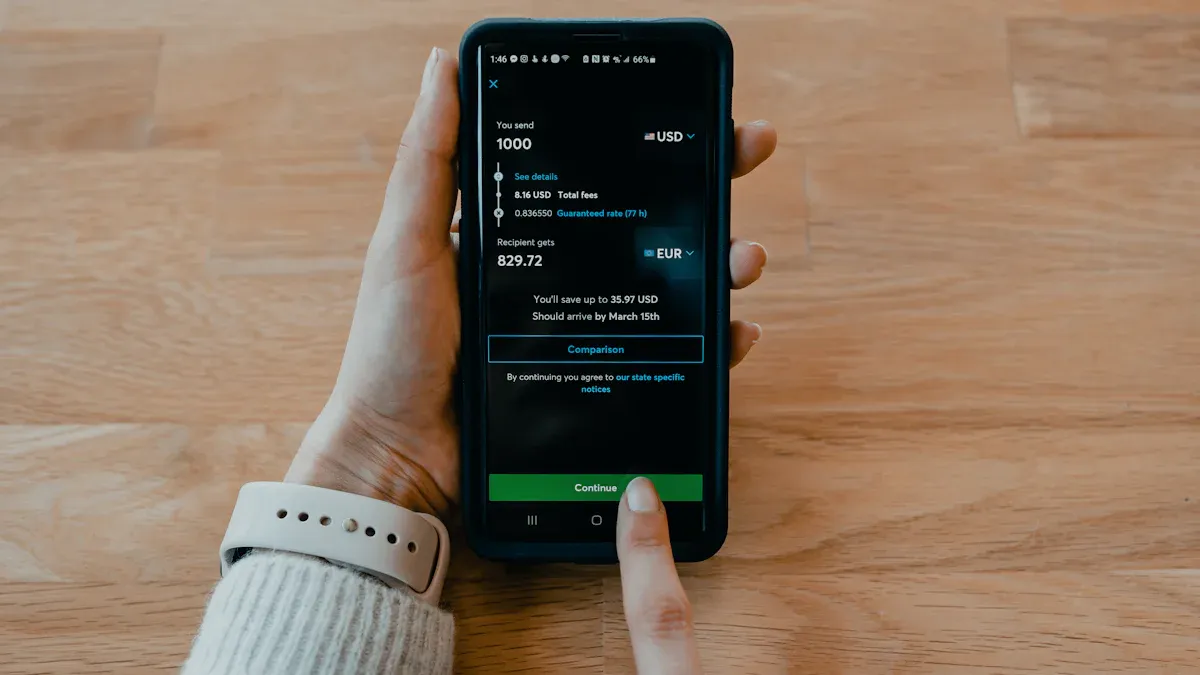

Image Source: pexels

Tracking your ria money transfers online saves you time and gives you peace of mind. You only need your PIN or order number, which you can find on your receipt. When you use the Track Ria Transfers feature, you get real-time updates on your money. If you ever face a problem, ria offers support to help you solve it. You can feel confident knowing your money moves safely with ria.

Key Takeaways

- Use your PIN or order number from your receipt to track Ria money transfers anytime on the website or mobile app.

- Check transfer status in real time and set up SMS alerts to get instant updates on your money.

- Double-check all details before tracking to avoid mistakes and delays in your transfer.

- Keep your PIN and order number safe and never share them with others to protect your money.

- Contact Ria support quickly if you face issues; they offer 24/7 help by phone, chat, or email.

Track Ria Transfers Online

Image Source: unsplash

Tracking your money with Ria gives you control and peace of mind. You can use the Ria website or the Ria money transfer mobile app to check the status of your transfers at any time. Both options let you track Ria transfers in real time, so you always know where your money is.

Track a Transfer on the Ria Website

You can track a transfer on the Ria website in just a few steps. The process is simple and works on any device with internet access. Here is how you do it:

- Go to the official Ria website at www.riamoneytransfer.com.

- Find the ‘Track a Transfer’ page in the top menu on the homepage.

- Enter your order number or PIN in the field provided.

- Press the ‘Track transfer’ button to see the current status and details of your money transfer.

Tip: You can find your PIN or order number on your receipt, usually at the top right corner. Keep this information safe, as you will need it every time you want to track Ria money transfers.

The Ria website gives you real-time updates about your transfers. You can see the progress and the expected delivery date with just one click. The track a transfer tool is available 24/7, so you can check your money whenever you want.

Track a Transfer in the Ria App

The Ria money transfer mobile app makes it easy to track your transfers on the go. You can download the app from the App Store or Google Play. Once you have the app, follow these steps to track a transfer in the Ria app:

- Open the Ria money transfer mobile app and log in to your account.

- Tap the ‘Track’ option on the main screen or in the menu.

- Enter your PIN or order number when prompted.

- View the status and details of your transfer instantly.

The app lets you track Ria transfers in real time, just like the website. You can also set up SMS alerts to get updates about your money. This way, you never miss a change in your transfer status.

