- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Options for Fast and Affordable Money Transfers from Canada to the USA

Image Source: pexels

When you look for the best options for transferring money from Canada to USA, you will find Wise, Revolut, major banks, and Western Union as leading choices. These options let you send money quickly, often with low fees and strong exchange rates. Many people choose these options because they make transferring money from Canada to USA simple and safe. In 2025, people in Canada are expected to transfer over US$4.41 billion using digital methods. The table below shows key figures for digital remittances:

| Metric | Value | Year/Period |

|---|---|---|

| Projected transaction value of digital remittances from Canada | US$4.41 billion | 2025 |

| Number of users in digital remittances market | 779,460 users | 2029 (projected) |

| Average transaction value per user | US$6,190 | 2025 |

You should compare each option to find the best options for your needs when transferring money from Canada to USA.

Key Takeaways

- Online services like Wise and Revolut offer fast, low-cost transfers with good exchange rates, making them great for quick and affordable money transfers.

- Banks provide secure options for large transfers but usually charge higher fees and take longer to process international wire transfers.

- Cash transfer services like Western Union deliver money quickly and in cash but often have higher fees and are best for urgent needs or recipients without bank accounts.

- Money transfer apps add convenience by letting you send money from your phone with low fees and fast delivery times.

- Always compare fees, exchange rates, and transfer speeds before sending money to save costs and ensure your transfer is safe and efficient.

Best Options for Transferring Money from Canada to USA

When you look for the best options for transferring money from Canada to USA, you will see several choices. You can use online services like Wise, Revolut, and Remitly. You can also use major banks such as RBC, TD, BMO, and CIBC. If you want to send cash, Western Union is a popular option. Each option has different features, fees, and speeds. You should compare these options to find the most cost-effective option for your needs.

Speed and Cost Comparison

Speed is important when you need to send money quickly. Online services like Wise and Revolut often process international transfers within one to two business days. Remitly can deliver funds in minutes if you pay extra. Major banks usually take longer for international wire transfers. The time depends on the bank and the cut-off time for sending money.

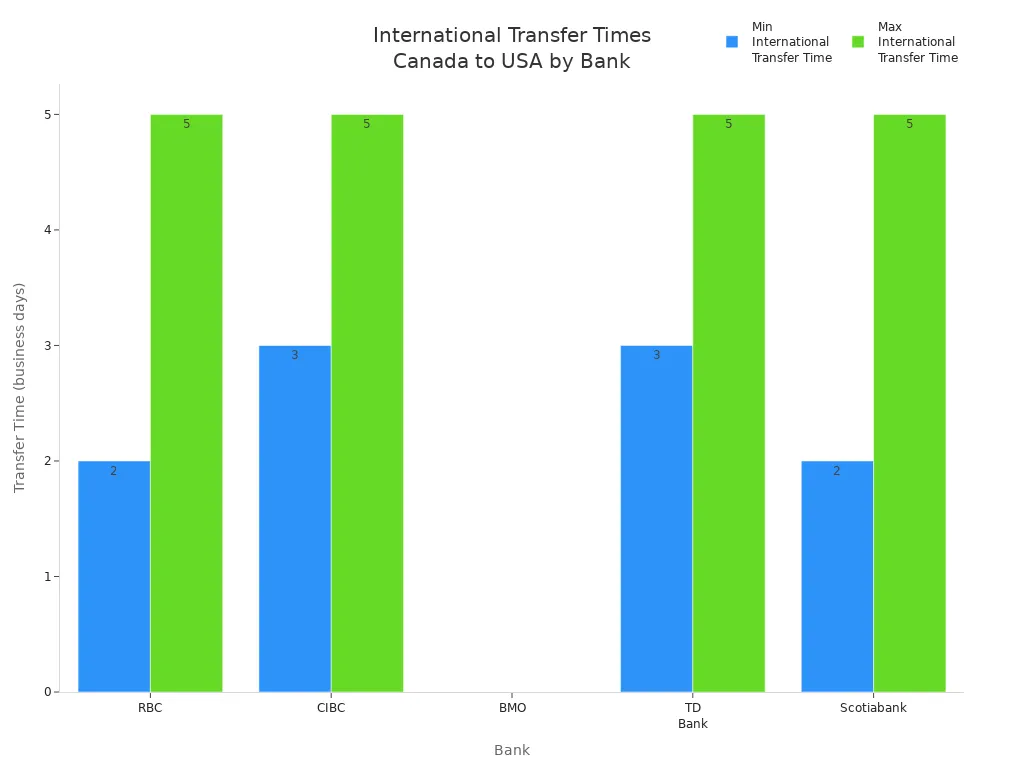

Here is a table showing how long it takes for money to arrive using major Canadian banks:

| Bank | Domestic Transfer Time | International Transfer Time |

|---|---|---|

| RBC | Same business day if before cut-off | 2 to 5 business days |

| CIBC | Within 1 business day | 3 to 5 business days |

| BMO | Same business day if before cut-off | A few business days (not specified) |

| TD Bank | Within 1 business day | 3 to 5 business days |

| Scotiabank | 1 to 2 business days | 2 to 5 business days |

Online international money transfer services often offer faster delivery than banks. You can expect your money to arrive in one to two days with Wise or Revolut. Western Union can deliver cash in minutes, but you may pay higher fees for this speed.

Fees and rates are also important. Online services usually have lower transfer fees and offer competitive exchange rates. Banks often charge higher fees for international wire transfers. You may also get less favorable rates. Western Union charges variable fees based on the amount and delivery speed. You should always check the total cost, including both fees and exchange rates, before you send money.

Tip: To get the best exchange rates, compare several international money transfer services before you choose one. Some services show you the real exchange rate, while others add a markup.

Convenience and Security

Convenience matters when you transfer money. Online services and money transfer apps let you send money from your phone or computer. You can link your bank account or card and complete the process in minutes. Major banks let you send international wire transfers through online banking, but the process may take longer and require more steps. Western Union lets you send cash in person or online, and the recipient can pick up cash at many locations.

Security is a top concern for anyone sending money. Leading money transfer providers use several measures to keep your funds and data safe:

- They use encryption technologies like SSL/TLS to protect your information during transfers.

- Two-factor authentication (2FA) adds an extra layer of security to your account.

- Intelligent fraud detection systems monitor transactions in real-time to spot suspicious activity.

- Providers follow strict rules such as Anti-Money Laundering (AML) and Know Your Customer (KYC) to prevent illegal transfers.

- Secure payment gateways protect your payment details during processing.

- Customer support teams help you resolve any issues or unauthorized transactions.

- Some services plan to add biometric verification and blockchain technology for even stronger security in the future.

You should always choose a secure money transfer service. Look for providers that follow international standards and offer strong customer support. This will help you avoid problems and keep your money safe.

When you compare the best options for transferring money from Canada to USA, think about speed, fees, rates, convenience, and security. Online services often give you the best exchange rates and lower fees. Banks offer reliability but may take longer and cost more. Western Union is useful if you need to send cash fast. By understanding these transfer options, you can make the right choice for your needs.

Bank Transfers

How Bank Transfers Work

You can use a bank transfer to send money from Canada to the USA. Major Canadian banks like RBC, TD, BMO, and CIBC offer cross-border solutions for international wire transfer. To start, you need accounts at both a Canadian and a U.S. bank, such as RBC Royal Bank and RBC Bank in the USA. You link these accounts through online banking or a mobile app. Once linked, you can begin an international wire transfer. The process usually involves these steps:

- Gather the recipient’s full name, bank account number, bank name, and address.

- Enter the bank identification code (SWIFT/BIC) for the international wire transfer.

- Choose the amount to send and confirm the currency.

- Review any transfer fees and exchange rates.

- Submit the transfer and keep the confirmation for your records.

Some banks let you use tools like foreign exchange calculators to check rates and fees before you send money. You can often transfer up to $25,000 USD instantly between linked accounts.

Fees and Rates

When you use a bank for an international wire transfer, you need to watch out for both transfer fees and exchange rates. Canadian banks often charge international wire transfer fees that range from $10 USD to $50 USD per transaction. These fees depend on the bank and the amount you send. You may also face extra charges if the receiving bank in the USA, such as Chase or Bank of America, applies its own fees.

Banks do not always give you the best rates. They often add a hidden markup to the exchange rate, so you get less money than the mid-market rate shown on Google. This means you pay more than just the international wire transfer fees. Services like Wise show you the real mid-market rate and list all fees up front, which can save you money on cross-border transactions.

| Bank | International Wire Transfer Fees (USD) | Exchange Rate Markup | Receiving Bank Fees (USD) |

|---|---|---|---|

| RBC | $13–$50 | Yes | $15–$20 |

| TD | $15–$50 | Yes | $15–$20 |

| BMO | $15–$40 | Yes | $15–$20 |

| CIBC | $15–$50 | Yes | $15–$20 |

Note: Always check both the transfer fees and the exchange rates before you send money. The total cost of an international wire transfer can be higher than you expect.

