- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Uncovering the Maximum Amount You Can Send with Remitly

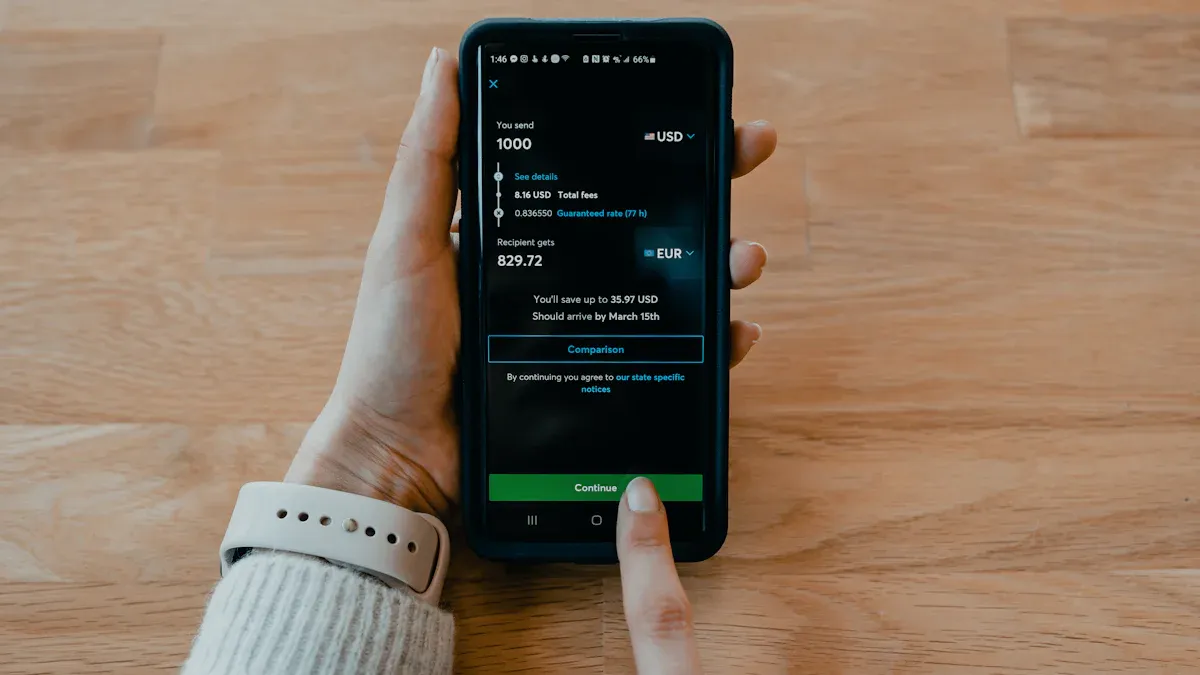

Image Source: pexels

When you use Remitly to send money, knowing your Maximum Amount matters. Remitly sets a $20,000 transfer limit per transaction. This limit helps keep your transfer safe and follows international remittance rules. You might see different limits for each country and delivery method. Remitly can ask for your photo ID or proof of address if you want to send larger amounts. If you need to send money more often, Remitly may request extra documents, like a utility bill or bank statement. Sending money with Remitly means you work within these limits, but you can ask for higher sending limits if your needs change. Other remittance services, like Wise, offer higher transfer amounts, but Remitly keeps things predictable and secure. Remitly’s limits can change with exchange rates or remittance partner rules, so always check before you send money.

Key Takeaways

- Remitly sets transfer limits based on your country, delivery method, and verification level to keep your money safe and follow laws.

- You start with low sending limits and can increase them by verifying your identity with documents like a photo ID and proof of address.

- Different delivery options like Express, Economy, and Premier have different maximum amounts you can send per transaction.

- You can check your current sending limits easily in the Remitly app or website before making a transfer.

- If you need to send more money, you can request higher limits by providing extra documents and contacting Remitly support.

Remitly Transfer Limits

Image Source: pexels

Maximum Amount per Transaction

When you send money with Remitly, you want to know the maximum amount you can transfer in one go. Remitly sets different transaction limits based on where you send money from. These limits help keep your payments safe and follow international remittance rules. Here is a table showing the maximum amount you can send per transaction from some of the most common countries:

| Country/Region | Maximum Amount per Transaction |

|---|---|

| United States | 25,000 USD |

| United Kingdom | 25,000 GBP |

| Europe (Eurozone) | 30,000 EUR |

| Canada | 15,000 CAD |

| Australia | 10,000 AUD |

| New Zealand | 50,000 NZD |

| Singapore | 40,000 SGD |

| United Arab Emirates | 110,000 AED |

You can see that the maximum amount changes depending on your location. If you send money from the United States, you can transfer up to $25,000 in a single transaction. If you send money from Europe, the maximum amount is 30,000 EUR. Remitly sets these limits to match local regulations and payment partner rules. The delivery method you choose, like bank deposit or cash pickup, can also affect your transaction limit.

