- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

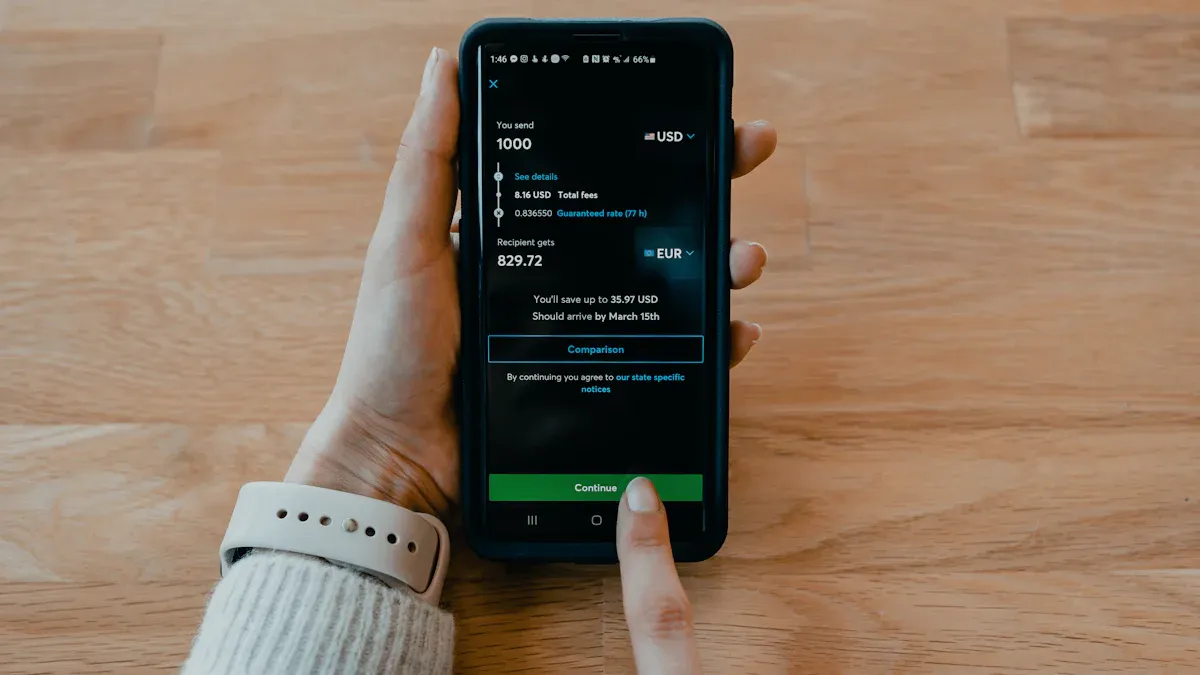

Making Money Transfers from USA to Ukraine Easy and Secure

Image Source: unsplash

If you want to send money from the USA to Ukraine, you can do it in just a few steps. The easiest and most secure way uses trusted online providers that help you avoid the stress of banks or carrying cash. Even though challenges exist—like high fees, safety concerns, and bank delays—you can find hassle-free money transfers by choosing the right service. Many people in the USA use hassle-free money transfers to support loved ones in Ukraine, and the total transaction value keeps growing:

| Metric | Value | Year/Period |

|---|---|---|

| Projected transaction value in Ukraine’s digital remittances market | $52.75 million | 2025 |

| Expected annual growth rate (CAGR) of transaction value | 6.35% | 2025-2029 |

| Projected transaction value by 2029 | $67.47 million | 2029 |

| Expected number of users in digital remittances market | 28,180 users | 2029 |

| Average transaction value per user | $2,400 | 2025 |

| Highest global transaction value source country (USA) | $44.64 billion | 2025 |

You can feel confident that hassle-free money transfers from USA to Ukraine are simple, secure, and affordable when you know what to look for.

Key Takeaways

- Choose trusted money transfer providers with low fees and good exchange rates to save money and send funds quickly.

- Double-check your recipient’s details before sending to avoid delays or mistakes in the transfer process.

- Use online comparison tools to find the best transfer options based on speed, cost, and features.

- Track your money transfer through apps or websites to stay informed and ensure your funds arrive safely.

