- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send Money from the US to Canada: E-Transfer Explained

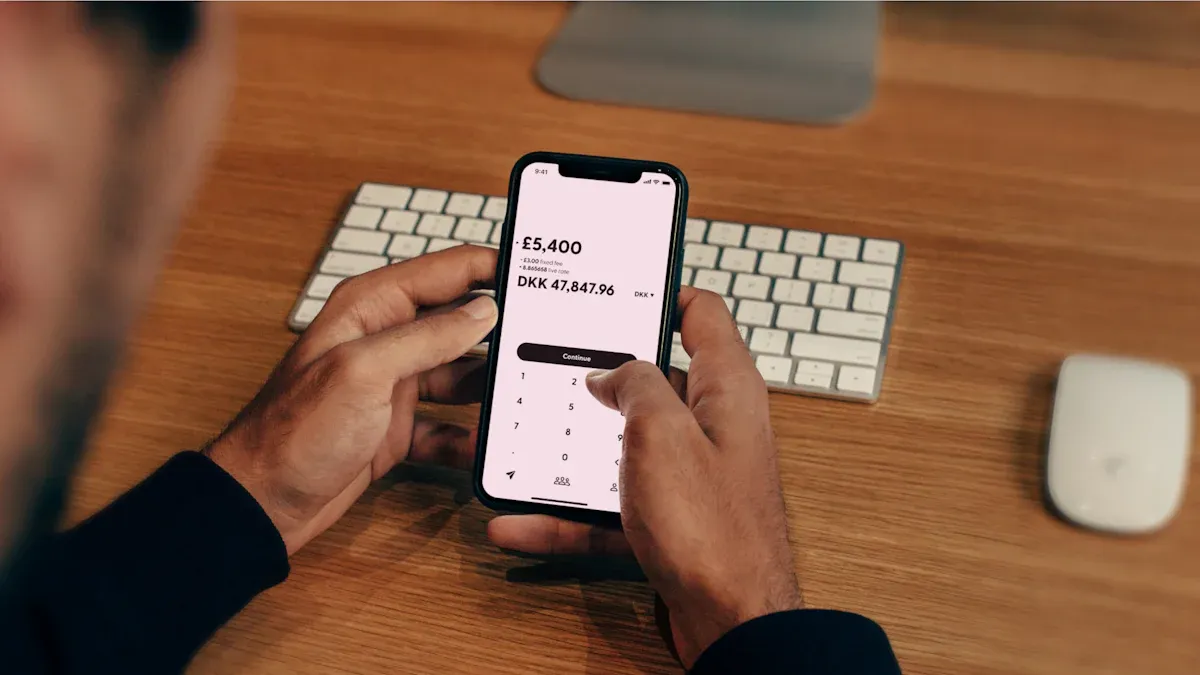

Image Source: unsplash

Wondering how to send money from the US to Canada? Many people in Canada trust Interac e-Transfer to move money quickly and safely. You cannot use Interac e-Transfer directly from the US, but you can send money internationally with trusted money transfer services like Wise, PayPal, or Western Union. These services help you send money to Canada, but you should always check fees and double-check recipient details. When you want to know how to send money internationally, choosing a secure method gives you peace of mind.

Key Takeaways

- You cannot send Interac e-Transfer directly from the US; use trusted services like Wise, PayPal, or Western Union instead.

- Always double-check the recipient’s name, email, and bank details to avoid delays or lost money.

- Compare fees and exchange rates carefully to get the best value and save money on transfers.

- Use secure services with two-factor authentication and strong encryption to keep your money safe.

- Track your transfer and contact customer support if you face any issues to ensure a smooth process.

How to Send Money

Image Source: pexels

Choosing a Service

You want to send money from the US to Canada, but you cannot use Interac e-Transfer directly. Instead, you need to pick a reliable third-party service. Many people use money transfer apps like Wise, PayPal, Remitly, WorldRemit, or TransferGo. These money transfer services help you move money quickly and safely. Each service has its own features, fees, and speed. Some focus on low costs, while others offer fast delivery or easy-to-use apps.