Note: The PIN or order number is always on your receipt. If you use the app, you can also find it in your account history.

Common Mistakes to Avoid

When you track Ria money transfers, you may run into some common problems. Here are a few mistakes people make:

- Entering the wrong recipient details, such as the recipient’s name or bank account number.

- Expecting the sender’s name to show on the recipient’s bank statement. The transfer usually appears as coming from RIA Financial Services or its partners.

- Not accounting for possible fees that the recipient’s bank or intermediaries may deduct from the amount sent.

- Not considering that transfer processing can take time, which may cause confusion when tracking the transfer online.

Tip: Double-check all details before you use the track a transfer tool. This helps you avoid delays and confusion.

Ria makes tracking easy and accessible. You can use any device to track Ria transfers, and you get real-time notifications about your money. Ria works with partners like Xe and Google to improve accessibility, so you can always monitor your transfers and make sure your money arrives safely.

Track Ria Money Transfers: What You Need

Image Source: pexels

Required Information

To track ria transfers, you need specific details. The most important pieces of information are your PIN and order number. These numbers help you check the status of your money and make sure it reaches the right person. When you want to track ria money transfers, always have these details ready.

Tip: Never share your PIN or order number with anyone except the intended recipient. If someone else gets this information, they could access your money or even collect it without your permission. Ria uses secure systems and identity checks to protect your transfers, but you should stay careful. Use the app’s ‘Share Order Details’ feature if you need to send information safely. Avoid sharing sensitive details through public or unsecured channels.

Ria protects your privacy by encrypting your personal data and storing it on secure servers. Only authorized staff can access your information. The company follows strict rules and uses firewalls to keep your data safe. Even though no system is perfect, these steps help keep your money and details secure while you track ria transfers.

Where to Find Your PIN or Order Number

You can find your PIN and order number in several places, depending on how you sent your money. Here is where you should look:

- Check your confirmation email after you complete a transfer. The email includes both your PIN and order number.

- Open your online account or the Ria app. Go to the Activity Feed and select the transfer you want to track. You will see the details there.

- If you sent money at a Ria location, look at your printed receipt. The order number appears at the top right, and the PIN is just below it.

The Ria Help Center has articles that show you exactly where to find your PIN or order number. These guides explain how to use the ‘Track a Transfer’ tool and what information you need. For cash pickups, the recipient must give the PIN or order number, their legal name, and the pickup location.

| Method | Where to Find PIN/Order Number |

|---|---|

| In-person transfer | Printed receipt (top right corner) |

| Online transfer | Confirmation email, Activity Feed |

| Ria app | Activity Feed, transfer details |

When you track ria transfers, always double-check your numbers. This helps you avoid mistakes and keeps your money safe.

Troubleshooting Track a Transfer

If Tracking Doesn’t Work

Sometimes, you may not see your money transfer status when you try to track a transfer online or in the app. Several common issues can cause this:

- Transfers canceled because you sent money for goods or services instead of personal reasons

- Sending money to unknown recipients or possible scams

- Transfers to countries with high fraud rates may get flagged and canceled

- Billing address mismatch between your payment method and your ria account

- Not paying the full amount or missing the payment deadline

- Not providing requested verification documents

Technical problems can also stop you from tracking your money. These include app crashes, login issues, network errors, or using an outdated app version. Try force stopping the app, clearing cache, updating your app and device, or checking your internet connection. If you use a VPN, turn it off and try again.

Always double-check your PIN or order number and make sure you enter the correct recipient details. This helps you track transfer status without delays.

Delays or Missing Transfers

If your money does not arrive on time, check the transfer status using your order number or PIN. Payment method affects timing. Bank transfers or direct debits can take up to 4 working days. Debit or credit card payments usually process instantly. Sometimes, recipient banks need up to two extra days to process the money. Weekends, public holidays, and local business hours can also slow things down.

- Watch your email, including spam folders, for messages from ria. They may ask for more information.

- Respond quickly if ria requests documents. If you do not reply within 7 days, ria may cancel your transfer.

- Enable push notifications in the ria app for updates.

- Remind your recipient to check for ria payments and use the track a transfer tool to confirm the status.

Contacting Support

If you still cannot track your money or need help, contact ria customer support. You can reach them in several ways:

| Contact Method | Details |

|---|---|

| Phone (General) | Call 1-877-443-1399 for tracking issues and general questions. |

| Phone (Order Inquiries) | Call 1-855-355-2144 for order-specific help. |

| Live Chat | Use the chat icon on the ria website for quick support in over 100 languages. |

| Send your questions to customerservice@riamoneytransfer.com. |

Phone support is available 24/7. Live chat works Sunday to Friday, and on Saturdays from 6 am to 8 pm PST. Have your order number, PIN, and your name ready when you contact support. If your issue is not resolved, you can file a complaint with your state’s regulatory agency.

Extra Tips and Alternatives

SMS Alerts

You can make tracking your ria money transfers even easier by signing up for SMS alerts. These alerts send real-time updates straight to your phone, so you always know the status of your money. Many users find SMS alerts helpful because they keep you informed without needing to check the app or website.