- Protect your personal information by using secure platforms, strong passwords, and avoiding public Wi-Fi when sending money.

Hassle-Free Money Transfers

Best Money Transfer Options

When you want to send money from the USA to Ukraine, you have many choices. The best money transfer providers make the process fast, safe, and simple. You can pick from well-known names like Western Union, Remitly, Wise, TransferGo, Xoom, Paysend, Ria, and PayPal. Each provider offers something unique, so you can find the best ways to send money that fit your needs.

The digital remittance market includes major providers such as Western Union, MoneyGram, Wise, PayPal, Xoom, and Remitly. Western Union and MoneyGram have large networks, so you can send money to many places in Ukraine. Wise and Xoom use digital tools to make transfers cheaper and faster. Xoom works with Visa Direct, which helps you send money quickly to Ukraine. Wise, Remitly, and Xoom are popular among people who want to send money online or with an app.

| Provider | Unique Features | Transfer Speed | Fees (approx.) | Payment Methods | Transfer Limits (USD) |

|---|---|---|---|---|---|

| Western Union | 174+ years, cash pickups, money orders, phone & email support, apps, 100+ currencies | 1-10 days | Up to 3% | Cash, bank transfer, debit card, credit card | Min: $1, Max: $10,000 (varies) |

| TransferGo | 13+ years, international, phone & email support, apps, 38 currencies | 1-10 days | 0.5%-1.5% | Bank transfer, debit card, credit card | Min: $2, Max: $1,200,000 |

| Wise | Transparent fees, real exchange rates, multicurrency account, app | Minutes to 2 days | Varies, no markup | Bank account, debit/credit card, SWIFT | Varies by country |

| Remitly | Fast, affordable, two speed options, cash pickup, bank deposit, app | Minutes to hours | Varies | Bank account, debit/credit card | Varies by method |

Wise stands out for its clear fees and real exchange rates. You always know what you pay. Remitly gives you two speed options: Express for fast delivery and Economy for lower fees. Western Union lets you send money for cash pickup, which is helpful if your recipient does not have a bank account. TransferGo offers low fees and supports many currencies.

Other providers like Xoom, Paysend, Ria, and PayPal also help you send money from the USA to Ukraine. Xoom, a PayPal service, lets you send money quickly to a bank account or for cash pickup. Paysend and Ria offer simple apps and good rates. PayPal is easy to use if you already have an account.

Note: Zelle does not support international money transfers to Ukraine. You cannot use Zelle for this purpose.

If you want the best money transfer experience, compare these providers. Look at their fees, speed, and features. This helps you find the best ways to send money and avoid surprises.

How to Send Money

You can send money from the USA to Ukraine in a few easy steps. Most international money transfer services let you do this online, with an app, or in person. Here is how to send money using some of the most popular methods:

Online or App Transfers

- Choose a provider like Wise, Remitly, Xoom, or PayPal.

- Create an account or log in.

- Enter the amount you want to send and select Ukraine as the destination.

- Add your recipient’s details. This could be their name, email, phone number, or bank account.

- Pick your payment method. You can use a bank account, debit card, credit card, or PayPal balance.

- Review the fees and exchange rate.

- Confirm and send money.

For example, if you use PayPal:

- Open the PayPal app and go to ‘Send & Request’.

- Enter your recipient’s name, email, Ukrainian phone number, bank account, or card number.

- Set the amount and currency to Ukrainian Hryvnia (UAH).

- Choose your payment method.

- Confirm and send money.

If your recipient does not have a PayPal account, you can use Xoom inside the PayPal app. Just go to the App menu, select ‘Send and Pay’, and pick your delivery option.

Cash Pickup

Some providers let your recipient pick up cash at a bank or agent location in Ukraine. Here is how you do it:

- Choose a provider like Western Union, Ria, or Xoom.

- Enter the amount and your recipient’s details.

- Select a cash pickup location, such as Oschadbank, Privatbank, or Ukrgasbank.

- Pay with your chosen method.

- Share the pickup details with your recipient.

Money often arrives in minutes for cash pickup or bank deposit. This makes hassle-free money transfers possible even if your recipient does not have a bank account.

Bank Deposit

If you want to transfer to bank account in Ukraine, follow these steps:

- Choose a provider that supports bank deposits, like Wise, Remitly, or Xoom.