Here is a quick comparison of popular money transfer services:

| Service | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Wise | Mid-market rates, transparent fees | Fast, low-cost, easy to use | No cash pickup | Most users needing online transfers |

| PayPal | Large user base, global reach | Convenient, well-known | Higher fees, exchange rate markup | People who already use PayPal |

| Remitly | Multiple payout options, 24/7 support | Flexible, user-friendly | Transfer size limits | Small, flexible transfers |

| WorldRemit | Many payout methods, instant quotes | Wide coverage, instant fee quotes | Limited delivery in some areas | Users needing flexible payout |

| TransferGo | Competitive rates, responsive support | Low cost, transparent pricing | No cash pickup | Cost-conscious users |

When you choose a money transfer option, think about these factors:

- Exchange rates can change the total cost.

- Service charges may look low but can hide in poor exchange rates.

- Security and reputation matter. Look for services with strong security and good reviews.

- Delivery speed is important if you need to transfer your money fast.

- Customer support can help if you have questions or problems.

- Convenience and transparency make the process easier.

You must also meet some basic requirements. You need to be a legal US resident, at least 18 years old, and have a valid account with the service. You should use your own account and keep your login details safe. Most money transfer apps ask you to link a bank account, debit card, or credit card.

Setting Up for Email Money Transfer

After you pick a service, you need to set up your account for an email money transfer. Most services ask you to create an account online or in their app. You will need to provide your name, address, and sometimes a government-issued ID. You must also add a payment method, such as a debit or credit card. Make sure the name on your card matches your profile.

To send money, log in to your account. Choose the option to send money to Canada. Some services call this an international email money transfer. You will need your recipient’s email address. The recipient in Canada will get an email with instructions on how to receive the money. If you use a service like Wise, you may also need your recipient’s bank details.

Here is what you usually need:

- Your email address and online banking access

- A valid payment method (debit or credit card)

- The recipient’s email address

- Sometimes, the recipient’s bank account details

If you run into problems, check your login details and make sure you have enough funds. Some users face delays if they enter wrong information or if the service needs more documents. Always check your email for updates from the money transfer service.

Entering Recipient Details

Entering the correct recipient details is one of the most important steps. Mistakes can cause delays or even loss of money. When you send money, double-check the recipient’s full name, email address, and bank details. The name should match the bank records in Canada. Even small spelling errors can cause the transfer to fail.

Here are common mistakes and how to avoid them:

| Common Error | How to Avoid |

|---|---|

| Failing to verify recipient details | Double-check name, account number, bank name, and country |

| Incorrect recipient name | Get written confirmation of the exact name |

| Mixing up bank details | Use only recipient bank details; ask the bank if you are unsure |

Tips for entering recipient details:

- Ask your recipient to send their details in writing.

- Confirm the recipient’s bank name, address, account number, and routing number.

- For international transfers, you may need a SWIFT or IBAN code.

- Review all information before you confirm the transfer.

- Contact customer support if you notice any mistakes.

Remember, once you transfer your money, you cannot reverse it. Take your time and check every detail.

Confirming the Transfer

After you enter all the details, you need to confirm the transfer. Most money transfer services show you a summary screen. Check the amount, recipient information, and fees. Make sure everything is correct before you click send.

Once you confirm, you will get an email from the service. This email shows the transaction details, such as the amount and recipient. You can also check your bank account to see if the money has been deducted. Some services, like Wise, let you track your transfer in real time using their app or website. You may get notifications when the recipient receives the money.

Steps to confirm your transfer:

- Review the summary screen for accuracy.

- Confirm the transfer and wait for the email confirmation.

- Check your bank account for the deduction.

- Contact your recipient in Canada to make sure they received the money.

- If there are any issues, reach out to customer support.

If you want to know how to transfer money between banks, these steps are similar. Always keep your reference number or transaction ID in case you need to track your transfer.

Tip: Double-check all details before you send money. This helps you avoid delays, extra fees, or lost funds.

By following these steps, you can send money from the US to Canada with confidence. Using trusted money transfer apps and services makes the process simple and secure. If you ever wonder how to send money internationally, these steps will guide you through a safe and successful transfer.

