- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram Transactions Fees Explained Like a Movie Plot

Image Source: pexels

MoneyGram transaction fees are the extra costs you pay when you send money using MoneyGram. Think of moneygram transactions like a movie, where each fee acts as a unique character shaping the story of your money transfer. When you send money internationally, you want the plot to go smoothly. Many people use moneygram to send money, with a reported annual transfer volume of about $41 billion. Sometimes, unexpected fees can surprise you in the middle of your moneygram transactions. Always check the total cost before you send money internationally, so you do not let hidden fees steal the spotlight from your money.

Key Takeaways

- MoneyGram charges different fees like transfer fees, receiving fees, and exchange rate markups that affect how much money your recipient gets.

- Payment methods and delivery options change the fees; bank transfers usually cost less than credit cards, and direct bank deposits often have lower fees than cash pickups.

- Exchange rate markups can add hidden costs, so always compare MoneyGram’s rates with real market rates before sending money.

- Fees can vary by country, pickup location, and timing, so check all details and possible charges before you send money internationally.

- Use MoneyGram’s fee estimator and compare different services to find the best option and keep more money in your recipient’s hands.

MoneyGram Transactions: The Main Cast

Image Source: pexels

Every movie has its main characters. In the story of moneygram transactions, each fee plays a special role. When you send money across borders, these characters shape the journey of your transfer. Let’s meet the cast.

Transfer Fee

The transfer fee is the lead actor in your moneygram transactions. This fee appears every time you send money using the transfer service. You pay this cost upfront, and it depends on how much money you send, where you send it, and which transfer service you choose. If you send $100 or $500, the transfer fee may change. Some payment methods, like using a credit card, can make this fee higher. Always check the transfer fee before you start your cross-border payments. This way, you know how much money will reach your recipient.

Receiving Fee

The receiving fee is a supporting character. Sometimes, the person who gets the money pays this fee. Not every transfer includes a receiving fee, but some banks or pickup locations may charge it. For example, if your recipient uses a Hong Kong bank, the bank might take a small amount from the money before giving it out. This fee can surprise your recipient, so you should ask them to check with their bank or pickup location before the transfer. Knowing about the receiving fee helps you avoid confusion in your cross-border payments.

Exchange Rate Markup

The exchange rate markup is the plot twist in your moneygram transactions. When you send money to another country, the transfer service must convert your money into a different currency. Moneygram sets its own conversion rate, which is not always the same as the mid-market rate you see online. Moneygram can add a markup of up to 3% to the conversion rate. For example, if you send $500, this markup means you pay more in USD or your recipient gets less in their currency. The exchange rate markup increases the total cost of your cross-border payments. Always compare the conversion rate offered by moneygram with the real exchange rate before you send money. This step helps you understand the true cost of your transfer.

Note: The exchange rate markup often hides in plain sight. It can make your transfer more expensive than you expect, even if the transfer fee looks low.

Other Charges

Other charges are the background characters that sometimes steal a scene. These fees can appear based on the details of your moneygram transactions. Here are some examples:

- Transaction fees that change with the amount of money you send and the destination country.

- Foreign exchange fees from moneygram’s banking partners, which can shift with the conversion rate.

- Receiving fees from the recipient’s bank, depending on their rules.

- Extra fees for using certain payment methods, like credit or debit cards, charged by moneygram or your bank.

- Higher fees for sending money to countries with complex banking systems, strict regulations, or few remittance providers.

- Fees that change based on how fast you want the money delivered, such as same-day or next-day transfer service.

You should always review the full list of possible fees before starting your cross-border payments. This way, you avoid surprises and make sure your money reaches its destination as planned.

The Fee Plot: When and How Costs Appear

Image Source: pexels

Every movie has a plot, and in the world of cross-border payments, the plot centers on when and how fees appear. As you send money internationally, you meet different twists and turns. Each choice you make—how you pay, how your recipient gets the money, and where they pick it up—changes the story. Let’s walk through each scene.

Payment Methods

The way you pay for your transfer shapes the fees you face. If you use a debit card or bank transfer, you usually pay lower fees. Credit cards often bring the highest fees, and your card issuer may add extra charges, such as cash advance fees. These extra costs can make your transfer more expensive than you expect.