- Enter the amount and select Ukraine.

- Add your recipient’s bank details.

- Pay using your preferred method.

- Confirm and send money.

Most online money transfer services and international money transfer services make it easy to track your transfer. You get updates by email or in the app.

Tip: Always double-check your recipient’s details before you send money. This helps avoid delays or mistakes.

With so many providers and options, you can find the best money transfer solution for your needs. Whether you want to send money for cash pickup, bank deposit, or through an app, you have many safe and fast choices. These international remittance services help you support your loved ones in Ukraine with confidence.

Compare Money Transfer Methods

Image Source: unsplash

When you want to send money from the USA to Ukraine, you have several options. Each method has its own pros and cons. A good comparison helps you find the best money transfer solution for your needs. Let’s break down the main choices and see how they stack up.

Fees and Exchange Rates

You care about how much it costs to send money and what exchange rates you get. Online services like Wise, Remitly, and Paysend show their fees and rates upfront. Wise uses the mid-market rate with a small, clear fee. Paysend charges a fixed $2 fee per transfer, but may add a small margin to the exchange rate. Remitly’s transfer fees usually range from $3 to $6, but sometimes you pay nothing if you send over $1,000. Bank wire transfers (SWIFT) often have higher fees, sometimes $10-$35, plus extra charges from other banks along the way. Their exchange rates are less transparent and can cost you more.

Here’s a quick comparison:

| Feature | Wise (Online) | Bank Wire (SWIFT) |

|---|---|---|

| Fees | From 0.33% of amount | $10-$35 + hidden fees |

| Exchange Rates | Mid-market, no markup | Markup, less clear |

| Transparency | High | Low |

Providers like Western Union and MoneyGram also let you send money for cash pickup. Their fees and exchange rates can change based on how much you send and how fast you want it delivered. Always check the total cost before you send money. Monito is a helpful site for money transfer comparison, showing you the best rates and lowest fees.

Transfer Speed

Speed matters when you need your remittance to arrive fast. Online services like Wise and Paysend can deliver money to Ukraine in seconds or within a day. Remitly offers an express option for instant delivery, or an economy service that takes 3-5 days. Bank wire transfers usually take 1-5 business days. Cash pickup with Western Union or MoneyGram can be almost instant, but sometimes takes a few days.

| Provider | Estimated Transfer Time |

|---|---|

| Wise | Seconds to 2 days |

| Remitly | Minutes (Express), 3-5 days |

| Paysend | Instant to 3 days |

| Bank (SWIFT) | 1-5 days |

| Western Union | Minutes to 5 days |

TransferGo stands out for the fastest delivery, with some transfers arriving in under 30 minutes.