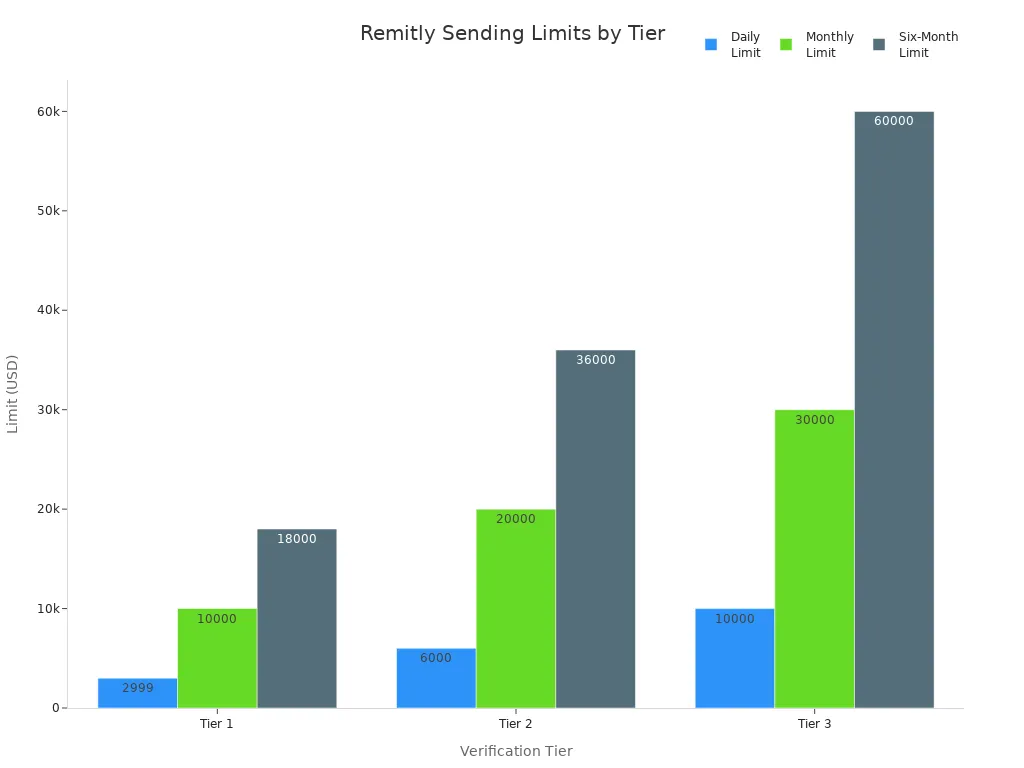

Daily, Monthly, and Six-Month Limits

Remitly does not just set a maximum amount per transaction. You also have daily, monthly, and six-month limits. These limits depend on your verification level and help keep your money transfer safe. Here is a table that shows how much you can send at each verification tier:

| Verification Tier | Daily Sending Limit | Monthly Sending Limit | Six-Month Sending Limit |

|---|---|---|---|

| Tier 1 | $2,999 USD | $10,000 USD | $18,000 USD |

| Tier 2 | $6,000 USD | $20,000 USD | $36,000 USD |

| Tier 3 | $10,000 USD | $30,000 USD | $60,000 USD |

You start at Tier 1 when you open your Remitly account. If you want to send more money, you can move up to Tier 2 or Tier 3 by providing more information. The monthly limit and six-month limit help Remitly follow international money transfer laws and prevent fraud. You can see these limits in the chart below:

If you reach your daily or monthly limit, you must wait until the next period to send more money. These limits apply to all your transactions, no matter which country you send money to.

Tiered Sending Levels

Remitly uses a tiered system for sending limits. This means you start with basic limits and can increase them by verifying your identity. Here is how the tiered system works:

- You begin at Tier 1 with basic sending limits when you create your Remitly account.

- If you want to send more money, you request a limit increase and provide extra information, like your government-issued ID.

- After Remitly checks your documents, you move to Tier 2 and get higher limits.

- You can request another increase to reach Tier 3 by submitting more documents, such as proof of address or source of funds.

- Your sending limits depend on both your location and the recipient’s country. Remitly also checks your payments over 24 hours, 30 days, and 180 days.

Remitly sets these levels to follow international remittance rules and keep your money safe. Regulations in each country can change your maximum amount and payment options. For example, if you send money to India, Remitly follows rules from the Reserve Bank of India. If you send money to Brazil, Remitly works with local partners and follows Brazilian laws. These rules help Remitly prevent fraud and keep your payments secure.