Interac and Email Money Transfer in Canada

Image Source: unsplash

How Interac Works

You might wonder how Interac helps people move money in Canada. Interac connects Canadian banks and lets you send an email money transfer using just the recipient’s email or phone number. You do not need to know their account number. Interac e-Transfer works only between Canadian bank accounts, so both you and the person you want to send money to must have accounts in Canada.

Here’s a quick look at how Interac compares to other ways to send money:

| Feature | Interac e-Transfer | Wire Transfer |

|---|---|---|

| Where it works | Only in Canada | International |

| Info needed | Email/phone number | Full bank details |

| Speed | 15-30 minutes | 1-5 business days |

| Fees | $0.50-$1.50 per transfer | Higher, varies |

| Limits | $3,000/day (individuals) | Higher limits |

You can use Interac for fast, easy email money transfer. If you want to send money outside Canada, you need a different service like Wise or Western Union.

Security Features

Interac puts a big focus on security. When you send an email money transfer, Interac uses strong encryption and secure channels to keep your money safe. You pick a security question and answer that only your recipient knows. This step helps make sure only the right person can receive money.

Here are some top security features you get with Interac:

- Advanced encryption protects your financial data.

- Two-factor authentication adds another layer of security.

- Security questions stop others from accessing your money.

- Auto-deposit lets trusted people receive money without answering questions, making it safer and faster.

Tip: Always choose a security question that is hard to guess. Never share your answer by email or text.

Scams can happen, so stay alert. Watch out for fake emails or texts that ask for your login or security info. If you get a strange request for money, double-check with the sender before you act.

Receiving Money in Canada

If you want to receive money in Canada through Interac, the process is simple. You get an email or text telling you about the transfer. Always check that the message is real before you click any links. Next, follow the steps to log in to your bank and answer the security question if needed. If you set up auto-deposit, the money goes straight into your account.

Here’s what you do to receive money:

- Open the email or text about the email money transfer.

- Make sure the message is from someone you trust.

- Click the link, pick your bank, and log in.

- Answer the security question if you do not use auto-deposit.

- Choose your account and accept the money.

You can only receive money this way if you have a Canadian bank account. If you get a transfer you did not expect, contact your bank before you accept it. This helps keep your money and your security safe.

Transfer Money: Fees and Speed

Typical Fees

When you want to transfer money from the US to Canada, you need to think about the fees. The cost of transferring money can change a lot depending on the service you pick. Some banks charge high fees for international transfers. Others, like online apps, may offer lower costs.

Here is a table showing what some major banks charge for sending money from the US to Canada:

| Bank | Outgoing International Wire Fee (USD) |

|---|---|

| Industry Average | Around $44 |

| Bank of America | $0 - $45 |

| Chase | $0 - $50 |

| Citi | $0 - $35 |

| Fidelity | $0 |

| Huntington | $75 |

| PNC | $5 - $50 |

| State Employees’ CU | $25 |

| TD Bank | $50 |

| Truist | $65 |

| U.S. Bank | $50 |

| Wells Fargo | $0 - $40 |

You can see that bank wire transfer fees usually range from $0 to $75. Some banks, like Fidelity, do not charge a fee, but this is rare. Many people choose online transfer services because they often have lower fees. For example, Revolut sometimes offers no fees for certain transfers, especially if you use their app and have a special plan. Western Union may give you a $0 fee for your first transfer, but after that, the fee depends on how you pay and how your recipient gets the money.

If you use Interac e-Transfer within Canada, the fee is much lower—usually between $0.50 and $1.50 (USD equivalent). This makes it a good choice for small payments, but you need a Canadian bank account to use it.

Tip: Always check the total fee and the exchange rate before you transfer money. Some services add extra costs in the exchange rate.

How Long Transfers Take

You probably want your money to arrive fast. The time it takes to transfer money from the US to Canada depends on the service you use. Bank wire transfers can take one to five business days. Online transfer services are often quicker. Many of them deliver money in one to two business days. Some, like Wise or Remitly, may even send money in a few hours if you pay extra.

If you use an email transfer service, expect the transfer to take about one to two business days. This is a bit slower than sending money within Canada, where transfers can happen in minutes. The speed depends on the banks and the transfer service you choose.