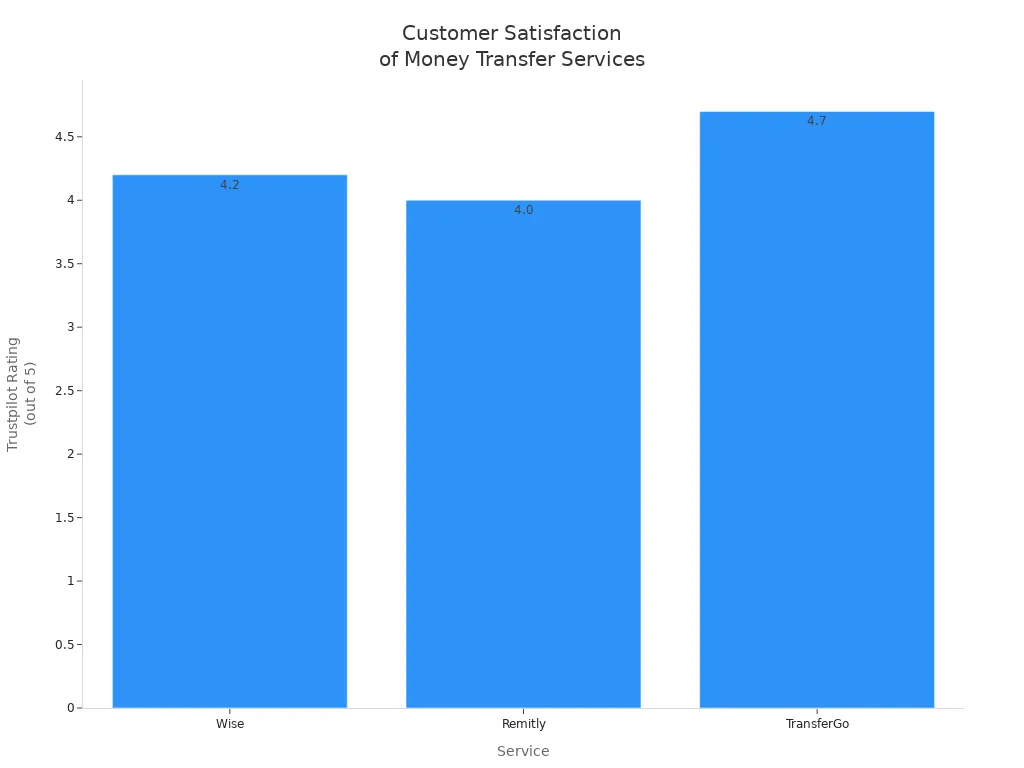

Security and Reliability

You want your money transfer to be safe and reliable. Top providers use strong security, like two-factor authentication and encryption. Paysend checks your identity and follows anti-money laundering rules. Wise and Remitly are fully regulated and protect your data. MoneyGram and Western Union require ID for cash pickup and use fraud detection systems.

Providers like Wise, Remitly, and TransferGo have high customer ratings. TransferGo, for example, has an “Excellent” Trustpilot score of 4.7/5. Most international money transfer services offer 24/7 support and refund guarantees if something goes wrong.

A good money transfer comparison helps you pick the safest and most reliable way to send money from the USA to Ukraine. Always check the latest rates, transfer fees, and customer reviews before you choose a provider.

Get the Best Money Transfer Rates

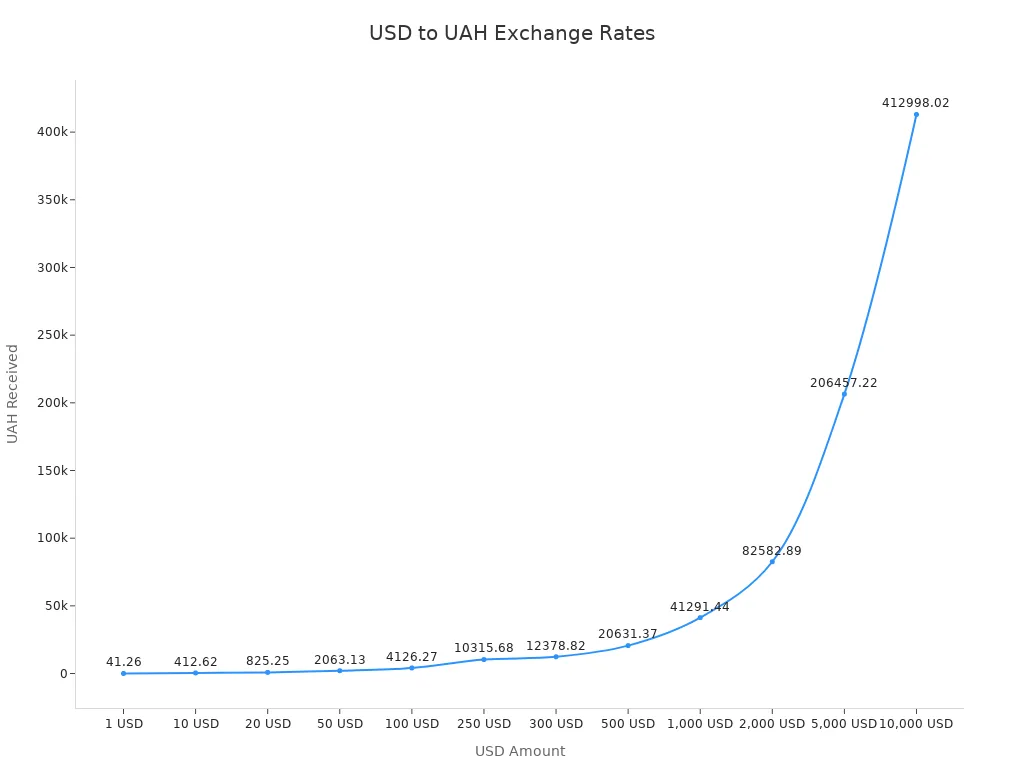

Convert USD to Ukrainian Hryvnia

When you send a remittance from the USA, you want to make sure you get the best rates. The amount your recipient gets depends on how you convert USD to Ukrainian hryvnia. Every money transfer provider sets its own rates, so you should always check before you send. Even a small change in rates can make a big difference in the final amount.