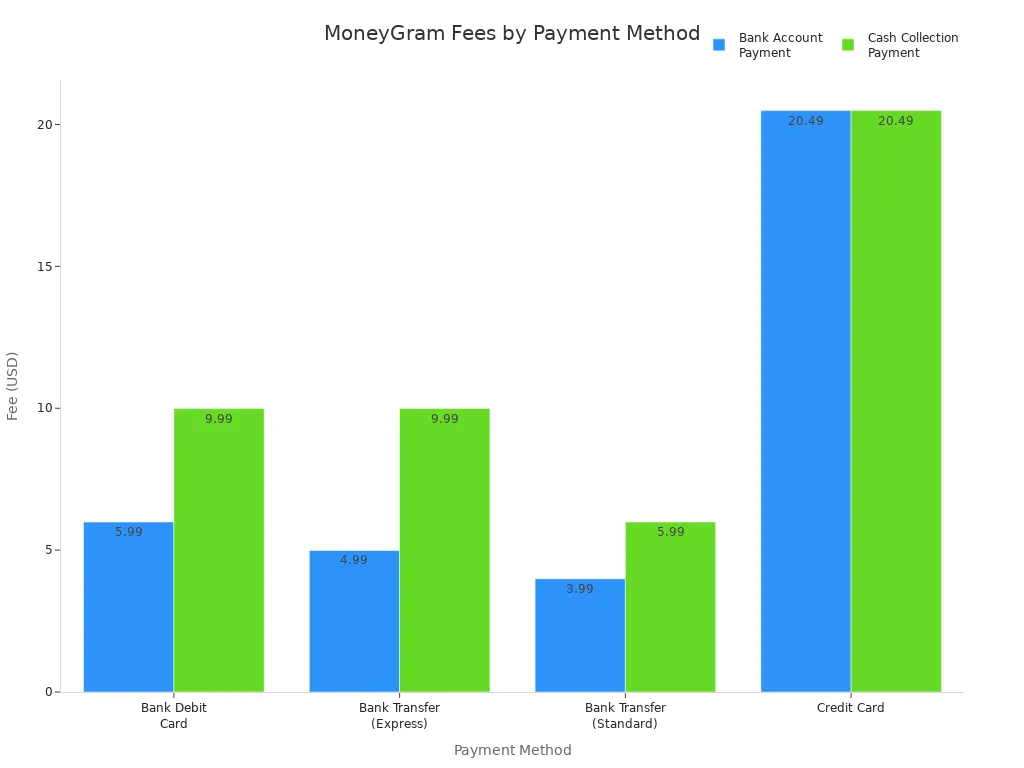

Here is a table that shows how fees change based on payment method when you send $500 USD:

| Payment Method | Fee for Bank Account Payment | Fee for Cash Collection Payment |

|---|---|---|

| Bank Debit Card | $1.99 to $9.99 | $9.99 |

| Bank Transfer (Express) | $4.99 | $9.99 |

| Bank Transfer (Standard) | $1.99 to $5.99 | $5.99 |

| Credit Card | $20.49 | $20.49 |

| Cash Payment | Variable by location | Variable by location |

You can see that credit cards cost the most. Debit cards and bank transfers are more cost-effective. If you want to lower your transfer costs, choose your payment method wisely. MoneyGram also offers a fee estimator tool. You can use this tool to compare fees before you send money internationally. This step helps you avoid surprises and keep more money in your recipient’s hands.

Tip: Always check if your card issuer charges extra fees for using a credit card. These can include cash advance fees and less favorable exchange rates.

Delivery Options

The delivery option you choose also changes the fees and the speed of your transfer. If you pick a cash pickup service, you often pay higher fees, especially if you want the money to arrive quickly. Direct-to-bank transfers usually have lower fees and can be more convenient for your recipient.

- Cash pickup service fees are higher, especially for urgent transfers.

- Direct-to-bank transfers have lower fees and may take longer, depending on the bank’s processing time.

- Both options add a margin to exchange rates, which increases the total cost of your transfer.

- The timing of funds depends on the delivery method. Cash pickups can be instant, but bank transfers may take a few hours or even a day.

When you send money internationally, always check the delivery options. If your recipient can wait, a direct-to-bank transfer may save you money. If they need the money fast, you might pay more for speed.

Pickup Locations

Pickup locations play a key role in the plot of your cross-border payments. MoneyGram has over 440,000 pickup locations worldwide. These include banks, retail stores, and other agents. The fees can change based on where your recipient picks up the money and the country they are in. For example, a Hong Kong bank may charge a receiving fee, which reduces the final amount your recipient gets.

- Fees may differ by country and by the type of pickup location.

- Some banks or agents may charge extra fees, so your recipient should always ask before picking up the money.

- The availability of funds depends on the hours of the pickup location and local regulations.

Note: Always use MoneyGram’s “Find a Location” tool to check the nearest and most convenient pickup spot for your recipient. Remind them to ask about any possible fees at the location.