Here is a quick list of what affects transfer speed:

- The payment method you use (bank account, card, or cash)

- The service you pick (bank, app, or money transfer company)

- The day and time you send the money

Note: If you need to transfer money quickly, look for services that offer instant or same-day delivery. Always check the estimated delivery time before you send.

Currency and Safety Tips

Currency Conversion

When you send money from the US to Canada, you need to pay attention to the exchange rate. Not all transfer services use the same rate. Some services, like Wise, use the real mid-market rate. This is the rate you see on Google or Yahoo Finance. Other banks or transfer companies often add a markup to the rate. This means your recipient gets less money, even if the fee looks low.

Here’s a quick comparison for a $1,000 transfer:

| Provider | Exchange Rate | Transfer Fee | Amount Recipient Gets (USD to CAD) |

|---|---|---|---|

| Wise | 1.36545 | $10.15 | 1,351.59 CAD |

| Traditional Bank | 1.32480 | $5.00 | 1,318.18 CAD |

You can see that Wise gives more money to your recipient, even with a higher fee. Always check both the fee and the exchange rate before you transfer. Some hidden costs can sneak in, like extra wire fees or percentage-based charges. Timing your transfer when rates are better can also help you save.

Tip: Compare providers and use online tools to see the real cost of your international transfer. Bundling your transfers or using cross-border accounts can help lower fees.

Keeping Your Transfer Secure

You want your money to reach the right person safely. Security is very important for every transfer. Use services that offer two-factor authentication and strong encryption. Always verify the recipient’s identity before you send money. Watch out for phishing emails or fake requests. Scammers may try to trick you into sending money to the wrong person.

Here’s a checklist to keep your transfer secure:

- Use a trusted transfer service with good reviews.

- Set up two-factor authentication on your account.

- Double-check the recipient’s details before you send.

- Never share your passwords or security answers.

- Monitor your account for any strange activity.

- Keep your devices updated with antivirus software.

Note: If you get an unexpected request for money, contact the sender directly to confirm. This helps prevent fraud and keeps your secure fund transfer safe.

By following these tips, you can make sure your international money transfer is both safe and cost-effective.

You want to send money safely and quickly. Trusted services like Wise and Western Union make it easy to transfer your money. Always check fees, review exchange rates, and confirm recipient details. Here’s a quick checklist before you start:

- Pick a reputable provider with strong security.

- Double-check recipient’s name and account info.

- Review all fees and exchange rates.

- Use secure internet and enable two-factor authentication.

- Track your transfer and contact support if needed.

| Service | Trustpilot Rating | App Store Rating |

|---|---|---|

| Wise | 4.3/5 | 4.8/5 |

| Western Union | 4.2/5 | 4.6/5 |

If you follow these steps, your international money transfer will go smoothly and your money will reach the right person.

FAQ

Can you send an Interac e-Transfer directly from the US to Canada?

You cannot send an Interac e-Transfer directly from the US. You need to use a third-party service like Wise or PayPal. These services help you send money to a Canadian bank account or email address.

What information do you need to send money to Canada?

You need the recipient’s full name, email address, and sometimes their bank account details. Always double-check this information before you send money. A mistake can delay your transfer.

How much does it cost to send money from the US to Canada?

Fees depend on the service you choose. Online transfer services usually charge between $5 and $15 USD per transfer. Some banks may charge up to $75 USD. Always check the exchange rate and total cost before you send.

How long does it take for the recipient to get the money?

Most online transfers arrive in one to two business days. Some services offer instant or same-day delivery for an extra fee. Bank wire transfers can take up to five business days.

Does the recipient need a Canadian bank account?

Yes, the recipient must have a Canadian bank account to receive money through Interac e-Transfer or most online transfer services. If they do not have one, look for services that offer cash pickup options.

Tip: Always ask your recipient which method works best for them before you send money.

Sending money from the US to Canada often comes with hidden costs—high wire fees, poor exchange rates, and waiting days for funds to clear. With BiyaPay, you gain full control of your cross-border transfers. The platform offers real-time exchange rate checks, fees as low as 0.5%, and flexible conversion between multiple fiat and digital currencies. Registration takes only minutes, and transfers are delivered the same day across most countries and regions, including Canada.

Make your next transfer simple, fast, and affordable—sign up for BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.