Here’s a quick look at how much hryvnia you get for different amounts of USD:

| USD Amount | Exchange Rate (UAH) |

|---|---|

| 1 USD | 41.26 UAH |

| 10 USD | 412.62 UAH |

| 20 USD | 825.25 UAH |

| 50 USD | 2,063.13 UAH |

| 100 USD | 4,126.27 UAH |

| 250 USD | 10,315.68 UAH |

| 300 USD | 12,378.82 UAH |

| 500 USD | 20,631.37 UAH |

| 1,000 USD | 41,291.44 UAH |

| 2,000 USD | 82,582.89 UAH |

| 5,000 USD | 206,457.22 UAH |

| 10,000 USD | 412,998.02 UAH |

Rates change all the time. When the hryvnia loses value, your recipient gets more for every dollar. If the hryvnia gets stronger, they get less. Sometimes, the official rate is different from the market rate, so the cost of your money transfer can go up or down. Always check the latest rates before you send money.

Avoid Hidden Fees

You want your remittance to arrive without surprise costs. Some providers show low fees but add extra charges in the exchange rates or through hidden transfer fees. For example, sending money to a PrivatBank account in Ukraine may cost less than sending to other banks, which can have extra correspondent fees. Payment methods like ACH or Wise balance can also change the total cost.

Here are some tips to help you avoid hidden fees:

- Compare rates using online tools before you send money.

- Pick providers with low fees and clear rates, like Wise or Paysend.

- Always choose to convert USD to Ukrainian hryvnia at the provider’s rate, not at an ATM or hotel.

- Avoid exchanging money at airports or hotels, where rates and fees are higher.

- Use the cheapest way to send money by checking both transfer fees and exchange rates.

Tip: The more you know about rates and fees, the more money your recipient gets. A little research can save you a lot of money on your next money transfer.

Step-by-Step Money Transfer Guide

Choose a Provider

You want to find the right service before you send money to Ukraine. Many providers offer different features, fees, and speeds. Some focus on fast delivery, while others keep costs low. Wise, Remitly, and Ria are popular choices. They let you send money online or with an app. Western Union and Xoom also give you options for cash pickup. If you want the best ways to send money, compare the fees, exchange rates, and transfer times. Look for a provider that fits your needs and gives you peace of mind.

Tip: Always check customer reviews and ratings. A trusted provider can make your money transfer smooth and safe.

Enter Recipient Details

After you pick a provider, you need to enter your recipient’s information. You do not need a Ukrainian bank account to send money. This makes the process easier for many people. Most services ask for your recipient’s full name, address, and phone number. If you send money to a bank account, you also need the bank name, account number, and sometimes a SWIFT/BIC code or IBAN. Double-check every detail before you confirm. Mistakes can cause delays or failed transfers.

Here’s a quick checklist for entering recipient details:

- Full name (as it appears on their ID)

- Address and phone number

- Bank name and account number (if sending to a bank)

- SWIFT/BIC code and IBAN (for international transfers)

- Confirm all details with your recipient

Note: Ask your recipient’s bank for written confirmation of their details. This helps you avoid errors and gives you proof if you need to check later.

Track Your Transfer

Once you send money, you want to know where it is. Most providers let you track your money transfer in real time. You can use the provider’s website or mobile app. Enter your reference or tracking number to see the status. Some services, like Ria, let you track transfers with a PIN or order number. If you have questions, contact customer support or visit a branch for help.

Here are some ways to track your transfer:

- Use the provider’s app or website with your tracking number.

- Call customer support if you need help.

- Visit a branch if you want in-person assistance.

- For bank transfers, ask for the MT103 form to track through the SWIFT network.

If your transfer is delayed, request a trace from your provider. This helps you find out what happened and get updates quickly.