Note: Remitly may delay or refuse a transaction if it does not meet legal or regulatory requirements. Always check your current limits before making a large money transfer.

Remitly’s tiered system gives you control over your money transfers. You can start small and increase your limits as your needs grow. If you need to send more money, you can always ask Remitly for a higher limit by providing the right documents.

Factors Affecting Maximum Amount

When you use Remitly to send money, several things can change your maximum amount. You might notice that your transfer limit is not the same as your friend’s. That is because Remitly looks at many details before letting you transfer money overseas. Let’s break down what matters most.

Sending and Receiving Country

The country you send money from and the country you send money to both play a big role. Remitly sets different limits for each country. For example, if you send money from the United States or Canada, you can transfer up to $50,000 per transaction. If you use Remitly in Australia or India, your maximum amount might be $25,000. The United Kingdom lets you transfer up to £40,000. These numbers can change if local rules or remittance partners update their requirements. Some countries have strict international payment laws, so Remitly must follow them. Always check your country’s rules before you start a money transfer.

Here is a quick look at how these factors compare:

| Factor | Details / Limits |

|---|---|

| Country of Origin and Destination | Limits vary by country; US and Canada up to $50,000 per transaction; Australia, India up to $25,000; UK up to £40,000 |

| Compliance with Local Laws | Transfers must follow local regulations; some countries set their own restrictions |

Delivery Method

Remitly gives you different options for sending money. The delivery method you pick can change your transfer limit. If you choose Express, you can send up to $2,999.99 per transaction. Economy lets you send up to $10,000. Premier gives you the highest limit, up to $50,000. Some payment options, like bank deposit or cash pickup, may also have their own limits. You should always check which payment options work best for your needs. If you want to transfer money overseas quickly, Express might be your choice, but the maximum amount will be lower.

- Express: up to $2,999.99 per transaction

- Economy: up to $10,000 per transaction

- Premier: up to $50,000 per transaction

Tip: If you need to send a large international payment, try Premier or Economy for higher limits.

Verification Status

Your verification status is another key factor. Remitly uses a tiered system for sending money. When you first sign up, you start at the lowest tier. You can only send a small amount until you verify your identity. If you want to increase your maximum amount, you need to provide more documents. Remitly may ask for your government ID, proof of address, or even your source of funds. The more you verify, the higher your transfer limit grows. If you have a good account history and provide all needed documents, Remitly may let you send more money.

Note: Transfers above your current limit may be delayed up to 24 hours for compliance checks. Always keep your documents ready if you plan to send larger payments.

Remitly wants to keep your international payments safe. By checking your country, delivery method, and verification status, you can make sure you get the best options for your cross border payment needs. If you ever need to send more, just update your information and ask Remitly for a higher limit. This way, you can keep sending money to your loved ones without worry.

How to Check Your Remitly Limits

Image Source: unsplash

You might wonder how much you can send with remitly before you hit your limit. Good news: remitly makes it easy to check your sending limits. You can do this right from your phone or computer. Let’s walk through both ways so you always know where you stand.

Using the App

If you use the remitly app, you can check your limits in just a few taps. Here’s how you do it:

- Open the remitly app and log in to your account.

- Tap the menu icon in the top left corner.

- Select “Account” or “Profile.”

- Look for the section called “Sending Limits” or “Limits.”

- You’ll see your current daily, monthly, and six-month limits. remitly also shows how much you have left to send.

Tip: If you want to send money and you’re close to your limit, remitly will show a warning. This helps you avoid failed transfers.

You can also find details about your verification tier here. remitly updates your limits if you move up a tier or finish extra verification.

On the Website

You can also check your remitly limits on the website. The steps look a bit different, but it’s still simple:

- Go to the remitly website and log in.

- Click your name or profile icon at the top right.

- Choose “Account Settings” from the dropdown menu.

- Find the “Sending Limits” section.

- Here, remitly lists your current limits and how much you have used.

If you plan to send money soon, always check your limits first. remitly keeps this information up to date, so you never have to guess. If you need higher limits, remitly will guide you through the steps to increase them.

Note: remitly may adjust your limits based on your account activity or new regulations. Always check before you send large amounts.

Increase Transfer Limits

If you need to send more money with remitly, you can increase your transfer limit by following a few simple steps. remitly makes the process clear and secure, so you can feel confident every time you send a transfer.

Verification Process

remitly uses a step-by-step process to help you raise your transfer limit. When you first sign up, you start with a basic limit. If you want to send a larger transfer, remitly will ask you to verify your identity. You can do this right in the remitly app or on the website. Just follow the prompts and upload the documents remitly requests. remitly uses both automated and manual checks to keep your information safe. They use strong encryption and only allow trained staff to see your details.

