- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tips for Fast and Secure Money Transfers with MoneyGram Online

Image Source: unsplash

You want to send money fast and securely. MoneyGram makes sending money online simple with its website and moneygram mobile app. Create your moneygram account, enter your recipient’s info, and choose how you want to send money. Always double-check recipient details before you send money online. Many people make mistakes like entering the wrong account or ignoring fees and exchange rates. If you compare money transfer services and stay alert for scams, you protect your account and your money. Following these tips helps you avoid delays and keeps your money safe.

Key Takeaways

- Create a MoneyGram account with accurate personal details and verify your identity to keep your transfers secure.

- Double-check recipient information carefully to avoid delays, extra fees, or sending money to the wrong person.

- Choose fast payment methods like debit cards and quick delivery options such as cash pickup or mobile wallets for speedy transfers.

- Use the official MoneyGram website or app to protect your account and avoid scams by never sharing your personal information.

- Review fees, exchange rates, and transfer limits before sending money to save costs and stay within allowed amounts.

How to Send Money Online

Image Source: unsplash

Sending money with MoneyGram Online is simple if you follow the right steps. You can use the website or the moneygram mobile app. Here’s how you can send money online quickly and securely.

Register or Log In

Before you start sending money, you need to create an account or log in. MoneyGram asks for your full legal name, address, phone number, and email. You also need to share your date of birth and Social Security Number (SSN) or ITIN. If you use the moneygram money transfers app, you must be at least 18 years old and have a U.S. address. Sometimes, you may need to upload a photo of your government-issued ID, like a driver’s license or passport, for extra security.

Tip: Always use your real name and details. MoneyGram checks your ID to keep your account safe and to follow international rules for money transfers.

Enter Recipient Details

After you log in, you can start a new transfer. Enter the recipient’s full name exactly as it appears on their ID. Add their location and contact details. If you want to send to a bank account, make sure you enter the correct bank name and account number. For international transfers, double-check the spelling and numbers. Even a small mistake can delay your transfer or send money to the wrong person.

- Incorrect recipient information can cause delays or failed transfers.

- Fixing mistakes may take time and cost extra fees.

- If you make repeated errors, MoneyGram might flag your account for suspicious activity.

Note: Always review the recipient’s details before you confirm. This step helps you avoid problems with international payments and keeps your transfer on track.