Ensure Secure Money Transfers

Image Source: pexels

Verify Provider Credentials

You want to feel safe every time you use a money transfer service. Before you send any remittance, always check if the provider has the right licenses. Look for valid Money Transmitter licenses from state financial authorities, like the New York State Department of Financial Services. You should also see if the provider is registered with the Nationwide Multistate Licensing System & Registry (NMLS). These credentials show that the company follows strict rules and keeps your money secure. For example, Western Union Financial Services, Inc. and Western Union International Services, LLC both hold these licenses and registrations. You can check a provider’s status on the NMLS Consumer Access website. Picking a reliable remittance service with these credentials helps protect your cross-border remittance services.

Protect Your Information

Keeping your personal and financial details safe is just as important as choosing the right provider. Here are some best practices you should follow:

- Use only reputable and regulated money transfer platforms.

- Turn on two-factor authentication (2FA) for extra security.

- Create strong, unique passwords with letters, numbers, and symbols.

- Avoid public Wi-Fi when sending remittance to Ukraine.

- Double-check recipient details before you send money.

- Watch out for phishing scams and suspicious messages.

- Check your account activity often for anything unusual.

- Report any strange or fraudulent activity to your provider right away.

Tip: Stay alert for charity scams or fake organizations, especially during crises. Always verify charities through trusted sites like Charity Navigator or BBB Wise Giving Alliance. Never share sensitive information with unverified contacts.

What to Do if Issues Arise

Sometimes, things do not go as planned. If your remittance is delayed, lost, or not received, you can take these steps:

- Double-check all transfer details, like account numbers and recipient names.

- Contact your provider or bank quickly and give them all the transaction info.

- For international transfers, ask for a SWIFT trace to track your money.

- If your provider cannot find the transfer, file a complaint with a regulatory authority such as the Consumer Financial Protection Bureau.

- If you think you are a victim of fraud, report it to your provider and follow their dispute process.

Most problems with money transfer services are delays, not losses. Acting fast and keeping good records helps you solve issues quickly and keeps your remittance safe.

You can make money transfers from the USA to Ukraine easy and secure by following a few simple steps.

- Pick a trusted provider with low fees and good rates.

- Double-check recipient details to avoid mistakes.

- Use a comparison of services to find the best option for your needs.

- Watch out for hidden fees and always review rates before sending.

- Track your transfer for peace of mind.

Start your next transfer with confidence and help your loved ones in Ukraine get the most from every dollar.

FAQ

How do you find the best money transfer provider from USA to Ukraine?

You can use a money transfer comparison tool to check rates, transfer fees, and speed. Look for providers with low fees and strong reviews. This helps you choose the best ways to send money and get the most value.

What is the cheapest way to send money to Ukraine?

Online money transfer services often offer the cheapest way to send money. Compare providers for low fees and good exchange rates. Wise and Paysend are popular for affordable transfers. Always check the total cost before you send money.

How can you convert USD to Ukrainian hryvnia safely?

Choose a reliable remittance service that shows real-time exchange rates. Most international money transfer services let you convert USD to Ukrainian hryvnia during the transfer. Review the rates and confirm the amount your recipient will get before you send.

Can you track your money transfer after sending it?

Yes, most money transfer providers let you track your transfer online or in their app. You can see updates in real time. If you have questions, contact customer support for help with your transfer to bank account or cash pickup.

What should you do if your remittance is delayed or lost?

First, double-check your transfer details. Contact your provider right away and give them your transaction info. Most cross-border remittance services offer support to help you solve issues quickly and keep your money safe.

Sending money from the USA to Ukraine doesn’t have to mean high fees, hidden costs, or long delays. With BiyaPay, you enjoy a faster and more transparent way to support loved ones abroad. Take advantage of remittance fees as low as 0.5%, real-time FX rate checks and instant conversions, and transfers in both fiat and digital currencies. Unlike traditional providers that can take days, BiyaPay ensures same-day transfers with same-day arrival, so your money gets where it needs to go quickly and securely. Registration takes only minutes, and you’ll always know exactly how much your recipient will receive before you confirm. Discover the smarter way to send money to Ukraine with BiyaPay.

Save more, send faster—start today with BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.