Note: remitly protects your data with industry-standard security, including 256-bit encryption and secure logins. Only authorized staff can access your information.

Required Documents

To increase your remitly transfer limit, you need to provide some important documents. remitly may ask for:

- A government-issued photo ID, like a passport or driver’s license

- Proof of address, such as a utility bill

- Bank statements or pay slips to show your source of funds

- Sometimes, extra documents like tax returns or business licenses

remitly may also check your credit score if you want to send a very large transfer. These steps help remitly follow the rules and keep your transfers safe.

Custom Limit Requests

If you need to send more than the usual remitly limit, you can ask for a custom limit. Just contact remitly customer service and explain your transfer needs. remitly will review your account, your documents, and your transfer history. They look at your country, payment method, and account type. remitly may ask for more information to make sure your transfer is safe and legal.

- You can talk to a remitly representative for special transfer needs.

- remitly offers three main limit tiers, but you can request more if needed.

- Verification and extra documents are key for custom limits.

remitly always puts your security first. They use trusted partners to check your documents and never share your information without your consent. If you want to send a bigger transfer, remitly will guide you every step of the way.

Restrictions and Considerations

Country-Specific Rules

When you use remitly, you need to pay attention to the rules in each country. Every country has its own laws about sending money. Remitly follows these rules closely. For example, if you send payments to India, remitly checks the Reserve Bank of India’s requirements. If you send money to Brazil, remitly works with local partners and follows Brazilian laws. These country-specific rules can change how much you can send and which payment options you can use. Sometimes, remitly may lower your sending limit if there are new regulations or if you have not finished your verification. You might also see stricter limits for cash pick-up options because of anti-money laundering rules. Remitly always updates its limits to match the latest laws and keep your payments safe.

Payment Method Limits

Remitly gives you several payment options, but each one comes with its own rules. Some payment methods, like debit cards, let you send money faster. Other options, such as ACH bank transfers, might take longer. The speed of your payment depends on the method you choose. However, the maximum amount you can send with remitly is mostly set by the country’s rules and your verification status, not the payment method itself. If you want to send a large amount, remitly will ask you to complete extra verification. Cash pick-up options often have lower limits because remitly must follow strict anti-money laundering laws. You should always check which payment options work best for your needs before you send money.

Exceeding Your Limit

If you try to send more than your remitly limit, your payment will not go through. Remitly will show you a warning if you get close to your limit. If you reach your maximum, remitly may ask for more documents to verify your identity and the source of your funds. This is part of remitly’s effort to follow anti-money laundering rules and keep your payments secure. Sometimes, remitly may lower your limit for a short time if there are issues with your verification or if new rules come out. If you need to send more, you can always contact remitly and ask for a higher limit. Remitly will guide you through the steps and let you know which documents you need. By staying aware of your limits and keeping your information up to date, you can make sure your payments go through smoothly.

You want to make sure your money transfers go smoothly. Here’s why you should check your remitly limits often:

- Limits change based on your verification, delivery method, and country.

- New users start with lower limits, but you can increase them by verifying your account.

- Rules and limits may shift due to regulations or updates.

- Checking your limits helps you plan and avoid failed transfers.

- Staying updated keeps your transfers safe and on track.

If you need help, you can reach remitly’s support through their Help Center, phone, or chat. For the latest transfer limits and delivery options, always check the app or website before you send money.

FAQ

What happens if you try to send more than your Remitly limit?

Remitly will stop your transfer. You will see a warning message. You may need to provide more documents to raise your limit before you can send a larger amount.

How long does it take to increase your Remitly sending limit?

You can usually increase your limit within 1-2 business days after you submit your documents. Remitly will review your information and let you know if you need to send anything else.

Can you send money to a Hong Kong bank account with Remitly?

Yes, you can send money to Hong Kong bank accounts. Remitly supports transfers to major banks in Hong Kong. Always check the latest exchange rates in USD before you send your transfer.

Does Remitly charge extra fees for higher transfer amounts?

Remitly charges fees based on the amount, country, and delivery method. Here is a quick look:

| Transfer Amount (USD) | Typical Fee (USD) |

|---|---|

| Up to $500 | $3.99 |

| $500 - $2,999 | $7.99 |

| Over $2,999 | Varies |

Tip: You can see the exact fee before you confirm your transfer.

Remitly’s tiered limits keep your transfers compliant but often restrict how much you can send without lengthy verification. If you need higher limits, lower costs, and faster approvals, BiyaPay gives you more freedom.

With remittance fees as low as 0.5%, real-time exchange rates, and flexible sending limits, BiyaPay makes cross-border payments simple and transparent. No more waiting days for approvals—most transfers arrive the same day.

Take control of your international transfers—register with BiyaPay today and move money without unnecessary limits.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.