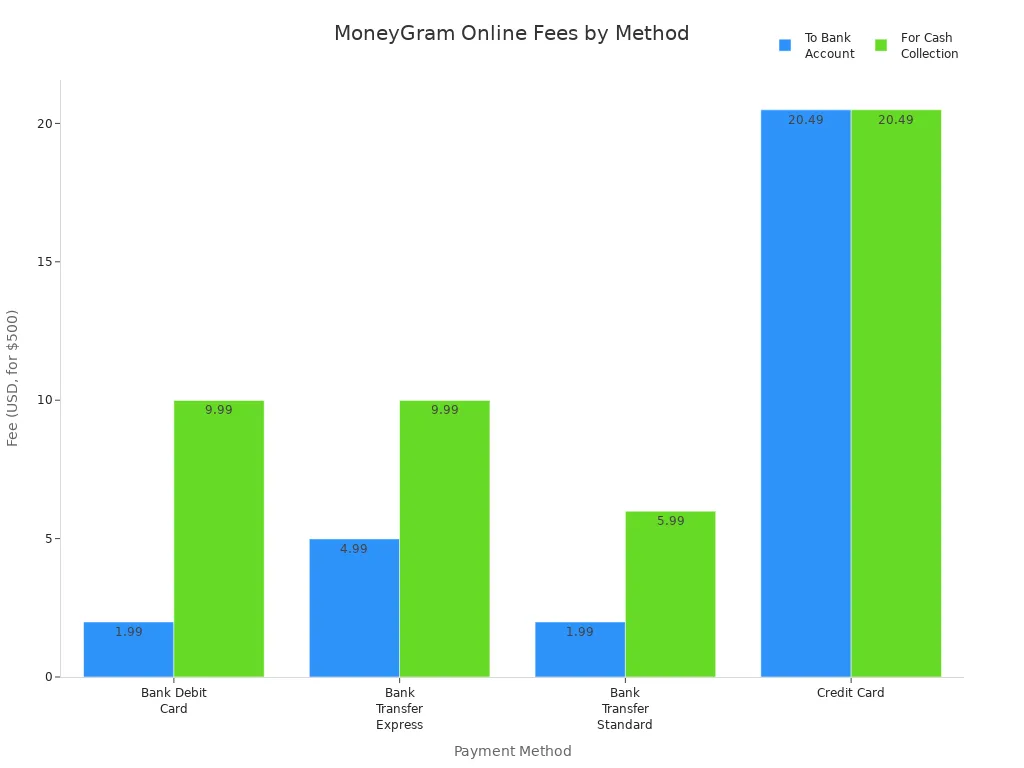

Choose Payment and Delivery

Now, you need to pick how you want to pay and how your recipient will get the money. MoneyGram gives you several options. Each one has different speeds and fees. Here’s a quick look:

| Payment Method | Delivery to Bank Account (Fee) | Delivery for Cash Collection (Fee) | Speed Notes |

|---|---|---|---|

| Bank Debit Card | $1.99 for $500 | $9.99 for $500 | Bank transfer is usually faster |

| Bank Transfer - Express | $4.99 for $500 | $9.99 for $500 | Express is faster but costs more |

| Bank Transfer - Standard | $1.99 for $500 | $5.99 for $500 | Standard is slower but cheaper |

| Credit Card | $20.49 for $500 | $20.49 for $500 | Instant but costly |

| Cash Payment | Variable fees | Variable fees | Depends on location and agent |

Paying by bank transfer is often cheaper than using a credit card. If your recipient wants cash, they can pick it up at a MoneyGram location. You can also send money to a mobile wallet or directly to a bank account. For international transfers, check which delivery options are available in the recipient’s country.

Note: Use MoneyGram’s online fee estimator to compare costs before you send money. Fees and exchange rates can change based on the country and payment method.

Review and Confirm

Before you finish, review all the details. Make sure the recipient’s name, account number, and amount are correct. MoneyGram uses Mobile Verify™ technology to check your ID. You may need to take a photo of your passport or driver’s license with your mobile device. This step helps prevent fraud and keeps your account secure.

- The name on the transfer must match the recipient’s ID.

- The recipient needs the correct reference number to collect the money.

- MoneyGram may ask for proof of address or other documents, especially for international transfers.

Once you confirm, MoneyGram processes your transfer. You will get a confirmation number. You can use this number to track your transfer online or in the app. If you send money internationally, let your recipient know the reference number and what ID they need to pick up the funds.

Tip: Always keep your confirmation number safe. If you have any issues, you can contact MoneyGram customer service by phone, email, or live chat.

Step-by-Step Guide to Sending Money Online with MoneyGram:

- Log into your account on the website or app.

- Go to the ‘Send’ feature.

- Enter the amount you want to send.

- Choose your payment method (bank debit card, bank transfer, credit card, or cash).

- Select how your recipient will receive the money (bank account, cash pickup, or mobile wallet).

- Enter the recipient’s details.

- Review all information carefully.

- Confirm and complete your transfer.

Sending money online with MoneyGram is easy when you follow these steps. You can send money internationally, pay for international payments, and choose the best way to send to a bank account or for cash pickup. Always double-check your details to avoid delays and keep your account safe.

Tips for Sending Money Fast

When you want your money to reach someone quickly, you need to make smart choices during your transfer. Here are some tips to help you speed up your next MoneyGram transfer.

Select Fast Payment Methods

You can choose from several payment methods, but some work faster than others. If you use a bank debit card, your transfer often processes in minutes. Credit cards also move money quickly, but they usually cost more. Bank transfers can take longer, especially if you send money outside the United States. Always check the estimated delivery time before you confirm your transfer.