- You can enroll in Ria’s SMS alert programs, such as RIALERT, Walmart Ria Alerts, or Kroger Ria Alerts.

- Enrollment is simple. For RIALERT, you just text “YES” to 45850 after you get an opt-in message.

- SMS alerts give you timely updates about your transfers, making it easier to send and track secure transfers.

- You control your messaging preferences. You can opt out by texting “STOP” or get help by texting “HELP.”

- Most major mobile carriers support these programs, so you can use them almost anywhere.

- Message frequency is limited. For example, RIALERT sends up to 15 messages per transaction, while Walmart and Kroger alerts send up to three messages over three days.

- You are responsible for any SMS or data fees from your carrier.

Here is a quick guide to the main SMS alert programs:

| SMS Alert Program | Opt-in Method | Opt-out Method | Message Frequency | Contact Information |

|---|---|---|---|---|

| RIALERT | Text “YES” to 45850 | Text “STOP” to 45850 | Up to 15 per transaction | 1-877-443-1399, us_support@riamoneytransfer.com |

| Walmart Ria Alerts | Auto opt-in via Walmart Ria Alerts | Text “STOP” to 48769 | Up to 3 over 3 days per transaction | 1-877-443-1399, us_support@riamoneytransfer.com |

| Kroger Ria Alerts | Auto opt-in via Kroger Ria Alerts | Text “STOP” to 55176 | Up to 3 over 3 days per transaction | 1-844-297-1287, us_support@riamoneytransfer.com |

SMS alerts improve your experience by giving you immediate updates, control, and support options.

Other Money Transfer Services

If you want more ways to send money overseas or track your transfers, you have several reputable options. These services let you send money overseas and track your money online. Each service offers different features, such as transparent fees, online tracking, and support for many countries. You can compare their pros and cons to find the best fit for your needs.

| Service | Key Features for Tracking and Reputation | Pros | Cons |

|---|---|---|---|

| Wise | Transparent fees, mid-market rates, online tracking, multi-currency accounts | Low fees, supports 80 countries | Small fee per transfer, not available everywhere |

| PayPal | Large user base, international transfers, online tracking | Widely used, free transfers within US/Canada | High fees for international transfers, currency conversion spreads |

| Remitly | Online tracking, cash pickup, home delivery | Express options, 24/7 support | Limited countries, variable exchange rates |

| OFX | No transfer fees, online tracking, 24/7 support | No fees, better rates for loyal users | Minimum $1,000 transfer, possible intermediary fees |

| Skrill | Mobile wallet, online tracking, email-based transfers | Prepaid card available | Potential fees, lengthy verification |

| Money2India | Online and app tracking, connected to Indian banks | Free transfers over $975, exchange rate lock-in | Only for transfers to India |

| WorldRemit | Online and app tracking, multiple delivery options | Upfront rates, many delivery methods | Not all services everywhere, variable fees |

You can choose a service that matches your needs for security, speed, and convenience. Always check the latest exchange rates in USD and review the service’s reputation before you send money.

Tracking your ria money transfers online or in the app is simple and reliable. You only need your correct PIN or order number to check your transfer status at any time.

- The ria app and website both offer real-time tracking, and users praise their user-friendly design and fast notifications.

- High ratings on iOS and Android show strong satisfaction with ria’s tracking features.

- The Track a Transfer tool will not work without the right PIN or order number, so always keep these details safe.

If you ever have trouble, reach out to ria support for help. You can feel confident knowing your money is secure and that help is always available.

FAQ

How long does a Ria money transfer usually take?

Most Ria transfers complete within minutes. Bank transfers may take up to 4 business days. Processing times depend on the payment method and the recipient’s bank. Always check your transfer status for updates.

What should you do if you lose your PIN or order number?

You can recover your PIN or order number by checking your confirmation email, your Ria app account, or your printed receipt. If you still cannot find it, contact Ria customer support for help.

Can you track a Ria transfer without an account?

Yes, you can track a transfer on the Ria website using your PIN or order number. You do not need to log in. Just enter the required details on the ‘Track a Transfer’ page.

Are there extra fees when sending money to Hong Kong banks?

Ria charges a transfer fee, which you see before you confirm your transaction. Some Hong Kong banks may charge additional fees. Always check the latest USD to HKD exchange rates before sending money.

What happens if your recipient does not collect the money?

If your recipient does not collect the money, Ria will hold the funds for a set period. After that, Ria may cancel the transfer and refund your money. You can contact support for more details.

While Ria’s tracking tools give you visibility, many users still face frustrations like hidden bank deductions, slow processing times, and high conversion spreads. If you want a faster and more transparent solution, BiyaPay offers real-time exchange rate checks, remittance fees starting as low as 0.5%, and support for converting between multiple fiat and digital currencies. With quick registration and same-day transfers to most countries and regions worldwide, you gain both speed and reliability without the extra costs.

Take control of your international transfers today—sign up for BiyaPay and experience a smarter way to move money.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.