Pros and Cons

Bank transfers offer several benefits for international wire transfer. You can use online banking, mobile apps, or visit a branch. Banks protect your money with strong security and encryption. You can send large amounts, and the process is familiar if you already use a bank.

However, international wire transfer has some drawbacks. Transfers from Canada to the USA can take several days to complete. International wire transfer fees can add up, especially if both the sending and receiving banks charge fees. Banks also limit how much you can send in one transaction. You may not get the best rates, since banks often add a markup to the exchange rate.

- Pros:

- Easy to use if you have accounts at both banks.

- Secure with strong protection.

- Good for large transfers.

- Cons:

- International wire transfer can take several days.

- International wire transfer fees and poor rates increase costs.

- Limits on transfer amounts.

You should always double-check recipient details before sending an international wire transfer. Mistakes are hard to fix, and you may lose money if you enter the wrong information. Monitor your account after the transfer to make sure everything went through as planned.

International Money Transfer Services

Online Platforms

You have many choices when you want to send money from Canada to the USA using an online money transfer service. These platforms make international money transfers simple and fast. Here is a table showing some popular online money transfer providers and their unique features:

| Platform | Transfer Methods | Unique Features |

|---|---|---|

| PayPal | PayPal Balance, Instant Transfer, Credit/Debit Card, eCheck | Buyer and seller protection; global reach; fast transfers; promotional offers; no cash pickup option |

| Remitly | Bank Deposit, Cash Pickup, Mobile Money, Home Delivery | Delivery time guarantee with refund; cash pickup at major US retailers; secure transactions; promotional rates |

| Sendwave | Mobile Wallets, Bank Accounts, Debit Cards (Visa/MasterCard), Cash Pickup | Quick verification; encrypted 256-bit connection; no credit card funding; sending limits for Canadians |

| Western Union | Bank Account, Credit/Debit Card, Cash Payment, Mobile Wallet | Extensive agent network (500,000+ locations) for cash pickups; rapid transfers; multiple payment options |

| WorldRemit | Bank Deposit, Credit Card, Debit Card, Apple Pay, Interac | Multiple payment options; fast transfers (90% within minutes); airtime top-ups; user-friendly platform |

| Wise | Interac e-Transfer, Bank Transfer, Direct Debit, Debit/Credit Card, Apple Pay, Google Pay | Mid-market exchange rates with no hidden fees; transparent pricing; multi-currency accounts; fast transfers |

You can use these online remittance service options for global money transfers. Each platform offers different transfer methods and features, so you can choose the one that fits your needs.

Exchange Rates and Fees

When you compare international money transfers, you should look at both rates and fees. Online money transfer service providers usually offer lower fees and more competitive exchange rates than banks. This means you get more money to your recipient. Here are some important points:

- Traditional banks charge higher fees and give you less favorable rates, so less money arrives.

- Online money transfer service platforms have lower fees and better rates, so you deliver more money.

- Banks take longer for international transfers, while online services can complete transfers in minutes or hours.

- Online money transfer service platforms are more user-friendly and transparent about rates and fees.

- For frequent or smaller international transfers, online money transfer service options save you money.

- Banks may work better for large or complex international money transfers because of their regulation and personal service.

- You can use comparison tools to find the best exchange rates and lowest transfer fees for your needs.

You should always check the total cost, including all fees and rates, before you send money. This helps you find the best exchange rates and avoid surprises.

Security and Speed

Security and speed matter when you send money across borders. Online money transfer service providers use strong security measures. They use encryption, two-factor authentication, and fraud detection to keep your money safe. You can trust these platforms for secure international money transfers.

Speed is another big advantage. Online money transfer service platforms like Wise can deliver funds instantly in some cases. About 45% of Wise transfers arrive right away. Most online money transfer service options complete international transfers within one to five business days. The exact speed depends on the platform, the payment method, and the time you send the money.

You should choose a secure online money transfer service that matches your needs for speed, rates, and fees. Many platforms also offer promotional rates for new users, so you can save even more on your first transfer.

Mobile Apps for Sending Money to the US from Canada

Image Source: unsplash

App Features

You can use money transfer apps to send money to the US from Canada with ease. These apps work as digital wallets and connect to your Canadian bank account or debit card. When you want to send money, you open the app, enter the amount, and choose the recipient. The app asks for your PIN or password to keep your money safe. After you confirm, the app sends a payment request to the processor. The processor checks and approves the transaction. This process often takes only seconds or minutes.