Tip: Debit cards usually offer the best mix of speed and cost for most transfers.

Choose Quick Delivery Options

How your recipient gets the money also affects the speed. If you pick cash pickup, your recipient can collect the money almost right away at a MoneyGram location. Sending to a mobile wallet is another fast option in many countries. Bank account transfers may take longer, especially for international transfers. If your recipient needs money fast, cash pickup or mobile wallet delivery is usually the best choice.

| Delivery Option | Speed | Best For |

|---|---|---|

| Cash Pickup | Minutes | Urgent transfers |

| Mobile Wallet | Minutes to hours | Quick international transfers |

| Bank Account | Hours to days | Non-urgent transfers |

Avoid Common Delays

You can avoid delays by double-checking all details before you send your transfer. Make sure the recipient’s name matches their ID. Enter the correct account number and location. For international transfers, review the country’s rules and required documents. If you send money to Hong Kong banks, confirm the bank code and account information. Mistakes can slow down your transfer or even cause it to fail.

Note: Always track your transfer status in the MoneyGram app or website. If you see a problem, contact customer service right away.

Sending Money Securely

Image Source: pexels

Protect Your Account

You want your money and information to stay safe. MoneyGram uses advanced encryption technology to protect your data when you send money online. You can make your account even safer by setting up two-factor authentication (2FA) and choosing strong security questions. Always create a strong, unique password and update it often. MoneyGram never stores your credit or debit card information, so your payment details stay private. The company also checks your identity with valid IDs for every transfer. If you send more than $15,000, you will need to complete extra verification steps.

Here are some ways MoneyGram helps keep your account secure:

- Encrypts all sensitive information during storage and transfer.

- Lets you customize security settings, like 2FA and security questions.

- Monitors accounts for suspicious activity with a dedicated fraud prevention team.

- Offers a security center with tips and videos to help you learn about online safety.

- Responds quickly to any security issues, usually within 24 to 48 hours.

If you notice anything strange, report it right away using MoneyGram’s hotline or support page.

Spot and Avoid Scams

Scammers try many tricks to steal your money. You might get a call from someone pretending to be an IRS agent or a message about a fake lottery win. Some scammers act like family members in trouble or offer fake loans. Others ask for payment for goods that do not exist or pretend to be from a charity after a disaster. Romance scams and elder abuse scams also happen often.

To protect yourself:

- Never send money to someone you do not know or trust.

- Do not share your account details or passwords.

- Watch out for urgent requests or threats.

- If something feels wrong, stop and check with MoneyGram’s support team.

Use Official Channels

Always use the official MoneyGram website or app to send money. Type the website address directly into your browser instead of clicking on links in emails. MoneyGram will never ask for your personal or financial information by email. If you get a suspicious message, report it through the official contact page. The company follows strict rules to prevent fraud and money laundering. You can also reach out to customer support if you have questions or concerns about your transfer.

Tip: Using official channels and following these steps gives you peace of mind and keeps your transfers secure.

Money Transfers Online: Fees and Limits

When you send money transfers online, you want to know exactly what you will pay and how much you can send. MoneyGram makes it easy, but you should always check the details before you start your transfer.