Real-time exchange rates also affect the final amount your recipient receives. MoneyGram updates rates often, and the rate you see when you start your transfer may change by the time you finish. Timing your transfer when rates are favorable can help your recipient get more money. The service adds a margin to the exchange rate, which is another way fees appear in your transfer story.

Callout: If you want to maximize the money your recipient gets, watch the exchange rates and choose the right time to send money internationally. This can make a big difference in cross-border payments.

Plot Twists: Hidden and Variable Fees

Every movie has unexpected turns. In the world of cross-border payments, hidden and variable fees play the role of surprise plot twists. You might think you know the cost of your transfer, but these twists can change the story of your money.

Exchange Rate Surprises

Exchange rates can shift quickly. When you send money, the service uses its own conversion rate, which often includes a markup. This means you pay more or your recipient gets less. The conversion rate you see at the start of your transfer may not match the final rate. MoneyGram profits from this difference, and the rate can change without warning. You should always compare the rate offered by the service with the real mid-market rate. This step helps you see the true cost of your cross-border payments.

Note: The exchange rate spread between retail and wholesale rates affects your total cost. You may not notice this fee right away, but it can make a big difference in how much money your recipient gets.

Location-Based Changes

Where you and your recipient live can change the fees you pay. MoneyGram sets fees based on the transfer amount, payment type, delivery method, and pickup location. These fees can change at any time, and you may not get a warning. Some banks, like those in Hong Kong, may add their own charges when your recipient picks up the money. The service does not say how often these fees change, so you should always check before you send money. This helps you avoid surprises in your cross-border payments.

- Fees can depend on:

- The country you send money from or to

- The pickup location your recipient uses

- Local taxes or government charges

Payment Method Surprises

The way you pay for your transfer can also bring surprises. Some payment methods, like credit cards, have higher fees. Your card issuer may add extra charges, such as cash advance fees. These costs can make your cross-border payments more expensive than you expect. Even if you use a bank transfer or debit card, the service may charge different fees based on your choices.

- Main factors that cause fees to vary:

- Fees from the transfer provider or agents

- Exchange rate costs during conversion

- Governmental taxes

- Different pricing strategies by the service

MoneyGram shares information about its fees, but the details can change without notice. Unlike some other services, such as Wise, MoneyGram does not always show all costs upfront. You need to check every detail before you send money. This helps you keep control of your transfer and avoid losing money to hidden fees.

Why MoneyGram Fees Exist

Setting Fees

You might wonder why MoneyGram charges fees when you send money. These fees help the company cover the costs of moving money across borders. MoneyGram sets its fees based on several factors that affect each international wire transfer. Here are some of the main reasons:

- The amount you send and the country you choose can change the fee.

- Your payment method, such as debit card, credit card, or bank transfer, affects the cost.

- The delivery method, like cash pickup or bank deposit, also plays a role.

- Pickup location and recipient bank charges, especially with Hong Kong banks, can add extra costs.

- Exchange rates can shift, and MoneyGram earns revenue from the difference between their rate and the real market rate.

- Promotions or discounts may lower your fees for a limited time.

You should know that MoneyGram can change its fees without warning. The company also earns money from currency exchange, not just from wire transfer fees. For international card transactions, a 3% foreign transaction fee often applies. If you use a MoneyGram Debit Card at an international ATM, you may pay a fixed fee, such as $3, plus any ATM surcharges.

The table below shows the main factors that influence how MoneyGram sets its fees:

| Factor Influencing MoneyGram Fees | Explanation |

|---|---|

| Destination Country | Fees vary depending on the country to which money is sent. |

| Payment Method | Using debit or credit cards affects fees; debit cards are accepted but policies vary. |

| Payment Channel | Transactions via mobile app or other channels may have different fees. |

| Transfer Type | Whether the transfer is cash pickup or bank deposit influences fees. |

| Exchange Rates | Exchange rates applied impact the overall cost beyond the fee itself. |

| Recipient Bank Charges | Additional charges from recipient banks can affect total cost. |

| Promotions and Discounts | Loyalty programs, partnerships, and promotions can reduce fees. |

| Amount Sent | Fees generally do not vary based on the amount sent. |

| Fee Payment Method | Fees are usually deducted from the amount sent, not paid in cash. |

| Cancellation Policies | Timing and cancellation conditions affect fee refunds or penalties. |

What Fees Cover

When you pay fees for an international wire transfer, you help MoneyGram cover the costs of running its service. These costs include technology, security, and customer support. The company also pays for partnerships with banks and agents around the world, including those in Hong Kong. MoneyGram uses part of the fee to manage risks, follow government rules, and keep your money safe.