Many money transfer apps offer special features for Canadian users. Some apps, like Wise, let you hold and spend money in different currencies. Wise also gives you a debit card for multi-currency spending. PESA offers a multi-currency wallet with zero fees and strong security. Wealthsimple Cash gives you instant e-transfers and cashback rewards. KOHO provides a prepaid Visa card and free transfers within its network. Interac e-Transfer is popular for quick transfers within Canada, but it has limits for cross-border use.

Here is a table showing some popular money transfer apps and their standout features:

| Mobile App | Standout Features |

|---|---|

| PESA | Multi-currency wallet; zero fees; strong security; fast and cost-effective transfers |

| Interac e-Transfer | Secure, instant transfers in Canada; needs Canadian bank account; limited cross-border use |

| Wise | Transparent pricing; mid-market exchange rates; Wise card; business accounts |

| Wealthsimple Cash | Fee-free instant e-transfers; cashback; unique Dollar $ign IDs |

| KOHO | Prepaid Visa card; instant, free transfers within KOHO; 1.5% foreign transaction fee |

Costs and Delivery Times

Money transfer apps help you save money and time. Most apps charge lower fees than banks. Some, like PESA and Wealthsimple Cash, offer zero or very low fees. Wise uses the real exchange rate and shows you all costs before you send money. KOHO charges a 1.5% fee for foreign transactions. You should always check the fee and exchange rate before you send money.

Speed is a key benefit of money transfer apps. Many apps offer instant transfer or deliver funds within minutes. Wise and PESA process most transfers quickly, so your recipient gets the money fast. Some apps may take longer if you send money outside regular hours or use certain payment methods. Always review the delivery time in the app before you confirm your transfer.

Tip: Use money transfer apps that link directly to your Canadian bank account for the fastest and most secure experience.

Cash and In-Person Transfers

Image Source: unsplash

How Cash Transfers Work

You can use cash and in-person transfer options when you need to send money quickly from Canada to the USA. Services like Western Union give you several options for sending funds. These options work well if your recipient does not have a bank account or needs cash right away.

To complete a cash transfer with Western Union, follow these steps:

- Download the Western Union app from the Play Store or Apple Store.

- Register your personal information in the app.

- Select the USA as your destination and enter the amount in Canadian dollars.

- Review the converted amount in US dollars.

- Choose how your recipient will get the money: direct to their bank account or cash pickup at a Western Union location.

- Pick your payment method: credit card, debit card, bank account, or pay in person at an agent.

- Pay the total amount, including any transfer fees.

- Receive a Money Transfer Control Number (MTCN) to track your transfer.

- Monitor your transfer status in the app.

These options let you send money even if you do not have online banking. You can visit a Western Union agent in person if you prefer not to use the app.

Fees and Pickup Options

Cash transfer options often cost more than online transfers. You pay fees based on the amount, payment method, and delivery speed. Western Union and similar services show you the total fees before you confirm the transfer. If you pay with a credit card, you may see higher fees. Bank account payments usually have lower fees.

Here is a table comparing common fees and pickup options:

| Service | Payment Options | Pickup Options | Typical Fees (USD) |

|---|---|---|---|

| Western Union | Credit card, debit card, bank account, cash at agent | Cash pickup, bank deposit | $5–$30 per transfer |

| MoneyGram | Credit card, debit card, bank account, cash at agent | Cash pickup, bank deposit | $5–$25 per transfer |

You should use cash transfer options when your recipient needs money fast or does not have a bank account. These options are also helpful in emergencies. Always check the total fees and compare options before you send money.

Alternative Ways to Transfer Money

Prepaid Cards and Money Orders

You have several options if you want to send money from Canada to the USA without using banks or online services. Prepaid debit cards, paper checks, and money orders are common choices. You can buy a prepaid card, load it with funds, and mail it to your recipient. The recipient can use the card at stores or ATMs in the USA. Money orders work like checks but are prepaid and traceable. You can buy a money order at a post office or a store, then mail it to the person in the USA. Paper checks are another option, but they take longer to clear and may cost more to cash.

Here is a table comparing these options:

| Payment Method | Pros | Cons |

|---|---|---|

| Prepaid Debit Card | Easy to get; fast access to funds; safer if lost | Fees for activation and use; limited fraud protection |

| Money Order | Traceable; safer than cash; accepted widely | Slower than electronic options; small fee to buy |

| Paper Check | Familiar; can cancel if lost | Slow delivery; high cashing fees; risk of loss |

Pros and Cons

These options offer benefits and drawbacks compared to online and bank transfers. Prepaid cards give you fast access to money and do not need a bank account. Money orders are safe and easy to track. Paper checks are simple and well-known. However, these options often take longer to deliver. Mailing a check or money order can take days or weeks. Cashing them in the USA may cost extra and take more time.