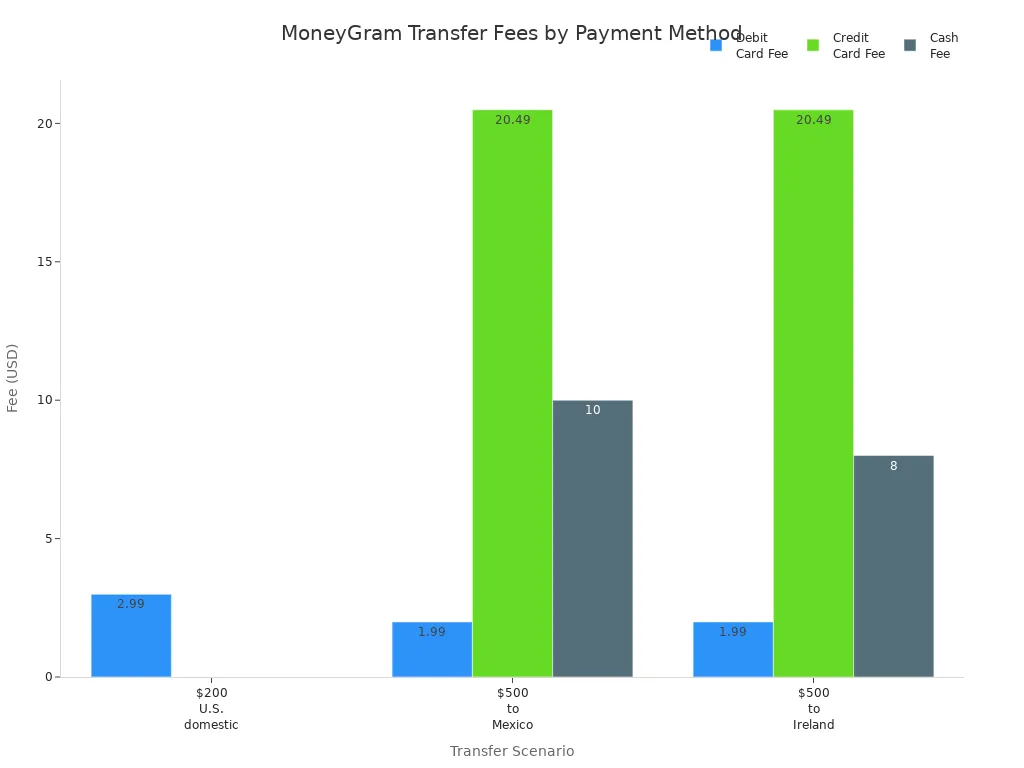

Understand Transfer Fees

MoneyGram’s fees change based on how you pay, how much you send, and where your recipient lives. If you pay from your bank account, you usually pay less than if you use a credit card. Sending money to Hong Kong banks or other international locations may have different fees than sending within the United States. The cost to transfer money also depends on the delivery method, like cash pickup or bank deposit. Sometimes, you see a low fee, but the exchange rate is not as good, so your recipient gets less money.

- Fees depend on the amount, payment type, delivery method, and pickup location.

- The destination country affects both the fee and how fast your recipient gets the money.

- MoneyGram can change fees and exchange rates at any time, so always check before you send.

Tip: Always compare both the transfer fee and the exchange rate to see the real cost.

Exchange Rates

Exchange rates play a big part in international money transfers online. MoneyGram adds a margin to the exchange rate, which means your recipient may get less money than you expect. For example, if you send $500 to France, you might see no transfer fee, but the exchange rate could be less favorable. Compared to some other services, MoneyGram’s exchange rate markup can be higher—sometimes up to 5%. This means even if the upfront fee looks low, the total cost can be higher.

Transfer Limits

You might wonder, how much money can I send online? MoneyGram sets limits to keep your transfers safe and follow rules. For most international transfers, you can send up to $10,000 per transaction and within any 30-day period. If you send money within the United States, the limit goes up to $15,000 per transfer. Some countries, like Chile, have lower limits. The payment method also matters. Card payments often have lower limits, around $6,000 per transfer, while bank account transfers can go up to $10,000. If you need to send more, you may need to visit a MoneyGram agent and show extra documents.

| Transfer Context | Limit Amount (USD) | Notes |

|---|---|---|

| Most international online transfers | $10,000 per transaction | Applies to most countries |

| US online transfers | $15,000 per transaction | Higher limit for transfers within the US |

| Chile | $5,000 per transfer | Country-specific exception |

| Card payments | ~$6,000 per transaction | Lower than bank account transfers |

| Bank account transfers | $10,000 per transaction | May vary by country |

If you try to send more than the limit, your transfer will not go through. Repeated attempts can flag your account for review. MoneyGram also offers a special service for high-value transfers, but you must provide extra ID and proof of income.