You may notice that MoneyGram’s fees are sometimes higher than other international wire transfer services. For example, MoneyGram’s exchange rate markup can range from 1% to 5%. Other services, like XE, offer lower markups, between 0.2% and 1.4%. Transfer fees with MoneyGram can range from $0 up to $100, depending on your location and payment method. XE charges a flat fee of about $2.50 for smaller transfers and no fee for larger amounts. Currencies Direct offers no transfer fees and better exchange rates, which can save you money.

| Service | Exchange Rate Markup | Transfer Fee (USD) | Max Transfer Limit (Online) |

|---|---|---|---|

| MoneyGram | 1% - 5% | $0 - $100 | $10,000 |

| XE | 0.2% - 1.4% | ~$2.50 (small) | Hundreds of thousands |

| Currencies Direct | Lower | $0 | Higher |

MoneyGram stands out for its speed, convenience, and global reach. You can send money to over 200 countries, and your recipient can pick up cash quickly. If you need fast service or want to send money to a remote area, MoneyGram can help. If you want the lowest cost, you may want to compare other services before you send your next international wire transfer.

Send Money Internationally: Tips for Lower Fees

When you send money internationally, you want your money to go as far as possible. You can take steps to lower fees and avoid surprises. Here are some practical tips to help you keep more money in your recipient’s hands.

Compare Options

You have many money transfer options. Before you choose a transfer service, compare the total cost. Look at both the transfer fee and the exchange rate. Some services, like Wise, use the mid-market exchange rate and charge low, clear fees. MoneyGram often charges higher fees and adds a markup to the exchange rate. This can make your international money transfer more expensive. Comparing different services can help you save up to six times the fees you might pay with MoneyGram. You can also check if online international transfers offer better rates than in-person services.

- Send higher amounts to spread fixed fees over more money.

- Watch exchange rates and send money when rates are good.

- Use online services for lower fees and better rates.

- Compare each money transfer service to find the best value.

- Consider fintech platforms for cost-effective remittances.

Read the Fine Print

Always read the terms before you send money internationally. Fees can change based on the amount, payment method, delivery option, and pickup location. The timing for international payments depends on the country, the bank’s hours, and local rules. MoneyGram lists all fees in its Account Agreement, but not all services are available everywhere. Make sure you know both the transfer fee and the exchange rate. These can change without notice.

Tip: Review the full fee schedule and check for hidden costs in the exchange rate.

Choose Payment Wisely

The way you pay affects the total cost and speed of your international wire transfer. Paying with a bank account usually costs less than using a credit or debit card. Cards often bring higher fees and extra charges. Some payment methods may also slow down your transfer if extra checks are needed. Choose the payment method that gives you the best balance of speed and cost.

| Payment Method | Typical Fee (USD) | Exchange Rate Markup | Speed |

|---|---|---|---|

| Bank Account | Low | Lower | Slower |

| Debit Card | Medium | Medium | Faster |

| Credit Card | High | Higher | Fastest |

By following these tips, you can make smarter choices when you send money internationally and keep more money for your recipient.

Understanding the different types of MoneyGram fees helps you make smarter choices when sending money internationally. Each fee acts as a character in your transfer story, and knowing the possible plot twists lets you avoid surprises.

- MoneyGram fees change based on where you send money, the amount, and how you pay.

- Exchange rate markups and extra charges can add up.

- Always check official provider websites and compare options before sending money.

This way, you keep more money in your recipient’s hands and avoid unexpected costs.

FAQ

What is the main fee you pay when using MoneyGram?

You pay a transfer fee each time you send money. This fee depends on the amount, the country, and your payment method. Always check the fee before you send money to avoid surprises.

Does MoneyGram charge extra for currency exchange?

Yes. MoneyGram adds a markup to the exchange rate. This means you pay more than the real market rate. Compare MoneyGram’s rate with the current USD exchange rate before you send money.

Can banks in Hong Kong charge a receiving fee?

Yes. Some Hong Kong banks may charge a receiving fee when your recipient picks up the money. Ask your recipient to check with their bank before you send money to avoid unexpected charges.

How can you lower your MoneyGram fees?

You can compare different payment methods and delivery options. Using a bank transfer often costs less than using a credit card. Always review the total cost, including the exchange rate, before you send money.

In the story of MoneyGram fees, too many “plot twists” can take money away from your recipient—hidden exchange rate markups, extra charges by banks, and high card fees often steal the spotlight. If you want a simpler script, BiyaPay offers a better ending: remittance fees as low as 0.5%, real-time exchange rate checks, and seamless conversion between multiple fiat and digital currencies. With global coverage and strong compliance, you can transfer money securely and even receive it the same day.

Don’t let hidden costs write your transfer story. Choose transparency, speed, and affordability—register with BiyaPay today and take control of your international payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.