You should also think about security. Prepaid cards limit your loss if stolen, but they do not offer strong fraud protection. Money orders are safer than mailing cash, but you must keep the receipt to track them. Checks have security features, but they can get lost or stolen in the mail.

Here is a table comparing the speed, cost, and security of these options to other transfer methods:

| Transfer Method | Speed | Cost | Security and Notes |

|---|---|---|---|

| Prepaid Debit Card | Fast to use | Fees for use | Safer than cash; limited fraud protection |

| Money Order | Slow (mail time) | $3–$10 per order | Traceable; safer than cash |

| Paper Check | Slow (days/weeks) | Fees to cash/check | Can cancel if lost; risk in transit |

| Online/Bank Transfers | Fast | $35–$45 per transfer | Secure; needs bank details |

You have many options for sending money. Each option has different costs, speeds, and security levels. Choose the option that fits your needs and your recipient’s situation.

How to Transfer Money from Canada to USA

Step-by-Step Guide

You can transfer money from Canada to the USA using several methods. The most common way is through an international wire transfer. Start by choosing the right provider. You can use your bank, an online service, or a cash transfer company. Compare fees, exchange rates, and delivery times before you decide. Prepare your documents and double-check all details. Follow these steps for an international wire transfer:

- Log in to your bank’s online platform or visit a branch.

- Select the option for an international wire transfer.

- Enter the recipient’s information and bank details.

- Choose the amount and currency.

- Review the transfer fees and exchange rate.

- Confirm the transfer and save the confirmation number.

Tip: Always compare at least two providers to find the best rates for your international wire transfer.

Required Information

You need specific information to complete an international wire transfer from Canada to the USA. Gather these details before you start:

- Recipient’s full name and complete address, including postal code.

- Recipient’s bank account number, 5-digit transit number, and 3-digit bank identification number.

- Transfer details: amount, currency, date, and who pays the transfer fees.

- Recipient bank’s name and address.

- SWIFT/BIC code of the recipient’s bank.

- Double-check all information to avoid delays.

Having all this information ready helps your international wire transfer go smoothly.

Tracking and Confirmation

After you send an international wire transfer, you want to track its status. Most banks give you a Federal Reference number. Use this number to check with your bank or provider. You can request a wire trace if needed. The recipient can also contact their bank with the reference number, SWIFT code, payment amount, and expected arrival date. Some banks may hold funds for a day or two before posting. For transfers through the SWIFT network, you can ask for an MT103 document to track the payment. If you use Western Union, track your transfer with the Money Transfer Control Number on their website. Wise and similar services offer real-time tracking in their apps.

Note: Always keep your confirmation number and tracking details until the international wire transfer is complete.

When transferring money from Canada to USA, you have many choices. Use online services for speed and low fees, banks for large transfers, and cash services for urgent needs. To save money, compare providers, send larger amounts, and avoid weekends. Watch for hidden fees and use secure payment methods. Always plan ahead and review provider reputations. By following these tips, you can make transferring money from Canada to USA safer and more affordable.

FAQ

What is the fastest way to send money from Canada to the USA?

You can use online services like Wise or Remitly for quick transfers. These platforms often deliver funds within minutes or a few hours. Bank transfers usually take longer, sometimes up to five business days.

How much does it cost to transfer money to the USA?

Fees depend on the provider and method. Online services charge between $2 and $10 per transfer. Banks may charge $15 to $50. Always check the exchange rate and total cost before you send money.

Are online money transfer services safe?

Yes, most online services use strong encryption and two-factor authentication. They follow strict rules to protect your money and information. You should always use trusted providers and keep your login details secure.

What information do I need to send money from Canada to the USA?

You need the recipient’s full name, bank account number, bank name, and SWIFT/BIC code. Some services may also ask for the recipient’s address. Double-check all details before you confirm the transfer.

Tired of paying more than you planned when sending CAD to the U.S.? Banks and cash services often hide the real cost in their FX spreads or make you wait days. With BiyaPay, you can check the live CAD⇄USD rate and convert in-app before you send, keep transfer fees as low as 0.5%, and move value across multiple fiat and digital currencies (e.g., CAD, USD, USDT) without juggling tools. Registration is fast, onboarding is guided, and pricing is transparent—so you always know what lands on the other side. Try a small test, compare the final amount, and keep more of every transfer with BiyaPay.

Start your Canada→USA transfer on your terms with real-time FX and low fees. Get started now: BiyaPay

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.