Note: Always check your limit in your MoneyGram account before you start a large transfer.

Quick Checklist for Online Transfers

Before You Send

You want your money to arrive fast and safe. Here’s a simple checklist to help you get everything right before you send a transfer with MoneyGram:

- Confirm your recipient’s status and location. For example, if you send money to someone in a Hong Kong bank, make sure they have access to their account.

- Gather all the recipient’s details. You need their full name, account number, city, state, and receive code. Double-check these to avoid mistakes.

- Prepare your identification. Have your passport, driver’s license, or national ID ready. MoneyGram may ask for this to keep your account secure.

- Use a secure device and browser. Open MoneyGram’s website or app on Google Chrome, Firefox, Safari, or Edge for the best security.

- Log in to your account or create one if you are new. Make sure your account information is up to date.

- Choose your payment method. Decide if you want to use a debit card, credit card, or bank transfer.

- Review all details before you hit send. Check the recipient’s account information and the amount.

- Save your receipt and confirmation number. You may need these if you have questions later.

Tip: Always follow up with your recipient to make sure they received the money in their account.

After You Send

Once you finish your transfer, you still have a few important steps to keep things smooth and secure:

- Keep your confirmation number safe. You get this by email or text after you send money.

- Track your transfer online. Use the reference number and your recipient’s last name to check the status in your account.

- Watch for updates. MoneyGram will send you emails or texts about your transfer.

- Double-check your transaction details. If you spot a mistake, contact MoneyGram support within 30 minutes to cancel or fix it.

- Protect your account. Never share your confirmation number or account details with anyone you do not trust.

- Use only the official MoneyGram website or app to manage your account and transfers.

- If your recipient has not received the money, reach out to MoneyGram support with your confirmation number for help.

Note: MoneyGram uses strong encryption and security checks to protect your account and personal information.

You can make your MoneyGram transfers fast and secure by double-checking every detail, choosing the right payment and delivery options, and keeping your reference number safe. Always use the official website or app, and watch out for scams—over $115 million has been lost to fraud in recent years. Use the checklist each time you send money. Careful steps and staying alert help you avoid mistakes and keep your money safe.

FAQ

How long does a MoneyGram online transfer take?

Most transfers arrive within minutes if you use a debit card or send to a cash pickup. Bank transfers, especially to Hong Kong banks, can take a few hours or up to two business days. Always check the estimated delivery time before you send.

What should I do if I entered the wrong recipient details?

Act fast. Log in to your MoneyGram account and check your transfer status. If the transfer is still pending, contact MoneyGram support right away. You may be able to cancel or correct the details before the money is picked up.

Are there limits on how much money I can send online?

Yes, MoneyGram sets limits for your safety. You can send up to $10,000 per transaction for most international transfers. For transfers within the United States, the limit is $15,000. Card payments usually have lower limits than bank transfers.

How do I track my MoneyGram transfer?

You can track your transfer online or in the app. Just enter your reference number and the recipient’s last name. MoneyGram updates the status in real time. If you have questions, use the support chat or call customer service.

What fees should I expect when sending money online?

Fees depend on your payment method, the amount, and the destination. For example, sending $500 to a Hong Kong bank from the United States may cost $1.99 with a bank transfer or $20.49 with a credit card. Always check the fee and exchange rate before you send.

MoneyGram helps you send money online, but high fees, exchange rate markups, and unpredictable delivery times can still be frustrating. If you want a smarter alternative, BiyaPay makes cross-border transfers faster, cheaper, and more transparent.

With remittance fees as low as 0.5%, real-time exchange rates, and same-day transfers in many cases, BiyaPay gives you peace of mind when sending money abroad. Whether you use fiat or digital currencies, registration takes only minutes.

Stop overpaying for your transfers—register with BiyaPay today and keep more of your money where it belongs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.